UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

SQZ Biotechnologies Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

SQZ Biotechnologies Company

NOTICE & PROXY STATEMENT

Annual Meeting of Stockholders

June 14, 2023

9:30 a.m. (Eastern time)

SQZ BIOTECHNOLOGIES COMPANY

200 ARSENAL YARDS BLVD, SUITE 210

WATERTOWN, MASSACHUSETTS 02472

April [ ], 2023

To Our Stockholders:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of SQZ Biotechnologies Company at 9:30 a.m. Eastern time, on Wednesday, June 14, 2023. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who can attend the Annual Meeting?” on page 3 of the proxy statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting online, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote online, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

Howard Bernstein, M.D., Ph.D.

Interim Chief Executive Officer and Director

TABLE OF CONTENTS

SQZ BIOTECHNOLOGIES COMPANY

200 Arsenal Yards Blvd, Suite 210

Watertown, Massachusetts 02472

Notice of Annual Meeting of Stockholders

To Be Held Wednesday, June 14, 2023

The Annual Meeting of Stockholders (the “Annual Meeting”) of SQZ Biotechnologies Company, a Delaware corporation (the “Company”), will be held at 9:30 a.m. Eastern time on Wednesday, June 14, 2023. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to participate in the Annual Meeting online, vote your shares electronically and submit your questions before and during the Annual Meeting by visiting www.proxydocs.com/SQZ. In order to attend and/or participate, you must register in advance at www.proxydocs.com/SQZ prior to the deadline of June 13, 2023 at 5:00 p.m. Eastern Time. Upon properly completing your registration, you will receive further instructions via email, including your unique live meeting link that will allow you access to the Annual Meeting and will also permit you to vote electronically and submit questions at the meeting. You will not be able to attend the Annual Meeting in person.

The Annual Meeting will be held for the following purposes:

•To elect Paul Bolno, M.D., Howard Bernstein, M.D., Ph.D., and Marc Schegerin, M.D., as Class III Directors to serve until the 2026 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To approve amendments to the Company’s restated certificate of incorporation, as amended, to effect a reverse stock split of the Company’s common stock at a ratio ranging from any whole number between 1-for-10 and 1-for-20, as determined by the Board of Directors in its discretion, subject to the Board of Directors’ authority to abandon such amendments;

•To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our common stock as of the close of business on April 17, 2023 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to Lawrence Knopf, General Counsel and Secretary, at GeneralCounsel@sqzbiotech.com, stating the purpose of the request and providing proof of ownership of Company stock. The list of these stockholders will also be available for examination by our stockholders during the Annual Meeting via the unique link that will allow you to access the meeting. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further

i

solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

Lawrence Knopf

General Counsel and Secretary

Watertown, Massachusetts

April [ ], 2023

ii

SQZ BIOTECHNOLOGIES COMPANY

200 Arsenal Yards Blvd, Suite 210

Watertown, Massachusetts 02472

Proxy Statement

This proxy statement is furnished in connection with the solicitation by the Board of Directors of SQZ Biotechnologies Company of proxies to be voted at our Annual Meeting of Stockholders to be held on Wednesday, June 14, 2023 (the “Annual Meeting”), at 9:30 a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

You will be able to participate in the Annual Meeting online, vote your shares electronically and submit your questions before and during the Annual Meeting by visiting www.proxydocs.com/SQZ. In order to attend and/or participate, you must register in advance at www.proxydocs.com/SQZ prior to the deadline of June 13, 2023 at 5:00 p.m. Eastern Time. Upon properly completing your registration, you will receive further instructions via email, including your unique live meeting link that will allow you access to the Annual Meeting and will also permit you to vote electronically and submit questions at the meeting. You will not be able to attend the Annual Meeting in person.

Holders of record of shares of our common stock, $0.001 par value per share, as of the close of business on April 17, 2023 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were [ ] shares of common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2022 (the “2022 Annual Report”) will be released on or about April [ ], 2023 to our stockholders on the Record Date.

In this proxy statement, “SQZ”, “Company”, “we”, “us”, and “our” refer to SQZ Biotechnologies Company.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON WEDNESDAY, JUNE 14, 2023

This Proxy Statement and our 2022 Annual Report to Stockholders are available at

http://www.proxydocs.com/SQZ

Proposals

At the Annual Meeting, our stockholders will be asked:

To elect Paul Bolno, M.D., Howard Bernstein, M.D., Ph.D., and Marc Schegerin, M.D., as Class III Directors to serve until the 2026 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To approve amendments to the Company’s restated certificate of incorporation, as amended, to effect a reverse stock split of the Company’s common stock at a ratio ranging from any whole number between

1

1-for-10 and 1-for-20, as determined by the Board of Directors in its discretion, subject to the Board of Directors’ authority to abandon such amendments (the “Reverse Stock Split”);

To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board

The Board of Directors (the “Board”) recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted, and the Board recommends that you vote:

•FOR the election of Paul Bolno, M.D., Howard Bernstein, M.D., Ph.D., and Marc Schegerin, M.D.,. as Class III Directors;

•FOR the approval of the Reverse Stock Split; and

•FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because SQZ’s Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, SQZ is making this proxy statement and its 2022 Annual Report available to its stockholders electronically via the Internet. On or about April [ ], 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 2022 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2022 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials,

2

as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact your bank, broker, or other nominee record holder, or you may contact our Secretary at our offices at 200 Arsenal Yards Blvd, Suite 210, Watertown, Massachusetts 02472.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact your bank, broker, or other nominee record holder, or you may contact our Secretary at our offices at 200 Arsenal Yards Blvd, Suite 210, Watertown, Massachusetts 02472.

3

Questions and Answers About the 2023 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 17, 2023. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of common stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were [ ] shares of common stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you may not vote your shares online at the Annual Meeting, unless you obtain a legal proxy from your bank or brokerage firm.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting online or by proxy, of the holders of a majority in voting power of the common stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

We have decided to hold the Annual Meeting entirely online this year. There will not be a physical meeting location and you will not be able to attend the meeting in person. To participate in the Annual Meeting virtually via the internet, please visit www.proxydocs.com/SQZ prior to the meeting.

You must register by June 13, 2023 at 5:00 p.m. Eastern Time to attend the Annual Meeting webcast.

Upon properly completing your registration, you will receive further instructions via email, including your unique live meeting link that will allow you access to the Annual Meeting and will permit you to submit questions before and during the Annual Meeting and vote. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:15 a.m. Eastern time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chair of the Annual Meeting is authorized by our Amended and Restated Bylaws to adjourn the meeting, without the vote of stockholders.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

4

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

•by Internet—You can vote over the Internet at www.proxypush.com/SQZ by following the instructions on the Internet Notice or proxy card;

•by Telephone—You can vote by telephone by calling 866-509-2154 and following the instructions on the proxy card;

•by Mail—You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or

•Electronically at the Meeting—To vote at the virtual Annual Meeting, you must register in advance at www.proxydocs.com/SQZ prior to the deadline of June 13, 2023 at 5:00 pm Eastern Time. You will be asked to provide the company number and control number from the Internet Notice. Upon properly completing your registration, you will receive further instructions via email, including your unique live meeting link that will allow you access to the meeting and you will have the ability to vote electronically.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day until the time at which online voting closes at the Annual Meeting.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically. We encourage stockholders to submit their proxy via the Internet or telephone.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If you wish to attend the Annual Meeting and vote your shares online at the Annual Meeting, you must register with your control number and obtain a legal proxy from your bank or broker in order to cast your vote. If your shares are not registered in your own name or if you lose your control number, you should contact your bank or broker to obtain your control number or otherwise vote through the bank or broker.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of SQZ prior to or at the Annual Meeting; or

•by voting online at the Annual Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Annual Meeting by obtaining a legal proxy from your bank or broker and submitting the legal proxy along with your ballot.

5

Who will count the votes?

A representative of Mediant Communications Inc., our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

We believe that hosting a virtual meeting this year is in the best interest of the Company and its stockholders. Furthermore, a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to attend the Annual Meeting online and submit your questions by visiting www.proxydocs.com/SQZ. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website, and the information for assistance will be located in the email you receive with information on how to join the Annual Meeting.

Will there be a question-and-answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during or prior to the meeting that are pertinent to the Company and the meeting matters, as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

•irrelevant to the business of the Company or to the business of the Annual Meeting;

•related to material non-public information of the Company, including the status or results of our business since our last Quarterly Report on Form 10-Q;

•related to any pending, threatened or ongoing litigation;

•related to personal grievances;

•derogatory references to individuals or that are otherwise in bad taste;

•substantially repetitious of questions already made by another stockholder;

•in excess of the two question limit;

6

•in furtherance of the stockholder’s personal or business interests; or

•out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Secretary in their reasonable judgment.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?”.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

|

|

|

|

|

Proposal |

|

Votes required |

|

Effect of Votes Withheld /

Abstentions and Broker

Non-Votes |

Proposal 1: Election of Directors |

|

The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. |

|

Votes withheld and broker non-votes will have no effect. |

Proposal 2: Approval of Reverse Stock Split |

|

The affirmative vote of the holders of a majority of the Company’s outstanding common stock. |

|

Abstentions will have the effect of a vote against this proposal. We do not expect any broker non-votes on this proposal. |

Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm |

|

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively. |

|

Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the proposal regarding the approval of the Reverse Stock Split or the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors. Abstentions have the effect of a vote against the approval of the Reverse Stock Split, but no effect on the ratification of the appointment of PricewaterhouseCoopers LLP.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the approval of the Reverse Stock Split and the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting, and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

7

Proposals To Be Voted On

Proposal 1: Election of Directors

At the Annual Meeting, three (3) Class III Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2026 and until each such director’s respective successor is elected and qualified or until each such director’s earlier death, resignation or removal.

We currently have ten (10) directors on our Board, including three (3) Class III Directors. Our current Class III Directors are Paul Bolno, M.D., Howard Bernstein, M.D., Ph.D., and Marc Schegerin, M.D. The Board has nominated all three current Class III Directors to stand for election as Class III Directors at the Annual Meeting.

As set forth in our Restated Certificate of Incorporation, the Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The current class structure is as follows: Class I, whose term will expire at the 2024 Annual Meeting of Stockholders; Class II, whose term will expire at the 2025 Annual Meeting of Stockholders; and Class III, whose current term will expire at the Annual Meeting and whose subsequent term will expire at the 2026 Annual Meeting of Stockholders. The current Class I Directors are Marc Elia, Pushkal Garg, M.D. and Patrick Vink, M.D.; the current Class II Directors are Amy W. Schulman, Sapna Srivastava, Ph.D., Klavs F. Jensen, Ph.D. and Bernard Coulie, M.D., Ph.D.; and the current Class III Directors are Paul Bolno, M.D., Howard Bernstein, M.D., Ph.D., and Marc Schegerin, M.D.

Our Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed from time to time by the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented thereby for the election as a Class III Director of the person whose name and biography appears below. In the event that any of Dr. Bolno, Dr. Bernstein or Dr. Schegerin should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that any of Dr. Bolno, Dr. Bernstein or Dr. Schegerin will be unable to serve if elected. Each of Dr. Bolno, Dr. Bernstein or Dr. Schegerin has consented to being named in this proxy statement and to serve if elected.

Vote required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors.

Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

8

Recommendation of the Board

|

|

|

The Board unanimously recommends a vote FOR the election of each of the below Class III Director nominees. |

Nominees For Class III Director (terms to expire at the 2026 Annual Meeting)

The current members of the Board who are also nominees for election to the Board as Class III Directors are as follows:

|

|

|

|

|

|

|

Name |

|

Age |

|

Served as a Director Since |

|

Position with SQZ |

Howard Bernstein M.D., Ph.D. |

|

65 |

|

2022 |

|

Director and Interim CEO |

Paul Bolno, M.D. |

|

48 |

|

2020 |

|

Director |

Marc Schegerin, M.D. |

|

46 |

|

2020 |

|

Director |

The principal occupations and business experience, for at least the past five years, of each Class III Director nominee for election at the Annual Meeting are as follows:

Howard Bernstein, M.D., Ph.D.

Howard Bernstein, M.D., Ph.D. has served as our Interim Chief Executive Officer since November 2022 and a member of our Board since October 2022. Previously, he served as our Chief Scientific Officer from June 2015 through September 2022. Prior to joining us, from November 2008 to May 2015, Dr. Bernstein served as the Chief Scientific Officer of Seventh Sense Biosystems, a medical device company. Dr. Bernstein holds an M.D. from Harvard Medical School, a Ph.D. in Chemical Engineering from the Massachusetts Institute of Technology and a Bachelor of Engineering from McGill University. He is a member of the National Academy of Engineering and a Fellow of the American Institute of Medical and Biological Engineering. We believe that Dr. Bernstein’s experience in the biotechnology industry and knowledge of our company qualify him to serve on our Board.

Paul B. Bolno, M.D.

Paul B. Bolno, M.D., has served on our Board since June 2020. Since December 2013, Dr. Bolno has served as the President and Chief Executive Officer of Wave Life Sciences Ltd., a genetic medicines company, and has served as a director of Wave Life Sciences Ltd. since April 2014. Prior to joining Wave, Dr. Bolno served at GlaxoSmithKline, a pharmaceutical company, from 2009 to 2013 in various roles, including Vice President, Worldwide Business Development—Head of Asia BD and Investments, Head of Global Neuroscience BD, a director of Glaxo Welcome Manufacturing, Pte. Ltd. in Singapore and Vice President, Business Development for the Oncology Business Unit, where he helped establish GlaxoSmithKline’s global oncology business and served as a member of the Oncology Executive Team, Oncology Commercial Board and Cancer Research Executive Team. Prior to GlaxoSmithKline, Dr. Bolno served as Director of Research at Two River LLC, a health care private equity firm, from 2004 to 2009. Dr. Bolno earned a medical degree from MCP-Hahnemann School of Medicine and an M.B.A. from Drexel University. He was a general surgery resident and cardiothoracic surgery postdoctoral research fellow at Drexel University College of Medicine. We believe that Dr. Bolno’s experience in the biotechnology industry and leading a biopharmaceutical company qualify him to serve on our Board.

Marc Schegerin, M.D.

Marc Schegerin, M.D. has served as a member of our Board since October 2020. Since April 2020, Dr. Schegerin has served as the Chief Financial Officer and Chief Operating Officer at Morphic Therapeutic, Inc., a biopharmaceutical company. From April 2018 to January 2020, Dr. Schegerin served as Chief Financial Officer, Treasurer and Head of Strategy & Communications at ArQule, an oncology-focused drug developer, until its acquisition by Merck & Co. in January 2020. Prior to this role, Dr. Schegerin served as a Director at Citigroup, from June 2016 to April 2018. Dr. Schegerin earned his M.D. from Dartmouth Medical School and M.B.A. from the Tuck School of Business at Dartmouth and undergraduate degrees in premedical studies from Harvard University and

9

finance from Tulane University. We believe Dr. Schegerin’s broad operational and transactional experience qualify him to serve on our Board.

Continuing members of the Board:

Class I Directors (terms to expire at the 2024 Annual Meeting)

The current members of the Board who are Class I Directors are as follows:

|

|

|

|

|

|

|

Name |

|

Age |

|

Served as a Director Since |

|

Position with SQZ |

Marc Elia |

|

47 |

|

2018 |

|

Director |

Pushkal Garg, M.D. |

|

55 |

|

2018 |

|

Director |

Patrick V.J.J. Vink, M.D. |

|

59 |

|

2021 |

|

Director |

The principal occupations and business experience, for at least the past five years, of each Class I Director are as follows:

Marc Elia

Marc Elia has served as a member of our Board since May 2018. In September 2019, Mr. Elia founded M28 Capital, a healthcare sector investment fund. Prior to that, from January 2012 to September 2019, Mr. Elia served as a partner at Bridger Capital, an investment fund. Mr. Elia holds a B.A. in Economics from Carleton College. We believe that Mr. Elia’s broad operational and transactional experience qualify him to serve on our Board.

Pushkal Garg, M.D.

Pushkal Garg, M.D. has served as a member of our Board since August 2018. Dr. Garg currently serves as Chief Medical Officer and Executive Vice President at Alnylam Pharmaceuticals, Inc., a biopharmaceutical company focused on the discovery, development, and commercialization of RNA interference therapeutics. Prior to joining Alnylam in October 2014, he held clinical development leadership roles at Bristol-Myers Squibb Corporation and Millennium Pharmaceuticals. Before joining the biopharmaceutical industry, he was on the faculty at Harvard Medical School and the Brigham and Women’s Hospital in Boston. Dr. Garg holds an M.D. from the University of California, San Francisco, School of Medicine, where he also completed a residency in Internal Medicine, and an A.B. in Biochemistry from the University of California, Berkeley. We believe Dr. Garg’s extensive medical and scientific knowledge and industry experience qualify him to serve on our Board.

Patrick V.J.J. Vink, M.D.

Patrick V.J.J. Vink, M.D. has served as a member of our Board since July 2021. He has significant experience as a senior executive, having worked in the pharmaceutical industry for more than 30 years. Since May 2020, Dr. Vink has served as Chairman at BiognoSys AG, a privately held proteomics company in Switzerland. Since June 2016, Dr. Vink has also served as Chairman of venture capital-backed NMD Pharma, a neurology biopharmaceutical company in Denmark and F2G Ltd, a rare fungal disease UK and Austria based company. In addition, Dr. Vink is a board member at Amryt Pharma PLC, Santhera AG and Spero Therapeutics, Inc. and in 2019 began working with Athyrium as a Senior Advisor. While serving in these capacities, Dr. Vink has been involved in initial public listings and geographic expansions and has contributed to the achievement of significant development and commercial milestones. Earlier in his career he held several leadership positions across the industry, including Head of Global Biopharmaceuticals for the Sandoz division of the Novartis Group, Vice President International Business for Biogen Inc., and Head of Worldwide Marketing, Cardiovascular and Thrombosis at Sanofi-Synthelabo Ltd. Dr. Vink also served as a member of the Executive Committee of the European Federation of Pharmaceutical Industries and Associations from 2013 to 2015. Dr. Vink graduated as a medical doctor from the University of Leiden, Netherlands in 1988 and obtained his Masters of Business Administration in 1992 at the University of Rochester. We believe Dr. Vink’s broad experience and leadership positions in the industry qualify him to serve on our Board.

10

Class II Directors (terms to expire at the 2025 Annual Meeting)

The current members of the Board who are Class II Directors are as follows:

|

|

|

|

|

|

|

Name |

|

Age |

|

Served as a Director Since |

|

Position with SQZ |

Bernard Coulie, M.D., Ph.D. |

|

57 |

|

2022 |

|

Director and Chair |

Klavs F. Jensen, Ph.D. |

|

70 |

|

2013 |

|

Director |

Sapna Srivastava, Ph.D. |

|

52 |

|

2020 |

|

Director |

Amy Schulman |

|

62 |

|

2015 |

|

Director |

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

Bernard Coulie, M.D., Ph.D.

Bernard Coulie, M.D., Ph.D., has served as a member of our Board since July 2021 and as our Chair since November 2022. Dr. Coulie has served as Chief Executive Officer and as a Director for Pliant Therapeutics, Inc., a biopharmaceutical company, since February 2016. Prior to joining Pliant, Dr. Coulie cofounded ActoGeniX N.V., a biopharmaceutical company, and held roles of increasing responsibility there, including as Vice President R&D, Chief Medical Officer, and Chief Executive Officer, from September 2006 until February 2015, when it was acquired by Intrexon Corporation. Prior to cofounding ActoGeniX, Dr. Coulie held various positions with increasing responsibilities in drug discovery and clinical development at Johnson & Johnson Pharmaceutical Research and Development Europe. Dr. Coulie previously served as a director of ActoGeniX from April 2010 until February 2015, Biogazelle N.V. from July 2015 until November 2018, and Myoscience from June 2016 until March 2019. Dr. Coulie is currently serving as a director and Chairman of Calypso BV. Dr. Coulie holds an M.D. and Ph.D. from the University of Leuven, Belgium and an MBA from the Vlerick Management School, Leuven, Belgium. We believe that Dr. Coulie’s experience in the biotechnology industry and executive leadership at various biopharmaceutical companies qualify him to serve on our Board.

Klavs F. Jensen, Ph.D.

Klavs F. Jensen, Ph.D. has served as a member of our Board since March 2013 and was a co-founder of our company. Since 1989, Dr. Jensen has served as Professor of Chemical Engineering and of Materials Science and Engineering at the Massachusetts Institute of Technology. From 2007 to 2015, Dr. Jensen served as Department Head for Chemical Engineering. Dr. Jensen was a member of the Board of Technical University of Denmark from 2009 to 2016. Dr. Jensen holds a Ph.D. in Chemical Engineering from the University of Wisconsin and an M.S. in Chemical Engineering from Technical University of Denmark. He is a member of the U.S. Academies of Engineering and Science. We believe Dr. Jensen’s pioneering academic work, extensive medical and scientific knowledge and industry experience qualify him to serve on our Board.

Sapna Srivastava, Ph.D.

Sapna Srivastava, Ph.D. has served as a member of our Board since October 2020. Dr. Srivastava served as the Interim Chief Financial Officer of eGenesis, Inc. from March 2021 to October 2021. From September 2017 to January 2019, Dr. Srivastava served as the Chief Financial and Strategy Officer at Abide Therapeutics, Inc., a biopharmaceutical company that was acquired by H. Lundbeck A/S in 2019. From April 2015 to December 2016, Dr. Srivastava served as the Chief Financial and Strategy Officer at Intellia Therapeutics, Inc., a genome editing company. Dr. Srivastava currently serves as a director of private company Asclepix Therapeutics, Inc. and multiple public companies, which are Talaris Therapeutics, Inc., Aura Biosciences, Nuvalent Inc, and Social Capital Suvretta Holdings Corp II. She also served as a director of VelosBio Inc. from October 2020 to December 2020. Dr. Srivastava holds a Ph.D. from N.Y.U. University School of Medicine and a B.S. from St. Xavier’s College,

11

University of Bombay. We believe Dr. Srivastava’s broad financial, operational, and transactional experience qualify her to serve on our Board.

Amy W. Schulman

Amy W. Schulman has served as a member of our Board since June 2015 and served as our Chair from June 2015 to November 2022. In July 2015, Ms. Schulman co-founded Lyndra Therapeutics, Inc., a pharmaceutical company, served as its Chief Executive Officer until February 2017 and as of September 2019 serves as Executive Chair. In addition, from August 2014 to November 2016, Ms. Schulman served as Chief Executive Officer of Arsia Therapeutics, Inc., a pharmaceutical company, until Arsia was acquired by Eagle Pharmaceuticals, Inc., a pharmaceutical company. Ms. Schulman joined Polaris Partners in August 2014 and became a Managing Partner in 2019. Since July 2014, Ms. Schulman has served as a senior lecturer at Harvard Business School. From January 2019 until January 2021, Ms. Schulman served as a director of Cyclerion Therapeutics, Inc. and currently serves as a director of Alnylam Pharmaceuticals, Inc. and on the Mount Sinai Hospital Board of Trustees. Ms. Schulman holds a J.D. from Yale Law School as well as B.A. degrees in Philosophy and English from Wesleyan University. We believe Ms. Schulman’s extensive industry experience qualifies her to serve on our Board.

Proposal 2: Approval of the Reverse Stock Split

General

Our Board has adopted and is recommending that our stockholders approve amendments to our Restated Certificate of Incorporation (our “Certificate of Incorporation”) to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-10 and 1-for-20, with the exact ratio within such range to be determined by the Board in its discretion (the “Reverse Stock Split”), subject to the Board’s authority to determine when to file the amendment and to abandon the other amendments notwithstanding prior stockholder approval of such amendments. Pursuant to the law of the State of Delaware, our state of incorporation, the Board must adopt any amendment to our Certificate of Incorporation and submit the amendment to stockholders for their approval. The form of the proposed amendments to our Certificate of Incorporation, one of which would be filed with the Secretary of State of the State of Delaware is attached to this proxy statement as Appendix A.

By approving this proposal, stockholders will approve alternative amendments to our Certificate of Incorporation pursuant to which a whole number of outstanding shares of our common stock between ten (10) and twenty (20), inclusive, would be combined into one share of our common stock. Upon receiving stockholder approval, the Board will have the authority, but not the obligation, in its sole discretion, to elect, without further action on the part of the stockholders, whether to effect the Reverse Stock Split and, if so, to determine the Reverse Stock Split ratio from among the approved range described above and to effect the Reverse Stock Split by filing a Certificate of Amendment with the Secretary of State of the State of Delaware, and all other amendments will be abandoned. The Board may also elect not to effect any Reverse Stock Split.

The Board’s decision as to whether and when to effect the Reverse Stock Split will be based on a number of factors, including market conditions, the historical, then-existing and expected trading price of our common stock, the anticipated impact of the Reverse Stock Split on the trading price of our common stock and on the number of holders of our common stock, and the continued listing requirements of the New York Stock Exchange (the “NYSE”). Although our stockholders may approve the Reverse Stock Split, we will not effect the Reverse Stock Split if the Board does not deem it to be in the best interests of the Company and its stockholders.

Because the Reverse Stock Split will decrease the number of outstanding shares of our common stock by a ratio in the range of 1-for-10 to 1-for-20 but would not effect a decrease to the number of shares of common stock that the Company will be authorized to issue, the proposed Reverse Stock Split amendments would result in a relative increase in the number of authorized and unissued shares of our common stock. For more information on the relative

12

increase in the number of authorized shares of our common stock, see “-Principal Effects of the Reverse Stock Split- Relative Increase in Number of Authorized Shares of Common Stock for Issuance” below.

Vote Required

Approval of the amendments to our Certificate of Incorporation requires the affirmative vote of a majority of the common stock outstanding and entitled to vote at the Annual Meeting. Abstentions will have the same effect as votes against this proposal. Because brokers have discretionary authority to vote on this proposal, we do not expect broker non-votes in connection with this proposal.

Recommendation of the Board

|

|

|

The Board unanimously recommends a vote FOR the approval of the Reverse Stock Split. |

Purpose and Background of the Reverse Stock Split

On April 6, 2023, the Board approved the proposed amendments to our Certificate of Incorporation to effect the Reverse Stock Split for the following reasons:

•The Board believes that effecting the Reverse Stock Split could be an effective means of regaining compliance with the minimum average closing stock price requirement for continued listing of our common stock on the NYSE;

•The Board believes that continued listing on the NYSE provides overall credibility to an investment in our stock, given the stringent listing and disclosure requirements of the NYSE, and some trading firms discourage investors from investing in lower priced stocks that are traded in the over-the-counter market because they are not held to the same stringent standards;

•The Board believes that a higher stock price, which may be achieved through a Reverse Stock Split, could help generate investor interest in the Company and help attract, retain, and motivate employees; and

•The Board believes that some current and potential employees are less likely to work for the Company if we have a low stock price or are no longer listed on the NYSE, regardless of size of our overall market capitalization.

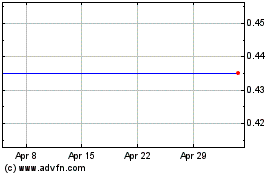

NYSE Requirements for Continued Listing

Our common stock is quoted on the NYSE under the symbol “SQZ”. One of the requirements for continued listing on the NYSE pursuant to Section 802.01C of the NYSE Listed Company Manual (“Section 802.01C”) is the maintenance of an average closing price of not less than $1.00 over a consecutive 30 trading-day period. On January 18, 2023, we received notice (the “NYSE Notification”) from the NYSE indicating that we are not in compliance with Section 802.01C because the average closing price of our common stock was less than $1.00 over a consecutive 30 trading-day period. Under NYSE rules, we have a period of six months from receipt of the NYSE Notification to cure the stock price deficiency and regain compliance with the NYSE’s continued listing standards. We can regain compliance at any time within the cure period if, on the last trading day of any calendar month during the cure period, we have a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month. Our common stock will continue to be listed and trade on the NYSE during this cure period, subject to our compliance with other NYSE continued listing standards.

If our common stock is delisted from the NYSE, we cannot assure you that our common stock would be listed on another national securities exchange, a national quotation service, the over-the-counter markets or the pink sheets. Delisting from the NYSE, or even the issuance of a notice of potential delisting, could also result in negative

13

publicity, make it more difficult for us to raise additional capital, adversely affect the market liquidity of our securities, decrease securities analysts’ coverage of us or diminish investor, supplier and employee confidence.

Potential Increased Investor Interest

In addition, in approving the proposed Reverse Stock Split amendments, the Board considered that the Reverse Stock Split and the expected resulting increase in the per share price of our common stock could encourage increased investor interest in our common stock and promote greater liquidity for our stockholders.

In the event that our common stock were to be delisted from the NYSE, our common stock would likely trade in the over-the-counter market. If our common stock were to trade on the over-the-counter market, selling our common stock could be more difficult because smaller quantities of shares would likely be bought and sold, and transactions could be delayed. In addition, many brokerage houses and institutional investors have internal policies and practices that prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers, further limiting the liquidity of our common stock. These factors could result in lower prices for our common stock. Additionally, investors may be dissuaded from purchasing lower priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. A greater price per share of our common stock could allow a broader range of institutions to invest in our common stock. For all of these reasons, we believe the Reverse Stock Split could potentially increase marketability, trading volume, and liquidity of our common stock.

Employee Retention

The Board believes that the Company’s employees and directors who are compensated in the form of our equity-based securities may be less incentivized and invested in the Company if we are no longer listed on the NYSE. Accordingly, the Board believes that maintaining NYSE listing qualifications for our common stock can help attract, retain, and motivate employees and members of our Board.

In light of the factors mentioned above, our Board unanimously approved the proposed amendments to our Certificate of Incorporation to effect the Reverse Stock Split as a potential means of increasing and maintaining the price of our common stock to above $1.00 per share in compliance with NYSE listing requirements. To the extent that the Reverse Stock Split facilitates our ability to raise equity capital, it may also facilitate our ability to comply with other NYSE continued listing requirements.

Board Discretion to Implement the Reverse Stock Split

The Board believes that stockholder approval of a range of ratios (as opposed to a single reverse stock split ratio) is in the best interests of our Company and stockholders because it is not possible to predict market conditions at the time that the Reverse Stock Split would be effected. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split ratio to be selected by our Board will be a whole number in a range of 1-for-10 to 1-for-20. The Board can only authorize

14

the filing of one Reverse Stock Split amendment and all other Reverse Stock Split amendments will be abandoned. The Board also has the authority to abandon the Reverse Stock Split amendments altogether.

In determining the Reverse Stock Split ratio and whether and when to effect the Reverse Stock Split following the receipt of stockholder approval, the Board will consider a number of factors, including, without limitation:

•our ability to maintain the listing of our common stock on the NYSE;

•the historical trading price and trading volume of our common stock;

•the number of shares of our common stock outstanding immediately before and after the Reverse Stock Split;

•the then-prevailing trading price and trading volume of our common stock and the anticipated impact of the Reverse Stock Split on the trading price and trading volume of our common stock;

•the anticipated impact of a particular ratio on the number of holders of our common stock; and

•whether the market price per share will either exceed or remain in excess of the $1.00 minimum average closing stock price as required by the NYSE, or that we will otherwise meet the requirements of the NYSE for continued listing on the NYSE.

We believe that granting the Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take these factors into consideration and to react to changing market conditions. If our Board chooses to implement the Reverse Stock Split, we will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Risks Associated with the Reverse Stock Split

There are risks associated with the Reverse Stock Split, including that the Reverse Stock Split may not result in a sustained increase in the per share price of our common stock. There is no assurance that:

•The market price per share of our common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split;

•The Reverse Stock Split will result in a per share price that will increase the level of investment in our common stock by institutional investors or increase analyst and broker interest in our Company;

•The Reverse Stock Split will result in a per share price that will increase our ability to attract and retain employees and other service providers; and

•The market price per share will either exceed or remain in excess of the $1.00 minimum average closing stock price as required by the NYSE, or that we will otherwise meet the requirements of the NYSE for continued inclusion for trading on the NYSE.

Stockholders should note that the effect of the Reverse Stock Split, if any, upon the market price of our common stock cannot be accurately predicted. In particular, we cannot assure you that the price for a share of our common stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our common stock outstanding immediately prior to the Reverse Stock Split. Furthermore, even if the market price of our common stock does rise following the Reverse Stock Split, we cannot assure you that the market price of our common stock after the Reverse Stock Split will be maintained for any period of time. Even if an increased per-share price can be maintained, the Reverse Stock Split may not achieve the desired results that have been outlined above. Moreover, because some investors may view the Reverse Stock Split negatively, we cannot assure you that the Reverse Stock Split will not adversely impact the market price of our common stock.

While we aim that the Reverse Stock Split will be sufficient to satisfy the minimum average closing stock price requirement in Section 802.01C, it is possible that, even if the Reverse Stock Split results in a price for our common

15

stock that exceeds $1.00 per share, we may not be able to continue to satisfy the NYSE’s additional criteria for continued listing of our common stock on the NYSE.

We believe that the Reverse Stock Split may result in greater liquidity for our stockholders. However, it is also possible that such liquidity could be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split, particularly if the price of our common stock does not increase as a result of the Reverse Stock Split.

Principal Effects of the Reverse Stock Split

Issued and Outstanding Shares of Common Stock

If the Reverse Stock Split is approved and effected, each holder of our common stock outstanding immediately prior to the effectiveness of the Reverse Stock Split will own a reduced number of shares of our common stock upon effectiveness of the Reverse Stock Split. The Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of common stock and the Reverse Stock Split ratio will be the same for all issued and outstanding shares of common stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of our stockholders owning a fractional share. After the Reverse Stock Split, the shares of our common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to our common stock now authorized. Common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse Stock Split will not affect the Company continuing to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Reverse Stock Split may result in some stockholders owning “odd-lots” of less than 100 shares of our common stock. Brokerage commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of 100 shares.

Relative Increase in Number of Authorized Shares of Common Stock for Issuance

The Reverse Stock Split will not affect the number of authorized shares or the par value of our capital stock, which will remain at 200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share (“Preferred Stock,” and together with our common stock, our “Capital Stock”).

Although the number of authorized shares of our Capital Stock will not change as a result of the Reverse Stock Split, the number of shares of our common stock issued and outstanding will be reduced in proportion to the ratio selected by the Board. Thus, the Reverse Stock Split will effectively increase the number of authorized and unissued shares of our common stock available for future issuance by the amount of the reduction effected by the Reverse Stock Split.

If the proposed Reverse Stock Split amendments are approved, all or any of the authorized and unissued shares of our common stock may be issued in the future for such corporate purposes and such consideration as the Board deems advisable from time to time, without further action by the stockholders of our Company and without first offering such shares to our stockholders. When and if additional shares of our common stock are issued, these new shares would have the same voting and other rights and privileges as the currently issued and outstanding shares of common stock, including the right to cast one vote per share.

The Company regularly considers its capital requirements and may conduct equity offerings in the future.

Because our stockholders have no preemptive rights to purchase or subscribe for any of our unissued shares of common stock, the future issuance of additional shares of common stock will reduce our current stockholders’ percentage ownership interest in the total outstanding shares of common stock. In the absence of a proportionate increase in our future earnings and book value, an increase in the number of our outstanding shares of common stock would dilute our projected future earnings per share, if any, and book value per share of all our outstanding shares of common stock. If these factors were reflected in the price per share of our common stock, the potential

16

realizable value of a stockholder’s investment could be adversely affected. An issuance of additional shares could therefore have an adverse effect on the potential realizable value of a stockholder’s investment.

Effect on Outstanding Equity Incentive Plans

The Company maintains the 2020 Incentive Award Plan (the “2020 Plan”), the 2014 Stock Incentive Plan (the “2014 Plan”), and the 2020 Employee Stock Purchase Plan (the “ESPP”, and together with the 2020 Plan and the 2014 Plan, the “Equity Plans”), which are designed primarily to provide stock-based incentives to individual service providers of the Company. As of April 17, 2023, no purchase rights were outstanding under the ESPP and options to purchase [ ˜ ] shares of our common stock (and no other awards) were outstanding under the other Equity Plans. In the event of a Reverse Stock Split, our Board generally has the discretion to determine the appropriate adjustment to awards granted and share-based limits under the Equity Plans. Accordingly, if the Reverse Stock Split is approved by our stockholders and our Board decides to implement the Reverse Stock Split, as of the Effective Time (as defined below) the number of shares issuable upon exercise and the exercise price of all outstanding options under the Equity Plans will be proportionately adjusted (and rounded down to the nearest whole share in the case of shares and up to the nearest whole cent in the case of exercise prices) based on the Reverse Stock Split ratio selected by our Board, in accordance with the terms of the Equity Plans and options, as applicable. In addition, the number of shares available for future issuance and any share-based award limits under the Equity Plans and the numbers of shares subject to awards to be automatically granted in the future under the 2020 Plan pursuant to our non-employee director compensation program will be proportionately reduced based on the Reverse Stock Split ratio selected by our Board.

Our Board has also authorized the Company to effect any other changes necessary, desirable or appropriate to give effect to the Reverse Stock Split, including any applicable technical, conforming changes.

Effects of the Amendment on our Common Stock

After the effective time of the amendment to our Certificate of Incorporation, each stockholder will own fewer shares of our common stock as a result of the Reverse Stock Split. Because the Reverse Stock Split will decrease the number of outstanding shares of our common stock, the proposed amendments will result in a relative increase in the number of authorized and unissued shares of our common stock. All outstanding options to purchase shares of our common stock, including any held by our officers and directors, would be adjusted as a result of the Reverse Stock Split. In particular, the number of shares issuable upon the exercise of each instrument would be reduced, and the exercise price per share, if applicable, would be increased, in accordance with the terms of each instrument and based on the ratio of the Reverse Stock Split.

Impact of Reverse Stock Split on Capital Structure

The chart below outlines the capital structure as described in this proposal and prior to and immediately following a possible Reverse Stock Split if the Reverse Stock Split is effected at a ratio of 1-for-10 or 1-for-20, based on share information as of the close of business on April 17, 2023. The below chart does not give effect to any other changes, including any issuance of securities, after April 17, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares of common stock before Reverse Stock Split |

|

|

1-for-10 |

|

|

1-for 20 |

|

Authorized |

|

|

200,000,000 |

|

|

|

200,000,000 |

|

|

|

200,000,000 |

|

Issued and Outstanding |

|

|

29,491,125 |

|

|

|

2,949,112 |

|

|

|

1,474,556 |

|

Issuable under Outstanding Stock Options |

|

|

7,218,878 |

|

|

|

721,887 |

|

|

|

360,943 |

|

Reserved for Issuance (1) |

|

|

3,627,209 |

|

|

|

362,720 |

|

|

|

181,360 |

|

Authorized but Unissued (2) |

|

|

163,289,997 |

|

|

|

196,329,001 |

|

|

|

198,164,501 |

|

17

(1)Shares reserved for future issuance under the Company’s Equity Plans, excluding shares issuable under outstanding stock options.

(2)Shares authorized but unissued represent common stock available for future issuance beyond shares outstanding as of April 17, 2023 and shares issuable under outstanding stock options.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates, if Applicable

If the proposed amendments to our Certificate of Incorporation are approved by the Company’s stockholders and the Board determines to effect the Reverse Stock Split, the Reverse Stock Split will become effective at 5:00 p.m. Eastern time, on the date the certificate of amendment is filed with the Secretary of State of the State of Delaware (the “Effective Time”). At the Effective Time, shares of common stock issued and outstanding immediately prior thereto will be combined, automatically and without any action on the part of the stockholders, into new shares of common stock in accordance with the Reverse Stock Split ratio contained in the certificate of amendment.

As soon as practicable after the Effective Time, stockholders will be notified by our transfer agent that the Reverse Stock Split has been effected. Since stockholders hold shares of common stock in book-entry form, you will not need to take any action to receive post-reverse stock split shares of our common stock. As soon as practicable after the Effective Time, the Company’s transfer agent will send to your registered address a transmittal letter along with a statement of ownership indicating the number of post-reverse stock split shares of common stock you hold. If applicable, a check representing a cash payment in lieu of fractional shares will also be mailed to your registered address as soon as practicable after the Effective Time (see “Fractional Shares” below).

Fractional Shares

No scrip or fractional shares would be issued if, as a result of the Reverse Stock Split, a stockholder would otherwise become entitled to a fractional share because the number of shares of common stock they hold before the Reverse Stock Split is not evenly divisible by the split ratio ultimately determined by the Board. Instead, each stockholder will be entitled to receive a cash payment in lieu of such fractional share. The cash payment to be paid will be equal to the fraction of a share to which the stockholder would otherwise be entitled multiplied by the closing price per share as reported by the NYSE (as adjusted to give effect to the Reverse Stock Split) on the date of the Effective Time. No transaction costs would be assessed to stockholders for the cash payment. Stockholders would not be entitled to receive interest for their fractional shares for the period of time between the Effective Time and the date payment is received.

After the Reverse Stock Split, then-current stockholders would have no further interest in our Company with respect to their fractional shares. A person entitled to a fractional share would not have any voting, dividend or other rights in respect of their fractional share except to receive the cash payment as described above. Such cash payments would reduce the number of post-reverse stock split stockholders to the extent that there are stockholders holding fewer than that number of pre-reverse stock split shares within the reverse stock split ratio that is determined by the Board as described above. Reducing the number of post-reverse stock split stockholders, however, is not the purpose of this proposal.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where we are domiciled and where the funds for fractional shares would be deposited, sums due to stockholders in payment for fractional shares that are not timely claimed after the Effective Time may be required to be paid to the

18

designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

No Appraisal Rights

Under the Delaware General Corporation Law, the Company’s stockholders will not be entitled to appraisal rights with respect to the Reverse Stock Split, and we do not intend to independently provide stockholders with any such right.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the Reverse Stock Split, the Board does not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Interests of Certain Persons in the Proposal

Certain of our officers and directors have an interest in this Proposal 2 as a result of their ownership of shares of our common stock, as set forth in the section entitled “Security Ownership of Certain Beneficial Owners and Management” below. However, we do not believe that our officers or directors have interests in Proposal 2 that are different from or greater than those of any of our other stockholders.

Anti-takeover Effects of Proposed Amendments

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any action, including the proposed amendments to our Certificate of Incorporation discussed herein, that may be used as an anti-takeover mechanism. An additional effect of the Reverse Stock Split would be to increase the relative amount of authorized but unissued shares of our common stock, which may, under certain circumstances, be construed as having an anti-takeover effect. Although not intended for such purposes, the effect of the increased available shares could be to render more difficult or discourage an attempt to take over or otherwise obtain control of the Company (for example, by permitting issuances that would dilute the stock ownership of a person or entity seeking to effect a change in the composition of the Board or contemplating a tender offer or other change in control transaction). In addition, our Certificate of Incorporation and our Amended and Restated Bylaws include provisions that may have an anti-takeover effect. These provisions, among things, permit the Board to issue preferred stock with rights senior to those of the common stock without any further vote or action by the stockholders and do not provide for cumulative voting rights, which could make it more difficult for stockholders to effect certain corporate actions and may delay or discourage a change in control.

Our Board is not presently aware of any attempt to acquire control of the Company, and the Reverse Stock Split proposal is not part of any plan by our Board to recommend or implement a series of anti-takeover measures.

Accounting Treatment of the Reverse Stock Split

If the Reverse Stock Split is effected, the par value per share of our common stock will remain unchanged at $0.001. Accordingly, at the Effective Time, the stated capital on the Company’s consolidated balance sheets attributable to our common stock will be reduced in proportion to the size of the Reverse Stock Split ratio, and the additional paid-in-capital account will be increased by the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, will remain unchanged as a result of the Reverse Stock Split. Per share net income or loss will be increased because there will be fewer shares of common stock outstanding. The Company does not anticipate that any other accounting consequences, including changes to the amount of stock-based compensation expense to be recognized in any period, will arise as a result of the Reverse Stock Split.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of certain U.S. federal income tax consequences of the Reverse Stock Split to stockholders that hold their shares of common stock as capital assets for U.S. federal income tax purposes. This summary is based upon the provisions of the U.S. Internal Revenue Code, or the Code, Treasury regulations promulgated thereunder, administrative rulings and judicial decisions, all as in effect as of the date hereof, and all of

19

which are subject to change and differing interpretations, possibly with retroactive effect. Changes in these authorities or their interpretation may result in the U.S. federal income tax consequences of the Reverse Stock Split differing substantially from the consequences summarized below.

This summary is for general information purposes only and does not address all aspects of U.S. federal income taxation that may be relevant to stockholders in light of their particular circumstances or to stockholders that may be subject to special tax rules, including, without limitation: (i) persons subject to the alternative minimum tax; (ii) banks, insurance companies, or other financial institutions; (iii) tax-exempt organizations; (iv) dealers in securities or commodities; (v) regulated investment companies or real estate investment trusts; (vi) partnerships (including entities or arrangements treated as partnerships for U.S. federal income tax purposes and their partners or members); (vii) traders in securities that elect to use the mark-to-market method of accounting; (viii) persons whose “functional currency” is not the U.S. dollar; (ix) persons holding our common stock in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; (x) persons who acquired our common stock in connection with employment or the performance of services; (xi) retirement plans; (xii) persons who are not U.S. Holders (as defined below); or (xiii) certain former citizens or long-term residents of the United States.