Genius Group Limited (NYSE American: GNS) (“Genius Group” or the

“Company”), a leading entrepreneur edtech and education group,

today announced its approval to dual list its shares on Upstream,

the revolutionary trading app for digital securities and NFTs

powered by Horizon Fintex (“Horizon”) and MERJ Exchange Limited

(“MERJ”). Trading begins on Upstream April 6th, 2023 at 10:00am ET

under the ticker symbol GNS.

The dual listing on Upstream is designed to

provide Genius Group the opportunity to access a global,

digital-first investor base that can trade using USDC digital

currency along with credit, debit, PayPal, and USD, unlocking

liquidity and enhancing price discovery while globalizing the

opportunity to invest in Genius Group.

Global investors can get ready to trade by

downloading Upstream from their preferred app store at

https://upstream.exchange/, creating an account by tapping sign up,

and completing a simple KYC identity verification by tapping the

settings icon on the home screen and tapping KYC.*

Existing shareholders may transfer their shares

by opening Upstream, tapping Investor, Manage Securities, Deposit

Securities, then entering the ticker symbol ‘GNS’ and the amount of

shares to deposit, and tapping Submit. Next, enter your brokerage

firm name and brokerage account number, and tap Submit. Finally,

tap Add E-Signature, sign your name on the screen using your

finger, tap Done, and then tap Sign.

After completion of the deposit request on

Upstream, shareholders will receive via email an executed

deposit form to submit to their current brokerage firm to initiate

a withdraw to the transfer agent. Shares will not be

transferred without notifying the current broker and requesting a

withdraw. On listing day, shareholders will receive a push

notification once the shares are deposited and available for

trading on Upstream.

Details on the Genius Group listing, how

shareholders can deposit shares and trade on Upstream, and how to

claim the free commemorative NFT can be found on Genius Group’s

Investor Relations website. The Upstream market is open 5 days a

week 20 hours a day, Monday to Friday: 10:00am to 06:00am UTC+4

(1:00am to 9:00pm EST).

Traders on Upstream’s blockchain-powered

platform will experience real-time trading and settlement and a

transparent orderbook which does not permit common market

manipulations. On listing day, Upstream participants will be

eligible to claim a free digital collectible (NFT) memorializing

the dual listing on Upstream. Shareholders may also be entitled to

participate in future digital promotions which may be redeemed for

products, services, or experiences for added value.

Roger Hamilton, CEO of Genius Group, commented,

“Building shareholder value is an ongoing goal of ours and we

believe a dual listing on Upstream will unlock liquidity and

enhance price discovery for our shareholders”.

About Genius Group

Genius Group is a world leading entrepreneur

Edtech and education group, with a mission to disrupt the current

education model with a student-centered, life-long learning

curriculum that prepares students with the leadership,

entrepreneurial and life skills to succeed in today’s market. The

group has a group user base of 4.3 million users in 200 countries,

ranging from ages 0 to 100.

For more information, please visit

https://www.geniusgroup.net/

About Upstream

Upstream, a MERJ Exchange Market

(merj.exchange), is a fully regulated global stock exchange for

digital securities and NFTs. Powered by Horizon's proprietary

blockchain-powered matching engine technology, the platform enables

users to trade NFTs, and invest in securities for IPOs, crowdfunded

companies, U.S. & international equities, and celebrity

ventures using the Upstream app. For more information, please visit

https://upstream.exchange/. Upstream is currently accepting

applications to dual list at

https://upstream.exchange/getlisted.

Disclaimers

This press release shall not constitute an offer

to sell securities or the solicitation of an offer to buy

securities in any jurisdiction where such offer or solicitation is

not permitted.

Upstream and Issuers do not charge for share

transfers, however, transfer agents may charge investors for share

transfers. Such fees are standard in the industry and if a fee is

required, the transfer agent will alert the investor of such

charges and how to pay via credit card, check or wire.

Discount coupon NFTs received are redeemable for

iGEMs, equivalent to $10 per share, however the NFTs have no

royalties, equity ownership, or dividends. NFTs are for utility,

collection, redemption or display purposes only.

NFTs received have no economic value, royalties,

equity ownership, or dividends. NFTs are for utility, collection,

redemption and display only.

*If you are a U.S. or Canadian-based citizen or

permanent resident that has invested in a company that's listed on

Upstream, you may transfer your shares to Upstream and sell them on

Upstream’s trading app for liquidation purposes only. You are not

permitted to purchase shares of other companies listed on Upstream

at this time. Anyone may buy and sell NFTs on Upstream.

If funding Upstream with an ACH or wire bank

payment, users must complete Upstream's in-app KYC process to get

their new, FDIC insured, Upstream U.S. bank account details via

email. Users may then initiate a funds-transfer from their bank or

financial institution to this new U.S. Dollar bank account. If you

haven't completed KYC yet, or didn't select ‘Bank' as the ‘Deposit

From' option when you completed the process initially, then please

go through KYC again selecting the ‘Bank' payment method. Users may

complete the simple KYC process by tapping the settings icon and

the KYC option inside the Upstream app.

Upstream is a MERJ Exchange market. MERJ

Exchange is a licensed Securities Exchange, an affiliate of the

World Federation of Exchanges, and a full member of ANNA. MERJ

supports global issuers of traditional and digital securities

through the entire asset life cycle from issuance to trading,

clearing, settlement, and registry. It operates a fair and

transparent marketplace in line with international best practices

and principles of operations of financial markets. Upstream does

not endorse or recommend any public or private securities bought or

sold on its app. Upstream does not offer investment advice or

recommendations of any kind. All services offered by Upstream are

intended for self-directed clients who make their own investment

decisions without aid or assistance from Upstream. All customers

are subject to the rules and regulations of their jurisdiction. By

accessing the site or app, you agreed to be bound by its terms of

use and privacy policy. Company and security listings on Upstream

are only suitable for investors who are familiar with and willing

to accept the high risk associated with speculative investments,

often in early and development stage companies. There can be no

assurance the valuation of any particular company's securities is

accurate or in agreement with the market or industry comparative

valuations. Investors must be able to afford market volatility and

afford the loss of their investment. Companies listed on Upstream

are subject to significant ongoing corporate obligations including,

but not limited to disclosure, filings, and notification

requirements, as well as compliance with applicable quantitative

and qualitative listing standards.

Investor Notice

Investing in our securities involves a high

degree of risk. Before making an investment decision, you should

carefully consider the risks, uncertainties and forward-looking

statements described in our most recent Annual Report on Form 20-F

for the fiscal year ended December 31, 2021, filed with the SEC on

May 13, 2022. If any of these risks were to occur, our business,

financial condition or results of operations would likely suffer.

In that event, the value of our securities could decline, and you

could lose part or all of your investment. The risks and

uncertainties we describe are not the only ones facing us.

Additional risks not presently known to us or that we currently

deem immaterial may also impair our business operations. In

addition, our past financial performance may not be a reliable

indicator of future performance, and historical trends should not

be used to anticipate results in the future. See “Forward-Looking

Statements” below.

Forward-Looking Statements

Statements made in this press release include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements can be

identified by the use of words such as “may,” “will,” “plan,”

“should,” “expect,” “anticipate,” “estimate,” “continue,” or

comparable terminology. Such forward-looking statements are

inherently subject to certain risks, trends and uncertainties, many

of which the Company cannot predict with accuracy and some of which

the Company might not even anticipate and involve factors that may

cause actual results to differ materially from those projected or

suggested. Readers are cautioned not to place undue reliance on

these forward-looking statements and are advised to consider the

factors listed above together with the additional factors under the

heading “Risk Factors” in the Company’s Annual Reports on Form

20-F, as may be supplemented or amended by the Company’s Reports of

a Foreign Private Issuer on Form 6-K. The Company assumes no

obligation to update or supplement forward-looking statements that

become untrue because of subsequent events, new information or

otherwise.

Contacts

Investors:Flora Hewitt, Vice President of Investor Relations and

Mergers and AcquisitionsEmail: investor@geniusgroup.net

Media Contacts: Adia PREmail: gns@adiapr.co.uk

US Investors: Dave GentryRedChip Companies

Inc1-800-RED-CHIPGNS@redchip.com

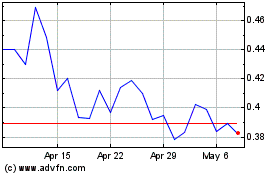

Genius (AMEX:GNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genius (AMEX:GNS)

Historical Stock Chart

From Apr 2023 to Apr 2024