Amended Statement of Beneficial Ownership (sc 13d/a)

January 23 2023 - 8:26AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

13D

(Rule 13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 16)*

BARNWELL INDUSTRIES, INC.

(Name of Issuer)

Common Stock, par value $0.50 per share

(Title of Class of Securities)

068221100

(CUSIP Number)

Ned L. Sherwood

151 Terrapin Point

Vero Beach, Florida 32963

(772) 257-6658

With a copy to:

Derek D. Bork

Thompson Hine LLP

3900 Key Center

127 Public Square

Cleveland, Ohio 44114

(216) 566-5500

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

January 21, 2023

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject

of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box ¨.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of

this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

| CUSIP No. 068221100 |

13D |

Page 2 of 7 Pages |

| 1 |

NAME OF REPORTING PERSON

Ned L. Sherwood |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY |

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

1,955,194.138* |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

1,955,194.138* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY REPORTING PERSON

1,955,194.138* |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11)

19.6% |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| |

|

|

|

|

* Includes (i) 1,717,156.138 shares of Common Stock held by MRMP-Managers

LLC, of which Ned L. Sherwood is the Chief Investment Officer, and (ii) 238,038 shares of Common Stock held by the Ned L. Sherwood

Revocable Trust, of which Ned L. Sherwood is the sole trustee and beneficiary. Ned L. Sherwood disclaims beneficial ownership of such

Common Stock except to the extent of his pecuniary interest therein.

| CUSIP No. 068221100 |

13D |

Page 3 of 7 Pages |

| 1 |

NAME OF REPORTING PERSON

MRMP-Managers LLC |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY |

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

1,717,156.138 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

1,717,156.138 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY REPORTING PERSON

1,717,156.138 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11)

17.2% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| |

|

|

|

|

| CUSIP No. 068221100 |

13D |

Page 4 of 7 Pages |

| 1 |

NAME OF REPORTING PERSON

Ned L. Sherwood Revocable Trust |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY |

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

238,038 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

238,038 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY REPORTING PERSON

238,038 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11)

2.4% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| |

|

|

|

|

| CUSIP No. 068221100 |

13D |

Page 5 of 7 Pages |

This Amendment No. 16

to Statement of Beneficial Ownership on Schedule 13D (this “Amendment No. 16”) amends the Statement of Beneficial Ownership

on Schedule 13D filed by Ned L. Sherwood on June 11, 2013 (as amended by the Reporting Persons, the “Schedule 13D” or

this “Statement”). Except as amended and supplemented by this Amendment No. 16, the Schedule 13D remains unchanged.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended and supplemented by

adding the following:

On January 21, 2023,

MRMP-Managers LLC, the Ned L. Sherwood Revocable Trust and Ned L. Sherwood (also referred to as the “Reporting Persons”) entered

into a cooperation and support agreement (the “Agreement”) with Alex Kinzler and Barnwell Industries, Inc. (the “Company”)

to settle the potential proxy contest pertaining to the election of directors to the Board at the Company’s 2023 annual meeting

of stockholders (the “2023 Annual Meeting”). Pursuant to the Agreement, the Company agreed to nominate Messrs. Woodrum,

Grossman and Kinzler, along with two new independent directors, Joshua Horowitz and Laurance Narbut, for election to the Board at the

2023 Annual Meeting and the 2024 annual meeting of stockholders (the “2024 Annual Meeting”). If at any time prior to the expiration

of the Standstill Period (as defined below), Messrs. Woodrum and Narbut (together, the “Sherwood Designees”) are unable

or unwilling to serve as a director, the Reporting Persons, so long as they maintain at least 50% of their current ownership of Common

Stock, shall have the right to appoint a replacement director subject to the reasonable approval of the Board; provided, that only one

Sherwood Designee may be an Affiliate of the Reporting Persons. As of the date hereof, neither of the current Sherwood Designees is an

Affiliate of the Reporting Persons.

The Reporting Persons agreed

to vote their shares of Common Stock in favor of the election of the designated slate, and agreed to customary standstill and voting provisions

until the date that is ten business days prior to the deadline for the submission of stockholder nominations for directors for the Company’s

2025 annual meeting of stockholders (“Standstill Period”).

Additionally, Mr. Sherwood

has agreed to not increase his stockholdings beyond 28 percent of the Company’s outstanding shares of Common Stock during the twelve

months following the standstill period (“Initial Security Restriction Period”) and to not increase his stockholdings beyond

30 percent of the Company’s outstanding shares of Common Stock during the twelve months following the Initial Security Restriction

Period.

The Company agreed not to

expand the size of the Board above five members during the standstill period, and not to establish or maintain an executive committee

or another committee with similar powers of the Board during the standstill period without each of the Sherwood Designees being appointed

as a member of such committee. The Company further agreed to reimburse the Reporting Persons for their expenses related to this Agreement.

The Reporting Persons shall

not be deemed to constitute a “group” for purposes of Section 13(d) with Mr. Kinzler.

| Item 5. | Interest in Securities of the Issuer. |

(a) Mr. Sherwood

beneficially owns in the aggregate 1,955,194.138 shares of Common Stock, which represents approximately 19.6% of the Company’s outstanding

shares of Common Stock.

Each percentage ownership

of Common Stock set forth in this Statement is based on the 9,956,687 shares of Common Stock reported by the Company as outstanding as

of December 9, 2022 in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on December 29,

2022.

(c) No transactions in

the Common Stock have been effected by the Reporting Persons since the filing of Amendment No. 15 on October 25, 2022.

| CUSIP No. 068221100 |

13D |

Page 6 of 7 Pages |

| Item 6. | Contracts, Arrangements, Understandings or Relationships

With Respect to Securities of the Issuer. |

Information set forth in Item

4 above is hereby incorporated herein by reference.

Pursuant to Rule 13d-1(k) promulgated

under the Securities Exchange Act of 1934, as amended, the Reporting Persons have entered into an agreement with respect to the joint

filing of this Statement, which agreement is set forth on the signature page to this Statement.

| Item 7. | Material to Be Filed as Exhibits. |

| Exhibit 99.1 | Cooperation and Support Binding Term Sheet, dated as of January 21,

2023, by and among MRMP-Managers LLC, the Ned L. Sherwood Revocable Trust, NLS Advisory Group, Inc., Ned L. Sherwood,

Alexander C. Kinzler, and Barnwell Industries, Inc. |

| CUSIP No. 068221100 |

13D |

Page 7 of 7 Pages |

SIGNATURE

After reasonable inquiry and

to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth

in this Statement is true, complete and correct.

In accordance with Rule 13d-1(k)(1)(iii) under

the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of this Statement

on Schedule 13D with respect to the Common Stock of the Company.

Dated: January 23, 2023

| |

|

| /s/ Ned L. Sherwood |

|

| NED L. SHERWOOD |

|

|

MRMP-MANAGERS LLC |

|

| |

|

| By: |

/s/ Ned L. Sherwood |

|

| Name: |

Ned L. Sherwood |

|

| Title: |

Chief Investment Officer |

|

|

NED L. SHERWOOD REVOCABLE TRUST |

|

| |

|

| By: |

/s/ Ned L. Sherwood |

|

| Name: |

Ned L. Sherwood |

|

| Title: |

Trustee |

|

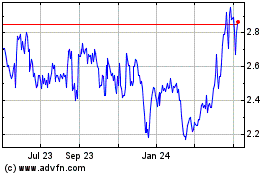

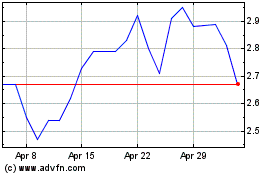

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Apr 2023 to Apr 2024