Alpha Pro Tech, Ltd. (NYSE American: APT), a

leading manufacturer of products designed to protect people,

products and environments, including disposable protective apparel

and building products, today announced financial

results

for the three and nine month periods

ended September 30, 2019.

Lloyd Hoffman, President and Chief Executive

Officer of Alpha Pro Tech, commented, “Sales in our Building Supply

segment continue to increase as a result of increasing sales

volumes in our TECHNO family of spunbond-based (SB) synthetic roof

underlayment products. The expansion of this line of products

earlier this year was instrumental in the more than 60% growth of

our TECHNO products and 16.7% overall growth in synthetic roof

underlayment during the third quarter of 2019 as compared to the

same quarter of 2018. At the same time, housewrap sales were up

more than 15% as a result of improved U.S. housing starts and our

increased efforts to grow market share.”

Hoffman continued, “Year-over-year, our third

quarter profitability was impacted by lower gross profit margin due

to the expiration of duty free status for several of our products

as of June 4, 2019, a change in the mix of building products,

increased rebates and a lower introductory price on products in the

TECHNO SB® synthetic roof underlayment family. Profitability was

further impacted by a significant unrealized loss on marketable

securities in the third quarter of 2019. We also have a challenging

comparable result due to a significant cost recovery from our

former litigation counsel during the third quarter of 2018 that was

not repeated in the third quarter of 2019. We expect gross profit

margin to be in the mid to high thirty percent range next

year.”

Net sales

Consolidated net sales for the third quarter of

2019 were $12.0 million, compared to $12.1 million for third

quarter of 2018, representing a slight decrease of 0.6%, reflecting

decreased sales in the Disposable Protective Apparel segment of

$313,000, partially offset by increased sales in the Building

Supply segment of $236,000.

Building Supply segment sales for the third

quarter of 2019 increased by $236,000, or 3.4%, to $7.2 million,

compared to $7.0 million for the same period of 2018. The segment

increase was primarily due to an increase in synthetic roof

underlayment sales of 16.7% and an increase in housewrap sales of

15.4%, while other woven material sales decreased 56.1% compared to

the same period of 2018. The increases in synthetic roof

underlayment and housewrap sales were primarily due to an increase

in sales of the economy TECHNO SB® family brand of synthetic roof

underlayment, which grew by 60.6% compared to third quarter of

2018, and an increase in sales of the economy REX™ Wrap brand of

housewrap.

Sales for the Disposable Protective Apparel

segment for the third quarter of 2019 decreased by $313,000, or

6.1%, to $4.8 million, compared to $5.1 million for the same period

of 2018. This segment decrease was primarily due to a decrease in

sales of disposable protective garments and face shields, partially

offset by an increase in sales of face masks. The decrease was

primarily due to decreased sales to a large national distributor

that lost business in a bid situation to another one of the

company’s national distributors. The end user continues to use the

company’s Critical Cover® Brand, and, once the end user runs

through its current inventory, we expect the end user to continue

to purchase Alpha Pro Tech products through the distributor that

won the bid. To a lesser extent, the decrease was due to lower

sales to a major international supply chain partner. However, this

partner’s sales of our products to its end users for the three

months ended September 30, 2019 were up 8%, demonstrating demand

for our products.

Consolidated sales for the nine months ended

September 30, 2019 increased to $35.75 million, up from $35.66

million for the nine months ended September 30, 2018, representing

an increase of $90,000, or 0.3%. This increase consisted of

increased sales in the Building Supply segment of $203,000,

partially offset by decreased sales in the Disposable Protective

Apparel segment of $113,000.

Building Supply segment sales for the nine

months ended September 30, 2019 increased by $203,000, or 1.0%, to

$20.4 million, compared to $20.2 million for the same period of

2018. The Building Supply segment increase was primarily due to a

5.3% increase in sales of our core building products, broken down

to an increase in sales of synthetic roof underlayment of 11.1% and

an increase in sales of housewrap of 1.5%, compared to the same

period of 2018. Synthetic roof underlayment sales have increased as

a result of increased sales of the TECHNO family products, and

management expects continued growth from this product line.

Although housewrap sales in the first half of 2019 were negatively

affected by softer U.S. housing starts due in part to unusually

severe weather across many parts of the country, sales in the third

quarter of 2019 increased 15.4%, and we expect continued growth in

housewrap sales due to the current positive outlook towards housing

starts.

In addition, Building Supply segment sales for

the nine months ended September 30, 2019 were significantly

affected by non-core sales of other woven material, which decreased

by 26.8% compared to the same period of 2018. These sales were down

due to lower orders from a customer that currently has seen a

decline in its business.

Sales for the Disposable Protective Apparel

segment for the nine months ended September 30, 2019 slightly

decreased by $113,000, or 0.7%, to $15.3 million, compared to $15.4

million for the same period of 2018. This segment decrease was

primarily due to a decrease in sales of face masks and face

shields, partially offset by a 1.3% increase in disposable

protective garments.

Gross profit

Gross profit decreased by $365,000, or 8.0%, to

$4.2 million for the three months ended September 30, 2019, from

$4.6 million for the same period of 2018. The gross profit margin

was 35.1% for the three months ended September 30, 2019, compared

to 37.9% for the same period of 2018. Gross profit margin in the

third quarter of 2019 was affected as certain products that were

tariff free until June 4, 2019 under the U.S. Customs and Borders

Protection Generalized System of Preferences are no longer duty

free, as the government program was terminated. This change

primarily affected gross profit of the Disposable Protective

Apparel segment and to a much lesser extent the Building Supply

segment. In addition, both segments were negatively impacted by

increased rebates and a change in product mix in the Building

Supply segment. In addition, our TECHNO family of spunbond based

(SB) products, which includes our new TECHNO SB® 25 product, has

been marketed with a lower introductory price that negatively

impacted gross profit in the third quarter. Pricing of the TECHNO

SB® family will be increased during the latter part of the fourth

quarter this year, which should improve gross profit margin going

forward.

Gross profit decreased by $630,000, or 4.6%, to

$13.1 million for the nine months ended September 30, 2019, down

from $13.8 million for the same period of 2018. The gross profit

margin was 36.7% for the nine months ended September 30, 2019,

compared to 38.6% for the same period of 2018.

Management expects gross profit margin to be in

the mid to high thirty percent range next year.

Selling, General and Administrative

Expenses

Selling, general and administrative expenses

increased by $496,000, or 18.5%, to $3.2 million for the three

months ended September 30, 2019, up from $2.7 million in the same

period last year. As a percentage of net sales, selling, general

and administrative expenses increased to 26.4% in the third quarter

of 2019, compared to 22.1% for the same period of 2018. The

increase in selling, general and administrative expenses was

primarily the result of a cost recovery in the third quarter of

2018 that did not recur in the third quarter of 2019. The recovery

in 2018 was due to a cost recovery from our former litigation

counsel.

Selling, general and administrative expenses

increased slightly by $84,000, or 0.8%, to $10.1 million for the

nine months ended September 30, 2019, from $10.0 million for the

nine months ended September 30, 2018. As a percentage of net sales,

selling, general and administrative expenses increased to 28.3% for

the nine months ended September 30, 2019, up from 28.1% for the

same period of 2018. The increase was primarily as a result of

increased Building Supply segment trade show expenses.

Income from Operations

Income from operations decreased by $863,000, or

48.8%, to $906,000 in the third quarter of 2019, compared to $1.8

million for the same period last year. The decreased income from

operations was primarily due to a decrease in gross profit of

$365,000 and an increase in selling, general and administrative

expense of $496,000. Income from operations for the third quarter

of 2018 was positively impacted by the cost recovery from our

former litigation counsel, as mentioned above, and is the primary

reason for the increase in selling, general and administrative

expenses in the third quarter of 2019. Income from operations as a

percentage of net sales for the three months ended September 30,

2019 was 7.5%, compared to 14.6% for the same period of 2018.

Income from operations decreased by $694,000, or

21.0%, to $2.6 million for the nine months ended September 30,

2019, compared to $3.3 million for the nine months ended September

30, 2018. The decreased income from operations was primarily due to

a decrease in gross profit of $630,000 and an increase in selling,

general and administrative expenses of $84,000, partially offset by

a decrease in depreciation and amortization expense of $20,000.

Income from operations as a percentage of net sales for the nine

months ended September 30, 2019 was 7.3%, compared to 9.3% for the

same period of 2018.

Net Income

Net income for the third quarter of 2019 was

$437,000, or $0.03 per diluted share, compared to $1.5 million, or

$0.11 per diluted share, for the same period of 2018, representing

a decrease of $1.1 million, or 71.6%. The net income decrease was

due to a decrease in income before provision for income taxes of

$1.4 million and a decrease in provision for income taxes of

$249,000. Net income in the third quarter of 2019, on a comparable

basis to the prior year period, was negatively impacted by two

large factors: the cost recovery from our former litigation counsel

in the third quarter of 2018 that did not recur in third quarter of

2019, and an unrealized loss on marketable securities of $387,000

in the third quarter of 2019. Net income as a percentage of net

sales for the third quarter of 2019 was 3.6%, and net income as a

percentage of net sales for the same period of 2018 was

12.7%.

Net income for the nine months ended September

30, 2019 was $2.7 million, compared to $3.0 million for the same

period of 2018, representing a decrease of $342,000, or 11.4%. The

net income decrease was due to a decrease in income before

provision for income taxes of $403,000 and a decrease in provision

for income taxes of $61,000. Net income as a percentage of net

sales for the nine months ended September 30, 2019 was 7.5%, and

net income as a percentage of net sales for the same period of 2018

was 8.4%. Basic and diluted earnings per common share for the nine

months ended September 30, 2019 and 2018 were $0.20 and $0.21,

respectively.

Balance Sheet

As of September 30, 2019, the company had cash

of $5.1 million, compared to $7.0 million as of December 31, 2018.

The decrease in cash was due to cash used in financing activities

of $2.0 million, primarily for the repurchase of common stock, and

cash used in investing activities of $1.0 million, partially offset

by cash provided by operating activities of $1.1 million. Working

capital decreased to $24,516,000, representing a decrease of

$24,000 from $24,540,000 as of December 31, 2018. As of September

30, 2019, the Company’s current ratio (current assets/current

liabilities) was 12:1, compared to a 14:1 current ratio as of

December 31, 2018.

Inventory increased by $1.4 million, or 13.9%,

to $11.3 million as of September 30, 2019, up from $9.9 million as

of December 31, 2018. The increase was primarily due to an increase

in inventory for the Building Supply segment, partially offset by a

decrease in inventory for the Disposable Protective Apparel

segment.

Colleen McDonald, Chief Financial Officer,

commented, “During the nine months ended September 30, 2019, we

repurchased 548,000 shares of common stock at a cost of $2.1

million. We have approximately $635,000 remaining for additional

stock repurchases based on the $2 million increase authorized by

our Board of Directors on December 20, 2018. All stock is retired

upon repurchase, and future repurchases are expected to be funded

from cash on hand and cash flows from operating activities.”

The Company currently has no outstanding debt

and maintains an unused $3.5 million credit facility. The Company

believes that current cash balances and the borrowings available

under its credit facility will be sufficient to satisfy projected

working capital needs and planned capital expenditures for the

foreseeable future.

About Alpha Pro Tech, Ltd.

Alpha Pro Tech, Ltd. is the parent company of

Alpha Pro Tech, Inc. and Alpha ProTech Engineered Products, Inc.

Alpha Pro Tech, Inc. develops, manufactures and markets innovative

disposable and limited-use protective apparel products for the

industrial, clean room, medical and dental markets. Alpha ProTech

Engineered Products, Inc. manufactures and markets a line of

construction weatherization products, including building wrap and

roof underlayment. The Company has manufacturing facilities in Salt

Lake City, Utah; Nogales, Arizona; Valdosta, Georgia; and a joint

venture in India. For more information and copies of all news

releases and financials, visit Alpha Pro Tech's Website at

http://www.alphaprotech.com.

Certain statements made in this press release

constitute “forward-looking statements” within the meaning of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include any statement that

may predict, forecast, indicate or imply future results,

performance or achievements instead of historical facts and may be

identified generally by the use of forward-looking terminology and

words such as “expects,” “anticipates,” “estimates,” “believes,”

“predicts,” “intends,” “plans,” “potentially,” “may,” “continue,”

“should,” “will” and words of similar meaning. Without limiting the

generality of the preceding statement, all statements in this press

release relating to estimated and projected earnings, margins,

costs, expenditures, cash flows, sources of capital, growth rates

and future financial and operating results are forward-looking

statements. We caution investors that any such forward-looking

statements are only estimates based on current information and

involve risks and uncertainties that may cause actual results to

differ materially from the results contained in the forward-looking

statements. We cannot give assurances that any such statements will

prove to be correct. Factors that could cause actual results to

differ materially from those estimated by us include the risks,

uncertainties and assumptions described from time to time in our

public releases and reports filed with the Securities and Exchange

Commission, including, but not limited to, our most recent Annual

Report on Form 10-K. We also caution investors that the

forward-looking information described herein represents our outlook

only as of this date, and we undertake no obligation to update or

revise any forward-looking statements to reflect events or

developments after the date of this press release. Given these

uncertainties, investors should not place undue reliance on

forward-looking statements as a prediction of actual

results.

| Company Contact: |

Investor Relations Contact: |

| Alpha Pro Tech, Ltd. |

Hayden IR |

| Donna Millar |

Cameron Donahue |

| 905-479-0654 |

651-653-1854 |

|

e-mail: ir@alphaprotech.com |

e-mail: cameron@haydenir.com |

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

|

|

September

30, |

December

31, |

| |

|

|

|

|

2019 |

|

2018 (1) |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

| |

Cash |

$ |

5,106,000 |

|

$ |

7,007,000 |

| |

Investments |

|

348,000 |

|

|

258,000 |

| |

Accounts receivable, net of allowance for doubtful accounts of |

|

|

|

| |

|

$58,000 and $64,000 as of September 30, 2019 and December 31,

2018 |

|

5,414,000 |

|

|

4,935,000 |

| |

Accounts receivable, related party |

|

755,000 |

|

|

383,000 |

| |

Inventories |

|

11,255,000 |

|

|

9,878,000 |

| |

Right-of-use assets |

|

682,000 |

|

|

- |

| |

Prepaid expenses |

|

3,144,000 |

|

|

3,999,000 |

| |

|

|

Total

current assets |

|

26,704,000 |

|

|

26,460,000 |

| |

|

|

|

|

|

|

|

Property and equipment, net |

|

4,002,000 |

|

|

3,244,000 |

|

Goodwill |

|

55,000 |

|

|

55,000 |

|

Definite-lived intangible assets, net |

|

13,000 |

|

|

16,000 |

|

Right-of-use assets, net of current portion |

|

2,239,000 |

|

|

- |

|

Equity investment in unconsolidated affiliate |

|

4,851,000 |

|

|

4,480,000 |

| |

|

|

Total

assets |

$ |

37,864,000 |

|

$ |

34,255,000 |

| |

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

Current liabilities: |

|

|

|

| |

Accounts payable |

$ |

674,000 |

|

$ |

578,000 |

| |

Accrued liabilities |

|

844,000 |

|

|

1,342,000 |

| |

Lease liabilities |

|

670,000 |

|

|

- |

| |

|

|

Total

current liabilities |

|

2,188,000 |

|

|

1,920,000 |

| |

|

|

|

|

|

|

|

Lease liabilities, net of current portion |

|

2,292,000 |

|

|

- |

|

Deferred income tax liabilities, net |

|

141,000 |

|

|

141,000 |

| |

|

|

Total

liabilities |

|

4,621,000 |

|

|

2,061,000 |

|

Commitments |

|

|

|

|

Shareholders' equity: |

|

|

|

| |

Common stock, $.01 par value: 50,000,000 shares authorized; |

|

|

|

| |

|

13,004,507 and 13,502,684 shares outstanding as of |

|

|

|

| |

|

September 30, 2019 and December 31, 2018, respectively |

|

130,000 |

|

|

135,000 |

| |

Additional paid-in capital |

|

1,058,000 |

|

|

2,669,000 |

| |

Retained earnings |

|

32,055,000 |

|

|

29,390,000 |

| |

|

|

Total

shareholders' equity |

|

33,243,000 |

|

|

32,194,000 |

| |

|

|

Total

liabilities and shareholders' equity |

$ |

37,864,000 |

|

$ |

34,255,000 |

(1)The condensed consolidated balance sheet as of December 31,

2018 has been prepared using information from the audited

consolidated balance sheet as of that date.

Condensed Consolidated Statements of Income

(Unaudited)

| |

|

|

|

For

the Three Months Ended |

|

For the Nine

Months Ended |

| |

|

|

|

September 30, |

|

September

30, |

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

12,027,000 |

|

|

$ |

12,104,000 |

|

$ |

35,745,000 |

|

$ |

35,655,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold, excluding depreciation |

|

|

|

|

|

|

|

|

| |

and amortization |

|

|

7,807,000 |

|

|

|

7,519,000 |

|

|

22,616,000 |

|

|

21,896,000 |

|

| |

|

Gross profit |

|

|

4,220,000 |

|

|

|

4,585,000 |

|

|

13,129,000 |

|

|

13,759,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

| |

Selling, general and administrative |

|

|

3,172,000 |

|

|

|

2,676,000 |

|

|

10,108,000 |

|

|

10,024,000 |

|

| |

Depreciation and amortization |

|

|

142,000 |

|

|

|

140,000 |

|

|

410,000 |

|

|

430,000 |

|

| |

|

Total operating expenses |

|

|

3,314,000 |

|

|

|

2,816,000 |

|

|

10,518,000 |

|

|

10,454,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Income from operations |

|

|

906,000 |

|

|

|

1,769,000 |

|

|

2,611,000 |

|

|

3,305,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Other income: |

|

|

|

|

|

|

|

|

| |

Equity in income of unconsolidated affiliate |

|

|

10,000 |

|

|

|

103,000 |

|

|

371,000 |

|

|

393,000 |

|

| |

Gain (loss) on marketable securities |

|

|

(387,000 |

) |

|

|

25,000 |

|

|

223,000 |

|

|

(40,000 |

) |

| |

Interest income, net |

|

|

18,000 |

|

|

|

1,000 |

|

|

52,000 |

|

|

2,000 |

|

| |

|

Total other income (loss) |

|

|

(359,000 |

) |

|

|

129,000 |

|

|

646,000 |

|

|

355,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Income before provision for income taxes |

|

|

547,000 |

|

|

|

1,898,000 |

|

|

3,257,000 |

|

|

3,660,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

110,000 |

|

|

|

359,000 |

|

|

592,000 |

|

|

653,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

437,000 |

|

$ |

$ |

1,539,000 |

|

$ |

2,665,000 |

|

$ |

3,007,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

|

$ |

0.03 |

|

|

$ |

0.11 |

|

$ |

0.20 |

|

$ |

0.21 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per common share |

|

$ |

0.03 |

|

|

$ |

0.11 |

|

$ |

0.20 |

|

$ |

0.21 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

|

13,056,173 |

|

|

|

13,795,007 |

|

|

13,209,598 |

|

|

14,031,518 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average common shares outstanding |

|

|

13,075,692 |

|

|

|

13,853,619 |

|

|

13,238,026 |

|

|

14,076,033 |

|

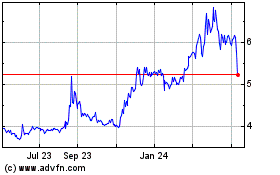

Alpha Pro Tech (AMEX:APT)

Historical Stock Chart

From Mar 2024 to Apr 2024

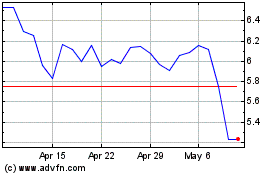

Alpha Pro Tech (AMEX:APT)

Historical Stock Chart

From Apr 2023 to Apr 2024