MARKET MOVEMENTS:

--Brent crude oil is down 1.9% at $83.14 a barrel.

--European benchmark gas is down 2% at EUR41.87 a megawatt

hour.

--Gold futures are down 1.6% at $1,987.80 a troy ounce.

--LME three-month copper futures are down 1.1% at $8,902 a

metric ton.

--Wheat futures are down 1.5% at $6.99 a bushel.

TOP STORY:

Glencore Willing to Consider Improvements to Teck Resources

Proposal

Glencore PLC said Wednesday that it would be prepared to

consider improvements to its merger, demerger proposal for Teck

Resources Ltd. if its board were willing to engage with it, but

would also be willing to go directly to its shareholders if

not.

The Anglo-Swiss commodity mining and trading company said that

any improvements to its proposal are best considered following

engagement with the Teck board as this would allow the parties to

jointly explore ways it could alter its proposal and address any

issues raised by Teck.

In an open letter to Teck Class B shareholders, Glencore said it

has tried to engage with the Teck board about its proposal but has

been consistently refused any engagement.

"We continue to believe that the proposed merger demerger being

a merger and not a takeover, is demonstrably superior to the

proposed Teck separation. It provides the most compelling value

proposition to Teck shareholders, who would fully and

disproportionately participate in the value creation, synergies and

upside," Glencore said in the letter.

It said that the Glencore proposal would stand and remain valid

if Teck delays its shareholder meeting, or voted down the proposed

separation at the meeting on April 26. However, if it were to go

ahead then Glencore's proposal wouldn't be able to proceed due to

the "significant value destruction" that would arise.

OTHER STORIES:

Copper Shortage Risks Green Transition

Metal markets seem to think copper is the new lithium. A lack of

new mining activity has added to worries that there won't be enough

of the red metal for the energy transition, a popular topic at this

week's World Copper Conference in Santiago, Chile.

South America currently dominates copper production and Chile is

the largest mined producer. Increasing mine output has proved a

challenge, prompting a wave of deal making in the industry and

warnings of a serious supply shortfall over the next decade.

Copper is used in wiring and construction as well as electric

vehicles, solar panels and other green technologies.

Electrification is expected to increase annual copper demand to

36.6 million metric tons by 2031, with supply forecast to be around

30.1 million tons, creating a 6.5 million ton shortfall at the

start of the next decade, according to consulting firm McKinsey

& Co.

In 2021, refined copper demand stood at 25.3 million tons,

according to the International Copper Study Group.

"The market overall is pretty tight," said Robert Edwards,

copper analyst at CRU. "Longer term there's a narrative around

resource scarcity and the green transition with EVs and renewables

as well as the build-out of electricity grids. On paper it's quite

a substantial supply gap opening up over the next 10 years," he

added.

---

TSMC Seeks Up to $15 Billion From U.S. for Chip Plants but

Objects to Conditions

The world's biggest contract chip maker is pushing back on some

of the conditions Washington has attached to chip-factory subsidies

as it looks for up to $15 billion in government money.

Taiwan Semiconductor Manufacturing Co., which plans to invest

$40 billion in two chip factories in Arizona, is concerned about

rules that could require it to share profits from the factories and

provide detailed information about operations, said people familiar

with the situation.

MARKET TALKS:

WTI Oil Falls Below $80 Ahead of EIA Data

0809 ET - Oil prices continue to struggle this week, with the US

crude benchmark falling another 2.1% to $79.14 a barrel, while the

global benchmark Brent drops 2.1% to $82.99. WTI crude is 4.1%

since the week began after a 24% rally over the previous four weeks

that was driven largely by a million-barrel-a-day production cut

announcement from members of the OPEC-plus group. Energy investors

are now awaiting a weekly EIA report on US oil inventories at

10:30am ET. A WSJ survey forecasts across-the-board declines in US

stockpiles of crude, gasoline and diesel, and are expecting

refinery activity to speed up as some plants conclude their spring

maintenance work. (dan.molinski@wsj.com)

---

Palm Oil Declines; Increase in Rapeseed Oil Supply Could

Weigh

1003 GMT - Crude palm oil prices fell in Asian trade. Malaysian

palm oil prices are projected to range between MYR3,500-MYR4,000 a

metric ton in the near term, said Abdul Hameed, director of sales

of Pakistan-based Manzoor Trading. While the supply of crude palm

oil in Malaysia remains tight, an increase in the global supply of

rapeseed oil could weigh on prices, he added. The benchmark

contract for July delivery closed MYR59 lower at MYR3,730 a ton.

(yiwei.wong@wsj.com)

---

Oil Falls After Iraqi Oil Flows Set to Resume

0929 GMT - Oil prices tumble after reports that oil exports from

Kurdish Iraq will resume this week. Brent crude oil slips 1.9% to

$83.13 a barrel while WTI drops 2% to $79.27 a barrel. Iraq's prime

minister said the flows, which total around 450,000 barrels a day,

would resume in the coming days, according to local media. The news

pushed down crude prices, according to DNB Markets. The supplies

had been halted amid a dispute between the Iraqi government in

Baghdad and the semi-autonomous oil-rich Kurdish region. The two

sides had already reached a temporary agreement earlier this month

but oil flows had yet to resume. (william.horner@wsj.com)

---

Glencore's Sweet-Talking of Teck Is Hardly Surprising

0836 GMT - Glencore indicates it could dig a bit deeper with its

merger proposal for Teck Resources if Teck's board willingly

engages in conversation--no big surprise as miners rarely back down

once they fixate on a new target, AJ Bell says. The Anglo-Swiss

mining and trading company said it is prepared to consider

improvements to its merger, demerger proposal if the board engaged,

but would be willing to go directly to shareholders if not. "Expect

this drama to keep playing out--ultimately, it is all down to price

and even the most stubborn will eventually cave in if enough

carrots are dangled in front of their face, " AJ Bell investment

director Russ Mould says. Glencore shares are down 0.6% at 495.05

pence. (joseph.hoppe@wsj.com)

---

Oil Weakens Amid Demand Worries

0744 GMT - Oil prices edge lower as demand concerns outweigh

signs of falling inventories and strong Chinese data. Brent crude

oil declined 0.5% to $84.32 a barrel while WTI edges down 0.6% to

$80.44 a barrel. Oil prices shrugged at Chinese GDP data Tuesday

that was stronger than expected, while prices seem to be similarly

unimpressed by American Petroleum Institute data that showed U.S.

crude inventories fell last week. "There are clearly still some

concerns over the demand outlook," says Warren Patterson, head of

commodities strategy at ING, in a note. "Weaker refinery margins

will be adding to these concerns," he says.

(william.horner@wsj.com)

---

Metals Slip as Dollar Inches Higher

0725 GMT - Metal prices are slipping in early trading in London,

while the dollar is inching higher with expectations of a rate hike

in May from the Federal Reserve rising. Three-month copper is down

0.7% to $8,942 a metric ton while aluminum is 1% lower at $2,415.50

a ton. Gold in New York is down 0.8% to $2,004.10 a troy ounce. "In

the short term, we expect the U.S. Federal Reserve to remain

hawkish as it battles inflation," ANZ Research says in a note.

However, ANZ adds that it does expect an eventual pause in rate

hikes, which should boost demand for goods like gold.

(yusuf.khan@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

April 19, 2023 09:04 ET (13:04 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

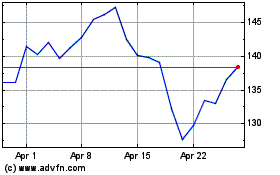

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024