Novartis's Sandoz Sets Out Growth Plan Following Proposed Spinoff

June 08 2023 - 2:03AM

Dow Jones News

By Giulia Petroni

Novartis's off-patent medicines division Sandoz set out its

growth plans as a standalone company following the proposed

spinoff, saying it is well positioned to continue delivering

mid-single digit sales growth.

Ahead of its capital markets day on Thursday, Sandoz said it

foresees mid-single digit net sales growth for the full year as

well as for the 2024-28 period.

The core earnings before interest, taxes, depreciation and

amortization margin is expected at 18%-19% in 2023 and at 24%-26%

in the mid term. An initial decrease from a core Ebitda margin of

21.2% in 2022 is due to inflation and investments required to stand

as a separate company.

Free cash flow is expected to more than double by 2028 from $800

million last year, Sandoz said. This would allow to pay a full-year

dividend of 20%-30% of core net income in 2023 and 30%-40% in the

mid term.

The proposed spinoff of Sandoz is expected to occur in the

second half of the year. Completion is subject to conditions.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

June 08, 2023 01:48 ET (05:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

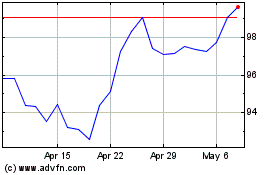

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

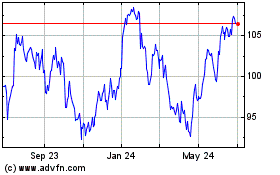

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024