L3Harris Stock Edges Higher After 4Q Results

January 27 2023 - 7:10AM

Dow Jones News

By Will Feuer

Shares of L3Harris Technologies Inc. edged higher in premarket

trading after the defense contractor posted better-than-expected

results for the fourth quarter, and said various pressures,

including cost inflation and supply-chain challenges, are

easing.

Shares rose about 3% to $202.44 in the premarket session. Over

the past 12 months, the stock has fallen about 9%.

L3Harris posted fourth-quarter profit of $416 million, or $2.17

a share, down from $484 million, or $2.46 a share, in the same

period a year earlier.

Adjusted earnings came to $3.27 a share, beating analyst

estimates by a penny.

Revenue rose 6% on an organic basis to $4.58 billion, boosted by

higher production in the Space & Airborne Systems and

Communication Systems segments as supply-chain challenges eased.

Analysts surveyed by FactSet were expecting revenue of $4.34

billion.

The company, which agreed last month to buy Aerojet Rocketdyne

Holdings Inc. in a $4.7 billion all-cash deal, also issued 2023

guidance, which L3Harris said reflects easing supply-chain issues

and plateauing cost inflation.

L3Harris guided for full-year revenue of $17.4 billion to $17.8

billion, up from $17.1 billion reported in 2022. Adjusted earnings

are expected to fall to a range of $12 a share to $12.50 a share,

down from the $12.90 a share reached in 2022.

In a letter to investors, the company said demand for L3Harris'

products remains strong, driven by elevated geopolitical tensions

in Asia and the Middle East, as well as the war between Russia and

Ukraine.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

January 27, 2023 06:55 ET (11:55 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

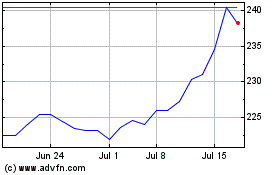

L3Harris Technologies (NYSE:LHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

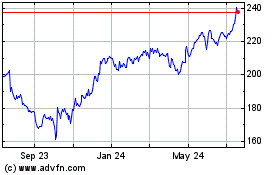

L3Harris Technologies (NYSE:LHX)

Historical Stock Chart

From Apr 2023 to Apr 2024