Altisource Asset Management Corporation Reports Third Quarter 2022 Results

November 02 2022 - 8:30AM

Altisource Asset Management Corporation (“AAMC” or the “Company”)

(NYSE American: AAMC) today announced financial and operating

results for the third quarter of 2022.

Third Quarter 2022 Highlights and

Recent Developments

- The Company has acquired and

originated more than $79.1 million in loan commitments and has

earned $1.9 million from loan interest and fee income during the

third quarter of 2022.

- As of September 30, 2022,

AAMC’s cash position was $13.5 million, which is net of the $97.7

million at quarter end for loans held for sale and investment at

fair value.

- The Company entered into a line of

credit agreement with Flagstar Bank FSB ("Flagstar"). As of

September 30, 2022, the Company has drawn $52.5 million on the

line of credit.

- The Company repurchased 286,873

shares of its common stock from Putnam Focused Equity Fund, a

series of Putnam Trust, at $10.00 per share in July 2022.

- The Company hired a Head of Sales

and leased office space in Tampa, Florida for its Alternative

Lending Group and has added staff to originate loans.

- The Company prevailed in our

litigation against its former CEO, Indroneel Chatterjee.

“Since March 2022, AAMC’s Alternative Lending

Group has utilized both its existing capital and new debt financing

to place the Company in a strong position to execute on its

business plan,” said Jason Kopcak, Chief Executive Officer. "We do

not plan on being an aggregator; however, the current volatility in

the fixed income market has delayed our forward flow initiative for

selling assets. We continue to make significant strides

of bringing new capital to the bridge space as take-out investors

for the alternative assets that we are creating.”

Third Quarter 2022 Financial

Results

AAMC’s net loss to common shareholders for the

third quarter of 2022 was $(4.0) million compared to $(5.7) million

for the same period in 2021. Diluted earnings per share was $(2.24)

for the third quarter 2022, compared to $4.76 for the same period

in 2021. The $4.76 includes a $16.1 million gain from a settlement

of preferred stock that is not reflected in the net loss to common

shareholders.

About AAMC

AAMC is an alternative lending company that

provides liquidity and capital to under-served markets. We also

continue to assess opportunities that could potentially be of

long-term benefit to shareholders such as Crypto-ATMs.

Additional information is available at

www.altisourceamc.com.

Forward-looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, regarding management’s beliefs, estimates,

projections, anticipations, and assumptions with respect to, among

other things, the Company’s financial results, margins, employee

costs, future operations, business plans including its ability to

sell loans and obtain funding, and investment strategies as well as

industry and market conditions. These statements may be identified

by words such as “anticipate,” “intend,” “expect,” “may,” “could,”

“should,” “would,” “plan,” “estimate,” “target,” “seek,” “believe,”

and other expressions or words of similar meaning. We caution that

forward-looking statements are qualified by the existence of

certain risks and uncertainties that could cause actual results and

events to differ materially from what is contemplated by the

forward-looking statements. Factors that could cause our actual

results to differ materially from these forward-looking statements

may include, without limitation, our ability to develop our

businesses, and to make them successful or sustain the performance

of any such businesses; our ability to purchase, originate, and

sell loans, our ability to obtain funding, market and industry

conditions, particularly with respect to industry margins for loan

products we may purchase, originate, or sell as well as the current

inflationary economic and market conditions and rising interest

rate environment; our ability to hire employees and the hiring of

such employees; developments in the litigation regarding our

redemption obligations under the Certificate of Designations of our

Series A Convertible Preferred Stock; and other risks and

uncertainties detailed in the “Risk Factors” and other sections

described from time to time in the Company’s current and future

filings with the Securities and Exchange Commission. The foregoing

list of factors should not be construed as exhaustive.

The statements made in this press release are

current as of the date of this press release only. The Company

undertakes no obligation to publicly update or revise any

forward-looking statements or any other information contained

herein, whether as a result of new information, future events or

otherwise.

| |

|

Altisource Asset Management

CorporationCondensed Consolidated Statements of

Operations(In thousands, except share and per

share amounts)(Unaudited) |

| |

|

|

|

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Revenues: |

|

|

|

|

|

|

|

|

Loan interest income |

$ |

1,739 |

|

|

$ |

— |

|

|

$ |

2,263 |

|

|

$ |

— |

|

| Loan fee income |

|

166 |

|

|

|

— |

|

|

|

175 |

|

|

|

— |

|

| Servicing fee revenue |

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Total revenues |

|

1,906 |

|

|

|

— |

|

|

|

2,439 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

1,563 |

|

|

|

878 |

|

|

|

4,042 |

|

|

|

4,078 |

|

| Legal fees |

|

796 |

|

|

|

2,207 |

|

|

|

3,532 |

|

|

|

5,726 |

|

| Professional fees |

|

262 |

|

|

|

165 |

|

|

|

837 |

|

|

|

1,186 |

|

| General and

administrative |

|

779 |

|

|

|

585 |

|

|

|

2,336 |

|

|

|

1,889 |

|

| Servicing and asset management

expense |

|

252 |

|

|

|

— |

|

|

|

433 |

|

|

|

— |

|

| Acquisition charges |

|

— |

|

|

|

1,353 |

|

|

|

513 |

|

|

|

1,353 |

|

| Interest expense |

|

435 |

|

|

|

— |

|

|

|

435 |

|

|

|

60 |

|

| Direct loan expense |

|

99 |

|

|

|

— |

|

|

|

99 |

|

|

|

— |

|

| Loan sales and marketing

expense |

|

5 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

| Total expenses |

|

4,191 |

|

|

|

5,188 |

|

|

|

12,232 |

|

|

|

14,292 |

|

| |

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

| Change in fair value of

loans |

|

(1,563 |

) |

|

|

— |

|

|

|

(1,888 |

) |

|

|

— |

|

| Change in fair value of equity

securities |

|

— |

|

|

|

(3,310 |

) |

|

|

— |

|

|

|

146 |

|

| Gain on sale of equity

securities |

|

— |

|

|

|

1,987 |

|

|

|

— |

|

|

|

8,347 |

|

| Dividend income |

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

3,061 |

|

| Other |

|

8 |

|

|

|

8 |

|

|

|

24 |

|

|

|

87 |

|

| Total other (expense)

income |

|

(1,555 |

) |

|

|

(1,295 |

) |

|

|

(1,864 |

) |

|

|

11,641 |

|

| |

|

|

|

|

|

|

|

| Net loss from continuing

operations before income taxes |

|

(3,840 |

) |

|

|

(6,483 |

) |

|

|

(11,657 |

) |

|

|

(2,651 |

) |

| Income tax expense

(benefit) |

|

146 |

|

|

|

(786 |

) |

|

|

158 |

|

|

|

1,175 |

|

| Net loss from continuing

operations |

$ |

(3,986 |

) |

|

$ |

(5,697 |

) |

|

$ |

(11,815 |

) |

|

$ |

(3,826 |

) |

| |

|

|

|

|

|

|

|

| Gain on discontinued

operations (net of income tax expense of $1,272) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,213 |

|

| Net (loss) income attributable

to common stockholders |

$ |

(3,986 |

) |

|

$ |

(5,697 |

) |

|

$ |

(11,815 |

) |

|

$ |

2,387 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Continuing operations earnings

per share |

|

|

|

|

|

|

|

| Net loss from continuing

operations |

$ |

(3,986 |

) |

|

|

(5,697 |

) |

|

$ |

(11,815 |

) |

|

|

(3,826 |

) |

| Gain on preferred stock

transaction |

|

— |

|

|

|

16,101 |

|

|

|

5,122 |

|

|

|

87,984 |

|

| Numerator for earnings

per share from continuing operations |

$ |

(3,986 |

) |

|

$ |

10,404 |

|

|

$ |

(6,693 |

) |

|

$ |

84,158 |

|

| |

|

|

|

|

|

|

|

| Earnings per share of

common stock – Basic: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

(2.24 |

) |

|

$ |

5.06 |

|

|

$ |

(3.41 |

) |

|

$ |

42.41 |

|

| Discontinued operations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.13 |

|

| Total |

$ |

(2.24 |

) |

|

$ |

5.06 |

|

|

$ |

(3.41 |

) |

|

$ |

45.54 |

|

| Weighted average common stock

outstanding |

|

1,777,009 |

|

|

|

2,055,561 |

|

|

|

1,964,198 |

|

|

|

1,984,294 |

|

| |

|

|

|

|

|

|

|

| Earnings per share of

common stock – Diluted: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

(2.24 |

) |

|

$ |

4.76 |

|

|

$ |

(3.41 |

) |

|

$ |

39.06 |

|

| Discontinued operations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.88 |

|

| Total |

$ |

(2.24 |

) |

|

$ |

4.76 |

|

|

$ |

(3.41 |

) |

|

$ |

41.94 |

|

| Weighted average common stock

outstanding |

|

1,777,009 |

|

|

|

2,187,585 |

|

|

|

1,964,198 |

|

|

|

2,154,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Altisource

Asset Management CorporationCondensed Consolidated

Balance Sheets(In thousands, except share and per

share amounts) |

| |

|

|

|

|

|

September 30, 2022 |

|

December 31, 2021 |

| |

(unaudited) |

|

|

|

ASSETS |

|

|

|

|

Loans held for sale, at fair value |

$ |

7,158 |

|

|

$ |

— |

|

| Loans held for investment, at

fair value |

|

90,514 |

|

|

|

— |

|

| Cash and cash equivalents |

|

10,195 |

|

|

|

78,349 |

|

| Restricted cash |

|

3,000 |

|

|

|

— |

|

| Other assets |

|

4,811 |

|

|

|

3,127 |

|

|

Total assets |

$ |

115,678 |

|

|

$ |

81,476 |

|

| |

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

Liabilities |

|

|

|

| Accrued expenses and other

liabilities |

$ |

3,887 |

|

|

$ |

7,145 |

|

| Lease liabilities |

|

976 |

|

|

|

859 |

|

| Credit facility |

|

52,467 |

|

|

|

— |

|

|

Total liabilities |

|

57,330 |

|

|

|

8,004 |

|

| |

|

|

|

| Commitments and

contingencies |

|

— |

|

|

|

— |

|

| |

|

|

|

| Redeemable preferred

stock: |

|

|

|

| Preferred stock, $0.01 par

value, 250,000 shares authorized as of September 30, 2022 and

December 31, 2021. 144,212 shares issued and outstanding and

$144,212 redemption value as of September 30, 2022 and 150,000

shares issued and outstanding and $150,000 redemption value as of

December 31, 2021. |

|

144,212 |

|

|

|

150,000 |

|

| |

|

|

|

| Stockholders'

deficit: |

|

|

|

| Common stock, $0.01 par value,

5,000,000 authorized shares; 3,425,058 and 1,777,205 shares issued

and outstanding, respectively, as of September 30, 2022 and

3,416,541 and 2,055,561 shares issued and outstanding,

respectively, as of December 31, 2021. |

|

34 |

|

|

|

34 |

|

| Additional paid-in

capital |

|

148,900 |

|

|

|

143,523 |

|

| Retained earnings |

|

45,635 |

|

|

|

57,450 |

|

| Accumulated other

comprehensive income |

|

25 |

|

|

|

54 |

|

| Treasury stock, at cost,

1,647,853 shares as of September 30, 2022 and 1,360,980 shares

as of December 31, 2021. |

|

(280,458 |

) |

|

|

(277,589 |

) |

|

Total stockholders' deficit |

|

(85,864 |

) |

|

|

(76,528 |

) |

|

Total Liabilities and Equity |

$ |

115,678 |

|

|

$ |

81,476 |

|

|

|

|

|

|

|

|

|

|

FOR FURTHER INFORMATION CONTACT:

Investor Relations

T: +1-704-275-9113

E: IR@AltisourceAMC.com

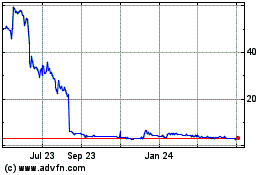

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

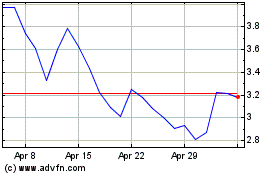

Altisource Asset Managem... (AMEX:AAMC)

Historical Stock Chart

From Apr 2023 to Apr 2024