Current Report Filing (8-k)

March 01 2023 - 2:01PM

Edgar (US Regulatory)

0000866439

false

0000866439

2023-02-24

2023-02-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

and Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 24, 2023

Commission File Number 000-18730

DARKPULSE,

INC.

(Exact name of small business issuer as specified

in its charter)

| Delaware |

|

87-0472109 |

|

(State or other jurisdiction

of incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

815

Walker Street, Suite 1155, Houston,

TX 77002

(Address of principal executive offices)

800-436-1436

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Not applicable. |

|

|

|

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry Into A Material Definitive Agreement. |

On February 24, 2023, DarkPulse, Inc., a Delaware

corporation (the “Company”), entered into an engagement letter (the “Engagement”) with Keystone

Global Holdings and its subsidiaries Keystone Global Strategies, LLC (“Keystone”) and KSG Advisors, LLC, (“KSG”)

together, “Keystone Global” to provide the Company certain services, specifically: (i) Keystone to render strategic

advisory and business development consulting including certain project development, whether related to one project or a series of projects

(the “Consulting Services”) and (ii) KSG, in connection with certain investment banking services related to the

sale of interests in the Company through certain financial instruments issued by the Company or any or all of the Company’s subsidiaries

whether effected in one transaction or a series of transactions (the “Transaction”).

If during the term of the Engagement, Keystone’s

Consulting Services result: (i) in a Definitive Agreement, or (ii) in a fully executed Contract (as defined in the Engagement) between

Company and a Keystone Project Target (as defined in the Engagement), (each a “Contract Award”), then Keystone shall

receive a fee (“Contract Award Fee”) equal to a percentage of the Contract Value (as defined in the Engagement) of

the Definitive Agreement or the Contract Award, regardless of the term of the Definitive Agreement or Contract as follows:

| · | 7% of the first $5 million; and |

| · | 5% on everything above $5 million. |

If during the term of the Engagement, a Transaction

is consummated, or the Company enters into an agreement which subsequently results in a Transaction being consummated with a Keystone

Investor Target (as defined in the Engagement), then KSG shall be paid a cash fee (the “Success Fee”) at the closing

of the Transaction equal to a percentage of the Aggregate Consideration (as defined in the Engagement) payable in connection with the

Transaction as follows:

| · | 7% of the first $5 million; and |

| · | 5% on everything above $5 million |

The Consulting Services shall continue in effect

until one year from the date of the Engagement and the Transaction advisory services shall continue in effect until six months from the

date of the Engagement, unless terminated at any time with or without cause by either Keystone Global or the Company upon ten business

days written notice thereof to the other party.

| Item 7.01 | Regulation FD Disclosure. |

On March 1, 2023, the Company issued press release

which announced the Engagement. The press release is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

The furnishing of the

press release is not an admission as to the materiality of any information therein. The information contained in the press release is

summary information that is intended to be considered in the context of more complete information included in the Company’s filings

with the U.S. Securities and Exchange Commission (the “SEC”) and other public announcements that the Company has made

and may make from time to time by press release or otherwise. The Company undertakes no duty or obligation to update or revise the information

contained in this report, although it may do so from time to time as its management believes is appropriate. Any such updating may be

made through the filing of other reports or documents with the SEC, through press releases or through other public disclosures.

The information in this

Item 7.01 of this Current Report on Form 8-K and the press release shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2)

of the Securities Act of 1933, as amended. The information contained in this Item 7.01 and in the press release shall not be incorporated

by reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DarkPulse, Inc.

|

| |

|

| Date:

March 1, 2023 |

By: |

/s/ Dennis O’Leary |

| |

|

Dennis O’Leary, Chief Executive Officer |

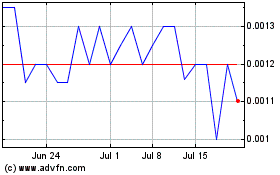

DarkPulse (PK) (USOTC:DPLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

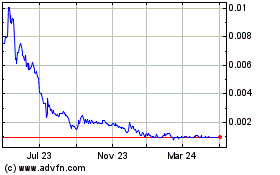

DarkPulse (PK) (USOTC:DPLS)

Historical Stock Chart

From Apr 2023 to Apr 2024