UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of October, 2022

Commission File Number: 001-35936

B2Gold

Corp.

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 3400, Park Place

666 Burrard Street

Vancouver, British Columbia

V6C 2X8

Canada

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| [ ] Form 20-F |

[X] Form 40-F |

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): [ ]

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): [ ]

DOCUMENTS INCLUDED AS PART

OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B2Gold Corp. |

|

| |

|

|

|

| |

|

|

|

| Date: October 17,

2022 |

By: |

/s/ Randall Chatwin |

|

| |

Name: |

Randall Chatwin |

|

| |

Title: |

Senior Vice President, Legal and Corporate Communications |

|

EXHIBIT INDEX

Exhibit 99.1

News Release

B2Gold Reports Total Gold Production for Q3 2022

of 227,016 oz;

Re-affirms Annual Guidance of 990,000 to 1,050,000

oz of Total Gold Production

Vancouver, October 17, 2022 – B2Gold

Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or the “Company”) is pleased to announce its gold production

and gold revenue for the third quarter of 2022. All dollar figures are in United States dollars unless otherwise indicated.

2022 Third Quarter Highlights

| · | On track to meet annual gold production guidance: Total gold production

in the third quarter of 2022 of 227,016 ounces, including 12,113 ounces of attributable production from Calibre Mining Corp. (“Calibre”),

less than planned due to challenges at Fekola and Otjikoto as discussed below. Total gold production for 2022 still anticipated to be

between 990,000 to 1,050,000 ounces. |

| · | Fekola to benefit from access to higher grade ore in Q4 2022: Gold

production from the Fekola Mine of 129,933 ounces in the third quarter of 2022. Fekola experienced a challenging rainy season which delayed

access to higher grade ore from Fekola Phase 6. The ore from Fekola Phase 6, which is currently being mined in the fourth quarter of 2022,

is anticipated to average between 3.4 to 3.5 grams per tonne (“g/t”) gold. |

| · | Consistent operational quarter at Masbate: Gold production from the

Masbate Mine of 49,902 ounces in the third quarter of 2022. Masbate remains on target to achieve the previously revised 2022 guidance

of between 215,000 and 225,000 ounces of gold. |

| · | Wolfshag Underground development ore production commenced at Otjikoto:

Gold production from the Otjikoto Mine of 35,068 ounces in the third quarter of 2022, less than anticipated due to a delay in bringing

the Wolfshag Underground mine into production. Gold production is forecast to significantly increase in the fourth quarter of 2022 when

mining reaches a higher grade zone in the Otjikoto pit and stope ore production commences from the Wolfshag Underground mine. |

| · | Fekola Complex feasibility study underway to deliver low capital intensity

production growth: Commencing a feasibility level engineering study of stand-alone oxide processing facilities at the Anaconda Area.

The study will be based on processing at least 4 million tonnes per annum (“Mtpa”) of saprolite and transitional (oxide) resources,

with an option to add fresh rock (sulphide) capabilities in the future. Results of this study are expected in the second quarter of 2023.

Conceptual analysis indicates that the combined Fekola and Anaconda processing facilities could have the potential to produce more than

800,000 ounces of gold per year commencing as early as 2026. |

| · | Financial position and capital returns program remain robust: The

Company remains in a strong net positive cash position and paid a third quarter dividend of $0.04 per common share (annualized rate of

$0.16 per common share), one of the highest dividend yields in the gold sector. |

Third Quarter 2022 Gold Production and Full Year 2022 Outlook

Mine-by-mine gold production in the third quarter

and first nine months of 2022 (including the Company’s approximately 25% attributable share of Calibre’s production) was as

follows:

| |

|

Gold Production |

| Mine |

|

Q3 2022 |

YTD 2022 |

FY 2022 Revised Guidance |

| Fekola |

oz |

129,933 |

354,647 |

570,000 - 600,000 |

| Masbate |

oz |

49,902 |

164,041 |

215,000 - 225,000 |

| Otjikoto |

oz |

35,068 |

101,546 |

165,000 - 175,000 |

| B2Gold Consolidated (1) |

oz |

214,903 |

620,234 |

950,000 – 1,000,000 |

| Equity interest in Calibre (2) |

oz |

12,113 |

39,770 |

40,000 - 50,000 |

| Total |

oz |

227,016 |

660,004 |

990,000 – 1,050,000 |

Notes:

| (1) | “B2Gold Consolidated” gold production is presented on a 100% basis, as B2Gold fully consolidates

the results of its Fekola, Masbate and Otjikoto mines in its consolidated financial statements (even though it does not own 100% of these

operations). |

| (2) | “Equity interest in Calibre” represents the Company’s

approximate 25% indirect share of Calibre’s operations. B2Gold applies the equity method of accounting for its 25% ownership interest

in Calibre. |

Fekola Gold Mine - Mali

| |

|

Q3 2022 |

| Total ore processed |

Mt |

2.29 |

| Gold mill feed grade |

g/t |

1.90 |

| Gold recovery |

% |

93.1% |

| Gold produced |

oz |

129,933 |

| Gold sold |

oz |

135,150 |

The Fekola Mine in Mali produced 129,933 ounces

in the third quarter of 2022, lower than planned due to a challenging rainy season in West Mali which delayed access to higher grade ore

from Fekola Phase 6. The Fekola processing facilities continued to outperform budget with 2.29 million tonnes processed during the third

quarter, due to favorable ore fragmentation and hardness as well as continued optimization of the grinding circuit. Mill feed grade was

impacted in the third quarter of 2022 due to the processing of low grade ore stockpiles as a replacement for delayed volumes of higher

grade ore from Fekola Phase 6. Mined ore tonnage and grade continue to reconcile well with the Fekola resource model.

In early October 2022, ore was mined from the

higher grade Fekola Phase 6 as the region exits its rainy season (which typically runs from June to September). Ore from Fekola Phase

6 is anticipated to average between 3.4 to 3.5 g/t gold, with fourth quarter of 2022 production expected to bring full year 2022 gold

production to within guidance of between 570,000 to 600,000 ounces.

Masbate Gold Mine – The Philippines

| |

|

Q3 2022 |

| Total ore processed |

Mt |

1.89 |

| Gold mill feed grade |

g/t |

1.10 |

| Gold recovery |

% |

74.7% |

| Gold produced |

oz |

49,902 |

| Gold sold |

oz |

62,600 |

The Masbate Mine in the Philippines remains on

target to achieve its previously revised 2022 guidance and produced 49,902 ounces in the third quarter of 2022. The ratio of sulphide

and transitional ore to oxide ore was higher than budgeted in the third quarter, which contributed to the lower-than-planned throughput

and recovery and higher-than-planned gold mill feed grade.

The Masbate Mine is expected to produce towards

the lower end of guidance of between 215,000 and 225,000 ounces of gold in 2022.

Otjikoto Gold Mine - Namibia

| |

|

Q3 2022 |

| Total ore processed |

Mt |

0.88 |

| Gold mill feed grade |

g/t |

1.27 |

| Gold recovery |

% |

98.0% |

| Gold produced |

oz |

35,068 |

| Gold sold |

oz |

31,650 |

The Otjikoto Mine in Namibia produced 35,068

ounces in the third quarter of 2022, lower than planned mainly due to delays in bringing the Wolfshag Underground mine into production.

Project delays were due to issues achieving development rates in prior periods, which have been addressed through appointing a new development

contractor in April 2022. Development rates in the Wolfshag Underground mine have recovered, with access to initial development ore achieved

in the third quarter of 2022 and stope ore production expected to commence in the fourth quarter of 2022. Mined ore tonnage and grade

continue to reconcile well with Otjikoto’s resource model, with production forecast to significantly increase in the fourth quarter

of 2022 when mining reaches a higher grade zone in the Otjikoto pit and with stope ore production commencing from the Wolfshag Underground

mine. The initial underground Mineral Reserve estimate for the down-plunge extension of the Wolfshag deposit includes 210,000 ounces of

gold in 1.2 million tonnes of ore at 5.57 g/t gold. Ongoing delineation drilling for the initial stope indicates very good reconciliation

with the resource model and stope location.

The Otjikoto Mine is expected to produce towards

the lower end of guidance of between 165,000 and 175,000 ounces of gold in 2022.

Fekola Complex – Pathway to Increased Annual Gold Production

Based on the updated Anaconda Area Mineral Resource

estimate and B2Gold’s preliminary planning, the Company has demonstrated that the Anaconda Area (Bantako and Menankoto license areas)

could provide selective higher grade saprolite material (average grade of 2.2 g/t gold) to be trucked to and fed into the Fekola mill

at a rate of up to 1.5 million tonnes per annum. Trucking of selective higher grade saprolite material to the Fekola mill will increase

the ore processed and annual gold production from the Fekola mill, with the potential to add an average of approximately 80,000 to 100,000

ounces of gold per year to the Fekola mill's annual production.

In 2022, the Company budgeted $33 million for

development of saprolite mining at the Anaconda Area including road construction, mine infrastructure, and mining equipment. The construction

mobile equipment fleet is arriving, and the Company expects to break ground on roads and mining infrastructure construction in the fourth

quarter of 2022. Engineering and procurement of the mine workshop and mobile equipment is on schedule for saprolite production from the

Bantako license area as early as the second quarter of 2023 and from the Dandoko license area as early as the fourth quarter of 2023.

Production from Bantako and Dandoko is contingent upon receipt of all necessary permits as well as optimizing long-term project value

from the various oxide and sulphide material sources now available including Fekola Pit, Fekola Underground, Cardinal, Bantako, Menankoto,

Dandoko, and Bakolobi.

Preliminary results of a Fekola Complex optimization

study, coupled with 2022 exploration drilling results, indicate that there is a significant opportunity to increase gold production and

resource utilization with the addition of oxide processing capacity. The Company has therefore commenced a feasibility level engineering

study of stand-alone oxide processing facilities at the Anaconda Area. The study will be based on processing at least 4 Mtpa of saprolite

and transitional (oxide) resources, with an option to add fresh rock (sulphide) capabilities in the future. Results of this study are

expected in the second quarter of 2023. Conceptual analysis indicates that the combined Fekola and Anaconda processing facilities could

have the potential to produce more than 800,000 ounces of gold per year commencing as early as 2026, subject to completion of final feasibility

studies, and the receipt of all necessary regulatory approvals and permits. Further expansion of the Mamba and Cobra sulphide zones (see

September 15, 2022 press release) could sustain a production profile averaging over 800,000 ounces of gold per year over a 10-year period.

Drilling is currently ongoing at the Mamba and Cobra sulphide zones.

Gold Revenue

For the third quarter of 2022, consolidated gold

revenue was $393 million on sales of 229,400 ounces at an average realized gold price of $1,711 per ounce.

Third Quarter 2022 Financial Results - Conference Call Details

B2Gold will release its third quarter of 2022

financial results after the North American markets close on Tuesday, November 1, 2022.

B2Gold executives will host a conference call

to discuss the results on Wednesday, November 2, 2022, at 10:00 am PST / 1:00 pm EST. You may access the call by dialing the operator

at +1 (778) 383-7413 / +1 (416) 764-8659 (Vancouver / Toronto) or toll free at +1 (888) 664-6392 prior to the scheduled start time or

you may listen to the call via webcast by clicking here. A playback version will be available for two weeks after the call at +1 (416)

764-8677 (local or international) or toll free at +1 (888) 390-0541 (passcode 705653 #).

Qualified Persons

Bill Lytle, Senior Vice President and Chief Operating

Officer, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters contained

in this news release.

Brian Scott, P. Geo., Vice President, Geology

& Technical Services, a qualified person under NI 43-101, has approved the scientific and technical information related to exploration

and mineral resource matters contained in this news release.

On

Behalf of B2GOLD CORP.

“Clive T. Johnson”

President & Chief

Executive Officer

For more information on B2Gold please visit

the Company website at www.b2gold.com or contact:

| Michael McDonald |

Cherry DeGeer |

| VP, Investor Relations & Corporate Development |

Director, Corporate Communications |

| +1 604-681-8371 |

+1 604-681-8371 |

| investor@b2gold.com |

investor@b2gold.com |

The Toronto Stock Exchange and NYSE American

LLC neither approve nor disapprove the information contained in this news release.

Production results and production guidance

presented in this news release reflect total production at the mines B2Gold operates on a 100% project basis. Please see our Annual Information

Form dated March 30, 2022 for a discussion of our ownership interest in the mines B2Gold operates.

This news release includes certain "forward-looking

information" and "forward-looking statements" (collectively forward-looking statements") within the meaning of applicable

Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; and other statements

regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs

(sustaining and non-sustaining) and operating costs, including projected cash operating costs and AISC, and budgets on a consolidated

and mine by mine basis; and including, without limitation: projected gold production, cash operating costs and AISC on a consolidated

and mine by mine basis in 2022, including production being weighted heavily to the second half of 2022; total consolidated gold production

of between 990,000 and 1,050,000 ounces in 2022; the potential upside to increase Fekola’s gold production in 2022 by trucking material

from the Anaconda area, including the potential to add approximately 80,000 to 100,000 per year to Fekola’s annual production profile,

and for the Anaconda area to provide saprolite material to feed the Fekola mill starting in the second quarter of 2023; the timing and

results of a feasibility study for the Anaconda area to review the project economics of a stand-alone oxide mill; the potential for the

Fekola complex to produce 800,000 ounces of gold per year over a 10-year period starting in 2026; stope ore production at the Wolfshag

underground mine at Otjikoto commencing in the fourth quarter of 2022; the potential payment of future dividends, including the timing

and amount of any such dividends, and the expectation that quarterly dividends will be maintained at the same level; and B2Gold's attributable

share of Calibre’s production. All statements in this news release that address events or developments that we expect to occur in

the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally,

although not always, identified by words such as "expect", "plan", "anticipate", "project", "target",

"potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe"

and similar expressions or their negative connotations, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates

of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and

uncertainties, certain of which are beyond B2Gold's control, including risks associated with or related to: the duration and extent of

the COVID-19 pandemic, the effectiveness of preventative measures and contingency plans put in place by the Company to respond to the

COVID-19 pandemic, including, but not limited to, social distancing, a non-essential travel ban, business continuity plans, and efforts

to mitigate supply chain disruptions; escalation of travel restrictions on people or products and reductions in the ability of the Company

to transport and refine doré; the volatility of metal prices and B2Gold's common shares; changes in tax laws; the dangers inherent

in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost

or other estimates; actual production, development plans and costs differing materially from the estimates in B2Gold's feasibility and

other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities;

environmental regulations or hazards and compliance

with complex regulations associated with mining activities; climate change and climate change regulations; the ability to replace mineral

reserves and identify acquisition opportunities; the unknown liabilities of companies acquired by B2Gold; the ability to successfully

integrate new acquisitions; fluctuations in exchange rates; the availability of financing; financing and debt activities, including potential

restrictions imposed on B2Gold's operations as a result thereof and the ability to generate sufficient cash flows; operations in foreign

and developing countries and the compliance with foreign laws, including those associated with operations in Mali, Namibia, the Philippines

and Colombia and including risks related to changes in foreign laws and changing policies related to mining and local ownership requirements

or resource nationalization generally; remote operations and the availability of adequate infrastructure; fluctuations in price and availability

of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory,

political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors,

third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which

owns the Masbate Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain

skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition

with other mining companies; community support for B2Gold's operations, including risks related to strikes and the halting of such operations

from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to

maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance

with anti-corruption laws, and sanctions or other similar measures; social media and B2Gold's reputation; risks affecting Calibre having

an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other

factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information

Form, B2Gold's current Form 40-F Annual Report and B2Gold's other filings with Canadian securities regulators and the U.S. Securities

and Exchange Commission (the "SEC"), which may be viewed at www.sedar.com and www.sec.gov, respectively (the "Websites").

The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements.

B2Gold's forward-looking statements are based

on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to

management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to B2Gold's ability

to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development

and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or

reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; B2Gold's ability

to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including

gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political

conditions; and other assumptions and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based

on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's

beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking

statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in,

or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. For the reasons set

forth above, undue reliance should not be placed on forward-looking statements.

Cautionary Statement Regarding Mineral

Reserve and Resource Estimates

The disclosure in this news release was prepared

in accordance with Canadian National Instrument 43-101, which differs significantly from the requirements of the United States Securities

and Exchange Commission ("SEC"), and resource and reserve information contained or referenced in this news release may not

be comparable to similar information disclosed by public companies subject to the technical disclosure requirements of the SEC. Historical

results or feasibility models presented herein are not guarantees or expectations of future performance.

This regulatory filing also includes additional resources:

ex991.pdf

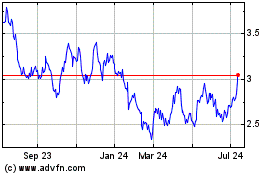

B2Gold (AMEX:BTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

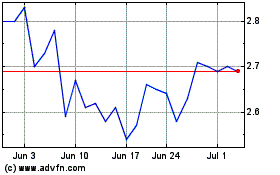

B2Gold (AMEX:BTG)

Historical Stock Chart

From Apr 2023 to Apr 2024