Current Report Filing (8-k)

November 22 2022 - 6:02AM

Edgar (US Regulatory)

CONNS INC false 0001223389 0001223389 2022-11-17 2022-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2022

CONN’S, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-34956 |

|

06-1672840 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

| 2445 Technology Forest Blvd., Suite 800 The Woodlands, Texas 77381 |

| (Address of principal executive offices) |

(936) 230-5899

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

CONN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement |

Amendment to Revolving Credit Facility

On November 21, 2022, Conn’s, Inc. (the “Company”) entered into an Amendment No. 1 (the “Amendment”) to the Fifth Amended and Restated Loan and Security Agreement, dated as of March 29, 2021, by and among the Company, as parent and guarantor, Conn Appliances, Inc., Conn Credit I, LP and Conn Credit Corporation, Inc., as borrowers, certain banks and financial institutions named therein, as lenders, and JPMorgan Chase Bank, N.A., as Administrative Agent for the Lenders (the “Agreement”). The Amendment, among other things, (a) replaces the interest rate benchmark under the Agreement from LIBOR to Term SOFR; (b) provides for a covenant relief period, which removes testing of the interest coverage covenant for the fiscal quarter ended October 31, 2022 and each fiscal quarter ended thereafter during the Covenant Relief Period (but before April 30, 2024), commencing on November 21, 2022 through the earlier of (i) the date on which the Company delivers financial statements and a compliance certificate for the fiscal quarter ending April 30, 2024 (demonstrating compliance with the then applicable interest coverage and leverage covenants) and (ii) the date that is 10 business days after the Administrative Agent receives (1) written notice electing to terminate the covenant relief period (such notice not to be delivered prior to November 1, 2023) and (2) projections demonstrating future compliance with the interest coverage and leverage covenants for the fiscal quarters ending on or prior to January 31, 2025 (the “Covenant Relief Period”); (c) adds a minimum liquidity covenant, which requires at all times during the Covenant Relief Period that the Company and certain of its subsidiaries maintain minimum liquidity of (i) $125 million through October 31, 2023 and (ii) on and after November 1, 2023, $112.5 million; (d) adds an anti-cash hoarding covenant, which requires at all times during the Covenant Relief Period mandatory prepayments of the revolver loans with the amount of any cash on the Company’s balance sheet in excess of $100 million to the extent any revolving loans are then outstanding; (e) adds a minimum excess availability covenant, which requires at all times during the Covenant Relief Period availability under the revolver of no less than the greater of (i) 25% of the borrowing base and (ii) $75,000,000; (f) provides for increased reporting requirements during the Covenant Relief Period and (g) restricts the ability to make permitted acquisitions and certain non-ordinary course investments, restricted payments and restricted debt payments during the Covenant Relief Period.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by the full text of the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth above under Item 1.01 is hereby incorporated by reference into this Item 2.03.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(b) Departure of Vice President and Chief Accounting Officer. On November 18, 2022, Ryan R. Nelson, Vice President and Chief Accounting Officer of the Company announced his resignation from the Company, effective December 14, 2022.

(c) Assumption of Chief Accounting Officer Duties. George L. Bchara, 39, the Company’s Executive Vice President and Chief Financial Officer since May, 2019 and the Company’s former Chief Accounting Officer from December, 2016 to May, 2019, will assume the duties of the Chief Accounting Officer role effective December 14, 2022 until a replacement is appointed.

There is no arrangement or understanding with any person pursuant to which Mr. Bchara was appointed to assume these duties. There are no family relationships between Mr. Bchara and any director or executive officer of the Company, and Mr. Bchara is not a party to any transaction requiring disclosure under Item 404(a) of Regulation S-K.

(e) Compensation of NEOs. On November 17, 2022, the Compensation Committee of the Board of Directors of the Company approved a special, one-time retention award of $200,000 in restricted stock units (“RSUs”) under the Company’s 2020 Omnibus Equity Plan along with a special, one-time retention cash award of $125,000 to each of George L. Bchara, Executive Vice President and Chief Financial Officer, Rodney D. Lastinger, President, Retail and Mark L. Prior, Senior Vice President, General Counsel and Secretary. The RSU and cash awards vest ratably over a two-year period beginning on the date of grant.

2

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| Exhibit Number |

|

Description |

|

|

| Exhibit 10.1 |

|

Amendment No. 1 to Fifth Amended and Restated Loan and Security Agreement, dated November 21, 2022, among the Company, Conn Appliances, Inc., Conn Credit I, LP and Conn Credit Corporation, Inc., certain banks and financial institutions named therein, as lenders, and JPMorgan Chase Bank, N.A., as administrative agent for the lenders |

|

|

| Exhibit 104 |

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CONN’S INC. |

|

|

|

|

| Date: November 21, 2022 |

|

|

|

By: |

|

/s/ George L. Bchara |

|

|

|

|

Name: |

|

George L. Bchara |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

4

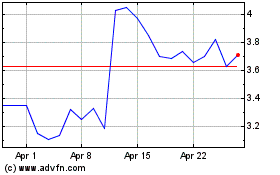

Conns (NASDAQ:CONN)

Historical Stock Chart

From Mar 2024 to Apr 2024

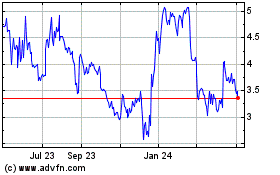

Conns (NASDAQ:CONN)

Historical Stock Chart

From Apr 2023 to Apr 2024