Current Report Filing (8-k)

May 26 2023 - 5:17PM

Edgar (US Regulatory)

8-K0001365916FALSE00013659162023-05-252023-05-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): May 25, 2023

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | AMRS | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 26, 2023, Amyris, Inc. (the “Company”) received a deficiency letter from the Nasdaq Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, for the last 30 consecutive business days, the closing bid price for the Company’s common stock has been below the minimum $1.00 per share required for continued listing on The Nasdaq Global Select Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”). The Nasdaq deficiency letter has no immediate effect on the listing of the Company’s common stock which will continue to trade on The Nasdaq Global Select Market under the symbol “AMRS”.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided an initial period of 180 calendar days, or until November 22, 2023, to regain compliance with the Minimum Bid Price Requirement. If at any time before November 22, 2023, the bid price of the Company’s common stock closes at $1.00 per share or more for a minimum of ten consecutive business days, the Staff will provide written confirmation that the Company has achieved compliance.

If the Company does not regain compliance with the Minimum Bid Price Requirement by November 22, 2023, the Company’s common stock will become subject to delisting. In the event that the Company receives notice that its common stock is being delisted, the Nasdaq listing rules permit the Company to appeal a delisting determination by the Staff to a hearings panel.

The Company intends to monitor the bid price of its common stock and consider available options if its common stock does not trade at a level likely to result in the Company regaining compliance with Nasdaq’s minimum bid price rule by November 22, 2023, including such options as effecting a reverse stock split.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 25, 2023, the Company held its 2023 Annual Meeting of Stockholders (the “Annual Meeting”) for the following purposes:

a.To elect the four Class I directors nominated by the Company’s board of directors (the “Board”) to serve on the Board for a three-year term (“Proposal 1”);

b.To ratify the appointment of Macias Gini & O’Connell LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (“Proposal 2”);

c.To approve a non-binding advisory vote on the compensation of our named executive officers (“Proposal 3”);

d.To approve a non-binding advisory vote on the frequency of future stockholder say-on-pay votes (“Proposal 4”);

e.To approve an amendment to the Company’s certificate of incorporation to increase the number of total authorized shares from 555,000,000 to 755,000,000 and the number of authorized shares of common stock from 550,000,000 to 750,000,000 (“Proposal 5”); and

f.To act upon such other matters as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The following Class I directors listed in Proposal 1 were elected to the Board based on the following votes:

| | | | | | | | | | | |

| For | Withhold | Broker Non-Vote |

| Ana Dutra | 165,780,465 | 24,596,176 | 81,132,977 |

| Geoffrey Duyk | 167,584,724 | 22,791,917 | 81,132,977 |

| James McCann | 157,011,318 | 33,365,323 | 81,132,977 |

| Steven Mills | 165,349,722 | 25,026,919 | 81,132,977 |

Proposal 2 was approved by the following vote:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 251,075,958 | 15,477,835 | 4,955,825 | — |

Proposal 3 was approved by the following vote:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 165,826,409 | 22,137,785 | 2,412,447 | 81,132,977 |

The "every one year" option in Proposal 4 was approved by the following vote:

| | | | | | | | | | | | | | |

| One Year | Two Years | Three Years | Abstain | Broker Non-Vote |

| 178,361,147 | 1,450,941 | 3,191,815 | 7,372,738 | 81,132,977 |

In accordance with the Board’s recommendation and in light of such vote, the Company determined that the advisory vote to approve the compensation of the Company’s named executive officers will be held every one year until the next required vote on the frequency of the advisory approval of the compensation of the Company’s named executive officers.

Proposal 5 was approved by the following vote:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 224,199,363 | 44,951,062 | 2,359,193 | — |

No further business was brought before the Annual Meeting.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: May 26, 2023 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | | Chief Financial Officer |

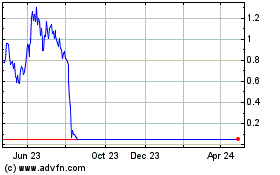

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Apr 2023 to Apr 2024