Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258818

13,500,213 Shares of Common Stock

The selling stockholders named in this prospectus, or the Selling Stockholders, may offer and sell from time to time up to 13,500,213 shares of our common stock, par value $0.001 per share (the “Registered Shares”).

The Selling Stockholders may offer, sell or distribute all or a portion of the Registered Shares publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Registered Shares. We will bear all costs, expenses and fees in connection with the registration of these Registered Shares, including with regard to compliance with state securities or “blue sky” laws. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of common stock or warrants. See “Plan of Distribution” beginning on page 13 of this prospectus.

Our common stock is currently listed on The Nasdaq Global Select Market under the symbol “APLD.” On May 15, 2023, the last reported sale price of our common stock on the Nasdaq Global Select Market was $3.49 per share.

The public offering price per share of common stock will be determined by the Selling Stockholders and may be at a discount to the then current market price. Therefore, the recent market price used throughout this prospectus may not be indicative of the final offering price.

On April 12, 2022, we effected a 1-for-6 reverse stock split of our common stock, whereby each 6 shares of our common stock and common stock equivalents were converted into 1 share of common stock. All share and per share amounts in the registration of which this Prospectus forms a part have been adjusted to give effect to the reverse stock split.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 16, 2023

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to time, sell the Registered Shares offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Stockholders of the Registered Shares offered by them described in this prospectus.

This prospectus incorporates by reference important information about us that is not included in or delivered with this prospectus as described in “Incorporation of Certain Information by Reference” beginning on page 18 and “Additional Information” beginning on page 17. To the extent required by applicable law or as otherwise determined necessary, we may file one or more prospectus supplements to the registration statement of which this prospectus forms a part that may contain material information relating to this offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to the offering. If there is any inconsistency between the information in the prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement, as applicable. You should not assume that the information in this prospectus or any accompanying prospectus supplement is accurate as of any date other than the date on the front cover of such document or that the information in any document incorporated by reference is accurate as of any date other than the date such document was filed with the SEC.

Neither we nor the selling stockholders have authorized anyone to provide you with information or to make any representations that is different from that contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You should not rely on any unauthorized information or representation. Neither this prospectus nor any prospectus supplement constitutes an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they relate, nor does this prospectus or a prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “APLD,” “we,” “us,” “our” and similar terms refer to Applied Digital Corporation and its consolidated subsidiaries.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity, and market size, is based on information from various third-party industry and research sources, as well as assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our products and services. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity, and market size information included in this prospectus is generally reliable, information of this sort is inherently imprecise. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

This prospectus contains statistical data, estimates, and forecasts that are based on industry publications or reports generated by third-party providers, or other publicly available information, as well as other information based on internal estimates.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read the entire prospectus and any applicable prospectus supplement and the documents incorporated by reference before investing in our common stock, including the sections titled “Forward-Looking Statements” and “Risk Factors” provided elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See the section titled “Forward-Looking Statements.” Unless the context otherwise requires, the terms “Applied Digital,” “the company,” “we,” “us” and “our” in this prospectus refer to Applied Digital Corporation and our consolidated subsidiaries.

Our Business

We are a builder and operator of Next-Gen data centers across North America, which provide substantial computing power to high power computing applications such as blockchain infrastructure, nature language processing, and artificial intelligence. We have a colocation business model where customers place hardware they own into our facilities and we provide full operational and maintenance services for a fixed fee. We typically enter into long term fixed rate contracts with our customers.

On April 12, 2022, we effected a one-for-six (1:6) reverse split (the “Reverse Stock Split”) of shares of our common stock, par value $0.001 per share (the “Common Stock”). All references to Common Stock, options to purchase Common Stock, restricted stock units, share data, per share data and related information contained in the condensed consolidated financial statements have been retrospectively adjusted to reflect the effect of the Reverse Stock Split for all periods presented. No fractional shares of Common Stock were issued in connection with the Reverse Stock Split. Any fractional share resulting from the Reverse Stock Split was rounded down to the nearest whole share and the affected holder received cash in lieu of such fractional share.

Hosting Operation

We purchased property in North Dakota on which we constructed our first co-hosting facility. We entered into an Amended and Restated Energy Services Agreement for the purpose of supplying 100 megawatts (“MW”) of electricity to be used by our co-hosting customers at this facility. We also entered into agreements with five customers (JointHash Holding Limited (a subsidiary of GMR), Spring Mud (a subsidiary of GMR), Bitmain Technologies Limited, F2Pool Mining, Inc. and Hashing LLC, ) which utilize the total available energy under the Amended and Restated Energy Services Agreement. The company pays for energy from part of the revenue from customers.

Working with expert advisors in the fields of power, crypto mining operations, procurement, and construction, we have designed a plan for a prefabricated facility and organization within the facility that can be delivered and installed quickly and maximize performance and efficiency of the facility and our customers’ crypto mining equipment. Construction of our first co-hosting facility began in September 2021. On February 2, 2022, we brought our first facility online. It is now fully operational.On November 24, 2021, we entered into a letter of intent to develop a second datacenter facility. On April 13, 2022, the Company entered into a 99-year ground lease in Garden City, TX, with the intent to build our second datacenter facility on this site. On April 25, 2022 the Company began construction on this site. This facility is collocated with a wind farm and upon completion is expected to provide 200 MW of power to hosting customers. The facility is expected to begin operating in calendar Q2 of 2023 and the 200 MW capacity is fully contracted with our customers.

On January 6, 2022, we and Antpool, an affiliate of Bitmain Technologies Holding Company, entered into a Limited Liability Company Agreement of 1.21 Gigawatts, LLC (“1.21 Gigawatts”), pursuant to which we and Antpool contributed $8,000 and $2,000, respectively, and will initially own 80% and 20%, respectively, of 1.21 Gigawatts. 1.21 Gigawatts will develop, acquire, construct, finance, operate, maintain and own one or more Next-Gen datacenters with up to 1.5 gigawatts (“GW”) of capacity for hosting blockchain infrastructure. We are the managing member of 1.21 Gigawatts and are primarily responsible for all site development, construction and the eventual operations of the datacenters. However, certain activities of 1.21 Gigawatts and its subsidiaries require the vote of 90% of the then outstanding units of each such entity. As long as Antpool owns 10% or more of the total issued and outstanding units of 1.21 Gigawatts, Antpool may appoint an individual with industry expertise to serve as an advisor to 1.21 Gigawatts. 1.21 Gigawatts will pay fees to such advisor as reasonably determined by us as managing member. Transfers by members of units of 1.21 Gigawatts are prohibited without approval of 90% of units then outstanding, which consent may be granted or withheld for any reason, and transfers of such units to non-affiliates, after obtaining consent, are subject to a right of first refusal of the other members to purchase some or all of such units. Additionally, Antpool has the right at any time to convert all or any portion of its 1.21 Gigawatts units into a

number of shares of Common Stock. The number of shares that Antpool may convert is equal to the capital contributions of 1.21 Gigawatts made by Antpool divided by $7.50, which will result in an increase in our ownership percentage of 1.21 Gigawatts.

As our co-hosting operations expand, we believe our business structure will become conducive to a REIT structure, comparable to Digital Realty Trust (NYSE: DLR) and Equinix, Inc. (NASDAQ: EQIX), each of which is a traditional datacenter operator, and Innovative Industrial Properties, Inc. (NYSE: IIPR), a specialty REIT that similarly services a new growth industry. We have begun to investigate the possibility, costs and benefits of converting to a REIT structure.

On July 12, 2022, the Company entered into a five-year hosting contract with Marathon Digital Holdings, Inc. ("Marathon") for 270 MW of mining capacity. As a result of this arrangement, the Company will supply Marathon with 90 MW of hosting capacity at its facility in Texas and 180 MW of hosting capacity at its second facility in North Dakota. Marathon has subsequently added 39.6 MW of additional capacity at the Company’s Jamestown, North Dakota facility.

On August 8, 2022, the Company completed the purchase of 40 acres of land in Ellendale, North Dakota, for a total cost of $1 million. The Company took possession of the land on August 15, 2022, built a hosting facility, and began energizing the site on March 4, 2023. Once fully energized, this location will bring the Company to 280 MW of total hosting capacity across its facilities in North Dakota, all of which are contracted out to customers on multi-year terms.

On October 13, 2022, the Company entered into a joint venture agreement with Foundry Technologies, Inc. (“Foundry”) to form SAI Computing, LLC (“SAI”). SAI will provide artificial intelligence and machine learning application customers with access to machines and a hosting environment. The Company is currently expanding capacity at the Jamestown, North Dakota datacenter facility to provide access to SAI and its customers. The Company has an 98% ownership interest in SAI and consolidates the entity.

On December 14, 2022, the Company began construction of its latest specialized processing center, a 5 MW facility next to the Company’s currently operating 100-MW hosting facility in Jamestown, North Dakota. This separate and unique building, designed and purpose-built for Graphics Processing Units (“GPUs”), will sit separate from the Company’s current buildings and plans to host more traditional high performance computing (“HPC”) applications, such as natural language processing, machine learning, and additional HPC developments.

Our Competitive Strengths

Premier strategic partnerships with leading industry participants.

In March 2021, we executed a strategy planning and portfolio advisory services agreement (“Services Agreement”) with GMR Limited, a British Virgin Island limited liability company (“GMR”), Xsquared Holding Limited, a British Virgin Island limited liability company (“SparkPool”) and Valuefinder, a British Virgin Islands limited liability company (“Valuefinder”) and, together with GMR and SparkPool, (the “Service Provider(s)”). Jason Zhang, one of our board members, is the sole equity holder and manager of Valuefinder and a related party. Pursuant to the Services Agreement, the Service Providers agreed to provide cryptoasset mining management and analysis and to assist us in securing difficult to obtain equipment and we agreed to issue 7,440,148 shares of Common Stock to GMR or its designees, 7,440,148 shares of Common Stock to SparkPool or its designees and 3,156,426 shares of Common Stock to Valuefinder or its designees. Each Service Provider has provided such services to us which services commenced in June 2021. Each of these Service Providers assisted in the creation of our crypto mining operations, which we then terminated on March 9, 2022. Each of them also advised us in connection with the design and buildout of our co-hosting operations. GMR and SparkPool have since become customers of our co-hosting operations. As of June 2022, SparkPool ceased all operations and is no longer in a position to provide services under the Services Agreement. On June 2, 2022, SparkPool forfeited 4,965,432 shares of Common Stock back to us.

We believe that our partnerships with GMR, Bitmain and certain other partners have provided, and continue to provide, us with a significant competitive advantage. GMR has also been a proponent of our hosting strategy, having signed a contract for approximately 50% of our 100 MW capacity as part of our hosting operation under development. Bitmain, provides leads for potential hosting customers. SparkPool, GMR, and Bitmain are each strategic equity investors in our company. Each of them also advised us in connection with the design and buildout of our co-hosting operations. GMR, SparkPool and Bitmain have since become customers of our co-hosting operations.

Access to low-cost power with long-term services agreement.

One of the main benefits of our Amended and Restated Electric Service Agreement is the low cost of power for mining. Even prior to the crypto mining restrictions in China, power capacity available for Bitcoin mining was scarce, especially at scalable sites with over 100 MW of potential capacity. This scarcity of mining power allows us to realize attractive hosting rates in the current market, in particular given our ability to provide long-term (3-5 year) hosting contracts.

Benefits of Next-Gen datacenters compared to traditional datacenters.

Next-Gen datacenters are optimized for large computing power and require more power than traditional datacenters that are optimized for data retention and retrieval. Next-Gen datacenters and traditional datacenters also have very different layouts, internet connection requirements and cooling designs to accommodate different power demands and customer requirements. Traditional datacenters cannot be easily converted to Next-Gen datacenter facilities like ours because of these differences. Geographically, traditional datacenters are at a disadvantage because they require fiber bases, low-latency connections and connection redundancies that are usually found in high-cost areas with high-density populations.

Hosting provides predictable, recurring revenue and cash flow as compared to more volatile mining operations.

As compared to our previous mining operations, co-hosting revenues are less subject to volatility related to the underlying cryptoasset markets. Through our Amended and Restated Electric Service Agreement with a utility in the upper Midwest, we have a contractual ceiling for our energy costs. The Electric Service Agreement has also enabled us to launch our hosting business with long-term customer contracts. Cambridge Bitcoin Electricity Consumption Index reported that as of February 1, 2021 more than 6 GW of Bitcoin was mined in China (or $4.3 billion of power cost, assuming $0.08 per kWh average hosting cost). China has since banned cryptoasset mining related activity. We expect much of the demand for hosting locations previously met in China will move to the United States due to its reliable power options. We intend for the steady cash flows generated by our hosting operations to be reinvested into the hosting business.

Strong management team and board of advisors with deep experience in crypto mining and hosting operations.

We have recently expanded our leadership team by attracting top talent in the hosting space. Recent hires from both publicly traded and private companies have allowed us to build a team capable of designing and constructing hosting facilities. In addition, our board of advisors includes experts in the crypto space, including the co-founders of SparkPool and GMR.

Our Growth Strategies

Leverage partners to grow hosting operations while minimizing risk.

Our strategic partners GMR and Bitmain have entered into hosting contracts with us that will utilize the available capacity from our currently operating 100 MW hosting site, which enabled us to pre-fill our initial site before breaking ground. Beyond their own use of our hosting capabilities, our partners have strong relationships across the cryptocurrency ecosystem, and we believe that we will be able to leverage their networks to identify leads for our expansion of hosting operations. We believe we have sufficient demand to fill our planned hosting expansion.

Secure scalable power sites in areas favorable for crypto mining.

We have developed a pipeline of potential power sources. Our first hosting site in North Dakota is fully operational and our second site in North Dakota began energizing in March 2023. Further, we expect our facility in Garden City, TX to begin energizing during calendar Q2 of 2023. Combined, these facilities will provide total hosting capacity of roughly 500 MW. Through our build-out of our first North Dakota facility and the prior experience our leadership team brings to our initiatives, we believe that we have developed a repeatable power strategy to significantly scale our operations. In addition, we are currently focused on and will continue to target states that have favorable laws and regulations for the crypto mining and HPC application industries, which we believe further minimizes the associated with risks the scaling of our operations.

Vertically integrate power assets.

With recent additions to our management team, we are increasingly looking at various types of power assets to support the growth of our hosting operations. This also includes power generation assets, which longer-term could be used to reduce our cost of power. Our management team has experience not only in evaluating and acquiring power assets, but also in the conversion of power assets to crypto mining/hosting operations and the construction of datacenters with the specific purpose of mining cryptocurrency assets.

Expand into other high computing processing applications and businesses.

While we no longer mine cryptoassets and have no plans to return to crypto mining operations, we see potential value in the ecosystems developing around cryptoassets. We deem the following factors important in making a decision to enter into a particular line of business: advice from securities and regulatory legal counsel about the regulatory framework applicable to such line of business, including the Howey test for whether or not a particular asset could be a security and consequences thereof, as applicable at the time, economic conditions, costs and benefits resulting from investing in a new line of business rather than our current co-hosting business, other costs of establishing such new or additional line of business, investor appetite, and other factors that may arise from time to time which could impact the costs and benefits to us and our stockholders.

Our Company History

Applied Digital Corporation was incorporated in Nevada in May 2001 and conducted business under several names until July 2009, when we filed a Form 15 with the SEC to suspend the registration of Common Stock and our obligations to file annual, quarterly and other periodic reports with the SEC in order to conserve financial and other resources for the continuing development and commercialization of our business. Our Common Stock continued to trade on the OTC Pink Market. In 2021, we changed our name to Applied Blockchain, Inc. and began our current next-gen data center business. On February 2, 2022, we brought our first North Dakota facility online. It is now fully operational. In April 2022, we completed our initial public offering and our Common Stock began trading on The Nasdaq Global Select Market. In November 2022, we changed our name to Applied Digital Corporation.

Our Corporate Information

Our executive office is located at 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219, and our phone number is (214) 427-1704. Our principal website address is www.applieddigital.com The information on any of our websites is deemed not to be incorporated in this prospectus or to be part of this prospectus.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies so long as the market value of our voting and non-voting Common Stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our Common Stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

RISK FACTORS

An investment in our common stock involves a high degree of risk. We urge you to carefully consider the risk factors described under the heading “Risk Factors” in our most recently filed Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q, which are incorporated by reference in this prospectus, together with all of the other information contained in or incorporated by reference in this prospectus and in any applicable prospectus supplement. The risks described in the foregoing documents could adversely affect our business, financial condition or results of operation. Please also read the section below entitled “Forward-Looking Statements.”

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. In some cases you can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “seek,” “should,” “will,” and “would,” or similar words. Statements that contain these words and other statements that are forward-looking in nature should be read carefully because they discuss future expectations, contain projections of future results of operations or of financial positions or state other “forward-looking” information.

These statements are based on our management’s beliefs and assumptions, which are based on currently available information. Our actual results, and the assumptions on which we relied, could prove materially different from our expectations. You are cautioned not to place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to:

•Labor and other workforce shortages and challenges;

•our dependence on principal customers;

•the addition or loss of significant customers or material changes to our relationships with these customers;

•our sensitivity to general economic conditions including changes in disposable income levels and consumer spending trends;

•our ability to timely and successfully build new hosting facilities with the appropriate contractual margins and efficiencies;

•our ability to continue to grow sales in our hosting business;

•volatility of cryptoasset prices

•uncertainties of cryptoasset regulation policy; and

•equipment failures, power or other supply disruptions.

You should carefully review the risks described in “Risk Factors” beginning on page 7 as the occurrence of any of these events could have an adverse effect, which may be material, on our business, results of operations, financial condition or cash flows.

USE OF PROCEEDS

All the Registered Shares offered by the Selling Stockholders will be sold by them for their respective accounts. We will not receive any of the proceeds from these sales.

The Selling Stockholders will pay any underwriting fees, discounts, selling commissions, stock transfer taxes and certain other legal expenses incurred by such Selling Stockholders in disposing of their Registered Shares, and we will bear all other costs, fees and expenses incurred in effecting the registration of such Registered Shares, including, without limitation, all registration and filing fees, or Nasdaq Global Select Market listing fees, and fees and expenses of our counsel and our independent registered public accountants.

SELLING STOCKHOLDERS

This prospectus relates to the resale by the Selling Stockholders from time to time of up to 13,500,213 shares of Common Stock (the “Registered Shares”). Selling Stockholders originally acquired the Registered Shares upon the conversion of:

shares of our Series C Convertible Redeemable Preferred Stock (the “Series C Preferred Stock”) and paid-in-kind dividends accrued thereon through April 13, 2022 when the Registration Statement of which this prospectus forms a part was declared effective by the Securities Exchange Commission, or the SEC. The shares of Series C Preferred Stock were issued in a private placement pursuant to subscription agreements entered into on April 15, 2021; or

shares of Common Stock issued upon automatic conversion of 1,380,000 shares of our Series D Convertible Redeemable Preferred Stock (the “Series D Preferred Stock”) and paid-in-kind dividends accrued thereon through April 13, 2022 when the Registration Statement of which this prospectus forms a part was declared effective by the SEC. The shares of Series D Preferred Stock were issued in a private placement pursuant to subscription agreements entered into on July 30, 2021, August 24, 2021 and October 7.

The Selling Stockholders may from time to time offer and sell any or all of the Registered Shares set forth below pursuant to this prospectus and any accompanying prospectus supplement. When we refer to the “Selling Stockholders” in this prospectus, we mean the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors, designees and others who later come to hold any of the Selling Stockholders’ interest in the Registerable Shares other than through a public sale.

The following table sets forth, as of the date of this prospectus, the names of the Selling Stockholders, the aggregate number of shares of Common Stock beneficially owned, the aggregate number of shares of Registered Shares that the Selling Stockholders may offer pursuant to this prospectus and the number of shares our Common Stock beneficially owned by the Selling Stockholders after the sale of the Registered Shares offered hereby. We have based percentage ownership on 95,908,964 shares of Common Stock outstanding as of May 1, 2023.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all securities that they beneficially own, subject to community property laws where applicable.

We cannot advise you as to whether the Selling Stockholders will in fact sell any or all of their Registered Shares. In addition, the Selling Stockholders may sell, transfer or otherwise dispose of, at any time and from time to time, the Registered Shares or other shares of our Common Stock in transactions exempt from the registration requirements of the Securities Act after the date of this prospectus.

Selling Stockholder information for each additional Selling Stockholder, if any, will be set forth by prospectus supplement to the extent required prior to the time of any offer or sale of such Selling Stockholder’s shares pursuant to this prospectus. Any prospectus supplement may add, update, substitute, or change the information contained in this prospectus, including the identity of each Selling Stockholder and the number of shares registered on its behalf. A Selling Stockholder may sell or otherwise transfer all, some or none of such shares in this offering. See “Plan of Distribution.”

| | | | | | | | | | | | | | | | | |

Name of Selling Stockholder | Shares Beneficially Owned | Registered Shares |

| Percentage Owned After Sale of Registered Shares(a) |

Percentage Owned Prior to Sale of Registered Shares | Shares Owned After Sale of Registered Shares (a) |

Alan N. Forman | 97,000 | 97,000 | * | — | * |

Allison Wolford | 3,939 | 3,939 | * | — | * |

Andrew Moore | 1,076,055(b)(c) | 675,780(e) | 1.1% | 400,275(b)(f) | * |

Bitmain Delaware Holding

Company, Inc. | 1,180,824 | 1,180,824 | 1.2% | — | * |

Brett Chiles | 7,878 | 7,878 | * | — | * |

Brian Herman | 39,365 | 39,365 | * | — | * |

Brian Smoluch | 457,864 | 457,864 | * | — | * |

B. Riley Securities, Inc | 613,163 | 458,163 | * | 155,000 | * |

Bryant and Carleen Riley

JTWROS | 3,668,743(c)(d) | 652,163(e) | 3.8% | 3,017,034(d)(f) | 3.2% |

David G. Swank | 157,443 | 157,443 | * | — | * |

David S. Hunt | 86,600 | 86,600 | * | — | * |

Deep Field Opportunities Fund, LP | 1,671,276 | 1,671,276 | 1.7% | — | * |

Drew Rossi | 1,969 | 1,969 | * | — | * |

F2Pool Mining Inc | 1,968,039 | 1,968,039 | 2.0% | — | * |

Granite Point Capital Master Fund, LP | 785,675 | 785,675 | * | — | * |

Granite point Capital Scorpion Focused Ideas Fund | 785,675 | 785,675 | * | — | * |

Harvey SMIDCAP Fund, LP | 34,361 | 34,361 | * | — | * |

Hunt Technology

Ventures, LP | 121,100 | 121,100 | * | — | * |

Jimmy Baker | 55,433 | 55,433 | * | — | * |

John B. Berding | 151,589 | 151,589 | * | __ | * |

Jonathan Talcott | 9,848 | 9,848 | * | — | * |

Kingdom Investments,

Limited | 261,945 | 261,945 | * | — |

* |

Lyda Hunt-Herbert Trusts –

Bruce William Hunt | 142,888 | 142,888 | * | — | * |

MACABA Holdings, LLC | 51,960 | 51,960 | * | __ | * |

Martin Friedman | 19,687 | 19,687 | * | — | * |

MC Opportunities Fund LP | 137,765 | 137,765 | * | — | * |

| | | | | | | | | | | | | | | | | |

Millbrook Consulting

Group LLC | 19,687 | 19,687 | * | — | * |

Nokomis Capital Master Fund LP | 3,061,025 | 994,529 | 3.2% |

| 2.2% |

Patrick Hanniford | 9,848 | 9,848 | * | — | * |

Placid Ventures, L.P. | 212,180 | 212,180 | * | — | * |

Rohan Kumar | 150,232 | 150,232 | * | — | * |

Star V Partners LLC | 459,890 | 459,890 | * | — | * |

Voss Value Master Fund, L.P. | 1,662,600 | 1,662,600 | 1.7% | — | * |

Voss Value-Oriented Special Situations Fund, LP | 196,808 | 196,808 | * | — | * |

William Herbert Hunt

Trust, Estate | 694,536 | 694,536 | * | — |

* |

_______________________

* Less than 1%.

(a) Assumes that the Selling Stockholders will have sold all of the securities covered by this prospectus upon the completion of the offering.

(b) Includes (i) 118,630 shares of Common Stock held by Virginia Moore, Mr. Moore’s spouse, (ii) 76,191 shares of restricted stock held by Virginia Moore, which will vest on November 10, 2023.

(c) Includes 613,617 shares of common stock held by B. Riley Securities, Inc. of which Mr. Moore is the Chief Executive Officer and which is a wholly owned subsidiary of B. Riley Financial, Inc., of which Bryant Riley is chairperson of the board and co-chief executive officer and of which Mr. Riley, together with his spouse, own 20.5%.

(d) Includes 427,833 shares of common stock held by B. Riley Financial, Inc., of which Bryant Riley is chairperson of the board and co-chief executive officer and of which Mr. Riley, together with his spouse, own 20.5%.

(e) Includes 458,163 shares of common stock, the resale of which is registered on the registration statement of which this prospectus forms a part. Such shares are held by B. Riley Securities, Inc., of which Mr. Moore is the Chief Executive Officer, and which is a wholly owned subsidiary of B. Riley Financial, Inc., of which Bryant Riley is chairperson of the board and co-chief executive officer and of which Mr. Rile, together with his spouse, own 20.5%.

(f) Includes 155,00 shares of common stock held after this offering by B. Riley Securities, Inc., of which Mr. Moore is the Chief Executive Officer and which is a wholly owned subsidiary of B. Riley Financial, Inc., of which Bryant Riley is chairperson of the board and co-chief executive officer and of which Mr. Riley, together with his spouse, own 20.5%.

In 2009, certain affiliates of B. Riley Securities, Inc., including members of senior management, purchased preferred shares of, and funded certain loans to, us. Such shares and loans have been converted into an aggregate of approximately 3.6 million shares of our Common Stock. In April 2021, certain employees of B. Riley Securities, Inc. purchased an aggregate of 67,400 shares of our Series C Preferred Stock. B. Riley Securities, Inc. provided investment banking services in connection with the offering of our Series C Preferred Stock. Additionally, in July 2021, certain employees of B. Riley Securities, Inc. purchased an aggregate of 85,960 shares of our Series D Preferred Stock. B. Riley Securities, Inc. provided investment banking services in connection with the offering of our Series D Preferred Stock.

On August 4, 2021, our chairman of the Board, chief executive officer and president, Wes Cummins, sold a majority interest in 272 Capital LP, a registered investment adviser controlled by him, to B. Riley Financial, Inc. and became the CEO and President of B. Riley Capital Management, LLC. In addition, Chuck Hastings, CEO of B. Riley Wealth Management, Inc., serves on our Board and Virginia Moore, a member of the Board, is the spouse of the CEO of B. Riley Securities, Inc.

Additionally, in December 2021 and February 2022, the holders of more than a majority of each of our Series C Preferred Stock and our Series D Preferred Stock agreed to amend the applicable Registration Rights Agreements to prohibit, subject to certain limited exceptions, holders of Series C Preferred Stock or Series D Preferred Stock from offering, pledging, selling, contracting to sell, granting any option to purchase or otherwise disposing of our equity securities, including our Common Stock issuable up conversion of the Series C Preferred Stock and Series D Preferred Stock, or to enter into any hedge or other arrangement or any transaction that transfers, directly or indirectly, the economic consequences of ownership of such Common Stock for a period that ended on June 11, 2022.

PLAN OF DISTRIBUTION

The Selling Stockholders, which, as used herein, includes their permitted transferees, may, from time to time, sell, transfer or otherwise dispose of any or all of their Registered Shares on the Nasdaq Global Select Market or any stock exchange, market or trading facility on which our commons stock is listed or traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices.

The Selling Stockholders may use any one or more of the following methods when disposing of their Registered Shares:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•in underwritten transactions;

•settlement of short sales entered into after the date of this prospectus;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price;

•distribution to members, limited partners or stockholders of Selling Stockholders;

•“at the market” or through market makers or into an existing market for the shares;

•a combination of any such methods of sale; and

•any other method permitted pursuant to applicable law.

The Selling Stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of our Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell their Registered Shares, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b) or other applicable provision of the Securities Act amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus. The Selling Stockholders also may transfer their shares in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our Registered Shares, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our securities in the course of hedging the positions they assume. The Selling Stockholders may also sell their securities short and deliver these securities to close out their short positions, or loan or pledge such securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Stockholders from the sale of our Registered Shares offered by them will be the purchase price of the Registered Shares less discounts or commissions, if any. The Selling Stockholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of our Common Stock or Warrants to be made directly or through agents. We will not receive any of the proceeds from any offering by the Selling Stockholders.

The Selling Stockholders also may in the future resell a portion of our Common Stock in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities Act.

The Selling Stockholders and any underwriters, broker-dealers or agents that participate in the sale of our Registered Shares or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of Registered Shares may be underwriting discounts and commissions under the Securities Act. If any Selling Stockholder is an “underwriter” within the meaning of Section 2(11) of the Securities Act, then the Selling Stockholder will be subject to the prospectus delivery requirements of the Securities Act. Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into with us and the Selling Stockholders, to indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities Act.

To the extent required, the Registered Shares to be sold, the respective purchase prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable discounts, commissions, concessions or other compensation with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

To facilitate an offering of the securities, certain persons participating in the offering may engage in transactions that stabilize, maintain, or otherwise affect the price of the securities. This may include over-allotments or short sales of the securities, which involves the sale by persons participating in the offering of more securities than we sold to them. In these circumstances, these persons would cover the over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option. In addition, these persons may stabilize or maintain the price of the securities by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

We have agreed to maintain the effectiveness of this registration statement until all such securities have been sold under this registration statement or Rule 144 under the Securities Act or are no longer outstanding. We are required to pay all fees and expenses incident to the registration of the shares of our Common Stock and Warrants to be offered and sold pursuant to this prospectus. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their sale of Registered Shares.

The Selling Stockholders may use this prospectus in connection with resales of the Registered Shares. This prospectus and any accompanying prospectus supplement will identify the Selling Stockholders, the terms of the Registered Shares and any material relationships between us and the Selling Stockholders. The Selling Stockholders may be deemed to be underwriters under the Securities Act in connection with the Registered Shares they resell and any profits on the sales may be deemed to be underwriting discounts and commissions under the Securities Act. Unless otherwise set forth in a prospectus supplement, the Selling Stockholders will receive all the net proceeds from the resale of the Registered Shares.

A Selling Stockholder that is an entity may elect to make an in-kind distribution of the Registered Shares to its members, partners or stockholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent that such members, partners or stockholders are not affiliates of ours, such members, partners or stockholders would thereby receive freely tradable Common Stock pursuant to the distribution through a registration statement.

LEGAL MATTERS

The validity of the securities offered in this prospectus is being passed upon for us by Snell & Wilmer L.L.P. Kelley Drye & Warren LLP and Wick Phillips, LLP have also acted as counsel to us in connection with this offering.

EXPERTS

The consolidated financial statements of Applied Digital Corporation as of May 31, 2022 and May 31, 2021 and for the years ended May 31, 2022 and 2021, incorporated by reference herein and elsewhere in the registration statement, have been audited by Marcum, LLP, an independent registered public accounting firm, as stated in their report, and have been incorporated herein by reference upon their authority as experts in accounting and auditing.

ADDITIONAL INFORMATION

We have filed a registration statement on Form S-3, including exhibits, under the Securities Act with respect to the Common Stock offered by this prospectus. This prospectus does not contain all of the information included or incorporated by reference in the registration statement. For further information pertaining to us and our securities, you should refer to the registration statement and our exhibits or the exhibits to the reports or other documents incorporated by reference into this prospectus.

In addition, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public on a website maintained by the SEC located at www.sec.gov. We also maintain a website at www.applieddigital.com. Through our website, we make available, free of charge, annual, quarterly and current reports and other information as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference in this prospectus the information in documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information in this prospectus updates (and, to the extent of any conflict, supersedes) information incorporated by reference that we have filed with the SEC prior to the date of this prospectus. You should read the information incorporated by reference because it is an important part of this prospectus.

We incorporate by reference the documents listed below, excluding any portions of any Current Report on Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form 8-K:

•Our Annual Report on Form 10-K for the fiscal year ended May 31, 2022, filed with the SEC on August 29, 2022;

•Our Quarterly Report on Form 10-Q for the fiscal quarter ended February 28, 2023, filed with the SEC on April 6, 2023;

•Our Quarterly Report on Form 10-Q for the fiscal quarter ended November 30, 2022, filed with the SEC on January 10, 2023;

•Our Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2022, filed with the SEC on October 12, 2022;

•Our Current Report on Form 8-K filed with the SEC on June 8, 2022;

•Our Current Report on Form 8-K filed with the SEC on June 14, 2022;

•Our Current Report on Form 8-K filed with the SEC on July 18, 2022 (as to filed portions only);

•Our Current Report on Form 8-K filed with the SEC on July 29, 2022;

•Our Current Report on Form 8-K filed with the SEC on August 5, 2022

•Our Current Report on Form 8-K filed with the SEC on August 12, 2022

•Our Current Report on Form 8-K filed with the SEC on November 14, 2022

•Our Current Report on Form 8-K filed with the SEC on January 6, 2023

•Our Current Report on Form 8-K filed with the SEC on February 21, 2023;

•Our Current Report on Form 8-K filed with the SEC on March 7, 2023; and

•The description of our Common Stock in our Registration Statement on Form 8-A, filed with the SEC on April 11, 2022, including any amendment or reports filed for the purpose of updating such description; and

•All documents subsequently filed by the Company with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents.

We also incorporate by reference any future filings we will make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act (other than filings or portions of filings that are furnished under applicable SEC rules rather than filed), including those made after the date of filing of the initial registration statement of which this prospectus is a part and prior to its effectiveness, until we file a post-effective amendment that indicates the termination of the offering of the securities made by this prospectus. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

We hereby undertake to provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, a copy of any or all documents that are incorporated by

reference into this prospectus, but not delivered with the prospectus, other than exhibits to such documents unless such exhibits are specifically incorporated by reference into the documents that this prospectus incorporates. To request such materials, please contact Dianne Garcia by email at dianne@applieddigital.com. These documents are also available free of charge on the SEC’s website at www.sec.gov and through the Investors section on our website at http://www.applieddigital.com as soon as practicable after such materials have been electronically filed with, or furnished to, the SEC.

13,500,213 Shares of Common Stock

PROSPECTUS

May 16, 2023

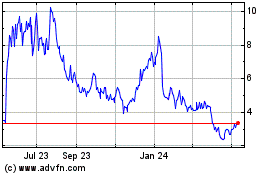

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

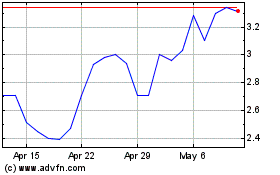

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

From Apr 2023 to Apr 2024