BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a blockchain

technology-focused company, created a new series of convertible

preferred stock, designated Series V Convertible Preferred Stock

(the “Voucher”), and plans to distribute these Vouchers to each and

every shareholder of record as of a to be announced record date.

Each Voucher is intended to be convertible into one share of the

Company’s common stock listed on a security exchange that utilizes

blockchain technology, subject to certain approvals and the terms

of the Voucher’s Certificate of Designation filed with the state of

Nevada.

“We are excited to announce the creation and

potential distribution of the Voucher, which we believe will create

a pathway for every single BTCS shareholder to utilize blockchain

technology seamlessly in their daily lives on an exchange where

order books are enforced by blockchain smart contracts,” said

Charles Allen, CEO of BTCS. “Exchanges built on blockchain

technology should enable transparent public orderbooks, eliminate

failure to delivers, provide access to a global digital-first

investor base, and enable direct to investor communications,

distributions, and dividends without the friction we encountered

with the processing of our Bividend.”

Allen continued, “In order to have fair and

transparent markets which protect our retail investors, the time is

now to move away from T+2 settlement. For the integrity of our

markets and the protection of all investors, we need to embrace

blockchain technology and have real-time settlement. Taking this

step and creating a path to have every single BTCS shareholder

utilize this technology is a way BTCS can illustrate the power of

blockchain technologies we secure, and, hopefully, jump-starting

and fast-tracking the ongoing discussion initially proposed by the

SEC on February 9, 2022.”

“It’s unconscionable that since going public,

BTCS has been on the Reg SHO Threshold List 77 times; further,

between January 7 and January 19, 2022 a total of 2.16 million

shares failed to deliver, representing approximately 26% of our

public float as of December 31, 2021, raising many questions about

the efficacy of current systems,” continued Allen. “With blockchain

technology and instant settlement, intermediaries could be

eliminated, thus reducing potential share imbalances and the risks

and costs associated with traditional T+2 settlements. This move

represents our commitment to innovation and delivering superior

value to our investors.”

Some claim blockchain technology lacks real

world applications, however, security exchanges built on

blockchains such as Ethereum are strong use cases that illustrate

the potential future of capital markets. BTCS believes the time to

start transitioning is now. While BTCS highlighted this use case in

an investor presentation filed as an exhibit to an 8-K on July 7,

2015 (page 7), only now, after years of research, are we finally in

a position to make this a reality. This is a natural extension of

BTCS’s commitment to innovation and reflects the Company's belief

in both Ethereum and the potential of decentralized technologies to

bring innovation to traditional financial markets.

The Vouchers will have no voting rights, no

rights to dividends, be redeemable by the Company after one year

from issuance, and not be eligible for conversion after December

31, 2024. The record date for the distribution of the Vouchers will

be announced upon achieving greater clarity on certain

administrative processes for effecting it, which includes

successfully obtaining a DTC eligible CUSIP, among other things.

Shareholders are encouraged to consult with their financial advisor

to understand the terms of the Voucher and its potential impact on

their investment in BTCS.

*Investor

NoticeWhile the Voucher is not deemed a “sale” under the

Securities Act of 1933 and the Company does not believe it is a

“sale” under states securities laws, investors should consider the

following disclaimer:

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the Voucher and no

offer, solicitation or sale of the Voucher shall be made in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. Offers,

solicitations and sales of the Voucher will be made only by means

of a prospectus supplement and the accompanying prospectus, forming

a part of an effective registration statement or under an

applicable exemption from registration. Investors should note that

the Company does not plan to list the Voucher for trading on any

exchange.

About BTCS:BTCS Inc. is a

Nasdaq listed company operating in the blockchain technology space

since 2014 and is one of the first U.S. publicly traded companies

with a primary focus on blockchain infrastructure and staking. BTCS

secures and operates validator nodes on disruptive next-generation

blockchain networks that power Web 3, earning native token rewards

by staking our proof-of-stake digital assets. “StakeSeeker” is

BTCS’ newly introduced proprietary Cryptocurrency Dashboard and

Staking-as-a-Service platform, developed to empower users to better

understand and grow their crypto holdings with innovative portfolio

analytics and a non-custodial process to earn staking rewards on

digital asset holdings. Users can easily link and monitor their

cryptocurrency portfolios across exchanges, wallets, validator

nodes, and other sources; and have access to a suite of data

analytic tools such as performance and reward tracking.

StakeSeeker’s Staking Hub allows users to earn rewards by

participating in network consensus mechanisms by staking and

delegating their cryptocurrencies to company-operated validator

nodes for a growing number of supported blockchains. As a

non-custodial validator operator, BTCS will receive a percentage of

token holders staking rewards generated as a validator node fee,

creating the potential opportunity for a highly scalable business

with limited additional costs. For more information visit:

www.btcs.com.

Forward-Looking

Statements:Certain statements in this press release,

constitute “forward-looking statements” within the meaning of the

federal securities laws including statements regarding the

potential distribution of the Vouchers including its timing, terms

and the exchange on which the common stock into which the Voucher

would be convertible will be listed for trading, as well as the

perceived and anticipated benefits to shareholders and the

financial markets in general of the Vouchers and blockchain

technology. Words such as “may,” “might,” “will,” “should,”

“believe,” “expect,” “anticipate,” “estimate,” “continue,”

“predict,” “forecast,” “project,” “plan,” “intend” or similar

expressions, or statements regarding intent, belief, or current

expectations, are forward-looking statements. While the Company

believes these forward-looking statements are reasonable, undue

reliance should not be placed on any such forward-looking

statements, which are based on information available to us on the

date of this release. These forward-looking statements are based

upon current estimates and assumptions and are subject to various

risks and uncertainties, including without limitation, the

possibility that the Company does not proceed with the Voucher

distribution due to administrative, regulatory or other challenges,

including failure to obtain a DTC eligible CUSIP number, the

Company’s broad discretion with respect to the Vouchers, possible

trading volatility, pricing discrepancies or other negative

characteristics of the exchange selected for trading of the common

stock into which the Voucher would be convertible, dilution for

Voucher holders who do not make a conversion election before the

Voucher is redeemed, future regulatory issues, market or economic

downturns or other adverse developments with respect to our

business and the digital assets on which it depends, as well as

risks set forth in the Company’s filings with the Securities and

Exchange Commission including its Form 10-K for the year ended

December 31, 2021. Thus, actual results could be materially

different. The Company expressly disclaims any obligation to update

or alter statements, whether as a result of new information, future

events or otherwise, except as required by law.

Investor Relations:ir@btcs.com

Public Relations: Mercy Chikowore m.chikowore@btcs.com

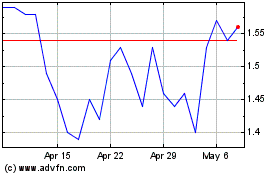

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

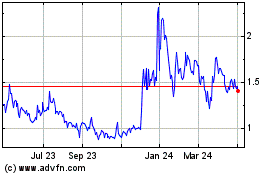

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Apr 2023 to Apr 2024