BTCS Addresses Recent SEC Action Against Coinbase and Clarifies its Non-Custodial Staking Operations

June 06 2023 - 11:30AM

BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a blockchain

technology-focused company, today addresses the recent Securities

and Exchange Commission (“SEC”) action against Coinbase regarding

its staking operations and clarifies the differences between BTCS's

non-custodial staking model and the practices that the SEC has

taken issue with.

Today, the SEC took action against Coinbase for

its staking operations among other things. Similar to Coinbase,

BTCS conducted a thorough analysis over two years ago, concluding

in our view, that “Core Staking” as defined by Coinbase, does not

create a security. BTCS performs “Core Staking” under the

terminology of “non-custodial staking” or “staking-as-a-service”.

While Coinbase’s analysis under the Howey test is valuable (link:

here) and we commend their efforts, it is important to note that in

a February 10, 2023 blog post, they state “At Coinbase, our core

staking service is offered through our Coinbase Earn program, which

allows users to stake certain assets for a recurring payment from

the blockchain protocol.” However, in the Coinbase Earn program,

Coinbase takes your private keys, i.e. they hold your crypto, which

is a material difference and not in line with their own analysis

and assertion under the Howey test regarding an investment of

money. By presenting an argument that doesn’t apply to the SEC’s

concerns, Coinbase is muddying the waters and doing a disservice to

companies like BTCS, the crypto industry, the general public, and

regulators.

BTCS’s CEO, Charles Allen, states, “Following

the FTX fiasco, industry leaders should be transparent, especially

with respect to rules that are clearly black and white versus those

that need further clarity. We should work to educate regulators,

politicians, and the general public in a positive way to ensure any

new regulations or the interpretation of current regulations allow

the U.S. to become a leader in blockchain innovation.”

BTCS's non-custodial staking-as-a-service

platform, StakeSeeker, significantly differs from other industry

staking programs. StakeSeeker only operates a non-custodial model,

which contrasts with the custodial models utilized by Kraken,

Coinbase, and others. The differences between BTCS's StakeSeeker

model and the custodial models under scrutiny have been outlined in

our recent press release on February 10, 2023, where we clarified

how StakeSeeker operates within the parameters of the Howey test

and does not in our view create securities. The following table

summarizes the key differences between BTCS’s, Coinbase’s, and

Kraken’s business models which the SEC has taken issue with.

|

Key Howey Test Components |

Kraken |

Coinbase(Earn Program) |

BTCS |

|

Has custody of user crypto assets?i.e. an investment |

Yes |

Yes |

No |

|

Pool crypto assets with others?i.e. a common enterprise |

Yes |

Yes |

No |

|

Expectation of profits from effort of others? |

Yes |

Yes |

No |

Allen continues “We believe it is essential to

differentiate between non-custodial staking models like ours and

the practices that have been called into question by regulators. We

have proactively analyzed our staking model and drawn conclusions

that align with those presented by Coinbase regarding “Core

Staking” and while we believe our non-custodial staking does not

create securities, we cannot provide assurances that either the SEC

or other regulatory authorities will agree.”

“As the oldest public company in the crypto and

blockchain sector, we have learned many lessons over the years. Our

commitment to offering a transparent, secure, and compliant

non-custodial staking model demonstrates our dedication to the best

interests of the industry and the general public.” stated

Allen.

For more information on BTCS's StakeSeeker and

its non-custodial staking model, please visit

https://stakeseeker.com/.

About BTCS:BTCS Inc. is a

Nasdaq listed company operating in the blockchain technology space

since 2014 and is one of the first U.S. publicly traded companies

with a primary focus on blockchain infrastructure and staking. BTCS

secures and operates validator nodes on disruptive next-generation

blockchain networks that power Web 3, earning native token rewards

by staking our proof-of-stake crypto assets. “StakeSeeker” is BTCS’

newly introduced proprietary Cryptocurrency Dashboard and

Staking-as-a-Service platform, developed to empower users to better

understand and grow their crypto holdings with innovative portfolio

analytics and a non-custodial process to earn staking rewards on

crypto asset holdings. Users can easily link and monitor their

cryptocurrency portfolios across exchanges, wallets, validator

nodes, and other sources; and have access to a suite of data

analytic tools such as performance and reward tracking.

StakeSeeker’s Staking Hub allows users to earn rewards by directly

participating in network consensus mechanisms by staking and

delegating their cryptocurrencies to company-operated validator

nodes for a growing number of supported blockchains. As a

non-custodial validator operator, BTCS receives a percentage of

token holders staking rewards generated as a validator node fee,

creating the potential opportunity for a highly scalable business

with limited additional costs. For more information visit:

www.btcs.com.

Investor Relations:ir@btcs.com

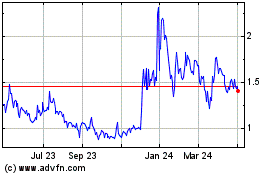

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

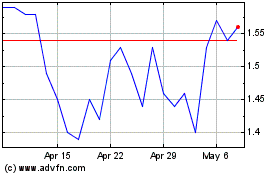

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Apr 2023 to Apr 2024