Asensus Surgical, Inc. (NYSE American: ASXC), a medical device

company that is digitizing the interface between the surgeon and

the patient to pioneer a new era of Performance-Guided

Surgery™(PGS), today announced its operating and financial results

for the fourth quarter and full year 2022.

As the Company hosted an Investor Day on Tuesday, February 21,

2023 during which an in-depth review of the business was provided,

the Company will not be hosting an earnings conference call in

conjunction with this earnings release.

Recent Highlights

- In February 2023,

unveiled plans for the LUNA™ Surgical System, its next generation

digital surgery platform

- In February 2023,

announced the intention to collaborate with KARL STORZ on

developing next-generation instrumentation and an agreement in

which KARL STORZ intends to sell the Company’s Intelligent Surgical

Unit™ (ISU™) as a standalone device

- In February 2023,

announced a multi-year collaboration with Google Cloud to further

expand the capabilities of the Company’s Performance-Guided Surgery

framework enabled through the ISU

- In January 2023,

received CE Mark for expanded machine vision capabilities within

the ISU, including 3D measurement, digital tagging, image

enhancement, and enhanced camera control

Fourth Quarter HighlightsIn line with the

preliminary results released on January 9, 2023, the Company

announced:

- Over 840 surgical

procedures were performed globally during the quarter, representing

growth of over 29% compared to the fourth quarter 2021

- Five Senhance®

Surgical Programs were initiated during the quarter, including two

in Germany, two in Japan, and one in the CIS region

- Fourth quarter

revenue of $2.5 million

Full Year Highlights

- Over 3,100 surgical

procedures were performed globally, representing growth of over 29%

compared to 2021

- In 2022, nine

Senhance Surgical Programs were initiated, in-line with guidance of

8-10 systems

- Full year 2022

revenue of $7.1 million

- The Company had

cash, cash equivalents, short-term and long-term investments,

excluding restricted cash, of approximately $74.4 million at

December 31, 2022

“2022 was an exciting year for the company. We continued to see

strong adoption and utilization trends as more surgeons across the

globe were performing procedures using Senhance, and we made

significant progress in the development and launch of cutting-edge

digital surgical capabilities to help surgeons perform better, more

consistent surgery,” said Anthony Fernando, Asensus Surgical

President and CEO. “As we look to the future, we are incredibly

excited about the opportunity we have to revolutionize patient care

through Performance-Guided Surgery. By introducing the most

advanced robotics platforms in combination with novel clinical

intelligence being bolstered by leading cloud computing power, we

believe we can reduce surgical variability and help surgeons

achieve better outcomes, regardless of their skill level or

geographic location.”

Upcoming 2023 MilestonesFor the full year 2023,

the Company expects to initiate 10 - 12 new Senhance programs.

During the first half of 2023, the Company expects to achieve

the following regulatory milestone:

- FDA clearance of

Senhance Surgical System for pediatric indication

During the second half of 2023, the Company expect to achieve

the following developmental milestones:

- Integrated system

testing for LUNA Surgical System

- Preclinical

evaluation for LUNA Surgical System

- Standalone ISU final

testing

2023 Investor DayOn February 21, 2023, the

Company hosted an Investor Day. Based on its clinical and

commercial experience to date, the Company introduced an integrated

Digital Surgery solution comprising a next generation surgical

platform and instruments, real-time intraoperative clinical

intelligence and a secure cloud platform to apply machine learning

to deliver clinical insights. This Digital Surgery solution will

enable the Company’s vision of Performance-Guided Surgery.

A link to a video replay of the event can be found HERE.

LUNA, the Company’s Next Generation Digital Surgery

PlatformDesigned based on the feedback received from over

10,000 digital laparoscopic procedures performed with the Senhance

System, the LUNA Surgical System is the Company’s next generation

digital surgery platform. Through a combination of advanced

minimally invasive instrumentation, the first ever digital

interface between the surgeon and the console, and industry-leading

clinical intelligence tools, we believe LUNA is poised to

revolutionize the way surgery is performed.

The LUNA Surgical System is under development, and not currently

available for use.

KARL STORZ Collaboration AgreementThe Company

previously announced that it had entered into a Memorandum of

Understanding with KARL STORZ VentureONE Pte. Ltd. (KARL STORZ), a

new wholly owned subsidiary of KARL STORZ SE & Co. KG. As part

of this agreement, KARL STORZ intends to market and sell Asensus’

Intelligent Surgical Unit as a standalone device together with

their IMAGE1 S™ Imaging system and OR1™ integration solution. The

companies also intend to work together on the integration of the

ISU into KARL STORZ's laparoscopic vision systems and jointly

collaborate on developing next-generation instrumentation to be

used with Asensus and KARL STORZ surgical platforms.

New Intelligent Surgical

Unit Capabilities AnnouncedIn

January 2023, the Company received CE Mark for an expansion of

machine vision capabilities on the previously cleared ISU. This

approval included a review of the Senhance Surgical System

platform, making Senhance one of the first robotic surgical systems

to be approved through the new, more rigorous EU Medical Device

Regulation, or MDR, process. These expanded ISU capabilities are

now commercially available across all of the Company’s key

geographies, including the European Union, Japan, and the U.S.

In February 2023, the Company announced incremental features

sets which are now under development, including an analytical

feature set, a safety feature set, and a training and education

set.

Google Cloud

CollaborationAsensus Surgical previously announced

that it agreed on a multi-year strategic collaboration with Google

Cloud to integrate Google Cloud’s secure cloud data architecture

and machine learning technologies to further expand the

capabilities of the Asensus Surgical’s Performance-Guided Surgery

framework enabled through the ISU. Google’s secure cloud data

architecture will capture this data and Asensus will enable

customer access portals and performance dashboards for surgeons and

hospitals. Google’s machine learning technologies will be utilized

to analyze the data and discern clinical intelligence that can be

utilized by surgeons and hospitals in addition to continuously

improving the software in the ISU to provide better intra-operative

clinical insight.

Articulating Instrument

LaunchThese instruments were commercially launched

in the U.S., Japan and Europe, in the fourth quarter of 2022.

Articulating Instruments offer better access to difficult-to-reach

areas of the anatomy by providing two additional degrees of

freedom.

U.S. Pediatric Regulatory SubmissionThe Company

submitted its U.S. FDA 510(k) application for pediatric clearance

in the U.S. during the third quarter of 2022. The Senhance System’s

unique combination of 3mm instrumentation with a 5mm camera scope

combined with haptic feedback make it a unique robotic assisted

laparoscopic solution for pediatric surgeries. The Company expects

to receive FDA 510(k) clearance during the first half of 2023.

Market Development2022 Senhance Program

InitiationsDuring the fourth quarter of 2022, the Company initiated

five new Senhance Surgical System placements, two in Germany, two

in Japan, and one in the CIS region, bringing the total number of

new Senhance Surgical System placements to nine in 2022.

Procedure VolumesPreviously, the Company has used the terms

“surgical procedure” and “surgical case” interchangeably to mean a

single surgery. Following an analysis of the growing collection of

Senhance surgical data, it was identified that it is becoming

increasingly common that multiple surgical procedures are being

performed during a single surgical case. As a result, the Company

will now report the number of total surgical procedures completed.

During 2023 we will provide data from similar periods in 2022 using

the same methodology. As an example, in previous quarters, a

surgical case where both a cholecystectomy (gallbladder removal)

and an umbilical hernia repair were completed, it would have been

counted as a single procedure. Under the revised definition, that

example would be counted as two procedures.

In 2022, surgeons performed over 3,100 surgical procedures

utilizing the Senhance System, representing a 29% increase over the

2,400 surgical procedures performed in the previous year. These

procedures included general surgery, gynecology, urology,

colorectal, pediatric, and bariatric surgical cases.

Fourth Quarter Financial Results

For the three months ended December 31, 2022, the Company

reported revenue of $2.5 million as compared to revenue of $2.5

million in the three months ended December 31, 2021. Revenue in the

fourth quarter of 2022 included $1.3 million in system revenue,

$0.4 million in lease revenue, $0.5 million in instruments and

accessories, and $0.3 million in services.

For the three months ended December 31, 2022, total operating

expenses were $18.3 million, as compared to $15.9 million, in the

three months ended December 31, 2021.

For the three months ended December 31, 2022, net loss was $17.9

million, or $0.08 per share, as compared to a net loss of $15.9

million, or $0.07 per share, in the three months ended December 31,

2021.

Adjusted net loss is a non-GAAP financial measure. See the

reconciliation of GAAP to Non-GAAP Measures below. For the three

months ended December 31, 2022, the adjusted net loss was $16.7

million, or $0.07 per share, as compared to an adjusted net loss of

$15.7 million, or $0.07 per share in the three months ended

December 31, 2021, after adjusting for the following charges:

amortization of intangible assets, change in fair value of

contingent consideration, and property and equipment impairment,

all of which are non-cash charges.

Balance Sheet Updates

The Company had cash, cash equivalents, short-term and long-term

investments, excluding restricted cash of approximately $74.4

million as of December 31, 2022.

The Company intends to file its Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 on or about March 2, 2023,

with the Securities and Exchange Commission. The Company expects

that the audited financial statements that will be included in the

filing will contain statements regarding management’s assessment of

the Company’s ability to continue as a going concern, and a going

concern qualification in the audit opinion from its independent

registered public accounting firm. This announcement is made

pursuant to NYSE American Company Guide Sections 401(h) and 610(b),

which require public announcement of the receipt of an audit

opinion containing a going concern paragraph.

About Asensus Surgical, Inc.

Asensus Surgical, Inc. is digitizing the interface between the

surgeon and patient to pioneer a new era of Performance-Guided

Surgery by unlocking clinical intelligence for surgeons to enable

consistently superior outcomes and a new standard of surgery. Based

upon the foundations of Digital Laparoscopy and the Senhance

Surgical System, the Company is developing the LUNA Surgical

System, a next generation robotic and instrument system as a

foundation of its Digital Surgery solution. These systems will be

powered by the Intelligent Surgical Unit to increase surgeon

control and reduce surgical variability. With the addition of

machine vision, Augmented Intelligence, and deep learning

capabilities throughout the surgical experience, we intend to

holistically address the current clinical, cognitive and economic

shortcomings that drive surgical outcomes and value-based

healthcare. The Senhance Surgical System is now available for sale

in the US, EU, Japan, Russia, and select other countries. For a

complete list of indications for use, visit:

www.senhance.com/indications. To learn more about

Performance-Guided Surgery, Digital Laparoscopy with the Senhance

Surgical System and the new LUNA System visit www.asensus.com.

Follow Asensus

Email Alerts: https://ir.asensus.com/email-alerts

LinkedIn: https://www.linkedin.com/company/asensus-surgical-inc

Twitter: https://twitter.com/AsensusSurgical

YouTube: https://www.youtube.com/c/transenterix

Vimeo: https://vimeo.com/asxc

Forward-Looking Statements

This press release includes statements relating to Asensus

Surgical, the LUNA Surgical System, the Senhance Surgical System

and our 2022 results. These statements and other statements

regarding our future plans and goals constitute "forward looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934, and

are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of

1995. Such statements are subject to risks and uncertainties that

are often difficult to predict, are beyond our control and which

may cause results to differ materially from expectations and

include whether we will be able to revolutionize patient care

through Performance-Guided Surgery, whether our robotics platforms

in combination with novel clinical intelligence can reduce surgical

variability and help surgeons achieve better outcomes, whether we

will be able to initiate 10-12 new Senhance Surgical Systems in

2023, whether, in the first half of 2023, we will be able to

achieve FDA clearance of the Senhance Surgical System for a

pediatric indication, whether, in the second half of 2023, we will

be able to achieve developmental milestones: integrating system

testing for the LUNA Surgical System, preclinical evaluation for

the LUNA Surgical System and standalone ISU final testing, whether

the LUNA Surgical System will revolutionize the way surgery in

performed, whether the collaboration between Asensus Surgical and

Google Cloud will be successful and whether definitive agreements

will be successfully negotiated and lead to a successful

collaboration between Asensus Surgical and Karl Storz. For a

discussion of the risks and uncertainties associated with the

Company’s business, please review our filings with the Securities

and Exchange Commission (SEC). You are cautioned not to place undue

reliance on these forward-looking statements, which are based on

our expectations as of the date of this press release and speak

only as of the origination date of this press release. We undertake

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Asensus Surgical,

Inc.Consolidated Statements of Operations and

Comprehensive Loss(in thousands, except per share

amounts)(Unaudited)

| |

Three Months Ended |

|

|

Years Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

$ |

1,762 |

|

|

$ |

1,748 |

|

|

$ |

4,327 |

|

|

$ |

5,399 |

|

|

Service |

|

306 |

|

|

|

340 |

|

|

|

1,373 |

|

|

|

1,520 |

|

|

Lease |

|

396 |

|

|

|

388 |

|

|

|

1,387 |

|

|

|

1,313 |

|

| Total revenue |

|

2,464 |

|

|

|

2,476 |

|

|

|

7,087 |

|

|

|

8,232 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

987 |

|

|

|

1,070 |

|

|

|

5,303 |

|

|

|

5,741 |

|

|

Service |

|

668 |

|

|

|

453 |

|

|

|

2,174 |

|

|

|

1,799 |

|

|

Lease |

|

643 |

|

|

|

764 |

|

|

|

3,395 |

|

|

|

3,556 |

|

| Total cost of revenue |

|

2,298 |

|

|

|

2,287 |

|

|

|

10,872 |

|

|

|

11,096 |

|

| Gross loss |

|

166 |

|

|

|

189 |

|

|

|

(3,785 |

) |

|

|

(2,864 |

) |

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

8,520 |

|

|

|

6,575 |

|

|

|

28,942 |

|

|

|

19,348 |

|

|

Sales and marketing |

|

3,820 |

|

|

|

3,229 |

|

|

|

14,756 |

|

|

|

13,395 |

|

|

General and administrative |

|

4,794 |

|

|

|

5,926 |

|

|

|

20,172 |

|

|

|

19,323 |

|

|

Amortization of intangible assets |

|

107 |

|

|

|

2,721 |

|

|

|

7,708 |

|

|

|

11,254 |

|

|

Change in fair value of contingent consideration |

|

53 |

|

|

|

(2,578 |

) |

|

|

(1,115 |

) |

|

|

(1,565 |

) |

|

Property and equipment impairment |

|

999 |

|

|

|

— |

|

|

|

1,431 |

|

|

|

— |

|

| Total Operating Expenses |

|

18,293 |

|

|

|

15,873 |

|

|

|

71,894 |

|

|

|

61,755 |

|

| Operating Loss |

|

(18,127 |

) |

|

|

(15,684 |

) |

|

|

(75,679 |

) |

|

|

(64,619 |

) |

| Other Income (Expense),

net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,847 |

|

|

Change in fair value of warrant liabilities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,981 |

) |

|

Interest income |

|

335 |

|

|

|

337 |

|

|

|

1,141 |

|

|

|

590 |

|

|

Interest expense |

|

30 |

|

|

|

(293 |

) |

|

|

(410 |

) |

|

|

(370 |

) |

|

Employee retention tax credit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,311 |

|

|

Other expense, net |

|

(34 |

) |

|

|

(12 |

) |

|

|

(295 |

) |

|

|

(15 |

) |

| Total Other Income (Expense),

net |

|

331 |

|

|

|

32 |

|

|

|

436 |

|

|

|

2,382 |

|

| Loss before income taxes |

|

(17,796 |

) |

|

|

(15,652 |

) |

|

|

(75,243 |

) |

|

|

(62,237 |

) |

|

Income tax expense |

|

(94 |

) |

|

|

(229 |

) |

|

|

(318 |

) |

|

|

(225 |

) |

| Net loss |

|

(17,890 |

) |

|

|

(15,881 |

) |

|

|

(75,561 |

) |

|

|

(62,462 |

) |

| Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

(17,890 |

) |

|

|

(15,881 |

) |

|

|

(75,561 |

) |

|

|

(62,462 |

) |

| Foreign currency translation

loss |

|

2,151 |

|

|

|

(588 |

) |

|

|

(1,867 |

) |

|

|

(2,985 |

) |

| Unrealized gain (loss) on

available-for-sale investments |

|

353 |

|

|

|

(194 |

) |

|

|

(257 |

) |

|

|

(247 |

) |

| Comprehensive loss |

$ |

(15,386 |

) |

|

$ |

(16,663 |

) |

|

$ |

(77,685 |

) |

|

$ |

(65,694 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share

attributable to commonstockholders – basic and diluted |

$ |

(0.08 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

shares used in computingnet loss per common share – basic and

diluted |

|

236,843 |

|

|

|

234,851 |

|

|

|

236,492 |

|

|

|

226,960 |

|

Asensus Surgical,

Inc.Consolidated Balance

Sheets(in thousands, except share

amounts)(Unaudited)

| |

December 31, |

|

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

6,329 |

|

|

$ |

18,129 |

|

|

Short-term investments, available-for-sale |

|

64,195 |

|

|

|

80,262 |

|

|

Accounts receivable, net |

|

2,256 |

|

|

|

749 |

|

|

Inventories |

|

8,284 |

|

|

|

8,634 |

|

|

Prepaid expenses |

|

3,584 |

|

|

|

3,255 |

|

|

Employee retention tax credit receivable |

|

554 |

|

|

|

1,311 |

|

|

Other current assets |

|

1,671 |

|

|

|

957 |

|

| Total Current Assets |

|

86,873 |

|

|

|

113,297 |

|

|

Restricted cash |

|

1,141 |

|

|

|

1,154 |

|

|

Long-term investments, available-for-sale |

|

3,865 |

|

|

|

37,435 |

|

|

Inventories, net of current portion |

|

5,469 |

|

|

|

7,074 |

|

|

Property and equipment, net |

|

9,542 |

|

|

|

10,971 |

|

|

Intellectual property, net |

|

1,576 |

|

|

|

9,892 |

|

|

Net deferred tax assets |

|

174 |

|

|

|

288 |

|

|

Operating lease right-of-use assets, net |

|

4,950 |

|

|

|

5,348 |

|

|

Other long-term assets |

|

2,463 |

|

|

|

1,014 |

|

| Total Assets |

$ |

116,053 |

|

|

$ |

186,473 |

|

| Liabilities and Stockholders’

Equity |

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

3,348 |

|

|

$ |

3,448 |

|

|

Accrued employee compensation and benefits |

|

4,508 |

|

|

|

3,559 |

|

|

Accrued expenses and other current liabilities |

|

1,293 |

|

|

|

1,617 |

|

|

Operating lease liabilities – current portion |

|

800 |

|

|

|

683 |

|

|

Deferred revenue |

|

465 |

|

|

|

543 |

|

| Total Current Liabilities |

|

10,414 |

|

|

|

9,850 |

|

| Long Term Liabilities: |

|

|

|

|

|

|

|

|

Contingent consideration |

|

1,256 |

|

|

|

2,371 |

|

|

Noncurrent operating lease liabilities |

|

4,738 |

|

|

|

5,006 |

|

| Total Liabilities |

|

16,408 |

|

|

|

17,227 |

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

Common stock $0.001 par value, 750,000,000 shares authorized

atDecember 31, 2022 and December 31, 2021; 236,895,440

and235,218,552 shares issued and outstanding at December 31, 2022

andDecember 31, 2021, respectively |

|

237 |

|

|

|

235 |

|

|

Preferred stock, $0.01 par value, 25,000,000 shares authorized, no

sharesissued and outstanding at December 31, 2022 and December 31,

2021,respectively |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

962,731 |

|

|

|

954,649 |

|

|

Accumulated deficit |

|

(860,935 |

) |

|

|

(785,374 |

) |

|

Accumulated other comprehensive loss |

|

(2,388 |

) |

|

|

(264 |

) |

| Total Stockholders’

Equity |

|

99,645 |

|

|

|

169,246 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

116,053 |

|

|

$ |

186,473 |

|

Asensus Surgical,

Inc.Consolidated Statements of Cash

Flows(in

thousands)(Unaudited)

| |

Years Ended |

|

|

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

Operating Activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(75,561 |

) |

|

$ |

(62,462 |

) |

|

Adjustments to reconcile net loss to net cash and cash equivalents

used in operating activities: |

|

|

|

|

|

|

|

|

Depreciation |

|

3,368 |

|

|

|

2,857 |

|

|

Amortization of intangible assets |

|

7,708 |

|

|

|

11,254 |

|

|

Amortization of discounts and premiums on investments, net |

|

565 |

|

|

|

409 |

|

|

Stock-based compensation |

|

8,416 |

|

|

|

9,429 |

|

|

Gain on extinguishment of debt |

|

— |

|

|

|

(2,847 |

) |

|

Deferred tax expense |

|

318 |

|

|

|

225 |

|

|

Change in inventory reserves |

|

620 |

|

|

|

(492 |

) |

|

Bad debt expense |

|

9 |

|

|

|

144 |

|

|

Property and equipment impairment |

|

1,431 |

|

|

|

— |

|

|

Loss on disposal of property and equipment |

|

122 |

|

|

|

— |

|

|

Change in fair value of warrant liabilities |

|

— |

|

|

|

1,981 |

|

|

Change in fair value of contingent consideration |

|

(1,115 |

) |

|

|

(1,565 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

(1,528 |

) |

|

|

174 |

|

|

Inventories |

|

(2,302 |

) |

|

|

(611 |

) |

|

Operating lease right-of-use assets |

|

232 |

|

|

|

(4,254 |

) |

|

Prepaid expenses |

|

(450 |

) |

|

|

146 |

|

|

Employee retention tax credit receivable |

|

757 |

|

|

|

(1,311 |

) |

|

Other current and long-term assets |

|

(2,101 |

) |

|

|

902 |

|

|

Accounts payable |

|

35 |

|

|

|

1,614 |

|

|

Accrued employee compensation and benefits |

|

4,523 |

|

|

|

(859 |

) |

|

Accrued expenses |

|

(3,955 |

) |

|

|

384 |

|

|

Deferred revenue |

|

(55 |

) |

|

|

(229 |

) |

|

Operating lease liabilities |

|

26 |

|

|

|

4,452 |

|

| Net cash and cash equivalents

used in operating activities |

|

(58,937 |

) |

|

|

(40,659 |

) |

| Investing Activities: |

|

|

|

|

|

|

|

|

Purchase of available-for-sale investments |

|

(33,886 |

) |

|

|

(122,330 |

) |

|

Proceeds from maturities of available-for-sale investments |

|

82,702 |

|

|

|

4,030 |

|

|

Purchase of property and equipment |

|

(1,279 |

) |

|

|

(1,368 |

) |

| Net cash and cash equivalents

provided by (used in) investing activities |

|

47,537 |

|

|

|

(119,668 |

) |

| Financing Activities: |

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock and warrants, net of

issuance costs |

|

— |

|

|

|

131,929 |

|

|

Taxes paid related to net share settlement of vesting of restricted

stock units |

|

(350 |

) |

|

|

(1,063 |

) |

|

Proceeds from exercise of stock options and warrants |

|

18 |

|

|

|

30,839 |

|

| Net cash and cash equivalents

(used in) provided by financing activities |

|

(332 |

) |

|

|

161,705 |

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

(81 |

) |

|

|

376 |

|

| Net (decrease) increase in

cash, cash equivalents and restricted cash |

|

(11,813 |

) |

|

|

1,754 |

|

| Cash, cash equivalents and

restricted cash, beginning of period |

|

19,283 |

|

|

|

17,529 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

7,470 |

|

|

$ |

19,283 |

|

| |

|

|

|

|

|

|

|

| Supplemental Disclosure for

Cash Flow Information: |

|

|

|

|

|

|

|

|

Cash paid for leases |

$ |

984 |

|

|

$ |

1,490 |

|

|

Cash paid for taxes |

$ |

165 |

|

|

$ |

170 |

|

| |

|

|

|

|

|

|

|

| Supplemental Schedule of

Non-cash Investing and Financing Activities: |

|

|

|

|

|

|

|

|

Transfer of inventories to property and equipment |

$ |

2,693 |

|

|

$ |

3,244 |

|

|

Reclass of warrant liability to common stock and additional

paid-in-capital |

$ |

— |

|

|

$ |

2,236 |

|

|

Lease liabilities arising from obtaining right-of-use assets |

$ |

577 |

|

|

$ |

5,119 |

|

Asensus Surgical,

Inc.Reconciliation of Non-GAAP

MeasuresAdjusted Net Loss and Adjusted Net Loss

per Share(in thousands except per share

amounts)(Unaudited)

| |

|

Three Months Ended |

|

|

Years Ended |

| |

|

December 31, |

|

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

(GAAP) |

$ |

(17,890 |

) |

|

$ |

(15,881 |

) |

|

$ |

(75,561 |

) |

|

$ |

(62,462 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

107 |

|

|

|

2,721 |

|

|

|

7,708 |

|

|

|

11,254 |

|

|

Change in fair value of contingent consideration |

|

53 |

|

|

|

(2,578 |

) |

|

|

(1,115 |

) |

|

|

(1,565 |

) |

|

Property and equipment impairment |

|

999 |

|

|

|

— |

|

|

|

1,431 |

|

|

|

— |

|

|

Gain on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,847 |

) |

|

Change in fair value of warrant liabilities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,981 |

|

|

Employee retention tax credit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,311 |

) |

| Adjusted

net loss attributable to common stockholders

(Non-GAAP) |

$ |

(16,731 |

) |

|

$ |

(15,738 |

) |

|

$ |

(67,537 |

) |

|

$ |

(54,950 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Years Ended |

| |

|

December 31, |

|

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| Net loss

per share attributable to common stockholders (GAAP) |

$ |

(0.08 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

— |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.05 |

|

|

Change in fair value of contingent consideration |

|

— |

|

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

Property and equipment impairment |

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

Gain on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

Change in fair value of warrant liabilities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

Employee retention tax credit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Adjusted

net loss per share attributable to common stockholders

(Non-GAAP) |

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.24 |

) |

The non-GAAP financial measures for the three

months and years ended December 31, 2022 and 2021, which provide

management with additional insight into the Company’s results of

operations from period to period without non-cash charges and are

calculated using the following adjustments:

a) Intangible assets that are amortized consist

of developed technology and purchased patent rights recorded at

cost and amortized over 5 to 10 years.

b) Contingent consideration in connection with

the acquisition of the Senhance System in 2015 is recorded as a

liability and is the estimate of the fair value of potential

milestone payments related to business acquisitions. Contingent

consideration is measured at fair value using a Monte-Carlo

simulation utilizing significant unobservable inputs including the

probability of achieving each of the potential milestones, revenue

volatility, EURO to USD exchange rate, and an estimated discount

rate associated with the risks of the expected cash flows

attributable to the various milestones. Significant increases or

decreases in any of the probabilities of success or changes in

expected timelines for achievement of any of these milestones would

result in a significantly higher or lower fair value of these

milestones, respectively, and commensurate changes to the

associated liability. The contingent consideration is revalued at

each reporting period and changes in fair value are recognized in

the consolidated statements of operations and comprehensive

loss.

c) Property and equipment impairment associated

with returned Senhance Systems under operating leases and Senhance

Systems currently under operating leases that are not expected to

generate future cash flows sufficient to recover their net book

value.

d) During 2021, the Company received

notification from the U.S. Small Business Administration that the

principal amount of its Paycheck Protection Program loan of $2.8

million and related interest had been forgiven. Gain on

extinguishment of debt of $2.8 million was recognized for the year

ended December 31, 2021, in the consolidated statement of

operations and comprehensive loss.

e) The Company’s Series B Warrants were measured

at fair value using a simulation model which took into account, as

of the valuation date, factors including the current exercise

price, the expected life of the warrant, the current price of the

underlying stock, its expected volatility, holding cost and the

risk-free interest rate for the term of the warrant. The warrant

liability was revalued upon exercise and the final change in fair

value was recognized in the first quarter of 2021.

f) During 2021, the Company submitted a refund

for incurred employee payroll taxes of $1.3 million under the

Employee Retention Tax Credit provision as part of the Coronavirus

Aid, Relief, and Economic Security Act (the “CARES Act”).

INVESTOR CONTACT:

Mark Klausner or Mike Vallie, 443-213-0499

invest@asensus.com

MEDIA CONTACT:

Isabella Rodriguez, 708-833-1572

CG Life

irodriguez@cglife.com

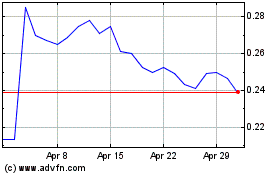

Asensus Surgical (AMEX:ASXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asensus Surgical (AMEX:ASXC)

Historical Stock Chart

From Apr 2023 to Apr 2024