Prospectus Supplement No. 10

(to Prospectus dated November 10, 2022) |

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258993 |

201,218,630 Shares of Class

A Common Stock

Up to 284,070,555 Shares

of Class A Common Stock

Issuable Upon Exercise of

the Warrants and Conversion of the SPA Notes

Up to 276,131 Private Warrants

This prospectus supplement

updates and supplements the prospectus dated November 10, 2022 (the “Prospectus”), which forms a part of our Registration

Statement on Form S-1, as amended (Registration No. 333-258993). This prospectus supplement is being filed to update and supplement the

information in the Prospectus with the information contained in our Current Report on Form 8-K/A, filed with the Securities and Exchange

Commission on February 1, 2023 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus

supplement.

The Prospectus and this prospectus

supplement relate to the issuance by us of an aggregate of up to 24,353,356 shares of our common stock, $0.0001 par value per share (“Common

Stock”), which consists of (i) 27,733,421 shares of the Class A common stock, par value $0.0001 per share, of Faraday Future Intelligent

Electric Inc. (“FFIE” and such Class A common stock, the “Class A Common Stock”) originally purchased in the PIPE

Financing (as defined in the Prospectus) by certain of the selling securityholders named in the Prospectus (the “Selling Securityholders”)

at a purchase price of $10.00 per share, (ii) 213,366 Founder Shares (as defined in the Prospectus) by certain of the Selling Securityholders

previously acquired by our predecessor’s sponsor at an effective purchase price of $0.0043 per share, (iii) 170,131 shares of Class

A Common Stock issued to designees of EarlyBirdCapital, Inc. as underwriters’ compensation in connection with the initial public

offering of Property Solutions Acquisition Corp. (“PSAC”) at an effective purchase price of $0.0041 per share, (iv) 586,000

shares of Class A Common Stock issued on July 22, 2022 as consideration for consulting and advisory services pursuant to an omnibus transaction

services fee agreement and acknowledgement, as amended, with Riverside Management Group in connection with the Business Combination (as

defined in the Prospectus), (v) 86,395,848 shares of Class A Common Stock originally issued to Season Smart Limited (“Season Smart”)

and Founding Future Creditors Trust as consideration in connection with the Business Combination at a per share value of $10.00 per share,

(vi) 64,000,588 shares of Class A Common Stock underlying the shares of FFIE’s Class B common stock, par value $0.0001 per share

originally issued to FF Top Holding LLC (“FF Top”) as consideration in connection with the Business Combination at a per share

value of $10.00 per share, (vii) 21,263,758 Earnout Shares not currently beneficially owned that Season Smart, FF Top and certain FF executives

have the contingent right to receive pursuant to the Merger Agreement, (viii) 150,322 shares of Class A Common Stock issued to certain

FF executives in satisfaction of deferred compensation owed by FF to such FF executives prior to the closing of the Business Combination,

(ix) 484,856 shares of Class A Common Stock issued to certain FF executives upon such FF executives’ exercise of options, and (x)

the resale of 54,252 shares of Class A Common Stock issued to Chui Tin Mok upon closing of the Business Combination in satisfaction of

his related party note payable. This prospectus also relates to the offer and sale from time to time by the Selling Securityholders of

up to 276,131 warrants (the “Private Warrants”), all of which were included in the private units purchased by our predecessor’s

sponsor and EarlyBirdCapital, Inc. in connection with the initial public offering of PSAC at a price of $10.00 per unit.

The Prospectus and this prospectus

supplement also relate to the offer and sale from time to time by the Selling Securityholders of (i) up to an aggregate of 284,070,555

shares of Class A Common Stock which consists of (i) 276,131 shares of Class A Common Stock that are issuable upon the exercise of the

Private Warrants, (ii) 23,375,988 shares of Class A Common Stock that are issuable upon the exercise of the 23,375,988 warrants (the “Public

Warrants”) originally issued in the initial public offering of PSAC, (iii) 28,431,635 shares of Class A Common Stock issuable upon

exercise of certain warrants issued in a private placement to certain institutional investors pursuant to a Second Amended and Restated

Note Purchase Agreement, dated as of October 9, 2020 (as amended from time to time, the “NPA,” and such warrants, the “ATW

NPA Warrants”), and (iv) 168,429,666 shares of Class A Common Stock issuable upon conversion of certain convertible notes and 63,557,135

shares of Class A Common Stock issuable upon exercise of certain warrants, in each case issued in a private placement to certain institutional

investors pursuant to Securities Purchase Agreement, dated as of August 14, 2022, as amended on September 23, 2022 (the “SPA”),

pursuant to the Joinder and Amendment Agreement to the SPA (the “Joinder”), dated as of September 25, 2022, pursuant to the

Limited Consent and Third Amendment to the SPA (the “Third Amendment”), dated as of October 24, 2022, and pursuant to the

Limited Consent and Amendment to the SPA (the “Fourth Amendment”), dated as of November 8, 2022 (such notes under the SPA

and Joinder, the “SPA Notes”).

This prospectus supplement

should be read in conjunction with the Prospectus. This prospectus supplement updates and supplements the information in the Prospectus.

If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information

in this prospectus supplement.

Our shares of Class A Common

Stock and our Public Warrants are listed on The Nasdaq Stock Market (“Nasdaq”), under the symbols “FFIE” and “FFIEW.” On

January 31, 2023, the closing price of our Class A Common Stock was $0.85 per share and the closing price of our Public Warrants was $0.1

per Public Warrant.

See the section entitled

“Risk Factors” beginning on page 13 of the Prospectus and under similar headings in any further amendments or supplements

to the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus

or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February

1, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 26, 2022

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39395 |

|

84-4720320 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

18455 S. Figueroa Street

Gardena, CA |

|

90248 |

| (Address of principal executive offices) |

|

(Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

FFIE |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

FFIEW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.02 | Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On November 28, 2022, Faraday Future Intelligent

Electric Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) disclosing that the

Board of Directors of the Company (the “Board”) voted to remove Dr. Carsten Breitfeld as Global Chief Executive Officer of

the Company on November 26, 2022. As set forth in the Original Form 8-K, the Company and Dr. Breitfeld expected to enter into a separation

agreement at a later date.

On January 30, 2023, the Company and Dr. Breitfeld

entered into a Termination Agreement and General Release (the “Termination Agreement”), pursuant to which, in exchange for

Dr. Breitfeld’s execution and non-revocation of the Termination Agreement, and his continued compliance with the ongoing obligations

set forth in his employment agreement and the At-Will Employment Confidential Information Invention Assignment Arbitration Agreement between

Dr. Breitfeld and the Company dated August 24, 2019, Dr. Breitfeld is entitled to (i) a lump sum payment equal to the base salary he would

have been had he remained employed through the end of the term of his employment agreement on March 3, 2023; (ii) monthly payments equal

to the monthly employer contribution, less applicable withholdings, that the Company would have made to provide health insurance to Dr.

Breitfeld through March 31, 2023 had Dr. Breitfeld remained employed by the Company through such date; and (iii) an extension of the post-termination

exercise period applicable to Dr. Breitfeld’s vested stock option awards until March 26, 2023 (i.e., the 90th day following Dr.

Breitfeld’s termination date).

The foregoing description of the Termination Agreement

is a summary and is qualified in its entirety by reference to the full text of the Termination Agreement, which is attached as Exhibit

10.1 to this Current Report on Form 8-K/A and incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed with this Current

Report on Form 8-K/A:

| * |

|

An

attachment to this Exhibit has been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally

a copy of any such attachment to the SEC upon request. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Faraday Future Intelligent Electric Inc. |

| |

|

| Date: February 1, 2023 |

By: |

/s/ Yun Han |

| |

Name: |

Yun Han |

| |

Title: |

Interim Chief Financial Officer |

Exhibit 10.1

EXECUTION VERSION

TERMINATION AGREEMENT AND

GENERAL RELEASE

This Termination

Agreement and General Release (“Termination Agreement”) is entered into by and among Carsten Breitfeld (“Employee”),

Faraday Future Intelligent Electric Inc. (the “Company”) and Faraday&Future Inc., a wholly-owned subsidiary

of the Company and the employer of Employee (“Faraday Future”), as of January 30, 2023 (the “Effective

Date”).

WHEREAS,

Employee, the Company and Faraday Future entered into an Employment Agreement, effective July 21, 2021, as amended January 31, 2022 and

September 3, 2022 (the “Employment Agreement”).

WHEREAS,

Employee is separating from the Company and Faraday Future, as discussed in more detail below, and Employee, the Company and Faraday Future

desire to bring the employment relationship to a conclusion;

NOW, THEREFORE,

FOR AND IN CONSIDERATION of good and valuable consideration set forth below, the receipt and sufficiency of which are hereby acknowledged

by each party, the parties agree as follows.

1. Termination.

Employee has been provided thirty days’ advance notice of his termination, pursuant to Section 6 of the Employment Agreement. Employee’s

employment with the Company ended on December 26, 2022 (“Termination Date”). The Company has paid Employee all wages

owed up through and including the Termination Date, including unused accrued vacation in the amount of twenty (20) days of base salary;

Employee’s healthcare coverage ended on December 31, 2022. Provided Employee timely elects continued healthcare coverage pursuant

to the Consolidated Omnibus Budget Reorganization Act of 1985 (“COBRA”), Employee may continue healthcare coverage

at his own expense, as more fully set forth in a COBRA Notice which Employee will receive under separate cover. All other benefits shall

end in accordance with the terms of such benefit plans and policies and the Company will take back possession of Employee’s Company

provided automobile on the Termination and will take all necessary actions to remove Employee from the lease and any and all obligations

thereunder.

2. Severance

Benefit. Pursuant to the Employment Agreement, the Company is offering Employee the opportunity to receive severance benefits

to which he is not otherwise entitled in exchange for Employee’s execution and non-revocation of this Termination Agreement, which

includes a general release of claims against the Company. In exchange for the release of claims set forth below, provided that Employee

(i) timely executes and does not revoke this Termination Agreement; (ii) continues to comply with his ongoing obligations in the Employment

Agreement and the At-Will Employment Confidential Information Invention Assignment Arbitration Agreement between Employee and the Company

dated August 24, 2019 (the “CIIA”); (iii) cooperates with the transition of his work to his successor; (iv)

continues to protect the Company’s confidential information in accordance with this Termination Agreement, the CIIA, and Company

policies; and (v) agrees and abides by the other terms and conditions set forth in this Termination Agreement, the Company shall:

| a. | pay to Employee a lump sum amount equal to Employee’s

base salary for the remainder of the term of the Employment Agreement, calculated at the base salary rate of $1,687,500 (from December 27, 2022 - March 3, 2023), less applicable

withholdings and deductions, to be paid on the 60th day following the Effective Date (but in any event no later than March 15, 2023); |

| b. | extend the post-termination exercise period for any stock options with respect

to the Company that have vested in accordance with their terms as of the Termination Date to 90-days post-termination. For the avoidance

of doubt, any stock options that have not vested in accordance with their terms as of the Termination Date shall be forfeited for no consideration;

and |

| c. | pay to the Employee, on a monthly basis, an amount equal to the monthly employer

contribution, less applicable withholdings, that the Company would have made to provide health insurance to the Employee if the Employee

had remained employed by the Company through March 31, 2023, based on the premiums as of the Separation Date. For the avoidance of doubt,

it will be the Employee’s sole responsibility to elect COBRA and pay for such continued coverage. |

Paragraphs a, b and c inclusive are collectively referred to

as (“Severance Benefits”).

3. Nothing Owed.

| a. | For the avoidance of doubt, Employee acknowledges and agrees that the Severance

Benefits provided for in this Termination Agreement constitute his sole and exclusive entitlement to any compensation in relation to the

cessation of his employment, and, further, that he is relinquishing any claim he may have to any other compensation, including, without

limitation, any claim for any annual bonus or any claim for severance pay under any claimed policy or practice of the Company or Faraday

Future. |

| b. | By signing this Termination Agreement, Employee acknowledges receipt of all compensation

due to him, including, accrued and unused vacation (upon payment of the twenty (20) days of accrued vacation time), commissions, bonuses

and expense reimbursements, and that no additional compensation of any nature is due to him, except on the terms and conditions set forth

in this Termination Agreement. Employee affirms that he has no known workplace injuries or occupational diseases which would be compensable

under the workers’ compensation laws of any state, and that he has been provided and/or has not been denied or retaliated against

for requesting or taking any leave under any leave laws including but not limited to the Family and Medical Leave Act, the California

Family Rights Act, and any other similar state or local laws providing for leave. |

4. Taxes. All amounts and

benefits payable hereunder shall be reduced by any and all required or authorized withholding and deductions and shall be subject to

any and all reporting obligations in accordance with and to the extent required by applicable law. This Termination Agreement is

intended to comply with or be exempt from the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the

“Code”), and shall be interpreted and construed consistently with such intent. All payments made under

this Termination Agreement are intended to be exempt from Section 409A of the Code to the maximum extent possible, including as

short- term deferrals pursuant to Treasury regulation §1.409A-1(b)(4). For this purpose each payment shall be deemed a separate

payment. The Company makes no representation that any or all of the payments described in this Termination Agreement will be exempt

from or comply with Section 409A of the Code. In no event whatsoever shall the Company be liable for any additional tax, interest or

penalties that may be imposed on Employee by Section 409A of the Code or any damages for failing to comply with Section 409A of the

Code.

5. Resignation from

Other Positions. Upon the Termination Date, Employee shall be deemed to have resigned,

without any further action by Employee, from any and all officer and director positions that Employee, immediately prior to the Termination

Date, (i) held with the Company, Faraday Future or any of their affiliates (including, without limitation, as a member of the Board of

Directors of the Company) or (ii) held with any other entities at the direction of, or as a result of your affiliation with, the Company,

Faraday Future or any of their affiliates. In order to effectuate such resignations, then Employee shall, upon the Company’s request,

execute any documents or instruments that the Company may deem necessary or desirable to effectuate such resignations, including, but

not limited to, the resignation letter attached hereto as Exhibit A, which letter Employee shall execute and return to

the Company on or before the Termination Date. In addition, Employee hereby designates the Secretary or any Assistant Secretary of the

Company, Faraday Future and their affiliates to execute any such documents or instruments as Employee’s attorney-in-fact to effectuate

such resignations if execution by the Secretary or any Assistant Secretary of the Company, Faraday Future or their affiliates is deemed

by the Company, Faraday Future or their affiliates to be a more expedient means to effectuate such resignation or resignations.

6. Return

of Company Property. Employee shall promptly return all of the Company’s property (electronic and hardcopy) in his possession,

including, without limitation, electronically- stored information or data, reports, customer lists, files, memoranda, records, documents,

credit cards, keys, passwords, computers, software, telecommunication equipment, and other physical or personal property (and all copies

thereof) that he received, prepared, or helped prepare in connection with his employment. Employee agrees that, in the event that Employee

subsequently discovers any Company property in Employee’s possession, Employee will promptly return such property to the Company

(or its designee). Further, Employee agrees to execute and abide by the Termination Certificate attached to the CIIA.

7.

Release. In consideration for the Severance Benefits outlined in this Termination Agreement, to which Employee is not

otherwise entitled, Employee, and anyone claiming through Employee or on Employee’s behalf, hereby generally and completely

releases and waives each and every past, present, and future parent, division, subsidiary, partnership, owner, trustee, fiduciary,

administrator, member, shareholder, investor, associate, affiliate, predecessor, successor and related company of the Company,

Faraday Future, and all of their respective current or former agents, officers, directors, partners, representatives, attorneys,

contractors, insurance companies, administrators, successors, assigns, current and former employees, plan administrators, insurers,

and any other persons acting by, through, under, or in concert with any of the persons or entities referenced in this subsection,

the predecessors, successors, and assigns of the Company, and each of them (“Released Parties”), from any

and all claims, rights, debts, liabilities, demands, causes of action, obligations, and damages, known or unknown, suspected or

unsuspected, arising as of or prior to the date of Employee’s signature to this Termination Agreement, under federal, state,

local, or common law, including but not limited to claims in any way related to Employee’s employment with the Company or the

Released Parties, Employee’s Employment Agreement, Employee’s termination from employment, the terms and conditions of

Employee’s employment, and all claims under the Civil Rights Act of 1866, Title VII of the Civil Rights Act of 1964, the Civil

Rights Act of 1991, the Employee Retirement Income Security Act of 1974, the Equal Pay Act, the Lilly Ledbetter Fair Pay Act of

2009, the Family and Medical Leave Act, the Genetic Information Nondiscrimination Act, the Fair Credit Reporting Act, the Americans

with Disabilities Act, the Worker Adjustment and Retraining Notification Act, the Age Discrimination in Employment Act, the Older

Workers Benefit Protection Act, the California Labor Code, the California Business and Professions Code, all California Wage Orders,

the California Fair Employment and Housing Act, the California Family Rights Act, the California Civil Code, the California

Government Code, and/or the laws prohibiting discrimination, harassment, and/or retaliation in any state in which Employee is

employed, and any and all federal, state, and local employment laws, as well as any and all common law tort or contract theories

under federal, state or local laws (“Released Claims”). The Released Claims also include claims of

discrimination or retaliation on the basis of workers’ compensation status, but do not include workers’ compensation

claims or any claim that by law may not be released.

8. Exceptions.

| a. | Notwithstanding anything in this Termination Agreement to the contrary, nothing in this Termination

Agreement prohibits Employee (or his attorney) from confidentially or otherwise communicating or filing a charge or complaint with a

governmental or regulatory entity, participating in a governmental or regulatory entity investigation, or giving other disclosures

to a governmental or regulatory entity concerning suspected violations of the law, in each case without receiving prior

authorization from or having to disclose any such conduct to the Company, or from responding if properly subpoenaed or otherwise

required to do so under applicable law. Nothing in this Termination Agreement shall be construed to affect the Equal Employment

Opportunity Commission’s (“Commission”), National Labor Relations Board’s, the Occupational

Safety and Health Administration’s, and the Securities and Exchange Commission’s, or any federal, state, or local

governmental agency or commission’s (“Governmental Agencies”) or any state agency’s

independent right and responsibility to enforce the law, nor does this Termination Agreement affect Employee’s right to file a

charge or participate in an investigation or proceeding conducted by either the Commission or any such Governmental Agency, although

this Termination Agreement does bar any claim that Employee might have to receive monetary damages in connection with any Commission

or Governmental Agency proceeding concerning matters covered by this Termination Agreement. This Termination Agreement does not

limit Employee’s right to receive an award or bounty for information provided to any Governmental Agencies, including under

the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank”). Further, nothing in

this Termination Agreement prohibits Employee from testifying in an administrative, legislative or judicial proceeding regarding

alleged criminal conduct or harassment, when Employee has been required or requested to attend a proceeding pursuant to court order, subpoena, or written

request from an administrative agency or the legislature. Moreover, nothing in this Termination Agreement prevents the disclosure of factual

information relating to claims of sexual assault, harassment, discrimination, failure to prevent harassment or discrimination, or retaliation

against a person for reporting an act of harassment or discrimination, as those claims are defined under the California Fair Employment

and Housing Act, to the extent the claims are filed in a civil or administrative action, and to the extent such disclosures are protected

by law. |

| b. | Execution of this Termination Agreement does not bar any claim that arises hereafter, including (without

limitation) a claim for breach of this Termination Agreement, any claim to indemnity under section 2802 of the California Labor Code,

and does not release Employee’s eligibility for indemnification in accordance with applicable laws, the articles, charter and bylaws

of the Company. Employee is entitled to ongoing indemnification under prior indemnification agreements and the Director and Officer Indemnification

Agreement dated July 21, 2021 and such indemnification shall include but not be limited to his attorneys’ fees incurred in negotiating

this Termination Agreement. For the avoidance of doubt, Employee’s prior indemnification agreement and the Director and Officer

Indemnification Agreement dated July 21, 2021 remain in force until otherwise terminated by the applicable parties or in accordance with

the terms of such agreements. |

| c. | Employee acknowledges that he has been advised or has had an opportunity to seek

advice by legal counsel and he is, by this Termination Agreement, waiving claims pursuant to California Civil Code Section 1542 or the

laws of other states similar hereto, and he expressly waives such rights as quoted below: |

“A GENERAL RELEASE

DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING

THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.”

Employee hereby expressly waives any

rights he may have under any other statute or common law principles of similar effect.

9. Review

Period. Employee has twenty-one (21) days from receipt of this Termination Agreement in which to consider it

(“Review Period”). Employee is advised that he has the right to consult an attorney regarding this

Termination Agreement. Once Employee signs this Termination Agreement, Employee should return it to Nan Yang at nan.yang@ff.com.

Employee may return this Termination Agreement any time before the expiration of the Review Period, but should he do so, he waives

any time remaining of the Review Period. A modification of this Termination Agreement, whether material or immaterial, will not

restart the Review Period.

10. Revocation

Period. Employee will have an additional seven (7) days after signing this Termination Agreement to revoke his acceptance (the

“Revocation Period”) by submitting a written statement of revocation to Nan Yang at nan.yang@ff.com. If Employee

does not timely revoke his acceptance during the Revocation Period, this Termination Agreement will become final and effective.

11. No

Admissions. The parties agree that neither this Termination Agreement, nor the furnishing of the consideration for this Termination

Agreement, shall be deemed or construed at any time to be an admission by the Company, Faraday Future, any Released Party or Employee

of any improper or unlawful conduct.

12. Indemnification.

For the avoidance of doubt, Employee’s prior indemnification agreement and the Director and Officer Indemnification Agreement

dated July 21, 2021 remain in force until otherwise terminated by the applicable parties or in accordance with the terms of such agreements.

13. Non-Disparagement.

Subject to the exceptions set forth in Section 8 of this Termination Agreement, Employee agrees that he will not make any statement to

any third party that is intended to or is reasonably likely to disparage, slander or otherwise damage the business reputation of the Company,

Faraday Future, any of the other Released Parties or any of their respective directors, members, board members, officers or employees.

Notwithstanding anything contained in this Section 13 to the contrary, neither Employee nor any other person shall be prohibited from

making truthful statements in connection with any litigation, arbitration, deposition or other legal proceeding, or as may be required

by law, any subpoena or any governmental or quasi- governmental authority. Nothing in this Termination Agreement prevents Employee from

discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that

Employee has reason to believe is unlawful. The Company shall direct the members of its Board of Directors and its executive officers

not to disparage the Employee.

14.

Cooperation. Employee agrees to make himself reasonably available to, and to cooperate with the Company and Faraday Future

in, any internal investigation or administrative, regulatory, or judicial inquiry, investigation, proceeding or arbitration.

Employee understands and agrees that his reasonable cooperation includes, but is not limited to, making himself available to the

Company and Faraday Future upon reasonable notice for interviews and factual investigations; appearing at the Company’s or

Faraday Future’s request to give testimony without requiring service of a subpoena or other legal process; volunteering to the

Company or Faraday Future pertinent information; and turning over all relevant documents which are or may come into his possession.

The term “cooperation” does not mean that Employee must provide information that is favorable to the Company or Faraday

Future; it means only that Employee will provide truthful information within his knowledge and possession upon request of the

Company or Faraday Future. Employee understands that, if the Company or Faraday Future asks for his cooperation in accordance with

this provision, or he is required to participate in an administrative or legal proceeding or arbitration related to matters within

the scope of his employment at the Company or Faraday Future (including any predecessor employers), the Company

will reimburse him for reasonable travel expenses provided that Employee submits to the Company appropriate documentation of such expenses

within thirty (30) calendar days after such expenses are incurred (provided that such proceeding was not initiated by Employee and does

not otherwise concern any claims by Employee against the Company or any of the other Released Parties). Any cooperation required of Employee

shall be provided at times and locations that are mutually convenient to Employee and the Company or Faraday Future. Employee also agrees

to cooperate with the transition of his work and responsibilities to his successor or, upon the Company’s request, others within

and outside the Company.

15. Confidentiality Obligations.

| a. | Employee acknowledges that, in the course of employment, Employee has had access to confidential competitive

information, pricing, marketing, trade secrets (as defined under applicable law) and other information or materials relating or belonging

to the Company or any of its affiliates (whether or not reduced to writing) of the Company, as well as corporate affiliates (including,

but not necessarily limited to, the parent, subsidiary, and sister companies of the Company) and predecessors of the Company, or provided

by a client or other third party to the Company on a confidential basis, including without limitation all non-public information furnished

or disclosed to or otherwise obtained by Employee in the course of Employee’s employment, relating, but not limited to, the Company’s

customers, mailing lists, customer sales history, and other customer information, vendor lists, contracts, leases, payroll, and other

employee information, creative files, marketing plans, pricing data, financial and strategic plans, corporate procedures and policies,

and other proprietary information. At any time following the Termination Date, Employee agrees not to directly or indirectly use, communicate,

or otherwise disclose any such confidential information of the Company to, or for the benefit of, any person, firm or corporation, except

as required by law or other compulsory disclosure process. The obligations set forth in this section are in addition to the confidentiality

obligations that Employee has pursuant to the Employment Agreement and the CIIA. |

| b. | Employee continues to comply with the ongoing confidentiality and restrictive covenant obligations contained

in the CIIA and the Employment Agreement. |

| c. | The U.S. Defend Trade Secrets Act of 2016 provides that: an individual shall not be held criminally or

civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (A) is made (i) in confidence to

a federal, state, or local government official, either directly or indirectly, or to an attorney, and (ii) solely for the purpose of reporting

or investigating a suspected violation of law; or (B) is made in a complaint or other document

filed in a lawsuit or other proceeding, if such filing is made under seal. An individual who files a lawsuit for retaliation by an employer

for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information

in the court proceeding if the individual files any document containing the trade secret under seal and does not disclose the trade secret

except pursuant to court order. |

Nothing in this Termination Agreement prohibits or creates

liability for any such protected conduct.

16. Remedies for Breach of Confidentiality. Employee recognizes and agrees that the payment of damages is not an adequate remedy for a breach by Employee of the confidentiality provisions in Sections 15.a and 15.b above. Employee recognizes that irreparable injury will result to the Company, its business, and property in the event of any such breach, and therefore Employee agrees that the Company may, in addition to recovering damages, proceed in equity to enjoin Employee from violating any such agreement. In addition, Employee acknowledges that any breach of the confidentiality provisions of this Termination Agreement will constitute a material breach of this Termination Agreement for which Employee will be liable to the Company. Employee further agrees to reimburse the Company and its affiliates for all costs and expenditures, including but not limited to reasonable attorneys’ fees and court costs, incurred by any of them in connection with the successful enforcement of any of their rights under any of Section of this Termination Agreement.

17. Choice

of Law and Forum. This Termination Agreement will be governed by and construed in accordance with the laws of the State of California,

without regard to any conflict of law or choice of law provisions thereof. Any dispute between the parties shall be resolved exclusively

in the state and/or federal courts encompassing Los Angeles County, California.

18. Compliance

with Termination Agreement. To receive the Severance Benefits set forth in Section 2 of this Termination Agreement, Employee must

comply with the terms of this Termination Agreement. In the event Employee breaches or fails to abide by the terms of this Termination

Agreement, in addition to other remedies which the Company may have pursuant to this Termination Agreement or in equity or at law, the

Company may permanently discontinue all remaining payments and benefits described herein that are conditioned on Employee’s adherence

to the terms of this Termination Agreement (including, without limitation, waiver of the extended post-termination exercise period for

Employee’s vested stock options) and, to the extent any of such payments and benefits already have been made, Employee must return

such payments and the value of such benefits to the Company, with the value of any exercised stock options based the difference between

(i) the Fair Market Value of a share of Common Stock of the Company on the date such portion of the stock option was exercised following

the Termination Date and (ii) the per share exercise price of the stock option, multiplied by the number of shares of Common Stock of

the Company purchased pursuant to the exercise of such portion of the stock option. Should the Company exercise its right to discontinue

or recoup these payments and benefits, Employee will continue to be bound by this Termination Agreement.

19. Severability.

Whenever possible, each provision of this Termination Agreement shall be interpreted in such manner as to be effective and valid under

applicable law, but if any provision of this Termination Agreement is held to be invalid, illegal or unenforceable in any respect under

any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision or

any other jurisdiction, but this Termination Agreement shall be reformed, construed and enforced in such jurisdiction as if such invalid,

illegal or unenforceable provision had never been contained herein.

20. ADEA

Waiver. Employee acknowledges that he is knowingly and voluntarily waiving and releasing any rights Employee has under the Age

Discrimination in Employment Act (“ADEA”) and that the consideration given for the waiver and release is in

addition to anything of value to which he was already entitled. Employee further acknowledge that he has been advised by this writing,

as required by the ADEA, that:

| a. | Employee’s waiver and release specified in this Termination Agreement do not apply to any rights

or claims that arise after the date he signs this Termination Agreement; |

| b. | Employee has the right to consult with an attorney prior to signing this Termination Agreement; |

| c. | Employee acknowledges that he has twenty-one (21) days to consider and accept this Termination Agreement

(although he may choose voluntarily to sign this Termination Agreement earlier and waive any remaining portion of the Review period); |

| d. | Employee has been advised that he has up to seven (7) days after he signs this Termination Agreement to

revoke this Termination Agreement; and |

| e. | This Termination Agreement will not be effective until the date on which the Revocation Period has expired,

which will be the eighth day after Employee signs this Release, assuming he has returned it to the Company by such date. |

21. Entire

Agreement; Amendment. This Termination Agreement is the entire agreement between Employee and the Company with respect to the

matters addressed herein with the exception of ongoing obligations in (a) CIIA; (b) the Employment Agreement; (c) prior indemnification

agreement and the Director and Officer Indemnification Agreement dated July 21, 2021; and (d) Employee’s stock option agreements

as modified hereby. The Company makes no representations regarding its relationship with or obligations to Employee, or as to the tax

consequences of Employee’s entering into this Termination Agreement except as set forth in this Termination Agreement. Employee

expressly agrees that the Company shall have no liability to him for any tax or penalty imposed on him as a result of this Termination

Agreement. This Termination Agreement supersedes all existing agreements, whether written or oral, between Employee and the Company concerning

his employment, provided, however, this Termination Agreement will be in addition to and not in lieu of (i) the restrictive covenants

or obligations contained in the Employment Agreement and the CIIA, including, but not limited to non- solicitation provisions contained

in the CIIA; and (ii) Employee’s obligation, contractual or otherwise, to maintain the confidentiality of information learned or

received during the course of employment. This Termination Agreement cannot be amended, supplemented, or modified nor may any provision

hereof be waived, except by a written instrument executed by the parties hereto.

22. Voluntary Execution.

Employee acknowledges that he has carefully read this Termination Agreement and that he understands all of its terms including the

full and final release of claims set forth in Section 7. Employee further acknowledges that he has voluntarily entered into this

Termination Agreement; that he has not relied upon any representation or statement, written or oral, not set forth in this

Termination Agreement; that the only consideration for signing this Termination Agreement is as set forth herein; that the

consideration received for executing this Termination Agreement is greater than that to which he would otherwise be entitled; and

that this document gives him the opportunity and encourages him to have this Termination Agreement reviewed by his attorney. Both

Employee and the Company stipulate that the Company is relying upon these representations and warranties in entering into this

Termination Agreement.

23. Acceptance.

In order to signify his acceptance of this offer, Employee shall execute this Termination Agreement where indicated below, and return

it to Nan Yang at nan.yang@ff.com, whereupon, subject to the seven-day Revocation Period described in Section 10, it shall become binding

and effective. Employee may waive any portion of the 21-day period for reviewing this Termination Agreement but should he do so, he waives

the portion remaining. If Employee elects to revoke this Termination Agreement during the Revocation Period, such revocation must be in

writing and, within seven (7) days of the date upon which this Termination Agreement was signed by him, delivered to Nan Yang at nan.yang@ff.com.

24. Assignment.

This Termination Agreement is enforceable by the Company, Faraday Future and their affiliates and may be assigned or transferred by the

Company or Faraday Future to, and shall be binding upon and inure to the benefit of, any parent or other affiliate of the Company or Faraday

Future, as applicable, or any person which at any time, whether by merger, purchase, or otherwise, acquires all or substantially all of

the assets, stock or business of the Company or of any division thereof. Employee may not assign any of his rights or obligations under

this Termination Agreement.

25. Counterparts.

This Termination Agreement may be executed in any number of counterparts and such counterparts may be obtained by PDF, e-mail, or facsimile

transmission, each of which taken together will constitute one and the same instrument.

IN WITNESS WHEREOF, the parties

have executed this Termination Agreement as of the latest date set forth below.

| Faraday Future Intelligent Electric Inc. |

|

| |

|

|

| By: |

/s/ Xuefeng Chen |

|

| Title: |

Chief Executive Officer |

|

| |

|

|

| Date: |

1/30/2023 |

|

| |

|

|

| Faraday&Future Inc. |

|

| |

|

|

| By: |

/s/ Xuefeng Chen |

|

| Title: |

Director |

|

| |

|

|

| Date: |

1/30/2023 |

|

| |

|

|

| Employee |

|

| |

|

|

| /s/ Carsten Breitfeld |

|

| Carsten Breitfeld |

|

| |

|

| Date: |

1/23/2023 |

|

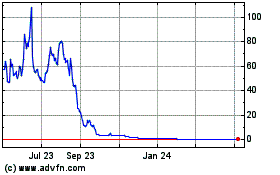

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

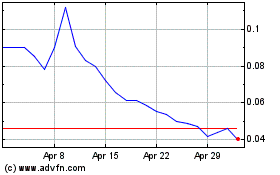

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Apr 2023 to Apr 2024