Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 31 2023 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number: 001-41359

Belite Bio, Inc

(Exact name of registrant as specified

in its charter)

Not Applicable

(Translation of Registrant´s name into English)

12750 High Bluff Drive Suite 475,

San Diego, CA 92130

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the Registrant is submitting

this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the Registrant is submitting

this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Indicate by check mark whether

the registrant by furnishing the information contained in this Form 6-K is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes ¨ No x

On May 30, 2023, Belite Bio, Inc (the “Company”)

entered into an underwriting agreement (the “Underwriting Agreement”) with SVB Securities LLC and Cantor Fitzgerald &

Co., as representatives of the underwriters named therein, relating to the underwritten public offering (the “Offering”) of

2,000,000 American Depositary Shares, or ADSs, each representing one ordinary share, and warrants to purchase 2,000,000 ordinary shares

represented by ADSs, at a price to the public of $15.00 per ADS and accompanying warrant. The warrants are exercisable immediately,

expire five years from the date of issuance and have an exercise price of $18.00 per ADS. The gross proceeds to the Company from the

Offering are expected to be approximately $30 million, before deducting underwriting discounts and commissions and estimated

offering expenses. The Offering is expected to close on or about June 2, 2023, subject to the satisfaction of customary closing conditions.

The Offering was made pursuant to the Company’s

shelf registration statement on Form F-3 (File No. 333-272125), which was declared effective on May 30, 2023,

as supplemented by a prospectus supplement dated May 30, 2023.

A copy of the Underwriting Agreement is attached

hereto as Exhibit 1.1 and is incorporated herein by reference. A copy of the form of warrant is attached hereto as Exhibit 4.1 and is

incorporated herein by reference. The foregoing descriptions of the Underwriting Agreement and warrants do not purport to be complete

and are subject to and qualified in their entirety by reference to, the Underwriting Agreement and form of warrant, which are attached

hereto as Exhibits 1.1 and 4.1, respectively, and are incorporated herein by reference.

The legal opinions of Maples and Calder

(Hong Kong) LLP and O'Melveny & Myers LLP relating to the ADSs and warrants are filed as Exhibits 5.1 and 5.2, respectively, to this

Form 6-K and incorporated by reference herein.

On May 30, 2023, the Company issued a press

release announcing the pricing of the Offering. A copy of this press release is filed as Exhibit 99.1 to this Form 6-K.

The information contained in this

Form 6-K, including Exhibits 1.1, 4.1, 5.1 and 5.2 hereto, but excluding Exhibit 99.1, is hereby incorporated by reference

into the Company’s Registration Statement on Form F-3 (File No. 333-272125).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Belite Bio, Inc |

| |

|

| |

By: |

/s/ Yu-Hsin Lin |

| |

Name: |

Yu-Hsin Lin |

| |

Title: |

Chief Executive Officer and Chairman |

Date: May 30, 2023

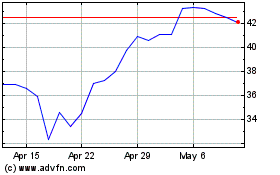

Belite Bio (NASDAQ:BLTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

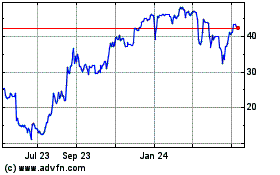

Belite Bio (NASDAQ:BLTE)

Historical Stock Chart

From Apr 2023 to Apr 2024