UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

AGEAGLE

AERIAL SYSTEMS INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

AGEAGLE AERIAL SYSTEMS INC.

8833 E. 34th Street North

Wichita, Kansas 67226

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

to be held on February 3, 2023

TO THE SHAREHOLDERS OF AGEAGLE AERIAL SYSTEMS

INC.:

This Special Meeting of the Shareholders

(the “Special Meeting”) of AgEagle Aerial Systems Inc., a Nevada corporation (the “Company”), will be held on

February 3, 2023, at 11:00 a.m., local time, 700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118, for the following purposes:

(1)

To approve the issuance of shares of our common stock, par value $0.001 per share (the “Common

Stock”), representing more than 20% of our Common Stock outstanding upon the purchase

of series F convertible preferred stock, par value $0.001 per share (the “Series F

Convertible Preferred Stock”) convertible into shares of Common Stock and warrants

exercisable for shares of Common Stock (the “Warrants”), in accordance with NYSE

American Rule 713(a)(ii);

(2) To

approve a reverse stock split of the Common Stock in the range of one share of Common Stock for every three shares of Common Stock to

one share for every eight shares of Common Stock, with the final ratio to be determined by the Company’s board of directors (the

“Board”); and

(3) To

consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

Proposals.

Shareholders of record of the

Company’s Common Stock at the close of business on December 9, 2022 are entitled to notice of, and to vote at, the Special

Meeting or any adjournment or postponement thereof.

Your attention is directed to

the Proxy Statement accompanying this Notice for a more complete statement of matters to be considered at the Special Meeting.

We

are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows

companies to furnish proxy materials primarily over the Internet. We believe that it will

expedite shareholders’ receipt of proxy materials, lower costs and reduce the environmental

impact of distributing proxy materials for our Special Meeting. It is anticipated that on

or about December 16, 2022, we will commence mailing to our shareholders (other than those

who previously requested electronic or paper delivery) a Notice of Internet Availability

of Proxy Materials (the “Notice”) containing instructions on how to access our

proxy materials, including this Proxy Statement over the Internet. The Notice also includes

instructions on how you can receive a paper copy of the proxy materials by mail. If you receive

meeting materials by mail, the Notice, this Proxy Statement and proxy card will be enclosed.

If you receive your proxy materials via e-mail, the e-mail will contain voting instructions

and links to this Proxy Statement on the Internet, which is available at www.proxyvote.com.

All shareholders are cordially

invited to attend the meeting. Whether or not you plan to participate in this Special Meeting, your vote is very important and we encourage

you to vote promptly. After reading this Proxy Statement, please promptly mark, sign and date the enclosed proxy card and return it by

following the instructions on the proxy card or voting instruction card or vote by telephone or by Internet. If you attend the Special

Meeting, you will have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with

a brokerage firm, bank, or other nominee, please follow the instructions you receive from your brokerage firm, bank, or other nominee

to vote your shares.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Barrett Mooney |

| |

Barrett Mooney |

| |

Chairman of the Board of Directors |

| |

|

| Dated: December 16 , 2022 |

|

AGEAGLE AERIAL SYSTEMS INC.

8833 E. 34th Street North

Wichita, Kansas 67226

PROXY STATEMENT

for

Special Meeting of Shareholders

to be held February 3, 2023

PROXY SOLICITATION

The

Company is soliciting proxies on behalf of the Board of Directors (the “Board”)

in connection with the Special Meeting of the shareholders (the “Special Meeting”)

of AgEagle Aerial Systems Inc., a Nevada corporation (the “Company”), which will

be held on February 3, 2023, at 11:00 a.m., local time, at 700 NW 1st Avenue, Ste.

1200, Miami, Florida 33136-4118, for the following purposes:

(1) To

approve the issuance of shares of our Common Stock, par value $0.001 per share (the “Common

Stock”), representing more than 20% of our Common Stock outstanding upon the purchase

of series F convertible preferred stock, par value $0.001 per share (the “Series F

Convertible Preferred Stock”) convertible into shares of Common Stock and warrants

exercisable for shares of Common Stock (the “Warrants”), in accordance with NYSE

American Rule 713(a)(ii);

(2) To

approve a reverse stock split of the Common Stock in the range of one share of Common Stock for every three shares of Common Stock outstanding

to one share for every eight shares of Common Stock outstanding, with the final ratio to be determined by the Company’s board of

directors (the “Board”); and

(3) To

consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

Proposals.

The

Board set December 9, 2022 as the record date (the “Record Date”) to determine

those holders of the Common Stock who are entitled to notice of, and to vote at, the Special

Meeting. A list of the shareholders entitled to vote at the meeting may be examined at the

Company’s office at 8833 E 34th Street North, Wichita, Kansas 67226 during the 10-day

period preceding the Special Meeting.

It

is anticipated that on or about December 16, 2022, the Company shall commence mailing to

all shareholders of record, as of the Record Date, a Notice of Availability of Proxy Materials

(the “Notice”). Please carefully review the Notice for information on how to

access the Notice of Special Meeting and access the Proxy Statement on www.proxyvote.com,

in addition to instructions on how you may request to receive a paper or email copy of

these documents. There is no charge to you for requesting a paper copy of these documents.

IMPORTANT: Please mark, date, and sign the

enclosed proxy card and promptly return it in the accompanying postage-paid envelope or vote by telephone or by Internet to assure that

your shares are represented at the meeting.

IMPORTANT

NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD ON FEBRUARY 3, 2023: Our Proxy Statement is enclosed.

A complete set of proxy materials relating to our Special Meeting, consisting of the Notice

of the Special Meeting of Shareholders, the Proxy Statement is available on the Internet.

The Proxy Statement may be viewed at www.proxyvote.com.

GENERAL INFORMATION ABOUT VOTING

Proxy Materials

Why am I receiving these materials?

The

Board of Directors (the “Board”) of AgEagle Aerial Systems Inc. (the “Company”)

has made these proxy materials available to you on the Internet, or, upon your request, has

delivered printed versions of these materials to you by mail, in connection with the solicitation

of proxies for use at the Company’s Special Meeting, which will take place on February

3, 2023, at 11:00 a.m. local time at 700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118.

As a shareholder, you are invited

to participate in the Special Meeting and are requested to vote on the proposals described in this Proxy Statement. This Proxy Statement

includes information that we are required to provide to you under Securities and Exchange Commission (“SEC”) rules and is

designed to assist you in voting your shares.

What is included in these materials?

The proxy materials include:

| ● | this Proxy Statement for the Special

Meeting; and |

| ● | the proxy card or a voting instruction

card for the Special Meeting. |

Why did I receive a notice in the mail

regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

In

accordance with rules adopted by the SEC, we may furnish proxy materials, including this Proxy Statement, to our shareholders by providing

access to such documents over the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the

proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (“Notice”), which

was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet.

If you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting such materials in

the Notice.

How can I access the proxy materials over the

Internet?

The

Notice of Internet Availability, proxy card or voting instructions card will contain instructions on how to:

| ● | access and view our proxy materials

for the Special Meeting over the Internet; and |

| ● | how to vote your shares. |

If you choose to receive our

future proxy materials electronically, it will save us the cost of printing and mailing documents to you and will reduce the impact of

printing and mailing these materials on the environment. If you choose to receive future proxy materials electronically, you will receive

an e-mail next year with instructions containing a link to the website where those materials are available. Your election to receive

proxy materials electronically will remain in effect until you terminate it.

How may I obtain a paper copy of the

proxy materials?

Shareholders receiving a Notice

will find instructions in that notice about how to obtain a paper copy of the proxy materials. Shareholders receiving a Notice by e-mail

will find instructions in that e-mail about how to obtain a paper copy of the proxy materials. Shareholders who have previously submitted

a standing request to receive paper copies of our proxy materials will receive a paper copy of the proxy materials by mail.

What shares are included on the proxy

card?

If you are a shareholder of record,

you will receive only one proxy card for all the shares you hold of record in certificate form and in book-entry form.

If

you are a beneficial owner, you will receive voting instructions from your broker, bank or other holder of record.

What is “householding” and

how does it affect me?

We have adopted a procedure approved

by the SEC called “householding.” Under this procedure, shareholders of record who have the same address and last name and

do not participate in electronic delivery of proxy materials will receive only one copy of the Notice of the Special Meeting of Stockholders

and this Proxy Statement, unless we are notified that one or more of these stockholders wishes to continue receiving individual copies.

This procedure will reduce our printing costs and postage fees.

Shareholders who participate

in householding will continue to receive separate proxy cards.

If you are eligible for householding,

but you and other shareholders of record with whom you share an address currently receive multiple copies of the Notice the Special Meeting

of Shareholders and the Proxy Statement, or if you hold stock of the Company in more than one account, and in either case you wish to

receive only a single copy of each of these documents for your household, please contact the Corporate Secretary of the Company by sending

a written request to AgEagle Aerial Systems Inc., Corporate Secretary, 8833 E 34th Street North, Wichita, Kansas 67226.

If you participate in householding

and wish to receive, free of charge, a separate copy of the Notice of Special Meeting of Shareholders and this Statement, or if you do

not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact

the Corporate Secretary of the Company, as set forth above.

If you are a beneficial owner,

you can request information about householding from your broker, bank, or other holder of record.

Voting Information

What items of business will be voted

on at the Special Meeting?

The items of business scheduled

to be voted on at the Special Meeting are:

(1) To

approve the issuance of shares of our Common Stock, representing more than 20% of our Common Stock outstanding upon the Series F Convertible

Preferred Stock convertible into shares of Common Stock and Warrants exercisable for shares of Common Stock, in accordance with NYSE

American Rule 713(a)(ii);

(2) To

approve a reverse stock split of the Common Stock in the range of one share of Common Stock for every three shares of Common Stock outstanding

to one share for every eight shares of Common Stock outstanding, with the final ratio to be determined by the Company’s board of

directors (the “Board”); and

(3) To

consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

Proposals.

How does the Board recommend that I vote?

The Board unanimously recommends

that you vote your shares:

| |

● |

“FOR”

approving the issuance of shares of our Common Stock representing more than 20% of our Common Stock outstanding upon the conversion

of the Series F Convertible Preferred Stock and exercise of the Warrantin accordance with NYSE American Rule 713(a)(ii); |

| |

● |

“FOR”

approving a reverse stock split of the Common Stock in the range of one share of Common Stock for every three shares of Common Stock

outstanding to one share for every eight shares of Common Stock outstanding, with the final ratio to be determined by the Company’s

board of directors (the “Board”); and |

| |

● |

“FOR” adjourning the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Proposals. |

Who is entitled to vote at

the Special Meeting?

Only

shareholders of record at the close of business on December 9, 2022 (the “Record

Date”) will be entitled to vote at the Special Meeting. As of the Record Date, 88,009,151

shares of the Common Stock were outstanding and entitled to vote. Each share of Common

Stock outstanding on the Record Date is entitled to one vote on each proposal.

Is there a list of shareholders entitled

to vote at the Special Meeting?

The names of shareholders of

record entitled to vote at the Special Meeting will be available for ten days prior to the Special Meeting at our principal executive

offices at 8833 E 34th Street North, Wichita, Kansas 67226. If you would like to examine the list for any purpose germane to the Special

Meeting prior to the meeting date, please contact our Corporate Secretary.

How can I vote if I own shares directly?

Most shareholders do not own

shares registered directly in their name, but rather are “beneficial holders” of shares held in a stock brokerage account

or by a bank or other nominee (that is, shares held “in street name”). Those shareholders should refer to “How can

I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?” below for instructions regarding how

to vote their shares.

If, however, your shares are

registered directly in your name with our transfer agent, Equiniti Trust Company, you are considered, with respect to those shares, the

shareholder of record, and these proxy materials are being sent directly to you. You may vote in the following ways:

| ● | By Mail: Votes may

be cast by mail, as long as the proxy card or voting instruction card is delivered in accordance

with its instructions prior to 4:00 p.m., Eastern Daylight Time, on February 2, 2023.

Shareholders who have received a paper copy of a proxy card or voting instruction card by

mail may submit proxies by completing, signing, and dating their proxy card or voting instruction

card and mailing it in the accompanying pre-addressed envelope. |

| ● | By Attending the Meeting:

Please follow the instructions in the “How can I participate and vote in the Special

Meeting” section of this proxy statement. |

| |

● |

By

Phone or Internet: Shareholders may vote by phone or Internet by following the instructions included in the proxy card they received.

Your vote must be received by 11:59 p.m., Eastern Time on February 2, 2023 to be counted. If you receive a Notice by mail, you

may vote by proxy over the Internet by going to www.proxyvote.com to complete an electronic proxy card or vote your proxy by phone

by calling 1-800-690-6903. Have your proxy card available when you access the website or when you call. We provide Internet and

telephone proxy voting to allow you to vote your shares on-line or by phone, with procedures designed to ensure the authenticity and

correctness of your proxy vote instructions. However, please be aware that you must bear any costs or usage charges from Internet access

providers and telephone companies. |

If

you vote by proxy, your vote must be received by 11:59 p.m. U.S. Eastern Daylight Time on

February 2, 2023, to be counted.

Whichever method you select to

transmit your instructions, the proxy holders will vote your shares in accordance with those instructions. If no specific instructions

are given, the shares will be voted in accordance with the recommendation of our Board and as the proxy holders may determine in their

discretion with respect to any other matters that properly come before the meeting.

How can I vote if my shares are held

in a stock brokerage account, or by a bank or other nominee?

If your shares are held in a

stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street

name,” and your broker or nominee is considered the “stockholder of record” with respect to those shares. Your broker

or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank,

or other nominee how to vote, and you are also invited to participate in the Special Meeting. However, since you are not the stockholder

of record, you may not vote these shares in person unless you obtain a legal proxy from your brokerage firm or bank. If a broker, bank,

or other nominee holds your shares, you will receive instructions from them that you must follow in order to have your shares voted.

What is a quorum for the Special Meeting?

The presence of the holders of

stock representing a majority of the voting power of all shares of Common Stock issued and outstanding as of the Record Date, represented

in person or by proxy, is necessary to constitute a quorum for the transaction of business at the Special Meeting. Your shares will be

counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker) or if you participate

in, and vote electronically at, the Special Meeting. Abstentions and broker non-votes will be counted as present for purposes of determining

a quorum.

What is the voting requirement to approve

each of the proposals?

| Proposal |

|

Vote

Required |

|

Broker Discretionary Voting

Allowed |

| No. 1

– Approval of Issuance of More than 20% of our Common Stock Upon Conversion of Series F Convertible Preferred Stock and Exercise

of the Warrant |

|

Affirmative

vote of a majority of shares present and entitled to vote in person or by proxy |

|

No |

| No.

2 – Approval of a reverse stock split of the Common Stock in the range of one share of Common Stock for every three shares

of Common Stock outstanding to one share for every eight shares of Common Stock outstanding, with the final ratio to be determined

by the Company’s board of directors (the “Board”); and |

|

Affirmative

vote of a majority of shares issued and outstanding |

|

No |

| No.

3– Adjourn the Special Meeting to solicit more votes to approve the Proposals |

|

Affirmative

vote of a majority of shares present and entitled to vote in person or by proxy |

|

No |

What is the effect of abstentions and

broker non-votes?

Abstentions will have the same

effect as an “AGAINST” vote while broker non-votes will not be counted as votes cast and, accordingly, will not have an effect

on Proposal Nos. 1 and 3. Abstentions and broker non-votes will have the same effect as an “AGAINST” vote on Proposal No.

2.

If

you are a beneficial owner and hold your shares in “street name” in an account

at a bank or brokerage firm, it is critical that you cast your vote if you want it to count

in the vote on the above proposals. Under the rules governing banks and brokers who submit

a proxy card with respect to shares held in “street name,” such banks and brokers

have the discretion to vote on routine matters, but not on non-routine matters. Banks and

brokers may not vote any of the proposals being presented at the Special Meeting if you do

not provide specific voting instructions. Accordingly, we encourage you to vote promptly,

even if you plan to participate in the Special Meeting. In tabulating the voting results

for any particular proposal, shares that constitute broker non-votes are not considered entitled

to vote on that proposal.

Can I change my vote or revoke my proxy?

Subject to any rules and deadlines

your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Special

Meeting. If you are a shareholder of record, you may change your vote by (1) delivering to the Company’s Corporate Secretary, prior

to your shares being voted at Special Meeting, a written notice of revocation dated later than the prior proxy card relating to the same

shares, (2) delivering a valid, later-dated proxy in a timely manner, (3) attending the Special Meeting and voting electronically (although

attendance at the Special Meeting will not, by itself, revoke a proxy), or (4) voting again via phone or Internet at a later date.

If you are a beneficial owner

of shares held in street name, you may change your vote (1) by submitting new voting instructions to your broker, trustee or other nominee,

or (2) if you have obtained a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote

the shares and provided a copy to our transfer agent and registrar, Equiniti, together with your email address as described below, by

attending the Special Meeting and voting electronically.

Any written notice of revocation

or subsequent proxy card must be received by the Company’s Corporate Secretary prior to the taking of the vote at the Special Meeting.

Who will bear the cost of soliciting

votes for the Special Meeting?

The Company will bear the cost

of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you access the proxy materials

over the Internet, you are responsible for Internet access charges you may incur. In addition, we will request banks, brokers and other

intermediaries holding shares of our Common Stock beneficially owned by others to obtain proxies from the beneficial owners and will

reimburse them for their reasonable expenses in so doing. Solicitation of proxies by mail may be supplemented by telephone, by electronic

communications and personal solicitation by our Executive Officers, Directors, and employees. No additional compensation will be paid

to our Executive Officers, Directors or employees for such solicitation.

Proxies with respect to the Special

Meeting may be solicited by telephone, by mail on the Internet or in person. AgEagle has engaged Advantage Proxy to assist in the solicitation

of proxies.

Who Can Answer Your Questions About Voting Your

Shares?

If you are a holder of AgEagle’s

shares and have any questions about how to vote or direct a vote in respect of your securities, you may call Advantage Proxy, P.O. Box

13581, Des Moines, WA 98198 Attention: Karen Smith, Telephone: 877-870-8565.

PROPOSAL NO. 1

APPROVAL

OF THE ISSUANCE OF SHARES OF OUR COMMON STOCK REPRESENTING MORE THAN 20% OF OUR COMMON STOCK

OUTSTANDING UPON EXERCISE OF SERIES F CONVERTIBLE PREFERRED AND WARRANT TO BE ISSUED IN ACCORDANCE

WITH NYSE AMERICAN RULE 713(a)(ii).

Our Common Stock is currently

listed on the NYSE American. We are subject to NYSE American Rule 713(a)(ii), which requires us to obtain shareholder approval when shares

will be issued in connection with a transaction involving the sale, issuance or potential issuance by the issuer of Common Stock (or

securities convertible into or exercisable for Common Stock) equal to 20% or more of presently outstanding shares for less than the greater

of book or market value of the shares.

Securities Purchase Agreement

On June 26, 2022, the Company

entered into a Securities Purchase Agreement (the “Agreement”) with an institutional investor (the “Investor”)

that is an existing shareholder of the Company. Pursuant to the terms of the Agreement, the Board authorized the sale of 10,000 shares

of a newly designated series of preferred stock, the Series F 5% Convertible Preferred Stock (the “Series F Convertible Preferred

Stock”) and warrants exercisable for up to 16,129,032 shares of the Common Stock an exercise price of $0.96 per share (the “Warrants”),

for gross proceeds of approximately $15.5 million. The Series F Convertible Preferred Stock will convert into 16,129,032 shares of the

Company’s Common Stock (the “Conversion Shares,” and together with the shares underlying the Warrants, the “Underlying

Shares”) at a conversion price of $0.62 per share. The Warrants are not exercisable for the first six months after issuance and

have a three-year term from the exercise date. Upon exercise of the Warrants in full by the Investor, the Company would receive additional

gross proceeds of approximately $10 million.

Additional Series F Convertible Preferred

Stock and Warrants to be Issued

During the period beginning June

26, 2022 and ending on the 18 month anniversary of the Company’s receipt of shareholder approval, which is the subject of this

Proposal No. 1 (the “Shareholder Approval”), the Investor has the right to purchase additional Series F Convertible Preferred

Stock and Warrants from the Company, in minimum aggregate subscription amount tranches of $2,000,000 each, up to a total aggregate additional

stated value of the Series F Convertible Preferred Stock equal to $25,000,000 (the “Additional Investment”).

The Series F Convertible Preferred

Stock and Warrants in the Additional Investment shall be identical to the securities sold on June 26, 2022, except (i) the original issue

date of the Series F Convertible Preferred Stock and the initial exercise date and termination date of the Warrants shall be from the

applicable subsequent Closing Date, and (ii) the purchase price per share of Series F Convertible Preferred Stock shall be adjusted such

that the conversion price shall equate to the average of the VWAPs for the three trading days prior to the date on which the Investor

gives notice to the Company of an additional closing, and the Warrant exercise price shall also be the average of the VWAPs for the three

trading days prior to the date on which the Investor gives notice to the Company of an additional closing. As a condition to the Investor’s

purchase of the Additional Investment, among other things, the Company must obtain Shareholder Approval for the issuance of all of the

Underlying Shares in excess of 19.99% of the issued and outstanding Common Stock as of the execution date of the Agreement.

Why Approval is Needed and Proposed Use

of Funds

At the time of the execution

of the Agreement, the Additional Investment in shares of Series F Convertible Preferred and Warrants would have been convertible for

more than 20% of our Common Stock outstanding. NYSE American Rule 713(a)(ii) requires that we obtain shareholder approval of the issuances

of Common Stock and/or securities convertible into, or exercisable for, Common Stock in excess of 20% of our current issued and outstanding

shares of Common Stock. Accordingly, we seek your approval of Proposal No. 1 to issue additional Series F Convertible Preferred Stock

and Warrants to the Investor, at its option, in order to satisfy the requirements of NYSE American Rule 713(a)(ii).

Assuming

this Proposal No. 1 is approved by the shareholders, and the Investor, at its option, purchases

up to the full $25 million in Additional Investments, we currently anticipate that the

net proceeds raised from the Additional Investments would be used for:

| ● | research and development to further

enhance the performance and capabilities of our current product offerings and to continue

introducing new, innovative drone products; |

| ● | global sales and marketing initiatives

designed to fuel greater awareness and appreciation of our products and accelerate our sales

growth, and |

| ● | investments in potential strategic

acquisitions and organic growth initiatives. |

Approval Required

The approval of Proposal No.

1 requires the affirmative vote of holders of a majority of the stock having voting power present in person or represented by proxy at

the Special Meeting. Abstentions have the effect of a vote “AGAINST” Proposal No. 1 and broker “non-votes” will

have no effect with respect to the approval of the Proposal No.1.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL NO. 1.

PLEASE NOTE: If your shares are held in street

name, your broker, bank, custodian or other nominee holder cannot vote your shares for Proposal No. 1, unless you direct the holder how

to vote, by marking your proxy card, or by following the instructions on the enclosed proxy card to vote on the Internet or by telephone.

PROPOSAL NO. 2

APPROVAL TO EFFECT A REVERSE SPLIT OF THE COMPANY’S

COMMON STOCK

Purpose of the Reverse Split

Our Board has determined that

it is in our best interest to effect a reverse split of our Common Stock. At this time, the Board is seeking approval from the shareholders

to authorize a reverse split in the range of one share for every three shares outstanding to one share for every eight shares outstanding

with all fractional shares rounded up to the next whole share (the “Reverse Split”). If Proposal No. 2 is approved, the Board

would make the determination as to the final ratio of the reverse stock split. Our Board believes that the Reverse Split of our Common

Stock will provide for a higher stock price that will attract greater interest and sponsorship from institutional investors.

Certain Risks Associated with the Reverse Split

While the Board believes that

the Company’s Common Stock would trade at higher prices after the consummation of the Reverse Split, there can be no assurance

that the increase in the trading price will occur, or, if it does occur, that it will equal or exceed three to eight times the market

price of the Common Stock prior to the Reverse Split. In some cases, the total market value of a company following a reverse stock split

is lower, and may be substantially lower, than the total market value before the reverse stock split. In addition, the fewer number of

shares that will be available to trade could possibly cause the trading market of the Common Stock to become less liquid, which could

have an adverse effect on the price of the Common Stock. The market price of the Common Stock is based on our performance and other factors,

some of which may be unrelated to the number of our shares outstanding. In addition, there can be no assurance that the Reverse Split

will result in a per share price that will attract brokers and investors who do not trade in lower priced stock.

Principal Effects of the Reverse Split

The

Reverse Split would have the following effects based upon 88,009,151 shares Common

Stock issued and outstanding as of the Record Date. In the following discussion, we provide

examples of the effects of the Reverse Split at the lower-end of the Reverse Split range

and at the higher-end of the Reverse Split range.

If the Reverse Split is approved

at the lower end of the Reverse Split range:

| ● | in a one-for-three Reverse Split,

every three of our shares of Common Stock issued and outstanding immediately prior to the

Reverse Split effective date (the “Old Shares”) owned by a shareholder will automatically

and without any action on the part of the shareholders be converted into one (1) share of

our Common Stock (the “New Shares”); and |

| |

● |

the

number of shares of our Common Stock issued and outstanding will be reduced from 88,009,151 shares to approximately 29,336,384

shares. |

If the Reverse Split is approved

at the higher end of the Reverse Split range:

| |

● |

in

a one-for-eight Reverse Split, every eight of our Old Shares owned by a shareholder would be exchanged for one (1) New Share; and |

| |

● |

the

number of shares of our Common Stock issued and outstanding will be reduced from 88,009,151 shares to approximately 11,001,144

shares. |

The Reverse Split will be effected

simultaneously for all of our outstanding Common Stock and the exchange ratio will be the same for all of our outstanding Common Stock.

The Reverse Split will affect all of our shareholders uniformly and will not affect any shareholder’s percentage ownership interests

in the Company, except to the extent that the Reverse Split results in any of our shareholders owning a fractional share. As described

below, shareholders and holders of options and warrants holding fractional shares will have their shares rounded up to the nearest whole

number. Common Stock issued pursuant to the Reverse Split will remain fully paid and non-assessable.

Fractional Shares. No

scrip or fractional share certificates will be issued in connection with the Reverse Split. Shareholders who otherwise would be entitled

to receive fractional shares because they hold a number of Old Shares not evenly divisible by one (1) for three (3) or by one (1) for

eight (8) Reverse Split ratio, will be entitled, upon surrender of certificate(s) representing these shares, to a number of shares of

New Shares rounded up to the nearest whole number. The ownership of a fractional interest will not give the shareholder any voting, dividend

or other rights except to have his or her fractional interest rounded up to the nearest whole number when the New Shares are issued.

Options and Warrants. All

outstanding options, warrants, notes, debentures and other securities convertible into Common Stock will be adjusted as a result of the

Reverse Split, as required by the terms of these securities. In particular, the conversion ratio for each instrument will be reduced,

and the conversion price or exercise price, if applicable, will be increased, in accordance with the terms of each instrument and based

on the ratio in the range of one share of Common Stock for every three shares of Common Stock to one share for every eight shares of

Common Stock, with the final ratio to be determined by the Company’s board of directors.

Authorized Shares. The

Company is presently authorized under its Articles of Incorporation to issue 250,000,000 shares of Common Stock. Upon effectiveness of

the Reverse Split, the number of authorized shares of Common Stock would remain the same, although the number of shares of Common Stock

issued and outstanding will decrease. Because the number of issued and outstanding shares of Common Stock will decrease, the number of

shares of Common Stock remaining authorized and available for issuance will increase. The issuance in the future of additional shares

of our Common Stock may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and

voting rights of the currently outstanding shares of our Common Stock. The effective increase in the number of authorized but unissued

and unreserved shares of the Company’s Common Stock may be construed as having an anti-takeover effect as further discussed below.

Authorized but unissued shares will be available for issuance, and we may issue such shares in future financings or otherwise. If we

issue additional shares, the ownership interest of holders of our Common Stock would be diluted. Also, the issued shares may have rights,

preferences or privileges senior to those of our Common Stock.

Impact

of the Reverse Split on Awards Issued under our 2017 Omnibus Equity Incentive Plan (the “Plan”).

The Company currently has reserved a total of 10,000,000 shares of Common Stock for issuance

as awards to be made under the Plan. As of the date hereof, the Company has 3,566,313

awards granted under the Plan, and has 4,4045,970 shares of Common Stock remaining

for future issuance under the Plan. Pursuant to the Plan, in the event of any adjustment,

including a reverse stock split as proposed, the aggregate number of shares of Common Stock

available under the Plan may be appropriately adjusted by the Board. The Board

has determined to maintain the current number of shares of Common Stock available for issuance

of awards under the Plan at 10,000,000 shares of Common Stock. The Board believes that maintaining

the number of shares of Common Stock available for issuance as provided in the Plan will

provide the Compensation Committee with greater flexibility in the administration of the

Plan and is appropriate in light of the growth of the Company in order to attract and retain

key individuals. The effect of the Reverse Split on the awards issued under the Plan based

on the range is as follows:

| |

● |

in

a one-for-three Reverse Split, the number of shares previously issued under the award granted under the Plan will be reduced from3,566,313

to 1,188,771 and |

| |

● |

in

a one-for-eight Reverse Split, the number of shares previously issued under the award granted under the Plan will be reduced from

3,566,313 to 445,789. |

If the Reverse Split is approved,

at the lower end of the Reverse Split range, the total authorized number of shares under the Plan will represent approximately 11.9%

of the issued and outstanding shares of Common Stock of the Company as of the date hereof.

If the Reverse Split is approved,

at the higher end of the Reverse Split range, the total authorized number of shares under the Plan will represent approximately 0.45%

of the issued and outstanding shares of Common Stock of the Company as of the date hereof.

Accounting

Matters. The Reverse Split will not affect the par value of our Common Stock. As

a result, on the effective date of the Reverse Split, the stated capital on our balance sheet

attributable to our Common Stock will be reduced in proportion to the Reverse Split ratio

(that is, in a one-for-three Reverse Split, the stated capital attributable to our Common

Stock will be reduced to one-third of its existing amount and in a one-for-eight Reverse

Split, the stated capital attributable to our Common Stock will be reduced to one-eighth

of its existing amount) and the additional paid-in capital account shall be credited

with the amount by which the stated capital is reduced. The per share net income or loss

and net book value of our Common Stock will also be increased because there will be fewer

shares of our Common Stock outstanding.

Potential Anti-Takeover Effect. Although

the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect

(for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition

of our Board or contemplating a tender offer or other transaction for the combination of the Company with another company), the Reverse

Split was not proposed in response to any effort of which we are aware to accumulate our shares of Common Stock or obtain control of

us, nor is it part of a plan by management to recommend a series of similar actions having an anti-takeover effect to our Board and shareholders.

Other than the Reverse Split, our Board does not currently contemplate recommending the adoption of any other corporate action that could

be construed to affect the ability of third parties to take over or change control of the Company.

The number of shares held by

each individual shareholder will be reduced if the Reverse Split is implemented. This will increase the number of shareholders who hold

less than a “round lot,” or 100 shares. Typically, the transaction costs to shareholders selling “odd lots” are

higher on a per share basis. Consequently, the Reverse Split could increase the transaction costs to existing shareholders in the event

they wish to sell all or a portion of their shares.

The Company is subject to the

periodic reporting and other requirements of the Exchange Act. If the proposed Reverse Split is implemented, our Common Stock will continue

to be reported on The NYSE American under the symbol “UAVS.” We will continue to be subject to the periodic reporting requirements

of the Exchange Act.

Procedure for Effecting a Reverse Split and

Exchange of Stock Certificates

The Reverse Split will be accomplished

by amending the Company’s Articles of Incorporation to effect the split. The Reverse Split will become effective at such future

date and the exact ratio to be as determined by the Board, as evidenced by the filing of an amendment to the Company’s Articles

of Incorporation with the Secretary of State of the State of Nevada (which we refer to as the “Effective Time”) following

the affirmative vote of the Company’s shareholders at the Special Meeting. Beginning at the Effective Time, each certificate representing

Old Shares will be deemed for all corporate purposes to evidence ownership of New Shares. As soon as practicable after the Effective

Time, shareholders will be notified that the Reverse Split has been effected. The Company expects that its transfer agent, Equiniti Trust,

will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of Old Shares will be asked to surrender

to the exchange agent certificates representing Old Shares in exchange for certificates representing New Shares in accordance with the

procedures to be set forth in the letter of transmittal the Company sends to its shareholders. No new certificates will be issued to

any shareholder until such shareholder has surrendered such shareholder’s outstanding certificate(s), together with the properly

completed and executed letter of transmittal, to the exchange agent. Any Old Shares submitted for transfer, whether pursuant to a sale,

other disposition or otherwise, will automatically be exchanged for New Shares. Equiniti Trust, does not charge a fee for each certificate

issued representing New Shares.

SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S)

AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Material U.S. Federal Income Tax Consequences

of the Reverse Split

The following is a general discussion

of the material U.S. federal income tax consequences of the Reverse Split to a current shareholder of the Company that is a U.S. Holder

(as defined below), and who holds stock of the Company as a “capital asset,” as defined in Section 1221 of the Code (generally,

property held for investment). This discussion does not purport to be a complete analysis of all of the potential tax effects of the

Reverse Split. Tax considerations applicable to a particular shareholder will depend on that shareholder’s individual circumstances.

This discussion is based on provisions

of the Code, the Treasury Regulations promulgated thereunder (whether final, temporary, or proposed), administrative rulings of the IRS,

and judicial decisions, all as in effect on the date hereof, and all of which are subject to differing interpretations or change, possibly

with retroactive effect. This discussion does not purport to be a complete analysis or listing of all potential U.S. federal income tax

considerations that may apply to a holder as a result of the Reverse Split. In addition, this discussion does not address all aspects

of U.S. federal income taxation that may be relevant to particular holders nor does it take into account the individual facts and circumstances

of any particular holder that may affect the U.S. federal income tax consequences to such holder, and accordingly, is not intended to

be, and should not be construed as, tax advice. This discussion does not address the U.S. federal 3.8% Medicare tax imposed on certain

net investment income or any aspects of U.S. federal taxation other than those pertaining to the income tax, nor does it address any

tax consequences arising under any tax laws other than the U.S. federal income tax law, such as gift or estate tax laws, U.S. state and

local, or non-U.S. tax laws.

This discussion does not address

all aspects of U.S. federal income taxation that may be important to holders in light of their individual circumstances, including holders

subject to special treatment under the U.S. tax laws, such as, for example:

| ● | banks or other financial institutions,

underwriters, or insurance companies; |

| ● | traders in securities who elect

to apply a mark-to-market method of accounting; |

| ● | real estate investment trusts and

regulated investment companies; |

| ● | tax-exempt organizations, qualified

retirement plans, individual retirement accounts, or other tax- deferred accounts; |

| ● | expatriates or former long-term

residents of the United States; |

| ● | subchapter S corporations, partnerships

or other pass-through entities or investors in such entities; |

| ● | dealers or traders in securities,

commodities or currencies; |

| ● | persons subject to the alternative

minimum tax; |

| ● | U.S. persons whose “functional

currency” is not the U.S. dollar; |

| ● | persons who received stock of the

Company through the issuance of restricted stock under an incentive plan or through a tax-qualified

retirement plan or otherwise as compensation; |

| ● | persons who own (directly or through

attribution) 5% or more (by vote or value) of the outstanding stock of the Company; |

| ● | holders who hold stock of the Company,

as a position in a “straddle,” as part of a “synthetic security”

or “hedge,” as part of a “conversion transaction,” or other integrated

investment or risk reduction transaction; |

| ● | controlled foreign corporations,

passive foreign investment companies, or foreign corporations with respect to which there

are one or more United States shareholders within the meaning of Treasury Regulation Section

1.367(b)-3(b)(1)(ii); or |

| ● | the Sponsor or its affiliates. |

As used in this proxy statement/consent

solicitation statement/prospectus, the term “U.S. Holder” means a beneficial owner of stock of the Company that is, for U.S.

federal income tax purposes:

| ● | an individual who is a citizen or

resident of the United States; |

| ● | a corporation (or other entity that

is classified as a corporation for U.S. federal income tax purposes) that is created or organized

in or under the laws of the United States or any state thereof or the District of Columbia; |

| ● | an estate the income of which is

subject to U.S. federal income tax regardless of its source; or |

| ● | a trust (i) if a court within the

United States is able to exercise primary supervision over the administration of the trust

and one or more U.S. persons have the authority to control all substantial decisions of the

trust, or (ii) that has a valid election in effect under applicable Treasury Regulations

to be treated as a U.S. person for U.S. federal income tax purposes. |

If a partnership, including for

this purpose any entity or arrangement that is treated as a partnership for U.S. federal income tax purposes, holds stock of the Company,

the U.S. federal income tax treatment of a partner in such partnership will generally depend on the status of the partner and the activities

of the partner and the partnership. A holder that is a partnership and the partners in such partnership should consult their own tax

advisors with regard to the U.S. federal income tax consequences of the Reverse Split.

The Reverse Split should constitute

a “recapitalization” for U.S. federal income tax purposes. As a recapitalization, no gain or loss should be recognized by

a U.S. Holder upon such shareholder’s deemed exchange of Old Shares for New Shares pursuant to the Reverse Split. A U.S. Holder’s

aggregate tax basis of the New Shares received in the Reverse Split should be the same as such shareholder’s aggregate tax basis

in the Old Shares being exchanged, and the holding period of the New Shares should include the holding period of such shareholder in

the Old Shares.

A U.S. Holder whose fractional

shares resulting from the Reverse Split are rounded up to the nearest whole share may recognize gain for U.S. federal income tax purposes

equal to the value of the additional fractional share. The treatment of the exchange of a fractional share for a whole share in the Reverse

Split is not clear under current law and a U.S. Holder may recognize gain for U.S. federal income tax purposes equal to the value of

the additional fraction of a share of Common Stock received by such U.S. Holder.

Because of the complexity

of the tax laws and because the tax consequences to the Company or to any particular shareholder may be affected by matters not discussed

herein, shareholders are urged to consult their own tax advisors as to the specific tax consequences to them in connection with the Reverse

Split, including tax reporting requirements, the applicability and effect of non-U.S., U.S. federal, state and local and other applicable

tax laws and the effect of any proposed changes in the tax laws.

Dissenters’ Rights of Appraisal

We are a Nevada corporation and

are governed by the Nevada Revised Statutes. Holders of the Company’s Common Stock will not have appraisal or dissenter’s

rights under Nevada law in connection with the Reverse Split.

Interest of Certain Persons in Matters to be

Acted Upon

No director, executive officer,

associate of any director or executive officer or any other person has any substantial interest, direct or indirect, by security holdings

or otherwise, in the Reverse Split that is not shared by all other shareholders of ours.

Approval Required

The

approval of Proposal No. 2 requires the affirmative vote of holders of a majority of the issued and outstanding Common Stock. Abstentions

and broker “non-votes” have the effect of a vote “AGAINST” Proposal No. 2.

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” THE REVERSE SPLIT.

PLEASE NOTE: If your shares are held in street

name, your broker, bank, custodian, or other nominee holder cannot vote your shares for Proposal No. 2, unless you direct the holder

how to vote, by marking your proxy card, or by following the instructions on the enclosed proxy card to vote on the Internet or by telephone.

PROPOSAL NO. 3

THE ADJOURNMENT PROPOSAL

Overview

The Adjournment Proposal, if adopted, will allow the

Board to adjourn the Special Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal will

only be presented to the Company’s shareholders, in the event that, based upon the tabulated vote at the time of the Special Meeting

there are insufficient votes for, or otherwise in connection with, the approval of Proposals No. 1 and 2.

Consequences if the Adjournment Proposal is

Not Approved

If the Adjournment Proposal is not approved by the

shareholders, the Board may not be able to adjourn the Special Meeting to a later date in the event that there are insufficient votes

for, or otherwise in connection with, the approval of Proposals No. 1 and 2.

Vote Required for Approval

The approval of Proposal No.

3 requires the affirmative vote of holders of a majority of the shares of Common Stock having voting power present in person or represented

by proxy at the Special Meeting. Abstentions have the effect of a vote “AGAINST” Proposal No. 3 and broker “non-votes”

will have no effect with respect to the approval of the Proposal No. 3.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADJOURNMENT PROPOSAL.

PLEASE NOTE: If your shares are held in street

name, your broker, bank, custodian, or other nominee holder cannot vote your shares for Proposal No. 3, unless you direct the holder

how to vote, by marking your proxy card, or by following the instructions on the enclosed proxy card to vote on the Internet or by telephone.

OTHER INFORMATION

Important Notice Regarding Delivery of Shareholder

Documents

If your shares are held in street

name, your broker, bank, custodian, or other nominee holder may, upon request, deliver only one copy of this proxy statement to shareholders

to multiple shareholders sharing an address, absent contrary instructions from one or more of the shareholders. The Company will, upon

request, deliver a separate copy of the proxy materials to a shareholder at a shared address to which a single copy was delivered, upon

written or oral request, to Nicole Fernandez-McGovern, Secretary, AgEagle Aerial Systems Inc., 8863 E. 34th Street North,

Wichita, Kansas 67226. Shareholders sharing an address and receiving multiple copies of the proxy materials who wish to receive a single

copy should contact their broker, bank, custodian, or other nominee holder.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Barrett Mooney |

| |

Barrett

Mooney |

| |

Chairman

of the Board of Directors |

| |

|

December

16 2022 |

|

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS

PROXY

FOR THE SPECIAL MEETING OF SHAREHOLDERS OF

AGEAGLE AERIAL SYSTEMS INC.

TO BE HELD ON FEBRUARY 3, 2023

Barrett Mooney and Nicole Fernandez-McGovern,

and each of them, each with full power of substitution, hereby are authorized to vote as specified below or, with respect to any matter

not set forth below, as a majority of those or their substitutes present and acting at the meeting shall determine, all of the shares

of common stock, par value $0.001 per share (the “Common Stock”), of the Company. that the undersigned would be entitled

to vote, if personally present, at the special meeting of shareholders and any adjournment thereof. Unless otherwise specified, this

proxy will be voted FOR Proposals 1, 2 and 3.

PROPOSAL NO. 1.

Approval of the issuance of shares of our Common

Stock, representing more than 20% of our Common Stock upon the purchase of series F convertible preferred stock, par value $0.001 per

share (the “Series F Convertible Preferred Stock”) convertible into shares of Common Stock and warrants exercisable for shares

of Common Stock (the “Warrants”), in accordance with NYSE American Rule 713(a)(ii).

☐ FOR ☐ AGAINST ☐ ABSTAIN

PROPOSAL

NO. 2

Approval

of a reverse stock split of the Common Stock in the range of one share of Common Stock for every three shares of Common Stock to one

share for every eight shares of Common Stock, with the final ratio to be determined by the Company’s board of directors (the “Board”);

and

☐ FOR ☐ AGAINST ☐ ABSTAIN

PROPOSAL

NO. 3

Approve

the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if,

based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Proposals.

☐ FOR ☐ AGAINST ☐ ABSTAIN

Please

sign exactly as your name appears below. When shares are held by joint tenants, each should sign. When signing as attorney, executor,

administrator, trustee, guardian, corporate officer, or partner, please give full title as such.

| Date ________________, 2023 |

|

|

| |

|

Signature |

| |

|

|

| |

|

|

| |

|

Signature if held jointly |

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD

PROMPTLY USING THE ENCLOSED ENVELOPE.

The

Special Meeting of the shareholders (the “Special Meeting”) of AgEagle Aerial

Systems Inc., a Nevada corporation (the “Company”), will be held on February

3, 2023, at 11:00 a.m., local time, 700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118.

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement

is available at www.proxyvote.com.

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF

DIRECTORS

PROXY FOR THE SPECIAL MEETING OF SHAREHOLDERS

OF AGEAGLE AERIAL SYSTEMS INC.

AgEagle Aerial Systems Inc.

Special Meeting of Shareholders

February 3, 2023 at 11:00 AM Local Time

This proxy is solicited by the Board Of Directors

Barrett Mooney and Nicole Fernandez-McGovern, and each of them, each with full power of substitution, hereby are authorized to vote

as specified below or, with respect to any matter not set forth below, as a majority of those or their substitutes present and acting

at the meeting shall determine, all of the shares of capital stock of the Company. that the undersigned would be entitled to vote,

if personally present, at the special meeting of shareholders and any adjournment thereof.

Unless otherwise specified, this proxy will be voted FOR Proposals 1, 2 and 3. The Board of Directors recommends a vote FOR 1,

2 and 3.

Continued and to be signed on reverse side |

AgEagle Aerial Systems Inc.

Important Notice Regarding the Availability of Proxy Materials for

the Special Meeting of Shareholders to be held on February 3, 2023

700 NW 1st Avenue, Ste. 1200, Miami, Florida 33136-4118 at 11:00 am local time

|

This

communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage

you to access and review all of the important information contained in the proxy materials before voting.

The Proxy Statement is available at www.proxyvote.com.

If you want to receive a paper or e-mail copy of these documents, you must request one. There is no charge to you for requesting

a copy. Please make your request for a copy as instructed below on or before January 20, 2023, to facilitate timely delivery.

Unless requested, you will not receive a paper or e-mail copy.

Important information regarding the Internet availability of the Company’s proxy materials, instructions for accessing your

proxy materials and voting online, and instructions for requesting paper or e-mail copies of your proxy materials are provided on

the reverse side of this Notice. |

SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND

THE SPECIAL MEETING AND VOTE IN PERSON.

To the Shareholders of AgEagle Aerial Systems Inc.:

Notice

is hereby given that a Special Meeting of Shareholders of AgEagle Aerial Systems Inc. will

be held on February 3. 2023 at 11:00 a.m. local time at 700 NW 1st Avenue, Ste. 1200,

Miami, Florida 33136-4118 for the following purposes.

PROPOSAL NO. 1 - To approve the issuance

of shares of our Common Stock, par value $0.001 per share (the “Common Stock”), representing more than 20% of our Common

Stock outstanding upon the purchase of series F convertible preferred stock, par value $0.001 per share (the “Series F Convertible

Preferred Stock”) convertible into shares of Common Stock and warrants exercisable for shares of Common Stock (the “Warrants”),

in accordance with NYSE American Rule 713(a)(ii);

PROPOSAL NO. 2 - To approve a reverse stock

split of the Common Stock in the range of one share of Common Stock for every three shares of Common Stock outstanding to one share for

every eight shares of Common Stock outstanding, with the final ratio to be determined by the Company’s board of directors (the

“Board”); and

PROPOSAL NO. 3 - To consider and vote upon

a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies

if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Proposals.

The Board of Directors recommends a vote “FOR”

Proposals 1, 2 and 3.

The Securities and Exchange Commission rules permit

us to make our proxy materials available to our shareholders via the Internet.

Material for this Special Meeting and future

meetings may be requested by one of the following methods:

You must use the 11 digit control number located

in the box below.

AgEagle Aerial Systems Inc.

The

Proxy Statement is available for you to review at: www.proxyvote.com

ACCESSING YOUR PROXY MATERIALS ONLINE

Have this notice available when you request a paper

copy of the proxy materials or to vote your proxy electronically. You must reference your control number to vote by Internet or request

a paper copy of the proxy materials.

You May Vote Your Proxy When You View The Material

On The Internet. You Will Be Asked To Follow The Prompts To Vote Your Shares.

Your electronic vote authorizes the named proxies

to vote your shares in the same manner as if you marked, signed, dated and returned the proxy card.

REQUESTING A PAPER COPY OF THE PROXY MATERIALS

By telephone please call 1-800-579-1639

or

By logging onto www.proxyvote.com

or

By email at:ksmith@advantageproxy.com

Please include the company name and your control number

in the subject line.

22

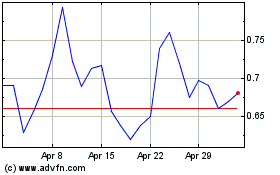

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Apr 2023 to Apr 2024