Current Report Filing (8-k)

May 03 2023 - 6:02AM

Edgar (US Regulatory)

0001502966

false

0001502966

2023-04-20

2023-04-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): April

20, 2023

Digipath,

Inc.

(Exact

name of registrant as specified in charter)

Nevada

|

|

000-54239

|

|

27-3601979

|

(State

or other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.) |

| 6450

Cameron Street, Suite 113 Las Vegas, NV |

|

89118 |

| (Address of principal executive

offices) |

|

(zip code) |

(702)

527-2060

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any

of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On

April 20, 2022, Digipath, Inc. (“the “Company”), and Digipath Labs, Inc. (“Digipath Labs”), a wholly-owned

subsidiary of the Company, entered into an Asset Purchase Agreement (the “Purchase Agreement”) with DPL NV, LLC (“Buyer”),

pursuant to which Digipath Labs has agreed to sell substantially all of its assets to Buyer for a cash purchase price of $2,300,000 (the

“Purchase Price”). The Purchase Price is subject to adjustments at closing based on, among other things, the amount by which

the working capital of Digipath Labs at the closing is greater or less than $150,000.

The

Purchase Agreement includes a number of representations, warrantees, covenants and conditions to closing customary for this type of transaction.

In addition, the closing of the transaction is subject to the approval of the Nevada Cannabis Compliance Board (the “CCB”).

In the event CCB approval is not obtained by June 30, 2024, or any other condition to closing has not been satisfied by such date, either

party may terminate the Purchase Agreement.

Pursuant

to the Purchase Agreement, the Buyer deposited $230,000 into an escrow account upon the execution of the Purchase Agreement, and such

amount will continue to be held in escrow for a 12-month period following closing to satisfy any indemnification claims Buyer may have

against Digipath Labs.

In

connection with the transactions contemplated by the Purchase Agreement, Digipath, Digipath Labs and Buyer entered into a Management

Services Agreement (the “Management Services Agreement”), dated as of April 30, 2023, pursuant to which Buyer has been engaged

to manage the operation of Digipath Labs’ cannabis testing laboratory (the “Lab”). The effectiveness of the Management

Services Agreement is subject to the approval of the CCB, which has not yet been obtained. Pursuant to the Management Services Agreement,

after the payment of expenses to third parties and a payment of 15% of cash collections to Digipath (but not less than $15,000) in each

month, Buyer will be entitled to a management fee of $10,000 per month. Any remaining cash generated from the operation of the Lab in

any month will be payable 45% to the Buyer and 55% to the Company.

The

descriptions of the Purchase Agreement and Management Services Agreement are qualified in their entirety by reference to the actual terms

thereof, which have been filed as Exhibits 2.1 and 10.1 to this Current Report on Form 8-K, and which are incorporated herein by reference.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

May 2, 2023, Bruce Raben submitted a letter to the Company resigning from his position as a director of the Company.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit 2.1 |

|

Asset

Purchase Agreement between Digipath, Inc., Digipath Labs, Inc. and IHE Holdings, LLC, dated April 20, 2023 |

| Exhibit 10.1 |

|

Management

Services Agreement between Digipath, Inc., Digipath Labs, Inc. and IHE Holdings, LLC, dated April 20, 2023 |

| Exhibit 104 |

|

Cover Page Interactive Data

File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Digipath,

Inc. |

| |

|

|

| |

Date: May 2, 2023 |

| |

|

|

| |

By: |

/s/

A. Stone Douglass |

| |

|

A.

Stone Douglass |

| |

|

Chief

Financial Officer |

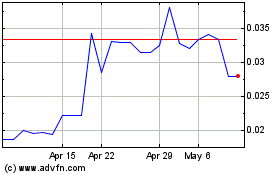

Digipath (PK) (USOTC:DIGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

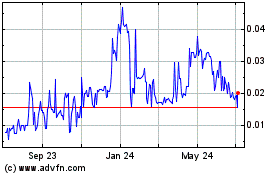

Digipath (PK) (USOTC:DIGP)

Historical Stock Chart

From Apr 2023 to Apr 2024