(Name, address, including zip code, and telephone

number, including area code, of agent for service)

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

We are offering up to shares of common stock,

together with Series D warrants to purchase up to shares of common stock, each a Series D Common Warrant, and Series E warrants to

purchase up to shares of common stock, each a Series E Common Warrant, at a combined public offering price of $ per share and

Series D Common Warrant and Series E Common Warrant (and the shares issuable from time to time upon exercise of the Series D Common Warrants

and the Series E Common Warrants) pursuant to this prospectus. The Series D Common Warrants and the Series E Common Warrants are collectively

referred to as the “Common Warrants.” The assumed combined public offering price is equal to the closing price per share of

our common stock on The Nasdaq Capital Market (“Nasdaq”) on April , 2023. The shares of common stock and Common Warrants

will be separately issued, but must be purchased together in this offering. The shares of common stock and Common Warrants will be sold

in fixed combinations, with each share of common stock that we sell in this offering being accompanied by one Series D Common Warrant

to purchase one share of common stock and one Series E Common Warrant to purchase one share of common stock. Each Series D Common

Warrant will have an exercise price of $ per share, will be exercisable upon issuance and will expire five years from the date of issuance.

Each Series E Common Warrant will have an exercise price of $ per share, will be exercisable upon issuance and will expire three

years from the date of issuance.

We are also offering up to

pre-funded warrants, or Pre-Funded Warrants, to purchase up to an

aggregate of shares of common stock to those purchasers whose

purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following

the consummation of this offering in lieu of the shares of our common stock that would result in ownership in excess of 4.99% (or,

at the election of the purchaser, 9.99%). Each Pre-Funded Warrant will be exercisable for one share of common stock at an exercise

price of $0.0001 per share. Each Pre-Funded Warrant is being issued together with one Series D Common Warrant to purchase one

share of common stock and one Series E Common Warrant to purchase one share of common stock as described above being issued

with each share of common stock. The assumed combined public offering price for each such Pre-Funded Warrant, together with the

Common Warrant, is $ which is equal to the closing price of our common

stock on Nasdaq on April , 2023, less the $0.0001 per share exercise

price of each such Pre-Funded Warrant. Each Pre-Funded Warrant will be exercisable upon issuance and will expire when exercised in

full. The Pre-Funded Warrants and Common Warrants are immediately separable and will be issued separately in this offering, but must

be purchased together in this offering. For each Pre-Funded Warrant we sell, the number of shares of common stock we are offering

will be decreased on a one-for-one basis. This offering also relates to the shares of common stock issuable upon the exercise of the

Pre-Funded Warrants and the Common Warrants.

This offering will terminate on , unless we

decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for

all the securities purchased in this offering. The combined public offering price per share of common stock (or Pre-Funded Warrant)

and Common Warrants will be fixed for the duration of this offering.

We have engaged (“ ”) to act as our

exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange

for the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the securities we are

offering and the placement agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities.

We have agreed to pay the placement agent the fees set forth in the table below, which assumes that we sell all of the securities offered

by this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum offering

requirement. We will bear all costs associated with the offering. See “Plan of Distribution” on page 33 of this

prospectus for more information regarding these arrangements.

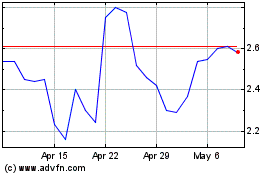

Our common stock and our Series A Warrants

are currently listed on Nasdaq under the symbols “TBLT” and “TBLTW,” respectively. On April

, 2023, the closing price of our common stock on Nasdaq was

$ per share. All share, Common Warrant, and Pre-Funded Warrant numbers

are based on an assumed combined public offering price of $ per share

and the accompanying Common Warrants and $ per Pre-Funded Warrant

and the accompanying Common Warrants. There is no established public trading market for the Pre-Funded Warrants or the Common

Warrants that are part of this offering, and we do not expect a market to develop. We do not intend to apply for listing of the

Pre-Funded Warrants or the Common Warrants on any securities exchange or other nationally recognized trading system. Without an

active trading market, the liquidity of the Pre-Funded Warrants and the Common Warrants will be limited.

The actual combined public offering price per

share and Common Warrants and the actual combined public offering price per Pre-Funded Warrant and Common Warrants will be determined

between us, the placement agent and investors in this offering based upon a number of factors, including our history and our prospects,

the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general

condition of the securities markets at the time of this offering and may be at a discount to the current market price of our common stock.

Therefore, the recent market price used throughout this prospectus may not be indicative of the final offering price.

You should read this prospectus, together with

additional information described under the headings “Information Incorporated by Reference” and “Where You

Can Find More Information,” carefully before you invest in any of our securities.

The delivery of the shares of common stock (or

Pre-Funded Warrants in lieu thereof) and the Common Warrants to purchasers is expected to be made on or about , 2023, subject to satisfaction

of customary closing conditions.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

Except for historical information, this prospectus

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include

statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and

future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may

cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed

or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking

statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,”

“assume,” “should,” “indicate,” “would,” “believe,” “contemplate,”

“expect,” “seek,” “estimate,” “continue,” “plan,” “point to,”

“project,” “predict,” “could,” “intend,” “target,” “potential”

and other similar words and expressions of the future and variations thereof.

There are a number of important factors that could

cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include,

but are not limited to:

| |

● |

our lack of operating history;

|

| |

● |

the expectation that we will incur significant

operating losses for the foreseeable future and will need significant additional capital;

|

| |

● |

our current and future capital requirements to support our development and commercialization efforts for our product candidates and our ability to satisfy our capital needs; |

| |

|

|

| |

● |

our dependence on third-parties to manufacture

our products;

|

| |

● |

our ability to maintain or protect the validity

of our intellectual property;

|

| |

● |

interpretations of current laws and the passages of future laws;

|

| |

● |

the accuracy of our estimates regarding expenses and capital requirements;

|

| |

● |

our ability to adequately support organizational and business growth;

and

|

| |

● |

the continued spread of COVID-19 and the resulting global pandemic

and its impact on our financial condition and results of operations. |

The foregoing does not represent an exhaustive

list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may

cause our actual results to differ from those anticipated in such forward-looking statements. The events and circumstances reflected

in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the

forward-looking statements. You should refer to the “Risk Factors” section of this prospectus for a discussion of important

factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. You

should review the factors and risks and other information we describe in the reports we will file from time to time with the Securities

and Exchange Commission (“SEC”) after the date of this prospectus.

All forward-looking statements are expressly qualified

in their entirety by this cautionary note. You are cautioned to not place undue reliance on any forward-looking statements, which speak

only as of the date of this prospectus or the date of the document incorporated by reference into this prospectus. You should read this

prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement of which this

prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether

as a result of new information, future events or otherwise. Moreover, except as required by law, neither we nor any other person assumes

responsibility for the accuracy and completeness of the forward-looking statements. We have expressed our expectations, beliefs and projections

in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will

result or be achieved or accomplished.

PROSPECTUS SUMMARY

This summary highlights information about our

company, this offering and information contained in greater detail in other parts of this prospectus or incorporated by reference into

this prospectus from our filings with the SEC listed in the section entitled “Information Incorporated by Reference.” Because

it is only a summary, it does not contain all of the information that you should consider before purchasing our securities in this offering

and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated

by reference into this prospectus. You should read the entire prospectus, the registration statement of which this prospectus is a part,

and the information incorporated by reference into this prospectus in their entirety, including the “Risk Factors” and our

financial statements and the related notes incorporated by reference into this prospectus, before purchasing our securities in this offering.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “ToughBuilt” “the

Company,” “we,” “us” and “our” refer to ToughBuilt Indutries, Inc., a Nevada corporation, and

its subsidiaries.

Overview

We were formed to design, manufacture, and distribute

innovative tools and accessories to the building industry. We market and distribute various home improvement and construction product

lines for both Do-It-Yourself and professional markets under the TOUGHBUILT® brand name, within the global multibillion-dollar per

year tool market. All of our products are designed by our in-house design team. Since our initial launch of product sales nine years ago,

we have experienced annual sales growth from approximately $1,000,000 in 2013 to approximately $95,000,000 in 2022.

Our business is currently based on development

of innovative and state-of-the-art products, primarily in tools and hardware category, with particular focus on building and construction

industry with the ultimate goal of making life easier and more productive for contractors and workers alike. Our three major categories

contain a total of 19 product lines, consisting of (i) Soft Goods, which includes kneepads, tool bags, pouches and tool belts, (ii) Metal

Goods, which consists of sawhorses, tool stands and workbench and (iii) Utility Products, which includes utility knives, aviation snips,

shears, lasers and levels, tape measures and chalk reels, striking tools, garden and landscaping tools and pliers and clamps. We also

have several additional categories and product lines in various stages of development.

We design and manage our product life cycles through

a controlled and structured process. We involve customers and industry experts from our target markets in the definition and refinement

of our product development. Product development emphasis is placed on meeting and exceeding industry standards and product specifications,

ease of integration, ease of use, cost reduction, design-for manufacturability, quality, and reliability.

Our mission consists, of providing products to

the building and home improvement communities that are innovative, of superior quality derived in part from enlightened creativity for

our end users while enhancing performance, improving well-being, and building high brand loyalty.

We operate through the following subsidiaries:

(i) ToughBuilt Industries UK Limited; (ii) ToughBuilt Mexico; (iii) ToughBuilt Armenia, LLC; and (iv) ToughBuilt Brazil.

Business Developments

The following highlights recent material developments

in our business:

| |

● |

In first quarter of 2022, we announced that our online sales through Amazon

increased by 41% to approximately $3.4 million for the quarter ended March 31, 2022, compared to approximately $2.4 million for the first

quarter of 2021. |

| |

|

|

| |

● |

In second quarter of 2022, we announced that

our online sales through Amazon.com were $3.6 million. This represents a 17% increase from the same quarter in 2021. Sales for the first

half of 2022 increased by 28% to approximately $7.0 million compared to $5.31 million for the first half of 2021. |

| |

|

|

| |

● |

In July 2022, we announced that we entered

into an agreement with Ace Hardware USA and International to sell 35 ToughBuilt products. |

| |

● |

In August 2022, we announced that we started to

sell 93 ToughBuilt products on Amazon.It (Italy) and Amazon.de (Germany).

|

| |

● |

In August 2022, we announced our entry into a

supply agreement with Elecktro3 S.C.C.L (“Elecktro3”) and NCC Hardware Purchasing and Services Centers, SL (“NCC”),

increasing our presence in Spain’s hardware marketplace.

|

| |

● |

In August 2022, we announced the launch of our

all-new Reload Utility Knife, a groundbreaking new cutting tool made available for purchase through a leading US home improvement retailer

and across their global strategic network of ToughBuilt’s partners and buying groups, servicing over 15,500 storefronts around the

world.

|

| |

● |

In September 2022, we announced our entry into

the global measuring and marking market segment category with a feature-rich family of tape measures and chalk reels.

|

| |

● |

In September 2022, we announced that we entered

into an agreement with two major wholesale tool distributors in Switzerland, marking an expansion of European distribution that includes

more than 250 retailers, nationwide.

|

| |

● |

In September 2022, we announced our launch of

21 new SKUs into the global handsaws segment, beginning with a line of seven cutting tools featuring ToughBuilt’s QuickSet™

Double-Edge Pull Saw, the first ever safe-folding pull saw. The new line will be available Q4 2022 and beyond for purchase through a leading

US home improvement retailer and across global strategic network of partners and buying groups, servicing over 15,500 storefronts around

the world.

|

| |

● |

In September 2022, we announced major expansions

to its network of storefronts in Great Britain, confirming broad new and expanding agreements with Huws Gray, Selco Builders Warehouse,

MKM, City Electrical Factors, and Carpet & Flooring.

|

| |

● |

In October 2022, we announced the launch of an

all-new line of striking tools, including an innovative series of ShockStop™ hammers, marking their entry into the global tool-hammer

market.

|

| |

● |

In

October 2022, we announced that we entered into four major retailers in Germany, which accounted for a 35% share of the global hand tools

market in 2019.

|

| |

● |

In October 2022, we announced that our online sales for Q3 2022 through Amazon.com were $3.91 million. This represents a 38% rise from the same quarter in 2021. Sales for the 9-month period ending on September 30, 2022, increased by 32% to approximately $10.92 million, compared to $8.30 million for the same period in 2021. |

| |

● |

In October 2022, we announced the launch of our

all-new 500 ft. Rotary Laser Level Kit. The level comes with an intuitive, first-of-its-kind, 3-piece stacking guide rod that allows for

a rolling laser receiver to provide bracket-free attachment and a one-handed interface for fast operation. It emits a laser that displays

a consistent, accurate signature that is detectable up to 500-feet of distance from its projection point. The kit also includes an innovative

tripod with a rapid-use bullseye level and telescoping legs to promote accurate placement on uneven terrain.

|

| |

● |

In October 2022, we announced that we reached

a comprehensive distribution agreement with Sodimac, the largest home improvement and construction supplier in South America; beginning

with Peru and Colombia with 15 ToughBuilt SKUs.

|

| |

● |

In October 2022, we announced that we expanded

our distribution of 84 ToughBuilt branded products to be sold in all Sears’ Mexico locations, totaling 96 storefronts nationwide.

Sears continues to be a leading supplier to its core consumers in the hardware and home improvement trades in Latin America, and its

comprehensive store count and geographical presence across Mexico offer ToughBuilt an opportunity to offer a wide product range to professional

end users in the country. |

| |

● |

In November 2022, we announced that we entered

into a distribution agreement with Lamed LLP (“Lamed”) – one of the largest suppliers of equipment, tools and building

materials in Kazakhstan. Lamed begins this agreement with 76 ToughBuilt SKUs and will stock the entire ToughBuilt product range.

|

| |

● |

In December 2022, we announced that we are strengthening

our relationship with European and UK retailers Wickes, Toolstation UK & Toolstation France. After a successful launch of ToughBuilt

products, Wickes, which has 230 locations across the United Kingdom, will be increasing the number of ToughBuilt SKUs available to its

customer base, from 15 to 48 SKUs beginning January 2023. Additionally, Toolstation UK, with over 550 stores nationwide, following consistent

and impressive sales, Toolstation UK has increased its ToughBuilt SKUs to 35 total SKUs and has committed to several national promotions,

contributing to a significant uplift in sales conversions. Toolstation France has also more than doubled its original offering of the

ToughBuilt range to from 25 to 65 SKUs in total.

|

| |

● |

In December 2022, we announced the launch of our

new line of Long Handle Garden and Landscaping Tools. Beginning with 11 out of about 150 SKUs, the new line includes many innovative improvements.

|

| |

● |

In January 2023, our global Amazon sales for 2022 through Amazon.com were approximately $15.91 million. This represents an approximate 34% increase from 11.87 million in Amazon sales in 2021.

|

| |

● |

In January 2023, we launched more than 40 new SKUs into the Handheld Screwdrivers segment, including ratcheting bit drivers, insulated screwdrivers, precision, slotted, Phillips, Torx, and cabinet screwdrivers and demolition drivers.

|

| |

● |

In January 2023, we expanded our distribution agreement with Sodimac, the largest home improvement and construction supplier in South America. In this extended agreement, stores in Chile, Peru, Argentina, Colombia, Brazil, and Uruguay will initially begin with 15 SKUs in-store and brings 23 SKUs to Sodimac’s online marketplace.

|

| |

● |

In January 2023, we launched more than 20 new SKUs into the Handheld Wrenches segment, including adjustable wrenches, construction wrenches and pipe wrenches.

|

| |

● |

In February 2023, we launched our new line of pliers and clamps. The new line, comprised of more than 40 SKUs, will be made available for purchase through leading US home improvement retailers and across ToughBuilt’s growing strategic networks of North American and global trade partners and buying groups, servicing over 18,900 storefronts and online portals worldwide. |

Our Products

We create innovative products that help our customers

build faster, build stronger, and work smarter. We accomplish this by listening to what our customers want and need and researching how

professionals work, then we create tools that help them save time, hassle and money.

TOUGHBUILT® manufactures and distributes an

array of high-quality and rugged tool belts, tool bags, and other personal tool organizer products. We also manufacture and distribute

a complete line of knee pads for various construction applications, a variety of metal goods, including utility knives, aviation snips

and shears and digital measures such as lasers and levels. Our line of job site tools and material support products consists of a full

line of miter saw and table saw stands, saw horses/job site tables, roller stands and workbench. All of our products are designed and

engineered in the United States and manufactured in China, India and the Philippines under our quality control supervision. We do not

need government approval for any of our products.

Our soft-sided tool storage line is designed for

a wide range of Do-It-Yourself and professional needs. This line of pouches and tool and accessories bags is designed to organize our

customers’ tools faster and easier. Interchangeable pouches clip on and off any belt, bag ladder wall, or vehicle. Our products

let our customers carry what they want so they have it when they want it. ToughBuilt’s wide mouth tool carry-all bags come in sizes

from 12 inches to 30 inches. They all have steel-reinforced handles and padded shoulder straps which allow for massive loads to be carried

with ease. Rigid plastic hard-body lining protects everything inside. Double mesh pockets included inside provide complete visibility

for stored items. They include a lockable zipper for added security and safety and secondary side handles for when it takes more than

one to carry the load.

All of these products have innovative designs

with unique features that provide extra functionality and enhanced user experience. Patented features such as our exclusive “Cliptech”

mechanism incorporated in some of the products in this line are unique in these products for the industry and have distinguished the line

from other similarly situated products thus we believe, increasing appeal among the other products of this category in the professional

community and among the enthusiasts.

Soft Goods

The flagship of the product line is the soft goods

line that consists of over 100 variations of tool pouches, tool rigs, tool belts and accessories, tool bags, totes, variety of storage

solutions, and office organizers/bags for laptop/tablet/cellphones, etc. Management believes that the breadth of the line is one of the

deepest in the industry and has specialized designs to suit professionals from all sectors of the industry including plumbers, electricians,

framers, builders, and more.

We have a selection of over 10 models of kneepads,

some with revolutionary and patented design features that allow the users to interchange components to suit particular conditions of use.

Management believes that these kneepads are among the best performing kneepads in the industry. Our “all terrain” knee pad

protection with snapshell technology is part of our interchangeable kneepad system which helps to customize the jobsite needs. They are

made with superior quality using multilevel layered construction, heavy-duty webbing, and abrasion-resistant PVC rubber.

Metal Goods

Sawhorses and Work Support Products

The second major category consists of Sawhorses

and Work Support products with unique designs and robust construction targeted for the most discerning users in the industry. The innovative

designs and construction of the more than 18 products in this category have led to the sawhorses becoming among the best sellers of category

everywhere they are sold. The newest additions in this category include several stands and work support products that are quickly gaining

recognition in the industry and are expected to position themselves in the top tier products in a short time. Our sawhorse line, miter

saw, table saw & roller stands and workbench are built to very high standards. Our sawhorse/jobsite table is fast to set up, holds

2,400 pounds, has adjustable heights, is made of all-metal construction, and has a compact design. We believe that these lines of products

are slowly becoming the standard in the construction industry.

All of our products are designed in house to achieve

features and benefits for not only the professional construction worker but also for the Do-It-Yourself person.

Electronic Goods

Digital measures and levels

TOUGHBUILT’s third major product line is

the digital measure and levels. These digital measures are targeted towards the PROs for accurate job site measuring, to make sure the

job is done right and in time. These digital measures help calculated what amount of construction product is needed to finish the job.

Such as measure for floors, tile, and paint.

Our Business Strategy

Our product strategy is to develop product lines in a number of categories

rather than focus on a single line of goods. We believe that this approach allows for rapid growth, wider brand recognition, and may ultimately

result in increased sales and profits within an accelerated time period. We believe that building brand awareness of our current ToughBuilt

lines of products will expand our share of the pertinent markets. Our business strategy includes the following key elements:

| |

● |

A commitment to technological innovation achieved through consumer insight, creativity, and speed to market; |

| |

● |

A broad selection of products in both brand and private labels; |

| |

● |

Superior customer service; and |

We will continue to consider other market opportunities

while focusing on our customers’ specific requirements to increase sales.

Market

In addition to the construction market, our products

are marketed to the “Do-It-Yourself” and home improvement market place. The home improvement industry has fared much better

in the aftermath of the Great Recession than the housing market. The U.S. housing stock of more than 130 million homes requires regular

investment merely to offset normal depreciation. And many households that might have traded up to more desirable homes during the downturn

decided instead to make improvements to their current homes. Meanwhile, federal and state stimulus programs encouraged homeowners and

rental property owners to invest in energy-efficient upgrades that they might otherwise have deferred. Finally, many rental property owners,

responding to a surge in demand from households either facing foreclosure or nervous about buying amid the housing market uncertainty,

reinvested in their units.

TOUGHBUILT® products are available worldwide

in many major retailers ranging from home improvement and construction products and services stores to major online outlets. Currently,

we have placement in Lowes, Home Depot, Menards, Bunnings (Australia), Princess Auto (Canada), Dong Shin Tool PIA (S. Korea) and others,

as well as seeking to grow our sales in global markets such as Western and Central Europe, Russia and Eastern Europe, South America and

the Middle East.

Retailers by region include:

| |

● |

United States: Lowe’s, Home Depot, Menards, Harbor Freight, ACE Hardware, Acme, TSC; |

| |

● |

United Kingdom: Wickes, TOOL STATION, Huws Gray, Selco Builders Warehouse, MKM, City Electrical Factors, and Carpet & Flooring; |

| |

|

|

| |

● |

Europe: Elecktro3 and NCC Hardware; |

| |

|

|

| |

● |

South America: Sodimac; |

| |

|

|

| |

● |

Mexico: Sears; |

| |

● |

Middle East: Lamed; |

| |

|

|

| |

● |

Australia: Kincrome, and Bunnings; |

| |

● |

New Zealand: Kincrome, and Bunnings; |

| |

● |

Russia: VSEInstrumenti.ru; and |

| |

● |

South Korea: Dong Shin Tool PIA Co., Ltd. |

We are actively expanding into other markets including

South Africa.

We are currently in product line reviews and discussions

with Home Depot Canada, Do It Best, True Value, and other major retailers both domestically and internationally. A product line review

requires the supplier to submit a comprehensive proposal which includes product offerings, prices, competitive market studies, and relevant

industry trends, and other information. Management anticipates, within the near term, adding to its customer base up to three major retailers,

along with several distributors and private retailers within six sectors and among fifty-six targeted countries.

New Products

Tools

In 2022, we launched the following product lines:

| |

● |

Tape Measures and Chalk Reels |

| |

● |

Long Handle Garden and Landscaping Tools |

In 2022, we launched the following tools:

| |

● |

21 new SKUs into the global handsaws segment |

| |

● |

500 ft. Rotary Laser Level Kit |

| |

● |

40+ new SKUs into the Handheld Screwdrivers segment |

| |

|

|

| |

● |

20 new SKUs into the Handheld Wrenches segment |

Mobile Device Products

Since 2013, we have been planning, designing,

engineering, and sourcing the development of a new line of ToughBuilt mobile devices and accessories to be used in the construction industry

and by building enthusiasts. However, due to microchip shortages, we have suspended this segment and will continue development in the

near future.

Intellectual Property

We hold several patents and trademarks of various

durations and believe that we hold, have applied for or license all of the patent, trademark, and other intellectual property rights necessary

to conduct our business. We utilize trademarks (licensed and owned) on nearly all of our products and believe having distinctive marks

that are readily identifiable is an important factor in creating a market for our goods, in identifying our brands and our Company, and

in distinguishing our goods from the goods of others. We consider our ToughBuilt®, Cliptech®, and Fearless®

trademarks to be among our most valuable intangible assets. Trademarks registered both in and outside the U.S. are generally valid

for 10 years, depending on the jurisdiction, and are generally subject to an indefinite number of renewals for a like period on appropriate

application.

In 2019, the United States Patent and Trademark

Office (USPTO) granted two new design patents (U.S. D840,961 S and US D841,635 S) that cover ToughBuilt’s ruggedized mobile devices,

which are valid for a period of 15 years. We also have several patents pending with the USPTO and anticipate three or four of them to

be granted in the near future.

We also rely on trade secret protection for our

confidential and proprietary information relating to our design and processes for our products. Copyright protection is also utilized

when appropriate.

Domain names are a valuable corporate asset for

companies around the world, including ToughBuilt. Domain names often contain a trademark or service mark or even a corporate name and

are often considered intellectual property. The recognition and value of the ToughBuilt name, trademark, and domain name are our core

strengths.

We have entered into and will continue to enter

into confidentiality, non-competition, and proprietary rights assignment agreements with our employees and independent contractors. We

have entered into and will continue to enter into confidentiality agreements with our suppliers to protect our intellectual property.

We have not entered into any royalty agreements

with respect to our intellectual property.

Implications of Being an Emerging Growth Company and a Smaller Reporting

Company

We are an “emerging growth company,”

as defined in the JOBS Act. We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following

the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities

Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the

date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which

we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for

the foreseeable future but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth

company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock

pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are

permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are

not emerging growth companies. These exemptions include:

| |

● |

being permitted to provide only two years

of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| |

● |

not being required to comply with the requirement

of auditor attestation of our internal controls over financial reporting; |

| |

● |

not being required to comply with any requirement

that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s

report providing additional information about the audit and the financial statements; |

| |

● |

reduced disclosure obligations regarding

executive compensation; and |

| |

● |

not being required to hold a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

An emerging growth company can take advantage

of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting

standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise

apply to private companies. We have elected to avail ourselves of this extended transition period and, as a result, we will not be required

to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company”

as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure available for smaller

reporting companies. We will remain a smaller reporting company until the end of the fiscal year in which (i) we have a public common

equity float of more than $250 million, or (ii) we have annual revenues for the most recently completed fiscal year of more than

$100 million and a public common equity float or a public float of more than $700 million. We also would not be eligible for status as

a smaller reporting company if we become an investment company, an asset-backed issuer or a majority-owned subsidiary of a parent company

that is not a smaller reporting company.

We have elected to take advantage of certain of

the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of

other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different

from what you might receive from other public reporting companies in which you hold equity interests.

Corporate History

We were incorporated in the State of Nevada on

April 9, 2012, as Phalanx, Inc. We changed our name to ToughBuilt Industries, Inc. on December 29, 2015. Our principal executive offices

are located at 8669 Research Drive, Irvine, CA 92618, and our telephone number is (949) 528-3100. Our website address is www.toughbuilt.com.

Information contained in, or accessible through, our website does not constitute part of this prospectus or registration statement and

inclusions of our website address in this prospectus or registration statement are inactive textual references only. You should not rely

on any such information in making your decision whether to purchase our securities.

THE OFFERING

| Common Stock to be Offered |

|

Up to shares of common stock based on

the sale of our common stock at an assumed combined public offering price of $ per share of common stock and accompanying Common

Warrants, which is the closing price of our common stock on April 2023, assuming no sale of any Pre-Funded Warrants.

|

| Pre-Funded Warrants to be Offered |

|

We are also offering to certain purchasers whose purchase

of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties,

beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following

the consummation of this offering, the opportunity to purchase, if such purchasers so choose, Pre-Funded Warrants to purchase shares of

common stock, in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding

4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-Funded Warrant will be exercisable for one

share of our common stock. The purchase price of each Pre-Funded Warrant and accompanying Common Warrants will equal the price at which

the share of common stock and accompanying Common Warrants are being sold to the public in this offering, minus $0.0001, and the exercise

price of each Pre-Funded Warrant will be $0.0001 per share. The Pre-Funded Warrants will be exercisable immediately and may be exercised

at any time until all of the Pre-Funded Warrants are exercised in full.

This offering also relates to the shares of common

stock issuable upon exercise of the Pre-Funded Warrants sold in this offering. For each Pre-Funded Warrant we sell, the number of shares

of common stock we are offering will be decreased on a one-for-one basis. Because we will issue one Common Warrant for each share of our

common stock and for each Pre-Funded Warrant to purchase one share of our common stock sold in this offering, the number of Common Warrant

sold in this offering will not change as a result of a change in the mix of the shares of our common stock and Pre-Funded Warrants sold.

|

| Common Warrants to be Offered |

|

Each share of our common stock and each Pre-Funded

Warrant to purchase one share of our common stock is being sold together with a Series D Common Warrant to purchase one share of our common

stock and a Series E Common Warrant to purchase one share of our common stock.

Each Series D Common Warrant will have an

exercise price of $ per share, will be immediately exercisable and will expire on the five year

anniversary of the original issuance date.

Each Series E Common Warrant will have an

exercise price of $ per share, will be immediately exercisable and will expire on the

three year anniversary of the original issuance date.

The shares of common stock and Pre-Funded Warrants,

and the accompanying Common Warrants, as the case may be, can only be purchased together in this offering but will be issued separately

and will be immediately separable upon issuance. This prospectus also relates to the offering of the shares of common stock issuable upon

exercise of the Common Warrants.

|

| Offering Period |

|

This offering will terminate

on , unless we decide to terminate the offering (which we may do at any time in our discretion) prior to

that date. We will have one closing for all the securities purchased in this offering. The combined public offering price per share of

common stock (or Pre-Funded Warrant in lieu thereof) and Common Warrants will be fixed for the duration of this offering. |

| Placement Agent Warrants |

|

We have agreed to issue to the placement agent or

its designees warrants (the “Placement Agent Warrants”) to purchase up to 6.0% of the aggregate number of shares of common

stock (or Pre-Funded Warrants in lieu thereof) sold in this offering at an exercise price equal to 125% of the public offering price per

share and accompanying Common Warrants to be sold in this offering. The placement agent warrants will be exercisable upon issuance and

will expire five years from the commencement of sales under this offering.

|

|

Common Stock to be Outstanding Immediately After this Offering(1)

|

|

shares, (assuming we sell only shares of common stock and no Pre-Funded Warrants and assuming no exercise of the Common Warrants). |

| Use of Proceeds |

|

We estimate that the net proceeds from this offering

will be approximately $ million, based on an assumed combined public offering price of $ per share of common stock and

accompanying Common Warrants which was the closing price of our common stock on Nasdaq on April , 2023, after deducting the placement

agent fees and estimated offering expenses payable by us, and assuming we sell only shares of common stock and no Pre-Funded Warrants

and excluding the proceeds, if any, from the exercise of the Common Warrants in this offering. We currently intend to use any of the net

proceeds for working capital purposes.

|

| Risk Factors |

|

An investment in our securities involves a

high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus and the other information

included and incorporated by reference in this prospectus for a discussion of the risk factors you should carefully consider before

deciding to invest in our securities.

|

| National Securities Exchange Listing |

|

Our common stock and our Series A Warrants are currently listed on Nasdaq under the symbols “TBLT” and “TBLTW,” respectively. There is no established public trading market for the Pre-Funded Warrants or Common Warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants or Common Warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited. |

(1) The above discussion and table are based on

14,946,442 shares outstanding as of April , 2023 and excludes:

| ● | 1,351,271

shares of common stock issuable upon the exercise of outstanding stock options and restricted

stock units (“RSUs”); |

| ● |

133 shares of common stock issuable upon the exercise of warrants issued

to the placement agents for $1,500 per share until August 18, 2024; |

| ● | 7

shares of common stock issuable upon the exercise of warrants issued to the placement agent

for $18,000 per share until either (i) May 15, 2023 or (ii) September 4, 2023; |

| ● | 47

shares of common stock issuable upon the exercise of Class B Warrants for $18,000 per share

with expiration dates within the period between October 17, 2021 and May 15, 2023; |

| ● | 3,460 shares of common stock issuable upon the exercise of Series A

Warrants for $5,505 per share until either (i) November 14, 2023, (ii) December 17, 2023 or (iii) January 24, 2024; |

| ● | 102,450 shares of common stock issuable upon the exercise of warrants issued in connection with the Company’s public offering

on June 2, 2020 for $1,729 per share until June 2, 2025; |

| ● | 153,433

shares of common stock issuable upon the exercise of warrants issued in connection with a

July 2021 private placement offering for $121.50 per share until July 14, 2026 (the “July

2021 Offering”); |

| ● | 18,412 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the July 2021

Offering for $162.94 per share until July 14, 2026; |

| ● | 125,000 shares of common stock issuable upon the exercise of the warrants

issued to the investors of the Series F Preferred Stock and Series G Preferred Stock for $37.65 per share until February 15, 2027 (the

“February 2022 Offering”); |

| ● | 10,000 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the February

2022 Offering for $7.50 per share until February 15, 2027; |

| ● | 5,000 shares of common stock issuable upon the exercise of warrants for $1.90 per share until June 22, 2027 (the “June 2022

Offering”); |

| ● | 189,474 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the June 2022

Offering for $2.375 per share until June 22, 2027; |

| |

● |

240,000 shares of common stock issuable upon the exercise of warrants issued

to the placement agent in connection with a private placement for $6.25 per share until July 28, 2025 (the “July 2022 Private Placement”); |

| ● | 10,619,911 shares of common stock issuable upon exercise of the Series C preferred investment options issued to certain stockholders

in the 2022 Private Placement for $2.356 per share until November 17, 2025; and |

| ● | 157,195 shares of common stock issuable upon exercise of preferred investment options issued to the placement agent in connection

with the 2022 Private Placement for $3.578365 per share until November 17, 2025. |

Unless otherwise indicated, all information

contained in this prospectus assumes (i) no exercise of options issued under our equity incentive plans and (ii) no exercise of Common

Warrants and the Placement Agent Warrants.

RISK FACTORS

Before purchasing any of the securities you

should carefully consider the risk factors set forth below and incorporated by reference in this prospectus from our Annual Report on

Form 10-K for the fiscal year ended December 31, 2022, and any subsequent updates described in our Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, as well as the risks, uncertainties and additional information set forth in our SEC reports on Forms 10-K,

10-Q, and 8-K and in the other documents incorporated by reference in this prospectus. For a description of these reports and documents,

and information about where you can find them, see “Additional Information” and “Incorporation of Certain Information

By Reference.” Additional risks not presently known or that we presently consider to be immaterial could subsequently materially

and adversely affect our financial condition, results of operations, business, and prospects.

Risks Related to Our Company

There

is substantial doubt about our ability to continue as a going concern.

We have incurred substantial operating losses

since its inception. As reflected in the consolidated financial statements, we had an accumulated deficit of approximately $145 million

at December 31, 2022 a net loss of approximately $39.3 million, and approximately $37.3 million of net cash used in operating activities

for the year ended December 31, 2022. The accompanying consolidated financial statements have been prepared on a going concern basis,

which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. We anticipate incurring

additional losses until such time, if ever, that we will be able to effectively market our products. As such, it is likely that additional

financing will be needed by us to fund our operations. These factors raise substantial doubt about our ability to continue as a going

concern.

This

offering is being made on a best efforts basis and we may sell fewer than all of the securities offered hereby and may receive significantly

less in net proceeds from this offering. Assuming that we receive net proceeds of $

from this offering (assuming an offering with gross proceeds of $ ),

we believe that the net proceeds from this offering will meet our capital needs for the next

months under our current business plan. Assuming that we receive net proceeds of $

from this offering (assuming an offering with gross proceeds of $ ),

we believe that the net proceeds from this offering will satisfy our capital needs for the next months

under our current business plan. If we have insufficient capital to operate our business under our current business plan, we have contingency

plans for our business that include, among other things, the delay of the introduction of new products, a reduction in headcount, and

a reduction of the expansion of our distribution networks, which is expected to substantially reduce revenue growth and delay our profitability.

There can be no assurance that our implementation of these contingency plans will not have a material adverse effect on our business.

Following this offering, we will seek to obtain

additional capital through the sale of debt or equity financings or other arrangements to fund operations; however, there can be no assurance

that we will be able to raise needed capital under acceptable terms, if at all. The sale of additional equity may dilute investors and

newly issued shares may contain senior rights and preferences compared to currently outstanding shares of common stock. Issued debt securities

may contain covenants and limit our ability to pay dividends or make other distributions to stockholders. If we are unable to obtain such

additional financing, future operations would need to be scaled back or discontinued. Due to the uncertainty in our ability to raise capital,

management believes that there is substantial doubt in our ability to continue as a going concern for the next twelve months.

We will require additional capital in order

to achieve commercial success and, if necessary, to finance future losses from operations as we endeavor to build revenue, but we do not

have any commitments to obtain such capital and we cannot assure you that we will be able to obtain adequate capital as and when required.

We may not be able to generate any profit in the

foreseeable future. For the fiscal year ended December 31, 2022, we have a net loss of approximately

$39 million compared to a net loss of approximately $38 million for the fiscal year ended

December 31, 2021. Accordingly, there is no assurance that we will realize profits in fiscal year 2023 or thereafter. If we fail

to generate profits from our operations, we will not be able to sustain our business. We may never report profitable operations or generate

sufficient revenue to maintain our Company as a going concern. We continue to control our cash expenses as a percentage of expected revenue

on an annual basis and thus may use our cash balances in the short term to invest in revenue growth; however, we cannot give assurance

that we can increase our cash balances or limit our cash consumption and thus maintain sufficient cash balances for our planned operations.

Future business demands may lead to cash utilization at levels greater than recently experienced. We may need to raise additional capital

in the future. However, we cannot assure that we will be able to raise additional capital on acceptable terms, or at all. Our inability

to generate profits could have an adverse effect on our financial condition, results of operations, and cash flows. See “Management’s

Discussion and Analysis of Financial Condition and Results of Operations; Liquidity and Capital Resources.”

Risks Related to Ownership of Securities

We have broad discretion in the use of the

net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the

application of the net proceeds, including for any of the purposes described in the section of this prospectus entitled “Use

of Proceeds.” You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will

not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. The failure

by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business

and cause the price of our securities to decline. Pending the application of these funds, we may invest the net proceeds from this offering

in a manner that does not produce income or that loses value.

There is no public market for the Common

Warrants or Pre-Funded Warrants being offered by us in this offering.

There is no established public trading market

for the Common Warrants or the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply to

list the Common Warrants or Pre-Funded Warrants on any national securities exchange or other nationally recognized trading system. Without

an active market, the liquidity of the Common Warrants and Pre-Funded Warrants will be limited.

The Common Warrants and Pre-Funded Warrants

are speculative in nature.

The Common Warrants and Pre-Funded Warrants

offered hereby do not confer any rights of share of common stock ownership on their holders, such as voting rights or the right to

receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price. Specifically,

commencing on the date of issuance, holders of the Common Warrants may acquire the shares of common stock issuable upon exercise of

such warrants at an exercise price of $ per

share of common stock, and holders of the Pre-Funded Warrants may acquire the shares of common stock issuable upon exercise of such

warrants at an exercise price of $0.0001 per share of common stock. Moreover, following this offering, the market value of the

Common Warrants and Pre-Funded Warrants is uncertain and there can be no assurance that the market value of the Common Warrants or

Pre-Funded Warrants will equal or exceed their respective public offering prices. There can be no assurance that the market price of

the shares of common stock will ever equal or exceed the exercise price of the Common Warrants or Pre-Funded Warrants, and

consequently, whether it will ever be profitable for holders of Common Warrants to exercise the Common Warrants or for holders of

the Pre-Funded Warrants to exercise the Pre-Funded Warrants.

Holders of the Common Warrants and Pre-Funded

Warrants offered hereby will have no rights as common stockholders with respect to the shares our common stock underlying the warrants

until such holders exercise their warrants and acquire our common stock, except as otherwise provided in the Common Warrants and Pre-Funded

Warrants.

Until holders of the Common Warrants and the Pre-Funded

Warrants acquire shares of our common stock upon exercise thereof, such holders will have no rights with respect to the shares of our

common stock underlying such warrants. Upon exercise of the Common Warrants and the Pre-Funded Warrants, the holders will be entitled

to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

This is a best efforts offering, with no

minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business

plans, including our near-term business plans.

The placement agent has agreed to use its reasonable

best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum

number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required

as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently

determinable and may be substantially less than the maximum amounts set forth above. We may sell fewer than all of the securities offered

hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund

in the event that we do not sell an amount of securities sufficient to support our continued operations, including our near-term continued

operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise

additional funds, which may not be available or available on terms acceptable to us.

We currently, and may in the future, have

assets held at financial institutions that may exceed the insurance coverage offered by the Federal Deposit Insurance Corporation, the

loss of such assets would have a severe negative affect on our operations and liquidity.

We may maintain our cash assets at certain financial

institutions in the U.S. in amounts that may be in excess of the Federal Deposit Insurance Corporation (“FDIC”) insurance

limit of $250,000. In the event of a failure of any financial institutions where we maintain our deposits or other assets, we may incur

a loss to the extent such loss exceeds the FDIC insurance limitation, which could have a material adverse effect upon our liquidity, financial

condition and our results of operations.

If you purchase common stock sold in this

offering, you will experience immediate dilution as a result of this offering.

Because

the price per share of our common stock being offered may be higher than the net tangible book value per share of our common stock, you

will experience dilution to the extent of the difference between the offering price per share of common stock you pay in this offering

and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of December

31, 2022, was approximately $28,269,863, or $2.01 per share of common stock. Net tangible book value per share is equal to our total

tangible assets minus total liabilities, all divided by the number of shares of common stock outstanding. See the section titled “Dilution”

for a more detailed discussion of the dilution you will incur if you purchase shares in this offering.

If you purchase our securities in this offering

you may experience future dilution as a result of future equity offerings or other equity issuances.

In order to raise additional capital, we believe

that we will offer and issue additional shares of common stock or other securities convertible into or exchangeable for our shares of

common stock in the future. We cannot assure you that we will be able to sell shares of common stock or other securities in any other

offering at a price per share that is equal to or greater than the price per share of common stock paid by investors in this offering,

and investors purchasing other securities in the future could have rights superior to existing stockholders. The price per share at which

we sell additional shares of common stock or other securities convertible into or exchangeable for our shares of common stock in future

transactions may be higher or lower than the price per share in this offering.

In addition, we have a significant number of share

options and warrants outstanding. To the extent that outstanding share options or warrants have been or may be exercised or other shares

issued, you may experience further dilution. Further, we may choose to raise additional capital due to market conditions or strategic

considerations even if we believe we have sufficient funds for our current or future operating plans.

USE OF PROCEEDS

We estimate that the net proceeds from the

offering will be approximately $ million,

assuming a combined public offering price per share of common stock and accompanying Common Warrants of $ , the closing price

per share of our common stock on Nasdaq on April , 2023, after deducting the placement agent fees and estimated offering

expenses payable by us, assuming no sale of any fixed combinations of Pre-Funded Warrants and Common Warrants offered hereunder and

excluding the proceeds, if any, from the exercise of the Common Warrants issued in this offering.

If the Common Warrants are exercised in full for

cash, the estimated net proceeds will increase to $ million. We cannot predict when or if these Common Warrants will be exercised.

It is possible that these Common Warrants may expire and may never be exercised. Additionally, the Common Warrants contain a cashless

exercise provision that permit exercise of Common Warrants on a cashless basis at any time where there is no effective registration statement

under the Securities Act of 1933, as amended, covering the issuance of the underlying shares.

However, because this is a best efforts offering

and there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, the placement

agent’s fees and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth

on the cover page of this prospectus. In addition, we may receive proceeds from the exercise of the placement agent warrants, to the extent

such placement agent warrants are exercised for cash, but we will not receive any proceeds from any sale of the shares of common stock

underlying the placement agent warrants.

The table below depicts how we plan to utilize

the proceeds in the event that 25%, 50%, 75% and 100% of the securities in this offering are sold, after deducting estimated offering

expenses payable by us. These estimates exclude the proceeds, if any, from the exercise of Common Warrants issued in this offering.

| Use of Proceeds | |

| 100% | | |

| 75% | | |

| 50% | | |

| 25% | |

| Working Capital/General Corporate Purposes | |

$ | | | |

$ | | | |

$ | | | |

$ | | |

| Total: | |

$ | | | |

$ | | | |

$ | | | |

$ | | |

We intend to use the net proceeds from the offering

for general corporate purposes, which includes, without limitation, working capital. As of the date of this prospectus, we cannot specify

with certainty all of the particular uses for the net proceeds from this offering. The amounts and timing of our actual expenditures will

depend on numerous factors, including factors described under “Risk Factors” in this prospectus and the documents incorporated

by reference herein and therein.

CAPITALIZATION

The following table sets forth our consolidated

cash and capitalization, as of December 31, 2022. Such information is set forth on the following basis:

| |

● |

on an as adjusted basis to reflect our receipt of the net proceeds our sale and issuance of

shares of common stock (assuming no sale of any Pre-Funded

Warrants) in this offering based on the public offering price of $

per share of common stock (the last reported sale price of

our common stock on Nasdaq on April

, 2023) after deducting estimated underwriting discounts and commissions and estimated

offering expenses payable by us and after the use of net proceeds therefrom. |

You should read the following table in conjunction

with “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and our financial statements and related notes included in this prospectus. The following table sets forth our cash

and cash equivalents and capitalization as of December 31, 2022 (in thousands):

| |

Actual |

|

As Adjusted (1) |

|

| Cash, cash equivalents and investments |

$ |

2,564,237 |

|

$ |

|

|

| Common stock, $0.0001 par value, 200,000,000 shares authorized, 14,078,997 shares issued and outstanding at December 31, 2022; shares issued and outstanding, as adjusted |

|

1,408 |

|

|

|

|

| Series C Preferred Stock, $0.0001 par value, 4,268 authorized, 0 issued and outstanding at December 31, 2022 |

|

- |

|

|

- |

|

| Series D Preferred Stock, $1,000 par value, 5,775 authorized, 0 issued and outstanding at December 31, 2022 |

|

- |

|

|

- |

|

| Series E Preferred Stock, $0.0001 par value, 15 authorized, 0 issued and outstanding at December 31, 2022 |

|

- |

|

|

- |

|

| Series F Preferred Stock, $0.0001 par value, 2,500 authorized, 0 issued and outstanding at December 31, 2022 |

|

- |

|

|

- |

|

| Series G Preferred Stock, $0.0001 par value, 2,500 authorized, 0 issued and outstanding at December 31, 2022. |

|

- |

|

|

- |

|

| Additional paid-in capital |

|

174,659,589 |

|

|

|

|

| Accumulated deficit |

|

(144,953,053 |

) |

|

|

|

| Total stockholders’ equity |

|

29,707,944 |

|

|

|

|

| Total capitalization |

$ |

351,884,823 |

|

$ |

|

|

A $1.00 increase or decrease in the assumed

public offering price of $ per share of common stock

(the last reported sale price of our common stock on Nasdaq on April , 2023) would increase or decrease the as adjusted amount

of each of cash and cash equivalents, additional paid-in capital, total stockholders’ equity (deficit) and total

capitalization by approximately $ million, assuming that the number of shares offered by us, as set forth on the

cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and

estimated offering expenses payable by us and assuming no exercise of the Common Warrants issued in this offering and assuming no

sale of any Pre-Funded Warrants. An increase or decrease of shares of common stock offered by us, as set forth on the

cover page of this prospectus, would increase or decrease the as adjusted amount of each of cash and cash equivalents, additional

paid-in capital, total stockholders’ equity (deficit) and total capitalization by approximately $ , assuming

no change in the assumed public offering price per share of common stock and after deducting the estimated underwriting discounts

and commissions and estimated offering expenses payable by us and assuming no exercise of the Common Warrants issued in this

offering and assuming no sale of any Pre-Funded Warrants.

| |

(1) |

|

This is based on

14,946,442 shares outstanding as of April , 2023 and excludes: |

| |

● |

1,351,271

shares of common stock issuable upon the exercise of outstanding stock options and RSUs; |

| |

● |

133 shares

of common stock issuable upon the exercise of warrants issued to the placement agents for $1,500 per share until August 18, 2024; |

| |

● |

7 shares of common stock issuable upon the exercise of warrants issued to the placement agent

for $18,000 per share until either (i) May 15, 2023 or (ii) September 4, 2023; |

|

● |

47 shares

of common stock issuable upon the exercise of Class B Warrants for $18,000 per share with expiration dates within the period between

October 17, 2021 and May 15, 2023; |

| |

● |

3,460

shares of common stock issuable upon the exercise of Series A Warrants for $5,505 per share until either (i) November 14, 2023, (ii)

December 17, 2023 or (iii) January 24, 2024; |

| |

● |

102,450

shares of common stock issuable upon the exercise of warrants issued in connection with the Company’s public offering on June

2, 2020 for $1,729 per share until June 2, 2025; |

| |

● |

153,433

shares of common stock issuable upon the exercise of warrants issued in connection with a July 2021 private placement offering for

$121.50 per share until July 14, 2026; |

| |

● |

18,412 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the July 2021 Offering for $162.94 per share until July 14, 2026; |

| |

● |

125,000 shares of common stock issuable upon the exercise of the warrants issued to the investors of the Series F Preferred Stock and Series G Preferred Stock for $37.65 per share until February 15, 2027; |

| |

● |

10,000 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the February 2022 Offering for $7.50 per share until February 15, 2027; |

| |

● |

5,000 shares of common stock issuable upon the exercise of warrants for $1.90 per share until June 22, 2027; |

| |

● |

189,474 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the June 2022 Offering for $2.375 per share until June 22, 2027; |

| |

● |

240,000 shares of common stock issuable upon the exercise of warrants issued to the placement agent in connection with the July 2022 Private Placement for $6.25 per share until July 28, 2025; |

| ● | 10,619,911 shares of common stock issuable upon exercise of the Series C preferred investment options

issued to certain stockholders in the 2022 Private Placement for $2.356 per share until November 17, 2025; and |

| ● | 157,195 shares of common stock issuable upon exercise of preferred investment options issued to the placement

agent in connection with the 2022 Private Placement for $3.578365 per share until November 17, 2025. |

DILUTION

Purchasers of our securities in this offering will

experience an immediate and substantial dilution in the as adjusted net tangible book value of their shares of our common stock. Dilution

in net tangible book value represents the difference between the public offering price per share of common stock (attributing no value

to the Common Warrants issued in this offering and assuming no sale of any Pre-Funded Warrants) and the as adjusted net tangible book

value per share of our common stock immediately after the offering.

The historical net tangible book value of our common

stock as of December 31, 2022, was $28,269,863 or $2.01 per share. Historical net tangible book value per share of our common stock represents

our total tangible assets (total assets less intangible assets) less total liabilities divided by the number of shares of our common stock

outstanding as of that date. After giving effect to the sale of shares of common stock in this offering at a public offering price of

$ per share of common stock (the last reported sale price of our common stock on Nasdaq on April , 2023) and assuming no exercise

of the Common Warrants issued in this offering and assuming no sale of any Pre-Funded Warrants for net proceeds of approximately $ as if such offering and such share issuances had occurred on December 31, 2022, our as adjusted net tangible book value as of December