Thales's Transport-Systems Sale to Hitachi Likely Delayed Amid UK Antitrust Concerns

December 09 2022 - 5:01AM

Dow Jones News

By Joshua Kirby

A sale of Thales SA's transportation-systems business to Japan's

Hitachi Ltd. is likely to be delayed by months until the second

half of next year amid antitrust concerns in the U.K, the French

aerospace-and-defense group said Friday.

U.K. regulator the Competition & Markets Authority said the

tie-up would remove a credible competitor for signaling business in

the country, lessening competition and driving up fares for

passengers. The CMA said it will open a phase 2 probe into the deal

unless its concerns are addressed by Hitachi Rail, a subsidiary of

the Tokyo-based conglomerate.

As a result, the sale of the ground-transportation solutions

business--valued by Hitachi's bid, launched last summer, at 1.66

billion euros ($1.75 billion)--is likely to close in the second

half of 2023, rather than early in the year, as previously

estimated, Thales said.

"Thales and Hitachi Rail strongly believe in the competitive

benefits of the transaction, which will deliver value for customers

in the rail-signaling and mobility sectors in the U.K., Europe and

globally," Thales said.

"The two companies remain committed to working with all

regulatory bodies to ensure the successful close of the transaction

as soon as possible," the company added, noting that merger

clearance has been achieved in nine out of 13 required

jurisdictions. Hitachi Rail is currently in talks with the European

Union's antitrust body on approval of the tie-up, Thales said.

Shares in Thales traded 2% lower at EUR120.30 following the

news.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

December 09, 2022 04:46 ET (09:46 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

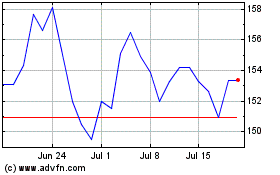

Thales (EU:HO)

Historical Stock Chart

From Mar 2024 to Apr 2024

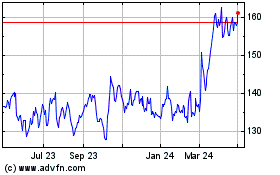

Thales (EU:HO)

Historical Stock Chart

From Apr 2023 to Apr 2024