Amended Statement of Beneficial Ownership (sc 13d/a)

March 15 2023 - 10:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 1) *

Todos

Medical Ltd.

(Name

of Issuer)

Ordinary

Shares, par value NIS 0.01 per share

(Title

of Class of Securities)

M8790Y108

(CUSIP

Number)

Strategic

Investment Holdings, LLC

875

Carretera 693, Suite 201

Dorado,

PR 00646

Tel:

(787) 626-6500

(Name/Address/Telephone

Number of Person Authorized to Receive Notices and Communications)

March

13, 2023

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box [X].

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

13d-7(b) for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D

| CUSIP

No. M8790Y108 |

|

Page

2 of 5 |

| 1 |

NAME

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON (ENTITIES ONLY)

Strategic

Investment Holdings, LLC (ID 82-1548155) |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

[ ]

(b)

[ ] |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Nevada,

USA |

Number

of

shares

beneficially

owned

by each

reporting

person

with |

7 |

SOLE

VOTING POWER

78,600,000 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

78,600,000 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

78,600,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS) [ ]

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.14% |

| 14 |

TYPE

OF REPORTING PERSON

CO |

| CUSIP

No. M8790Y108 |

|

Page

2 of 5 |

| 1 |

NAME

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSON (ENTITIES ONLY)

Robb

Rill |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

[ ]

(b)

[ ] |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Nevada,

USA |

Number

of

shares

beneficially

owned

by each

reporting

person

with |

7 |

SOLE

VOTING POWER

78,600,000 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

78,600,000 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

78,600,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS) [ ]

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.14% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

Explanatory

Note

This

Amendment No. 1 amends and supplements the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on

February 17, 2023. Except as otherwise specified in this Amendment No. 1, all items left blank remain unchanged in all material respects.

Capitalized terms used herein but not defined have the respective meanings ascribed to them in the Schedule 13D.

Item

1. Security and Issuer

This

Schedule 13D relates to the common shares of Todos Medical Ltd. (the “Company”). The address of the principal executive office

of the Company is 121 Derech Menachem Begin, 30th Floor, Tel Aviv, 6701203 Israel.

Item

2. Identity and Background

| |

(a) |

This

Schedule 13D is filed by Strategic Investment Holdings, LLC, a Nevada limited liability company, (“SIH”) and Robb Rill,

the manager of SIH, (the “Manager”), (SIH and the Manager are collectively referred to as the “Reporting Persons”). |

| |

(b) |

The

Reporting Persons’ principal business and principal office address is 875 Carretera 693, suite 201, Dorado, PR 00646. |

| |

(c) |

SIH

is a private investor whose principal occupation is making private investments. The Manager is the manager of SIH. |

| |

(d) |

During

the last five years, the Reporting Persons have not been convicted in a criminal proceeding. |

| |

(e) |

During

the last five years, the Reporting Persons have not been a party to a civil proceeding of any judicial or administrative body of

competent jurisdiction as a result of which neither it nor either of them was or is subject to a judgment, decree or final order

enjoining future violations at, or prohibiting or mandating activities subject to, federal or state securities laws or finding any

violation with respect to such laws. |

| |

(f) |

SIH

is domiciled in the state of Nevada. |

Item

3. Source and Amount of Funds or Other Consideration

The

sale of 72,804,000 shares of the Company reported hereunder were issued to SIH as payment for $1,097,000 of a $3,500,000

Convertible Note issued by the Company as partial payment for the Company’s purchase of Provista Diagnostics, Inc from SIH.

Item

4. Purpose of Transaction

The

Reporting Persons acquired the 72,804,000 shares of the Company reported as sold hereunder as payment for the Company’s

purchase of Provista Diagnostics, Inc.

Item

5. Interest in Securities of the Issuer

Item

5 of this 13D is amended and supplemented as follows:

| |

(a) |

The

Reporting Persons beneficially own 78,600,000 common shares of the Company. In determining the percentage ownership of the

outstanding common shares, the Reporting Persons are relying on the most recently available information obtained from the Company’s

transfer agent and published by the OTC Markets which indicates 1,899,770,981 common shares are outstanding as of March

10, 2023. Based on the foregoing, The Reporting Person’s ownership represents approximately 4.14% of the outstanding

common shares. The Manager is deemed to be the beneficial owner of all shares owned by SIH. |

| |

|

|

| |

(b) |

Subject

to the above discussion, SIH has sole power to vote and dispose of 78,600,000 common shares; and the Manager has complete

power to vote and dispose of the 78,600,000 common shares held by SIH. |

| |

(c) |

The

Reporting Persons have effected the following transactions in securities not previously reported.

All sales were effected by such Reporting Person in public market transactions.

|

| Name

of Security | |

Purchase

or Sale | |

Date | | |

Number

of Shares | | |

Price

per Share | |

| Common

Stock | |

Sale | |

3/01/2023 | | |

| 1,000,000 | | |

$ | .002 | |

| Common

Stock | |

Sale | |

3/02/2023 | | |

| 4,800,000 | | |

$ | .001906 | |

| Common

Stock | |

Sale | |

3/03/2023 | | |

| 1,200,000 | | |

$ | .0019 | |

| Common

Stock | |

Sale | |

3/06/2023 | | |

| 1,200,000 | | |

$ | .0017 | |

| Common

Stock | |

Sale | |

3/07/2023 | | |

| 500,000 | | |

$ | .00168 | |

| Common

Stock | |

Sale | |

3/08/2023 | | |

| 2,700,000 | | |

$ | .001511 | |

| Common

Stock | |

Sale | |

3/10/2023 | | |

| 36,004,000 | | |

$ | .00108 | (1) |

| Common

Stock | |

Sale | |

3/13/2023 | | |

| 25,400,000 | | |

$ | .000835 | (2) |

| (1) | Reflects

the weighted average sales price. These shares were sold in multiple transactions at prices

ranging from $.001 to $.0014, inclusive. The reporting person undertakes to provide the staff

of the SEC, upon request, full information regarding the number of shares sold at each separate

price within such range. |

| (2) | Reflects

the weighted average sales price. These shares were sold in multiple transactions at prices

ranging from $.0007 to $.001, inclusive. The reporting person undertakes to provide the staff

of the SEC, upon request, full information regarding the number of shares sold at each separate

price within such range. |

| |

(d) |

No

person other than the Reporting Persons has the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, the 78,600,000 common shares beneficially held by the Reporting Persons. |

| |

|

|

| |

(e) |

N/A. |

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| March

15, 2023 |

/s/

Robb Rill |

| Date |

Signature |

| |

Robb

Rill, Managing Director |

| |

Strategic

Investment Holdings, LLC |

| |

Name/Title |

| |

|

| March

15, 2023 |

/s/

Robb Rill |

| Date |

Name/Title |

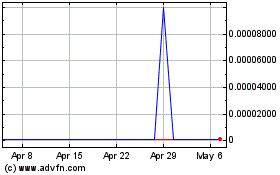

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Mar 2024 to Apr 2024

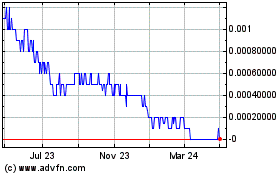

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Apr 2023 to Apr 2024