As

filed with the Securities and Exchange Commission on January 8, 2021

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

82-1436829

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification

No.)

|

1101

Marina Village Parkway, Suite 201

Alameda,

California 94501

(510)

671-8370

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Andrea

Park

Chief

Financial Officer

AgeX

Therapeutics, Inc.

1101

Marina Village Parkway, Suite 201

Alameda,

California 94501

(510)

671-8370

(Name,

address including zip code, and telephone number, including area code, of agent for service)

With

copies to:

Richard

S. Soroko, Esq.

Thompson

Welch Soroko & Gilbert LLP

3950

Civic Center Drive

Suite

300

San

Rafael, CA 94903

Tel:

(415) 448-5000

Approximate

date of commencement of proposed sale to the public: From time to time, after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

|

Non-accelerated

filer ☒

|

Smaller

reporting company ☒

|

|

|

|

Emerging

growth company ☒

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☒

CALCULATION

OF REGISTRATION FEE

|

Title

of each class of

securities

to be registered

|

|

Amount

to

be

registered(1)

|

|

|

Proposed

maximum

offering

price

per

unit

|

|

|

Proposed

maximum

aggregate

offering

price

|

|

|

Amount

of

registration

fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

(3)

|

|

|

-

|

|

|

Preferred Stock, par value $0.0001 per share

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

(3)

|

|

|

-

|

|

|

Warrants

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

(3)

|

|

|

-

|

|

|

Units

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

(3)

|

|

|

-

|

|

|

Total Primary Offering

|

|

|

|

|

|

|

|

|

|

$

|

50,000,000.00

|

|

|

$

|

5,455.00

|

(4)

|

|

Secondary Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

|

16,447,500

|

(5)

|

|

$

|

1.56

|

(6)

|

|

|

25,658,100.00

|

(6)

|

|

|

2,799.30

|

|

|

Common Stock

underlying warrants

|

|

|

2,919,299

|

(7)

|

|

$

|

2.60

|

(8)

|

|

|

7,590,177.40

|

(8)

|

|

|

828.09

|

|

|

Total

|

|

|

19,366,799

|

|

|

|

|

|

|

$

|

83,248,277.40

|

|

|

$

|

9,082.39

|

|

|

(1)

|

Pursuant

to Rule 416(a) under the Securities Act, the shares being registered hereunder include such indeterminate number of shares

of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of

share splits, share dividends or similar transactions.

|

|

|

|

|

(2)

|

There

are being registered hereunder such indeterminate number of shares of common stock and preferred stock, and such indeterminate

number of warrants to purchase shares of common stock and preferred stock, and such indeterminate number of units to be sold

by the Registrant which together shall have an aggregate public offering price not to exceed $50,000,000. Any such

securities registered hereunder may be sold by the Registrant separately or in combination with the other securities

registered hereunder. The securities registered also include such indeterminate number of shares of common stock and preferred

stock as may be issued upon conversion of or exchange for preferred stock that provide for conversion or exchange, upon exercise

of warrants, or pursuant to the anti-dilution provisions of any such securities.

|

|

|

|

|

(3)

|

The

proposed maximum aggregate offering price per class of security will be determined, from time to time, by the Registrant in

connection with the issuance by the Registrant of the securities registered hereunder and is not specified as to each class

of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act.

|

|

|

|

|

(4)

|

With

respect to the primary offering, the registration fee has been calculated in accordance with Rule 457(o) under the Securities

Act..

|

|

|

|

|

(5)

|

The

Registrant is hereby registering 16,447,500 shares of common stock for resale by the Selling Securityholder named in the prospectus

included in this Registration Statement.

|

|

|

|

|

(6)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, based on the

average of the high and low prices of the Registrant’s common stock on January 4, 2021, as reported on the NYSE

American LLC.

|

|

|

|

|

(7)

|

The

Registrant is hereby registering 2,919,299 shares of common stock underlying warrants held by the Selling Securityholder as

of the date of filing this Registration Statement.

|

|

|

|

|

(8)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act.

|

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on

such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and

it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED January 8, 2021

PROSPECTUS

$50,000,000

Common

Stock

Preferred

Stock

Warrants

Units

19,366,799

Shares Common Stock

Offered

by the Selling Securityholder

We

may, from time to time in one or more offerings, offer and sell up to $50.0 million in the aggregate of common stock, preferred

stock, warrants, and units or any combination of the foregoing, either individually or as a combination of one or more of those

securities. This prospectus provides a general description of the securities we may offer. We will provide the specific terms

of the securities offered in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses

to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may

add, update or change information contained in this prospectus. We may sell these securities directly to investors, through agents

designated from time to time or to or through underwriters or dealers. See the section of this prospectus entitled “Plan

of Distribution for the Company” for additional information. If any underwriters are involved in the sale of any securities

with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions or discounts

will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive

from such sale will also be set forth in a prospectus supplement.

This

prospectus also relates to the offer and resale of up to an aggregate of 19,366,799 shares of our common stock, or the Resale

Shares, by the security holder identified as the Selling Securityholder in the section of this prospectus entitled “SELLING

SECURITYHOLDER.” The Resale Shares include (i) 16,447,500 shares of our common stock presently held by the Selling Securityholder

as of the date of this prospectus, and (ii) 2,919,299 shares of our common stock issuable upon the exercise of outstanding warrants,

or the Warrants, held by the Selling Securityholder as of the date of this prospectus.

The

registration of the Resale Shares on behalf of the Selling Securityholder does not necessarily mean that the Selling Securityholder

will offer or sell their Resale Shares pursuant to this prospectus or at any time in the near future. The Selling Securityholder

will be responsible for all discounts, selling commissions and other costs related to the offer and sale of the Resale Shares.

If required, the number of Resale Shares to be sold, the public offering price of those Resale Shares, the names of any broker-dealers

and any applicable commission or discount will be included in a supplement to this prospectus. The Selling Securityholder and

any participating broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933,

as amended, or the Securities Act, in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the Resale Shares purchased by them may be deemed to be underwriting compensation under

the Securities Act. We will not receive any of the proceeds from the sale of the Resale Shares being offered by the Selling Securityholder,

although we may receive proceeds from cash exercises of the Warrants.

Please

read carefully this prospectus, all applicable prospectus supplements, any related free writing prospectuses, and the documents

incorporated by reference herein and therein before you invest in any of our securities. This prospectus may not be used to offer

or sell any securities unless accompanied by the applicable prospectus supplement.

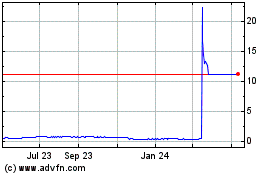

Our

common stock is traded on the NYSE American under the symbol “AGE”. On January 5, 2021, the last reported sales

price of our common stock on the NYSE American was $1.63 per share. None of the other securities we may offer are currently

traded on any securities exchange. The applicable prospectus supplement and any related free writing prospectus will contain information,

where applicable, as to any other listing on the NYSE American or any securities market or exchange of the securities covered

by the prospectus supplement and any related free writing prospectus.

Under

the registration statement to which this prospectus forms a part, we may not sell our securities in a primary offering with a

value exceeding one-third of our public float in any 12-month period (unless our public float rises to $75.0 million or more).

The aggregate market value of AgeX’s outstanding voting and nonvoting common equity held by non-affiliates computed in accordance

with General Instruction I.B.6 to Form S-3 is $37,903,811, based on 20,712,465 shares of common stock held by non-affiliates

and a $1.83 closing price of the common stock on the NYSE American on a date within 60 days prior to the date of this prospectus.

No securities have been offered by AgeX pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month

period that ends on, and includes, the date of this prospectus. We have not offered any securities pursuant to General Instruction

I.B.6. of Form S-3 in the prior 12-month period that ends on and includes the date of this prospectus, other than $12,600,000

of our common stock that may be issued and sold under the sales agreement dated January 8, 2021 with Chardan Capital

Markets LLC, which is being registered concurrently herewith.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS

Act, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and our

filings with the Securities and Exchange Commission.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus,

and under similar headings in the documents incorporated by reference into this prospectus or any applicable prospectus supplement

or any related free writing prospectus for a discussion of the factors we urge you to consider carefully before deciding to purchase

our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is _____________, 2021

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC,

under the Securities Act, using a “shelf” registration process. Under this process, we may, from time to time, offer

and sell, either individually or in combination, in one or more offerings, up to a total dollar amount of $50.0 million

of any of the securities described in this prospectus. This prospectus also includes shares of common stock that may be sold by

the Selling Securityholder from time to time for its own account.

This

prospectus provides a general description of the securities we may offer. Each time we offer and sell securities under this prospectus,

we will provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize

one or more free writing prospectuses to be provided to you that may contain material information relating to a particular offering.

The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this

prospectus or in any documents that we have incorporated by reference into this prospectus with respect to that offering. To the

extent there is a conflict between any statement contained in this prospectus, any applicable prospectus supplement, any related

free writing prospectus or any document incorporated by reference into this prospectus, the statement in the document having the

later date modifies or supersedes the earlier statement.

The

information appearing in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate

only as of the date on the front of the document, and any information we have incorporated by reference is accurate only as of

the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus

supplement or any related free writing prospectus, or the time of any sale of a security. Our business, financial condition, results

of operations and prospects may have changed since those dates.

You

should rely only on the information contained in, or incorporated by reference into, this prospectus and any applicable prospectus

supplement, or the information contained in any free writing prospectus we have authorized for use in connection with a specific

offering. We and the Selling Securityholder have not authorized anyone to provide you with different or additional information.

This prospectus is neither an offer to sell nor a solicitation of an offer to buy any securities other than those registered by

this prospectus, nor is it an offer to sell or a solicitation of an offer to buy securities where an offer or solicitation would

be unlawful.

As

permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information

not contained in this prospectus. This prospectus also contains summaries of certain provisions of the documents described herein,

but all summaries are qualified in their entirety by reference to the actual documents. You may read the registration statement

and the other reports we file with the SEC, and you may obtain copies of the actual documents summarized herein (if and when filed

with the SEC), at the SEC’s website. See “Where You Can Find More Information.”

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document incorporated

by reference into this prospectus were made solely for the benefit of the parties to such agreement, including for the purpose

of allocating risks among such parties, and should not be deemed to be a representation, warranty or covenant to you. Moreover,

such representations, warranties or covenants do not purport to be accurate as of any date other than when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain

all the information you should consider before investing in our securities pursuant to this prospectus. Before making an investment

decision, please carefully read this entire prospectus and the documents incorporated by reference into this prospectus, including

the “Risk Factors” section of this prospectus and our financial statements and the related notes incorporated by reference

into this prospectus. In this prospectus, unless the context otherwise requires, the terms “AgeX,” “we,”

“us” or “our” refer to AgeX Therapeutics, Inc.

Overview

We

are a biotechnology company focused on the development and commercialization of novel therapeutics targeting human aging and degenerative

diseases. Our mission is to apply our comprehensive experience in fundamental biological processes of human aging to a broad range

of age-associated medical conditions. We believe that demand for therapeutics addressing such conditions is on the rise, commensurate

with the demographic shift of aging in the United States and many other industrialized countries.

Our

proprietary technology, based on telomerase-mediated cellular immortality and regenerative biology, allows us to utilize telomerase-expressing

regenerative pluripotant stem cells (“PSCs”) for the manufacture of cell-based therapies to regenerate tissues afflicted

with age-related chronic degenerative disease. Our main technology platforms and product candidates are:

|

|

●

|

PureStem®

PSC-derived clonal embryonic progenitor cell lines

that may be capable of generating a broad range of cell types for use in cell-based therapies;

|

|

|

|

|

|

|

●

|

UniverCyte™

which uses the HLA-G gene to suppress rejection of transplanted cells and tissues to confer low immune observability to cells;

|

|

|

|

|

|

|

●

|

AGEX-BAT1

using adipose brown fat cells for metabolic diseases such as Type II diabetes;

|

|

|

|

|

|

|

●

|

AGEX-VASC1

using vascular progenitor cells to treat tissue ischemia; and

|

|

|

|

|

|

|

●

|

Induced

tissue regeneration or iTR technology to regenerate or rejuvenate cells to treat a variety of degenerative diseases including

those associated with aging, as well as other potential tissue regeneration applications such as scarless wound repair.

|

We

own or have licenses to a number of patents and patent applications used in the generation of these technologies and product candidates,

as well as a license to use patented HyStem® delivery matrices for the transplant of therapeutic cells.

AgeX

plans to use or license its patented UniverCyte™ technology to produce HLA-G-modified pluripotent stem cells that may be

used by AgeX or potential licensees such as other biotechnology or pharma companies to derive universally transplantable specific

cell types suitable for use in cellular transplant therapies.

AgeX’s

other product candidates and its iTR technology are in the discovery stage. The next steps in the development pathway for those

product candidates, including any product candidates developed with iTR technology, is the performance of proof-of-concept studies

in animal models, potentially followed by further pre-clinical lab and animal studies needed to prepare an investigational new

drug or IND submission to the United States Food and Drug Administration or FDA, or a comparable foreign regulatory agency, for

permission to commence clinical trials.

We

are also sponsoring a research program to derive neural stem cells from PSCs to treat Huntington’s Disease, for which proof

of concept studies in animal models have already been conducted at a California university. These neural stem cells may also have

applications in other neurological diseases and disorders, such as Alzheimer’s disease and stroke.

Summary

of Risk Factors

Investing

in AgeX securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus, and

more particularly the risk factors discussed in the documents and other information incorporated by reference in or included in

this prospectus for a discussion of the risks you should carefully consider before investing in AgeX securities. Those Risk Factors

include but are not limited to the following:

Risks

Related to Our Financial Condition

|

|

●

|

We

need additional financing to execute our operating plan and continue to operate as a going concern.

|

|

|

|

|

|

|

●

|

We

do not meet the NYSE American (the “Exchange”) $2,000,000 minimum stockholders equity requirement for continued

listing of our common stock on the Exchange, and as a result our common stock could be delisted if we do meet the Exchange’s

continued listing standards by December 1, 2021 or if prior to that date we do not make progress toward compliance, satisfactory

to the Exchange, under a compliance plan we submitted to the Exchange.

|

|

|

|

|

|

|

●

|

We

are a discovery-stage development company and have incurred operating losses since our inception. We anticipate that we will

incur continued losses for the foreseeable future, and we do not know if we will ever attain profitability.

|

|

|

|

|

|

|

●

|

Our

ability to continue the development of our product candidates and technologies will be adversely impacted by budget constraints

and the reduction in staffing that eliminated most of our research personnel.

|

|

|

|

|

|

|

●

|

If

we fail to meet our obligations under license agreements, we may lose our rights to key technologies on which our business

depends.

|

|

|

|

|

|

|

●

|

We

do not currently have any products on the market and have not yet generated any substantial revenues from operations.

|

|

|

|

|

|

|

●

|

If

the market opportunities for our product candidates are smaller than we believe they are, we may not meet our revenue expectations

and, even assuming approval of a product candidate, our business may suffer.

|

Risks

Related to Our Industry

|

|

●

|

We

have not tested any of our product candidates in clinical trials. Success in early development and preclinical studies or

clinical trials may not be indicative of results obtained in later preclinical studies and clinical trials.

|

|

|

|

|

|

|

●

|

The

regulatory approval processes of the United States Food and Drug Administration, or the FDA, and comparable foreign

authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory

approval for our product candidates, our business will be substantially harmed.

|

|

|

|

|

|

|

●

|

Clinical

studies are costly, time consuming and inherently risky, and we may fail to demonstrate safety and efficacy to the satisfaction

of applicable regulatory authorities.

|

|

|

●

|

The

commercial success of any of our current or future product candidates will depend upon the degree of market acceptance by

physicians, patients, third-party payors, and others in the medical community.

|

|

|

|

|

|

|

●

|

We

will face risks related to the manufacture of medical products for any product candidates that we develop.

|

|

|

|

|

|

|

●

|

Any

cell-based products that receive regulatory approval may be difficult and expensive to manufacture on a commercial scale.

|

|

|

|

|

|

|

●

|

Our

product candidates may cause serious adverse events or undesirable side effects or have other properties which may delay or

prevent their regulatory approval, limit the commercial profile of an approved label, or, result in significant negative consequences

following marketing approval, if any.

|

|

|

|

|

|

|

●

|

The

price and sale of any products that we may develop may be limited by health insurance coverage and government regulation.

|

|

|

|

|

|

|

●

|

We

may become dependent on future collaborations to develop and commercialize our product candidates and to provide the regulatory

compliance, sales, marketing, and distribution capabilities required for the success of our business.

|

|

|

|

|

|

|

●

|

We

have no marketing, sales, or distribution resources for the commercialization of any products or technologies that we might

successfully develop.

|

Risks

Related to Intellectual Property

|

|

●

|

If

we are unable to obtain and enforce patents and to protect our trade secrets, others could use our technology to compete with

us, which could limit opportunities for us to generate revenues by licensing our technology and selling our products.

|

|

|

|

|

|

|

●

|

There

is no certainty that our pending or future patent applications will result in the issuance of patents.

|

|

|

|

|

|

|

●

|

Our

patents may not protect our technologies or products from competition.

|

Risks

Related to Our Relationship with Juvenescence Limited

|

|

●

|

Conflicts

of interest may arise from our relationship with our largest stockholder Juvenescence Limited, or Juvenescence, which

owns a significant percentage of our common stock and is a significant creditor and will be able to substantially influence

us and exert control over matters subject to stockholder approval and the election of directors. The Chairman of our Board

of Directors is the Chief Executive Officer of Juvenescence.

|

|

|

●

|

A

Secured Convertible Facility Agreement, or the 2020 Loan Agreement, between AgeX and Juvenescence provides that the aggregate

principal cash amount outstanding under the 2020 Loan Agreement may be converted, in whole or in part, into shares of AgeX

common stock at any time at Juvenescence’s election. The 2020 Loan Agreement and the Warrants issued in conjunction

with the 2020 Loan Agreement contain a “change of control blocker” provision intended to prevent Juvenescence

from converting an amount of the outstanding loan balance or exercising an amount of Warrants that would result in Juvenescence

holding 50% or more of the outstanding shares of AgeX common stock without approval by the AgeX stockholders. As required

by the 2020 Loan Agreement, at the 2020 annual meeting of stockholders AgeX submitted to its stockholders a proposal to

permit Juvenescence to convert loans outstanding under the 2020 Loan Agreement and to exercise Warrants issued in conjunction

with the 2020 Loan Agreement even if the conversion or exercise would result in Juvenescence holding 50% or more of the outstanding

shares of AgeX common stock. AgeX stockholders approved that proposal and as a result of that approval, Juvenescence may,

through the exercise of Warrants that it holds or through the conversion of outstanding loans to AgeX into shares of AgeX

common stock, acquire additional shares of AgeX common stock that would increase Juvenescence’s holdings to more than

50% of the outstanding shares of AgeX common stock. As a controlling stockholder, Juvenescence would have the power to elect

all directors of AgeX and to approve or reject all matters submitted for stockholder approval by the AgeX Board of Directors,

by Juvenescence, or by other stockholders, including but not limited to: equity compensation plans for employees, officers,

and directors; mergers, acquisitions, and consolidations; sales of AgeX assets; and amendments of our certificate of incorporation

and bylaws. Furthermore, upon Juvenescence holding more than 50% the outstanding AgeX common stock, AgeX would qualify as

a “controlled company” as defined by the NYSE American Company Guide. Being a “controlled company”

would entitle AgeX to exempt itself from the requirement that a majority of its directors be “independent” directors

as defined in the NYSE American Company Guide, and that the Compensation Committee and the Nominating & Corporate Governance

Committee be comprised entirely of independent directors.

|

Risks

Related to the COVID-19 Pandemic

|

|

●

|

The

ongoing COVID-19 global pandemic and the worldwide attempts to contain it could harm our business and our results of operations

and financial condition could be adversely impacted by such pandemic.

|

Corporate

Information

We

were incorporated in 2017 in the state of Delaware and were formerly a majority-owned subsidiary of Lineage Cell Therapeutics,

Inc. (formerly known as BioTime, Inc.) (“Lineage”), a publicly-traded biotechnology company. Since December 28, 2018,

we ceased to be a subsidiary of Lineage for financial reporting purposes when Lineage’s percentage ownership of our outstanding

common stock declined below 50%. As of the date of this prospectus, Lineage’s ownership interest in our common

stock has decreased to below 5%, and Lineage no longer exercises significant influence over our operations and management. Our

principal executive offices are located at 1101 Marina Village Parkway, Suite 201, Alameda, California 94501. Our telephone

number is (510) 671-8370. Our website is www.agexinc.com. Information contained on, or that can be accessed through, our website,

is not, and shall not be considered part of, or deemed to be incorporated in, this prospectus.

RISK

FACTORS

Investing

in our securities involves a high degree of risk and uncertainty. Before making an investment decision with respect to our securities,

we urge you to carefully consider the risks, uncertainties and assumptions described in this prospectus, the applicable prospectus

supplement and the documents incorporated by reference herein and therein, including the risks described in the “Risk

Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Reports on

Form 10-Q for the quarterly periods ended March 31, 2020, June 30, 2020, and September 30, 2020, which are incorporated

by reference into this prospectus. We expect to update these risk factors from time to time in the periodic and current reports

that we file with the SEC after the date of this prospectus, which will be incorporated by reference into this prospectus. In

connection with any specific offering, we also expect to provide risk factors and other information in the applicable prospectus

supplement.

If

one or more of the adverse events relevant to these risks and uncertainties actually occurs, our business, financial condition,

results of operations, cash flows or prospects could be materially adversely affected. This could cause the trading price of our

securities to decline, and you could lose all or part of your investment. Additional risks and uncertainties not presently known

to us or that we currently deem immaterial also may have similar adverse effects on us.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents that are incorporated by reference into this prospectus contain “forward-looking statements”

that involve risks and uncertainties. Our actual results could differ materially from those discussed in the forward-looking statements.

All statements, other than statements of historical fact, included or incorporated by reference in this prospectus, including

but not limited to those regarding our strategy, plans, objectives, expectations, prospects, future operations, capital resources,

financial position, projected costs of and progress with development of our product candidates, regulatory requirements and approvals,

commercialization of our product candidates, collaborations, competition, market exclusivity, and intellectual property, are forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act”, and

Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements are often identified

by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “seek,” “should,” “strategy,” “target,” “will,”

“would” and similar expressions or variations intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. These statements are based on the beliefs and assumptions of our management based

on information currently available to management but such forward-looking statements are subject to risks, uncertainties and other

important factors that could cause actual results and the timing of certain events to differ materially from future results expressed

or implied by such forward-looking statements. These important factors include but are not limited to those discussed under the

“Risk Factors” sections of this prospectus, our Annual Report on Form 10-K, and the other periodic reports and other

filings that we file from time to time with the SEC. Accordingly, we cannot guarantee that we actually will achieve the plans,

intentions or expectations expressed in our forward-looking statements and you should not place undue reliance on our forward-looking

statements. Furthermore, such forward-looking statements speak only as of the date of this prospectus. Except as required by law,

we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such

statements.

Please

consider our forward-looking statements in light of those risks as you read this prospectus. It is not possible for our management

to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You

should not assume that the information contained in this prospectus is accurate as of any date other than as of the date of this

prospectus, or that any information incorporated by reference into this prospectus is accurate as of any date other than the date

of the document so incorporated by reference. Except as required by law, we assume no obligation to update these forward-looking

statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future. Thus, you should not assume that our silence over time means

that actual events are bearing out as expressed or implied in such forward-looking statements.

If

one or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual

results may vary materially from what we anticipate. All subsequent written and oral forward-looking statements attributable to

us or individuals acting on our behalf are expressly qualified in their entirety by this note. Before purchasing any securities

offered by this prospectus, you should consider carefully all of the factors set forth or referred to in this prospectus and the

documents incorporated by reference that could cause actual results to differ.

USE

OF PROCEEDS

Except

as described in any prospectus supplement in connection with a specific offering, we intend to use the net proceeds from our sale

of the securities offered under this prospectus for working capital and general corporate purposes. The principal purposes for

which we intend to use the net proceeds from a specific offering and the approximate amounts intended to be used for each such

purpose will be set forth in the prospectus supplement relating to that offering. We will not receive any proceeds from the sale

of Resale Shares by the Selling Securityholder but we would receive the exercise price of any Warrants that are exercised by the

Selling Securityholder.

MARKET,

INDUSTRY AND OTHER DATA

This

prospectus contains or incorporates by reference estimates, projections and other information concerning our industry, our business

and the markets for our product candidates, including data regarding the estimated size of those markets and their projected growth

rates We obtained the industry, market and other data from our own internal estimates and research, as well as from independent

industry publications and other publicly available information, including information from government agencies. Although we believe

that these sources are reliable, we do not guarantee the accuracy or completeness of third-party information and we have not independently

verified that information. Although we are not aware of any misstatements regarding the market and industry data presented in

this prospectus and the documents incorporated herein by reference, estimates, forecasts, projections, market research or similar

data is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances

that are assumed in that data and are subject to change based on various factors, including those discussed under the heading

“Risk Factors” in this prospectus and under similar headings in the other documents that are incorporated by reference

into this prospectus. Accordingly, investors should not place undue reliance on this information.

DIVIDEND

POLICY

We

have never paid cash dividends on our capital stock and we do not anticipate paying cash dividends in the foreseeable future,

but intend to retain our capital resources for reinvestment in our business. Any future determination to pay cash dividends will

be at the discretion of our board of directors and will be dependent upon our financial condition, results of operations, capital

requirements, requirements of our then-existing credit agreements and other factors as our board of directors deems relevant.

SECURITIES

THAT MAY BE OFFERED

We

may offer shares of common stock, shares of preferred stock, warrants, units consisting of a combination of the foregoing securities

or any other combination of the foregoing. We may offer up to $50.0 million of securities under this prospectus. The prices

and terms of any offering will be determined by market conditions at the time of offering. We may issue preferred stock that is

exchangeable for or convertible into common stock or any of the other securities that may be sold under this prospectus. Each

time we offer securities under this prospectus, we will provide offerees with a prospectus supplement that will describe the specific

amounts, prices and other important terms of the securities being offered.

The

summaries below provide a general description of the securities we may offer and are not intended to be complete. The particular

terms of any security will be described in the applicable prospectus supplement.

DESCRIPTION

OF CAPITAL STOCK

The

following description of our common stock and preferred stock, together with any additional information we include in any applicable

prospectus supplement, documents incorporated by reference or any related free writing prospectus, summarizes the material terms

and provisions of our common stock that we may offer, and the preferred stock that we may offer, under this prospectus. We will

describe the particular terms of any class or series of these securities in more detail in the applicable prospectus supplement.

The description of our capital stock below is summarized from, and qualified in its entirety by reference to, our Certificate

of Incorporation and our bylaws, in each case, as amended and as in effect on the date of this prospectus, each of which has been

publicly filed with the SEC. Certain terms of our capital stock described below are also based on the Delaware General Corporation

Law as in existence on the date of this prospectus, and may be affected by future amendments to such code.

General

Our

Certificate of Incorporation currently authorizes the issuance of up to 100,000,000 shares of common stock, par value $0.0001

per share, and up to 5,000,000 shares of preferred stock, par value $0.0001 per share.

Common

Stock

Each

holder of record of common stock is entitled to one vote for each outstanding share owned, on every matter properly submitted

to the shareholders for their vote. Subject to any dividend rights of holders of any of the preferred stock that we may issue

from time to time, holders of common stock are entitled to any dividend declared by our board of directors out of funds legally

available for that purpose.

Subject

to the prior payment of any liquidation preference to holders of any preferred stock that we may issue from time to time, holders

of common stock are entitled to receive on a pro rata basis all of our remaining assets available for distribution to the holders

of common stock in the event of the liquidation, dissolution, or winding up of our operations. Holders of our common stock do

not have any preemptive, subscription, or redemption rights. All of the outstanding shares of our common stock are fully paid

and non-assessable.

Preferred

Stock

We

may issue preferred stock in one or more series, at any time, with such rights, preferences, privileges and restrictions as our

board of directors may determine, all without further action of our shareholders. Any series of preferred stock which may be authorized

by our board of directors in the future may be senior to and have greater rights and preferences than our common stock. There

are no shares of preferred stock presently outstanding and we have no present plan, arrangement, or commitment to issue any preferred

stock.

The

rights, privileges, preferences and restrictions of any class or series of preferred stock may be subordinated to, pari passu

with or senior to any of those of any present or future class or series of preferred stock or common stock. Our board of directors

is also expressly authorized to increase or decrease the number of shares of any series subsequent to the issue of that series,

but not below the number of shares of such series then outstanding. The issuance of preferred stock may have the effect of decreasing

the market price of our common stock and may adversely affect the voting power of holders of our common stock and reduce the likelihood

that holders of our common stock will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred

stock could have the effect of delaying, deferring or preventing a change in our control or other corporate action.

The

particular terms of each class or series of preferred stock that we may offer under this prospectus, including redemption privileges,

liquidation preferences, voting rights, dividend rights or conversion rights, will be more fully described in the applicable prospectus

supplement relating to the preferred stock offered thereby. The applicable prospectus supplement will specify the terms of the

class or series of preferred stock we may offer, including:

|

|

●

|

the

distinctive designation and the maximum number of shares in the class or series;

|

|

|

|

|

|

|

●

|

the

number of shares we are offering and the purchase price per share;

|

|

|

●

|

the

liquidation preference, if any;

|

|

|

|

|

|

|

●

|

the

terms on which dividends, if any, will be paid;

|

|

|

|

|

|

|

●

|

the

voting rights, if any;

|

|

|

|

|

|

|

●

|

the

terms and conditions, if any, on which the shares of the class or series shall be convertible into, or exchangeable for, shares

of any other class or series of authorized capital stock;

|

|

|

|

|

|

|

●

|

the

terms on which the shares may be redeemed, if at all;

|

|

|

|

|

|

|

●

|

any

listing of the preferred stock on any securities exchange or market;

|

|

|

|

|

|

|

●

|

a

discussion of any material or special U.S. federal income tax considerations applicable to the preferred stock; and

|

|

|

|

|

|

|

●

|

any

or all other preferences, rights, restrictions, including restrictions on transferability and qualifications of shares of

the class or series.

|

NYSE

American Listing

Our

common stock is listed on the NYSE American under the symbol “AGE.”

Transfer

agent and registrar

The

transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn,

New York 11219.

DESCRIPTION

OF WARRANTS

General

We

may offer warrants for the purchase of shares of common stock, shares of preferred stock or the other securities registered hereby,

in one or more series. We may issue the warrants by themselves or together with common stock, preferred stock, other warrants

or units, and the warrants may be attached to or separate from any offered securities. While the terms we have summarized below

will apply generally to any warrants that we may offer under this prospectus, we will describe in particular the terms of any

series of warrants that we may offer in more detail in the applicable prospectus supplement and any applicable free writing prospectus.

The terms of any warrants offered by a prospectus supplement may differ from the terms described below.

We

will file as an exhibit to the registration statement of which this prospectus forms a part, or will incorporate by reference

from another report that we file with the SEC, the form of warrant or warrant agreement, which may include a form of warrant certificate,

as applicable, that describes the terms of the particular series of warrants we may offer before the issuance of the related series

of warrants. We may issue the warrants under a warrant agreement that we will enter into with a warrant agent to be selected by

us. The warrant agent will act solely as our agent in connection with the warrants and will not assume any obligation or relationship

of agency or trust for or with any registered holders of warrants or beneficial owners of warrants. The following summary of material

provisions of the warrants and warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions

of the form of warrant or warrant agreement and warrant certificate applicable to a particular series of warrants. We urge you

to read the applicable prospectus supplement and any related free writing prospectus, as well as the complete form of warrant

or the warrant agreement and warrant certificate, as applicable, that contain the terms of the warrants.

The

particular terms of any issue of warrants will be described in the prospectus supplement relating to the issue. Those terms may

include:

|

|

●

|

the

title of such warrants;

|

|

|

|

|

|

|

●

|

the

aggregate number of such warrants;

|

|

|

|

|

|

|

●

|

the

price or prices at which such warrants will be issued;

|

|

|

|

|

|

|

●

|

the

currency or currencies (including composite currencies) in which the price of such warrants may be payable;

|

|

|

|

|

|

|

●

|

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise

of such warrants;

|

|

|

|

|

|

|

●

|

the

price at which the securities purchasable upon exercise of such warrants may be purchased;

|

|

|

|

|

|

|

●

|

the

date on which the right to exercise such warrants will commence and the date on which such right shall expire;

|

|

|

|

|

|

|

●

|

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price

of the warrants;

|

|

|

|

|

|

|

●

|

if

applicable, the minimum or maximum amount of such warrants that may be exercised at any one time;

|

|

|

|

|

|

|

●

|

if

applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants

issued with each such security;

|

|

|

|

|

|

|

●

|

if

applicable, the date on and after which such warrants and the related securities will be separately transferable;

|

|

|

|

|

|

|

●

|

information

with respect to book-entry procedures, if any;

|

|

|

|

|

|

|

●

|

the

terms of any rights to redeem or call the warrants;

|

|

|

|

|

|

|

●

|

U.S.

federal income tax consequences of holding or exercising the warrants, if material; and

|

|

|

|

|

|

|

●

|

any

other terms of such warrants, including terms, procedures and limitations relating to the exchange or exercise of such warrants.

|

Each

warrant will entitle its holder to purchase the number of securities at the exercise price set forth in, or calculable as set

forth in, the applicable prospectus supplement. The warrants may be exercised as set forth in the prospectus supplement relating

to the warrants offered. Unless we otherwise specify in the applicable prospectus supplement, warrants may be exercised at any

time up to the close of business on the expiration date set forth in the prospectus supplement relating to the warrants offered

thereby. After the close of business on the expiration date, unexercised warrants will become void.

We

will specify the place or places where, and the manner in which, warrants may be exercised in the form of warrant, warrant agreement

or warrant certificate and applicable prospectus supplement. Upon receipt of payment and the warrant or warrant certificate, as

applicable, properly completed and duly executed at the designated office of any warrant agent, or any other office (including

ours) indicated in the prospectus supplement, we will, as soon as practicable, issue and deliver the securities purchasable upon

such exercise. If less than all of the warrants (or the warrants represented by such warrant certificate) are exercised, a new

warrant or a new warrant certificate, as applicable, will be issued for the remaining amount of warrants. If we so indicate in

the applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for

warrants.

Prior

to the exercise of any warrants to purchase common stock or preferred stock, holders of the warrants will not have any of the

rights of holders of common stock or preferred stock purchasable upon exercise, including the right to vote or to receive any

payments of dividends or payments upon our liquidation, dissolution or winding up on the common stock or preferred stock purchasable

upon exercise, if any.

DESCRIPTION

OF UNITS

The

following description, together with the additional information we may include in any applicable prospectus supplement, summarizes

the material terms and provisions of the units that we may offer under this prospectus. While the terms we have summarized below

will apply generally to any units that we may offer under this prospectus, we will describe the particular terms of any series

of units in more detail in the applicable prospectus supplement and any related free writing prospectus. The terms of any units

offered by a prospectus supplement may differ from the terms described in this prospectus.

We

will file as an exhibit to the registration statement of which this prospectus forms a part, or will incorporate by reference

from another report we file with the SEC, the form of unit agreement that describes the terms of the series of units we may offer

under this prospectus, and any supplemental agreements, before the issuance of the related series of units. The following summaries

of material terms and provisions of the units are subject to, and qualified in their entirety by reference to, all the provisions

of the unit agreement and any supplemental agreements applicable to a particular series of units. We urge you to read the applicable

prospectus supplement and any related free writing prospectus, as well as the complete unit agreement and any supplemental agreements

that contain the terms of the units.

General

We

may offer units comprised of any combination of our common stock, preferred stock, warrants or other units, in one or more series.

Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder

of a unit will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is

issued may provide that the securities included in the unit may not be held or transferred separately, at any time or at any time

before a specified date.

We

will describe in the applicable prospectus supplement the terms of the series of units, including:

|

|

●

|

the

designation and terms of the units and of the securities comprising the units, including whether and under what circumstances

those securities may be held or transferred separately;

|

|

|

|

|

|

|

●

|

any

provisions of the governing unit agreement that differ from those described in this prospectus; and

|

|

|

|

|

|

|

●

|

any

provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units.

|

The

provisions described in this section, as well as those described in the sections of this prospectus titled “Description

of Capital Stock” and “Description of Warrants” will apply to each unit and to any common stock,

preferred stock or warrant included in each unit, respectively.

Enforceability

of Rights by Holders of Units

Each

unit agent will act solely as our agent under the applicable unit agreement and will not assume any obligation or relationship

of agency or trust with any holder of any unit. A single bank or trust company or other institution may act as unit agent

for more than one series of units. A unit agent will have no duty or responsibility in case of any default by us under the applicable

unit agreement or unit, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand

upon us. Any holder of a unit may, without the consent of the related unit agent or the holder of any other unit, enforce by appropriate

legal action its rights as holder under any security included in the unit.

We

and any unit agent (including any of its agents) may treat the registered holder of any unit certificate as an absolute owner

of the units evidenced by that certificate for any purpose and as the person entitled to exercise the rights attaching to the

units so requested, despite any notice to the contrary.

AGEX

PLAN OF DISTRIBUTION

We

may sell our securities directly to one or more investors. We may also sell our securities through agents designated from time

to time or to or through underwriters or dealers. The applicable prospectus supplement and any related free writing prospectus

will describe the terms of the offering of the securities, including, to the extent applicable:

|

|

●

|

the

name or names of any agents, underwriters or dealers;

|

|

|

|

|

|

|

●

|

the

purchase price of the securities being offered and the net proceeds we will receive from the sale;

|

|

|

|

|

|

|

●

|

any

over-allotment options under which underwriters may purchase additional securities from us;

|

|

|

|

|

|

|

●

|

any

agency fees or underwriting discounts and other items constituting agents’ or underwriters’ compensation;

|

|

|

|

|

|

|

●

|

any

discounts or concessions allowed or re-allowed or paid to dealers; and

|

|

|

|

|

|

|

●

|

any

securities exchanges or markets on which such securities may be listed.

|

We

may distribute our securities from time to time in one or more transactions at:

|

|

●

|

a

fixed price or prices, which may be changed from time to time;

|

|

|

|

|

|

|

●

|

market

prices prevailing at the time of sale;

|

|

|

|

|

|

|

●

|

prices

related to such prevailing market prices; or

|

|

|

|

|

|

|

●

|

negotiated

prices.

|

Agents

We

may designate agents who agree to use their reasonable efforts to solicit purchases of our securities for the period of their

appointment or to sell our securities on a continuing basis. We will name any agent involved in the offering and sale of securities

and we will describe any fees or commissions we will pay the agent in the applicable prospectus supplement.

Underwriters

If

we use underwriters for a sale of securities, the underwriters will acquire the securities for their own account. The underwriters

may resell the securities in one or more transactions, including negotiated transactions, at a fixed public offering price or

at varying prices determined at the time of sale. The obligations of the underwriters to purchase the securities will be subject

to the conditions set forth in the applicable underwriting agreement. Subject to certain conditions, the underwriters will be

obligated to purchase all the securities of the series offered if they purchase any of the securities of that series. We may change

from time to time any public offering price and any discounts or concessions the underwriters allow or reallow or pay to dealers.

We may use underwriters with whom we have a material relationship. We will name any underwriter involved in the offering and sale

of securities, describe any discount or other compensation and describe the nature of any material relationship in any applicable

prospectus supplement. Only underwriters we name in the prospectus supplement will be underwriters of the securities offered by

that prospectus supplement.

Underwriters,

dealers and agents that participate in the distribution of the securities may be underwriters as defined in the Securities Act,

and any discounts or commissions they receive from us and any profit on their resale of the securities may be treated as underwriting

discounts and commissions under the Securities Act. We will identify in the applicable prospectus supplement any underwriters,

dealers or agents and will describe their compensation. We may have agreements with the underwriters, dealers and agents to indemnify

them against specified civil liabilities related to offerings under this prospectus, including liabilities under the Securities

Act, or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities. Underwriters,

dealers and agents may engage in transactions with or perform services for us in the ordinary course of their businesses.

Trading

Markets and Listing of Securities

Unless

otherwise specified in the applicable prospectus supplement, each class or series of securities will be a new issue with no established

trading market, other than our common stock, which is currently listed on the NYSE American. We may elect to list or qualify for

trading any other class or series of securities on any securities exchange or other market, but we are not obligated to do so.

It is possible that one or more underwriters may make a market in a class or series of securities, but the underwriters will not

be obligated to do so and may discontinue any market making at any time without notice. We cannot give any assurance as to the

liquidity of the trading market for any of the securities.

Stabilization

Activities

Any

underwriter may engage in overallotment, stabilizing transactions, short covering transactions and penalty bids in accordance

with Regulation M under the Exchange Act. Overallotment involves sales in excess of the offering size, which create a short position.

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified

maximum. Short covering transactions involve purchases of the securities in the open market after the distribution is completed

to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities

originally sold by the dealer are purchased in a covering transaction to cover short positions. Those activities may cause the

price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of these activities

at any time.

Passive

Market Making

Any

underwriter who is a qualified market maker on the NYSE American may engage in passive market making transactions in securities

listed on the NYSE American in accordance with Rule 103 of Regulation M, during the business day prior to the pricing of the offering,

before the commencement of offers or sales of the securities. A passive market maker must comply with applicable volume and price

limitations and must be identified as a passive market maker. In general, a passive market maker must display its bid at a price

not in excess of the highest independent bid for such security. If all independent bids are lowered below the passive market maker’s

bid, however, the passive market maker’s bid must then be lowered when certain purchase limits are exceeded.

SELLING

SECURITYHOLDER

This

prospectus also relates to the offer and resale of up to an aggregate of 19,366,799 shares of our common stock, or the Resale

Shares, by Juvenescence Limited as the Selling Securityholder. The Resale Shares are comprised of: (i) 16,447,500 shares held

by the Selling Securityholder as of the date of this prospectus, and (ii) 2,919,299 shares issuable upon the exercise of Warrants

held by the Selling Securityholder as of the date of this prospectus.

Selling

Securityholder Table

The

following table and accompanying footnotes, which were prepared based on information furnished to us by or on behalf of the Selling

Securityholder and information filed with the SEC, set forth information regarding the beneficial ownership of shares of our common

stock owned by the Selling Securityholder as of January 5, 2021. Beneficial ownership is determined in accordance with

rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under the rules

of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting

power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which

includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner

of a security if that person has the right to acquire beneficial ownership of such security within 60 days. The potential acquisition

of additional shares of common stock by the Selling Securityholder through the conversion of the principal balances of loans outstanding

under the 2019 Loan Agreement and 2020 Loan Agreement is discussed below under the caption “Certain Transactions and Relationships

Between AgeX and the Selling Securityholder.” Shares of common stock that may be issued to the Selling Securityholder upon

the conversion of future loans that may be made under the 2020 Loan Agreement or upon the exercise of any Warrants that may be

issued to the Selling Securityholder in the future if additional loans are made under the 2020 Loan Agreement, are not included

as shares beneficially owned because the amount of those shares will depend on future lending events and market prices for AgeX

common stock which are not presently determinable.

The

percentage of shares beneficially owned is based on 37,691,047 shares of our common stock issued and outstanding as of

January 5, 2021. Shares of our common stock that the Selling Securityholder has the right to acquire within 60 days

of the filing date of this prospectus are deemed outstanding for purposes of computing the percentage ownership of the Selling

Securityholder’s holdings. The number of shares and percentage of our outstanding common stock to be beneficially owned

after completion of this offering assumes that the Selling Securityholder will sell all the Resale Shares offered hereby. The

Selling Securityholder may offer all, some, or none of the Resale Shares. The Selling Securityholder may have sold, transferred,

otherwise disposed of or purchased, or may sell, transfer, otherwise dispose of or purchase, at any time and from time to time,

shares of our common stock in transactions exempt from the registration requirements of the Securities Act, or in the open market

after the date on which they provided the information set forth in the table below. As discussed above, the Selling Securityholder

may also acquire additional shares of AgeX common stock through the conversion of the principal balance of future loans to AgeX

and the exercise of any additional Warrants that may be issued in connection with any such future loans.

Information

concerning the Selling Securityholder may change over time. Any changed information will be set forth in amendments to the registration

statement of which this prospectus forms a part or in supplements to this prospectus, if and when necessary or as otherwise required

by law.

|

|

|

Beneficial

Ownership of

|

|

|

Common

Stock

|

|

|

Beneficial

Ownership

|

|

|

|

|

Common

Stock Prior

|

|

|

Saleable

|

|

|

of

Common Stock

|

|

|

|

|

to

the Offering

|

|

|

Pursuant

|

|

|

After

the Offering (2)

|

|

|

|

|

Number

of

|

|

|

Percent

of

|

|

|

to

This

|

|

|

Number

of

|

|

|

Percent

of

|

|

|

Name

of Selling Stockholder

|

|

Shares(1)

|

|

|

Class

|

|

|

Prospectus

|

|

|

Shares(2)

|

|

|

Class

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Juvenescence Limited

|

|

|

23,354,529

|

|

|

|

52.37

|

%

|

|

|

19,366,799

|

|

|

|

3,987,730

|

|

|

|

8.94

|

%

|

(1)

The Selling Securityholder beneficially owns an aggregate of 23,354,529 shares of common stock, representing (i) 16,447,500

shares of common stock held directly, (ii) 150,000 shares of common stock that may be acquired on exercise of the 2019 Warrants,

(iii) 2,769,299 shares of common stock that may be acquired on exercise of New Warrants issued connection with advances under

the 2020 Loan Agreement, and (iv) an additional 3,987,730 shares the Selling Securityholder may acquire through the conversion

of the principal balance of the current amounts outstanding under the 2020 Loan Agreement that may be issued as of January