Current Report Filing (8-k)

February 10 2023 - 6:08AM

Edgar (US Regulatory)

0000948320

false

0000948320

2023-02-04

2023-02-04

0000948320

LFMD:CommonStockParValue0.01PerShareMember

2023-02-04

2023-02-04

0000948320

LFMD:SeriesCumulativePerpetualPreferredStockParValue0.0001PerShareMember

2023-02-04

2023-02-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 4, 2023

LIFEMD,

INC.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-39785 |

|

76-0238453 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

236

Fifth Avenue, Suite 400

New

York, NY 10001

(Address

of principal executive offices, including zip code)

(866)

351-5907

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any

of the following provisions:

| ☐ |

Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.01 per share |

|

LFMD |

|

The Nasdaq Global Market |

| Series A Cumulative Perpetual

Preferred Stock, par value $0.0001 per share |

|

LFMDP |

|

The Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

Amendment

of Cleared Technologies Stock Purchase Agreement

As

previously disclosed, on January 11, 2022, LifeMD, Inc., a Delaware corporation (the “Company”), entered into a Stock Purchase

Agreement (the “Purchase Agreement”), by and among the Company, Cleared Technologies, PBC, a Delaware public benefit corporation

(“Cleared”) and the stockholders of Cleared identified in the Purchase Agreement (the “Sellers”).

On

February 4, 2023, the Company entered into the First Amendment to the Purchase Agreement (the “Amendment”), pursuant to which

the Purchase Agreement was amended to, among other things: (i) reduce the total purchase price by $250,000 to a total of $3,670,000;

(ii) change the timing of the payment of the purchase price under the Purchase Agreement to $460,000 paid at closing (which has already

been paid by the Company), with the remaining amount to be paid in 5 quarterly installments beginning on or before February 6, 2023 and

ending January 15, 2024; (iii) removing all “earn-out” payments payable by the Company to the Sellers; and (iv) removing

certain representations and warranties of the Company and Sellers in connection with the transaction.

Except

as modified by the Amendment, the Purchase Agreement remains in full force and effect.

The

foregoing descriptions of the Amendment and the transactions contemplated thereby are not complete and are subject to and qualified in

their entirety by reference to the Amendment, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated

herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

The

information provided in response to Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

As

previously disclosed, the Company may issue shares of its common stock in lieu of cash as the purchase price, if applicable, to persons

who are “accredited investors” as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933, as amended

(the “Securities Act”). The issuance of shares of common stock in lieu of cash as the purchase price in the transaction will

be made in reliance on the exemption from registration afforded under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation

D under the Securities Act.

Cautionary

Statements Regarding Forward-Looking Information

Certain

statements contained in this report that are not statements of historical fact constitute forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, certain plans, expectations,

goals, projections and benefits relating to the Acquisition, which are subject to numerous assumptions, risks and uncertainties. Words

such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,”

“estimated,” ‘‘intends’’ and other similar expressions are intended to identify forward-looking statements

but are not the exclusive means of identifying such statements. Please refer to the Company’s Report on Form 10-K for the year

ended December 31, 2021, as well as its Quarterly Reports on Form 10-Q and other filings with the SEC, for a more detailed discussion

of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements.

Forward-looking

statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which,

by their nature, are inherently uncertain and outside of the management’s control. It is possible that actual results and outcomes

will differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. All forward-looking

statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except

as required by law, the Company does not assume any obligation to update any forward-looking statement.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

*Schedules

and exhibits to the Amendment have been omitted. A copy of any omitted schedule or exhibit will be furnished supplementally to the SEC

upon its request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

LIFEMD, INC. |

| |

|

|

| Dated: |

February

9, 2023 |

By: |

/s/ Eric

Yecies |

| |

|

|

Eric Yecies |

| |

|

|

General Counsel and Chief Compliance Officer |

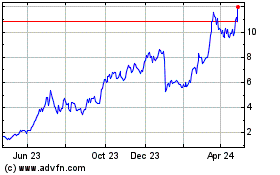

LifeMD (NASDAQ:LFMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

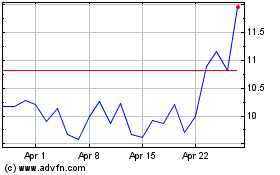

LifeMD (NASDAQ:LFMD)

Historical Stock Chart

From Apr 2023 to Apr 2024