Trust Stamp Announces Pricing of $2.9 Million Registered Direct Offering and Concurrent Private Placement Priced At-The-Market

June 01 2023 - 8:30AM

Trust Stamp (Nasdaq: IDAI), the Privacy-First Identity

Company™ providing artificial intelligence (AI)-powered trust

and identity services used globally across multiple sectors, today

announced that it has entered into a securities purchase agreement

with a single institutional investor to purchase 1,279,700 shares

of common stock (or pre-funded warrants in lieu thereof) in a

registered direct offering priced at-the-market under Nasdaq rules.

In a concurrent private placement, the Company also agreed to issue

and sell unregistered warrants to purchase up to an aggregate of

1,279,700 shares of common stock. The combined effective offering

price for each share of common stock (or pre-funded warrant in lieu

thereof) and accompanying warrant is $2.30. The warrants will be

immediately exercisable, will expire five years from the issuance

date and will have an exercise price of $2.30 per share.

The gross proceeds to the Company from the

registered direct offering and concurrent private placement are

estimated to be approximately $2.9 million before deducting the

placement agent’s fees and other estimated offering expenses

payable by the Company. The offering is expected to close on or

about June 5, 2023, subject to the satisfaction of customary

closing conditions.

Maxim Group LLC is acting as the sole placement

agent in connection with the offering.

Trust Stamp has also agreed that certain

existing warrants to purchase up to an aggregate of 390,000 shares

of common stock of the Company that were issued to such

institutional investor on September 14, 2022, at an exercise price

of $8.85 per share (as adjusted), will be amended effective upon

the closing of the offering so that the amended warrants will have

an exercise price of $2.30.

The shares of common stock (or pre-funded

warrants in lieu thereof) are being offered pursuant to a shelf

registration statement on Form S-3 (File No. 333-271091), which was

declared effective by the U.S. Securities and Exchange Commission

(the “SEC”) on April 12, 2023. The offering of shares of common

stock (or pre-funded warrants in lieu thereof) will be made only by

means of a prospectus supplement that forms a part of such

registration statement. The warrants to be issued in the concurrent

private placement and the shares issuable upon exercise of such

warrants were offered in a private placement under Section 4(a)(2)

of the Securities Act of 1933, as amended (the “Act”), and

Regulation D promulgated thereunder and have not been registered

under the Act or applicable state securities laws.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor will there be

any sales of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such jurisdiction. A

prospectus supplement relating to the shares of common stock and

pre-funded warrants will be filed by the Company with the SEC. When

available, copies of the prospectus supplement relating to the

registered direct offering, together with the accompanying

prospectus, can be obtained at the SEC's website at www.sec.gov or

from Maxim Group LLC, 300 Park Avenue, New York, NY 10022,

Attention: Syndicate Department, or via email at

syndicate@maximgrp.com or telephone at (212) 895-3500.

About Trust Stamp

Trust Stamp the Privacy-First Identity Company™,

is a global provider of AI-powered identity services for use in

multiple sectors including banking and finance, regulatory

compliance, government, real estate, communications, and

humanitarian services. Its technology empowers organizations with

advanced biometric identity solutions that reduce fraud, protect

personal data privacy, increase operational efficiency, and reach a

broader base of users worldwide through its unique data

transformation and comparison capabilities.

Located in nine countries across North America,

Europe, Asia, and Africa, Trust Stamp trades on the Nasdaq Capital

Market (Nasdaq: IDAI). The company was founded in 2016 by Gareth

Genner and Andrew Gowasack.

Forward-Looking Statements

All statements in this release that are not

based on historical fact are “forward-looking statements” including

within the meaning of the Private Securities Litigation Reform Act

of 1995 and the provisions of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. The information in this announcement may contain

forward-looking statements and information related to, among other

things, the company, its business plan and strategy, and its

industry. These statements reflect management’s current views with

respect to future events based on information currently available

and are subject to risks and uncertainties that could cause the

company’s actual results to differ materially from those contained

in the forward-looking statements. Investors are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date on which they are made. The company does

not undertake any obligation to revise or update these

forward-looking statements to reflect events or circumstances after

such date or to reflect the occurrence of unanticipated events.

Trust Stamp

Gareth Genner, Chief Executive

OfficerEmail: Shareholders@truststamp.ai

Investor

Relations

Crescendo Communications Tel: +1

212-671-1021 Email: idai@crescendo-ir.com

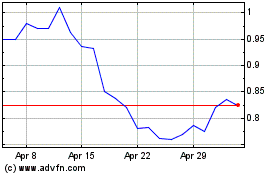

T Stamp (NASDAQ:IDAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

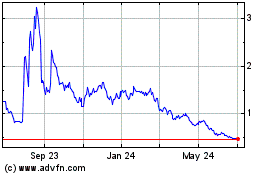

T Stamp (NASDAQ:IDAI)

Historical Stock Chart

From Apr 2023 to Apr 2024