Current Report Filing (8-k)

February 08 2019 - 8:17AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

February 7, 2019

CPI

AEROSTRUCTURES, INC.

(Exact

Name of Registrant as Specified in Charter)

|

New

York

|

|

001-11398

|

|

11-2520310

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

91

Heartland Boulevard, Edgewood, New York

|

11717

|

|

(Address

of Principal Executive Offices)

|

(Zip Code)

|

(631)

586-5200

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item

4.02

|

Non-Reliance

on Previously Issued Financial Statements or a Related Audit Report or Completed Interim

Review.

|

On

February 7, 2019, the Audit Committee of the Board of Directors (the “Audit Committee”) of CPI Aerostructures,

Inc. (the “Company”), determined based on the recommendation of management and in consultation with CohnReznick

LLP (“CohnReznick”), the Company’s independent registered public accounting firm, that the Company’s

previously issued financial statements as of and for the three and nine months ended September 30, 2018 included in its Form

10-Q as filed with the Securities and Exchange Commission on November 13, 2018, should no longer be relied upon due to an

error in the financial statements that was identified by management.

This

error occurred in the Company’s billing process and resulted in the overstatement of revenue for the three and nine months

ended September 30, 2018. The identification of the error was made by management during the Company’s review of the billing

process for the year ended December 31, 2018 in connection with the preparation of the Company’s 2018 financial statements.

Management’s preliminary conclusion is that the error was limited to one instance and that the effect of correcting the

foregoing error in the Company’s financial statements for the three and nine months ended September 30, 2018 is (i) a reduction

of revenue and income before provision for income taxes of approximately $900,000 to $950,000, (ii) a reduction of net income

of approximately $725,000 to $775,000 and (iii) a reduction of fully diluted earnings per share of approximately $ 0.09, for each

such period. The error is not expected to have a material impact on the Company’s balance sheet as of September 30, 2018

or the statement of cashflows for the three and nine months ended September 30, 2018.

The

Company has reviewed its financial closing process and believes it has identified the corrective action to remediate

the cause of the error. The Company expects

to file an amended Quarterly Report on Form 10-Q/A for the periods ended September 30, 2018 to restate the financial statements

and other disclosures contained therein for the error noted above as soon as practical.

In

connection with the restatement noted above, management has determined that a material weakness existed in the Company’s

internal control over financial reporting as of September 30, 2018. As a result, the Company’s chief executive officer and

chief financial officer have concluded that the Company’s disclosure controls and procedures were not effective at the reasonable

assurance level as of September 30, 2018. A discussion of the Company’s plan to remediate the material weakness will be

contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, which the Company expects to

file with Securities and Exchange Commission on or before its filing deadline.

The

Company’s Audit Committee and members of the Company’s management have discussed the matters disclosed in this Item

4.02 with CohnReznick.

Forward

Looking Statements

When

used in this Current Report on Form 8-K, the words or phrases “will likely result,” “management expects”

or “the Company expects,” “will continue,” “is anticipated,” “estimated” or similar

expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Readers are cautioned not to place undue reliance on any such forward-looking statements, each of which speaks

only as of the date made. Such statements are subject to certain risks and uncertainties that could cause actual results to differ

materially from historical earnings and those presently anticipated or projected. The risks are included in our Annual Report

on Form 10-K for the year ended December 31, 2017 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March

31, 2018, June 30, 2018 and September 30, 2018. We have no obligation to publicly release the result of any revisions which may

be made to any forward-looking statements to reflect anticipated or unanticipated events or circumstances occurring after the

date of such statements.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated: February 8, 2019

|

CPI AEROSTRUCTURES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/

Vincent Palazzolo

|

|

|

|

Vincent Palazzolo

|

|

|

|

Chief Financial Officer

|

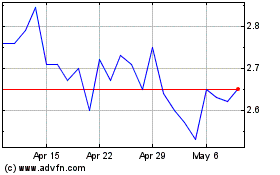

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Mar 2024 to Apr 2024

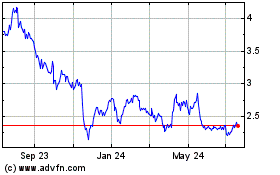

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Apr 2023 to Apr 2024