Current Report Filing (8-k)

January 03 2023 - 8:31AM

Edgar (US Regulatory)

0001761510false00017615102022-12-302022-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 30, 2022

TILT HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | |

British Columbia | 000-56422 | 83-2097293 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| |

2801 E. Camelback Road #180 Phoenix, Arizona | 85016 |

(Address of principal executive offices) | (Zip Code) |

(623) 887-4900 |

(Registrant’s telephone number, including area code) |

Not applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.424) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 30, 2022, TILT Holdings Inc. (“TILT”) and Innovative Industrial Properties Inc. (“IIPR”) entered into a Fifth Amendment (the “IIPR Amendment”) to the Purchase and Sale Agreement between White Haven RE, LLC, a subsidiary of TILT and IIP-PA 9 LLC, a subsidiary of IIPR, dated April 19, 2022 (the “Agreement”). The IIPR Amendment extends the investigational period under the Agreement to a date that is on or before February 28, 2023. The IIPR Amendment also allows TILT to set the closing date of the contemplated sale and leaseback transaction upon five business days’ notice to IIPR, provided the closing date is not extended beyond February 28, 2023. Except as described above, all other terms and provisions of the Agreement remain in full force and effect. The foregoing description does not purport to be complete and is qualified in its entirety by reference to the IIPR Amendment which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

In addition, on December 30, 2022, TILT’s subsidiaries, Jimmy Jang L.P., Baker Technologies, Inc., Jupiter Research, LLC and Commonwealth Alternative Care, Inc. (collectively, the “Subsidiaries”) and certain holders of its senior secured promissory notes (the “Participating Note Holders”), each entered into the fourth amendment (collectively, the “Fourth Note Amendments”) to the Promissory Notes, dated as of November 1, 2019 (the “Senior Notes”). The Fourth Note Amendments extend the maturity date of approximately US $2.1 million in outstanding principal amount of the Senior Notes (the “Extended Notes”) from December 31, 2022 to February 28, 2023 (the “New Maturity Date”). The material terms of the Senior Notes, as previously amended (other than the maturity date of the Extended Notes) were not changed by the Fourth Note Amendments. Mark Scatterday, one of the Participating Note Holders, is the former Chief Executive Officer of TILT and current member of the Board of Directors of TILT. The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Fourth Note Amendments, the form of which is filed herewith as Exhibit 10.2 and is incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information relating to the Fourth Note Amendments set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 8.01 Other Events

On January 3, 2023, TILT issued a press release announcing the IIPR Amendment and the Fourth Note Amendments. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | TILT Holdings Inc. |

| | |

Date: January 3, 2023 | | By: | /s/ Gary F. Santo, Jr. |

| | Name: | Gary F. Santo, Jr. |

| | Its: | Chief Executive Officer |

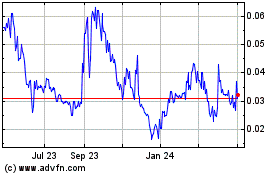

TILT (QB) (USOTC:TLLTF)

Historical Stock Chart

From Mar 2024 to Apr 2024

TILT (QB) (USOTC:TLLTF)

Historical Stock Chart

From Apr 2023 to Apr 2024