As filed with the Securities and Exchange Commission

on April 28, 2023

Registration No. 333-269512

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1 to

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

1847 HOLDINGS LLC

(Exact name of registrant as specified in its charter)

| Delaware |

|

38-3922937 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

590 Madison Avenue, 21st Floor

New York, NY 10022

(212) 417-9800

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Ellery

W. Roberts

Chief

Executive Officer

590 Madison Avenue, 21st Floor

New York, NY 10022

(212) 417-9800

Copies to:

Louis A. Bevilacqua, Esq.

BEVILACQUA PLLC

1050 Connecticut Ave., NW, Suite 500

Washington, DC 20036

(202) 869-0888

(Names, address, including zip code, and telephone

number, including area code, of agent for service)

Approximate date of commencement of proposed

sale to the public: From time to time after this Registration Statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐ |

Accelerated filer ☐ |

| |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE AND STATEMENT PURSUANT RULE 429

Pursuant to Rule 429 under the

Securities Act of 1933, as amended (the “Securities Act”), the prospectus (the “Prospectus”) included in this

registration statement on Form S-3 (this “Registration Statement”) is a combined prospectus relating to this Registration

Statement and to: (i) the registration statement on Form S-1 (Registration No. 333-236041), which was originally filed

with the U.S. Securities and Exchange Commission (the “SEC”) on January 23, 2020 and declared effective on February 12, 2020,

as amended by Post-Effective Amendment No. 1 filed with the SEC on September 23, 2020 and declared

effective on September 14, 2020 and Post-Effective Amendment No. 2 filed with the SEC on September 17, 2021 and declared effective on

September 28, 2021 (“Registration Statement I”); (ii) the registration statement on Form S-1 (Registration No.

333-249752), which was originally filed with the SEC on October 10, 2020 and declared effective on November 12, 2020, as amended by Post-Effective

Amendment No. 1 filed with the SEC on September 17, 2021 and declared effective on September 28, 2021 (“Registration Statement

II”); (iii) the registration statement on Form S-1 (Registration No. 333-259115), which was originally filed with

the SEC on August 27, 2021 and declared effective on September 13, 2021, as amended (“Registration Statement III”); and (iv)

the registration statement on Form S-1 (Registration No. 333-259011), which was originally filed with the SEC on August

23, 2021 and declared effective on August 2, 2022, as amended (“Registration Statement IV” and, together with Registration

Statement I, Registration Statement II and Registration Statement III, the “Prior Registration Statements”).

This Registration Statement, which is a new

registration statement, combines 4,157,105 common shares from the Prior Registration Statements with an additional 3,726,117 common shares,

all of which are registered hereby for offer and resale by the selling shareholders named in the Prospectus, to enable an aggregate of

7,883,222 common shares to be offered pursuant to the combined Prospectus. Pursuant to Rule 429 under the Securities Act,

this Registration Statement also constitutes a post-effective amendment to the Prior Registration Statements (the “Post-Effective

Amendment”), and such Post-Effective Amendment shall hereafter become effective concurrently with the effectiveness of this Registration

Statement in accordance with Section 8(c) of the Securities Act.

The

information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

| PROSPECTUS | SUBJECT

TO COMPLETION, DATED APRIL 28, 2023 |

1847

HOLDINGS LLC

7,883,222 Common Shares

This prospectus relates to 7,883,222 common

shares that may be sold from time to time by the selling shareholders named in this prospectus, which includes:

| ● | 2,671,865 common shares issuable

to selling shareholders upon the exercise of warrants; |

| ● | 455,414 common shares issuable to selling shareholders upon the conversion of our series A senior convertible

preferred shares; |

| ● | up to an estimated 735,288 common shares that may be issued as payment of dividends on our series A senior

convertible preferred shares; |

| ● | 929,798 common shares issuable

to selling shareholders upon the conversion of our series B senior convertible preferred

shares; and |

| ● | up to an estimated 2,709,256

common shares that may be issued upon certain adjustments to the conversion price of our

series B senior convertible preferred shares and/or as payment of dividends on our series

B senior convertible preferred shares. |

We will not receive any proceeds from the sales

of outstanding common shares by the selling shareholders, but we will receive funds from the exercise of the warrants held by the selling

shareholders.

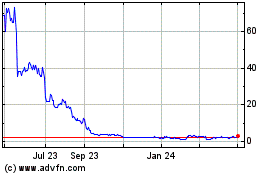

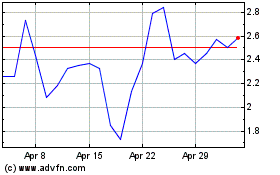

Our common shares are listed on NYSE American

under the symbol “EFSH.” On April 26, 2023, the last reported sale price of our common shares on NYSE American was $0.75

per share. There is no public market for the warrants.

The selling shareholders may offer and sell the

common shares being offered by this prospectus from time to time in public or private transactions, or both. These sales may occur at

fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices.

The selling shareholders may sell shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form

of discounts, concessions or commissions from the selling shareholders, the purchasers of the shares, or both. Any participating broker-dealers

and any selling shareholders who are affiliates of broker-dealers may be deemed to be “underwriters” within the meaning of

the Securities Act of 1933, as amended, or the Securities Act, and any commissions or discounts given to any such broker-dealer or affiliates

of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling shareholders have informed

us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common shares. See

“Plan of Distribution” for a more complete description of the ways in which the shares may be sold.

Investing in our common shares involves

a high degree of risk. See “Risk Factors” beginning on page 4 to read about factors you should consider before you

make an investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

You should rely only on the information that

we have provided or incorporated by reference in this prospectus, any applicable prospectus supplement and any related free writing prospectus

that we may authorize to be provided to you. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information

or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related

free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by

reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus,

any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

PROSPECTUS SUMMARY

This summary highlights selected information

that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information

that may be important to you and your investment decision. Before investing in our securities, you should carefully read this entire prospectus,

including the matters set forth in the section of this prospectus titled “Risk Factors” and the financial statements and related

notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports

on Form 10-Q. Unless the context indicates otherwise, references in this prospectus to “we,” “us,” “our”

and “our company” refer, collectively, to 1847 Holdings LLC and its subsidiaries taken as a whole.

Our Company

Overview

We are an acquisition holding company focused

on acquiring and managing a group of small businesses, which we characterize as those that have an enterprise value of less than $50 million,

in a variety of different industries headquartered in North America.

Through our structure, we offer investors an opportunity

to participate in the ownership and growth of a portfolio of businesses that traditionally have been owned and managed by private equity

firms, private individuals or families, financial institutions or large conglomerates. We believe that our management and acquisition

strategies will allow us to achieve our goals to make and grow regular distributions to our common shareholders and increasing common

shareholder value over time.

We seek to acquire controlling interests in small

businesses that we believe operate in industries with long-term macroeconomic growth opportunities, and that have positive and stable

earnings and cash flows, face minimal threats of technological or competitive obsolescence and have strong management teams largely in

place. We believe that private company operators and corporate parents looking to sell their businesses will consider us to be an attractive

purchaser of their businesses. We make these businesses our majority-owned subsidiaries and actively manage and grow such businesses.

We expect to improve our businesses over the long term through organic growth opportunities, add-on acquisitions and operational improvements.

Our Businesses

Retail and Appliances

Our retail and appliances business is

operated by Asien’s Appliance, Inc., a California corporation, or Asien’s. This business segment, which was acquired in the

second quarter of 2020, accounted for approximately 21.8% and 41.6% of our total revenues for the years ended December 31, 2022 and 2021,

respectively.

Since 1948, we have been providing a wide variety

of appliance services, including sales, delivery/installation, in-home service and repair, extended warranties, and financing in the North

Bay area of Sonoma County, California. Our main focus is delivering personal sales and exceptional service to our customers at competitive

prices. We operate one of the area’s oldest appliance stores and are well known and highly respected throughout the North Bay area.

We have strong, established relationships with customers and contractors in the community. We provide products and services to a diverse

group of customers, including homeowners, builders, and designers. As a member of BrandSource, a buying group that offers vendor programs,

factory direct deals, marketing support, opportunity buys, close-outs, consumer rebates, finance offers, and similar benefits, we offer

a full line of top brands from U.S. and international manufacturers.

Custom Carpentry

Our custom carpentry business is operated

through our subsidiaries Kyle’s Custom Wood Shop, Inc., an Idaho corporation, or Kyle’s, High Mountain Door & Trim Inc.,

a Nevada corporation, or High Mountain, and Sierra Homes, LLC d/b/a Innovative Cabinets & Design, a Nevada limited liability company,

or Innovative Cabinets. Kyle’s was acquired in the third quarter of 2020 and High Mountain and Innovative Cabinets were acquired

in the fourth quarter of 2021. This business segment accounted for approximately 64.9% and 39.8% of our total revenues for the years

ended December 31, 2022 and 2021, respectively.

We specialize in all aspects of finished carpentry

products and services, including doors, door frames, base boards, crown molding, cabinetry, bathroom sinks and cabinets, bookcases, built-in

closets, and fireplace mantles, among others. We also install windows and kitchen countertops. We primarily service large homebuilders

and homeowners of single-family homes and commercial and multi-family developers in the greater Reno-Sparks-Fernley metro area in Nevada

and in the Boise, Idaho area.

Automotive Supplies

Our automotive supplies business is operated

by Wolo Mfg. Corp., a New York corporation, and Wolo Industrial Horn & Signal, Inc., a New York corporation (which we collectively

refer to as Wolo). This business segment, which was acquired at the end of the first quarter of 2021, accounted for approximately 13.3%

and 18.6% of our total revenues for the years ended December 31, 2022 and 2021, respectively.

Our automotive supplies business is headquartered

in Deer Park, New York and was founded in 1965. We design and sell horn and safety products (electric, air, truck, marine, motorcycle

and industrial equipment), and offer vehicle emergency and safety warning lights for cars, trucks, industrial equipment and emergency

vehicles. Focused on the automotive and industrial after-market, we sell our products to big-box national retail chains, through specialty

and industrial distributors, as well as on- line/mail order retailers and original equipment manufacturers.

Eyewear Products

Our eyewear products business is operated

by ICU Eyewear Holdings, Inc., a California corporation, and its subsidiary ICU Eyewear, Inc., a California corporation (which we collectively

refer to as ICU Eyewear). This business was acquired in the first quarter of 2023.

ICU Eyewear, which was founded in 1956 and

is headquartered in Hollister, California, is a leading designer of over-the-counter, or OTC, non-prescription reading glasses, sunglasses,

blue light blocking eyewear, sun readers and outdoor specialty sunglasses, as well as select health and personal care items, such as

surgical face masks. We sell our products to big-box national retail chains, through various distributors, as well as online direct to

consumer sales. We believe that we are the only OTC eyewear supplier in the U.S. to have meaningful penetration in all significant retail

channels including grocery, specialty, office supply, pharmacy, and outdoor sports stores.

Our Manager

We have engaged 1847 Partners LLC, which we refer

to as our manager, to manage our day-to-day operations and affairs, oversee the management and operations of our businesses and perform

certain other services on our behalf, subject to the oversight of our board of directors. Ellery W. Roberts, our Chief Executive Officer,

is the sole manager of our manager and, as a result, our manager is an affiliate of Mr. Roberts.

We have entered into a management services

agreement with our manager, pursuant to which we are required to pay our manager a quarterly management fee equal to 0.5% (2.0% annualized)

of our company’s adjusted net assets (as defined in the management services agreement) for services performed. Pursuant to the

management services agreement, we have agreed that our manager may, at any time, enter into offsetting management services agreements

with our businesses pursuant to which our manager may perform services that may or may not be similar to management services. Any fees

to be paid by one of our businesses pursuant to such agreements are referred to as offsetting management fees and will offset, on a dollar-for-dollar

basis, the management fee otherwise due and payable by us under the management services agreement with respect to a fiscal quarter. Our

manager has entered into offsetting management services agreements with our subsidiaries 1847 Asien Inc., 1847 Cabinet Inc., 1847 Wolo

Inc. and 1847 ICU Holdings Inc., which provide for the payment of quarterly management fees equal to the greater of $75,000 or 2% of

adjusted net assets; provided that the fee for 1847 Cabinet Inc. is the greater of $125,000 or 2% of adjusted net assets. The management

services agreement provides that the aggregate amount of offsetting management fees to be paid to our manager with respect to any fiscal

quarter shall not exceed the management fee to be paid to our manager with respect to such fiscal quarter.

Our manager also owns all of our allocation shares,

which are a separate class of limited liability company interests. The allocation shares generally will entitle our manager to receive

a 20% profit allocation upon the sale of a particular subsidiary, calculated based on whether the gains generated by such sale (in excess

of a high-water mark) plus certain historical profits of the subsidiary exceed an annual hurdle rate of 8% (which rate is multiplied by

the subsidiary’s average share of our consolidated net assets). Once such hurdle rate has been exceeded, then the profit allocation

becomes payable to our manager.

Corporate Information

Our principal executive offices are located

at 590 Madison Avenue, 21st Floor, New York, NY 10022 and our telephone number is 212-417-9800. We maintain a website at www.1847holdings.com.

Asien’s maintains a website at www.asiensappliance.com, Kyle’s maintains a website at www.kylescabinets.com, Wolo maintains

a website at www.wolo-mfg.com, Innovative Cabinets maintains a website at www.innovativecabinetsanddesign.com and ICU Eyewear maintains

a website at icueyewear.com. Information available on our websites is not incorporated by reference in and is not deemed a part of this

prospectus.

The Offering

| Common shares offered by selling shareholders: |

This prospectus

relates to 7,883,222 common shares that may be sold from time to time by the selling shareholders named in this prospectus, which

includes: |

| |

|

|

|

| |

|

● |

381,601 common shares; |

| |

|

|

|

| |

|

● |

2,671,865 common shares

issuable to selling shareholders upon the exercise of warrants; |

| |

|

|

|

| |

|

● |

455,414 common shares issuable

to selling shareholders upon the conversion of our series A senior convertible preferred shares; |

| |

|

|

|

| |

|

● |

up to an estimated 735,288

common shares that may be issued as payment of dividends on our series A senior convertible preferred shares; |

| |

|

|

|

| |

|

● |

929,798 common shares

issuable to selling shareholders upon the conversion of our series B senior convertible preferred shares; and |

| |

|

|

|

| |

|

● |

up to an estimated 2,709,256

common shares that may be issued upon certain adjustments to the conversion price of our series B senior convertible preferred shares

and/or as payment of dividends on our series B senior convertible preferred shares. |

| Common

shares outstanding(1): |

4,655,636

common shares. |

| |

|

| Use

of proceeds: |

We

will not receive any proceeds from the sales of outstanding common shares by the selling shareholders, but we will receive funds

from the exercise of the warrants held by the selling shareholders. See “Use of Proceeds.” |

| |

|

| Risk

factors: |

Investing

in our securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment.

You should carefully consider the information set forth in the “Risk Factors” section beginning on page 4.

|

| |

|

| Trading

market and symbol: |

Our

common shares are listing on NYSE American under the symbol “EFSH.” |

| (1) | The number of common shares outstanding excludes the following: |

| ● | 455,414 common shares issuable upon the conversion of our

outstanding series A senior convertible preferred shares; |

| ● | 929,798 common

shares issuable upon the conversion of our outstanding series B senior convertible preferred

shares; |

| ● | 4,684,273 common

shares issuable upon the exercise of outstanding warrants at a weighted average exercise

price of $3.83 per share; |

| ● | common shares

issuable upon the conversion of secured convertible promissory notes in the aggregate principal

amount of $24,860,000, which are convertible into our common shares at a conversion price

of $4.20 (subject to adjustment); |

| ● | common shares

issuable upon the conversion of promissory notes in the aggregate principal amount of $4,039,575,

which are convertible into our common shares only upon an event of default under the promissory

notes at a conversion price equal to the lower of $4.20 and 80% of the lowest volume weighted

average price of our common shares on any trading day during the 5 trading days prior to

the conversion date; and |

| ● | common shares issuable upon the exchange of 6% subordinated

convertible promissory notes in the aggregate principal amount of $2,826,580, which are exchangeable for our common shares at an exchange

price equal to the higher of $10.00 or the 30-day volume weighted average price of our common shares (subject to adjustment). |

RISK FACTORS

An investment in our securities involves a high

degree of risk. You should consider the risks, uncertainties and assumptions discussed under “Part I-Item 1A-Risk Factors”

of our most recent Annual Report on Form 10-K and in “Part II-Item 1A-Risk Factors” in our most recent Quarterly Report on

Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may be amended, supplemented or superseded

from time to time by other reports we file with the Securities and Exchange Commission, or the SEC, in the future. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our operations.

FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and

the information incorporated by reference in this prospectus and each prospectus supplement contain certain statements that constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. The words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “could,” “would,”

“project,” “plan,” “potentially,” “likely,” and similar expressions and variations thereof

are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements

appear in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly

in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and include statements regarding the intent, belief or current expectations of our management that are subject to

known and unknown risks, uncertainties and assumptions. You are cautioned that any such forward-looking statements are not guarantees

of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking

statements as a result of various factors.

Because forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements

as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur

and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law,

including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise

any forward-looking statements contained herein after we distribute this prospectus, whether as a result of any new information, future

events or otherwise.

In addition, statements that “we believe”

and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available

to us as of the date of this prospectus, and although we believe such information forms a reasonable basis for such statements, such information

may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review

of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly

rely upon these statements.

This prospectus and the documents incorporated

by reference in this prospectus may contain market data that we obtain from industry sources. These sources do not guarantee the accuracy

or completeness of the information. Although we believe that our industry sources are reliable, we do not independently verify the information.

The market data may include projections that are based on a number of other projections. While we believe these assumptions to be reasonable

and sound as of the date of this prospectus, actual results may differ from the projections.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of common shares by the selling shareholders. We may, however, receive up to approximately $11.3 million from the exercise of warrants

held by selling shareholders. We will retain broad discretion over the use of the net proceeds to us. We currently expect to use the

net proceeds that we receive from the exercise of warrants for working capital and other general corporate purposes. We may also use

a portion of the net proceeds to acquire, license or invest in complementary products, technologies or businesses. The expected use of

net proceeds represents our current intentions based on our present plans and business conditions. We cannot specify with certainty all

of the particular uses for the net proceeds to be received upon exercise of the warrants. Pending these uses, we may invest the net proceeds

of this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit

or direct or guaranteed obligations of the U.S. government.

The selling shareholders will pay any underwriting

discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred

by them in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares

covered by this prospectus, including, without limitation, all registration and filing fees and fees and expenses of our counsel and our

accountants.

DESCRIPTION OF SHARE CAPITAL

The description of our share capital is incorporated

by reference to Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on April

11, 2023.

SELLING SHAREHOLDERS

The common shares being offered by the selling

shareholders are those restricted common shares previously issued to the selling shareholders, common shares issuable to the selling shareholders

upon the exercise of warrants, shares issuable to the selling shareholders upon the conversion of our series A senior convertible preferred

shares and series B senior convertible preferred shares, and additional common shares that may be issued as payment of dividends on our

series A senior convertible preferred shares and series B senior convertible preferred shares and/or upon certain adjustments to the conversion

price of our series B senior convertible preferred shares. We are registering the shares in order to permit the selling shareholders to

offer the shares for resale from time to time.

We have determined beneficial ownership in accordance

with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the

persons and entities named in the table below have sole voting and investment power with respect to all shares that they beneficially

own, subject to applicable community property laws. Unless otherwise indicated in the footnotes below, based on the information provided

to us by or on behalf of the selling shareholders, no selling shareholder is a broker-dealer or an affiliate of a broker-dealer.

The table below lists the selling shareholders

and other information regarding the beneficial ownership of the common shares by each of the selling shareholders. The second column lists

the number of common shares beneficially owned by each selling shareholder. The third column lists the common shares being offered by

this prospectus by the selling shareholders. The fourth column assumes the sale of all of the ordinary shares offered by the selling shareholders

pursuant to this prospectus.

Applicable percentage ownership is based on

4,655,636 common shares outstanding as of April 26, 2023. For purposes of computing percentage ownership after this offering, we have

assumed that all common shares held by the selling shareholders will be sold in this offering and that all series A senior convertible

preferred shares, series B senior convertible preferred shares and warrants held by the selling shareholders will be converted to common

shares and sold in this offering. In computing the number of common shares beneficially owned by a person and the percentage ownership

of that person, we deemed to be outstanding all common shares subject to options, warrants or other convertible securities held by that

person or entity that are currently exercisable or releasable or that will become exercisable or releasable within 60 days of April 26,

2023. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Notwithstanding

the foregoing, the series A senior convertible preferred shares, series B senior convertible preferred shares and warrants held by certain

selling shareholders contain ownership limitations, such that the we shall not effect any conversion or exercise of such securities to

the extent that after giving effect to the issuance of common shares upon conversion or exercise thereof, such holder, together with

its affiliates, would beneficially own in excess of 4.99% of the number of common shares outstanding immediately after giving effect

to the issuance of such common shares, which such limitation may be waived by us upon no fewer than 61 days’ prior notice. Therefore,

if a selling shareholder subject to these limitations would beneficially own in excess of 4.99%, we have reduced the applicable percentage

to 4.99%.

The selling shareholders may sell all, some or

none of their shares in this offering. See “Plan of Distribution.”

| | |

Common Shares

Beneficially Owned

Prior to this Offering | | |

Number of Common Shares Being | | |

Common Shares

Beneficially Owned

After this Offering | |

| Name of Beneficial Owner | |

Shares | | |

% | | |

Offered | | |

Shares | | |

% | |

| Robert D. Barry(1) | |

| 4,375 | | |

| * | | |

| 4,375 | | |

| - | | |

| - | |

| Louis A. Bevilacqua(2) | |

| 369,442 | | |

| 7.94 | % | |

| 12,500 | | |

| 356,942 | | |

| 7.67 | % |

| Craft Capital Management LLC(3) | |

| 35,715 | | |

| * | | |

| 35,715 | | |

| - | | |

| - | |

| Rory D. Crawford(4) | |

| 104,077 | | |

| 2.19 | % | |

| 137,669 | | |

| - | | |

| - | |

| Dream Equity LLC(5) | |

| 187,500 | | |

| 3.87 | % | |

| 673,133 | | |

| - | | |

| - | |

| Dunkley Capital Corporation(6) | |

| 119,048 | | |

| 2.49 | % | |

| 119,048 | | |

| - | | |

| - | |

| DZW Investments LLC(7) | |

| 46,673 | | |

| * | | |

| 60,877 | | |

| - | | |

| - | |

| Evergreen Capital Management LLC(8) | |

| 79,366 | | |

| 1.68 | % | |

| 79,366 | | |

| - | | |

| - | |

| FirstFire Global Opportunities Fund LLC(9) | |

| 163,764 | | |

| 3.40 | % | |

| 163,764 | | |

| - | | |

| - | |

| Paul A. Froning(10) | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| - | | |

| - | |

| Evan Goldenberg(11) | |

| 43,358 | | |

| * | | |

| 55,223 | | |

| - | | |

| - | |

| GS Capital Partners, LLC(12) | |

| 514,118 | | |

| 4.99 | % | |

| 1,043,679 | | |

| 247,452 | | |

| 5.32 | % |

| Elliot Gunsburg(13) | |

| 272,440 | | |

| 4.99 | % | |

| 781,879 | | |

| - | | |

| - | |

| Zalman Gurkov(14) | |

| 20,829 | | |

| * | | |

| 20,829 | | |

| - | | |

| - | |

| Halevi Enterprises(15) | |

| 53,392 | | |

| 1.13 | % | |

| 77,198 | | |

| - | | |

| - | |

| Zhongzheng Hao(16) | |

| 197,016 | | |

| 4.06 | % | |

| 511,447 | | |

| - | | |

| - | |

| HRW Legacy(17) | |

| 86,715 | | |

| 1.83 | % | |

| 110,521 | | |

| - | | |

| - | |

| KDI Corporation Ltd. (18) | |

| 6,650 | | |

| * | | |

| 6,650 | | |

| - | | |

| - | |

| Leonite Capital LLC(19) | |

| 2,047,819 | | |

| 4.99 | % | |

| 2,245,658 | | |

| 297,620 | | |

| 4.99 | % |

| Leonite LLC(20) | |

| 46,906 | | |

| 1.00 | % | |

| 61,187 | | |

| - | | |

| - | |

| Shalom Lerner(21) | |

| 33,323 | | |

| * | | |

| 33,323 | | |

| - | | |

| - | |

| Stephen Mallatt, Jr. and Rita Mallatt(22) | |

| 364,815 | | |

| 7.84 | % | |

| 175,000 | | |

| 189,815 | | |

| 4.08 | % |

| Quick Capital LLC(23) | |

| 17,095 | | |

| * | | |

| 17,095 | | |

| - | | |

| - | |

| R.F. Lafferty & Co. Inc.(24) | |

| 35,715 | | |

| * | | |

| 35,715 | | |

| - | | |

| - | |

| Robert Rausman(25) | |

| 75,000 | | |

| 1.59 | % | |

| 269,253 | | |

| - | | |

| - | |

| Ellery W. Roberts(26) | |

| 507,028 | | |

| 8.08 | % | |

| 595,395 | | |

| 251,000 | | |

| 5.39 | % |

| SDS Capital LLC(27) | |

| 86,948 | | |

| 1.83 | % | |

| 110,754 | | |

| - | | |

| - | |

| Adam Szweras(28) | |

| 94,107 | | |

| 1.98 | % | |

| 195,614 | | |

| - | | |

| - | |

| Twin Bridges Ventures LLC(29) | |

| 22,500 | | |

| * | | |

| 80,776 | | |

| - | | |

| - | |

| Abraham Zeines(30) | |

| 130,773 | | |

| 2.73 | % | |

| 154,579 | | |

| - | | |

| - | |

| (1) | The total number of shares owned and offered includes 4,375 common shares. Mr. Barry is a member of our

board of directors. |

| (2) | The total number of shares owned includes 84,375 common shares held by Mr. Bevilacqua and 285,067 common

shares held by Bevilacqua PLLC. The number of shares offered includes 12,500 common shares held directly by Mr. Bevilacqua. |

| (3) | The total number of shares owned and offered includes 35,715 common shares issuable upon the exercise

of warrants at an exercise price of $5.25 (subject to adjustments). Craft Capital Management LLC is a registered broker-dealer. |

| (4) | The total number of shares owned includes 8,658 common shares issuable upon the conversion of series A

senior convertible preferred shares and 95,419 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject

to adjustments). The total number of shares offered includes 8,658 common shares issuable upon the conversion of series A senior convertible

preferred shares, 95,419 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments),

and up to an estimated 33,592 common shares that that may be issued as payment of dividends on the series A senior convertible preferred

shares. |

| (5) | The total number of shares owned includes 166,666 common shares issuable

upon the conversion of series B senior convertible preferred shares and 20,834 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). The total number

of shares offered includes 166,666 common shares issuable upon the conversion of series B senior convertible

preferred shares, 20,834 common shares issuable upon the exercise of warrants at an exercise price of

$4.20 (subject to adjustments), and up to an estimated 485,633 common shares that that may be issued

as payment of dividends on the series B senior convertible preferred shares and/or upon certain adjustments

to the conversion price of the series B senior convertible preferred shares. |

| (6) | The total number of shares owned and offered includes 119,048 common shares issuable upon the exercise

of warrants at an exercise price of $4.20 (subject to adjustments). |

| (7) | The total number of shares owned includes 1,994 common shares, 4,330 common shares issuable upon the conversion

of series A senior convertible preferred shares and 40,349 common shares issuable upon the exercise of warrants at an exercise price of

$4.20 (subject to adjustments). The total number of shares offered includes 1,994 common shares, 4,330 common shares issuable upon the

conversion of series A senior convertible preferred shares, 40,349 common shares issuable upon the exercise of warrants at an exercise

price of $4.20 (subject to adjustments), and up to an estimated 14,204 common shares that that may be issued as payment of dividends on

the series A senior convertible preferred shares. |

| (8) | The total number of shares owned and offered includes 79,366 common shares issuable upon the exercise

of warrants at an exercise price of $4.20 (subject to adjustments). |

| (9) | The total number of shares owned and offered includes 163,764 common shares issuable upon the exercise

of warrants at an exercise price of $4.20 (subject to adjustments). |

| (10) | The total number of shares owned and offered includes 15,000 common shares. Mr. Froning is a member of

our board of directors. |

| (11) | The total number of shares owned includes 997 common shares, 8,658 common shares issuable upon the conversion

of series A senior convertible preferred shares and 33,703 common shares issuable upon the exercise of warrants at an exercise price of

$4.20 (subject to adjustments). The total number of shares offered includes 997 common shares, 8,658 common shares issuable upon the conversion

of series A senior convertible preferred shares, 33,703 common shares issuable upon the exercise of warrants at an exercise price of $4.20

(subject to adjustments), and up to an estimated 11,865 common shares that that may be issued as payment of dividends on the series A

senior convertible preferred shares. |

| (12) | The total number of shares owned includes 247,452 common shares and

266,666 common shares issuable upon the conversion of series B senior convertible preferred shares.

The total number of shares offered includes 266,666 common shares issuable upon the conversion of series

B senior convertible preferred shares and up to an estimated 777,013 common shares that that may be

issued as payment of dividends on the series B senior convertible preferred shares and/or upon certain

adjustments to the conversion price of the series B senior convertible preferred shares. |

| (13) | The total number of shares owned includes 17,316 common shares issuable

upon the conversion of series A senior convertible preferred shares, 166,666 common shares issuable

upon the conversion of series B senior convertible preferred shares and 88,458 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). The total number

of shares offered includes 17,316 common shares issuable upon the conversion of series A senior convertible

preferred shares, 166,666 common shares issuable upon the conversion of series B senior convertible

preferred shares, 88,458 common shares issuable upon the exercise of warrants at an exercise price of

$4.20 (subject to adjustments), up to an estimated 23,806 common shares that that may be issued as payment

of dividends on the series A senior convertible preferred shares and up to an estimated 485,633 common

shares that that may be issued as payment of dividends on the series B senior convertible preferred

shares and/or upon certain adjustments to the conversion price of the series B senior convertible preferred

shares. |

| (14) | The total number of shares owned and offered includes 997 common shares and 19,832 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). |

| (15) | The total number of shares owned includes 17,316 common shares issuable upon the conversion of series

A senior convertible preferred shares and 36,076 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject

to adjustments). The total number of shares offered includes 17,316 common shares issuable upon the conversion of series A senior convertible

preferred shares, 36,076 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments),

and up to an estimated 23,806 common shares that that may be issued as payment of dividends on the series A senior convertible preferred

shares. |

| (16) | The total number of shares owned includes 1,894 common shares, 17,143

common shares issuable upon the conversion of series A senior convertible preferred shares, 100,000

common shares issuable upon the conversion of series B senior convertible preferred shares and 77,979

common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments).

The total number of shares offered includes 1,894 common shares, 17,143 common shares issuable upon

the conversion of series A senior convertible preferred shares, 100,000 common shares issuable upon

the conversion of series B senior convertible preferred shares, 77,979 common shares issuable upon the

exercise of warrants at an exercise price of $4.20 (subject to adjustments), up to an estimated 23,051

common shares that that may be issued as payment of dividends on the series A senior convertible preferred

shares and up to an estimated 291,380 common shares that that may be issued as payment of dividends

on the series B senior convertible preferred shares and/or upon certain adjustments to the conversion

price of the series B senior convertible preferred shares. |

| (17) | The total number of shares owned includes 1,994 common shares, 17,316 common shares issuable upon the

conversion of series A senior convertible preferred shares and 67,405 common shares issuable upon the exercise of warrants at an exercise

price of $4.20 (subject to adjustments). The total number of shares offered includes 1,994 common shares, 17,316 common shares issuable

upon the conversion of series A senior convertible preferred shares, 67,405 common shares issuable upon the exercise of warrants at an

exercise price of $4.20 (subject to adjustments), and up to an estimated 23,806 common shares that that may be issued as payment of dividends

on the series A senior convertible preferred shares. |

| (18) | The total number of shares owned and offered includes 398 common shares and 6,252 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). |

| (19) | The total number of shares owned includes 34,419 common shares, 308,399

common shares issuable upon the conversion of series A senior convertible preferred shares and 1,705,001

common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments).

The total number of shares offered includes 34,419 common shares, 308,399 common shares issuable upon

the conversion of series A senior convertible preferred shares, 1,407,381 common shares issuable upon

the exercise of warrants at an exercise price of $4.20 (subject to adjustments), and up to an estimated

495,459 common shares that that may be issued as payment of dividends on the series A senior convertible

preferred shares. As noted above, our series A senior convertible preferred shares and warrants contain

ownership limitations, which in the case of Leonite Capital LLC is 9.99% as opposed to 4.99%. As a result,

we have reduced its ownership percentage to 9.99%. |

| (20) | The total number of shares owned includes 2,954 common shares, 4,330

common shares issuable upon the conversion of series A senior convertible preferred shares and 40,568

common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments).

The total number of shares offered includes 2,008 common shares, 4,330 common shares issuable upon the

conversion of series A senior convertible preferred shares, 40,568 common shares issuable upon the exercise

of warrants at an exercise price of $4.20 (subject to adjustments), and up to an estimated 14,281 common

shares that that may be issued as payment of dividends on the series A senior convertible preferred

shares. |

| (21) | The total number of shares owned and offered includes 1,994 common shares and 31,329 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). |

| (22) | The total number of shares owned includes 364,815 common shares and the total number of shares offered

includes 175,000 common shares. |

| (23) | The total number of shares owned and offered includes 1,023 common shares and 16,072 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). |

| (24) | The total number of shares owned and offered includes 35,715 common shares issuable upon the exercise

of warrants at an exercise price of $5.25 (subject to adjustments). R.F. Lafferty & Co. Inc. is a registered broker-dealer. |

| (25) | The total number of shares owned includes 66,666 common shares issuable

upon the conversion of series B senior convertible preferred shares and 8,334 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). The total number

of shares offered includes 66,666 common shares issuable upon the conversion of series B senior convertible

preferred shares, 8,334 common shares issuable upon the exercise of warrants at an exercise price of

$4.20 (subject to adjustments), and up to an estimated 194,253 common shares that that may be issued

as payment of dividends on the series B senior convertible preferred shares and/or upon certain adjustments

to the conversion price of the series B senior convertible preferred shares. |

| (26) | The total number of shares owned includes 376,000 common shares,

116,468 common shares issuable upon the conversion of series B senior convertible preferred shares and

14,560 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to

adjustments). The total number of shares offered includes 125,000 common shares, 116,468 common shares

issuable upon the conversion of series B senior convertible preferred shares, 14,560 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments), and up to an estimated

339,367 common shares that that may be issued as payment of dividends on the series B senior convertible

preferred shares and/or upon certain adjustments to the conversion price of the series B senior convertible

preferred shares. Mr. Roberts is our Chairman and Chief Executive Officer. |

| (27) | The total number of shares owned includes 2,008 common shares, 17,316 common shares issuable upon the

conversion of series A senior convertible preferred shares and 67,624 common shares issuable upon the exercise of warrants at an exercise

price of $4.20 (subject to adjustments). The total number of shares offered includes 2,008 common shares, 17,316 common shares issuable

upon the conversion of series A senior convertible preferred shares, 67,624 common shares issuable upon the exercise of warrants at an

exercise price of $4.20 (subject to adjustments), and up to an estimated 23,806 common shares that that may be issued as payment of dividends

on the series A senior convertible preferred shares. |

| (28) | The total number of shares owned includes 17,316 common shares issuable

upon the conversion of series A senior convertible preferred shares, 26,666 common shares issuable upon

the conversion of series B senior convertible preferred shares and 50,125 common shares issuable upon

the exercise of warrants at an exercise price of $4.20 (subject to adjustments). The total number of

shares offered includes 17,316 common shares issuable upon the conversion of series A senior convertible

preferred shares, 26,666 common shares issuable upon the conversion of series B senior convertible preferred

shares, 50,125 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject

to adjustments), up to an estimated 23,806 common shares that that may be issued as payment of dividends

on the series A senior convertible preferred shares and up to an estimated 77,701 common shares that

that may be issued as payment of dividends on the series B senior convertible preferred shares and/or

upon certain adjustments to the conversion price of the series B senior convertible preferred shares. |

| (29) | The total number of shares owned includes 20,000 common shares issuable

upon the conversion of series B senior convertible preferred shares and 2,500 common shares issuable

upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments). The total number

of shares offered includes 20,000 common shares issuable upon the conversion of series B senior convertible

preferred shares, 2,500 common shares issuable upon the exercise of warrants at an exercise price of

$4.20 (subject to adjustments), and up to an estimated 58,276 common shares that that may be issued

as payment of dividends on the series B senior convertible preferred shares and/or upon certain adjustments

to the conversion price of the series B senior convertible preferred shares. |

| (30) | The total number of shares owned includes 17,316 common shares issuable upon the conversion of series

A senior convertible preferred shares and 113,457 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject

to adjustments). The total number of shares offered includes 17,316 common shares issuable upon the conversion of series A senior convertible

preferred shares, 113,457 common shares issuable upon the exercise of warrants at an exercise price of $4.20 (subject to adjustments),

and up to an estimated 23,806 common shares that that may be issued as payment of dividends on the series A senior convertible preferred

shares. |

We do not currently have any arrangements which

if consummated may result in a change of control of our company.

PLAN OF DISTRIBUTION

The selling shareholders and any of their pledgees,

donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their common shares on any stock

exchange, market or trading facility on which the shares are traded or quoted or in private transactions. These sales will occur at fixed

prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices.

The selling shareholders may use any one or more

of the following methods when selling shares:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits investors; |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and

resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately negotiated transactions; |

| ● | through the writing of options on the shares; |

| ● | to cover short sales made after the date that the registration statement of which this prospectus is a

part is declared effective by the SEC; |

| ● | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a

stipulated price per share; and |

| ● | a combination of any such methods of sale. |

The selling shareholders may also sell shares

under Rule 144 of the Securities Act, if available, rather than under this prospectus. The selling shareholders shall have the sole and

absolute discretion not to accept any purchase offer or make any sale of shares if it deems the purchase price to be unsatisfactory at

any particular time.

The selling shareholders or their respective pledgees,

donees, transferees or other successors in interest, may also sell the shares directly to market makers acting as principals and/or broker-dealers

acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form of discounts, concessions

or commissions from the selling shareholders and/or the purchasers of shares for whom such broker-dealers may act as agents or to whom

they sell as principal or both, which compensation as to a particular broker-dealer might be in excess of customary commissions. Market

makers and block purchasers purchasing the shares will do so for their own account and at their own risk. It is possible that a selling

shareholder will attempt to sell shares in block transactions to market makers or other purchasers at a price per share which may be below

the then existing market price. We cannot assure that all or any of the shares offered in this prospectus will be issued to, or sold by,

the selling shareholders. The selling shareholders and any brokers, dealers or agents, upon effecting the sale of any of the shares offered

in this prospectus, may be deemed to be “underwriters” as that term is defined under the Securities Act, the Exchange Act

and the rules and regulations of such acts. In such event, any commissions received by such broker-dealers or agents and any profit on

the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay all fees and expenses incident

to the registration of the shares, including fees and disbursements of counsel to the selling shareholders, but excluding brokerage commissions

or underwriter discounts.

The selling shareholders, alternatively, may sell

all or any part of the shares offered in this prospectus through an underwriter. The selling shareholders have not entered into any agreement

with a prospective underwriter and there is no assurance that any such agreement will be entered into.

The selling shareholders may pledge their shares

to their brokers under the margin provisions of customer agreements. If a selling shareholder defaults on a margin loan, the broker may,

from time to time, offer and sell the pledged shares. The selling shareholders and any other persons participating in the sale or distribution

of the shares will be subject to applicable provisions of the Exchange Act, and the rules and regulations under such act, including, without

limitation, Regulation M. These provisions may restrict certain activities of, and limit the timing of purchases and sales of any of the

shares by, the selling shareholders or any other such person. In the event that any of the selling shareholders are deemed an affiliated

purchaser or distribution participant within the meaning of Regulation M, then the selling shareholders will not be permitted to engage

in short sales of common shares. Furthermore, under Regulation M, persons engaged in a distribution of securities are prohibited from

simultaneously engaging in market making and certain other activities with respect to such securities for a specified period of time prior

to the commencement of such distributions, subject to specified exceptions or exemptions. In addition, if a short sale is deemed to be

a stabilizing activity, then the selling shareholders will not be permitted to engage in a short sale of our shares. All of these limitations

may affect the marketability of the shares.

If a selling shareholder notifies us that it has

a material arrangement with a broker-dealer for the resale of the shares, then we would be required to amend the registration statement

of which this prospectus is a part, and file a prospectus supplement to describe the agreements between the selling shareholder and the

broker-dealer.

LEGAL MATTERS

The validity of the securities offered hereby

will be passed upon for us by Bevilacqua PLLC, Washington, DC.

Bevilacqua PLLC owns 285,067 common shares

and Louis A. Bevilacqua, the managing member of Bevilacqua PLLC, owns 84,375 common shares, together representing approximately 7.94%

of our outstanding common shares as of the date of this prospectus. Mr. Bevilacqua also owns approximately 9% of 1847 Partners Class

A Member LLC and 10% of 1847 Partners Class B Member LLC, the owners of our manager. Mr. Bevilacqua received these securities as partial

consideration for legal services previously provided to us.

EXPERTS

The financial statements of our company for

the years ended December 31, 2022 and 2021 have been incorporated by reference in this prospectus in reliance upon the report of Sadler,

Gibb & Associates, LLC, an independent registered public accounting firm, upon the authority of said firm as experts in accounting

and auditing.

The financial statements of ICU Eyewear for

the years ended December 31, 2022 and 2021 have been incorporated by reference in this prospectus in reliance upon the report of Frank,

Rimerman + Co. LLP, an independent auditor, upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.1847holdings.com.

Information accessible on or through our website is not a part of this prospectus.

This prospectus is part of a registration statement

that we filed with the SEC and does not contain all of the information in the registration statement. You should review the information

and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities that we

are offering. Statements in this prospectus about these documents are summaries and each statement is qualified in all respects by reference

to the document to which it refers. You should read the actual documents for a more complete description of the relevant matters.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to incorporate by reference

much of the information that we file with the SEC, which means that we can disclose important information to you by referring you to those

publicly available documents. The information that we incorporate by reference in this prospectus is considered to be part of this prospectus.

Because we are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future filings

may modify or supersede some of the information included or incorporated by reference in this prospectus. This means that you must look

at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in any document

previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents listed

below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than

those documents or the portions of those documents furnished pursuant to Items 2.02 or 7.01 of any Current Report on Form 8-K and, except

as may be noted in any such Form 8-K, exhibits filed on such form that are related to such information), until the offering of the securities

under the registration statement of which this prospectus forms a part is terminated or completed:

| ● | our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on April 11, 2023; |

| ● | our Current Reports on Form 8-K filed

with the SEC on January 9, 2023, February 9, 2023, February 13, 2023, February 24, 2023, February 28, 2023, March 10, 2023, April 5, 2023 and April 27, 2023; |

| ● | our Definitive Proxy Statement

on Schedule

14A filed on April 11, 2023; and |

| ● | the description of our common

stock contained in Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on April 11, 2023,

including any amendment or report filed for the purpose of updating such description. |

You may request a copy of these filings, at no

cost, by writing or telephoning us at the following address:

1847 Holdings LLC

590 Madison Avenue, 21st Floor

New York, NY 10022

Attn: Secretary

(212) 417-9800

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth estimated fees

and expenses (except in the case of the SEC registration fee) in connection with the issuance and distribution of the securities being

registered.

| | |

Amount | |

| SEC registration fee | |

$ | 804.81 | |

| Accounting fees and expenses | |

| 2,000 | |

| Legal fees and expenses | |

| 15,000 | |

| Transfer agent fees and expenses | |

| 3,000 | |

| Printing and related fees and expenses | |

| 5,000 | |

| Miscellaneous fees and expenses | |

| 2,000 | |

| Total | |

$ | 27,804.81 | |

Item 15. Indemnification of Directors and Officers

Certain provisions of our operating agreement

are intended to be consistent with Section 145 of the General Corporation Law of the State of Delaware, which provides that a corporation

has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving at the request

of the corporation in related capacities against amounts paid and expenses incurred in connection with an action or proceedings to which

he is, or is threatened to be made, a party by reason of such position, if such person shall have acted in good faith and in a manner

he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal proceedings, if such person

had no reasonable cause to believe his conduct was unlawful; provided that, in the case of actions brought by or in the right of the corporation,

no indemnification shall be made with respect to any matter as to which such person shall have been adjudged to be liable to the corporation

unless and only to the extent that the adjudicating court determines that such indemnification is proper under the circumstances.

Our operating agreement includes a provision that

eliminates the personal liability of its directors for monetary damages for breach of fiduciary duty as a director, except for liability:

| ● | for any breach of the director’s duty of loyalty to the company or its members; |

| ● | for acts or omissions not in good faith or a knowing violation of law; |

| ● | regarding unlawful distributions and interest purchases analogous to Section 174 of the General Corporation

Law of the State of Delaware; or |

| ● | for any transaction from which the director derived an improper benefit. |

Our operating agreement provides that:

| ● | we must indemnify our directors and officers to the equivalent extent permitted by General Corporation

Law of the State of Delaware; |

| ● | we may indemnify our other employees and agents to the same extent that we indemnify our officers and

directors, unless otherwise determined by our board of directors; and |

| ● | we must advance expenses, as incurred, to our directors and executive officers in connection with a legal

proceeding to the extent permitted by Delaware law and may advance expenses as incurred to our other employees and agents, unless otherwise

determined by our board of directors. |

The indemnification provisions contained in our

operating agreement are not exclusive of any other rights to which a person may be entitled by law, agreement, vote of members or disinterested

directors or otherwise.

In addition, we have entered into indemnification

agreements with each of our executive officers and directors, pursuant to which we have agreed to indemnify them to the fullest extent

permitted by law. Under the indemnification agreements, we have agreed to advance all expenses incurred by or on behalf of the independent

directors in connection with any proceeding within thirty (30) days after the receipt by us of a statement requesting such advance, whether

prior to or after final disposition of such proceeding.

We also have insurance on behalf of our directors

and executive officers and certain other persons insuring them against any liability asserted against them in their respective capacities

or arising out of such status.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling us under the foregoing provisions, we have been

informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore

unenforceable.

Item 16. Exhibits.

The following exhibits are filed

as part of this registration statement:

| Exhibit No. |

|

Description |

| 3.1 |

|

Certificate

of Formation of 1847 Holdings LLC (incorporated by reference to Exhibit 3.1 to the Registration Statement on Form S-1 filed on February

7, 2014) |

| |

|

|

| 3.2 |

|

Second

Amended and Restated Operating Agreement of 1847 Holdings LLC, dated January 19, 2018 (incorporated by reference to Exhibit 3.1 to

the Current Report on Form 8-K filed on January 22, 2018) |

| |

|

|

| 3.3 |

|

Amendment

No. 1 to Second Amended and Restated Operating Agreement (incorporated by reference to Exhibit 3.1 to the Current Report on Form

8-K filed on August 11, 2021) |

| |

|

|

| 4.1 |

|

Amended

and Restated Share Designation of Series A Senior Convertible Preferred Shares (incorporated by reference to Exhibit 4.1 to the Current

Report on Form 8-K filed on April 1, 2021) |

| |

|

|

| 4.2 |

|

Amendment

No. 1 to Amended and Restated Share Designation of Series A Senior Convertible Preferred Shares (incorporated by reference to Exhibit

4.2 to the Current Report on Form 8-K filed on October 5, 2021) |

| |

|

|

| 4.3 |

|

Share

Designation of Series B Senior Convertible Preferred Shares (incorporated by reference to Exhibit 4.1 to the Current Report on Form

8-K filed on March 2, 2022) |

| |

|

|

| 4.4 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 22, 2023 (incorporated by reference to Exhibit

4.1 to the Current Report on Form 8-K filed on February 28, 2023) |

| |

|

|

| 4.5 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 22, 2023 (incorporated by reference to Exhibit

4.2 to the Current Report on Form 8-K filed on February 28, 2023) |

| |

|

|

| 4.6 |

|

Common Share Purchase Warrant issued by 1847 Holdings LLC to J.H. Darbie & Co., Inc. on February 22, 2023 |

| |

|

|

| 4.7 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Leonite Fund I, LP on February 9, 2023 (incorporated by reference to Exhibit

4.1 to the Current Report on Form 8-K filed on February 13, 2023) |

| |

|

|

| 4.8 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Leonite Fund I, LP on February 9, 2023 (incorporated by reference to Exhibit

4.2 to the Current Report on Form 8-K filed on February 13, 2023) |

| |

|

|

| 4.9 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 9, 2023 (incorporated by reference to Exhibit

4.3 to the Current Report on Form 8-K filed on February 13, 2023) |

| |

|

|

| 4.10 |

|

Common Share Purchase Warrant issued by 1847 Holdings LLC to J.H. Darbie & Co., Inc. on February 9, 2023 |

| |

|

|

| 4.11 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Leonite Fund I, LP on February 3, 2023 (incorporated by reference to Exhibit

4.1 to the Current Report on Form 8-K filed on February 9, 2023) |

| |

|

|

| 4.12 |

|

Common

Share Purchase Warrant issued by 1847 Holdings LLC to Mast Hill Fund, L.P. on February 3, 2023 (incorporated by reference to Exhibit

4.2 to the Current Report on Form 8-K filed on February 9, 2023) |

| |

|

|

| 4.13 |

|

Common Share Purchase Warrant issued by 1847 Holdings LLC to J.H. Darbie & Co., Inc. on February 3, 2023 |

| |

|

|

| 4.14 |

|

Warrant

Agent Agreement, dated January 3, 2023, between 1847 Holdings LLC and VStock Transfer, LLC and form of Warrant (incorporated by reference

to Exhibit 4.1 to the Current Report on Form 8-K filed on January 9, 2023) |

| 4.15 |

|

Common

Share Purchase Warrant issued to Craft Capital Management LLC on August 5, 2022 (incorporated by reference to Exhibit 4.1 to the

Current Report on Form 8-K filed on August 8, 2022) |

| |

|

|

| 4.16 |

|

Common

Share Purchase Warrant issued to R.F. Lafferty & Co. Inc. on August 5, 2022 (incorporated by reference to Exhibit 4.2 to the

Current Report on Form 8-K filed on August 8, 2022) |

| |

|

|

| 4.17 |

|

Warrant

for Common Shares issued by 1847 Holdings LLC to J.H. Darbie & Co., Inc. on July 8, 2022 (incorporated by reference to Exhibit

4.18 to the Registration Statement on Form S-3 filed on February 1, 2023) |

| |

|

|

| 4.18 |

|

Warrant

for Common Shares issued by 1847 Holdings LLC to Leonite Capital LLC on October 8, 2021 (incorporated by reference to Exhibit 4.2

to the Current Report on Form 8-K filed on October 13, 2021) |

| |

|

|

| 4.19 |

|

Form

of Common Share Purchase Warrant relating to 2022 private placement (incorporated by reference to Exhibit 4.2 to the Current Report

on Form 8-K filed on March 2, 2022) |

| |

|

|

| 4.20 |

|

Form