EQT Says Regulators Want More Info on THQ Acquisition

December 02 2022 - 8:16AM

Dow Jones News

By Dean Seal

EQT Corp. said Friday that antitrust regulators have asked for

more information about its plans to buy upstream assets from THQ

Appalachia I LLC and THQ-XcL Holdings I LLC, potentially delaying

finalization of the deal.

The natural gas producer said in a securities filing that it

will furnish additional information and documentary materials to

the U.S. Federal Trade Commission and the antitrust division of the

U.S. Department of Justice related to the acquisition announced

back in September.

The issuance of the request extends the 30-day waiting period,

established under the Hart-Scott-Rodino Antitrust Improvements Act

of 1976, that federal antitrust regulators have to challenge a

merger. The window is extended until 30 days after both EQT and THQ

have substantially complied with the regulators' request, unless

the FTC chooses to close the window sooner.

EQT said it plans to respond to the request and work

cooperatively with the FTC in its review. Because the deal cannot

close while the waiting period is still in effect, EQT and THQ are

in discussions about potentially pushing their agreed-upon outside

date, or the date at which either side would be allowed to walk

away from the deal without penalties, back from Dec. 30.

The proposed deal would provide EQT with 11 years of inventory

at maintenance capital levels and "95-miles of owned and operated

midstream gathering systems connected to every major long-haul

interstate pipeline in southwest Appalachia," the company said in

September.

EQT shares slipped 1.2% to $41 in premarket trading.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

December 02, 2022 08:01 ET (13:01 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

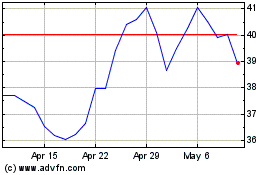

EQT (NYSE:EQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

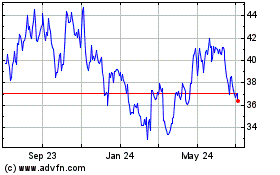

EQT (NYSE:EQT)

Historical Stock Chart

From Apr 2023 to Apr 2024