Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”)

(NASDAQ: SHIP) announced today an aggregate of $8.8 million of

buybacks of its securities consisting of:

(i) $8 million of its outstanding convertible

note with 5.5% coupon and a conversion price of $1.20 per share

(the “Note”), pursuant to the terms of the Note, and

(ii) $0.8 million in 4,038,114 warrants at $0.2

per warrant, pursuant to the recently completed tender offer. The

repurchased securities represent approximately 47% of the

outstanding Class E Warrants to purchase an equal number of shares

at an exercise price of $0.524 per share.

Moreover, Seanergy’s Chairman & CEO,

Stamatis Tsantanis, has since August 2022 purchased 300,000 of the

Company’s common shares in the open market.

The Company has also announced today that a

Special General Shareholders Meeting will be held on February 7,

2023,to vote on a reverse stock split of its common shares at a

ratio of not less than 1:8 and not more than 1:12.

Stamatis Tsantanis, the Company’s

Chairman & Chief Executive Officer, stated:

“The additional buybacks we completed recently

are another example of our shareholder rewarding initiatives that

we have implemented successfully over the last 12 months. We have

addressed decisively the legacy overhang on our share price, whilst

generating savings in interest expenses. We continuously

demonstrate our strong commitment to enhancing value for our

shareholders.

“I have also accelerated my own open market

purchases of Seanergy’s shares, with strong confidence in our

Company’s prospects and the industry’s fundamentals, and I intend

to continue demonstrating my support this way going forward.

“Concerning the reverse stock split proposal,

the trading of our shares below or around Nasdaq’s minimum bid

price levels is considered restrictive for certain larger investors

that could otherwise invest in Seanergy. In addition to ensuring

Nasdaq’s listing standards are met, we believe that eliminating

trading uncertainties and consolidating the outstanding number of

our common stock will be very beneficial for our shareholders and

will also increase the investor outreach for our stock attracting

fundamental, longer-term shareholders.

“We are excited to move forward stronger after

addressing share-price related overhang and in conjunction with our

significant recent progress in returning capital to our

shareholders. This is attested by the $35.5 million in securities

repurchases since December 2021, in combination with the $22.5

million in cash dividend distributions since April 2022.”

Buyback of Convertible

Notes

On January 3, 2023, the Company repaid $8.0

million of the Note held by Jelco Delta Holding Corp. (“JDH”) at

its face value, without any prepayment cost or additional

consideration and in accordance with the terms of the Note. Based

on an exercise price of $1.20 per share, the buyback has pre-empted

potential dilution of 6.67 million shares. In addition, considering

that the Note carries a fixed coupon of 5.5% p.a., the Company will

realize annual interest savings of $440,000. There are

approximately $3.2 million currently outstanding under the only

remaining convertible note. Since December 2021, the Company has

repurchased in total $31.95 million of its convertible notes held

by JDH, preempting potential dilution of 26.63 million shares.

Buyback of Class

E Warrants

Pursuant to the Tender Offer that was launched

on November 30, 2022, the Company has bought back 47% of its

outstanding Class E Warrants to purchase 4,038,114 million shares

for a price of $807,623, or $0.20 per warrant. The adjusted

exercise price of the Class E Warrants was $0.524 per share. Since

December 2021, Seanergy has repurchased warrants to purchase

8,323,828 shares. Following these transactions, there are

approximately 4.5 million Class E Warrants outstanding to purchase

an equal number of shares.

Open Market Purchases by the CEO

Seanergy’s Chairman & CEO, Stamatis

Tsantanis, has purchased in January 2023 an additional 250,500 of

the Company’s common shares in the open market. Mr. Tsantanis has

purchased in total 300,000 common shares of Seanergy in the open

market since August 2022.

Summary of Repurchases:

The following table summarizes the Company’s repurchases of its

securities and the price paid per share (including shares

underlying convertible securities) since December 2021:

|

|

Purchase price |

Price per share |

Shares |

Month Executed |

| Warrants |

$1,023,136 |

$0.939** |

4,285,714* |

Dec '21 |

| Note 1 |

$200,000 |

$1.20 |

166,666* |

Dec '21 |

| Note 3 |

$13,750,000 |

$1.20 |

11,458,333* |

Dec '21 |

| Common Shares |

$1,690,916 |

$0.993 |

1,702,103 |

Nov-Dec '21 |

| Note 2 |

$5,000,000 |

$1.20 |

4,166,667* |

Jan '22 |

| Note 2 |

$5,000,000 |

$1.20 |

4,166,667* |

Mar '22 |

| Warrants |

$807,623 |

$0.724*** |

4,038,114* |

Jan '23 |

| Note

2 |

$8,000,000 |

$1.20 |

6,666,667* |

Jan '23 |

| Total /

Average |

$35,471,675 |

|

36,650,931 |

|

|

|

|

|

|

|

| *Not issued:

shares underlying convertible securities |

| **Including $0.70

warrant exercise price per share |

| ***Including

$0.524 warrant exercise price per share |

| |

Special General Meeting of

Shareholders

Seanergy will hold a special general meeting of

shareholders (the “Meeting”) at its executive offices at 154

Vouliagmenis Avenue, 16674 Glyfada, Greece on February 7, 2023, at

6:00 p.m., local time, or 11:00 a.m. Eastern Time to approve a

reverse stock split at a ratio of not less than 1:8 and not more

than 1:12 with the exact ratio to be determined by the Company’s

Board of Directors. Shareholders of record as of the close of

business on January 19, 2023, are eligible to vote at the

Meeting.

The reverse stock split is intended to bring the

Company into compliance with the minimum bid price requirement for

maintaining its listing on the Nasdaq Stock Market.

Additionally, a number of institutional

investors and investment funds are reluctant to invest, and in some

cases may be prohibited from investing, in lower-priced stocks and

brokerage firms are reluctant to recommend lower-priced stocks to

their clients. By effecting a reverse stock split, the Company

believes that it may be able to raise its Common Share price to a

level where its Common Shares could be viewed more favorably by

potential investors. As such, the consolidation of the shares will

prove beneficial for the Company and its shareholders.

About Seanergy Maritime Holdings

Corp.

Seanergy Maritime Holdings Corp. is the only

pure-play Capesize ship-owner publicly listed in the US. Seanergy

provides marine dry bulk transportation services through a modern

fleet of Capesize vessels. Upon completion of the recently

announced sale of two Capesize bulkers, the Company's operating

fleet will consist of 16 Capesize vessels with an average age of

11.9 years and an aggregate cargo carrying capacity of

approximately 2,846,965 dwt.

The Company is incorporated in the Republic of

the Marshall Islands and has executive offices in Glyfada, Greece.

The Company's common shares trade on the Nasdaq Capital Market

under the symbol “SHIP”.

Please visit our company website at:

www.seanergymaritime.com.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events. Words such as "may",

"should", "expects", "intends", "plans", "believes", "anticipates",

"hopes", "estimates" and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks and are based upon

a number of assumptions and estimates, which are inherently subject

to significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the Company's operating

or financial results; the Company's liquidity, including its

ability to service its indebtedness; competitive factors in the

market in which the Company operates; shipping industry trends,

including charter rates, vessel values and factors affecting vessel

supply and demand; future, pending or recent acquisitions and

dispositions, business strategy, areas of possible expansion or

contraction, and expected capital spending or operating expenses;

risks associated with operations outside the United States; broader

market impacts arising from war (or threatened war) or

international hostilities, such as between Russia and Ukraine;

risks associated with the length and severity of the ongoing novel

coronavirus (COVID-19) outbreak, including its effects on demand

for dry bulk products and the transportation thereof; and other

factors listed from time to time in the Company's filings with the

SEC, including its most recent annual report on Form 20-F. The

Company's filings can be obtained free of charge on the SEC's

website at www.sec.gov. Except to the extent required by law, the

Company expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor RelationsTel: +30 213 0181 522E-mail:

ir@seanergy.gr

Capital Link, Inc.Paul Lampoutis 230 Park Avenue Suite 1536New

York, NY 10169Tel: (212) 661-7566E-mail:

seanergy@capitallink.com

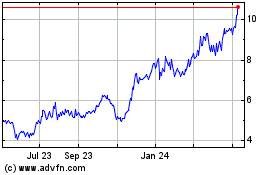

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

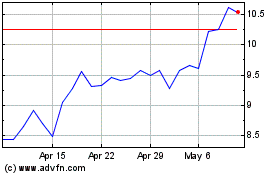

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Apr 2023 to Apr 2024