SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

| MMEX RESOURCES CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing is calculated and state how it was determined.): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

MMEX Resources Corporation

3600 Dickinson

Fort Stockton, TX 79735

NOTICE OF ACTION TAKEN WITHOUT A SHAREHOLDER MEETING

*************

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY. No action is required by you.

This Information Statement is furnished only to inform our shareholders of the actions described herein in

accordance with Rule 14c-2 promulgated under the Securities Act of 1934.

THIS IS NOT A NOTICE OF A MEETING OF SHAREHOLDERS AND NO SHAREHOLDERS’

MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

*************

To the Shareholders of MMEX Resources Corporation:

The attached Information Statement is being delivered by MMEX Resources Corporation (the “Company” or “MMEX”) in connection with the approval by our shareholders of an amendment to our Amended and Restated Articles of Incorporation to increase the authorized number of shares of common stock from 201,000,000 to 1,001,000,000 shares (the “Share Increase”). The text of the proposed amendment is set forth as Annex A to this Information Statement.

This Information Statement is being mailed to the shareholders of record as of January 23, 2023 and is being mailed to shareholders on February __, 2023. We anticipate that the amendment to our Amended and Restated Articles of Incorporation will become effective on or after February __, 2023. Each of these actions was approved by the holders of a majority of the outstanding voting power of the shareholders of MMEX by a written consent to action taken without a meeting, dated February __, 2023.

QUESTIONS AND ANSWERS REGARDING THE INFORMATION STATEMENT

What is the purpose of the Information Statement?

Section 78.320 of the Nevada Revised Statutes (“NRS”) provides that the written consent of the holders of outstanding shares of voting capital stock having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted can approve an action in lieu of conducting a special shareholders' meeting convened for the specific purpose of such action.

This Information Statement is being furnished to you pursuant to Section 14C of the Securities Exchange Act of 1934 (“Exchange Act”) to notify our shareholders of certain corporate actions taken by the holders of shares of voting securities representing approximately 59.2% of the voting power of the total issued and outstanding shares of voting common stock of the Company (the “Majority Holders”) pursuant to action by written consent. In order to eliminate the costs and management time involved in obtaining proxies and in order to effect the Share Increase as early as possible to accomplish the purposes hereafter described, our board of directors elected to seek the written consent of the Majority Holders to reduce the costs and implement the Share Increase in a timely manner.

What capital stock is authorized and outstanding?

We are currently authorized to issue 201,000,000 shares of capital stock, consisting of 200,000,000 shares of common stock, par value $0.001 per share, and 1,000,000 shares of preferred stock, par value $.0001 per share. As of December 5, 2022, there were 31,108,591 shares of our common stock and 1,000 Series A shares of preferred stock outstanding. The Series A Preferred Stock has no redemption, conversion or dividend rights; however, the holders of the Series A Preferred Stock, voting separately as a class, has the right to vote on all shareholder matters equal to 51% of the total vote. We have also designated, but not issued, shares of Series B Preferred Stock. Such shares have a stated value equal to $1,000, have no redemption or voting rights, and are entitled to receive dividends on preferred stock equal, on an as-of-converted-to-common-stock basis, to and in the same form as the dividends paid on shares of the common stock. The Series B preferred stock is convertible, at the option of the holder, into the number of shares of common stock determined by dividing the stated value of such share of Series B Preferred Stock by the initial Conversion Price of $0.10, which has subsequently been adjusted to $0.0093 per share.

What is the purpose of the Share Increase?

We are proposing to increase the number of authorized shares of common stock from 200,000,000 to 1,000,000,000 shares.

We have outstanding various notes and warrants which are convertible into a significant number of shares of our common stock. Substantially all of our authorized but unissued shares of common stock are reserved for issuance upon conversion or exercise of these securities. This has reduced our ability to issue shares for growth.

Until we have cash flow from operations, we are likely to seek further equity and equity-related offerings to continue as a going concern. As additional equity securities are issued, investors’ percentage interests in our equity ownership will be diluted. The result of this could be expected to reduce the value of current investors’ stock.

Having an increased number of authorized but unissued shares of our capital stock would allow us to take prompt action with respect to corporate opportunities that may develop in the future, without the delay and expense of convening a special meeting of shareholders for the purpose of approving an increase in our capitalization. Such opportunities might include, without limitation, issuance in public or private sales for cash as a means of obtaining additional capital for use in our business and operations, and issuance as part or all of the consideration required to be paid by us for acquisitions of other businesses or assets. Notwithstanding the foregoing, we have no obligation to issue such shares and there are no plans, proposals or arrangements currently contemplated by us that would involve the issuance of such additional shares. The additional capital stock can provide flexibility in structuring the terms of any future agreements, as well as any future financing and recapitalization efforts.

Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our board or contemplating a tender offer or other transaction for the combination of our company with another company), the Share Increase was not proposed in response to any effort of which we are aware to accumulate shares of common stock or obtain control of us, nor is it part of a plan by management to recommend a series of similar actions having an anti-takeover effect to the board and our stockholders.

When will the Share Increase Become Effective?

The Majority Holders consist of affiliates of Jack W. Hanks and Bruce N. Lemons, our two directors. The Majority Holders own 100% of our Series A Preferred Stock and approximately 16.8% of our outstanding common stock, which results in their ownership of approximately 59.2% of the voting power of our voting securities. The Majority Holders have voted in favor of the Share Increase thereby satisfying the requirement under the NRS that at least a majority of the voting equity vote in favor of a corporate action by written consent. Therefore, no other shareholder consents will be obtained in connection with this Information Statement.

Upon the effectiveness and on the date that is 20 days following the mailing of this Information Statement, the board of directors shall have the Company’s Certificate of Amendment to the Amended and Restated Articles of Incorporation filed with the State of Nevada in order to effect the Share Increase.

Who is entitled to notice?

Each outstanding share of common stock as of record on January 23, 2023 is entitled to notice of the action taken pursuant to the written consent of the Majority Holders. We will deliver, or cause to be delivered, only one copy of this Information Statement to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. We undertake to promptly deliver, or cause to be promptly delivered, upon written or oral request, a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this Information Statement is delivered. A stockholder can notify us that the stockholder wishes to receive a separate copy of this Information Statement by contacting us at the address set forth above. Conversely, if multiple stockholders sharing an address receive multiple Information Statements and wish to receive only one, such stockholders can notify us at the address set forth above.

Are there dissenter’s rights in connection with the Share Increase?

MMEX shareholders have no right under Nevada corporate law, the Company’s Amended and Restated Articles of Incorporation consistent with above, or Bylaws to dissent from any of the provisions of the Share Increase.

Are there federal income tax consequences arising from the Share Increase?

We believe that the Share Increase will have no federal income tax effects. We will not recognize gain or loss as a result of the Share Increase. However, we have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the Share Increase.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of January 20, 2023 , the name and number of shares of the Company’s common stock beneficially owned by (i) each of the directors and named executive officers of the Company, (ii) beneficial owners of 5% or more of our common stock; and (iii) all the officers and directors as a group. Pursuant to the rules and regulations of the SEC, shares of common stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person shown in the table.

SEC rules provide that, for purposes hereof, a person is considered the “beneficial owner” of shares with respect to which the person, directly or indirectly, has or shares the voting or investment power, irrespective of his/her/its economic interest in the shares. Unless otherwise noted, each person identified possesses sole voting and investment power over the shares listed, subject to community property laws.

The percentages in the table below are based on 45,970,724 shares of common stock outstanding as of January 20, 2023. Shares of common stock subject to options and warrants that are exercisable within 60 days of January 20, 2023 are deemed beneficially owned by the person holding such options for the purposes of calculating the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage of any other person.

| Name and Address of Beneficial Owners (1) | | Shares | | | Percentage Ownership of Class | | | Voting Power (4) | |

| Jack W. Hanks (2)(4) | | | 3,592,336 | | | | 7.81 | % | | | 54.82 | % |

| Bruce N. Lemons (3) | | | 4,147,681 | | | | 9.02 | % | | | 4.42 | % |

| Nabil Katabi(5) | | | 8,864,283 | | | | 19.28 | % | | | 9.44 | % |

| Robyn Watson | | | 2,929,523 | | | | 6.37 | % | | | 3.12 | % |

| All directors and officers as a group (two persons) | | | 7,740,017 | | | | 16.83 | % | | | 59.24 | % |

_______________

| (1) | Unless otherwise noted, the business address for each of the individuals set forth in the table is c/o MMEX Resources Corporation, 3600 Dickinson, Fort Stockton, Texas 79735. |

| (2) | Common shares for Mr. Hanks include: (i) 43 shares held by The Maple Gas Corporation, (ii) 136 shares held by Maple Structure Holdings, LLC, (iii) 592,157 shares held by Maple Resources Corporation and (iv) 3,000,000 shares issuable upon the exercise of outstanding warrants. This number excludes 1,161,746 shares owned by Leslie Doheny Hanks, the wife of Mr. Hanks, as to which Mr. Hanks disclaims any beneficial ownership. |

| (3) | Common shares for Mr. Lemons include: (i) 1,147,645 shares held by BNL Family Trust (ii) 36 shares held by AAM Investments, LLC, and (iii) 3,000,000 shares issuable upon the exercise of outstanding warrants. Mr. Lemons and his family are the beneficiaries of BNL Family Trust. AAM Investments, LLC is indirectly owned by BNL Family Trust, a trust established for the benefit of Mr. Lemons and his family. |

| (4) | The holders of Series A Preferred Stock have 51% of the voting power of the outstanding shares of capital stock of the Company. |

| (5) | Common shares for Mr. Katabi include (i) 5,864,283 shares personally and (ii) 3,000,000 shares issuable upon the exercise of outstanding warrants. |

ADDITIONAL INFORMATION

MMEX is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the Securities and Exchange Commission (the “Commission”). The Commission maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the Commission through the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”).

PROPOSALS BY SECURITY HOLDERS

No security holder has asked the Company to include any proposal in this Information Statement.

EXPENSE OF THIS INFORMATION STATEMENT

The expenses of this Information Statement will be borne by us, including expenses in connection with the preparation and sending of this Information Statement and all related materials. It is contemplated that brokerage houses, custodians, nominees, and fiduciaries will be requested to forward this Information Statement to the beneficial owners of our common stock held of record by such person and that we will reimburse them for their reasonable expenses incurred in connection therewith.

FORWARD-LOOKING STATEMENTS

This Information Statement contains forward-looking statements regarding our intentions to effectuate the Share Increase. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events or otherwise.

By Order of the Board of Directors

Jack W. Hanks, President and CEO

Fort Stockton, Texas

February __, 2023

Annex A

PROPOSED AMENDMENT TO ARTICLES OF INCORPORATION

ARTICLE IV

CAPITAL STOCK

The total number of shares of stock which the Corporation shall have authority to issue is One Billion One Million (1,100,000,000) shares, which shall consist of (i) One Billion (1,100,000,000) shares of common stock, par value $0.001 per share (the "Common Stock"), and (ii) One Million (1,000,000) shares of preferred stock, par value $0.001 per share (the "Preferred Stock"). The voting powers, designations, preferences, privileges and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions of each class or series of capital stock of the Corporation, shall be as provided in this Article IV.

A. PREFERRED STOCK.

The Preferred Stock may be issued from time to time by the Board of Directors as shares of one or more classes or series. The designations, powers, preferences and relative, optional, conversion and other special rights, and the qualifications, limitations and restrictions thereof, of Preferred Stock of each class or series shall be such as are stated and expressed herein and, to the extent not stated and expressed herein, shall be such as may be fixed by the Board of Directors (authority so to do being hereby expressly granted) and stated and expressed in a resolution or resolutions adopted by the Board of Directors providing for the issue of Preferred Stock of such class or series. Such resolution or resolutions shall (a) specify the class or series to which such Preferred Stock shall belong, (b) fix the dividend rate therefor, (c) fix the amount which the holders of Preferred Stock of such class or series shall be entitled to be paid in the event of a voluntary liquidation, dissolution or winding up of the Corporation, (d) state whether or not Preferred Stock of such class or series shall be redeemable and at what times and under what conditions and the amount or amounts payable thereon in the event of redemption, (e) fix the voting powers of the holders of Preferred Stock of such class or series, whether full or limited, or without voting powers, but in no event shall the holders of Preferred Stock of such class or series be entitled to more than one vote for each share held at all meetings of the stockholders of the Corporation; and may, in a manner not inconsistent with the provisions of this Article 4, (i) limit the number of shares of such class or series which may be issued, (ii) provide for a sinking or purchase fund for the redemption or purchase of shares of such class or series and the terms and provisions governing the operation of any such fund and the status as to reissuance of shares of Preferred Stock purchased or otherwise reacquired or redeemed or retired through the operation thereof, (iii) impose conditions or restrictions upon the creation of indebtedness of the Corporation or upon the issue of additional Preferred Stock or other capital stock ranking equally therewith or prior thereto as to dividends or distribution of assets on liquidation, and (iv) grant such other special rights to the holders of Preferred Stock of such class or series as the Board of Directors may determine and which are not inconsistent with the provisions of this Article 4. The term "fix for such class or series" and similar terms shall mean stated and expressed in a resolution or resolutions adopted by the Board of Directors providing for the issue of Preferred Stock of the class or series referred to therein. No further action or vote of the stockholders shall be required for any action taken by the Board of Directors pursuant to this Article 4.

The Board of Directors has previously designated (i) the Series A Preferred Stock, consisting of 1,000 shares and having the rights and preferences set forth in the Certificate of Designations of the Series A Preferred Stock and (ii) the Series B Preferred Stock, consisting of 1,500 shares and having the rights and preferences set forth in the Certificate of Designations of the Series B Preferred Stock

B. COMMON STOCK. All previously authorized shares of Class B Common Stock of the Company having been duly converted into shares of Class A Common Stock, all of the shares of Common Stock previously designated as Class A Common Stock are now referred to as “Common Stock.” The holder of each share of Common Stock shall be entitled to one vote for each such share as determined on the record date for the vote or consent of stockholders and shall vote together with the holders of Series A Preferred Stock of the Company as a single class upon any items submitted to a vote of stockholders, except with respect to matters requiring a separate series or class vote.

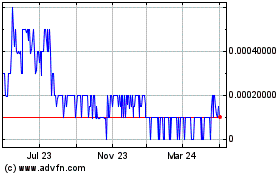

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

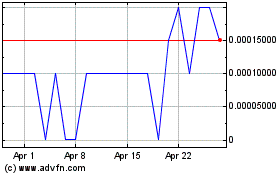

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024