Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

RiceBran Technologies

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

California

|

|

2040

|

|

87-0673375

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

25420 Kuykendahl Rd., Suite B300

Tomball, TX 77375

Telephone: (281) 675-2421

|

|

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

|

| |

|

Peter G. Bradley

Director and Executive Chairman

RiceBran Technologies

25420 Kuykendahl Rd., Suite B300

Tomball, TX 77375

Telephone: (281) 675-2421

|

|

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

|

| |

|

Copy to:

|

| |

|

Scott Rubinsky

K. Stancell Haigwood

Vinson & Elkins L.L.P.

845 Texas Avenue, Suite 4700

Houston, Texas 77002

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

| Non-accelerated Filer |

☒ |

Smaller Reporting Company |

☒ |

| |

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED May 1, 2023

PRELIMINARY PROSPECTUS

Up to 2,000,000 Shares of Common Stock

Issuable Upon Exercise of Outstanding Warrants

This prospectus relates to the resale from time to time, by the selling shareholders identified in this prospectus under the caption “Selling Shareholders,” of up to 2,000,000 shares of our common stock, no par value (the “Common Stock”), they may acquire upon the exercise of outstanding warrants, which we refer to as the “Warrants.” We issued the Warrants to the selling shareholders in a private placement concurrent with a registered direct offering of 675,000 shares of our Common Stock and pre-funded warrants (“Pre-Funded Warrants”) to purchase up to an aggregate of 325,000 shares of Common Stock, which was completed on October 20, 2022.

The selling shareholders may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in their shares of Common Stock on any stock exchange, market or trading facility on which the Common Stock is traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. See “Plan of Distribution” in this prospectus for more information. We will not receive any proceeds from the resale or other disposition of the shares of Common Stock by the selling shareholders. However, we will receive the proceeds of any cash exercise of the Warrants. See “Use of Proceeds” beginning on page 7 and “Plan of Distribution” beginning on page 13 of this prospectus for more information.

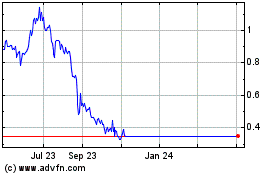

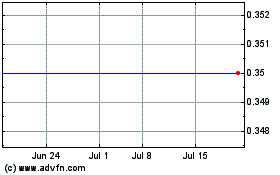

Our Common Stock is currently traded on the Nasdaq Capital Market under the symbol “RIBT.” On April 28, 2023, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $1.07 per share.

You should read this prospectus, together with additional information described under the headings “Information Incorporated by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the Securities and Exchange Commission (the “SEC”) on March 16, 2023, as amended on April 14, 2023, in our subsequent Quarterly Reports on Form 10-Q and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

We have not authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the full text of the actual documents, some of which have been filed or will be filed and incorporated by reference herein. See “Information Incorporated by Reference” and “Where You Can Find More Information” in this prospectus. We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus contains and incorporates by reference certain market data and industry statistics and forecasts that are based on studies sponsored by us, independent industry publications and other publicly available information. Although we believe these sources are reliable, estimates as they relate to projections involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and under similar headings in the documents incorporated by reference herein and therein. Accordingly, investors should not place undue reliance on this information.

SUMMARY

This summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the section entitled “Risk Factors” beginning on page 5 and our consolidated financial statements and the related notes and the other information incorporated by reference into this prospectus before making an investment decision.

All references to the terms “RiceBran,” the “Company,” “we,” “us” or “our” in this prospectus refer to RiceBran Technologies, a California corporation, and its subsidiaries, unless the context requires otherwise.

Overview

We are a specialty ingredient company that utilizes proprietary stabilization and separation technologies, supported by specialty milling processes, to deliver critical nutritional and functional ingredients derived from rice and other small and ancient grains for the food, nutraceutical, companion animal and equine feed categories. We are focused on milling rice and other small and ancient grains and producing, processing, and marketing value-added healthy, natural and nutrient dense products derived from these grains. Notably, we are a market leader in North America in converting raw rice bran into stabilized rice bran (“SRB”) and high value SRB derivative products including:

| |

●

|

RiBalance, a complete rice bran nutritional package derived from further processing SRB;

|

| |

●

|

RiSolubles, a highly nutritious, carbohydrate and lipid rich fraction of RiBalance;

|

| |

●

|

RiFiber, a protein and fiber rich insoluble derivative of RiBalance; and

|

| |

●

|

our family of ProRyza products, which includes derivatives composed of protein and protein/fiber blends.

|

Our existing and target customers are food and animal nutrition manufacturers, wholesalers and retailers, both domestically and internationally.

Corporate Information

We incorporated under the laws of the state of California in 2000, and our principal executive offices are located at 25420 Kuykendahl Rd., Suite B300, Tomball, TX 77375. Our telephone number is (281) 675-2421. Our website is located at www.ricebrantech.com. Information contained on, or that can be accessed through, our website is not part of this prospectus.

Recent Developments

Registered Direct Offering and Private Placement

On October 18, 2022, we entered into a securities purchase agreement (the “Purchase Agreement”) with certain institutional investors (the “Investors”) for the issuance and sale of 675,000 shares of Common Stock at a purchase price per share of $1.50 and Pre-Funded Warrants to purchase up to an aggregate of 375,000 shares of Common Stock at a purchase price of $1.4999 per Pre-Funded Warrant in a registered direct offering (the “Registered Offering”). The net proceeds from the Registered Offering, after deducting the placement agent fees and expenses payable by us, were approximately $1.0 million.

In a concurrent private placement (the “Private Placement” and together with the Registered Offering, the “Offering”), the Company also agreed to issue and sell to the Investors Warrants to purchase up to an aggregate of 2,000,000 shares of Common Stock. The Warrants are exercisable six months after issuance at an exercise price of $1.60 per share and have a term of two and one-half years from the initial exercise date. The closing of the issuance and sale of these securities was consummated on October 20, 2022. This prospectus covers the resale or other disposition by the selling shareholders of the shares of Common Stock issuable upon the exercise of the Warrants.

The Company engaged H.C. Wainwright & Co., LLC (“Wainwright”) to act as its exclusive placement agent in connection with the Offering. The Company issued Wainwright, or its designees, warrants (the “Wainwright Warrants”) to purchase up to 63,000 shares of Common Stock. The Wainwright Warrants have an exercise price equal to $1.875, or 125% of the offering price per share of Common Stock, and are exercisable for five years from the commencement of sales in the Offering.

Reverse Stock Split

On August 25, 2022, we amended our articles of incorporation, as amended (the “Articles of Incorporation”), by filing with the California Secretary of State an amendment to effect a 1-for-10 reverse stock split of our Common Stock and to decrease the total number of authorized shares of our Common Stock on a post-reverse stock split basis, so that the total number of shares that we have the authority to issue is now 15,000,000 shares of Common Stock. The reverse stock split became effective at 11:59 PM PST on August 25, 2022.

Unless otherwise noted, all share and per share numbers contained in this prospectus are reflected on a post-split basis for all periods presented.

The Offering

This prospectus relates to the resale or other disposition from time to time by the selling shareholders identified in this prospectus of up to 2,000,000 shares of Common Stock issuable upon exercise of the Warrants. None of the shares registered hereby are being offered for sale by us.

| Securities offered by the selling shareholder |

Up to 2,000,000 shares of Common Stock issuable upon exercise of the Warrants. |

| |

|

| Common Stock outstanding after this offering |

8,392,434 shares of Common Stock, assuming the exercise in full of the Warrants. |

| |

|

| Use of proceeds |

We will not receive any proceeds from the shares of Common Stock offered by the selling shareholders under this prospectus. However, we will receive the proceeds of any cash exercise of the Warrants. We intend to use the net proceeds from any cash exercise of the Warrants for general corporate purposes, which may include funding capital expenditures and working capital and repaying indebtedness. See “Use of Proceeds.” |

| |

|

| Nasdaq Capital Market Symbol |

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “RIBT.” |

| |

|

| Risk Factors |

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on March 16, 2023, as amended on April 14, 2023, subsequent Quarterly Reports on Form 10-Q and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein. |

| |

|

The number of shares of our Common Stock that will be outstanding immediately after this offering as shown above is based on 6,392,434 shares of Common Stock issued and outstanding as of May 1, 2023, and, unless otherwise indicated, excludes:

| |

●

|

51,205 shares of Common Stock reserved for future issuance upon the exercise of outstanding options, at a weighted average exercise price of $19.47 per share;

|

| |

●

|

159,467 shares of Common Stock reserved for issuance under our equity incentive plan;

|

| |

●

|

2,293,769 shares of Common Stock reserved for future issuance upon the exercise of outstanding warrants;

|

| |

●

|

661,645 shares of Common Stock issuable upon vesting of outstanding restricted stock units; and

|

| |

●

|

14,235 shares of Common Stock reserved for future issuance upon the conversion of outstanding Series G Preferred Stock.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on March 16, 2023, as amended on April 14, 2023, our subsequent Quarterly Reports on Form 10-Q and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could suffer materially. In such event, the trading price of our Common Stock could decline, and you might lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future events concerning our business and to our future revenues, operating results and financial condition. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,” “potential” or “continue,” or the negative of those terms or other comparable terminology.

Any forward-looking statements contained in this prospectus are only estimates or predictions of future events based on information currently available to our management and management’s current beliefs about the potential outcome of future events. Whether these future events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results or financial condition will improve in future periods are subject to numerous risks. There are a number of important factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 16, 2023, as amended on April 14, 2023, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. You should read these factors and the other cautionary statements made in this prospectus and in the documents we incorporate by reference into this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus or the documents we incorporate by reference into this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of Common Stock offered by the selling shareholders under this prospectus. However, we will receive the proceeds of any cash exercise of the Warrants. If all of the Warrants were exercised for cash, we would receive aggregate proceeds of approximately $3.2 million. We intend to use the net proceeds from any cash exercise of the Warrants for general corporate purposes, which may include funding capital expenditures and working capital and repaying indebtedness.

SELLING SHAREHOLDERS

This prospectus covers the resale or other disposition by the selling shareholders identified in the table below of up to an aggregate of 2,000,000 shares of Common Stock issuable upon the exercise of our outstanding Warrants.

The selling shareholders acquired their securities in the transactions described above under the heading “Prospectus Summary – Recent Developments – Registered Direct Offering and Private Placement.”

The Warrants held by the selling shareholders contain limitations which prevent the holders from exercising such Warrants if such exercise would cause the selling shareholders, together with certain related parties, to beneficially own a number of shares of Common Stock which would exceed 4.99% (or, upon election of the holder, 9.99%) of our then outstanding Common Stock following such exercise, excluding for purposes of such determination, shares of Common Stock issuable upon exercise of the Warrants which have not been exercised.

The table below sets forth, as of May 1, 2023, the following information regarding the selling shareholders:

| |

●

|

the names of the selling shareholders;

|

| |

●

|

the number of shares of Common Stock owned by each selling shareholder prior to this offering, without regard to any beneficial ownership limitations contained in the Warrants and the Pre-Funded Warrants;

|

| |

●

|

the number of shares of Common Stock to be offered by each selling shareholder in this offering;

|

| |

●

|

the number of shares of Common Stock to be owned by each selling shareholder assuming the sale of all of the shares of Common Stock covered by this prospectus; and

|

| |

●

|

the percentage of our issued and outstanding shares of Common Stock to be owned by each selling shareholder assuming the sale of all of the shares of Common Stock covered by this prospectus based on the number of shares of Common Stock issued and outstanding as of May 1, 2023.

|

Except as described above, the number of shares of Common Stock beneficially owned by the selling shareholders has been determined in accordance with Rule 13d-3 under the Exchange Act and includes, for such purpose, shares of Common Stock that the selling shareholders have the right to acquire within 60 days of May 1, 2023.

All information with respect to Common Stock ownership of the selling shareholders has been furnished by or on behalf of the selling shareholders. We believe, based on information supplied by the selling shareholders, that except as may otherwise be indicated in the footnotes to the table below, the selling shareholders have sole voting and dispositive power with respect to the shares of Common Stock reported as beneficially owned by them. Because the selling shareholders identified in the table may sell some or all of the shares of Common Stock beneficially owned by them and covered by this prospectus, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares of Common Stock, no estimate can be given as to the number of shares of Common Stock available for resale hereby that will be held by the selling shareholders upon termination of this offering. In addition, the selling shareholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of Common Stock they beneficially own in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the information set forth in the table below. We have, therefore, assumed for the purposes of the following table, that the selling shareholders will sell all of the shares of Common Stock owned beneficially by them that are covered by this prospectus, but will not sell any other shares of Common Stock that they presently own. The selling shareholders have not held any position or office, or have otherwise had a material relationship, with us or any of our subsidiaries within the past three years other than as a result of the ownership of our shares of Common Stock or other securities.

|

Name of Selling Shareholders

|

|

Shares Owned

Prior to This Offering

|

|

Shares Offered

by This

Prospectus

|

|

Shares Owned

After This Offering

|

|

Percentage of

Shares

Beneficially

Owned After

Offering (1)

|

|

Hudson Bay Master Fund Ltd. (2)

|

|

430,769

|

|

200,000

|

|

230,769

|

|

2.75%

|

|

Sabby Volatility Warrant Master Fund, Ltd. (3)

|

|

1,800,000

|

|

1,800,000

|

|

0

|

|

0.00%

|

|

(1)

|

Percentage is based on 8,392,434 shares of Common Stock outstanding as of May 1, 2023, assuming the resale of all of the shares of Common Stock covered by this prospectus.

|

|

(2)

|

Consists of Warrants to purchase up to 200,000 shares of Common Stock held by Hudson Bay Master Fund Ltd. (“Hudson Bay”) , and Warrants to purchase up to 230,769 shares of Common Stock held by Cove Lane Master Fund LLC (“Cove Lane”), an affiliate of Hudson Bay. The exercise of the Warrants held by Hudson Bay and Cove Lane are subject to a 4.99% beneficial ownership limitation, which prohibits Hudson Bay or Cove Lane from exercising any portion of those Warrants to the extent that, following such exercise, Hudson Bay, Cove Lane and their respective affiliates would own a number of our shares of Common Stock exceeding the applicable beneficial ownership limitation. The number of shares listed in the second and fourth columns are based on the number of shares of Common Stock and Warrants held by Hudson Bay and Cove Lane, assuming exercise in full of the Warrants without regard to any limitations on exercise. Hudson Bay Capital Management LP, the investment manager of Hudson Bay and Cove Lane, has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay, Cove Lane and Sander Gerber disclaims beneficial ownership over these securities.

|

|

(3)

|

Consists of Warrants to purchase up to 1,800,000 shares of Common Stock held by Sabby Volatility Warrant Master Fund, Ltd. (“Sabby”). The exercise of the Warrants held by Sabby are subject to a 4.99% beneficial ownership limitation, which prohibits Sabby from exercising any portion of those Warrants to the extent that, following such exercise, Sabby would own a number of our shares of Common Stock exceeding the applicable beneficial ownership limitation. The number of shares listed in the second and fourth columns are based on the number of shares of Common Stock and Warrants held by Sabby, assuming exercise in full of the Warrants without regard to any limitations on exercise. Sabby Management, LLC, in its capacity as the investment manager of Sabby, has the power to vote and the power to direct the disposition of all securities held by Sabby. Hal Mintz is the Managing Member of Sabby Management, LLC. Each of Sabby, Sabby Management, LLC and Mr. Mintz disclaim beneficial ownership of these securities, except to the extent of any pecuniary interest therein.

|

DESCRIPTION OF SECURITIES

Description of Capital Stock

The following summary of the terms of our capital stock is based upon our Articles of Incorporation and our bylaws (as amended, the “Bylaws”). The summary is not complete, and is qualified by reference to our Articles of Incorporation and our Bylaws, which are filed as exhibits to the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and are incorporated by reference herein. We encourage you to read our Articles of Incorporation, our Bylaws and the applicable provisions of the California Corporations Code for additional information.

Our authorized capital stock consists of 15,000,000 shares of Common Stock, no par value, and 20,000,000 shares of Preferred Stock, no par value, of which 3,000,000 shares are designated Series A Preferred Stock, 25,000 shares are designated Series B Preferred Stock, 25,000 shares are designated Series C Preferred Stock, 10,000 shares are designated Series D Preferred Stock, 2,743 shares are designated Series E Preferred Stock, 3,000 are designated as Series F Preferred Stock and 3,000 are designated as Series G Preferred Stock. As of May 1, 2023, there were 6,392,434 shares of Common Stock outstanding and 150 shares of Series G Preferred Stock outstanding. No other capital stock was outstanding as of May 1, 2023.

Common Stock

Subject to any preferential dividend rights granted to the holders of any shares of preferred stock that may be outstanding, the holders of our Common Stock are entitled to receive ratably dividends when, as, and if declared by our board of directors (the “Board”) out of funds legally available therefor. Upon our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to receive ratably the net assets available after the payment of all debts and other liabilities and subject to the prior rights of any outstanding shares of preferred stock.

The holders of our Common Stock are entitled to one vote for each share held on all matters submitted to a vote of our shareholders. Pursuant to our Bylaws, shareholders do not have the right to vote cumulatively. Holders of our Common Stock have no preemptive, subscription or redemption rights. The outstanding shares of our Common Stock are fully paid and nonassessable. The rights and privileges of holders of our Common Stock are subject to, and may be adversely affected by, the rights of holders of shares of preferred stock that we may designate and issue in the future.

Preferred Stock

Our Board is authorized to issue preferred stock in one or more series and to fix the rights, preferences, privileges, qualifications, limitations and restrictions thereof, including dividend rights and rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting any series or the designation of such series, without any vote or action by our shareholders. Any preferred stock to be issued could rank prior to our Common Stock with respect to dividend rights and rights on liquidation. Our Board, without shareholder approval, may issue preferred stock with voting and conversion rights which could adversely affect the voting power of holders of our Common Stock and discourage, delay or prevent a change in control of RiceBran.

Series G Preferred Stock

We have authorized a total of 3,000 shares of Series G Preferred Stock, 150 of which are issued and outstanding as of May 1, 2023. The Series G Preferred Stock is non-voting and may be converted into shares of our Common Stock at the holders’ election at any time, subject to certain beneficial ownership limitations, at a ratio of 1 share of Series G Preferred Stock for 94.89915 shares of Common Stock. The Series G Preferred Stock is entitled to receive dividends if we pay dividends on our Common Stock, in which case the holders of Series G Preferred Stock are entitled to receive the amount and form of dividends that they would have received if they held the common stock that is issuable upon conversion of the Series G Preferred Stock. If we are liquidated or dissolved, the holders of Series G Preferred Stock are entitled to receive, before any amounts are paid in respect of our Common Stock, an amount per share of Series G Preferred Stock equal to $1,000, plus any accrued but unpaid dividends thereon.

Listing

Our Common Stock is listed and principally traded on The Nasdaq Stock Market LLC under the symbol “RIBT.”

Transfer Agent

American Stock Transfer & Trust Company, New York, New York, serves as transfer agent for the shares of Common Stock.

Certain Anti-Takeover Effects

Certain provisions of our Articles of Incorporation and Bylaws may be deemed to have an anti-takeover effect.

Advance Notice Requirements for Shareholder Proposals and Director Nominations. Our Bylaws provide advance notice procedures for shareholders seeking to bring business before our annual meeting of shareholders or to nominate candidates for election as directors at our annual meeting of shareholders and specify certain requirements regarding the form and content of a shareholder’s notice. These provisions might preclude our shareholders from bringing matters before our annual meeting of shareholders or from making nominations for directors at our annual meeting of shareholders if the proper procedures are not followed.

Additional Authorized Shares of Capital Stock. The additional shares of authorized Common Stock and preferred stock available for issuance under our Articles of Incorporation could be issued at such times, under such circumstances and with such terms and conditions as to impede a change in control.

Warrants

The Warrants were issued in the Private Placement on October 20, 2022 in connection with the Registered Offering of shares of our Common Stock and Pre-Funded Warrants to purchase shares of Common Stock.

Exercisability. The Warrants are exercisable six months following issuance and have a term of two and one-half years from the initial exercise date. The Warrants will be exercisable, at the option of the holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of shares of Common Stock underlying the Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of Common Stock purchased upon such exercise. If at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of the shares of Common Stock underlying the Warrants, then the Warrants may also be exercised, in whole or in part, at such time by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of Common Stock determined according to the formula set forth in the Warrant.

Exercise Limitation. A holder will not have the right to exercise any portion of the Warrants if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of our shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. However, any holder may increase or decrease such percentage, but in no event may such percentage be increased to more than 9.99%, provided that any increase will not be effective until the 61st day after such election.

Exercise Price. The Warrants have an exercise price of $1.60 per share. The exercise price of the Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our shares of Common Stock.

Transferability. Subject to applicable laws, the Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Warrants on any national securities exchange or other trading market.

Fundamental Transactions. In the event of any fundamental transaction, as described in the Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of Common Stock, then upon any subsequent exercise of a Warrant, the holder will have the right to receive as alternative consideration, for each share of Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of Common Stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of Common Stock for which the Warrant is exercisable immediately prior to such event.

Notwithstanding the foregoing, in the event of a fundamental transaction, we or a successor entity shall, at the holder’s option, exercisable at any time concurrently or within thirty days following the consummation of a fundamental transaction, purchase the Warrant by paying to the holder an amount equal to the Black Scholes Value (as defined in each Warrant) of the remaining unexercised portion of the Warrant on the date of the fundamental transaction. If the fundamental transaction is not within our control, the holders of the Warrants will only be entitled to receive from us or a successor entity the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Warrant, that is being offered and paid to the holders of our Common Stock in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination thereof, or whether the holders of our Common Stock are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

Rights as a Shareholder. Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of our Common Stock, the holder of a Warrant will not have the rights or privileges of a holder of our Common Stock, including any voting rights, until the holder exercises the Warrant.

Registration Rights. We have filed this registration statement with the SEC that includes this prospectus to register for resale under the Securities Act, the shares of Common Stock issuable upon exercise of the Warrants to satisfy our obligations in connection with the Private Placement under the Purchase Agreement. We will use commercially reasonable efforts to keep registration statement effective at all times until the selling shareholders no longer own any Warrants or shares issuable upon exercise thereof.

PLAN OF DISTRIBUTION

The selling shareholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling the shares of Common Stock, or interests in the shares of Common Stock received after the date of this prospectus from selling shareholders as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in the shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. The selling shareholders may sell all or a portion of the shares of Common Stock held by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold through underwriters or broker-dealers, the selling shareholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

| |

●

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

| |

●

|

in the over-the-counter market;

|

| |

●

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

| |

●

|

through the writing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise;

|

| |

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| |

●

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| |

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

| |

●

|

privately negotiated transactions;

|

| |

●

|

short sales effected after the date the registration statement of which this prospectus is a part was declared effective by the SEC;

|

| |

●

|

broker-dealers may agree with a selling shareholders to sell a specified number of such shares at a stipulated price per share;

|

| |

●

|

a combination of any such methods of sale; and

|

| |

●

|

any other method permitted pursuant to applicable law.

|

The aggregate proceeds to the selling shareholders from the sale of the shares of Common Stock offered by it will be the purchase price of the shares of Common Stock less discounts or commissions, if any. The selling shareholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of shares of Common Stock to be made directly or through agents. We will not receive any of the proceeds from sales of shares by the selling shareholders.

The selling shareholders may also sell shares of Common Stock under Rule 144 promulgated under the Securities Act, if available, rather than under this prospectus. In addition, the selling shareholders may transfer the shares of Common Stock by other means not described in this prospectus. If the selling shareholders effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling shareholders or commissions from purchasers of shares of Common Stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved but, except as set forth in a supplement to this prospectus to the extent required, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with FINRA Rule 5110).

In connection with sales of shares of Common Stock or otherwise, the selling shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares of Common Stock in the course of hedging in positions they assume. The selling shareholders may also sell shares of Common Stock short and deliver shares of Common Stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling shareholders may also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares. The selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares of Common Stock offered by this prospectus, which shares of Common Stock such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling shareholders may pledge or grant a security interest in some or all of the shares of Common Stock owned by it and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer and donate the shares of Common Stock in other circumstances as permitted by applicable law, in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

To the extent required by the Securities Act and the rules and regulations thereunder, the selling shareholders and any broker-dealer participating in the distribution of the shares of Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act. In such event, any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. Selling shareholders who are deemed to be “underwriters” under the Securities Act (if any) will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities of, including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act.

Each selling shareholder has informed us that it is not a registered broker-dealer and does not have any written or oral agreement or understanding, directly or indirectly, with any person to engage in a distribution of the shares of Common Stock. Upon us being notified in writing by a selling shareholder that any material arrangement has been entered into with a broker-dealer for the distribution of shares of Common Stock, a prospectus supplement, if required, will be distributed, which will set forth the aggregate amount of shares of Common Stock being distributed and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling shareholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under the securities laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

The selling shareholders may sell all, some or none of the shares of Common Stock registered pursuant to the registration statement of which this prospectus forms a part. If sold under the registration statement of which this prospectus forms a part, the shares of Common Stock registered hereunder will be freely tradable in the hands of persons other than our affiliates that acquire such shares.

We have advised the selling shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares of Common Stock in the market and to the activities of the selling shareholders and its affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling shareholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares of Common Stock against certain liabilities, including liabilities arising under the Securities Act.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Weintraub Tobin Chediak Coleman Grodin Law Corporation, Sacramento, California.

EXPERTS

The consolidated financial statements of RiceBran Technologies as of December 31, 2022 and 2021 and for each of the years in the two-year period ended December 31, 2022, incorporated in this prospectus by reference from the RiceBran Technologies Annual Report on Form 10-K for the year ended December 31, 2022, have been audited by RSM US LLP, an independent registered public accounting firm, as stated in their report thereon, incorporated herein by reference, and have been incorporated in this prospectus and registration statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

INTERESTS OF NAMED EXPERTS AND COUNSEL

Except as noted below, no expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the securities was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee. Weintraub Tobin Chediak Coleman Grodin Law Corporation and Weintraub Partners, a general partnership formed by certain shareholders at Weintraub Tobin Chediak Coleman Grodin Law Corporation, together owns 10,891 shares of the Common Stock.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with it into this prospectus, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus.

This filing incorporates by reference the following documents, which we have previously filed with the SEC pursuant to the Exchange Act (other than Current Reports on Form 8-K, or portions thereof, furnished under Items 2.02 or 7.01 of Form 8-K):

| |

●

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on March 16, 2023, as amended on April 14, 2023;

|

| |

●

|

The description of our Common Stock contained in our Form 8-A, filed with the SEC on December 12, 2013, as updated by the description of our Common Stock filed as Exhibit 4.03 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 16, 2023, including any amendments or reports filed for the purpose of updating such description.

|

We also incorporate by reference into this prospectus all documents (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus but prior to the termination of this offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part of this prospectus.

We hereby undertake to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been or may be incorporated by reference in this prospectus, other than exhibits to such documents. You may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (281) 675-2421 or by writing to us at the following address:

RiceBran Technologies

25420 Kuykendahl Rd., Suite B300

Tomball, Texas 77375

Attn: Corporate Secretary

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the Common Stock offered by this prospectus. This prospectus, which is part of the registration statement, omits certain information, exhibits, schedules and undertakings set forth in the registration statement. For further information pertaining to us and our Common Stock, reference is made to our SEC filings and the registration statement and the exhibits and schedules to the registration statement. Statements contained in this prospectus as to the contents or provisions of any documents referred to in this prospectus are not necessarily complete, and in each instance where a copy of the document has been filed as an exhibit to the registration statement, reference is made to the exhibit for a more complete description of the matters involved.

In addition, registration statements and certain other filings made with the SEC electronically are publicly available through the SEC’s web site at http://www.sec.gov. The registration statement, including all exhibits and amendments to the registration statement, has been filed electronically with the SEC.

We are subject to the information and periodic reporting requirements of the Exchange Act, and, in accordance with such requirements, will file periodic reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information will be available for inspection and copying at the web site of the SEC referred to above. We also maintain a website at http://www.ricebrantech.com, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Up to 2,000,000 shares of Common Stock

PRELIMINARY PROSPECTUS

, 2023

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 13.

|

Other Expenses of Issuance and Distribution.

|

The following table sets forth the costs and expenses, other than placement agent fees, paid or payable by RiceBran, or the Registrant, in connection with the sale and distribution of the securities being registered. All amounts are estimated except the SEC registration fee.

|

Item

|

|

Amount

|

|

|

SEC registration fee

|

|

$ |

202 |

|

|

Legal fees and expenses

|

|

|

79,000 |

|

|

Accounting fees and expenses

|

|

|

28,000 |

|

|

Printing and engraving expenses

|

|

|

3,000 |

|

|

Transfer agent and registrar fees and expenses

|

|

|

1,000 |

|

|

Miscellaneous fees and expenses

|

|

|

0 |

|

|

Total

|

|

$ |

111,202 |

|

|

Item 14.

|

Indemnification of Directors and Officers.

|

The California General Corporation Law, our Articles of Incorporation and Bylaws provide that we may indemnify our officers, directors, employees or agents or former officers, directors, employees or agents, against expenses actually and necessarily incurred by them, in connection with the defense of any legal proceeding or threatened legal proceeding, except as to matters in which such persons shall be determined to not have acted in good faith and in our best interest. This means that if indemnity is determined by the Board to be appropriate in any case we and not the individual might bear the cost of any suit that is filed by a shareholder against the individual officer, director or employee unless the court determines that the individual acted in bad faith. These provisions are sufficiently broad to permit the indemnification of such persons in certain circumstances against liabilities arising under the Securities Act.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors and officers, and to persons controlling our company pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

|

Item 15.

|

Recent Sales of Unregistered Securities.

|

In the three years preceding the filing of this registration statement, the Company made sales of the following unregistered securities:

Registered Offering and Private Placement

On October 18, 2022, we entered into the Purchase Agreement with the Investors for the issuance and sale of 675,000 shares of our Common Stock for $1.50 per share and Pre-Funded Warrants exercisable for up to 325,000 shares of our Common Stock for $1.4999 per Pre-Funded Warrant, in the Registered Offering. The net proceeds from the Registered Offering were approximately $1.0 million after deducting certain fees due to the Wainwright.

In the concurrent Private Placement, we issued and sold to the Investors Warrants to purchase up to 2,000,000 shares of our Common Stock. The Warrants are exercisable six months after issuance at an exercise price of $1.60 per share and have a term of two and one-half years from the initial exercise date.

The Company engaged Wainwright to act as its exclusive placement agent in connection with the Offering. The Company issued Wainwright, or its designees, the Wainwright Warrants to purchase up to 63,000 shares of Common Stock. The Wainwright Warrants have an exercise price equal to $1.875, or 125% of the offering price per share of Common Stock and are exercisable for five years from the commencement of sales in the Offering.

The Warrants and the Wainwright Warrants were not registered under the Securities Act and were instead offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act. We will receive the proceeds of any cash exercise of the Warrants. We intend to use the net proceeds from any cash exercise of the Warrants for general corporate purposes, which may include funding capital expenditures and working capital and repaying indebtedness.

Gander Foods Agreement

On September 25, 2022, we engaged Gander Foods, LLC, a New Jersey limited liability company (“Gander Foods”), to perform services in connection with the rice milling operations of the Company and Golden Ridge Rice Mills, Inc., a wholly owned subsidiary of the Company. In exchange for Gander Foods’ services, the Company agreed to pay Gander Foods initial cash compensation of $200,000 (the “Initial Compensation”) and quarterly performance-based cash compensation beginning with the quarter commencing October 1, 2022, if the applicable performance criteria are met during such quarter (the “Performance Compensation”). The Initial Compensation will be used by Gander Foods to purchase 38,968 unvested restricted stock units of the Company (“RSUs”), each representing the contingent right to receive one share of the Common Stock. The RSUs were offered and sold in a private placement to an eligible investor pursuant to Section 4(a)(2) of the Securities Act.

The Performance Compensation will be paid quarterly in an amount of cash equal to (a) the Company’s Adjusted EBITDA generated during the applicable quarterly period (the “Performance Period”), multiplied by (b) a performance multiplier (ranging from 10% to 20%) based on the Company’s aggregate Adjusted EBITDA generated during all Performance Periods that have elapsed in the applicable fiscal year, which may then be used to purchase from the Company (at the election of Gander Foods) a number of RSUs following each quarter equal to (a) the Performance Compensation, divided by (b) the volume weighted average closing price per share of the Common Stock, as reported by Nasdaq, over the 90 consecutive trading days ending on the last day of the applicable Performance Period. The aggregate amount of RSUs purchased by Gander Foods with the Initial Compensation or the Performance Compensation will not exceed 1,000,000.

On November 1, 2022, we amended the terms of our engagement with Gander Foods, so the Initial Compensation will be used by Gander Foods to purchase an aggregate of 160,000 unvested RSUs, each representing the contingent right to receive one share of our Common Stock. All other terms of the engagement remain the same and are unchanged, and the total amount of RSUs that may be purchased by Gander Foods with the Initial Compensation or the Performance Compensation may still not exceed 1,000,000.

March 2023 Private Placements

On March 31, 2023, we issued 600 shares of Common Stock to a service provider, which is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $444. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

On March 2, 2023, we issued 6,132 shares of Common Stock to a service provider, that is not a natural person, upon vesting of restricted stock units issued as compensation for service provided. The shares were valued at an aggregate of $4,568. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

December 2022 Private Placement

On December 31, 2022, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $2,100. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

September 2022 Private Placement

On September 30, 2022, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $2,100. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

June 2022 Private Placement

On June 30, 2022, we issued 600 shares of Common Stock to a service provider, which is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $2,100. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

March 2022 Private Placement

On March 31, 2022, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $2,100. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

December 2021 Private Placement

On December 31, 2021, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $2,100. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

September 2021 Private Placement

On September 30, 2021, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $5,460. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

June 2021 Private Placement

On June 30, 2021, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $5,460. We also issued 177,936 shares of Common Stock to warrant holder upon the cash exercise of a warrant with an exercise price of $0.96 per share. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

March 2021 Private Placement

On March 31, 2021, we issued 600 shares of Common Stock to a service provider, that is not a natural person, as compensation for service provided. The shares were valued at an aggregate of $5,460. The securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act. The issuance was made without any public solicitation, to a limited number of sophisticated persons and were acquired for investment purposes only.

June 2020 Unregistered Sales of Equity Securities

During the quarter ended June 30, 2020, we issued the securities described below without registration under the Securities Act. Unless otherwise indicated below, the securities were issued pursuant to the private placement exemption provided by Section 4(a)(2) of the Securities Act.

On May 5, 2020 and May 11, 2020, we issued 3,054 shares and 2,410 shares, respectively, of Common Stock upon cashless exercise of warrants for the purchase of up to 21,574 shares of Common Stock at an exercise price of $0.96 per share.

On May 11, 2020, we issued 1,295 shares of Common Stock upon the cash exercise of a warrant for the purchase of up to 1,295 shares of Common Stock at an exercise price of $0.96 per share.

On June 30, 2020, we issued 3,131 shares of Common Stock to a vendor, which vested on June 30, 2020, at a grant date fair value or $1.14 per share.

|

Item 16.

|

Exhibits and Financial Statement Schedules.

|

(a) Exhibits

The exhibits listed in the accompanying Exhibit Index are filed or incorporated by reference as part of this Registration Statement.

EXHIBIT INDEX

| |

|

|

|

Incorporated by Reference

|

|

|

|

Exhibit

Number

|

|

Exhibit Description

|

|

Form

|

|

File No.

|

|

Exhibit

Number

|

|

Filing/ Effective

Date

|

|

Filed

Herewith

|

|

3.01.01

|

|

Restated and Amended Articles of Incorporation filed with the Secretary of State of California on December 13, 2001

|

|

10-KSB

|

|

000-32565

|

|

3.3

|

|

April 16, 2002

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.02

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on August 4, 2003

|

|

SB-2

|

|

333-129839

|

|

3.01.1

|

|

November 21, 2005

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.03

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on October 31, 2003

|

|

10-QSB

|

|

000-32565

|

|

3.4

|

|

November 19, 2003

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.04

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on September 29, 2005

|

|

SB-2

|

|

333-129839

|

|

3.03

|

|

November 21, 2005

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.05

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on August 20, 2007

|

|

10-Q

|

|

000-32565

|

|

3.1

|

|

August 14, 2007

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.06

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on June 30, 2011

|

|

8-K

|

|

000-32565

|

|

3.1

|

|

July 5, 2011

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.07

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on July 12, 2013

|

|

10-Q

|

|

000-32565

|

|

3.1

|

|

August 14, 2013

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.08

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on May 30, 2014

|

|

S-3

|

|

333-196541

|

|

3.01.08

|

|

June 5, 2014

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.09

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on February 15, 2017

|

|

S-3

|

|

333-217131

|

|

3.1.9

|

|

April 04, 2017

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.10

|

|

Certificate of Amendment of Articles of Incorporation filed with the Secretary of State of California on June 18, 2020

|

|

10-Q

|

|

001-36245

|

|

3.1

|

|

August 12, 2020

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.01.11

|

|

Certificate of Amendment of Articles of Incorporation as field with the California Secretary of State effective August 25, 2022

|

|

8-K

|

|

001-36245

|

|

3.1

|

|

August 25, 2022

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.02

|

|

Certificate of Designation of the Rights, Preferences, and Privileges of the Series A Preferred Stock filed with the Secretary of State of California on December 13, 2001

|

|

SB-2

|

|

333-89790

|

|

4.1

|

|

June 4, 2002

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.03

|

|

Certificate of Determination, Preferences and Rights of Series B Convertible Preferred Stock filed with the Secretary of State of California on October 4, 2005

|

|

8-K

|

|

000-32565

|

|

3.1

|

|

October 4, 2005

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.04

|

|

Certificate of Determination, Preferences and Rights of Series C Convertible Preferred Stock filed with the Secretary of State of California on May 10, 2006

|

|

8-K

|

|

000-32565

|

|

3.1

|

|

May 15, 2006

|

|

|

| |

|

|

|

Incorporated by Reference

|

|

|

|

Exhibit

Number

|

|

Exhibit Description

|

|

Form

|

|

File No.

|

|

Exhibit

Number

|

|

Filing/ Effective

Date

|

|

Filed

Herewith

|

|

3.05

|

|

Certificate of Determination, Preferences and Rights of the Series D Convertible Preferred Stock, filed with the Secretary of State of California on October 17, 2008

|

|

8-K

|

|

000-32565

|

|

3.1

|

|

October 20, 2008

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.06

|

|

Certificate of Determination, Preferences and Rights of the Series E Convertible Preferred Stock, filed with the Secretary of State of California on May 7, 2009

|

|

8-K

|

|

000-32565

|

|

3.1

|

|

May 8, 2009

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.07

|

|

Certificate of Determination, Preferences and Rights of the Series F Convertible Preferred Stock, filed with the Secretary of State of California on February 18, 2016

|

|

8-K

|

|

001-36245

|

|

3.1

|

|