DEF 14AFALSE000006675600000667562022-01-012022-12-310000066756ale:MsOwenMember2022-01-012022-12-31iso4217:USD0000066756ale:MrHodnikMember2022-01-012022-12-31iso4217:USDxbrli:shares0000066756ale:MsOwenMember2021-01-012021-12-310000066756ale:MrHodnikMember2021-01-012021-12-3100000667562021-01-012021-12-310000066756ale:MsOwenMember2020-01-012020-12-310000066756ale:MrHodnikMember2020-01-012020-12-3100000667562020-01-012020-12-310000066756ale:MsOwenMemberale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:PeoMember2022-01-012022-12-310000066756ale:MsOwenMemberale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:PeoMember2021-01-012021-12-310000066756ale:MsOwenMemberale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:PeoMember2020-01-012020-12-310000066756ale:MrHodnikMemberale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:PeoMember2020-01-012020-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberale:MsOwenMemberecd:PeoMember2022-01-012022-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberale:MsOwenMemberecd:PeoMember2021-01-012021-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberale:MsOwenMemberecd:PeoMember2020-01-012020-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberale:MrHodnikMemberecd:PeoMember2020-01-012020-12-310000066756ale:MsOwenMemberale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:PeoMember2022-01-012022-12-310000066756ale:MsOwenMemberale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:PeoMember2021-01-012021-12-310000066756ale:MsOwenMemberale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:PeoMember2020-01-012020-12-310000066756ale:MrHodnikMemberale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:PeoMember2020-01-012020-12-310000066756ale:MsOwenMemberale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:PeoMember2022-01-012022-12-310000066756ale:MsOwenMemberale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:PeoMember2021-01-012021-12-310000066756ale:MsOwenMemberale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:PeoMember2020-01-012020-12-310000066756ale:MrHodnikMemberale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberale:MsOwenMemberecd:PeoMember2022-01-012022-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberale:MsOwenMemberecd:PeoMember2021-01-012021-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberale:MsOwenMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberale:MrHodnikMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberale:MsOwenMemberecd:PeoMember2022-01-012022-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberale:MsOwenMemberecd:PeoMember2021-01-012021-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberale:MsOwenMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberale:MrHodnikMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberale:MsOwenMemberecd:PeoMember2022-01-012022-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberale:MsOwenMemberecd:PeoMember2021-01-012021-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberale:MsOwenMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberale:MrHodnikMemberecd:PeoMember2020-01-012020-12-310000066756ale:MsOwenMemberale:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000066756ale:MsOwenMemberale:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000066756ale:MsOwenMemberale:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000066756ale:MrHodnikMemberale:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000066756ale:EquityAwardsThatFailedToMeetVestingConditionsMemberale:MsOwenMember2022-01-012022-12-310000066756ale:EquityAwardsThatFailedToMeetVestingConditionsMemberale:MsOwenMember2021-01-012021-12-310000066756ale:EquityAwardsThatFailedToMeetVestingConditionsMemberale:MsOwenMember2020-01-012020-12-310000066756ale:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberale:MsOwenMemberecd:PeoMember2022-01-012022-12-310000066756ale:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberale:MsOwenMemberecd:PeoMember2021-01-012021-12-310000066756ale:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberale:MsOwenMemberecd:PeoMember2020-01-012020-12-310000066756ale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:AdjustmentChangeInActuarialPresentValueOfPensionBenefitsMemberMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:AdjustmentChangeIncreaseForCurrentYearServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:AdjustmentChangeIncreaseForPriorServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:DeductionForStockAwardsFromSummaryCompensationTableMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:EquityAwardsOutstandingAndUnvestedPriorMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000066756ale:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000066756ale:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000066756ale:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310000066756ale:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310000066756ale:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310000066756ale:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-31

Item 3: The advisory vote on the frequency of future advisory votes on executive compensation will be decided by an affirmative vote of a majority of the shares present or represented by proxy and entitled to vote, provided that the total number of shares voting for this proposal represents more than 25 percent of the Common Stock shares outstanding on the Record Date. Your vote in favor of one of the frequency choices, or your abstention, will have the same effect as a vote against the other frequency choices (or against all the choices in the case of your abstention). Although this is a non-binding, advisory vote, the ECHC Committee and the Board will consider the outcome of the vote when determining the frequency of future advisory votes on executive compensation.

Item 4: The affirmative vote of a majority of the shares present in person or represented by proxy is required to ratify the selection of PricewaterhouseCoopers as our independent registered public accounting firm for 2023, provided that the total number of shares voting for this proposal represents more than 25 percent of the shares outstanding on the Record Date. If you abstain from voting for the ratification of the selection of PricewaterhouseCoopers, your abstention will have the same effect as a vote against this proposal.

A “broker non-vote” occurs when a broker submits a proxy card for shares to the Company but does not indicate a vote on a particular matter because the broker has not received timely voting instructions from the beneficial owner with respect to that particular matter. Broker non-votes are not counted for or against any proposal. They are treated as shares not present and not entitled to vote on a particular proposal. An automated system administered by Broadridge Investor Communications Solutions, Inc. will tabulate the proxy votes.

Can I change my vote or revoke my proxy?

Yes. If you are a shareholder of record, you can change your vote or revoke your proxy at any time before it is voted at the Annual Meeting, either by signing and returning a proxy card with a later date or by attending the Annual Meeting and changing your vote prior to the start of the meeting. If you have voted your shares online or by telephone, you can revoke your prior online or telephonic vote by recording a different vote, or by signing and returning a proxy card dated as of a date later than your last online or telephonic vote. If you are a beneficial owner, you must contact your broker, bank, or other nominee to change your vote or revoke your proxy.

Where can I find the voting results?

We will announce preliminary results at the Annual Meeting and publish the results in a Form 8-K filed with the SEC within four business days after the date of the Annual Meeting.

Who can answer additional questions?

You are welcome to contact ALLETE Shareholder Services with any questions you may have regarding this Proxy Statement. The telephone number is (218) 355-3114. The mailing address is: ALLETE, Inc., Attention: Shareholder Services, 30 West Superior Street, Duluth, MN 55802.

OWNERSHIP OF ALLETE COMMON STOCK

________________________________________________________________

Company records and other information available from outside sources, including information filed with the SEC, indicate that the following shareholders beneficially owned more than five percent of the Company's voting securities as of March 10, 2023:

| | | | | | | | | | | | | | | | | | | | |

| Securities Owned by Certain Beneficial Owners |

| Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial Ownership | | Percent of Class1 |

| Common Stock | | BlackRock, Inc.2 55 East 52nd Street New York, NY 10055 | | 7,254,952 | | 12.7% |

| Common Stock | | The Vanguard Group3 100 Vanguard Boulevard Malvern, PA 19355 | | 6,208,467 | | 10.8% |

1 As of March 10, 2023.

2 The information shown, including the aggregate number of shares beneficially owned, comes from information filed with the SEC on Schedule 13G/A on January 26, 2023. The information reflects the number of Common Stock shares beneficially owned as of December 31, 2022, by BlackRock, Inc. and certain of its subsidiaries.

3 The information shown, including the number of shares beneficially owned, comes from information filed with the SEC on Schedule 13G/A on February 9, 2023. The information reflects the number of Common Stock shares beneficially owned as of December 31, 2022, by The Vanguard Group and certain of its subsidiaries.

Securities Owned by Directors and Management

As discussed on page 30, non-employee Directors are expected to own shares with a valuation equal to at least five times their annual cash retainer within five years of election. As of March 10, 2023, all independent Directors met the Common Stock ownership guideline, except: Ms. Thomas, who first became subject to the guideline in 2021, and Mr. Matthews, who first became subject to the guideline in 2022; both are making expected progress toward meeting the guideline.

Common Stock ownership guidelines applicable to NEOs are discussed on pages 30 and 50. The Board reviewed executive stock ownership in April 2022. As of March 10, 2023, all NEOs met their respective share ownership guideline, except: Ms. Owen, who was promoted to a position with a higher stock ownership guideline in 2019, and again in 2020, Mr. Morris who was promoted to a position with a higher stock ownership guideline in 2022, and Ms. Thickens, who first became subject to a stock ownership guideline with her promotion in 2019; all three are making expected progress toward meeting their guidelines.

In determining whether Directors and NEOs met the Common Stock ownership guidelines, we include deferred shares and RSUs because we believe these derivative holdings accomplish similar objectives as stock ownership, namely they encourage Directors and NEOs to have a stake in the Company and they align the Directors' and NEOs' interests with those of shareholders.

The following table shows the shares of Common Stock beneficially owned, as of March 10, 2023, by Directors, nominees for Director, executive officers named in the Summary Compensation Table on page 56, and all Directors, nominees for Director, and executive officers as a group. Except as otherwise indicated, the persons shown have sole voting and investment power over the Common Stock listed. | | | | | | | | | | | | | | | | | | | | |

| Securities Owned by Directors and Management |

| | | Other2 | | |

| Name of

Beneficial Owner | Number of Shares Beneficially Owned1 |

Restricted

Stock Units | Deferred

Shares

Under the

Director

Deferred

Stock Plan | Total Shares Beneficially Owned for Common Stock Ownership Guideline Purposes |

Number of Shares Needed to Meet Common Stock Ownership Guidelines3 |

| Non-Employee | George G. Goldfarb | 2,851 | | — | | 15,914 | | 18,765 | | 7,047 | |

| Directors and | James J. Hoolihan | 12,003 | | — | | 10,212 | | 22,215 | | 7,047 | |

| Nominees for | Madeleine W. Ludlow | 15,564 | | — | | 4,636 | | 20,200 | | 7,047 | |

| Director | Charles W. Matthews | 639 | | — | | 1,390 | | 2,029 | | 7,047 | |

| Susan K. Nestegard | 686 | | — | | 7,725 | | 8,411 | | 7,047 | |

| Douglas C. Neve | 9,850 | | — | | 14,198 | | 24,048 | | 7,047 | |

| Barbara A. Nick | 7,515 | | — | | — | | 7,515 | | 7,047 | |

| Robert P. Powers | 664 | | — | | 8,188 | | 8,852 | | 7,047 | |

| Charlene A. Thomas | 3,091 | | — | | — | | 3,091 | | 7,047 | |

| | | | | | |

| Named | Bethany M. Owen | 15,373 | | 10,388 | | — | | 25,761 | | 60,949 | |

| Executive | Steven W. Morris | 7,945 | | 2,942 | | — | | 10,887 | | 19,914 | |

| Officers | Margaret A. Thickens | 2,906 | | 2,548 | | — | | 5,454 | | 6,477 | |

| Nicole R. Johnson | 7,293 | | 2,758 | | — | | 10,051 | | 6,133 | |

| Patrick L. Cutshall | 5,950 | | 2,352 | | — | | 8,302 | | 4,913 | |

| Robert J. Adams | 12,556 | | — | | — | | 12,556 | | — | |

| | | | | | |

All Directors, nominees for Director,

and executive officers as a group (15): | 115,258 | | | | | |

1 The share amounts in this column include: (i) shares as to which voting and investment power is shared with the person's spouse: Mr. Hoolihan—12,003, Mr. Matthews—639, and Mr. Neve—9,850; and (ii) shares owned by the person as custodian for child: Ms. Johnson—60. Each Director, nominee for Director, and executive officer, individually, and all Directors, nominees for Director, and executive officers as a group, beneficially own only a fraction of one percent of the

Common Stock outstanding.

2 The amounts in the “Other” column do not represent either issued Common Stock or a right of the holder to receive Common Stock within 60 days and are not considered beneficially owned in accordance with Rule 13d-3 under the Exchange Act. The amounts are shown here because the Company includes those holdings when determining whether a Director or NEO has met their applicable stock ownership guideline. Directors are able to defer their cash and stock retainers under the Deferral Plan II. Distributions of deferred shares will be made in Common Stock.

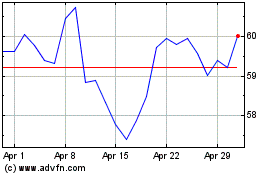

3 The stock ownership guideline amounts shown have been calculated using a Common Stock valuation of $60.31 per share, the closing price on March 10, 2023. The amount shown for non-employee Directors was determined based on the annual cash retainer in effect for Directors as of March 10, 2023. Stock ownership guidelines shown for all NEOs were determined based on the NEO's salary as of March 10, 2023.

Pledging, Hedging, and Short Sales of Common Stock Prohibited

The ALLETE Purchase and Sale of Company Securities Policy prohibits Directors and officers, including each NEO, from holding Common Stock in a margin account or otherwise entering into any pledge arrangement that would permit a third party to sell the securities without the Director's or officer's consent or knowledge. In addition, no Director or officer, including any NEO, may enter into any transaction that allows him or her to be insulated from the full risk or reward of Common Stock ownership (i.e., hedging) nor may a Director or officer enter into any transaction that allows him or her to benefit if the value of the Common Stock decreases (i.e., short sale).

ITEM NO. 1—ELECTION OF DIRECTORS

________________________________________________________________

Ten Director nominees have been recommended by the CG Committee and nominated by the Board. Each Director elected will serve until the next annual election of Directors and until a successor is qualified and elected, or until the Director's earlier resignation or removal. If any nominee should become unavailable, which is not anticipated, the Board may provide by resolution for a lesser number of Directors, or designate substitute nominees, who would receive the votes represented by proxies.

Unless otherwise directed, all shares represented by proxy will be voted “FOR” the election of the ten nominees for Director named below and on the following pages.

| | | | | |

| Nominees for Director |

| |

| Qualifications and Experience Ms. Owen has served in a wide variety of roles with increasing responsibility over two decades since first joining the Company as an attorney. She has extensive experience with business strategy development and implementation, regulatory policy development and implementation, renewable energy, enterprise risk management, cyber security, information and operations technology strategy, compliance, corporate governance, and leading business transformation. Ms. Owen also serves on a variety of community and non-profit boards. Business Experience •Chair, President, and CEO, ALLETE (Since May 2021) •President and CEO, ALLETE (February 2020 to May 2021) •President, ALLETE (January 2019 to February 2020) •Senior Vice President, Chief Legal and Administrative Officer, and Secretary, ALLETE (2016 to January 2019) •Vice President–ALLETE Information Technology Solutions, Vice President, Minnesota Power, an operating division of ALLETE and President, Superior Water, Light and Power Company, a wholly owned subsidiary of ALLETE (2014 to 2016) •Vice President, Minnesota Power, an operating division of ALLETE and President, Superior Water, Light and Power Company (2012 to 2014) •President, Superior Water, Light and Power Company (2010 to 2012) Other Public Company Boards •None Other •Member, University of Minnesota Foundation Board of Trustees, which oversees and supports fundraising activities for the University of Minnesota's campuses, colleges, and programs, as well as the management and investment of the university's endowed funds (Since 2021)

|

Bethany M. Owen Board Chair |

| Age: 57 |

| Director Since: 2019 |

|

| |

| | | | | |

| Nominees for Director |

| |

| Qualifications and Experience Ms. Nestegard brings extensive business experience, including audit committee experience, strategy development, enterprise risk management, a background in innovation and disruptive technologies, and experience driving growth through mergers and acquisitions. Ms. Nestegard has a demonstrated passion for supporting women in sciences and corporate leadership. She holds 26 patents in her name. As Lead Director, Ms. Nestegard is an ex officio member of each Board committee. Business Experience •Advisor, True Wealth Ventures, a venture capital fund focusing on investments in women-led businesses in high-growth markets where women are the primary customers (Since July 2017) •President of Global Healthcare, Ecolab, Inc. (NYSE:ECL), a global supplier of water, hygiene, and energy services (2010 to 2012) •Executive Vice President of Global Healthcare, Ecolab, Inc. (2008 to 2010) •Senior Vice President of Research, Development, and Engineering, and Chief Technical Officer, Ecolab, Inc. (2003 to 2008) •More than 20 years' experience with 3M Company (NYSE:MMM) in product development and business unit management, driving revenue expansion through innovation Other Public Company Boards •Hormel Foods, Inc. (NYSE:HRL) (Since 2009) ◦Governance Committee ◦Audit committee (2009 to 2019)

|

Susan K. Nestegard Lead Director |

Age 62 |

Director Since 2018 |

Committees Audit Committee (ex officio) ECHC Committee (ex officio) CG Committee (ex officio) |

|

| |

| Qualifications and Experience Mr. Goldfarb is an audit committee financial expert within the meaning of SEC rules. He brings a wealth of business knowledge and executive experience that includes deep ties to and insights into the local and regional economy, as well as extensive national branding experience. Business Experience •Director and Chair Emeritus, Maurices Incorporated, a specialty retailer selling women's apparel in approximately 900 stores and online (March 2021 to present) •President and CEO, Maurices Incorporated (2015 to March 2021) •President, Maurices Incorporated (2011 to 2015) •President and CEO of Value Fashion Segment of Ascena Retail Group, Inc., which included the Maurices and the Dressbarn brands (2016 to January 2018) •Vice Chair, Ascena Retail Group, Inc.'s wholly owned subsidiary, Catherines Stores, Inc. (2015 to 2016) •Chief Operating Officer, Maurices Incorporated (2006 to 2011) •CFO, Maurices Incorporated (2001 to 2006) Other Public Company Boards •None Other •Director, Essentia Health (Since 2019) ◦Board Vice Chair, Planning and Finance Committee Chair, and Audit Committee Member

|

| George G. Goldfarb |

Age 63 |

Director Since 2012 |

Committee Audit Committee Chair |

|

| |

| |

| | | | | |

| Nominees for Director |

| |

| Qualifications and Experience Mr. Hoolihan is a long-time business and community leader within the Company's electric utility service area. He brings a deep knowledge of the industries and political dynamics of our regional service area, as well as extensive business experience related to serving the large industries in the region. Business Experience •Owner and CEO, Can-Jer Industrial Lubricant, Ltd., which provides industrial supplies and services to mining and railroad industries that operate in Canada (Since 1983) •Owner, JHAC, LLC, a real estate investment company (Since October 2000) •CEO and Chair, Industrial Lubricant Company, which provides industrial supplies and services to mining and railroad industries (2011 to 2017) •President and CEO, Blandin Foundation, a private, philanthropic foundation whose mission is to strengthen communities in rural Minnesota (2004 to 2011) ◦Trustee, Blandin Foundation (Since 2012) ◦Co-trustee for the Charles K. Blandin Residuary Trust (Since 2012) •President, Industrial Lubricant Company (1981 to 2004) Other Public Company Boards •None Other •Served as Elected Mayor of the City of Grand Rapids, Minnesota (1990 to 1995) |

| James J. Hoolihan |

Age 70 |

Director Since 2006 |

Committee CG Committee |

| |

| |

| |

| |

| Qualifications and Experience Ms. Ludlow brings deep experience with and a sophisticated understanding of investment banking, finance, and accounting. Ms. Ludlow was a senior executive at a public utility and has worked closely with entrepreneurial and diversified businesses. Other areas of expertise include strategy development and execution, mergers and acquisitions, and business transformations. She also is qualified as an audit committee financial expert within the meaning of the SEC rules Business Experience •Founder and Managing Director, West Capital Advisors, LLC, which provides strategic and development advisory services for corporate innovation in private equity transactions (Since 2011) •Principal, Market Capital Partners LLC, Ohio-based investment banking firm serving mid-size-market companies (2009 to 2011) •LudlowWard Capital Advisors, LLC, Ohio-based investment banking firm serving mid-size market companies (2005 to 2009) •Chair, CEO, and President of Cadence Network, Inc., an internet-based provider of utility expense management services (2000 to 2004) •Vice President and CFO of Cinergy Corp., a Cincinnati-based energy company acquired by Duke Energy in 2006 (1997 to 2000) Other Public Company Boards •Director, Ohio National Fund, Inc., a registered investment company with 25 separate investment funds (Since 2012)

|

| Madeleine W. Ludlow |

Age 68 |

Director Since 2004 |

Committees CG Committee Chair ECHC Committee |

|

|

| |

| |

| | | | | |

| Nominees for Director |

| |

| Qualifications and Experience Mr. Matthews, an audit committee financial expert within the meaning of the SEC rules, brings extensive financial expertise, strategic leadership experience in the energy industry, as well as risk management and cybersecurity oversight expertise. He has a demonstrated understanding of the importance of serving customers with excellence, creating a more diverse and inclusive workforce, and supporting our communities to foster a more equitable society, all while creating value for shareholders. Mr. Matthews has served on numerous energy industry boards, as well as non-profit organizations. His experiences give him significant insight into environmental, social, and governance matters. Business Experience •President, Peoples Energy, LLC and President and CEO, The Peoples Gas Light and Coke Company and North Shore Gas Company, each of which is a subsidiary of WEC Energy Group Inc. (NYSE:WEC) (2015 to July 2022) •Senior Vice President – Wholesale Energy and Fuels, WE Energies, also a subsidiary of WEC Energy Group (2012 to 2015) •During his more than 40 years in the energy industry, Mr. Matthews also held leadership and other finance and regulatory positions with Mirant Corporation, Southern Company Services, and Exxon Company, U.S.A. Other Public Company Boards •None Other •Director, BMO Financial Corp. and BMO Harris Bank, N.A (Since May 2019) ◦Member, Audit Committee and Human Resource Committee |

| Charles R. Matthews |

Age 66 |

Director Since 2022 |

Committees Audit Committee |

|

| |

| |

| Qualifications and Experience Mr. Neve is a certified public accountant and an audit committee financial expert within the meaning of the SEC rules. He brings extensive knowledge of public accounting, corporate reporting, risk management, corporate finance, and compliance. Mr. Neve's background includes broad corporate leadership experience as an executive of a publicly traded company, and as a director, audit committee chair, compensation committee member, and governance committee member for publicly traded and privately held corporations, as well as public and non-profit entities. Mr. Neve also brings experience with mergers and acquisitions, energy industry experience, and renewable energy experience. Business Experience •Executive Vice President and CFO, Ceridian Corp., a Minneapolis-based multinational human resources company (2005 to 2007) •Audit Partner, Deloitte & Touche LLP, a public accounting firm (2002 to 2005) Other Public Company Boards •None |

| Douglas C. Neve |

Age 67 |

Director Since 2007 |

Committees Audit Committee CG Committee |

|

| |

| | | | | |

| Nominees for Director |

| |

| Qualifications and Experience With a career in the electric and gas energy industry that spanned four decades, Ms. Nick brings a wealth of knowledge and skills to the Board. She has extensive leadership, strategic, regulatory, operational, and developmental experience in five Midwest states. Ms. Nick also has strong financial skills and a long, proven record of principled corporate governance. Ms. Nick brings experience with mergers and acquisitions, renewable energy, and business transformations. She also has received a cyber security certification from the National Association of Corporate Directors. Business Experience •CEO, Dairyland Power Cooperative (2014 to July 2020) •President, Minnesota Energy Resources Corporation and President of Michigan Gas Utilities Corporation, both subsidiaries of what was then Integrys Energy Group (NYSE:TEG) and is now WEC Energy Group Inc. (NYSE:WEC) (2012 to 2014) •Senior Vice President of Energy Delivery and Customer Service, Wisconsin Public Service Company and President, Upper Peninsula Power Company, both also subsidiaries of what was then Integrys Energy Group and is now WEC Energy Group Inc. (2007 to 2012) •Vice President of Corporate Services, what was then WPS Resources Corporation (NYSE:WPS), now WEC Energy Group Inc. (2004 to 2007) Other Public Company Boards •None

Other •Chair, State of Wisconsin Investment Board, which provides oversight of the eighth-largest pension fund in the United States and the 25th-largest pension fund globally with investments valued at over $120 billion (Since 2015) •Director, Mead & Hunt, a national architecture and engineering firm (Since 2019) ◦Audit Committee ◦Chair, Governance Committee

|

| Barbara A. Nick |

Age 65 |

Director Since 2020 |

Committees Audit Committee ECHC Committee |

|

|

| |

| | | | | |

| Nominees for Director |

| |

| Qualifications and Experience Mr. Powers brings extensive and diverse regulated utility experience and strategic leadership, including expertise in strategic planning, executive compensation, mergers and acquisitions, renewable energy, business transformations, and cybersecurity oversight. Mr. Powers was an active member of utility industry associations and worked to recruit technical talent to utilities. Business Experience •Vice Chair and Senior Advisor to the Chair and CEO, American Electric Power Company (NYSE:AEP), one of the largest electric utilities in the United States with more than five million customers in eleven states (January 2017 to August 2017) •Executive Vice President and COO, AEP (2010 to December 2016) •President, AEP Utilities (2008 to 2010) •Executive Vice President, AEP East Utilities (2006 to 2008) •Executive Vice President of Generation, AEP East Utilities (2003 to 2006) •Worked for 16 years with Pacific Gas and Electric Company, rising to Site Vice President and Plant Manager at the Diablo Canyon Nuclear Generating Station; and six years with the Tennessee Valley Authority as a health physicist. Other Public Company Boards •None

|

| Robert P. Powers |

Age 69 |

Director Since 2017 |

Committees ECHC Committee Chair |

|

| |

| Qualifications and Experience Ms. Thomas brings a breadth of executive leadership skills, including broad strategy design and implementation experiences in industrial and business operations and large-scale human resources operations, having led strategic human resources initiatives for a workforce of more than 525,000 employees worldwide. Ms. Thomas has public company experience, has lead business transformations, and has demonstrated financial acumen. Ms. Thomas has expertise in complex distributed operations and has received an artificial intelligence certification from MIT. Business Experience •Executive Vice President and Chief Diversity, Equity and Inclusion Officer, United Parcel Service, Inc. (NYSE:UPS) (UPS) (January 2021 to October 2022) •Executive Vice President and Chief Human Resources Officer, UPS (July 2019 to December 2020) (March 2019 to June 2019) •President of Human Capital Transformation, UPS (March 2019 to June 2019) •President, UPS’s west region, with responsibility for product growth and delivery operations in 25 U.S. central and western states (April 2018 to February 2019) •President, UPS's mid-south district, with responsibility for package delivery operations in seven U.S. southern states (2016 to April 2018) Other Public Company Boards •None Other •Director, National Urban League (Since 2019) •Member, Executive Leadership Council, an independent non-profit organization that opens channels of opportunity for the development of Black executives to positively impact businesses and communities (Since 2020)

|

| Charlene A. Thomas |

Age 55 |

Director Since 2021 |

Committees Audit Committee ECHC Committee |

|

CORPORATE GOVERNANCE ________________________________________________________________

ALLETE operates from a foundation of sound corporate governance practices, with a Board that provides oversight focused on ensuring that the Company is managed in a manner that builds long-term value for our shareholders, customers, employees, and communities. Our governance framework is built around a skilled, engaged Board and focused attention to our values and culture. This provides a working structure for effective decision-making, principled actions, and appropriate monitoring of risks, compliance, and performance.

The Board takes an active role overseeing ALLETE’s strategy and approves the strategic direction of the Company, any changes in long term capital structure, significant transactions, and any entry into substantial new lines of business. We believe that taking the interests of our stakeholders into consideration and making decisions guided by Company values–with integrity at the foundation of all we do–are important to ALLETE's long-term success and profitability.

Governance Documents

ALLETE's key governance documents, including our Corporate Governance Guidelines, are available on our website at www.allete.com/Governance.

Our Corporate Governance Guidelines address the Board and committee responsibilities, Director selection, Board operating policies, Director compensation, expectations for Directors, Director stock ownership, and other matters. These guidelines were most recently revised in February 2023.

Each Board committee operates under its own charter. The Audit Committee Charter was last reviewed and revised in February 2022. The Executive Compensation and Human Capital Committee Charter, and the Corporate Governance and Nominating Committee Charter were each last reviewed and revised in February 2023.

Director Independence

Director independence is an essential requirement for sound governance. Our Corporate Governance Guidelines provide that a substantial majority of the Board must be independent. The Board has adopted independence standards that are consistent with the independence standards of the NYSE and the SEC. An “independent” Director is one who has no material relationship with the Company, other than as a Director, either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company.

The CG Committee provides recommendations to the Board with respect to whether an individual Director is independent, and the Board annually reviews and makes an affirmative determination of each Director's independence.

The CG Committee and the Board consider all relevant facts and circumstances in making independence recommendations and independence determinations. In addition, the Board has adopted certain categorical standards to assist in determining a Director's independence. Specifically, a “material relationship” with the Company exists and, therefore, a Director will not be independent, if any of the following applies:

1.The Director is or has been employed by the Company within the last three years (other than as a former interim Chair or a former interim CEO); or the Director’s immediate family member is or has been employed by the Company within the last three years as an executive officer;

2.The Director has received, or the Director has an immediate family member who has received, during any 12-month period in any of the last three years, more than $120,000 in direct compensation from the Company (other than Director and committee fees, pension, or other forms of deferred compensation for prior service so long as such compensation is not contingent on continued service);

3.The Director is a current partner or employee of a firm that is the Company’s current independent registered public accounting firm; the Director has an immediate family member who is a current partner of the Company’s current independent registered public accounting firm; the Director has an immediate family member who is a current employee of the Company’s current independent registered public accounting firm and who personally works on the Company’s audit; or the Director or an immediate family member was, within the last three years, a partner or employee of the Company’s current independent registered public accounting firm and personally worked on the Company’s audit within that time;

4.The Director or an immediate family member is or has been, within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee;

5.The Director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or two percent of such other company’s consolidated gross revenues; or

6.The Director or an immediate family member has been an executive officer of a foundation, university, non-profit trust, or other tax-exempt charitable organization, within the last three years, for which contributions from the Company and its respective trusts or foundations, account or accounted for more than the greater of $1 million, or two percent of such charitable organization’s consolidated gross revenue.

Director Independence Determinations

In considering the independence of the Directors, the CG Committee examined any transactions between Directors and the Company in 2022. In particular, the CG Committee considered Mr. Hoolihan's relationship to Industrial Lubricant Company (ILCO). ILCO is owned and operated by Mr. Hoolihan's immediate family members. ILCO provides lubricant products and services to one of the Company's generating facilities and to one of the Company's subsidiaries, BNI Energy, Ltd. During 2022, Company payments to ILCO totaled $603,956. The CG Committee reviewed the ILCO transactions, without Mr. Hoolihan's participation, and determined that the transactions with ILCO did not constitute a material relationship for purposes of the Company’s categorical standards in determining a Director’s independence. Further, Mr. Hoolihan had no personal involvement in the transactions and the transactions were not material to him or to any person or entity with whom he has an affiliation. The CG Committee concluded that Mr. Hoolihan did not have a direct or indirect material interest in the transactions. The CG Committee previously considered similar transactions that occurred in 2021 and 2020 and reached the same conclusions. Based on this, the CG Committee recommended to the Board, and the Board affirmatively determined, that these transactions did not impair Mr. Hoolihan's independence.

Applying the Company's independence standards and considering all relevant facts and circumstances in accordance with our determination process, the Board affirmatively determined that each Director, except Ms. Owen, is independent.

ALLETE's Board of Directors

ALLETE is overseen by a Board of Directors made up of highly qualified individuals with diverse skills, attributes, and experiences. We recognize the importance of a well-balanced Board with both the individual capabilities and the collective strengths to effectively address the Company's evolving needs and to act in the best interests of our shareholders, customers, employees, and communities.

| | | | | | | | | | | | | | |

| Board Structure |

| Independent Lead Director | | All committees comprised of and chaired by independent Directors | | All Directors, except Ms. Owen, are independent |

|

|

|

| | | | | | | | | | | | | | | | | |

| Board Members and Committee Memberships |

| Independent | Director Since | Audit Committee | ECHC Committee | CG Committee |

| Bethany M. Owen, Chair | | 2019 | | | |

| Susan K. Nestegard, Lead Director | l | 2018 | u | u | u |

| George G. Goldfarb | l | 2012 | v« | | |

| James J. Hoolihan | l | 2006 | | | u |

| Madeleine W. Ludlow | l | 2004 | | u | v |

| Charles R. Matthews | l | 2022 | u « | | |

| Douglas C. Neve | l | 2007 | u « | | u |

| Barbara A. Nick | l | 2020 | u | u | |

| Robert P. Powers | l | 2017 | | v | |

| Charlene A. Thomas | l | 2021 | u | u | |

v Chair u Member « Audit committee financial expert within the meaning of SEC rules |

| | | | | | | | | | | | | | |

| Board Composition |

50% of Directors self identify as women | | 20% of Directors self identify as Black or African American | | 50% of Directors have served on the Board less than five years |

|

|

|

Director Experience and Attributes

The Board has identified key skills, attributes, and expertise that are important for our Board based on the Company’s strategy and operations. Each Director brings a wealth of experience. The CG Committee regularly reviews with the Board the experience and attributes desired for effective governance in our changing industry and evaluates Board composition.

| | | | | | | | | | | | | | |

| Leadership and Strategy |

Directors who hold or have held significant leadership positions provide valuable leadership and strategy insights, as well as the ability to identify and help develop those qualities in others. They have practical understanding of strategy development, know how to create growth, and value and prioritize a strong corporate culture.

All of our Directors have experience with public company leadership and corporate governance, as well as experience in owning and driving strategy. Particular Director leadership and strategy experience includes: |

CEO Experience Ms. Owen, Mr. Goldfarb, Mr. Hoolihan, Ms. Ludlow, Mr. Matthews, and Ms. Nick

Legal & Regulatory Expertise Ms. Owen, Ms. Ludlow, Mr. Matthews, Mr. Neve, Ms. Nick, and Mr. Powers

Executive Compensation Expertise: Ms. Owen, Ms. Nestegard, Mr. Goldfarb, Ms. Ludlow, Mr. Matthews, Mr. Neve, Ms. Nick, Mr. Powers, and Ms. Thomas

Regional Business Expertise Ms. Owen, Ms. Nestegard, Mr. Goldfarb, Mr. Hoolihan, Mr. Matthews, Mr. Neve, and Ms. Nick

|

| | | | |

| Finance & Risk Management |

Directors who have financial experience, including experience with complex financings and financial reporting, provide important skills and insight to the Board, especially given the highly capital-intensive nature of our business. Effectively managing risk in a rapidly changing environment is also critical to our success.

All of our Directors have financial experience as well as experience in identifying and executing processes to mitigate risk. Particular Director finance and risk management experience includes: |

Chief Financial Officer Experience Mr. Goldfarb, Ms. Ludlow, and Mr. Neve

Qualify as Audit Committee Financial Experts Mr. Goldfarb, Ms. Ludlow, Mr. Matthews, and Mr. Neve

Cybersecurity Expertise Ms. Owen, Mr. Matthews, Mr. Neve, Ms. Nick, and Mr. Powers

|

| | | | |

| Energy/Renewable Energy Industries & Business Transformation |

Directors with experience leading dynamic, evolving, and complex operations in a rapidly changing industry environment are strategically equipped to oversee ALLETE's "sustainability in action" strategy execution.

All of all Directors have experience in dynamic industries that require extensive compliance obligations. Particular Director expertise includes: |

Business Transformation Experience Ms. Owen, Ms. Nestegard, Mr. Goldfarb, Mr. Hoolihan, Ms. Ludlow, Mr. Matthews, Ms. Nick, Mr. Powers, and Ms. Thomas

Transactional Experience: Ms. Owen, Ms. Nestegard, Mr. Goldfarb, Mr. Hoolihan, Ms. Ludlow, Mr. Matthews, Mr. Neve, Ms. Nick, and Mr. Powers

|

Board Diversity and Director Nominations

ALLETE seeks Directors whose diverse skills, experiences, backgrounds, and perspectives will serve shareholders well and contribute to sound corporate governance. The Board values diversity and believes representation from a range of professional backgrounds, as well as a mix of gender, racial, cultural, geographic, and other diverse perspectives enhances effective governance, contributes to robust discussion, and drives successful performance by increasing understanding of the expectations and viewpoints of our investors and other stakeholders. As we continue to refresh our Board over time, we will continue to seek for consideration candidates who, among other attributes, will enhance the Board's racial and ethnic diversity.

The CG Committee regularly reviews the skills, expertise, and attributes that are important for effective governance of the Company and recommends Director candidates to the Board. The CG Committee will consider any person proposed by a Director, management, a search firm, or any shareholder. All Director candidates will be evaluated based on the criteria identified below, regardless of who proposed such person.

In selecting Director nominees, the Board considers multiple factors including: integrity, qualifications, diversity, age, skills, experience, independence, commitment to sustainability as outlined in the Corporate Sustainability Report, how the candidate's relevant experience would complement and enhance Board composition, Board succession plans, the candidate's ability and willingness to devote adequate time to Board duties, and the likelihood that they will be willing and able to serve on the Board for a sustained period. The Board considers its overall balance of perspectives, backgrounds, and experiences; as part of this, the Board will consider whether a candidate's background will enhance the Board's racial and ethnic diversity. The CG Committee will consider the candidate's independence in accordance with ALLETE's Corporate Governance Guidelines and the NYSE and SEC rules. Director nominees must be willing and able to devote adequate time and attention to Board service, must demonstrate independent thinking, a collaborative nature, and stakeholder awareness. Director nominees must have experience with business and strategic planning, as well as prior service on, or experience working closely with, a board of directors. In connection with the selection, due consideration will be given to a candidate's particular experience, including but not limited to: executive corporate leadership experience; understanding of board committee functions; understanding of generally accepted accounting principles; financial expertise (including qualification as an audit committee financial expert within the meaning of the SEC's rules); financing experience; auditing experience; human resource and executive compensation expertise; strategic planning and business development experience; experience with regulated utilities; strategic experience with renewable energy businesses or technologies; familiarity with the regions in which Company provides services; and community leadership.

The Board may engage a search firm to assist in identifying and conducting due diligence on potential Director nominees.

Before making contact with a potential candidate, the CG Committee will notify the Board of its intent to do so, will provide the candidate's name and background information to the Board, and will allow time for Directors to comment. The CG Committee will screen potential candidates for the Board. A majority of the CG Committee members will interview any candidate before recommending that candidate to the Board. The recommendations of the CG Committee will be timed so as to allow Board members an opportunity to interview the candidate prior to the nomination of the candidate. The Board as a whole is responsible for nominating individuals for election to the Board and for filling vacancies on the Board that may occur between annual shareholders' meetings.

A shareholder who wishes to propose a candidate should provide the person's name and a detailed background of the candidate's qualifications to the Corporate Governance and Nominating Committee, c/o Corporate Secretary, ALLETE, Inc., 30 West Superior Street, Duluth, MN 55802.

Board Leadership

Ms. Owen has served as Board Chair since May 2021. As Chair, Ms. Owen presides over meetings of the Board, presides over meetings of the shareholders, consults with and advises the Board and its committees on the Company's business and affairs, and performs other duties as may be assigned by the Board.

Consistent with ALLETE's Corporate Governance Guidelines, because the Board Chair is not independent, the independent Directors select an independent Lead Director on an annual basis. The Lead Director:

•presides when the Board meets in executive session;

•presides at Board meetings when the Chair is not present to lead the Board's deliberations;

•serves as an ex officio member of each Board committee;

•serves as a liaison between the Chair and the independent Directors when necessary to provide a supplemental communication channel;

•works with the Chair to develop Board meeting agendas, schedules, and information to be provided to Directors;

•leads the evaluation of CEO performance in consultation with the CG Committee; and

•performs other duties as requested by the independent Directors.

The Board believes that its leadership structure—a combined Board Chair and CEO, an independent Lead Director, and committees comprised of and chaired by independent Directors—is the most effective for ALLETE at this time. In reaching this determination, the Board considered factors including the Company's size, the diversity and experience of our independent Board members, Ms. Owen's industry and governance experience, the Board's effective use of the Lead Director who provides coordination and leadership for the independent Directors, and the active engagement by all Directors.

The Board has three standing committees: the Audit Committee, the Executive Compensation and Human Capital Committee, and the Corporate Governance and Nominating Committee. We anticipate that committee chairs will rotate among Directors. The Board recognizes that rotating chairs provides development for the Directors and allows a variety of perspectives in leadership positions.

Audit Committee

| | | | | |

George G. Goldfarb (Chair) Susan K. Nestegard (ex officio) Douglas C. Neve Barbara A. Nick Charles R. Matthews Charlene A. Thomas

Five meetings during 2022

Audit Committee Report—page 83

| The Audit Committee helps oversee and monitor the following: •Integrity of financial statements •Internal controls over financial reporting •Compliance with corporate policies and procedures •Compliance with legal and regulatory requirements •Qualifications, independence, and performance of independent registered public accounting firm •Performance of internal audit function •Review of the adequacy and effectiveness of information security policies and internal controls regarding information security •Review and evaluation of accounting policies •Review of periodic financial reports to be provided to the public, and, upon favorable review, recommending approval of ALLETE's Consolidated Financial Statements

All Audit Committee members are independent under ALLETE's Corporate Governance Guidelines, within the meaning of SEC rules, and in accordance with NYSE listing standards.

All Audit Committee members are financially literate and three Audit Committee members qualify as an "audit committee financial expert" as defined by SEC rules. |

Executive Compensation and Human Capital Committee

| | | | | |

Robert P. Powers (Chair) Susan K. Nestegard (ex officio) Madeleine W. Ludlow Barbara A. Nick Charlene A. Thomas

Five meetings during 2022

ECHC Committee Report—page 55

| The ECHC Committee helps oversee and monitor Director and executive compensation and workforce strategy by: •Establishing compensation philosophy and policies related to Director and executives •Setting CEO compensation •Ensuring links between executive compensation and sustainability strategy as described in the Corporate Sustainability Report •Ensuring that design of Director and executive compensation is equitable, competitive, and aligned with compensation philosophy •Overseeing the administration of ALLETE's Director and executive compensation programs •Overseeing policies and strategies related to culture, safety, and human capital management, including DE&I

All members of the ECHC Committee qualify as “independent directors” under NYSE rules, “non-employee directors” under Rule 16b-3 under the Exchange Act, and “outside directors” under Section 162(m) of the Tax Code. |

Corporate Governance and Nominating Committee

| | | | | |

Madeleine W. Ludlow (Chair) Susan K. Nestegard (ex officio) James J. Hoolihan Douglas C. Neve

Four meetings during 2022

| The CG Committee assists with corporate governance oversight by: •Making recommendations to the Board with respect to Board membership, function, committee structure and membership, succession planning for executive management, and application of corporate governance principles •Performing the functions of a Director-nominating committee •Overseeing the Board's annual evaluation of the CEO •Developing and recommending to the Board standards for determining a director's independence •Providing recommendations to the Board with respect to independence determinations •Establishing guidelines for stock ownership •Reviewing ESG activities and overseeing ESG reporting The CG Committee is authorized to exercise the authority of the Board in the intervals between Board meetings. |

Board Role in Risk Oversight

The Board is responsible for risk management oversight at the Company. While the Board as a whole exercises direct oversight of strategic risks and other critical risk areas with enterprise-wide significance to the Company, substantial aspects of risk oversight are delegated to Board committees and management. The Board administers its risk oversight function in a variety of ways, including through a thoughtfully designed leadership and oversight structure illustrated as follows:

| | | | | | | | | | | | | | |

| Board of Directors |

Directly oversees ALLETE's strategy and critical risk areas with enterprise-wide significance to the Company; Reviews and discusses with management significant risks affecting ALLETE, including matters identified by Board committees from within their respective oversight areas, and oversees how senior management manages enterprise-level risks. |

| | | | | | | | | | | | | | |

| Audit Committee | | ECHC Committee | | CG Committee |

Oversees: financial reporting processes, business conduct, tax, and other financial risks; the appointment, evaluation, and oversight of the Company's independent registered public accounting firm; the internal audit function; legal and regulatory compliance, significant legal matters; insurance programs; market and credit risks; and physical and cybersecurity risks. | | Oversees: the design and administration of executive compensation policies and programs and ensures that executive compensation programs link to ALLETE's sustainability strategy. Also has primary responsibility for assisting the Board with oversight of ALLETE's talent strategy and programs to attract, develop, engage, and retain talent; ALLETE's safety policies, and strategies; DE&I initiatives; and human capital risks. | | Oversees: Board structure and function, including corporate governance risks; Board independence; Board succession and composition; CEO succession planning; code of ethics; and political contributions and lobbying policy. Also has primary responsibility for assisting the Board with oversight of ESG reporting. |

| | | | | | | | | | | | | | |

| Senior Management |

| ALLETE's CEO, CFO, Chief Legal Officer, Chief Risk Officer, and other senior leaders are responsible for implementing and supervising enterprise risk-management processes. Management confers with and reports to the Board and its committees with respect to key enterprise risk indicators, risk management and mitigation practices, and other significant matters. |

| | | | | | | | |

| Internal Audit Function | | Enterprise Risk Management Program |

Directly overseen by the Audit Committee. Prepares audit plans that are reviewed and approved by the Audit Committee at least annually. | | Ensures that strategic goals align with ALLETE’s mission, vision, and values and that decision-making and strategy execution includes adequate consideration of the associated risks. Includes the ALLETE Risk Management Committee, made up of executive officers and ALLETE's Chief Risk Officer, which regularly identifies and assesses key risks and defines procedures for mitigating and reporting significant risks. |

This tiered and structured approach provides a comprehensive framework designed to protect the interests of our shareholders and other stakeholders.

Code of Business Conduct and Ethics

ALLETE has adopted a written Code of Business Conduct (which includes our code of ethics) that applies to all Directors and employees and officers, including the CEO and the CFO, who is also the Company's principal accounting officer. The Code of Business Conduct also applies to our contractors, suppliers, and vendors. ALLETE's Code of Business Conduct is available on our website at www.allete.com/governance. Any amendment to the Code of Business Conduct, or waiver the Code of Business Conduct involving a Director or NEO, will be published on ALLETE's website promptly following the date of such amendment or waiver.

Shareholder Engagement

We seek out meaningful engagement with shareholders to understand their perspectives on corporate governance, executive compensation, and other issues that matter to investors. We engage with shareholders throughout the year to provide visibility and transparency into our businesses and our financial and operational performance, to listen to shareholders' perspectives and understand shareholders' expectations of us, to share our environmental and sustainability strategy and accomplishments, and to receive feedback on our communications and disclosures to shareholders.

Throughout the year, senior management and our investor relations team meet with analysts and institutional investors to review financial and other business and strategic issues, as well as to solicit input, provide perspective on Company policies and practices, and answer questions. We participate in investor conferences, other formal events and groups, and also in one-on-one meetings. We also engage with representatives of our large shareholders to discuss our programs and learn about the key areas on which their clients are focusing. During 2022, we contacted shareholders owning approximately 59% of our outstanding Common Stock, resulting in substantive engagements with the holders of approximately 38% of our outstanding shares. We discussed topics including: ALLETE's financial and operational performance; growth initiatives; strategy updates; dividend practices; executive compensation practices; and corporate governance practices, as well as ESG strategy, performance, and reporting.

The Board receives regular reports from senior management and ALLETE's investor relations team about shareholder engagements and what our investors are telling us about topics that matter to them.

Political Contributions and Lobbying

ALLETE believes that public policy engagement is an important part of responsible corporate citizenship. We participate in this process in accordance with good corporate governance practices. ALLETE's policy regarding political contributions and lobbying is overseen by the CG Committee. Our policy governs the Company’s corporate contributions to organizations registered under Section 527 of the Internal Revenue Code and ballot measures or initiative campaigns that impact the Company’s business. On the state level, employees have the opportunity—on a voluntary basis—to make political contributions through political action committees (PACs). Coordination of lobbying activities is done through ALLETE’s Safety and External Affairs Officer with the prior approval of senior management. All political contributions and lobbying activities are done in compliance with all laws and regulations.

ALLETE's Political Contributions and Lobbying Policy is available at on our website at

www.allete.com/Governance.

Sustainability, ESG Oversight, and Corporate Responsibility

Our commitment to sustainability is led and supported through strong Board leadership, intentional management focus, and sound corporate governance practices. The Board oversees ALLETE’s strategy, Enterprise Risk Management program, and ESG-related matters, including the evaluation of sustainability-related risks and opportunities, all in a manner designed to drive performance for our shareholders and other stakeholders. We honor our commitments to our customers, our communities, and the climate by acting to advance sustainability goals. Corporate responsibility is integrated into our governance processes and is embedded in our strategy and our core values, namely: integrity, safety, people, and planet.

ALLETE recognizes that impacts from human activity, including climate change, are real, and we are taking action to transform the nation’s energy landscape through sustainable solutions. ALLETE is committed to leading the path toward a carbon-free energy future. We are poised to add significantly more clean energy in the coming years while ensuring reliable, resilient energy delivery to our customers. Our overall strategy is to enhance and grow our companies by providing sustainable energy solutions to meet changing societal expectations and evolving regulations, and all of our companies play an important role in this strategy. We also recognize that the transition to a clean-energy future will only be truly successful if it is just and equitable, with new opportunities and investments designed to give everyone an opportunity to thrive.

Each business units’ mission, customer mix, and regulatory status are all key drivers in determining the carbon reduction strategies employed. Our "sustainability in action" growth strategy involves: continuing to reduce carbon emissions, delivering cleaner energy sources to our customers, strengthening the electric grid to accommodate for more intermittent renewable resources, and implementing innovative solutions to enhance resiliency for all our businesses. ALLETE's comprehensive ESG program also includes a committed social focus, which includes advancing DE&I in our workforce, supply chain, and community giving, outreach and engagement with tribal nations, health and wellness safety initiatives, as well as enhanced sustainability communication and disclosures.

The CG Committee oversees the process related to ESG matters and receives regular updates from senior management on such matters. During 2022, management actively engaged with investors and other key stakeholders to discuss ALLETE's sustainability strategy and initiatives and to gain insights into stakeholders' perspectives about sustainability and corporate responsibility, and how to effectively measure, communicate, and disclose our efforts. In January 2023, we released an update to our Corporate Sustainability Report, which can be found at our website www.allete.com/sustainability.

| | | | | | | | |

| Climate Milestones and Initiatives |

| Expand Renewable Energy Sources | For the past two years, ALLETE has ranked first among U.S.-based investor-owned utilities for investment in renewable energy based on market capitalization. Minnesota Power received approval for a resource plan that calls for adding up to 400 megawatts of wind energy and up to 300 megawatts of solar energy. |

| Reduce Overall Carbon Emissions | ALLETE’s approach to decarbonization includes coal fleet retirements, conversion to natural gas, and partnering with customers on carbon capture and sequestration projects. |

| Carbon-Free Vision | In 2021, Minnesota Power announced its vision to deliver

100% carbon-free energy by 2050. We expect a new Minnesota law requiring 100% carbon-free energy by 2040 to drive additional

clean-energy opportunities in our next integrated resource plan. |

| Strengthen the Electric

Grid | ALLETE is investing in infrastructure for managing the delivery of increasing amounts of renewable energy and enhancing the resiliency and reliability of the transmission and distribution grid. |

| Solar Projects | In April 2022, ALLETE acquired New Energy, one of the nation's leading distributed solar developers that has successfully completed hundreds of solar projects around the country, which together produce more than 580,000,000 kilowatt hours of electricity per year. |

| Adopt Innovative Solutions | We are reducing water use, investing in infrastructure that will be more resistant to weather changes, and implementing strategic underground replacements for energy-delivery components to reduce vulnerability to climate impacts. |

| | | | | | | | |

| Sustainability-Focused Workforce Practices |

| Leadership Diversity Recognition | Recognized by the Minnesota Census of Women in Corporate Leadership as an "Honor Roll" company since 2017, with additional special distinction since 2019 for having women representing at least 30 percent of our executive officers. In 2021, Moody’s Investors Service recognized ALLETE as having the most gender diverse board among 45 publicly traded utilities. |

| Diversity, Equity and Inclusion | Regularly updating recruitment practices and requiring training for all employees to enhance workplace DE&I; focus corporate giving and scholarships to help bridge community opportunity gaps. |

| Supply Chain | Expanding and partnering with diverse suppliers, better reflecting the diversity of the communities we serve; ALLETE provides equal access for all qualified businesses in our supply chain. |

| Veteran Outreach and Support | Minnesota Power and ALLETE Clean Energy each has been designated a "Yellow Ribbon" company, in recognition of the support provided for the needs of military-connected employees and families. |

| Employee Well-Being | Comprehensive health and wellness benefits and safety resources that support healthy, productive, and engaged employees. |

Meetings of Independent Directors

At each regularly scheduled Board meeting, the independent Directors meet in executive session for discussion without management present. These meetings are chaired by the Lead Director. The Board has direct access to management and meets with members of management individually when it deems appropriate.

Board Contact with Management and Independent Advisors

Executive officers and other management employees are regularly included in Board and committee meetings, as deemed appropriate. Directors may meet individually with executive officers and other management employees.

The Board and its committees also retain their own independent advisors at their discretion.

Board and Committee Evaluations

The Board and its committees undertake self-evaluations on an annual basis.

The Board's self-evaluation includes soliciting opinions from the Directors about topics related to Board effectiveness including:

•The sufficiency of and timeliness of briefing materials provided to Directors;

•The content and conduct of Board meetings;

•The adequacy of time allocated to, and the quality of, presentations and discussions;

•The Board's access to management;

•The Board’s understanding of issues;

•The Board’s consideration of shareholders’ interests in making decisions;

•The overall mix of characteristics and skill sets represented by Board members; and

•Any area previously identified by Board members as requiring improvement.

The assessments are used to improve Board performance and effectiveness.

Each Board committee's self-evaluation addresses matters the committee considers relevant to its performance, including a review and assessment of the adequacy of the committee's charter. A report on each committee's self-evaluation is presented to the Board.

Meeting Attendance

Our Corporate Governance Guidelines provide that Directors are expected to regularly attend Board meetings and meetings of the committee or committees on which they serve. The Board held nine meetings during 2022 and each Director attended every Board meeting. Each Director attended

100 percent of the aggregate number of meetings held in 2022 by the committees on which they served. Mr. Matthews, who was elected to the Board on July 6, 2022, attended every Board meeting held in 2022 since becoming a Director; Mr. Matthews also attended every meeting of the committee on which he serves that was held in 2022 since he became a Director.

Directors standing for election are expected to attend the Annual Meeting. Each Director attended the 2022 Annual Meeting.

Director Continuing Education

Ongoing development is an important aspect of governance. In addition to the frequent updates on corporate governance practices and requirements provided by the Company, Directors are asked to attend educational seminars, and to share their experiences with the other Directors. During 2022, Directors attended educational courses presented by outside entities on a variety topics including:

financial reporting; accounting; corporate taxation; addressing urgent climate change risks, cyber security risks and mitigation; resilient leadership; key strategic issues facing power and utility industries; challenges and opportunities associated with electric vehicles; information technology trends; and delivering shareholder value through strategic oversight.

In addition, Directors attended educational presentations hosted by the Company in 2022 covering the following topics: regional economic development; global and regional mining industry updates, including decarbonization trends, ESG initiatives, technological advancements, and domestic and international geopolitical industry trends; water treatment and hydroelectric operations; the Infrastructure Investment and Jobs Act and the Inflation Reduction Act of 2022 in relation to Company strategy; energy and utility sector shareholder landscape; and strategic and market developments in the electric utility industry.

Share Ownership Guidelines

The CG Committee has determined that Directors and executive officers should have an equity interest in the Company. The CG Committee believes that such equity ownership aligns the Directors' interests with those of the Company's shareholders. Accordingly, the Board has adopted stock ownership guidelines.

Directors are expected to own at least 500 shares of Common Stock prior to their election to the Board. Further, within five years of their election to the Board, non-employee Directors are expected to own shares worth at least five times the amount of the annual cash retainer paid to Directors. Executive stock ownership guidelines are discussed in the CD&A on page 33.

The CG Committee regularly reviews the stock ownership guidelines and may recommend changes to the Board as it deems appropriate.

Related Person Transactions

The Board recognizes that in the ordinary course of business, transactions may occur between ALLETE and its subsidiaries and entities with which some of our Directors and officers are or may have been affiliated. Such transactions are evaluated in accordance with ALLETE's Related Person Transaction Policy, which was last reviewed and approved by the Board in July 2022, and is available at www.allete.com/Governance.

Related persons include Directors, Director nominees, executive officers, and five percent shareholders, as well as their immediate family members and any entity controlled by these individuals or in which these individuals have a substantial financial interest.

The Related Person Transaction Policy applies to a financial transaction or arrangement, or a series of similar transactions or arrangements, which exceeds $25,000 annually or $6,250 quarterly, in which a related person has or will have a direct or indirect material interest.

Transactions between the Company and a related person generally require advance approval by the CG Committee. If a new situation arises where advance approval is not practical, it is discussed with the Chair of the CG Committee, or with another CG Committee member designated by the committee; an appropriate response might include subsequent ratification by the CG Committee.

The CG Committee also periodically reviews and assesses related person relationships to ensure ongoing fairness to the Company. Any member of the CG Committee who has an interest in a transaction will abstain from voting, but may participate in the discussion if invited to do so by the

CG Committee Chair, or the Lead Director if the CG Committee Chair has an interest in the transaction.

The CG Committee considers factors it deems relevant in determining whether to approve a related person transaction, including:

•the extent of the related person's interest in the transaction;

•the availability of comparable products or services from non-related persons;

•whether the transaction is on terms comparable to those that could be obtained in an arm's-length dealing with an unrelated third party;

•the business reasons to enter into the transaction;

•whether the transaction could impair the independence of a Director;

•whether the annual amount involved exceeds the greater of $200,000 or 5 percent of the recipient's gross revenues for the year; and

•whether the transaction would present an improper conflict of interest, taking into account the size of the transaction, the overall financial position of the related person, the direct or indirect relationship of the related person, and the ongoing nature of any proposed relationships.

Communications between Shareholders and Other Interested Parties and the Board

We believe that it is an important aspect of corporate governance to facilitate direct communication between the Board and shareholders and other stakeholders. Shareholders and other stakeholders may communicate directly with our Board, with any specified group of Directors, such as a Board committee or independent Directors, or with any individual Director. Such communications should be in writing and addressed to the Lead Director, c/o Corporate Secretary, ALLETE, Inc., 30 West Superior Street, Duluth, MN 55802. Communications that are determined to be primarily commercial in nature, such as business solicitations and advertisements, will not be forwarded to the Board.

ITEM NO. 2—ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION ________________________________________________________________

We are asking our shareholders to cast a non-binding, advisory vote approving compensation for our NEOs as reported in this Proxy Statement.

ALLETE's executive compensation program is designed to enhance shareholder value while attracting and retaining experienced, qualified executives. To fully understand ALLETE's 2022 executive compensation, we encourage you to read the CD&A, starting on page 33 as well as the compensation tables and narrative disclosures that follow the CD&A. Those sections describe how our compensation programs are designed to achieve ALLETE's compensation objectives and provide detailed information on the 2022 compensation of our NEOs. We believe our executive compensation program reflects a pay-for-performance philosophy and is aligned with shareholders' long-term interests.

This proposal, commonly known as "say-on-pay," is required under Section 14A of the Exchange Act. Although this say-on-pay vote is advisory and not binding on the Company, the ECHC Committee and the Board will review the voting results and will take the outcome of the vote into account when considering future executive compensation decisions.

Although the ECHC Committee and the Board will consider the outcome of the advisory shareholder vote on say-on-pay frequency in Item No. 3 of this Proxy Statement, we expect the next advisory shareholder say-on-pay vote will occur at the 2024 Annual Meeting.