FALSE0001587987January 6, 202300015879872023-01-062023-01-060001587987newt:CommonStockParValue002PerShareMember2023-01-062023-01-060001587987newt:FivePointSevenFivePercentNotesDue2024Member2023-01-062023-01-060001587987newt:FivePointFiveZeroPercentNotesDue2026Member2023-01-062023-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 6, 2023

Date of Report (date of Earliest Event Reported)

NEWTEKONE, INC.

(Exact Name of Company as Specified in its Charter)

| | | | | | | | |

| Maryland | 814-01035 | 46-3755188 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File No.) | (I.R.S. Employer Identification No.) |

4800 T Rex Avenue, Suite 120, Boca Raton, Florida 33431

(Address of principal executive offices and zip code)

(212) 356-9500

(Company’s telephone number, including area code)

(Former name or former address, if changed from last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.02 per share | | NEWT | | Nasdaq Global Market LLC |

| 5.75% Notes due 2024 | | NEWTL | | Nasdaq Global Market LLC |

| 5.50% Notes due 2026 | | NEWTZ | | Nasdaq Global Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

EXPLANATORY NOTE

NewtekOne, Inc., or together with its subsidiaries, where applicable, the Company, which may also be referred to as “we”, “us” or “our”, is filing this Amendment No. 1 (the “Amendment”) to the Company’s Form 8-K which was originally filed with the Securities and Exchange Commission on January 6, 2023 (“the Original Filing”), to include as Exhibits the financial statements and pro forma financial information required by Item 2.01:

Item 2.01. Completion of Acquisition or Disposition of Assets.

On January 6, 2023, NewtekOne, Inc. (formerly known as Newtek Business Services Corp.) (the “Company”) completed the previously announced acquisition of the National Bank of New York City (“NBNYC” and the “Acquisition,” respectively), a national bank regulated and supervised by the Office of the Comptroller of the Currency, pursuant to which the Company acquired from the NBNYC shareholders all of the issued and outstanding stock of NBNYC for $20 million. (See Stock Purchase Agreement annexed as Exhibit 10.1 to the Company’s Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 2, 2021). NBNYC has been renamed Newtek Bank, National Association (“Newtek Bank, N.A.”) and has become a wholly owned subsidiary of the Company. In connection with the completion of the Acquisition, the Company has contributed to Newtek Bank, N.A. $31 million of cash and two of the Company’s subsidiaries, Newtek Business Lending, LLC (“NBL”) and Small Business Lending, LLC (“SBL”). The Company also filed with the SEC a Form N-54C, Notification of Withdrawal of Election to be Subject to the Investment Company Act of 1940, and ceased to be a business development company as of January 6, 2023. As a result of the Acquisition, the Company is now a financial holding company subject to the regulation and supervision of the Board of Governors of the Federal Reserve System (the “Federal Reserve”) and the Federal Reserve Bank of Atlanta. The Company no longer qualifies as a regulated investment company for federal income tax purposes and no longer qualifies for accounting treatment as an investment company. As a result, in addition to Newtek Bank, N.A. and its consolidated subsidiaries, NBL and SBL, the following Newtek portfolio companies and subsidiaries will now be consolidated non-bank subsidiaries in the Company’s financial statements: Newtek Small Business Finance, LLC; Newtek Merchant Solutions, LLC; Mobil Money, LLC; CDS Business Services, Inc. d/b/a Newtek Business Credit Solutions; PMTWorks Payroll, LLC d/b/a Newtek Payroll and Benefits Solutions; Newtek Insurance Agency, LLC; Titanium Asset Management LLC; Newtek Business Services Holdco 6, Inc; Newtek Commercial Lending, Inc.; Excel WebSolutions, LLC; Newtek Technology Solutions, Inc and POS on Cloud, LLC, d/b/a Newtek Payment Systems. In addition, as a result of commitments made to the Federal Reserve, the Company will divest or otherwise terminate the activities conducted by Excel WebSolutions, LLC and Newtek Technology Solutions, Inc., including its subsidiary SIDCO, LLC d/b/a/ Cloud Nine Services, within two years of becoming a financial holding company, subject to any extension of the two-year period.

Included as Exhibits 99.1 and 99.2 hereto are the financial statements and pro forma financial information required by Item 2.01.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| | |

| | |

| 99.2 | | Unaudited pro forma condensed combined balance sheet of the Company as of September 30, 2022, giving effect to the Acquisition as if it had been completed on September 30, 2022, the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2022 and the fiscal year ended December 31, 2021, as if the Acquisition had been completed on January 1, 2021, furnished herewith. |

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| NEWTEKONE, INC. |

| | |

Date: January 27, 2023 | By: | /S/ BARRY SLOANE |

| | Barry Sloane |

| | Chief Executive Officer, President and Chairman of the Board |

SELECTED FINANCIAL DATA

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Introduction

The following unaudited pro forma condensed combined financial information is based on the historical consolidated financial statements of NewtekOne, Inc. and subsidiaries (“NewtekOne” or “the Company” and formerly known as Newtek Business Services Corp.) and the historical financial statements of National Bank of New York City (“NBNYC)”), after giving effect to NewtekOne’s January 6, 2023 acquisition of NBNYC (the “Acquisition”) and the repositioning of NewtekOne as a financial holding company (the “Reorganization”). The notes to the unaudited pro forma condensed combined financial information describe the transaction accounting adjustments to the financial information presented. Hereinafter, NewtekOne and NBNYC are collectively referred to as the “Companies,” and the Companies, subsequent to the Acquisition, are referred to herein as the “Combined Company.” The Acquisition and the Reorganization are collectively referred to as the “Transactions”.

The following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X, as amended by the final rule, Release No. 33-10786, “Amendments to Financial Disclosures about Acquired and Disposed Businesses,” and presents the combination of the historical financial information of NewtekOne and NBNYC adjusted to give effect to the Transactions.

The unaudited pro forma condensed combined balance sheets, which have been presented for the Combined Company as of September 30, 2022, gives effect to the Transactions, as if they were consummated on September 30, 2022.

The unaudited pro forma condensed combined statements of operations, which have been presented for the nine months ended September 30, 2022, give effect to the Transactions, as if they had occurred on January 1, 2021, the beginning of the earliest period presented.

The unaudited pro forma condensed combined statements of operations, which have been presented for the year ended December 31, 2021, give effect to the Transactions, as if they had occurred on January 1, 2021, the beginning of the earliest period presented.

Description of the Transactions

NewtekOne has historically elected to be treated as a business development company (BDC) under the Investment Company Act of 1940 (the "1940 Act") and accordingly has reported its financial information in accordance with investment company accounting.

On August 2, 2021, NewtekOne entered into a Stock Purchase Agreement to acquire all of the issued and outstanding stock of NBNYC. NBNYC is organized as a national banking association whose deposits are insured under the Deposit Insurance Fund, which is administered by the Federal Deposit Insurance Corporation. NBNYC provides a full range of banking services, primarily to commercial customers, through its sole office in Queens, New York.

This Acquisition is part of a plan to reposition NewtekOne as a financial holding company (“FHC”). In connection with this plan, on June 1, 2022, NewtekOne held a special meeting of shareholders, at which NewtekOne's shareholders approved a proposal to authorize its Board of Directors to discontinue NewtekOne’s election to be regulated under the 1940 Act, subject to required regulatory approvals and other conditions described in the proxy statement filed with the SEC on May 2, 2022.

The consideration payable by the Company at closing was $20.0 million in cash. In addition, the Stock Purchase Agreement provided that immediate prior to the closing NBNYC dividend to the NBNYC selling shareholders (“Sellers”) both NBNYC’s owned property in Flushing, New York and cash in the amount equal to the excess, if any, of NBNYC’s tangible common equity as of the closing date over $20.0 million.

In November 2022, NewtekOne received approval from the Federal Reserve to become a financial holding company and a financial holding company upon the completion of its acquisition of NBNYC. In December 2022, NewtekOne received conditional approval from the Office of the Comptroller of the Currency (“OCC”) to complete its acquisition of NBNYC.

On January 6, 2023, the Acquisition was completed. In addition, in connection with the Acquisition, immediately prior to the closing NBNYC paid a dividend of $17 million to the Sellers and dividended to the Sellers NBNYC’s owned property in Flushing, New York. NBNYC has been renamed Newtek Bank, National Association (“Newtek Bank, N.A.”) and is now a

wholly owned subsidiary of NewtekOne. In connection with the completion of the Acquisition, NewtekOne contributed to Newtek Bank, N.A. $31 million of cash and two of NewtekOne’s subsidiaries, Newtek Business Lending, LLC (“NBL”) and Small Business Lending, LLC (“SBL”). NewtekOne has also filed with the SEC a Form N-54C, Notification of Withdrawal of Election to be Subject to the Investment Company Act of 1940, and has ceased to be a BDC as of January 6, 2023 (“the Closing Date”). As a result of the Acquisition, NewtekOne is now a financial holding company subject to the regulation and supervision of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), the Federal Reserve Bank of Atlanta, and the OCC. NewtekOne no longer qualifies as a regulated investment company (RIC) for federal income tax purposes and no longer qualifies for accounting treatment as an investment company. The Company has also committed to divest activities of certain of NewtekOne’s technology portfolio companies within two years of becoming a financial holding company or any extensions thereof.

Anticipated Accounting Treatment

NBNYC Acquisition

The Acquisition is accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 805, Business Combinations (“ASC 805”). Under the acquisition method of accounting for purposes of the unaudited pro forma condensed combined financial information, management of NewtekOne has deemed NewtekOne to be the accounting acquirer and determined a preliminary estimated purchase price, calculated as described in Note 2: Preliminary Estimated Purchase Price Allocation to the unaudited pro forma condensed combined financial information. The NBNYC assets acquired and liabilities assumed in connection with the Acquisition are recorded at their estimated acquisition date fair values. A final determination of these estimated fair values will be based on the actual net assets of NBNYC that existed as of the Closing Date. Differences between these preliminary estimates and the final acquisition accounting may occur and these differences could be material.

The acquisition method of accounting is based on ASC 805 and uses the fair value concepts defined in ASC Topic 820, Fair Value Measurements (“ASC 820”). ASC 820 defines fair value, establishes a framework for measuring fair value, and sets forth a fair value hierarchy that prioritizes and ranks the level of observability of inputs used to develop the fair value measurements. Fair value is defined in ASC 820 as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” This is an exit price concept for the valuation of the asset or liability. In addition, market participants are assumed to be buyers and sellers in the principal (or the most advantageous) market for the asset or liability. Fair value measurements for a non-financial asset assume the highest and best use by these market participants. Many of these fair value measurements can be highly subjective, and it is possible that other professionals applying reasonable judgment to the same facts and circumstances, could develop and support a range of alternative estimated amounts.

Reorganization

The Reorganization is accounted for as a common control transaction in accordance with ASC 805 with no change in reporting entity.

NewtekOne will remain the reporting entity post-Reorganization, and all of NewtekOne’s subsidiaries included in the consolidated financial statements will remain consistent before and after the Reorganization. NewtekOne will retain the same ownership interests in its subsidiaries, either directly or indirectly (through its 100% ownership in NBNYC). NewtekOne’s governance and ownership structure will remain the same. Accordingly, each of these entities are entities under common control. The only change is the Company’s regulatory status from a BDC to a FHC, which does not represent a change in reporting entity under ASC 805-50.

As a FHC, NewtekOne will no longer be accounting for its investments in the controlled subsidiaries under ASC Topic 946, Financial Services – Investment Companies. ("ASC 946"). Accordingly, NewtekOne will be required to consolidate certain subsidiaries and account separately for their underlying assets and liabilities at the Closing Date. NewtekOne will recognize the underlying assets and liabilities of the controlled subsidiaries based on the carryover bases of the investments in subsidiaries, which would be fair value at the Closing Date. In addition, NewtekOne will derecognize its investments in the controlled subsidiaries. Any difference between the basis of the underlying assets and liabilities and the fair value of the investment will be recorded as an offsetting reduction to equity.

The guidance in both ASC 946 and ASC 805 (common control transactions) is applied. Based on the guidance in ASC 946, the fair value of NewtekOne’s investment at the date of Reorganization establishes the carrying basis of underlying assets and liabilities prospectively. The fair value of the investment, which represents an entity or enterprise valuation, may differ from the fair value or other basis of the underlying identifiable assets and liabilities. However, because the Reorganization is a common control transaction, any difference between the investment fair value and the fair value or other basis of the identifiable net assets should be recorded in equity; that is, no goodwill and no gain or loss should be recorded.

See Note 1: Basis of Presentation and Description of the Transactions to the unaudited pro forma condensed combined financial information.

Basis of Pro Forma Presentation

The historical financial information has been adjusted to give pro forma effect to events that are directly attributable to the Transactions. The adjustments presented on the unaudited pro forma condensed combined financial statements have been identified and presented to provide relevant information necessary for an accurate understanding of the combined company upon consummation of the Transactions.

The unaudited pro forma condensed combined financial information should be read in conjunction with the accompanying notes to the unaudited pro forma condensed combined financial information. In addition, the unaudited pro forma condensed combined financial information was based on:

a.the historical audited consolidated financial statements and related notes of NewtekOne as of December 31, 2021 and for the year ended December 31, 2021 and b) the historical unaudited condensed consolidated financial statements and related notes of NewtekOne as of September 30, 2022 and for the nine months ended September 30, 2022. These can be found in the Company’s Form 10-K filing for the year ended December 31, 2021 and in the Company’s Form 10-Q filing for the quarter ended September 30, 2022, respectively;

b.the historical audited financial statements and related notes of NBNYC as of December 31, 2021 and for the year ended December 31, 2021, which are Exhibit 99.1 filed herewith, and the historical unaudited financial statements of NBNYC as of September 30, 2022 and for the nine months ended September 30, 2022, which can be found within the unaudited pro forma financial information for such periods included herein;

c.the historical unaudited financial statements of NewtekOne’s controlled subsidiaries as of December 31, 2021 and for the year ended December 31, 2021 and the historical unaudited financial statements of NewtekOne’s controlled subsidiaries as of September 30, 2022 and for the nine months ended September 30, 2022. This information was used to determine the transaction accounting adjustments needed to consolidate these subsidiaries;

d.the Stock Purchase Agreement, which can be found in the Company's Form 8-K, Exhibit 10.1, filed on August 2, 2021.

The unaudited pro forma condensed combined financial information does not reflect the costs of any integration activities or benefits that may result from realization of future cost savings from operating efficiencies or other synergies that may result from the Acquisition.

NewtekOne and NBNYC did not have any historical relationship prior to the Acquisition. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

The unaudited pro forma condensed combined financial information is based on the assumptions and adjustments that are described in the accompanying notes. The pro forma adjustments reflected in the unaudited pro forma condensed combined financial information are preliminary and based on estimates, subject to further revision as additional information becomes available and additional analyses are performed and have been made solely for the purpose of providing unaudited pro forma condensed combined financial information. Differences between these preliminary adjustments reflected in the unaudited pro forma condensed combined financial information as of September 30, 2022 and the final application of the accounting for the Transactions may occur and those differences could be material. In addition, differences between the preliminary and final adjustments may occur, as well as other changes in assets and liabilities between September 30, 2022 and the closing of the Acquisition.

The unaudited pro forma condensed combined balance sheet does not purport to represent, and is not necessarily indicative of, what the actual financial condition of the Combined Company would have been had the Transactions taken place on September 30, 2022, nor is it indicative of the financial condition of the Combined Company as of any future date. The unaudited pro forma condensed combined statements of operations do not purport to represent, and are not necessarily indicative of, what the actual results of operations of the Combined Company would have been had the Transactions taken place on January 1, 2021, nor are they indicative of the results of operations of the Combined Company for any future period.

The unaudited pro forma condensed combined financial information has been prepared for illustrative purposes only and are not necessarily indicative of the financial position or results of operations in future periods or the results that actually would have been realized had NewtekOne and NBNYC been a combined company and/or NewtekOne operated as a FHC during the specified periods.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT BALANCE SHEET

AS OF SEPTEMBER 30, 2022

(In Thousands, except for Per Share Data and Par Value

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NewtekOne (1) Historical | | Reorganization Transaction Accounting Adjustments | Notes | NewtekOne- Pro Forma | | NBNYC(2) Historical | | NBNYC Acquisition Transaction Accounting Adjustments | Notes | Pro Forma Combined |

| | | | | | | | | | | |

| ASSETS | | | | | | | | | | | |

| Cash | $ | 7,355 | | | $ | 20,376 | | D | $ | 27,731 | | | $ | 24,773 | | | $ | (37,000) | | B,C | $ | 15,504 | |

| Restricted cash | 74,777 | | | 5,650 | | D | 80,427 | | | — | | | — | | | 80,427 | |

| SBA loans, at fair value | 511,325 | | | 85,170 | | D | 596,495 | | | — | | | — | | | 596,495 | |

| Loans receivable, net of allowance for loan losses | — | | | — | | | — | | | 162,972 | | | — | | | 162,972 | |

| Available for sale securities (at fair value) | — | | | — | | | — | | | 6,484 | | | — | | | 6,484 | |

| Servicing assets, at fair value | 33,530 | | | — | | | 33,530 | | | — | | | — | | | 33,530 | |

| Other investments | — | | | 18,159 | | D,E | 18,159 | | | 8,447 | | | — | | | 26,606 | |

| Controlled investments | 272,928 | | | (272,928) | | D | — | | | — | | | — | | | — | |

| Non-control investments | 1,360 | | | (1,360) | | D | — | | | — | | | — | | | — | |

| Broker receivable | 71,634 | | | — | | | 71,634 | | | — | | | — | | | 71,634 | |

| Goodwill and Intangible assets, net | — | | | 25,572 | | D | 25,572 | | | — | | | — | | | 25,572 | |

| Right of Use Assets | 6,381 | | | — | | | 6,381 | | | — | | | — | | | 6,381 | |

| Finance Inventory & AR Receivables | — | | | 16,236 | | D | 16,236 | | | — | | | — | | | 16,236 | |

| Due from related parties | 947 | | | (947) | | D,F | — | | | — | | | — | | | — | |

| Other assets | 26,298 | | | 17,573 | | D | 43,871 | | | 3,064 | | | — | | | 46,935 | |

| Total assets | $ | 1,006,535 | | | $ | (86,499) | | | $ | 920,036 | | | $ | 205,740 | | | $ | (37,000) | | | $ | 1,088,776 | |

| | | | | | | | | | | |

| LIABILITIES AND NET ASSETS | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | |

| Demand | $ | — | | | $ | — | | | $ | — | | | $ | 23,015 | | | $ | — | | | $ | 23,015 | |

| Savings, Super NOW | — | | | — | | | — | | | 12,633 | | | — | | | 12,633 | |

| Money Market | — | | | — | | | — | | | 103,186 | | | — | | | 103,186 | |

| Bank notes payable (par: $118,200) | 67,500 | | | 68,644 | | D | 136,144 | | | — | | | — | | | 136,144 | |

| Notes due 2026 (par: $115,000) | 112,666 | | | — | | | 112,666 | | | — | | | — | | | 112,666 | |

| Notes due 2024 (par: $38,250) | 37,847 | | | — | | | 37,847 | | | — | | | — | | | 37,847 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NewtekOne (1) Historical | | Reorganization Transaction Accounting Adjustments | Notes | NewtekOne- Pro Forma | | NBNYC(2) Historical | | NBNYC Acquisition Transaction Accounting Adjustments | Notes | Pro Forma Combined |

| Notes due 2025 (par: $30,000) | 29,246 | | | — | | | 29,246 | | | — | | | — | | | 29,246 | |

| Notes payable - Securitization trusts (par: $249,750) | 298,125 | | | — | | | 298,125 | | | — | | | — | | | 298,125 | |

| Advances from the Federal Home Loan Bank | — | | | — | | | — | | | 28,693 | | | — | | | 28,693 | |

| Due to participants | 34,660 | | | — | | | 34,660 | | | — | | | — | | | 34,660 | |

| Deferred tax liabilities | 12,908 | | | (8,993) | | D | 3,915 | | | (277) | | | — | | | 3,638 | |

| Notes payable - related parties | 150 | | | (150) | | D,F | — | | | — | | | — | | | — | |

| Due to related parties | 1,849 | | | (1,849) | | D,F | — | | | — | | | — | | | — | |

| Lease liabilities | 7,945 | | | (7,945) | | D | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| Accounts payable, accrued expenses and other liabilities | 11,840 | | | 30,722 | | D | 42,562 | | | 1,032 | | | 2,000 | | A | 45,594 | |

| Total liabilities | $ | 614,736 | | | $ | 80,429 | | | $ | 695,165 | | | $ | 168,282 | | | $ | 2,000 | | | $ | 865,447 | |

| | | | | | | | | | | |

| Net assets: | | | | | | | | | | | |

| Preferred stock (par value $0.02 per share; authorized 1,000 shares, no shares issued and outstanding) | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Common stock (par value $0.02 per share; authorized 200,000 shares, 24,159 and 21,970 issued and outstanding, respectively) | 485 | | | — | | | 485 | | | 840 | | | (840) | | B | 485 | |

| Additional paid-in capital | 370,703 | | | (146,317) | | D, G | 224,386 | | | 36,618 | | | (36,160) | | B, C | 224,844 | |

| Accumulated undistributed earnings | 20,611 | | | (20,611) | | G | — | | | — | | | (2,000) | | A | (2,000) | |

| Total net assets | 391,799 | | | (166,928) | | | 224,871 | | | 37,458 | | | (39,000) | | | 223,329 | |

| Total liabilities and net assets | 1,006,535 | | | (86,499) | | | 920,036 | | | 205,740 | | | (37,000) | | | 1,088,776 | |

(1) Derived from NewtekOne’s unaudited condensed consolidated balance sheet as of September 30, 2022.

(2) Derived from NBNYC’s unaudited condensed balance sheet as of September 30, 2022.

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

NINE MONTHS ENDED SEPTEMBER 30, 2022

(In Thousands, except for Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NewtekOne (3) Historical | | Reorganization Transaction Accounting Adjustments | Notes | NewtekOne Pro Forma | | NBNYC (4) Historical | | NBNYC Acquisition Transaction Accounting Adjustments | Notes | Pro Forma Combined |

| | | | | | | | | | | |

| Interest Income | | | | | | | | | | | |

| Interest income - SBA loans | $ | 23,915 | | | $ | 4,259 | | I | $ | 28,174 | | | $ | — | | | $ | — | | | $ | 28,174 | |

| | | | | | | | | | | |

| Interest income | — | | | — | | | — | | | 5,255 | | | — | | | 5,255 | |

| Interest income (from controlled investments) | 2,087 | | | (2,087) | | I | — | | | — | | | — | | | — | |

| Total interest income | 26,002 | | | 2,172 | | | 28,174 | | | 5,255 | | | — | | | 33,429 | |

| Interest expense | 17,412 | | | 2,973 | | I | 20,385 | | | 1,595 | | | — | | | 21,980 | |

| Net interest income | 8,590 | | | (801) | | | 7,789 | | | 3,660 | | | — | | | 11,449 | |

| Credit for loan losses | — | | | — | | | — | | | (200) | | | | | (200) | |

| Net interest income after credit for loan losses | 8,590 | | | (801) | | | 7,789 | | | 3,860 | | | — | | | 11,649 | |

| | | | | | | | | | | |

| Non-Interest Income | | | | | | | | | | | |

| Net gains on sale of SBA 7(a) loans | $ | 49,953 | | | $ | — | | | $ | 49,953 | | | $ | — | | | $ | — | | | $ | 49,953 | |

| Net loss on loans accounted for under the fair value option | — | | | (13,788) | | I | (13,788) | | | — | | | — | | | (13,788) | |

| Net realized depreciation on SBA guaranteed non-affiliate investments | (5,942) | | | 5,942 | | K | — | | | — | | | — | | | — | |

| Net realized depreciation on SBA unguaranteed non-affiliate investments | (6,473) | | | 6,473 | | K | — | | | — | | | — | | | — | |

| Gain on derivative transactions | 445 | | | 1,771 | | I | 2,216 | | | — | | | — | | | 2,216 | |

| Loss on servicing assets | (3,964) | | | — | | | (3,964) | | | — | | | — | | | (3,964) | |

| | | | | | | | | | | |

| Net unrealized appreciation on controlled investments | 1,582 | | | (1,582) | | I | — | | | — | | | — | | | — | |

| Net unrealized appreciation on derivative transactions | 183 | | | 1,277 | | I | 1,460 | | | — | | | — | | | 1,460 | |

| Loan servicing income | 9,931 | | | 1,000 | | I | 10,931 | | | — | | | — | | | 10,931 | |

| Web Hosting and IT Support Income | — | | | 22,733 | | I | 22,733 | | | — | | | — | | | 22,733 | |

| Electronic Payment Processing Revenue | — | | | 32,945 | | I | 32,945 | | | — | | | — | | | 32,945 | |

| Origination Income | — | | | 2,708 | | I | 2,708 | | | — | | | — | | | 2,708 | |

| Asset Backed Lending Income | — | | | 1,621 | | I | 1,621 | | | — | | | — | | | 1,621 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NewtekOne (3) Historical | | Reorganization Transaction Accounting Adjustments | Notes | NewtekOne Pro Forma | | NBNYC (4) Historical | | NBNYC Acquisition Transaction Accounting Adjustments | Notes | Pro Forma Combined |

| Insurance revenue | — | | | 1,432 | | I | 1,432 | | | — | | | — | | | 1,432 | |

| Payroll processing revenue | — | | | 1,224 | | I | 1,224 | | | — | | | — | | | 1,224 | |

| Other income | 6,499 | | | 4,531 | | I | 11,030 | | | 411 | | | — | | | 11,441 | |

| Dividend income (from non-control investments) | 62 | | | (62) | | I | — | | | — | | | — | | | — | |

| Dividend income (from controlled investments) | 19,989 | | | (19,989) | | I | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| Other income (from controlled investments) | 672 | | | (672) | | I | — | | | — | | | — | | | — | |

| Total non-interest income | 72,937 | | | 47,564 | | | 120,501 | | | 411 | | | — | | | 120,912 | |

| | | | | | | | | | | |

| Non-Interest Expense | | | | | | | | | | | |

| Salaries and benefits | 14,380 | | | 34,604 | | I | 48,984 | | | 2,119 | | | — | | | 51,103 | |

| Depreciation and amortization | 181 | | | 2,394 | | I | 2,575 | | | — | | | — | | | 2,575 | |

| Professional fees | 4,322 | | | 2,284 | | I | 6,606 | | | — | | | 2,000 | | H | 8,606 | |

| Origination and loan processing | 7,202 | | | 770 | | I | 7,972 | | | — | | | — | | | 7,972 | |

| Origination and loan processing - related party | 14,698 | | | (14,698) | | I, J | — | | | — | | | — | | | |

| Loss on extinguishment of debt | 417 | | | — | | I | 417 | | | — | | | — | | | 417 | |

| Cost of revenue - NTS | — | | | 14,514 | | I | 14,514 | | | — | | | — | | | 14,514 | |

| Electronic payment processing costs | — | | | 13,456 | | I | 13,456 | | | — | | | — | | | 13,456 | |

| Other general and administrative costs | 5,619 | | | 8,334 | | I | 13,953 | | | 1,111 | | | — | | | 15,064 | |

| Total non-interest expense | 46,819 | | | 61,658 | | | 108,477 | | | 3,230 | | | 2,000 | | | 113,707 | |

| | | | | | | | | | | |

| Net other income (loss) after other expenses | 26,118 | | | (14,094) | | | 12,024 | | | (2,819) | | | (2,000) | | | 7,205 | |

| | | | | | | | | | | |

| Income before taxes | 34,708 | | | (14,895) | | | 19,813 | | | 1,041 | | | (2,000) | | | 18,854 | |

| Change in provision for deferred taxes | (175) | | | 142 | | | (33) | | | — | | | — | | | (33) | |

| Provision for income taxes | — | | | — | | | — | | | (81) | | | — | | | (81) | |

| Net Income from operations | $ | 34,533 | | | $ | (14,753) | | | $ | 19,780 | | | $ | 960 | | | $ | (2,000) | | | $ | 18,740 | |

| | | | | | | | | | | |

| Weighted average shares outstanding, basic and diluted | 24,204 | | | | 24,204 | | | | | | 24,204 |

| Basic and diluted net income per share | $ | 1.43 | | | | | $ | 0.82 | | | | | | | $ | 0.77 | |

(3) Derived from NewtekOne’s unaudited condensed consolidated statement of operations for the nine months ended September 30, 2022.

(4) Derived from NBNYC’s unaudited condensed statement of operations for the nine months ended September 30, 2022.

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2021

(In Thousands, except for Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NewtekOne (5) Historical | | Reorganization Transaction Accounting Adjustments | Notes | NewtekOne Pro Forma | | NBNYC (6) Historical | | NBNYC Acquisition Transaction Accounting Adjustments | Notes | Pro Forma Combined |

| | | | | | | | | | | |

| Interest Income | | | | | | | | | | | |

| Interest income - SBA loans | $ | 25,951 | | | $ | 4,795 | | I | $ | 30,746 | | | $ | — | | | $ | — | | | $ | 30,746 | |

| Interest income - PPP loans | 49,989 | | | — | | | 49,989 | | | — | | | — | | | 49,989 | |

| Interest income | — | | | 428 | | I | 428 | | | 7,453 | | | — | | | 7,881 | |

| Interest income (from non-control investments) | 428 | | | (428) | | I | — | | | — | | | — | | | — | |

| Interest income (from controlled investments) | 2,598 | | | (2,598) | | I | — | | | — | | | — | | | — | |

| Total interest income | 78,966 | | | 2,197 | | | 81,163 | | | 7,453 | | | — | | | 88,616 | |

| Interest expense | 20,515 | | | 3,217 | | I | 23,732 | | | 2,316 | | | — | | | 26,048 | |

| Net interest income | 58,451 | | | (1,020) | | | 57,431 | | | 5,137 | | | — | | | 62,568 | |

| Credit for loan losses | — | | | — | | | — | | | (392) | | | | | (392) | |

| Net interest income after credit for loan losses | 58,451 | | | (1,020) | | | 57,431 | | | 5,529 | | | — | | | 62,960 | |

| | | | | | | | | | | |

| Non-Interest Income | | | | | | | | | | | |

| Net gains on sale of SBA 7(a) loans | $ | 53,113 | | | $ | — | | | $ | 53,113 | | | $ | — | | | $ | — | | | $ | 53,113 | |

| Net gains on loans accounted for under the fair value option | — | | | 11,192 | | I | 11,192 | | | — | | | — | | | 11,192 | |

| Net realized appreciation on SBA guaranteed non-affiliate investments | 6,380 | | | (6,380) | | K | — | | | — | | | — | | | — | |

| Net realized appreciation on SBA unguaranteed non-affiliate investments | 5,097 | | | (5,097) | | K | — | | | — | | | — | | | — | |

| Gain on derivative transactions | 590 | | | 644 | | I | 1,234 | | | — | | | — | | | 1,234 | |

| Loss on servicing assets | (6,778) | | | — | | | (6,778) | | | — | | | — | | | (6,778) | |

| Net realized loss on controlled investments | (1,266) | | | 1,266 | | I | — | | | — | | | — | | | — | |

| Net unrealized appreciation on controlled investments | 2,829 | | | (2,829) | | I | — | | | — | | | — | | | — | |

| Net unrealized depreciation on derivative transactions | (183) | | | (43) | | I | (226) | | | — | | | — | | | (226) | |

| Loan servicing income | 11,307 | | | 2,589 | | I | 13,896 | | | — | | | — | | | 13,896 | |

| Web Hosting and IT Support Income | — | | | 16,248 | | I | 16,248 | | | — | | | — | | | 16,248 | |

| Electronic Payment Processing Revenue | — | | | 38,879 | | I | 38,879 | | | — | | | — | | | 38,879 | |

| Origination Income | — | | | 2,304 | | I | 2,304 | | | — | | | — | | | 2,304 | |

| Asset Backed Lending Income | — | | | 1,850 | | I | 1,850 | | | — | | | — | | | 1,850 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NewtekOne (5) Historical | | Reorganization Transaction Accounting Adjustments | Notes | NewtekOne Pro Forma | | NBNYC (6) Historical | | NBNYC Acquisition Transaction Accounting Adjustments | Notes | Pro Forma Combined |

| Insurance revenue | — | | | 2,746 | | I | 2,746 | | | — | | | — | | | 2,746 | |

| Payroll processing revenue | — | | | 1,235 | | I | 1,235 | | | — | | | — | | | 1,235 | |

| Other income | | | 10,345 | | I | 10,345 | | | 444 | | | — | | | 10,789 | |

| Dividend income (from non-control investments) | 95 | | | (95) | | I | — | | | — | | | — | | | — | |

| Dividend income (from controlled investments) | 9,801 | | | (9,801) | | I | — | | | — | | | — | | | — | |

| Other income (from non-affiliate investments) | 5,696 | | | (5,696) | | I | — | | | — | | | — | | | — | |

| Other income (from controlled investments) | 2,629 | | | (2,629) | | I | — | | | — | | | — | | | — | |

| Total non-interest income | 89,310 | | | 56,728 | | | 146,038 | | | 444 | | | — | | | 146,482 | |

| | | | | | | | | | | |

| Non-Interest Expense | | | | | | | | | | | |

| Salaries and benefits | 17,866 | | | 44,248 | | I | 62,114 | | | 2,868 | | | — | | | 64,982 | |

| Depreciation and amortization | 304 | | | 3,305 | | I | 3,609 | | | — | | | — | | | 3,609 | |

| Professional fees | 5,610 | | | 2,828 | | I | 8,438 | | | — | | | 3,700 | | H | 12,138 | |

| Origination and loan processing | 10,234 | | | 573 | | I | 10,807 | | | — | | | — | | | 10,807 | |

| Origination and loan processing - related party | 19,272 | | | (19,272) | | I, J | — | | | — | | | — | | | — | |

| Loss on extinguishment of debt | 1,552 | | | — | | | 1,552 | | | — | | | — | | | 1,552 | |

| Cost of revenue - NTS | — | | | 8,153 | | I | 8,153 | | | — | | | — | | | 8,153 | |

| Electronic payment processing costs | — | | | 16,853 | | I | 16,853 | | | — | | | — | | | 16,853 | |

| Other general and administrative costs | 7,455 | | | 12,150 | | I | 19,605 | | | 1,874 | | | — | | | 21,479 | |

| Total non-interest expense | 62,293 | | | 68,838 | | | 131,131 | | | 4,742 | | | 3,700 | | | 139,573 | |

| | | | | | | | | | | |

| Net other income (loss) after other expenses | 27,017 | | | (12,110) | | | 14,907 | | | (4,298) | | | (3,700) | | | 6,909 | |

| | | | | | | | | | | |

| Income before taxes | 85,468 | | | (13,130) | | | 72,338 | | | 1,231 | | | (3,700) | | | 69,869 | |

| Change in provision for deferred taxes | (1,327) | | | — | | | (1,327) | | | — | | | — | | | (1,327) | |

| Provision for income taxes | — | | | — | | | — | | | (119) | | | — | | | (119) | |

| Net Income from operations | $ | 84,141 | | | $ | (13,130) | | | $ | 71,011 | | | $ | 1,112 | | | $ | (3,700) | | | $ | 68,423 | |

| | | | | | | | | | | |

| Weighted average shares outstanding, basic and diluted | 22,795 | | | | 22,795 | | | | | | 22,795 |

| Basic and diluted net income per share | $ | 3.69 | | | | | $ | 3.12 | | | | | | | $ | 3.00 | |

(5) Derived from NewtekOne’s audited consolidated statement of operations for the year ended December 31, 2021.

(6) Derived from NBNYC’s audited statement of operations for the year ended December 31, 2021.

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

(In Thousands, except for Per Share Data)

1. BASIS OF PRESENTATION AND DESCRIPTION OF THE TRANSACTIONS

On January 6, 2023 (the "Closing Date"), NewtekOne. Inc. (“NewtekOne” or “the Company”) completed the acquisition of the National Bank of New York City (“NBNYC” and the “Acquisition,” respectively), a national bank regulated and supervised by the Office of the Comptroller of the Currency ("OCC"), pursuant to which the Company acquired from the NBNYC shareholders all of the issued and outstanding stock of NBNYC for $20 million. NBNYC has been renamed Newtek Bank, National Association (“Newtek Bank, N.A.” or "Newtek Bank") and has become a wholly owned subsidiary of the Company.

In connection with the completion of the Acquisition, the Company contributed to Newtek Bank, N.A. $31 million of cash and two of the Company’s subsidiaries, Newtek Business Lending, LLC (“NBL”) and Small Business Lending, LLC (“SBL”). The Company also filed with the SEC a Form N-54C, Notification of Withdrawal of Election to be Subject to the Investment Company Act of 1940, and has ceased to be a business development company (“BDC”) as of January 6, 2023. As a result, the Company is now a financial holding company (“FHC”) subject to the regulation and supervision of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), the Federal Reserve Bank of Atlanta, and the OCC. The Company no longer qualifies as a regulated investment company for federal income tax purposes and no longer qualifies for accounting treatment as an investment company.

As a result, in addition to Newtek Bank, N.A. and its consolidated subsidiaries, NBL and SBL, the following NewtekOne portfolio companies and subsidiaries will now be consolidated non-bank subsidiaries in the Company’s financial statements: Newtek Small Business Finance, LLC; Newtek Merchant Solutions, LLC; Mobil Money, LLC; CDS Business Services, Inc. d/b/a Newtek Business Credit Solutions; PMTWorks Payroll, LLC d/b/a Newtek Payroll and Benefits Solutions; Newtek Insurance Agency, LLC; Titanium Asset Management LLC; Newtek Business Services Holdco 6, Inc; Newtek Commercial Lending, Inc.; Excel WebSolutions, LLC; Newtek Technology Solutions, Inc and POS on Cloud, LLC, d/b/a Newtek Payment Systems. In addition, as a result of commitments made to the Federal Reserve, the Company will divest or otherwise terminate the activities conducted by Excel WebSolutions, LLC and Newtek Technology Solutions, Inc., including its subsidiary SIDCO, LLC d/b/a/ Cloud Nine Services, within two years of becoming a financial holding company, subject to any extension of the two-year period.

The Accquisition and contemporaneous conversion from a BDC to a FHC are referred to as the “Reorganization,”,and collectively the “Transactions.” For further details on the Transactions see the section titled Description of the Transactions.

The unaudited pro forma condensed combined financial information presents the pro forma condensed combined financial position and results of operations of the Combined Company based upon the historical consolidated financial statements of NewtekOne and NBNYC, after giving effect to transaction accounting adjustments related to the Transactions and are intended to reflect the impact of such on the Combined Company’s historical consolidated financial statements.

The pro forma adjustments have been prepared as if the Transactions had been consummated on September 30, 2022 in the case of the unaudited pro forma condensed combined balance sheet, and the Transactions had been consummated on January 1, 2021, the beginning of the earliest period presented, in the case of the unaudited pro forma condensed combined statements of operations.

The adjustments presented in the unaudited pro forma condensed combined financial information have been identified and presented to provide relevant information necessary for an accurate understanding of NewtekOne after giving effect to the Transactions. Management has made significant estimates and assumptions in its determination of the pro forma adjustments. As the unaudited pro forma condensed combined financial information has been prepared based on these preliminary estimates, the final amounts recorded may differ materially from the information presented.

The unaudited pro forma condensed combined financial information has been prepared using the following:

a.the historical audited consolidated financial statements and related notes of NewtekOne as of December 31, 2021 and for the year ended December 31, 2021 and b) the historical unaudited condensed consolidated financial statements and related notes of NewtekOne as of September 30, 2022 and for the nine months ended September 30, 2022. These can be found in the Company’s Form 10-K filing for the year ended December 31, 2021 and in the Company’s Form 10-Q filing for the quarter ended September 30, 2022, respectively;

b.the historical audited financial statements and related notes of NBNYC as of December 31, 2021 and for the year ended December 31, 2021, which are Exhibit 99.1 filed herewith, and the historical unaudited financial statements of NBNYC as of September 30, 2022 and for the nine months ended September 30, 2022, which can be found within the unaudited pro forma financial information for such periods included herein;

c.the historical unaudited financial statements of NewtekOne’s controlled subsidiaries as of December 31, 2021 and for the year ended December 31, 2021 and the historical unaudited financial statements of NewtekOne’s controlled subsidiaries as of September 30, 2022 and for the nine months ended September 30, 2022. This information was used to determine the transaction accounting adjustments needed to consolidate these subsidiaries;

d.the Stock Purchase Agreement, which can be found in the Company's Form 8-K, Exhibit 10.1, filed on August 2, 2021.

The Transactions are accounted for as two distinct transactions: 1) the Acquisition of NBNYC and 2) the Reorganization related to the conversion of the Company from a BDC to a FHC.

NBNYC Acquisition

The Company accounted for the Acquisition of NBNYC as a business combination, with NewtekOne treated as the “acquirer” and NBNYC treated as the “acquired” company for financial reporting purposes. For accounting purposes, the acquirer is the entity that has obtained control of another entity and, thus, consummated a business combination. Management has determined that NewtekOne is the accounting acquirer and NBNYC is the acquired company, as NewtekOne acquired all of the equity of NBNYC for $20.0 million cash consideration.

Under the acquisition method of accounting, the total estimated purchase price of an acquisition is allocated to the net tangible and intangible assets based on their estimated fair values. Such valuations are based on available information and certain assumptions that management of NewtekOne believe are reasonable. The preliminary allocation of the estimated purchase price to the tangible and intangible assets acquired and liabilities assumed is based on various preliminary estimates. Accordingly, the pro forma adjustments are preliminary and have been made solely for the purpose of providing the unaudited pro forma condensed combined financial information. Differences between these preliminary estimates and the final acquisition accounting, which will be based on the actual net tangible and identifiable intangible assets that exist as of the closing of the Acquisition, may occur and these differences could be material. The differences, if any, could have a material impact on the accompanying unaudited pro forma condensed combined financial information and the Combined Company’s future results of operations and financial position. See Note 2.

Reorganization

As a result of the Company’s conversion from a BDC to FHC, the Company no longer qualifies as a regulated investment company for federal income tax purposes and no longer qualifies for accounting treatment as an investment company. As a result, NewtekOne will need to consolidate the underlying assets, liabilities, and results of operations of controlled subsidiaries that were previously accounted for as investments at fair value with changes in fair value reflected in earnings. The unaudited pro forma condensed combined financial information contains transaction accounting adjustments to consolidate these entities and to reclassify certain account balances to conform to presentation as an FHC.

The conversion, which includes the contribution of cash, NBL and SBL to Newtek Bank, N.A., is considered a common control transaction that did not result in a change in control of NewtekOne’s subsidiaries. Therefore, the Company accounts for the Reorganization as an equity transaction; no gain or loss is recognized in the Company’s consolidated financial statements as a result of the conversion.

Upon consolidation of the controlled subsidiaries, the Company recognizes the underlying assets and liabilities at their carryover bases, as if it had not applied investment company accounting as of the Closing Date. However, the Company is required to measure its investments at fair value under ASC 946 until the Closing Date. Therefore, at the Acquisition Date, the Company derecognizes its investments in the controlled subsidiaries and records any difference between the resulting underlying assets/liabilities and the fair value of the investments in additional-paid-in-capital.

The pro forma combined statements of operations present the consolidated results of the controlled subsidiaries as if the Company had not applied investment company accounting prior to the Closing Date. As a result, the pro forma combined statements of operations present transaction accounting adjustments to reverse the fair value adjustments related to these investments and to record the results of operations from these consolidated investees.

The SBA 7(a) loans held by NewtekOne were accounted for at fair value with changes in fair value recorded through earnings up to the Closing Date. The pro forma combined statements of operations presents changes in fair value related to these loans.

The unaudited pro forma condensed combined financial information does not reflect the following:

•Income tax effects of the pro forma adjustments. The Combined Company’s management believes this unaudited pro forma condensed combined financial information to not be meaningful

•Restructuring or integration activities that have yet to be determined or other costs that may be incurred to achieve cost or growth synergies of the Combined Company. As no assurance can be made that the costs will be incurred or the cost or growth synergies will be achieved, no adjustment has been made.

In addition, the unaudited pro forma condensed combined financial information does not necessarily reflect what the Combined Company’s financial condition or results of operations would have been had the Transactions occurred on the dates indicated. They also may not be useful in predicting the future financial condition and results of operations of the Combined Company. The actual financial position and results of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors.

2. PRELIMINARY ESTIMATED PURCHASE PRICE ALLOCATION

The Company has not completed a valuation analysis and accordingly, the pro forma adjustments included are based on certain assumptions and estimates for a preliminary allocation of the purchase price of NBNYC to the estimated fair values of assets acquired and liabilities assumed at the Closing Date based on certain currently available information and certain assumptions and methodologies that management believes are reasonable under the circumstances. The final allocation of the purchase price could differ materially from the preliminary allocation primarily because market prices, interest rates and other valuation variables will fluctuate over time and be different at the time of completion of the Acquisition compared to the amounts assumed for the pro forma adjustments.

The total consideration paid equals the fair value of the assets acquired and liabilities assumed; thus, no goodwill has been recorded.

This estimated preliminary purchase price allocation has been used to prepare the pro forma adjustments in the unaudited pro forma condensed combined balance sheet and statements of operations. The final purchase price allocation will be determined when the Combined Company has completed the detailed valuations and necessary calculations. The final allocation could differ materially from the preliminary allocation used in the pro forma adjustments. The final allocation may include (1) changes in fair values of loans and investments, (2) changes in fair value of deposits and borrowings and (3) calculation of the core deposit intangible.

3. ADJUSTMENTS TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X.

Adjustments to Unaudited Pro Forma Condensed Combined Balance Sheet

The transaction accounting adjustments included in the unaudited pro forma condensed combined balance sheet as of September 30, 2022 are as follows:

A.To accrue transaction costs incurred by NewtekOne subsequent to September 30, 2022 of $2.0 million.

B.To record the cash consideration paid to the Sellers. The Company has performed a preliminary valuation analysis of the fair market value of NBNYC's assets to be acquired and liabilities to be assumed. Using the total consideration for the acquisition, the Company has estimated the allocations to such assets and liabilities. The $20.0 million purchase price equals the preliminary fair value of the assets acquired and liabilities assumed; thus, no goodwill has been recorded for the Acquisition.

C.To reduce the cash balance of NBNYC for $17.0 million of dividends paid by NBNYC to the Sellers immediately prior to the closing.

D.As a BDC, the Company accounted for it Controlled Investments at fair value. This adjustment is needed to present the Controlled Investments under US GAAP relevant to an FHC, specifically to derecognize the investments in the controlled subsidiaries and to recognize the subsidiaries’ assets and liabilities. The difference between the underlying net assets ($106.0 million) and the fair value of the investments ($272.928 million) is recorded as a $166.928 million adjustment to additional-paid-in-capital.

E.To reclassify the Company’s $18.159 million non-consolidated investments, of which $16.26 million represents an investment in Newtek Conventional Lending, LLC which the Company will account for under the equity method as an FHC.

F.To eliminate intercompany receivables and payable between subsidiaries that the Company is required to consolidate under US GAAP as an FHC. As a BDC, the Controlled Investments were recorded at fair value.

G.As a result of the Transactions, the Company no longer qualifies as a regulated investment company for federal income tax purposes. This adjustment is to reclassify the Company’s accumulated undistributed earnings to Additional-paid-in-capital to reflect the Company’s change in tax status as an FHC.

Adjustments to Unaudited Pro Forma Condensed Combined Statements of Operations

The transaction accounting adjustments included in the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2022, and year ended December 31, 2021 are as follows:

H.To record transaction costs incurred by NewtekOne subsequent to September 30, 2022 and December 31, 2021 of $2 million and $3.7 million, respectively. The remaining transaction costs of $1.7 million and $.3 million are included in the historical income statements of the Company for the nine months ended September 30, 2022 and the year ended December 31, 2021, respectively.

I.As a BDC, the Company accounted for its Controlled Investments at fair value with changes in fair value recorded through earnings. This adjustment is needed to present the Controlled Investments under US GAAP relevant to an FHC; specifically to reverse the Interest income, Unrealized appreciation (depreciation), Dividend income, and Other income on controlled investments and to recognize the underlying profit and loss of the controlled subsidiaries as if they had been consolidated during the periods presented.

J.To eliminate intercompany origination and loan processing fees between subsidiaries that the Company is required to consolidate under US GAAP as an FHC. As a BDC, the Controlled Investments were recorded at fair value.

K.To reclassify ($12.42) million and $11.48 million net gains (losses) on SBA 7(a) loans for the nine months ended September 30, 2022 and for the year ended December 31, 2021, respectively to conform to the presentation as an FHC. As a BDC, the Company was required to account for these loans at fair value with changes in fair value recognized through earnings. As an FHC, the Company will elect to account for these loans under the fair value option.

4. INCOME PER SHARE

Net income per share is calculated using the historical weighted average shares outstanding for the nine months ended September 30, 2022 and for the year ended December 31, 2021 as if the Transactions had occurred as of January 1, 2021. The weighted average shares outstanding were not affected by the Transactions since no additional shares were issued.

| | | | | | | | |

| | Pro Forma Combined |

| | (In Thousands, except for Per Share Data) |

| Nine Months Ended September 30, 2022 | | |

| Net income | | $ | 18,740 | |

| Weighted average shares outstanding – basic and diluted | | 24,204 | |

| Basic and diluted net income per share | | $ | 0.77 | |

| | |

| Year Ended December 31, 2021 | | |

| Net income | | 68,423 | |

| Weighted average shares outstanding – basic and diluted | | 22,795 | |

| Basic and diluted net income per share | | $ | 3.00 | |

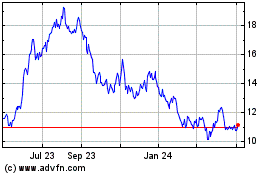

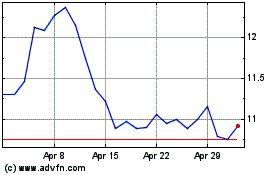

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024