Additional Proxy Soliciting Materials (definitive) (defa14a)

May 19 2023 - 2:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant

Check the appropriate box:

| | | | | | | | |

| | |

| | Preliminary Proxy Statement |

| | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | Definitive Proxy Statement |

| ☒ | | Definitive Additional Materials |

| | Soliciting Material under §240.14a-12 |

BlackBerry Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| | |

| ☒ | | No fee required. |

| o | | Fee paid previously with preliminary materials. |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

| | |

SUPPLEMENT TO THE MANAGEMENT PROXY CIRCULAR DATED MAY 5, 2023

FOR THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 27, 2023

The following information supplements and amends the management proxy circular (the “Proxy Circular”) of BlackBerry Limited (the “Company”) filed with the U.S. Securities and Exchange Commission and the Canadian securities regulatory authorities on May 16, 2023 and furnished to shareholders of the Company in connection with the solicitation of proxies by the Board of Directors of the Company for the 2023 Annual and Special Meeting of Shareholders of the Company to be held on June 27, 2023 and any adjournment or postponement thereof. Capitalized terms used in this supplement to the Proxy Circular (this “Supplement”) and not otherwise defined herein have the meaning given to them in the Proxy Circular.

This Supplement updates the disclosure in the 2023 Proxy Circular in the section titled “Business to be Transacted at the Meeting – 4. Approval of Unallocated Entitlements Under the DSU Plan” to include a reference to abstentions by replacing the penultimate paragraph in its entirety with the following:

The Board recommends that shareholders vote “FOR” the foregoing resolution. Unless a shareholder directs that his or her Common Shares are to be voted against this resolution or abstains from voting on this resolution, the persons named in the form of proxy will vote FOR the foregoing resolution. This resolution must be approved by the holders of a majority of the Common Shares voting at the Meeting.

This Supplement also updates the disclosure in the 2023 Proxy Circular in the section titled “Business to be Transacted at the Meeting – 5. Advisory Vote on Executive Compensation” to include a reference to abstentions by replacing the final paragraph in its entirety with the following:

The Board recommends that shareholders vote “FOR” the Say on Pay Resolution. Unless a shareholder directs that his or her Common Shares are to be voted against this resolution or abstains from voting on this resolution, the persons named in the form of proxy will vote FOR the resolution to accept the Company’s approach to executive compensation disclosed in this Management Proxy Circular.

This Supplement also updates the disclosure in the 2023 Proxy Circular by adding the following sentence at the end of the answer to the question “4. What items will be voted on?” on page 3 of the Proxy Circular:

Abstentions and broker non-votes will have no effect on the outcome of any resolution.

Except as described above, this Supplement to the Proxy Circular does not modify, amend, supplement, or otherwise affect the Proxy Circular. This Supplement should be read in conjunction with the Proxy Circular.

If you have already voted, you do not need to vote again unless you would like to change or revoke your prior vote on any proposal. If you would like to change or revoke your prior vote on any proposal, please refer to the Proxy Circular for instructions on how to do so.

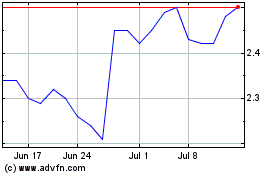

BlackBerry (NYSE:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

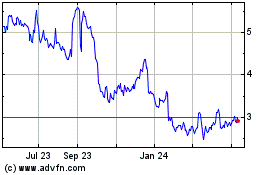

BlackBerry (NYSE:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024