As filed with the Securities and Exchange Commission

on April 21, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biophytis S.A.

(Exact name of Registrant as specified in its

charter)

| France |

|

Not Applicable |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Biophytis S.A.

Sorbonne University—BC 9, Bâtiment

A 4ème étage

4 place Jussieu

75005 Paris, France

+33 1 44 27 23 00

(Address and telephone number

of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

(302) 738-6680

(Name, address, and telephone

number of agent for service)

Copies to:

Wendy Grasso

Reed Smith LLP

599 Lexington Avenue, 26nd Floor

New York, NY 10022

+1 (212) 521-5400

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction

I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under

the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under

the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company x

If an emerging growth company that prepares its financial

statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of

1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting

pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state

where the offer or sale is not permitted.

Subject to completion, dated

April 21, 2023

$100,000,000

Ordinary Shares

Preferential

Shares

Warrants

Debt Securities

Units

Biophytis S.A.

We may, from time to time in one or more offerings, offer and

sell, together or separately, ordinary shares, which may be represented by American Depositary Shares (“ADSs”), preferential

shares, which may be represented by ADSs, warrants, debt securities or any combination thereof in units as described in this prospectus.

Any ADS will represent a specified number of ordinary shares or preferential shares. The preferential shares may be convertible into or

exchangeable for ordinary shares, the warrants may be exercisable for ordinary shares, preferential shares or debt securities and the

debt securities may be convertible into or exchangeable for ordinary shares or preferential shares or other debt securities.

This prospectus provides a general description

of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements to this prospectus.

We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement

and any related free writing prospectus may add, update or change information contained in this prospectus. You should read carefully

this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated or

deemed to be incorporated by reference, before you invest in any of our securities. This prospectus may not be used to offer or sell any

securities unless accompanied by the applicable prospectus supplement.

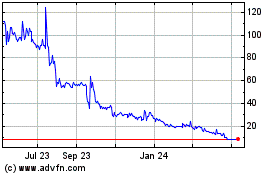

ADSs, each representing 100 of our ordinary shares (or a right to receive

100 ordinary shares), are listed on the Nasdaq Capital Market under the symbol “BPTS.” The last reported sale price of the

ADSs on the Nasdaq Capital Market on April 20, 2023 was $3.88 per ADS.

As of April 21, 2023, the aggregate market value of our outstanding

ordinary shares held by non-affiliates, or public float, was approximately $18,824,730, based on 311,416,551 of our ordinary shares outstanding,

of which approximately 299,280,298 shares are held by non-affiliates, and a per share price of approximately $0.0629, which represents

one one-hundredth of $6.29, which was the price of our ADSs on March 6, 2023, and which was the highest reported closing sale price of

our ADSs on The Nasdaq Capital Market, the principal market for our common equity, in the 60 days prior to April 21, 2023. We have

not offered any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends

on and includes the date of this prospectus. Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell securities

registered on this registration statement in a public primary offering with a value exceeding more than one-third of our public float

in any 12-month period so long as our public float remains below $75 million.

We may offer and sell our securities to or through one or more agents,

underwriters, dealers or other third parties or directly to one or more purchasers on a continuous or delayed basis. If agents, underwriters

or dealers are used to sell our securities, we will name them and describe their compensation in a prospectus supplement. The price to

the public of our securities and the net proceeds we expect to receive from the sale of such securities will also be set forth in a prospectus

supplement.

Investing

in our securities involves a high degree of risk. Before buying any of our securities, you should carefully read the discussion of material

risks of investing in our securities. Please see the section entitled “Risk Factors” beginning on page 8

of this prospectus.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The

date of this prospectus is , 2023

TABLE OF CONTENTS

We are responsible for the information contained and incorporated

by reference in this prospectus, in any accompanying prospectus supplement, and in any related free writing prospectus we prepare or authorize.

We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may

give you. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this documentation

are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document

does not extend to you. The information contained in this document speaks only as of the date of this document, unless the information

specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed

since those dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement that we have

filed with the U.S. Securities and Exchange Commission (the “SEC”). Under this shelf registration, we may offer our ordinary

shares or preferential shares, which may be in the form of ADSs, warrants to purchase ordinary shares, preferential shares or debt securities,

debt securities, or any combination thereof in the form of units, from time to time in one or more offerings.

This prospectus only provides you with a general description of the

securities that we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement

that will contain more specific information about the specific terms of the offering. If any such securities are to be listed or quoted

on a securities exchange or quotation system, the applicable prospectus supplement will say so. We may also authorize one or more free

writing prospectuses to be provided to you that may contain material information relating to these offerings. This prospectus may not

be used to sell our securities unless accompanied by a prospectus supplement. Each such prospectus supplement and any free writing prospectus

that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents incorporated

by reference into this prospectus. We urge you to carefully read this prospectus, any applicable prospectus supplement and any related

free writing prospectus, together with the information incorporated herein by reference as described under the headings “Where You

Can Find More Information” and “Incorporation by Reference” before you invest in our securities.

We have not authorized anyone to provide you with additional information

or information different from that contained in or incorporated by reference in this prospectus, any applicable prospectus supplement

and any related free writing prospectus filed with the SEC. We take no responsibility for, and can provide no assurances as to the reliability

of, any information not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that

we may authorize to be provided to you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where offers and sales of the securities are legally permitted.

The information contained in this prospectus, any applicable prospectus

supplement or any related free writing prospectus we file is accurate only as of the date on the front of the document and any information

incorporated by reference in such document is accurate only as of the date of the document incorporated by reference, regardless of the

time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

Our business, financial condition, results of operations and prospects may have changed since that date. We will update this prospectus

to the extent required by law.

This prospectus contains summaries of certain provisions contained

in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries

are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed

or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain

copies of those documents as described below under the heading “Where You Can Find More Information.”

We further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely

for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such

agreement rather than establishing matters of fact. The information in the exhibits should not be read alone and instead should be read

in conjunction with the information in this prospectus and other filings that we make with the SEC. Moreover, such representations, warranties

or covenants were accurate only as of the date they were made. Accordingly, such representations, warranties and covenants should not

be relied on as accurately representing the current state of our affairs.

Unless otherwise indicated or the context otherwise requires, references

in this prospectus to “Biophytis,” “the Company,” “we,” “us,” and “our” refer

to Biophytis S.A. and its consolidated subsidiaries. All references in this prospectus to “$,” “U.S. dollars,”

“dollars” and “USD” mean U.S. dollars and all references to “€” and “euros” mean

euros, unless otherwise noted.

Unless otherwise mentioned or unless the context requires otherwise,

throughout this prospectus, any applicable prospectus supplement and any related free writing prospectus, the words “Biophytis,”

“we,” “us,” “our,” “the company,” “our company” or similar references refer

to Biophytis S.A. and its consolidated subsidiaries; and the term “securities” refers collectively to our ordinary shares,

which may be in the form of ADSs, preferential shares, which may be in the form of ADSs, warrants to purchase ordinary shares, preferential

shares or debt securities, debt securities, or any combination of the foregoing securities in units.

MARKET AND INDUSTRY

DATA

Unless otherwise indicated, information contained

in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position,

market opportunity and market size estimates, is based on information from independent industry analysts, third-party sources and management

estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party

sources, as well as data from our internal research, and are based on assumptions made by us based on such data and our knowledge of such

industry and market, which we believe to be reasonable. Although we are responsible for all of the disclosures contained in this prospectus,

we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions

relied upon therein. In addition, while we believe the market opportunity information included in this prospectus is generally reliable

and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under the heading "Risk

Factors."

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes certain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), concerning our business, operations and financial performance

and condition as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any

statements that are not of historical facts may be deemed to be forward-looking statements. You can identify these forward-looking statements

by words such as “believes,” “estimates,” “anticipates,” “expects,” “plans,”

“intends,” “may,” “could,” “might,” “will,” “should,” “aims,”

or other similar expressions that convey uncertainty of future events or outcomes. Forward-looking

statements include, but are not limited to, statements about:

| · | the timing, progress and results of clinical trials for our drug candidates, including statements regarding the timing of initiation

and completion of clinical trials, dosing of subjects and the period during which the results of the clinical trials will become available; |

| · | the potential impact of COVID-19 on our clinical trials and our operations generally; |

| · | the timing, scope or likelihood of regulatory filings and approvals for our drug candidates; |

| · | our ability to successfully commercialize our drug candidates; |

| · | potential benefits of the clinical development and commercial experience of our management team; |

| · | our ability to effectively market any drug candidates that receive regulatory approval, emergency use authorization, or conditional

marketing authorization on our own or through third parties; |

| · | our commercialization, marketing and manufacturing capabilities and strategy; |

| · | our expectation regarding the safety and efficacy of our drug candidates; |

| · | the potential clinical utility and benefits of our drug candidates; |

| · | our ability to advance our drug candidates through various stages of development, especially through pivotal safety and efficacy trials; |

| · | the likelihood of success and difficulty in ensuring success of clinical investigations; |

| · | our estimates regarding the potential market opportunity for our drug candidates; |

| · | developments and projections relating to our competitors or our industry; |

| · | our ability to become profitable; |

| · | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| · | our ability to secure additional financing when needed on acceptable terms; |

| · | the impact of government laws and regulations in the United States, France and foreign countries; |

| · | the implementation of our business model, strategic plans for our business, drug candidates and technology; |

| · | our intellectual property position; |

| · | our ability to rely on orphan drug designation for market exclusivity; |

| · | our ability to attract or retain key employees, advisors or consultants; and |

| · | whether we are classified as a passive foreign investment company for current and future periods. |

By their nature, forward-looking statements involve risks and uncertainties

because they relate to events, competitive dynamics and industry change, and depend on economic circumstances that may or may not occur

in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each

forward-looking statement contained in this prospectus, we caution you that forward-looking statements are not guarantees of future performance

and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. All of our forward-looking

statements are subject to risks and uncertainties that may cause our actual results to differ materially from our expectations.

Any forward-looking statements that we make in this prospectus speak

only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after

the date of this prospectus or to reflect the occurrence of unanticipated events. Comparisons of results for current and any prior periods

are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed

as historical data. You should, however, review the factors and risks we describe in the reports we will file from time to time with the

SEC after the date of this prospectus. See “Where You Can Find More Information.”

You should also read carefully the factors described in the “Risk

Factors” section of this prospectus, in “Item 3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2022 and in the other documents that we file with the SEC after the date of this prospectus that

are incorporated by reference into this prospectus to better understand the risks and uncertainties inherent in our business and underlying

any forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus

will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light

of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty

by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

ABOUT THE COMPANY

Our Company

We are a clinical-stage biotechnology company focused

on the development of therapeutics that are aimed at slowing the degenerative processes associated with aging and improving functional

outcomes for patients suffering from age-related diseases, including severe respiratory failure in patients suffering from COVID-19. Our

goal is to become a leader in the emerging field of aging science by delivering life-changing therapies to the growing number of patients

in need. To accomplish this goal, we have assembled an experienced and skilled group of industry professionals, scientists, clinicians

and key opinion leaders from leading industry and academic institutions around the world.

A number of degenerative diseases associated with

aging have been characterized in the last century, including sarcopenia and age-related macular degeneration (AMD). The pathophysiology

of these and many other age-related diseases is not yet well understood, and effective treatment options are lacking. The global population

of people over the age of 60 is expected to double from approximately 962 million in 2017 to 2.1 billion by 2050, according

to estimates from the United Nations’ World Population Prospects: the 2017 Revision. We believe that the need for effective therapeutics

for age-related diseases will continue to grow throughout the 21st century. In addition, healthcare costs, including costs

associated with treatments and long-term care for age-related diseases associated with this demographic shift, are expected to rise proportionally,

as effective treatment options are currently lacking. We believe that developing treatments to slow disease progression and reduce the

risk of severe disability associated with age-related diseases is of the utmost importance.

As we age, our physical, respiratory, visual and

cognitive performances gradually decline due, in part, to the cumulative deleterious effect of multiple biological and environmental stresses,

including current and emerging viral infections, to which we are exposed during our lifetime. The functional decline can be much faster

in some individuals as a consequence of, among other things, the degenerative processes affecting specific cells, tissues and organs.

Through evolution, cells, tissues and organisms have developed natural means or pathways to counteract and balance the effects of the

many stresses they face. This natural ability to compensate for stress and remain functional, called biological resilience, degrades over

time. The decline in biological resilience contributes to the acceleration of these degenerative processes and the impairment of functional

performances, which, in turn, can lead to severe disability, reduced health-span and ultimately death. This occurs as we age, but can

occur at a younger age, when genetic mutations exist, or in the case of infection and inflammation.

Our lead drug candidate, Sarconeos (BIO101), is

a plant-derived pharmaceutical-grade purified 20-hydroxyecdysone that is an orally administered small molecule.

The initial indication we are seeking approval

for is sarcopenia, an age-related degeneration of skeletal muscle, which is characterized by a loss of muscle mass, strength and function

in elderly people (adults 65 years of age and older) leading to reduced mobility, or mobility disability, and increased risk of adverse

health events and hospitalization, and potential death resulting from falls, fractures, and physical disability. There is currently no

approved medication for sarcopenia, which is present in the elderly (greater than 65 years old) with an estimated prevalence range between

six to 22% worldwide.

Sarconeos (BIO101) is also being developed to treat

patients with severe respiratory manifestations of COVID-19. Our therapeutic approach is aimed at targeting and activating key biological

resilience pathways that can protect against and counteract the effects of the multiple biological and environmental stresses, including

inflammatory, oxidative, metabolic and viral stresses that lead to age-related diseases. We have conducted the COVA study, a global, multicenter,

double-blind, placebo-controlled, group-sequential, and adaptive two-part Phase 2-3 study, in patients with SARS-CoV-2 pneumonia. Final

results from this study were released on February 2, 2023. The study met its pre-defined primary endpoint demonstrating a statistically

significant difference between Sarconeos (BIO101) and placebo in the proportion of patients with respiratory failure or early death at

day 28, representing a relative reduction of risk of 44% (p=0.043, Cochran-Mantel-Haenszel test). Moreover, the analysis of time to respiratory

failure or early death had shown significant differences over 28 days in the Kaplan Meier curves for Sarconeos (BIO101) versus placebo

(p=0.022). The pre-specified analysis of time to death over the complete follow-up period over 90 days showed that mortality rate with

Sarconeos (BIO101) was reduced compared to placebo in the ITT population (p=0.083) and in the PP population (p=0.038).

Most people infected with the COVID-19 virus and

its variants experience mild to moderate respiratory illness and recover without requiring special treatment. Older people, and those

with underlying medical problems like cardiovascular disease, diabetes, chronic respiratory disease and cancer are more likely to develop

serious illness and to be at risk of respiratory failure. Based on the positive data from our COVA Phase 2-3 study, we initiated the Early

Access Program regulatory path in France in March 2023. We intend to renew the expanded access program to treat hospitalized patients

with severe COVID-19 symptoms that are mechanically ventilated with Sarconeos (BIO101) in Brazil as we did initially received approval

for such a program in January 2022. We also continue to prepare conditional marketing authorization applications in Europe and in

the US due to the health emergency

We are also developing Sarconeos (BIO101) for Duchenne

muscular dystrophy (“DMD”), a rare genetic neuromuscular disease in male children and young adults, which is characterized

by an accelerated degeneration of muscle and is responsible for a loss of mobility, respiratory failure and cardiomyopathy, leading to

premature death. There is currently no cure and limited treatment options for DMD, which affects approximately 2.8 out of 100,000 people

worldwide (approximately 20,000 new cases annually worldwide), based on our estimates from publicly available information.

Our second drug candidate, Macuneos (BIO201), is

an orally administered small molecule in development for the treatment of retinopathies. It is a plant-derived pharmaceutical-grade purified

norbixin. We have completed preclinical cellular and animal studies of Macuneos (BIO201) for the treatment of retinopathies. While we

are still in the early stages of development, we believe that the results from our preclinical studies support continued investigation

into whether Macuneos (BIO201) may stimulate biological resilience and protect the retina against phototoxic damage that leads to vision

loss. The initial indication we plan to seek approval for is dry AMD, a common eye disorder among people over the age of 50 that affects

central vision, impairing functions such as reading, driving, and facial recognition, and has a major impact on quality of life and the

ability to live independently. There are currently no approved treatments for dry AMD. Based on our estimates from publicly available

information, AMD affects approximately 8.5% of the global population (ages 45 to 85) and is expected to increase over time as the population

ages.

We are also exploring Macuneos (BIO201) as a potential

treatment for Stargardt disease, which shares many of the characteristics of dry AMD. Stargardt disease is the most common form of inherited

macular degeneration that typically develops in childhood and leads to vision loss and, in some cases, blindness.

We hold exclusive commercialization rights through

licenses for each of our drug candidates. We currently plan to develop our drug candidates through clinical PoC (typically Phase 2), and

then seek licensing and/or partnership opportunities for further clinical development through regulatory approval and commercialization.

We have developed our lead clinical drug candidate

Sarconeos (BIO101), preclinical drug candidate Macuneos (BIO201), and a preclinical pipeline of life-cycle extension products, consisting

of BIO103 and BIO203, through a drug discovery platform in collaboration with Sorbonne University in Paris, France based on work with

medicinal plants. Plants are major sources of small molecules, called secondary metabolites, which they produce as a defense mechanism

to various environmental stresses, including attack from predatory and pathogenic species (e.g., insects, bacteria and fungi).

Our drug discovery platform is based on a reverse pharmacology approach that tests a collection of bioactive secondary metabolites along

with chemical analogs that we have synthesized in phenotypic screens of various age-related diseases. Our long-term goal is to advance

the field of aging science with the continued discovery and development of new drug candidates that treat age-related diseases by stimulating

biological resilience pathways that are involved in the aging process and/or age-related diseases.

We have assembled an executive team of scientific,

clinical, and business leaders with broad expertise in biotechnology and clinical drug development (see Item 6.A for more information

on our directors and senior management).

Our Clinical Pipeline

We are developing a portfolio of programs targeting

biological resilience pathways that slow the degenerative processes associated with aging and improve functional outcomes for patients

suffering from age-related diseases. Our current pipeline of drug candidates is illustrated below.

Recent Developments

On

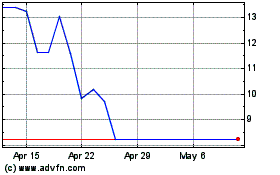

March 30, 2023, we effected a change to the ratio of our ADSs to ordinary shares from one ADS representing 10 ordinary shares

to one ADS representing 100 ordinary shares.

On April 17 ; 2023, the board of directors, acting upon

delegation of the shareholder meeting held on the same day, reduced the share capital from EUR 62,283,310.20 to EUR 3,114,165.51 by

way of cancellation of losses. The capital reduction was effected by reducing the par value of the ordinary shares from EUR 0.20 to

EUR 0.01.

Company Information

We were incorporated as a société anonyme under

the laws of France on September 27, 2006. We are registered at the Paris Registre du Commerce et des Sociétés under

the number 492 002 225. Our principal executive offices are located at Sorbonne University-BC 9, Bâtiment A 4ème étage,

4 place Jussieu 75005 Paris, France and our telephone number is +33 1 44 27 23 00. Our website address is www.biophytis.com. Our

agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware

19711. The reference to our website is an inactive textual reference only and the information contained in, or that can be accessed through,

our website is not a part of this prospectus and should not be considered a part of this prospectus or any supplement to this prospectus.

Our ordinary shares are listed on Euronext Growth Paris (Ticker: ALBPS

- ISIN: FR0012816825). The ADSs (American Depositary Shares) are listed on the Nasdaq Capital Market (Ticker: BPTS – ISIN: US09076G1040)

since February 10, 2021.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should

carefully consider the risks described in “Item 3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2022, which is incorporated herein by reference, and other documents we file with the SEC

that are incorporated by reference in this prospectus and any applicable prospectus supplement, before making an investment decision.

Each of the risks described could materially adversely affect our business, financial condition or results of operations, or the trading

price of our securities. In such case, you could lose all or a portion of your original investment. See “Where You Can Find More

Information.”

OFFER STATISTICS AND EXPECTED TIMETABLE

We may from time to time, offer and sell any combination

of the securities described in this prospectus up to a total dollar amount of $100,000,000 in one or more offerings. The securities offered

under this prospectus may be offered separately, together, or in separate series, and in amounts, at prices, and on terms to be determined

at the time of sale. We will keep the registration statement of which this prospectus is a part effective until such time as all of the

securities covered by this prospectus have been disposed of pursuant to and in accordance with such registration statement.

USE OF PROCEEDS

Unless otherwise set forth in a prospectus

supplement, we currently intend to use the net proceeds of any offering of securities for working capital and other general corporate

purposes. Accordingly, we will have significant discretion in the use of any net proceeds. We may provide additional information on the

use of the net proceeds from the sale of the offered securities in an applicable prospectus supplement relating to the offered securities.

DESCRIPTION OF SHARE CAPITAL

The following description of our share capital summarizes certain

provisions of our articles of associations. Such summaries do not purport to be complete and are subject to, and are qualified in their

entirety by reference to, all of the provisions of our articles of association, copies of which have been filed with the SEC. Holders

of ADSs will be able to exercise their rights with respect to the ordinary shares underlying the ADSs only in accordance with the terms

of the deposit agreement. See “Description of American Depositary Shares” for more information.

General

As of April 21, our outstanding share capital consisted of a total

of 311,416,551 issued and fully paid ordinary shares, with nominal value €0.01 per share. We have no preferred shares outstanding.

Under French law, our articles of association set forth only our issued

and outstanding share capital as of the date of the articles of association. Our fully diluted share capital represents all issued and

outstanding shares, as well as all potential shares which may be issued upon exercise of outstanding employee warrants, employee share

options and non-employee warrants, as granted by our board of directors.

We are entitled under French law to issue preferred shares but our

articles of association do not currently specify specific characteristics or rights attached to any specific category of preferred shares,

which would be determined by the extraordinary general meeting convened for such purpose.

Key Provisions of Our Articles of Association and French Law Affecting

Our Ordinary Shares

The

description below reflects the terms of our articles of association, and summarizes the material rights of holders of our ordinary shares

under French law. This is only a summary and is not intended to be exhaustive. For further information, please refer to the full version

of our articles of association, which are included Exhibit 1.1 to the annual report on Form 20-F of which this description

is also an exhibit.

Corporate

Purpose (Article 2 of the Articles of Association)

Our corporate purpose in France and

abroad includes:

| · | the creation, operation, leasing, lease management of all operating assets,

factories, institutions, the taking of stakes in any company, as well as all attached or connected commercial, financial, industrial,

securities and property operations, relating directly or indirectly to the activity of research production, distribution and marketing

of any product and service beneficial to human or animal health; |

| · | the research and development of drug candidates and nutraceuticals, particularly

in the field of age-related diseases; and |

| · | all financial, commercial, industrial, civil, securities or property operations,

which may be associated directly or indirectly, in whole or in part, with one or other of the purposes specified above or any other similar

or related purpose. |

Directors

Quorum and Voting (Article 17

of the Articles of Association). The board of directors may only deliberate validly if at least half of the

directors are present or considered to be present, subject to the adjustments made by the internal regulations (règlement intérieur)

in the event of use of videoconferencing or another means of telecommunication.

Unless otherwise provided in the articles of association and subject

to the adjustments made by the internal regulations in the event of use of videoconferencing or other means of telecommunications, decisions

are taken by majority of votes of members who are present or represented or regarded as present. In the event of a tied vote, the Chairman

of the session will have the deciding vote.

For the calculation of the quorum and majority, directors participating

in the board meeting by videoconference or telecommunications media will be regarded as present under the conditions defined by the internal

regulations of the board of directors. However, the effective presence or presence by representation will be necessary for all board of

director decisions regarding the drafting of the annual financial statements and consolidated accounts and the drawing up of the management

report and the report on the management of the group, as well as for decisions regarding the dismissal of the Chairman of the board of

directors, the CEO and, as the case may be, the Deputy CEO.

Directors' Voting Powers on Proposal,

Arrangement or Contract in which any Director Is Materially Interested (Article 21 of the Articles of Association). Except

for those relating to current operations concluded under normal conditions, any agreement entered into, directly or indirectly through

an intermediary, between the Company and any of our directors, CEO, deputy CEOs or with a shareholder holding more than 10% of the voting

rights of the Company, or in the case of a corporate shareholder, the company which controls it, will be subject to prior authorization

by the board of directors.

Agreements between the Company and another company will also be subject

to prior authorization, if the CEO, one of the deputy CEOs or a director of the Company is the owner, partner with unlimited liability,

manager, director, member of the supervisory board or, in general, a director of the Company.

Directors (other than legal entities) are forbidden from taking out

loans in any form from the Company, to be granted current account or overdraft by it, or arranging for the Company to guarantee or endorse

any commitments with regard to third parties.

Directors' Compensation (Article 20

of the Articles of Association). The General Meeting may allocate to the directors, as remuneration for their

activities, by way of attendance fees, a fixed annual sum, which this meeting will determine without being bound by previous decisions.

The amount of the same shall be attributed to operating expenses.

The board of directors will freely distribute among its members the

global overall amounts allocated to directors in the form of attendance fees; it may notably allocate to the directors who are members

of study committees, a higher share than that of the other directors.

The board of directors may allocate exceptional remuneration for assignments

or mandates entrusted to the directors. The board of directors may authorize the reimbursement of travel costs and expenses incurred by

the directors in the interest of the Company.

Board of Directors' Borrowing Powers. There

are currently no limits imposed on the amounts of loans or borrowings that the board of directors may approve.

Directors' Age Limits. There

are currently no age limits imposed for service on our board of directors. The Chairman of the board of directors must be under 75. The

number of directors aging above 75 shall not be greater than one third of the total number of directors.

Directors' Share Ownership Requirements. None.

Rights, Preferences and Restrictions Attaching to Ordinary Shares

Dividends (Article 34 of the

By-laws). We may only distribute dividends out of our "distributable profits," plus any

amounts held in our reserves that the shareholders decide to make available for distribution, other than those reserves that are specifically

required by law.

"Distributable profits" consists of (a) the

profits for the last closed financial period increased by (b) any retained earnings, less (c) losses carried forward increased

by (d) amounts to be placed in reserve pursuant to the law or the articles of association.

Legal Reserve. Pursuant

to French law, we must allocate 5% of our unconsolidated net profit for each year to our legal reserve fund before dividends may be paid

with respect to that year. Funds must be allocated until the amount in the legal reserve is equal to 10% of the aggregate par value of

the issued and outstanding share capital. This restriction on the payment of dividends also applies to our French subsidiary on an unconsolidated

basis.

Approval of Dividends. Pursuant

to French law, our board of directors may propose a dividend for approval by the shareholders at the annual ordinary general meeting.

Upon recommendation of our board of directors, our shareholders may

decide to allocate all or part of any distributable profits to special or general reserves, to carry them forward to the next fiscal year

as retained earnings or to allocate them to the shareholders as dividends. However, dividends may not be distributed when our net assets

are or would become as a result of such distribution lower than the amount of the share capital plus the amount of the legal reserves

which, under French law, may not be distributed to shareholders.

Our board of directors may distribute interim dividends after the end

of the fiscal year but before the approval of the financial statements for the relevant fiscal year when the interim balance sheet, established

during such year and certified by an auditor, reflects that we have earned distributable profits since the close of the last financial

year, after recognizing the necessary depreciation and provisions and after deducting prior losses, if any, and the sums to be allocated

to reserves, as required by law or the by-laws, and including any retained earnings. The amount of such interim dividends may not exceed

the amount of the profit so defined.

Distribution of Dividends. Dividends

are distributed to shareholders pro rata according to their respective holdings of shares. In the case of interim dividends, distributions

are made to shareholders on the date set by our board of directors during the meeting in which the distribution of interim dividends is

approved. The actual dividend payment date is decided by the shareholders at an ordinary general shareholders' meeting or by our board

of directors in the absence of such a decision by the shareholders. Shareholders that own shares on the actual payment date are entitled

to the dividend.

Dividends may be paid in cash or, if the shareholders' meeting so decides,

in kind, provided that all shareholders receive a whole number of assets of the same nature paid in lieu of cash.

Timing of Payment. Pursuant

to French law, dividends must be paid within a maximum of nine months after the close of the relevant fiscal year, unless extended by

court order. Dividends not claimed within five years after the payment date shall be deemed to expire and revert to the French state.

Voting Rights (Article 14

of the Articles of Association). The voting rights attached to ordinary shares or dividend shares is proportional

to the amount of capital they represent. Each share is entitled to one vote.

A double voting right has been established for all registered and fully

paid-up shares registered in the name of the same beneficiary for at least two years.

Under French law, treasury shares or shares held by entities controlled

by us are not entitled to voting rights and do not count for quorum purposes.

Rights to Share in Our Profit. Each

share entitles its holder to a portion of the corporate profits and assets proportional to the amount of share capital represented thereby.

Rights to Share in the Surplus

in the Event of Liquidation. If we are liquidated, any assets remaining after payment of the debts,

liquidation expenses and all of the remaining obligations will first be used to repay in full the par value of our shares. Any surplus

will be distributed pro rata among shareholders in proportion to the number of shares respectively held by them, taking into account,

where applicable, of the rights attached to shares of different classes.

Repurchase and Redemption of Shares. Under

French law, we may acquire our own shares for the following purposes only:

| · | to decrease our share capital, provided that such a decision is not driven

by losses and that a purchase offer is made to all shareholders on a pro rata basis, with the approval of the shareholders at an

extraordinary general meeting; in this case, the shares repurchased must be cancelled within one month from the expiry of the purchase

offer; |

| · | to provide shares for distribution to employees or managers under a profit-sharing,

free share or share option plan; in this case the shares repurchased must be distributed within 12 months from their repurchase failing

which they must be cancelled; |

| · | to meet obligations arising from debt securities that are exchangeable into

equity instruments; or |

| · | under a buy-back program to be authorized by the shareholders in accordance

with the provisions of Article L. 22-10-62 of the French Commercial Code and in accordance with the general regulations of, and market

practices accepted by the Financial Markets Authority (AMF). This authorization may only be given for a period not exceeding eighteen

months. |

Under The Market Abuse Regulation (MAR) and in accordance with the

General Regulations of the AMF (Réglement Général de l'AMF), a corporation shall report to the competent authority

of the trading value on which the shares have been admitted to trading or are traded, no later than by the end of the seventh daily market

session following the date of the execution of the transaction, all the transactions relating to the buy-back program, in a detailed form

and in an aggregated form.

No such repurchase of shares may result in us holding, directly or

through a person acting on our behalf, more than 10% of our issued share capital. Shares repurchased by us continue to be deemed "issued"

under French law but are not entitled to dividends or voting rights so long as we hold them directly or indirectly, and we may not exercise

the preemptive rights attached to them.

Sinking Fund Provisions. Our

articles of association do not provide for any sinking fund provisions.

Liability to Further Capital Calls. Shareholders

are liable for corporate liabilities only up to the par value of the shares they hold; they are not liable to further capital calls.

Requirements for Holdings Exceeding

Certain Percentages. None except as described below under "—Form, Holding and Transfer

of Shares—Ownership of Shares by Non-French Persons".

Actions Necessary to Modify Shareholders' Rights

Shareholders' rights may be modified as allowed by French law. Only

the extraordinary shareholders' meeting is authorized to amend any and all provisions of our articles of association. It may not, however,

increase shareholder commitments without the prior approval of each shareholder.

Special Voting Rights of Warrant Holders

Under French law, the holders of warrants of the same class (i.e., warrants

that were issued at the same time and with the same rights), including founders' warrants, are entitled to vote as a separate class at

a general meeting of that class of warrant holders under certain circumstances, principally in connection with any proposed modification

of the terms and conditions of the class of warrants or any proposed issuance of preferred shares or any modification of the rights of

any outstanding class or series of preferred shares.

Rules for Admission to and Calling Annual Shareholders'

Meetings and Extraordinary Shareholders' Meetings

Access to, Participation in and

Voting Rights at Shareholders' Meetings (Articles 27 &28 of the Articles of Association). Shareholders'

meetings are composed of all shareholders. Each shareholder has the right to attend the meetings and participate in the discussions (1) personally,

or (2) by granting proxy to any individual or legal entity of his choosing; or (3) by sending a proxy to the company without

indication of the mandate, or (4) by voting by correspondence, or (5) by videoconference or another means of telecommunication

in accordance with applicable laws that allow identification. For any proxy given by a shareholder without indication of the mandate,

the chairman of the general meeting shall cast a vote in favor of the adoption of the draft resolutions presented or approved by the board

of directors and a vote against the adoption of all other draft resolutions. The board of directors organizes, in accordance with legal

and regulatory requirements, the participation and vote of the shareholders at the meeting, assuring, in particular, the effectiveness

of the means of identification.

Participation in shareholders' general meetings, in any form whatsoever,

is subject to registration or registration of shares under the conditions and time limits provided for applicable laws.

The final date for returning voting ballots by correspondence is set

by the board of directors and disclosed in the notice of meeting published in the French Journal of Mandatory Statutory Notices (BALO).

This date cannot be earlier than three days prior to the meeting.

The shareholder having voted by correspondence will no longer be able

to participate directly in the meeting or to be represented. In the case of returning the proxy form and the voting by correspondence

form, the proxy form is taken into account, subject to the votes cast in the voting by correspondence form.

Any shareholder may be represented at meetings by any individual or

legal entity of his choosing, by means of a proxy form which is addressed to him by us (1) at his request, addressed to us by any

means. This request must be received at the registered office at least five days before the date of the meeting; or (2) at our initiative.

The proxy is only valid for a single meeting or for successive meetings

convened with the same agenda. It can also be granted for two meetings, one ordinary, the other extraordinary, held on the same day or

within a period of 15 days.

Any shareholder may vote by correspondence by means of a voting form,

which is sent by us (1) upon request, addressed in writing (this request must be received at the registered office at least six days

before the date of the meeting); or (2) at our initiative; or (3) in appendix to a proxy voting form under the conditions provided

for by current laws and requirements. In any case this voting form is available on our website at least 21 days before the date of

the meeting.

The voting by correspondence form addressed by a shareholder is only

valid for a single meeting or for successive meetings convened with the same agenda.

Notice of Annual Shareholders'

Meetings. Shareholders' meetings are convened by our board of directors, or, failing that, by the

statutory auditors, or by a court appointed agent or liquidator in certain circumstances. Meetings are held at our registered offices

or at any other location indicated in the convening notice. A convening notice is published in the French Journal of Mandatory Statutory

Notices (Bulletin des Annonces Légales Obligatoires (BALO)) at least 35 days prior to a meeting, as well as on our

website at least 21 days prior to the meeting. In addition to the particulars relative to the company, it indicates, notably, the

meeting's agenda and the draft resolutions that will be presented. The requests for recording of issues or draft resolutions on the agenda

must be addressed to the company under the conditions provided for in the current legislation.

Subject to special legal provisions, the meeting notice is sent out

at least 15 days prior to the date of the meeting, by means of a notice inserted both in a legal announcement bulletin of the registered

office department and in the French Journal of Mandatory Statutory Notices (BALO). Further, the holders of registered shares for at least

a month at the time of the latest of the insertions of the notice of meeting shall be summoned individually, by regular letter (or by

registered letter if they request it and include an advance of expenses) sent to their last known address. This notice may also be transmitted

by electronic means of telecommunication, in lieu of any such mailing, to any shareholder requesting it beforehand by registered letter

with acknowledgment of receipt in accordance with legal and regulatory requirements, specifying his e-mail address. The latter may at

any time expressly request by registered letter to the Company with acknowledgment of receipt that the aforementioned means of telecommunication

should be replaced in the future by a mailing.

The convening notice must also indicate the conditions under which

the shareholders may vote by correspondence and the places and conditions in which they can obtain voting forms by mail.

The convening notice may be addressed, where appropriate, with a proxy

form and a voting by correspondence form, under the conditions specified in our bylaws, or with a voting by correspondence form alone,

under the conditions specified in our bylaws. When the shareholders' meeting cannot deliberate due to the lack of the required quorum,

the second meeting must be called at least ten days in advance in the same manner as used for the first notice.

Agenda and Conduct of Annual Shareholders'

Meetings. The agenda of the shareholders' meeting shall appear in the notice to convene the meeting and

is set by the author of the notice. The shareholders' meeting may only deliberate on the items on the agenda except for the removal of

directors and the appointment of their successors which may be put to vote by any shareholder during any shareholders' meeting. One or

more shareholders representing a percentage of share capital required by French law, and acting in accordance with legal requirements

and within applicable time limits, may request the inclusion of items or proposed resolutions on the agenda.

Shareholders' meetings shall be chaired by the Chairman of the board

of directors or, in his or her absence, the meeting itself shall elect a Chairman. Vote counting shall be performed by the two members

of the meeting who are present and accept such duties, who represent, either on their own behalf or as proxies, the greatest number of

votes.

Ordinary Shareholders' Meeting. Ordinary

shareholders' meetings are those meetings called to make any and all decisions that do not amend our by-laws. An ordinary meeting shall

be convened at least once a year within six months of the end of each fiscal year in order to approve the annual and consolidated accounts

for the relevant fiscal year or, in case of postponement, within the period established by court order. Upon first notice, the meeting

may validly deliberate only if the shareholders present or represented by proxy or voting by mail, by videoconference or by means of telecommunication

(to the extent the board of directors authorizes it when convening the shareholders) represent at least one-fifth of the shares entitled

to vote. Upon second notice, no quorum is required. Decisions are made by a majority of the votes held by the shareholders present, or

represented by proxy, or voting by mail, by videoconference or by means of telecommunications (to the extent the board of directors authorizes

it when convening the shareholders). Pursuant to the French Law n° 2019-744, dated July 19, 2019, abstention from voting, blank

votes or null votes by those present or those represented by proxy or voting by email are no longer counted as votes against the resolution

submitted to a shareholder vote at any type of meeting.

Extraordinary Shareholders' Meeting. Only

an extraordinary shareholders' meeting is authorized to amend our by-laws. It may not, however, increase shareholder commitments without

the approval of each shareholder. Subject to the legal provisions governing share capital increases from reserves, profits or share premiums,

the resolutions of the extraordinary meeting shall be valid only if the shareholders present, represented by proxy or voting by mail,

by videoconference or by means of telecommunication (to the extent the board of directors authorizes it when convening the shareholders)

represent at least one-fourth of all shares entitled to vote upon first notice, or one-fifth upon second notice. If the latter quorum

is not reached, the second meeting may be postponed to a date no later than two months after the date for which it was initially called.

Decisions are made by a two-thirds majority of the votes held by the shareholders present, represented by proxy, or voting by mail, by

videoconference or by means of telecommunication (to the extent the board of directors authorizes it when convening the shareholders).

Pursuant to the French Law n° 2019-744, dated July 19, 2019, abstention from voting, blank votes or null votes by those present

or those represented by proxy or voting by email are no longer counted as votes against the resolution submitted to a shareholder vote

at any type of meeting.

Mechanisms for Delaying, Deferring

or Preventing a Change in Control of the Company

Provisions contained in our Articles of Association and/or French corporate

law could make it more difficult for a third party to acquire us, even if doing so might be beneficial to our shareholders. In addition,

provisions of our bylaws impose various procedural and other requirements, which could make it more difficult for shareholders to effect

certain corporate actions. These provisions include the following:

| · | under French law, the owner of 90% of voting rights of a public company listed

on a regulated market in a Member State of the European Union or in a state party to the European Economic Area, or EEA, Agreement, including

France, has the right to force out minority shareholders following a tender offer made to all shareholders; |

| · | under French law, a non-resident of France as well as any French entity controlled

by non-French residents may have to file an administrative notice with French authorities in connection with a direct or indirect investment

in us, as defined by administrative rulings; |

| · | a merger (i.e., in a French law context, a stock for stock exchange

following which our company would be dissolved into the acquiring entity and our shareholders would become shareholders of the acquiring

entity) of our company into a company incorporated in the European Union would require the approval of our board of directors as well

as a two-thirds majority of the votes held by the shareholders present, represented by proxy or voting by mail at the relevant meeting; |

| · | under French law, a cash merger is treated as a share purchase and would

require the consent of each participating shareholder; |

| · | our shareholders have granted and may grant in the future our board of directors

broad authorizations to increase our share capital or to issue additional ordinary shares or other securities, such as warrants, to our

shareholders, the public or qualified investors, including as a possible defense following the launching of a tender offer for our shares; |

| · | our shareholders have preferential subscription rights on a pro rata basis

on the issuance by us of any additional securities for cash or a set-off of cash debts, which rights may only be waived by the extraordinary

general meeting (by a two-thirds majority vote) of our shareholders or on an individual basis by each shareholder; |

| · | our board of directors has the right to appoint directors to fill a vacancy

created by the resignation or death of a director, for the remaining duration of such director's term of office, provided that prior to

such decision of the board of directors, the number of directors remaining in office exceeds the minimum required by law and by the bylaws,

and subject to the subsequent approval by the shareholders of such appointment at the next shareholders' meeting, which prevents shareholders

from having the sole right to fill vacancies on our board of directors; |

| · | our board of directors can be convened by our chairman (directly or upon

request of our managing director), or, when no board meeting has been held for more than three consecutive months, by directors representing

at least one third of the total number of directors; |

| · | our board of directors meetings can only be regularly held if at least half

of the directors attend either physically or by way of videoconference or teleconference enabling the directors' identification and ensuring

their effective participation in the board's decisions; |

| · | our shares are nominative or bearer, if the legislation so permits, according

to the shareholder's choice; |

| · | under French law, certain investments in any entity governed by French law

relating to certain strategic industries (such as research and development in biotechnologies and activities relating to public health)

and activities by individuals or entities not French, not resident in France or controlled by entities not French or not resident in France

are subject to prior authorization of the Ministry of Economy; |

| · | approval of at least a majority of the votes held by shareholders present,

represented by a proxy, or voting by mail at the relevant ordinary shareholders' general meeting is required to remove directors with

or without cause; |

| · | advance notice is required for nominations to the board of directors or for

proposing matters to be acted upon at a shareholders' meeting, except that a vote to remove and replace a director can be proposed at

any shareholders' meeting without notice; |

| · | our bylaws can be changed in accordance with applicable laws; |

| · | the crossing of certain thresholds has to be disclosed and can impose certain

obligations; |

| · | transfers of shares shall comply with applicable insider trading rules and

regulations and, in particular, with the Market Abuse Directive and Regulation dated April 16, 2014; and |

| · | pursuant to French law, our bylaws, including the sections relating to the

number of directors and election and removal of a director from office, may only be modified by a resolution adopted by two-thirds of

the votes of our shareholders present, represented by a proxy or voting by mail at the meeting. |

Declaration of Crossing of Ownership

Thresholds

Set forth below is a summary of certain provisions of our articles

of association and of the French Commercial Code applicable to us. This summary is not intended to be a complete description of applicable

rules under French law.

Our articles of association provide that any individual or legal entity

coming to directly or indirectly own, alone or in concert, a number of shares representing a fraction of our capital or voting rights

equal to 5%, 10%, 15%, 20%, 25%, 30%, 33.33%, 50%, 66.66%, 90% or 95% inform us of the total number of shares and voting rights and of

securities giving access to the capital or voting rights that it owns immediately or over time, within a period of four trading days from

the crossing of the said holding thresholds.

This obligation also applies under the same conditions when crossing

each of the above-mentioned thresholds in a downward direction.

In case of failure to declare, shares or voting rights exceeding the

fraction that should have been declared are deprived of voting rights at General Meetings of Shareholders for any meeting that would be

held until the expiry of a period of two years from the date of regularization of the notification in accordance with Article L.

233-14 of the French Commercial Code, if the failure to declare has been determined.

These requirements are without prejudice to the threshold crossing

declarations provided for under French law which impose a declaration to us and to the AMF upon crossing of the following thresholds no

later than the Fourth trading day following the crossing: 50% and 95% of the capital or voting rights.

Further, and subject to certain exemptions, any shareholder crossing,

alone or acting in concert, the 50% threshold shall file a mandatory public tender offer.

Changes in Share Capital

Increases in Share Capital. Pursuant

to French law, our share capital may be increased only with shareholders' approval at an extraordinary general shareholders' meeting following

the recommendation of our board of directors. The shareholders may delegate to our board of directors either the authority (délégation

de compétence) or the power (délégation de pouvoir) to carry out any increase in share capital.

Increases in our share capital may be effected by:

| · | issuing additional shares; |

| · | increasing the par value of existing shares; |

| · | creating a new class of equity securities; and |

| · | exercising the rights attached to securities giving access to the share capital. |

Increases in share capital by issuing additional securities may be

effected through one or a combination of the following:

| · | in consideration for cash; |

| · | in consideration for assets contributed in kind; |

| · | through an exchange offer; |

| · | by conversion of previously issued debt instruments; |

| · | by capitalization of profits, reserves or share premium; and |

| · | subject to certain conditions, by way of offset against debt incurred by

us. |

Decisions to increase the share capital through the capitalization

of reserves, profits and/or share premium require shareholders' approval at an extraordinary general shareholders' meeting, acting under

the quorum and majority requirements applicable to ordinary shareholders' meetings. Increases effected by an increase in the par value

of shares require unanimous approval of the shareholders, unless effected by capitalization of reserves, profits or share premium. All

other capital increases require shareholders' approval at an extraordinary general shareholders' meeting acting under the regular quorum

and majority requirements for such meetings.

Reduction in Share Capital. Pursuant

to French law, any reduction in our share capital requires shareholders' approval at an extraordinary general shareholders' meeting following

the recommendation of our board of directors. The share capital may be reduced either by decreasing the par value of the outstanding shares

or by reducing the number of outstanding shares. The number of outstanding shares may be reduced by the repurchase and cancellation of

shares. Holders of each class of shares must be treated equally unless each affected shareholder agrees otherwise.

Preferential Subscription Right. According

to French law, if we issue additional securities for cash, current shareholders will have preferential subscription rights to these securities

on a pro rata basis. Preferential subscription rights entitle the individual or entity that holds them to subscribe pro rata

based on the number of shares held by them to the issuance of any securities increasing, or that may result in an increase of, our share

capital by means of a cash payment or a set-off of cash debts. The preferential subscription rights are transferable during the subscription

period relating to a particular offering. Since October 1, 2016, preferential subscription rights may only be exercised two business

days prior to the day on which the subscription is opened until the second business day prior to its closing. Thus, the preferential subscription

rights are transferable during the same period as their period of exercise. In accordance with French law, the period of exercise shall

be no less than five business days.

The preferential subscription rights with respect to any particular

offering may be waived at an extraordinary general meeting by a two-thirds vote of our shareholders or individually by each shareholder.

Our board of directors and our independent auditors are required by French law to present reports to the shareholders' meeting that specifically

address any proposal to waive the preferential subscription rights.

Our current shareholders waived their preferential subscription rights

with respect to this offering at an extraordinary general shareholders' general meeting held on June 21, 2022.

In the future, to the extent permitted under French law, we may seek

shareholder approval to waive preferential subscription rights at an extraordinary general shareholders' meeting in order to authorize

the board of directors to issue additional shares and/or other securities convertible or exchangeable into shares.

Form, Holding and Transfer of Shares

Form of Shares. The

shares are nominative or bearer, if the legislation so permits, according to the shareholder's choice.

Further, in accordance with applicable laws, we may request at any

time from the central depository responsible for holding our Shares, the information referred to in Article L. 228-2 of the French

Commercial Code. Thus, we are, in particular and at any time, entitled to request the name and year of birth or, in the case of a legal

entity, the name and the year of incorporation, nationality and address of holders of securities conferring immediate or long-term voting

rights at its General Meetings of Shareholders and the amount of securities owned by each of them and, where applicable, the restrictions

that the securities could be affected by.

Holding of Shares. In

accordance with French law concerning the "dematerialization" of securities, the ownership rights of shareholders are represented

by book entries instead of share certificates. Shares issued are registered in individual accounts opened by us or any authorized intermediary,

in the name of each shareholder and kept according to the terms and conditions laid down by the legal and regulatory provisions.

Ownership of Shares by Non-French

Persons. Neither French law nor our articles of association limit the right of non-residents of

France or non-French persons to own or, where applicable, to vote our securities. However, (a) any non-French citizen, (b) any

French citizen not residing in France, (c) any non-French entity or (d) any French entity controlled by one of the aforementioned

persons or entities may have to file a declaration for statistical purposes with the Bank of France (Banque de France) within twenty

working days following the date of certain direct foreign investments in us, including any purchase of our ADSs. In particular, such filings

are required in connection with investments exceeding €15,000,000 that lead to the acquisition of at least 10% of our share capital

or voting rights or cross such 10% threshold. Violation of this filing requirement may be sanctioned by five years of imprisonment and

a fine of up to twice the amount of the relevant investment. This amount may be increased fivefold if the violation is made by a legal

entity.

Moreover, under French law, certain investments in any entity governed

by a French law relating to certain strategic industries (such as research and development in biotechnologies and activities relating

to public health) and activities by individuals or entities not French, not resident in France or controlled by entities not French or

not resident in France are subject to prior authorization of the Ministry of Economy.

Assignment and Transfer of Shares. Shares

are freely negotiable, subject to applicable legal and regulatory provisions. French law notably provides for standstill obligations and

prohibition of insider trading.

Registration Rights

None of our security holders possess registration rights.

Differences in Corporate Law

The laws applicable to French sociétés anonymes

differ from laws applicable to U.S. corporations and their shareholders. Set forth below is a summary of certain differences between the

provisions of the French Commercial Code applicable to us and the Delaware General Corporation Law relating to shareholders' rights and

protections.

| |

|

France |

|

Delaware |

| Number of Directors |

|

Under French law, a société anonyme must have at least three and may have up to 18 directors. The number of directors is fixed by or in the manner provided in the by-laws. |

|

Under Delaware law, a corporation must have at least one director and the number of directors shall be fixed by or in the manner provided in the by-laws. |

| |

|

|

|

|

| Director Qualifications |

|

Under French law, a corporation may prescribe qualifications for directors under its by-laws. In addition, under French law, members of a board of directors of a corporation may be legal entities (with the exception of the Chairman of the board of directors), and such legal entities may designate an individual to represent them and to act on their behalf at meetings of the board of directors. |

|

Under Delaware law, a corporation may prescribe qualifications for directors under its certificate of incorporation or by-laws. |

| |

|

|

|

|

| Removal of Directors |

|