Current Report Filing (8-k)

February 03 2023 - 5:11PM

Edgar (US Regulatory)

false000005604700000560472023-02-032023-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 3, 2023 |

KIRBY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada |

1-7615 |

74-1884980 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

55 Waugh Drive, Suite 1000 |

|

Houston, Texas |

|

77007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (713) 435-1000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KEX |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 3, 2023, Kirby Corporation (the “Company”) entered into a Cooperation Agreement (the “Cooperation Agreement”) with JCP Investment Management, LLC and certain of its affiliates and associates (collectively, “JCP”) regarding matters relating to the election of members of the Company’s Board of Directors (the “Board”) and certain other matters. The following description of the Cooperation Agreement does not purport to be complete and is qualified in its entirety by reference to the Cooperation Agreement, a copy of which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

Pursuant to the Cooperation Agreement, the Company agreed, among other things, to appoint Rocky B. Dewbre to the Board as a Class II director with a term expiring at the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”).

During the period beginning on the date of the Cooperation Agreement and ending on the earlier of (a) thirty (30) days prior to the deadline under the Company’s Bylaws for director nominations and stockholder proposals for the 2024 Annual Meeting and (b) one hundred and twenty (120) days prior to the first anniversary of the 2023 annual meeting of stockholders (the “Standstill Period”), JCP has agreed to certain standstill provisions, including, among other things, agreeing not to (i) acquire beneficial ownership in excess of four-and-a-half times (4.5x) the percentage of the Company’s outstanding common stock represented by JCP’s current aggregate beneficial ownership, (ii) seek to submit nominations in furtherance of a contested solicitation for the election or removal of directors with respect to the Company, (iii) submit any stockholder proposal or any notice of nomination or other business for consideration, (iv) nominate any candidate for election to the Board or (v) solicit any proxy or written consent of stockholders or conduct any other type of referendum with respect to, or from the holders of, the voting securities of the Company.

Pursuant to the Cooperation Agreement, JCP has also agreed during the Standstill Period to vote its voting securities of the Company at any annual or special meeting of stockholders in accordance with the Board’s recommendations with respect to (i) the election, removal or replacement of directors, (ii) the ratification of the appointment of the Company’s independent registered public accounting firm, (iii) the Company’s “say-on-pay” proposal and (iv) any other proposal to be submitted to the stockholders of the Company by either the Company or any stockholder of the Company; provided, however, that (i) if Institutional Shareholder Services Inc. (“ISS”) recommends otherwise with respect to any proposals (other than as related to the election, removal or replacement of directors), JCP shall be permitted to vote in accordance with ISS’s recommendation and (ii) that JCP shall be permitted to vote in its sole discretion in connection with an Extraordinary Transaction (as defined in the Cooperation Agreement). The Cooperation Agreement also includes a mutual non-disparagement provision.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in Item 1.01 is incorporated into this Item 5.02 by reference.

On February 3, 2023, the Company increased the size of the Board from 10 to 11 directors and elected Mr. Dewbre to fill the vacancy, to serve as a Class II director until the 2024 Annual Meeting. The Board determined that Mr. Dewbre will serve as an independent director. At this time, Mr. Dewbre has not been appointed to serve on a committee of the Board. The Board will take action to approve Mr. Dewbre’s director compensation at its next meeting, but it is anticipated that Mr. Dewbre will receive the standard compensation for directors under Kirby’s Nonemployee Director Compensation Program, prorated for his current term of office, including an automatic grant of approximately $41,875 in value of restricted shares of Kirby common stock and a prorated annual director fee of $18,750 payable quarterly. The shares of restricted stock vest six months after the date of grant.

As of the date hereof, there are no transactions between Mr. Dewbre and the Company that would be reportable under Item 404(a) of Regulation S-K.

Item 8.01 Other Events.

On February 3, 2023, the Company issued a press release announcing the Cooperation Agreement, a copy of which is attached as Exhibit 99.1 hereto and is incorporated by reference.

Item 9.01. Financial Statements and Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

KIRBY CORPORATION |

|

|

|

|

Date: |

February 3, 2023 |

By: |

/s/ Raj Kumar |

|

|

|

Raj Kumar

Executive Vice President

and Chief Financial Officer |

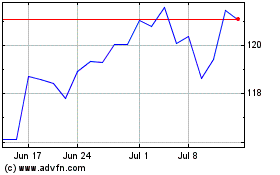

Kirby (NYSE:KEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

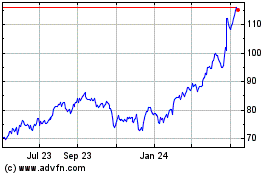

Kirby (NYSE:KEX)

Historical Stock Chart

From Apr 2023 to Apr 2024