Additional Proxy Soliciting Materials (definitive) (defa14a)

April 24 2023 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary

Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

ARES CAPITAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a6(i)(1) and 0-11. |

Ares Capital Corporation

245 Park Avenue, 44th Floor

New York, NY 10167

Commencing on April 24,

2023, Ares Capital Corporation made the following communications to certain of its stockholders.

April 24, 2023

Re: Supplemental Information Related to Proposal 1 (Election of

Directors)

Institutional Shareholder Services (“ISS”) has issued voting

recommendations that are inconsistent with the recommendations of the board of directors (the “Board” or the “Board

of Directors”) of Ares Capital Corporation (the “Company”) on the election of Michael J Arougheti and Steven B. McKeever

as Class I Directors.

Our Board of Director’s Nominating and Governance Committee and

our Board of Directors have both determined that the nomination and election of Michael J Arougheti and Steven B. McKeever are in the

best interests of the Company and our stockholders. Additionally, our Board of Directors believes that depriving the Company of the services

of Michael J Arougheti and Steven B. McKeever, both of whom are very important and active members of our Board of Directors, is not

in the best interests of the Company or our stockholders.

Our understanding is

that ISS policy allows for an exception to its policy of recommending “Against” votes for certain directors who serve on more

than three public company boards while serving as the Chief Executive Officer (“CEO”) of another company when service on one

of the boards is integral to the duties of the CEO. We do not believe ISS recognizes that Michael J Arougheti is only on the public company

boards of companies affiliated with Ares Management Corporation (“Ares Management”). We believe being on these boards is integral

to Michael J Arougheti’s job as CEO of Ares Management.

We believe ISS’s

recommendations do not reflect the deep level of commitment and importance of Michael J Arougheti and Steven B. McKeever to the Company

and Board.

We

urge you, for the reasons set forth below, to support the recommendation of our Board of Directors.

WE URGE YOU TO SUPPORT

THE RECOMMENDATIONS OF OUR BOARD OF DIRECTORS AND

VOTE “FOR” EACH NOMINEE FOR DIRECTOR.

Proposal 1 (Election of Directors)

We urge you to support and vote FOR the election of Michael J Arougheti

as a director of the Company:

Michael J Arougheti serves

as the Co-Chairperson of our Board of Directors and has been a formative and active Board member since 2009, and our Board believes that

Michael J Arougheti brings significant experience, skills and perspective to our Board. Michael J Arougheti has been instrumental in the

Company’s success from the beginning, serving as its President or CEO from its initial public offering in 2004 through July 2014,

and as the Co-Chair of our Board since July 2014. As a longtime Board member, current Co-Chairperson of our Board and former CEO

and President, Michael J Arougheti has contributed significantly to the Company and remains a crucial member of the Company’s Board.

In particular, Michael J Arougheti played a prominent role in the Company’s acquisitions of Allied Capital Corporation in 2010 and

American Capital Ltd. in 2017, both of which were transformative transactions for the Company. Our Board’s Nominating and Governance

Committee and our full Board have unanimously determined that the nomination and election of Michael J Arougheti is in the best interests

of the Company and the opportunity for long-term value creation for our stockholders. Additionally, both our Board’s Nominating

and Governance Committee and our full Board believe that depriving the Company of the services of Michael J Arougheti as a Board member

is not in the best interests of the Company or its stockholders.

We are aware that ISS

has adopted a policy of recommending “Against” votes for certain directors of public companies that serve on more than three

public company boards of directors while serving as a CEO of another public company. We believe this policy is designed to ensure that

executives have sufficient time to focus on the company for which they serve as CEO. Our Board’s Nominating and Governance Committee

and our full Board noted that while Michael J Arougheti serves as the CEO and President of Ares Management and sits on four public company

boards of directors (Ares Management, Ares Acquisition Corporation, Ares Capital Corporation, and Ares Commercial Real Estate Corporation),

all of such companies relate to Ares Management (either directly or companies that are externally managed or sponsored by affiliates of

Ares Management). We do not believe that ISS appreciates that the boards on which Michael J Arougheti sits are all Ares affiliated boards

and notably, Michael J Arougheti does not hold a board seat on any public company outside of these Ares affiliated companies. Furthermore,

our understanding is that ISS policy allows for an exception when service on one of the boards is integral to the CEO’s duties.

We believe that Michael J Arougheti’s service on these boards of directors is an essential element of his position at Ares Management,

enhances the collaboration across Ares’ vehicles and assists us in accomplishing our goal of delivering attractive risk adjusted

investment returns to stockholders throughout market cycles.

We urge you to support and vote FOR the election of Steven B. McKeever

as a director of the Company:

Steven B. McKeever served

as an independent director of the Company since 2012 and is the Chairperson of our Board’s Nominating and Governance Committee.

We are aware that ISS

has adopted a policy of recommending “Against” votes for certain directors of public companies that have governing documents

that provide the board with the exclusive power to amend the company’s bylaws. We believe that ISS is expressing this view through

their recommendation to withhold support for Steven B. McKeever’s election.

Our Board of Directors

believes that it remains in the best interests of the Company and our stockholders if the power to amend our bylaws is vested exclusively

in our Board of Directors as is permitted by Maryland law. Since our initial public offering in 2004, the power to amend our bylaws has

been vested exclusively with our Board of Directors. This arrangement has served the interests of the Company and our stockholders well,

we believe, because under Maryland law, our directors owe legal duties to the Company and our stockholders that require them to act with

a reasonable belief that their actions are in the best interests of the Company and our stockholders. On the other hand, under Maryland

law, stockholders are not bound by any such legal duty and are permitted to take or to recommend actions that are in their own individual

interests as stockholders without taking into account the broader interests of other stockholders or the interests of the Company. As

a result of these factors, we believe that our Board of Directors is in the best position to consider possible future bylaw amendments

and will adopt such amendments only after concluding that such amendments are in the best interests of the Company and our stockholders.

For

the foregoing reasons, we believe the against recommendation is unwarranted and we urge you to vote FOR the election of Michael J Arougheti

and Steven B. McKeever as directors of the Company

If you have any questions or need assistance

in voting your proxy, please call our proxy solicitor, D.F. King & Co., Inc., at 1-877-864-5060.

This information is being

provided to certain stockholders as a supplement to our Proxy Statement dated March 17, 2023, which you already received. Please

read the complete Proxy Statement and accompanying materials carefully before you make a voting decision. Even if voting instructions

for your proxy have already been given, you can change your vote at any time before the annual meeting by giving new voting instructions

as described in more detail in our Proxy Statement.

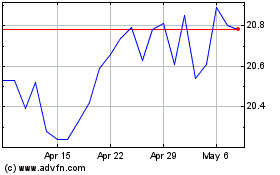

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Apr 2023 to Apr 2024