If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

We are also offering to those purchasers, if any, whose purchase of our common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity, in lieu of purchasing common stock, to purchase pre-funded warrants to purchase shares of our common stock. The purchase price of each pre-funded warrant will equal the price per share at which shares of our common stock are being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will equal $0.0001 per share of common stock. For each pre-funded warrant purchased in this offering in lieu of common stock, we will reduce the number of shares of common stock being sold in the offering on a one-for-one basis.

Each pre-funded warrant is exercisable for one share of our common stock (subject to adjustment as provided for therein) at any time at the option of the holder until such pre-funded warrant is exercised in full, provided that the holder will be prohibited from exercising pre-funded warrants for shares of our common stock if, as a result of such exercise, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice to us.

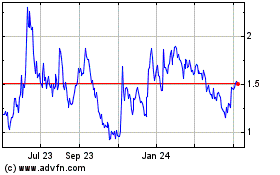

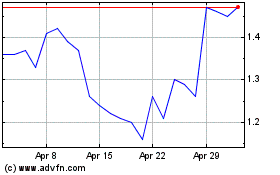

Our common stock is listed on The Nasdaq Capital Market under the symbol “CYTH.” The closing price of our common stock on November 16, 2022, as reported by The Nasdaq Capital Market, was $1.27 per share.

The public offering price per share of common stock and/or any pre-funded warrant, together with the common warrant that accompanies common stock or a pre-funded warrant will be determined between us and the underwriter in this offering at the time of pricing, and may be at a discount to the current market price. Therefore, the price of $1.27 per share of common stock used throughout this prospectus may not be indicative of the actual public offering price for our common stock, our pre-funded warrants and the common warrants. There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the pre-funded warrants or common warrants on any national securities exchange. Without an active trading market, the liquidity of the common warrants and the pre-funded warrants will be limited.

The underwriter expects to deliver the shares of common stock, common warrants and pre-funded warrants, if any, to purchasers in the offering on or about , 2022.

Prospectus dated , 2022.

|

Prospectus Summary

|

1

|

| |

|

|

Risk Factors

|

6 |

| |

|

|

Disclosure Regarding Forward-looking Statements

|

17 |

| |

|

|

Use Of Proceeds

|

18 |

| |

|

|

Dividend Policy

|

18 |

| |

|

|

Capitalization

|

19 |

| |

|

|

Dilution

|

20 |

| |

|

|

Description Of Securities

|

21 |

| |

|

|

Underwriting

|

25 |

| |

|

|

Legal Matters

|

28 |

| |

|

|

Experts

|

28 |

| |

|

|

Where You Can Find More Information

|

28 |

| |

|

|

Incorporation by Reference

|

28 |

________________________________________

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission (the “SEC”) includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation by Reference” before making your investment decision.

You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in this prospectus. In addition, this prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, governmental publications, reports by market research firms or other independent sources. Some data are also based on our good faith estimates.

References herein to the "Company," "Registrant," "we," "us," "our" and "our company" refer to Cyclo Therapeutics, Inc., a Nevada corporation and its subsidiaries.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

________________________________________

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS, INCORPORATED BY REFERENCE IN THIS PROSPECTUS OR IN ANY FREE WRITING PROSPECTUS WE MAY AUTHORIZE TO BE DELIVERED OR MADE AVAILABLE TO YOU. WE HAVE NOT, AND THE UNDERWRITER HAS NOT, AUTHORIZED ANYONE TO PROVIDE YOU WITH DIFFERENT INFORMATION. WE ARE NOT MAKING AN OFFER OF THESE SECURITIES IN ANY STATE WHERE THE OFFER IS NOT PERMITTED. YOU SHOULD NOT ASSUME THAT THE INFORMATION PROVIDED IN THIS PROSPECTUS IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ON THE FRONT OF THIS PROSPECTUS.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our securities. You should carefully read the entire prospectus, including “Risk Factors” as well as the documents that we incorporate by reference into this prospectus, including our financial statements and notes thereto, before making an investment decision.

Corporate Overview

We are a clinical stage biotechnology company that develops cyclodextrin-based products for the treatment of disease. We filed a Type II Drug Master File with the U.S. Food and Drug Administration (“FDA”) in 2014 for our lead drug candidate, Trappsol® Cyclo™ (hydroxypropyl beta cyclodextrin) as a treatment for Niemann-Pick Type C disease (“NPC”). NPC is a rare and fatal cholesterol metabolism disease that impacts the brain, lungs, liver, spleen, and other organs. In 2015, we launched an International Clinical Program for Trappsol® Cyclo™ as a treatment for NPC. In 2016, we filed an Investigational New Drug application (“IND”) with the FDA, which described our Phase I clinical plans for a randomized, double blind, parallel group study at a single clinical site in the U.S. The Phase I study evaluated the safety of Trappsol® Cyclo™ along with markers of cholesterol metabolism and markers of NPC during a 14-week treatment period of intravenous administration of Trappsol® Cyclo™ every two weeks to participants 18 years of age and older. The IND was approved by the FDA in September 2016, and in January 2017 the FDA granted Fast Track designation to Trappsol® Cyclo™ for the treatment of NPC. Initial patient enrollment in the U.S. Phase I study commenced in September 2017, and in May 2020 we announced Top Line data showing a favorable safety and tolerability profile for Trappsol® Cyclo™ in this study.

We have also completed a Phase I/II clinical study approved by several European regulatory bodies, including those in the United Kingdom, Sweden and Italy, and in Israel. The Phase I/II study evaluated the safety, tolerability and efficacy of Trappsol® Cyclo™ through a range of clinical outcomes, including neurologic, respiratory, and measurements of cholesterol metabolism and markers of NPC. Consistent with the U.S. study, the European/Israel study administered Trappsol® Cyclo™ intravenously to NPC patients every two weeks in a double-blind, randomized trial, but differs in that the study period was for 48 weeks (24 doses). The first patient was dosed in this study in July 2017, and in March of 2021 we announced that 100% of patients who completed the trial improved or remained stable, and 89% met the efficacy outcome measure of improvement in at least two domains of the 17-domain NPC severity scale.

Additionally, in February 2020 we had a face-to-face “Type C” meeting with the FDA with respect to the initiation of our pivotal Phase III clinical trial of Trappsol® Cyclo™ based on the clinical data obtained to date. At that meeting, we also discussed with the FDA submitting a New Drug Application (NDA) under Section 505(b)(1) of the Federal Food, Drug, and Cosmetic Act for the treatment of NPC in pediatric and adult patients with Trappsol® Cyclo™. A similar request was submitted to the European Medicines Agency (“EMA”) in February 2020, seeking scientific advice and protocol assistance from the EMA for proceeding with a Phase III clinical trial in Europe. In October 2020 we received a “Study May Proceed” notification from the FDA with respect to the proposed Phase III clinical trial, and in June of 2021 we commenced enrollment in TransportNPC, a pivotal Phase II study of Trappsol® Cyclo™ for the treatment of NPC.

Preliminary data from our clinical studies suggest that Trappsol® Cyclo™ releases cholesterol from cells, crosses the blood-brain-barrier in individuals suffering from NPC, and results in neurological and neurocognitive benefits and other clinical improvements in NPC patients. The full significance of these findings will be determined as part of the final analysis of these clinical trials.

On May 17, 2010, the FDA designated Trappsol® Cyclo™ as an orphan drug for the treatment of NPC, which would provide us with the exclusive right to sell Trappsol® Cyclo™ for the treatment of NPC for seven years following FDA drug approval. In April 2015, we also obtained Orphan Drug Designation for Trappsol® Cyclo™ in Europe, which will provide us with 10 years of market exclusivity following regulatory approval, which period will be extended to 12 years upon acceptance by the EMA’s Pediatric Committee of our pediatric investigation plan (PIP) demonstrating that Trappsol® Cyclo™ addresses the pediatric population. On January 12, 2017, we received Fast Track Designation from the FDA, and on December 1, 2017, the FDA designated NPC a Rare Pediatric Disease.

We are also exploring the use of cyclodextrins in the treatment of Alzheimer’s disease. In January 2018, the FDA authorized a single patient IND expanded access program using Trappsol® Cyclo™ for the treatment of Alzheimer’s disease. After 18 months of treatment in this geriatric patient with late-onset disease, the disease was stabilized and the drug was well tolerated. The patient also exhibited signs of improvement with less volatility and shorter latency in word-finding. We prepared a synopsis for an early stage protocol using Trappsol® Cyclo™ intravenously to treat Alzheimer’s disease that was presented to the FDA in January of 2021. We received feedback from the FDA on this synopsis in April 2021 and incorporated the feedback into an IND for a Phase II study for the treatment of Alzheimer’s disease with of Trappsol® Cyclo™ that we submitted to the FDA in November 2021. In December of 2021, we received IND clearance from the FDA, allowing us to proceed with our Phase II study of Trappsol® Cyclo™ for the treatment of Alzheimer’s disease. We expect to begin enrollment in this study during 2022.

We filed an international patent application in October 2019 under the Patent Cooperation Treaty directed to the treatment of Alzheimer’s disease with cyclodextrins, and we are pursuing national and regional stage applications based on this international application. The terms of any patents resulting from these national or regional stage applications would be expected to expire in 2039 if all the requisite maintenance fees are paid.

We also continue to operate our legacy fine chemical business, consisting of the sale of cyclodextrins and related products to the pharmaceutical, nutritional, and other industries, primarily for use in diagnostics and specialty drugs. However, our core business has transitioned to a biotechnology company primarily focused on the development of cyclodextrin-based biopharmaceuticals for the treatment of disease from a business that had been primarily reselling basic cyclodextrin products.

Risks Associated With our Business

Our ability to execute our business strategy is subject to numerous risks, as more fully described in the section captioned “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our securities. In particular, risks associated with our business include, but are not limited to, the following:

| |

●

|

We have suffered recent losses and our future profitability is uncertain.

|

| |

●

|

Even with the proceeds from this offering, we will need additional capital to fund our operations as planned.

|

| |

●

|

We have not received approval for any drug candidate for commercial sale and, as a result, we have never generated any revenue from the sale of biopharmaceutical products, and expect to continue to incur significant financial losses in the future, which makes it difficult to assess our future viability.

|

| |

●

|

We are largely dependent upon the success of our Trappsol® Cyclo™ product, which may never receive regulatory approval.

|

| |

●

|

Even if Trappsol® Cyclo™ receives regulatory approval, we may not be successful in our commercialization efforts and Trappsol® Cyclo™ may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors and others in the medical community necessary for commercial success.

|

| |

●

|

The results of our clinical trials may not support our product claims or may result in the discovery of adverse side effects.

|

| |

●

|

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

|

| |

●

|

Later discovery of previously unknown problems could limit our ability to market or sell Trappsol® Cyclo™, even if it is initially approved, and can expose us to product liability claims.

|

| |

●

|

We rely in part on third parties for research and clinical trials for products using Trappsol® Cyclo™.

|

| |

●

|

We currently have no marketing and sales organization for our pharmaceutical candidates and may have to invest significant resources to develop these capabilities. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to generate product revenue.

|

| |

●

|

We rely upon third parties for the manufacture of Trappsol® Cyclo™ and are dependent on their quality and effectiveness.

|

| |

●

|

We face competition from well-funded companies to treat NPC.

|

| |

●

|

The rights we rely upon to protect our unpatented trade secrets may be inadequate.

|

| |

|

|

| |

● |

We cannot ensure that patent rights relating to inventions described and claimed in our pending patent applications will issue, that patents based on our patent applications will not be challenged and rendered invalid and/or unenforceable, or that third parties will not find ways to circumvent our patent rights or claim co-ownership thereof.

|

| |

●

|

The pharmaceutical business is subject to increasing government price controls and other restrictions on pricing, reimbursement and access to drugs, which could adversely affect our future revenues and profitability.

|

| |

●

|

We are dependent on our executive officers, and we may not be able to pursue our current business strategy effectively if we lose them.

|

Corporate and other Information

We were organized as a Florida corporation on August 9, 1990, with operations beginning in July 1992. In conjunction with a restructuring in 2000, we changed our name from Cyclodextrin Technologies Development, Inc. to CTD Holdings, Inc. We changed our name to Cyclo Therapeutics, Inc. in September 2019 to better reflect our current business, and on November 6, 2020, we reincorporated from the State of Florida to the State of Nevada. Our principal offices are located at 6714 NW 16th Street, Suite B, Gainesville, FL 32653, and our telephone number is (386) 418-8060. We maintain a website at www.cyclotherapeutics.com. Information contained on our website does not constitute part of this prospectus.

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our shares of common stock held by non-affiliates does not equal or exceed $250 million as of the prior June 30th, or (2) our annual revenues did not equal or exceed $100 million during such completed fiscal year and the market value of our shares of common stock held by non-affiliates did not equal or exceed $700.0 million as of the prior June 30th. To the extent we take advantage of any reduced disclosure obligations, it may also make it difficult to compare our financial statements with other public companies.

Available Information

Because we are subject to the information and reporting requirements of the Exchange Act, we file or furnish, as applicable, annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov. We make available on our website at www.cyclotherapeutics.com, free of charge, copies of these reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The Offering

|

Common Stock Offered by Us

|

|

7,870,000 shares. |

| |

|

|

|

Pre-funded Warrants Offered by Us

|

|

We are also offering to certain purchasers whose purchase of our common stock in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase pre-funded warrants in lieu of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant and the accompanying common warrant will equal the price at which the common stock and the accompanying common warrant are being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until exercised in full. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue one common warrant for each share of common stock and for each pre-funded warrant to purchase one share of common stock sold in this offering, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold.

|

| |

|

|

|

Common Warrants Offered by Us

|

|

We are issuing to purchasers of shares of our common stock and/or pre-funded warrants in this offering a common warrant to purchase one share of our common stock for each share and/or pre-funded warrant purchased in this offering. Because a common warrant to purchase share(s) of our common stock is being sold together in this offering with each share of common stock and, in the alternative, each pre-funded warrant to purchase one share of common stock, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. The common warrants will be exercisable at an exercise price of $ per share (representing % of the price at which a share of common stock and accompanying common warrant are sold to the public in this offering) for a five-year period beginning on the effective date of an amendment to our articles of incorporation increasing the number of authorized shares of common stock to at least 30,000,000. No fractional shares of common stock will be issued in connection with the exercise of a common warrant. In lieu of fractional shares, we will round up to the next whole share. |

| |

|

|

|

Common stock outstanding prior to this offering (1)

|

|

8,481,848 shares

|

| |

|

|

|

Public offering price:

|

|

Assumed combined public offering price of $1.27 per share of common stock and accompanying common warrant, or pre-funded warrant and accompanying common warrant, as applicable, which is equal to the last reported sale price per share of our common stock on The Nasdaq Capital Market on November 16, 2022. |

| |

|

|

|

Common stock outstanding after this offering (1)

|

|

16,351,848 shares (assuming we sell only shares of common stock and no pre-funded warrants, and none of the common warrants issued in this offering are exercised).

|

| |

|

|

|

Use of proceeds

|

|

We estimate that we will receive net proceeds from this offering of approximately $9,100,000 based upon an assumed offering price of $1.27 per share of common stock and accompanying common warrant, or pre-funded warrant and accompanying common warrant, as applicable, after deducting the underwriting discount and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds we receive from this offering to (i) continue with our pivotal Phase III trial for the treatment of NPC with Trappsol® Cyclo™, (ii) fund further development of our preclinical programs towards IND filings and clinical trials for the treatment of Alzheimer’s disease with Trappsol® Cyclo™ and (iii) fund working capital and general corporate purposes using any remaining amounts. See “Use of Proceeds” on page 18. |

|

Lock-Up

|

|

Our directors and executive officers have agreed not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of days commencing on the date of this prospectus.

|

| |

|

|

|

Risk Factors

|

|

You should carefully read the “Risk Factors” section of this prospectus beginning on page 6 for a discussion of factors that you should consider before deciding to invest in our securities.

|

| |

|

|

|

Trading Symbol and Listing

|

|

Our common stock is listed on The Nasdaq Capital Market under the symbol “CYTH”. We do not intend to apply for listing of the common warrants or pre-funded warrants on any national securities exchange or trading system.

|

(1) Unless we indicate otherwise, the number of shares of our common stock outstanding after this offering is based on 8,481,848 shares of common stock outstanding on November 21, 2022, and excludes the following:

| |

●

|

425,646 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $5.17 per share;

|

| |

●

|

2,480,042 shares of our common stock reserved for issuance under our 2021 Equity Incentive Plan; and |

| |

●

|

2,045,846 shares of our common stock issuable upon the exercise of warrants, with a weighted-average exercise price of $11.22 per share. |

Unless otherwise noted, the information in this prospectus assumes:

| |

●

|

no exercise of the outstanding options and warrants described above; and

|

| |

●

|

no exercise of common warrants.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors in addition to other information in this prospectus before purchasing our securities. The risks and uncertainties described below are those that we currently deem to be material and that we believe are specific to our company, our industry and our securities. In addition to these risks, our business may be subject to risks currently unknown to us. We also update risk factors from time to time in our periodic reports on Forms 10-K, 10-Q and 8-K which will be incorporated by reference in this prospectus. If any of these or other risks actually occurs, our business may be adversely affected, the trading price of our securities may decline and you may lose all or part of your investment.

We have suffered recent losses and our future profitability is uncertain.

We have incurred net losses of approximately $14.3 million and $8.9 million for the years ended December 31, 2021 and December 31, 2020, respectively, and approximately $4.3 million and $10.6 million for the three and nine months ended September 30, 2022, respectively. Our recent losses have predominantly resulted from research and development expenses for our Trappsol® Cyclo™ product and other general operating expenses, including personnel costs. We believe our expenses will continue to increase as we conduct clinical trials and continue to seek regulatory approval for the use of Trappsol® Cyclo™ in the treatment of NPC and Alzheimer’s disease. As a result, we expect our operating losses to continue until such time, if ever, that product sales, licensing fees, royalties and other sources generate sufficient revenue to fund our operations. We cannot predict when, if ever, we might achieve profitability and cannot be certain that we will be able to sustain profitability, if achieved.

Even with the proceeds from our recent public offerings, we will need additional capital to fund our operations as planned.

For the year ended December 31, 2021 and nine months ended September 30, 2022, our operations used approximately $15.0 million and $12.4 million in cash, respectively. Cash used in operations consisted of cash on hand and cash raised through public offerings and private placements of our securities. At December 31, 2021, the Company had a cash balance of approximately $16.6 million and current liabilities of approximately $3.8 million, and at September 30, 2022, the Company had a cash balance of approximately $4.3 million and current liabilities of approximately $2.9 million. Although we raised approximately $10.8 million in our November 2021 public offering and approximately $8.0 million from the exercise of warrants originally issued in our December 2020 offering, we will need additional capital to continue our research and development programs, conduct clinical trials, seek regulatory approvals and manufacture and market our products. We will seek such additional funds through public or private equity or debt financings and other sources. We cannot be certain that adequate additional funding will be available to us on acceptable terms, if at all. In addition, in order to issue additional equity securities, we will need to obtain stockholder approval to increase the number of our authorized shares of common stock. If we cannot raise the additional funds required for our anticipated operations, we may be required to reduce the scope of or eliminate our research and development programs, delay our clinical trials and the ability to seek regulatory approvals, downsize our general and administrative infrastructure, or seek alternative measures to avoid insolvency. If we raise additional funds through future offerings of shares of our common stock or other securities, such offerings would cause dilution of current stockholders’ percentage ownership in the Company, which could be substantial. Future offerings also could have a material and adverse effect on the price of our common stock.

The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern.

Our auditors, WithumSmith+Brown, PC, have indicated in their report on our consolidated financial statements for the fiscal year ended December 31, 2021, that conditions exist that raise substantial doubt about our ability to continue as a going concern due to our recurring losses from operations and significant accumulated deficit. In addition, we continue to experience negative cash flows from operations. A “going concern” opinion could impair our ability to finance our operations through the sale of equity. Our ability to continue as a going concern will depend upon the availability of equity financing which represents the primary source of cash flows that will permit us to meet our financial obligations as they come due and continue our research and development efforts.

We have not received approval for any drug candidate for commercial sale and, as a result, we have never generated any revenue from the sale of biopharmaceutical products, and expect to continue to incur significant financial losses in the future, which makes it difficult to assess our future viability.

While we sell cyclodextrins for use and research in numerous industries, we have not yet received the necessary regulatory approvals to commercially sell any biopharmaceutical products. Biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk, including risks related to the regulatory approval process. Because the focus of our business has transitioned to the development of cyclodextrin-based products for the treatment of disease, we anticipate that our expenses will increase substantially as we:

| |

●

|

continue our ongoing and planned development of Trappsol® Cyclo™ for multiple indications;

|

| |

|

|

| |

●

|

initiate, conduct and complete ongoing, anticipated or future preclinical studies and clinical trials for our current and future product candidates;

|

| |

|

|

| |

●

|

seek marketing approvals for product candidates that successfully complete clinical trials; and

|

| |

|

|

| |

●

|

establish a sales, marketing and distribution infrastructure to commercialize products for which we may obtain marketing approval.

|

We will continue to incur significant losses until such time, if ever, as we are able to commercialize our drug candidates. If we are not able to do so we may not sustain a viable business.

Risks Related to Product Development, Regulatory Approval and Commercialization

We are largely dependent upon the success of our Trappsol® Cyclo™ product, which may never receive regulatory approval for the treatment of disease.

Our lead drug candidate, Trappsol® Cyclo™ is the focus of much of our management team’s development efforts. The product is currently designated as an orphan drug for the treatment of NPC in the United States and Europe. We plan to continue to make substantial investment in continued research and development of our Trappsol® Cyclo™ product in connection with obtaining approval for marketing the product for the treatment of NPC, as well as Alzheimer’s disease. The potential population of NPC patients is small, and our ability to market the drug for use other than research is severely constrained by regulatory restrictions. In the course of its development, our Trappsol® Cyclo™ drug product will be subject to extensive and rigorous government regulation through the European Medicines Agency in the E.U. and through the Food and Drug Administration (FDA) in the United States. Regulatory approval in any jurisdiction cannot be guaranteed. There can be no guarantees that our product will be effective and safe in the treatment of NPC, Alzheimer’s disease or any other disease nor is there any guarantee that it will be deemed by the regulatory agencies of any jurisdiction to be effective and safe. Despite the time and expense involved in developing a drug candidate, failure of a drug candidate can occur at any stage of development and for many reasons, including without limitation negative or inconclusive results from pre-clinical data or clinical trials. Failure to comply with applicable regulatory requirements in any jurisdiction, either before or after product approval, may subject us to administrative or judicially imposed sanctions.

Even if Trappsol® Cyclo™ receives regulatory approval, we may not be successful in our commercialization efforts and Trappsol® Cyclo™ may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors and others in the medical community necessary for commercial success.

Even if Trappsol® Cyclo™ receives regulatory approval, we may not be successful in our commercialization efforts and market acceptance by physicians, patients, third-party payors and others in the medical community may be less than estimated. Market acceptance will require us to build and maintain strong relationships with healthcare professionals involved in the treatment of NPC. The number of healthcare professionals associated with treatment centers that address NPC is limited. A failure to build or maintain these important relationships with these healthcare professionals and treatment centers could result in lower market acceptance. Our efforts to educate physicians, patients, third-party payors and others in the medical community on the benefits of Trappsol® Cyclo™ may require significant resources and may never be successful. The degree of market acceptance of Trappsol® Cyclo™, if approved for commercial sale, will depend on a number of factors, including:

| |

●

|

its efficacy;

|

| |

|

|

| |

●

|

limitations or warnings or any restrictions on the use of Trappsol® Cyclo™, together with other medications, and the prevalence and severity of any side effects;

|

| |

|

|

| |

●

|

the availability and efficacy of alternative treatments;

|

| |

|

|

| |

●

|

the effectiveness of sales and marketing efforts and the strength of marketing and distribution support;

|

| |

|

|

| |

●

|

the cost-effectiveness of Trappsol® Cyclo™ compared to alternative therapies and the ability to offer such drug for sale at competitive prices; and

|

| |

|

|

| |

●

|

availability and amount of coverage and reimbursement from government payors, managed care plans and other third-party payors.

|

The results of our clinical trials may not support our product claims or may result in the discovery of adverse side effects.

Even if our clinical trials are completed as planned, we cannot be certain that their results will support our product claims or that any regulatory authority whose approval we will require in order to market and sell our products in any territory will agree with our conclusions regarding them. Success in pre-clinical studies and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that clinical trials will replicate the results of prior trials and pre-clinical studies. The clinical trial process may fail to demonstrate that our product candidates are safe and effective for the proposed indicated uses, which could cause us to abandon a product and may delay development of others. Any delay or termination of our clinical trials will delay the filing of our regulatory submissions and, ultimately, our ability to commercialize our product candidates and generate revenues. It is also possible that patients enrolled in clinical trials will experience adverse side effects that are not currently part of the product candidate’s profile.

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

We have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approvals, including FDA approval. Clinical trials are expensive and complex, can take many years and have uncertain outcomes. We cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials that will cause us or regulatory authorities to delay or suspend clinical trials, or delay the analysis of data from completed or ongoing clinical trials. We estimate that clinical trials of Trappsol® Cyclo™ for the treatment of NPC will continue for several years, but they may take significantly longer to complete. Failure can occur at any stage of the testing and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent commercialization of our current or future therapeutic candidates, including but not limited to:

| |

●

|

delays in securing clinical investigators or trial sites for the clinical trials;

|

| |

●

|

delays in obtaining institutional review board and other regulatory approvals to commence a clinical trial;

|

| |

●

|

slower than anticipated patient recruitment and enrollment;

|

| |

●

|

negative or inconclusive results from clinical trials;

|

| |

●

|

unforeseen safety issues;

|

| |

●

|

uncertain dosing issues;

|

| |

●

|

an inability to monitor patients adequately during or after treatment; and

|

| |

●

|

problems with investigator or patient compliance with the trial protocols.

|

A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials, even after seeing promising results in earlier clinical trials. Despite the results reported in earlier clinical trials for Trappsol® Cyclo™, we do not know whether any Phase III or other clinical trials we may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market Trappsol® Cyclo™. If later-stage clinical trials do not produce favorable results, our ability to obtain regulatory approval for Trappsol® Cyclo™ may be adversely impacted.

Later discovery of previously unknown problems could limit our ability to market or sell Trappsol® Cyclo™, even if it is initially approved, and can expose us to product liability claims.

Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with any third-party manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may result in, among other things:

| |

●

|

refusals or delays in the approval of applications or supplements to approved applications;

|

| |

|

|

| |

●

|

refusal of a regulatory authority to review pending market approval applications or supplements to approved applications;

|

| |

|

|

| |

●

|

restrictions on the marketing or manufacturing of the product, withdrawal of the product from the market or voluntary or mandatory product recalls or seizures;

|

| |

|

|

| |

●

|

fines, warning letters, or holds on clinical trials;

|

| |

|

|

| |

●

|

import or export restrictions;

|

| |

|

|

| |

●

|

injunctions or the imposition of civil or criminal penalties;

|

| |

|

|

| |

●

|

restrictions on product administration, requirements for additional clinical trials, or changes to product labeling requirements; or

|

| |

|

|

| |

●

|

recommendations by regulatory authorities against entering into governmental contracts with us.

|

Discovery of previously unknown problems or risks relating to our product could also subject us to potential liabilities through product liability claims.

If we do not obtain required approvals in other countries in which we aim to market our products, we will be limited in our ability to export or sell the products in those markets.

Our lack of experience in conducting clinical trials in any jurisdiction may negatively impact the approval process in those jurisdictions where we intend to seek approval of Trappsol® Cyclo™. If we are unable to obtain and maintain required approval from one or more foreign jurisdictions where we would like to sell Trappsol® Cyclo™, we will be unable to market products as intended, our international market opportunity will be limited and our results of operations will be harmed.

We rely in part on third parties for research and clinical trials for products using Trappsol® Cyclo™.

We rely on contract research organizations (“CROs”), academic institutions, corporate partners, and other third parties to assist us in managing, monitoring, and otherwise carrying out clinical trials and research activities. We rely or will rely heavily on these parties for the execution of our clinical studies and control only certain aspects of their activities. Accordingly, we may have less control over the timing and other aspects of these clinical trials than if we conducted them entirely on our own. Although we rely on these third parties to manage the data from clinical trials, we will be responsible for confirming that each of our clinical trials is conducted in accordance with its general investigational plan and protocol. Our failure, or the failure of third parties on which we rely, to comply with the strict requirements relating to conducting, recording, and reporting the results of clinical trials, or to follow good clinical practices, may delay the regulatory approval process or cause us to fail to obtain regulatory approval for Trappsol® Cyclo™.

We currently have no marketing and sales organization for our pharmaceutical candidates and may have to invest significant resources to develop these capabilities. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to generate product revenue.

We have no internal sales, marketing or distribution capabilities for the sale of biopharmaceutical products. If any of our drug candidates ultimately receives regulatory approval, we may not be able to effectively market and distribute it. We may have to seek collaborators, especially for marketing and sales outside of the United States, or invest significant amounts of financial and management resources to develop internal sales, distribution and marketing capabilities. We may not be able to enter into collaborations or hire consultants or external service providers to assist us in sales, marketing and distribution functions on acceptable financial terms, or at all. In addition, our product revenues and our profitability, if any, may be lower if we rely on third parties for these functions than if we were to market, sell and distribute products that we develop ourselves. We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively. Even if we determine to perform sales, marketing and distribution functions ourselves, we could face a number of additional related risks, including:

| |

●

|

we may not be able to attract and build an effective marketing department or sales force;

|

| |

|

|

| |

●

|

the cost of establishing a marketing department or sales force may exceed our available financial resources and the revenue generated by our product candidates that we may develop, in-license or acquire; and

|

| |

|

|

| |

●

|

our direct sales and marketing efforts may not be successful.

|

We rely upon third parties for the manufacture of Trappsol® Cyclo™ and are dependent on their quality and effectiveness.

Trappsol® Cyclo™ requires precise, high-quality manufacturing. The failure to achieve and maintain high manufacturing standards, including the failure to conform to c-GMP (current Good Manufacturing Practice), or to detect or control anticipated or unanticipated manufacturing errors or the frequent occurrence of such errors, could result in discontinuance or delay of ongoing or planned clinical trials, delays or failures in product testing or delivery, cost overruns, product recalls or withdrawals, patient injury or death, and other problems that could seriously hurt our business. Contract drug manufacturers often encounter difficulties involving production yields, quality control and quality assurance and shortages of qualified personnel. These manufacturers are subject to stringent regulatory requirements, including the FDA’s c-GMP regulations and similar foreign laws and standards. If our contract manufacturers fail to maintain ongoing compliance at any time, the production of our product candidates could be interrupted, resulting in delays or discontinuance of our clinical trials, additional costs and loss of potential revenues.

We face competition from well-funded companies to treat NPC.

We face competition from other entities, including pharmaceutical and biotechnology companies and governmental institutions that are working on supporting orphan drug designations and clinical trials for the neurological manifestations of NPC. Some of these entities are well-funded, with more financial, technical and personnel resources than we have, and have more experience than we do in designing and implementing clinical trials. If we are unable to compete effectively against our current or future competitors, sales of our Trappsol® Cyclo™ product may not grow and our financial condition may suffer.

Our business and operations would suffer in the event of computer system failures or security breaches.

In the ordinary course of our business, we collect, store and transmit confidential information, including intellectual property, proprietary business information and personal information. Despite the implementation of security measures, our internal computer systems, and those of our contract research organizations, or CROs, and other third parties on which we rely, are vulnerable to damage from computer viruses, unauthorized access, cyberattacks, natural disasters, fire, terrorism, war and telecommunication and electrical failures. Cyberattacks are increasing in their frequency, sophistication and intensity. Cyberattacks could include the deployment of harmful malware, denial-of-service attacks, social engineering and other means to affect service reliability and threaten the confidentiality, integrity and availability of information. Significant disruptions of our information technology systems or security breaches could adversely affect our business operations and/or result in the loss, misappropriation, and/or unauthorized access, use or disclosure of, or the prevention of access to, confidential information (including trade secrets or other intellectual property, proprietary business information and personal information), and could result in financial, legal, business and reputational harm to us. If such disruptions were to occur and cause interruptions in our operations, it could result in a material disruption of our product development programs. For example, the loss of clinical trial data from completed, ongoing or planned clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. Further, the COVID-19 pandemic has resulted in a significant number of our employees and partners working remotely, which increases the risk of a data breach or issues with data and cybersecurity. To the extent that any disruption or security breach results in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the further development of our future product candidates could be delayed.

We are subject to risks arising from COVID-19.

The COVID-19 coronavirus has spread across the globe and is impacting worldwide economic activity. A pandemic, including COVID-19 or other public health epidemic, poses the risk that we or our employees, CROs, suppliers, manufacturers and other partners may be prevented from conducting business activities for an indefinite period of time, including due to the spread of the disease or shutdowns that may be requested or mandated by governmental authorities. While it is not possible at this time to estimate the full impact that COVID-19 could have on our business, the continued spread of COVID-19 could disrupt our clinical trials, supply chain and the manufacture or shipment of our cyclodextrin products, and other related activities, which could have a material adverse effect on our business, financial condition and results of operations. COVID-19 has also had an adverse impact on global economic conditions which could impair our ability to raise capital when needed. While we have not yet experienced any disruptions in our business or other negative consequences relating to COVID-19, the extent to which the COVID-19 pandemic impacts our results will depend on future developments that are highly uncertain and cannot be predicted.

Risks Related to Our Intellectual Property

The rights we rely upon to protect our unpatented trade secrets may be inadequate.

To manufacture and produce Trappsol® Cyclo™, we rely primarily on unpatented trade secrets, know-how and technology which are difficult to protect, especially in the pharmaceutical industry, where much of the information about a product must be made public during the regulatory approval process. We seek to protect trade secrets, in part, by entering into confidentiality agreements with third-party manufacturers, employees, consultants and others. These parties may breach or terminate these agreements or may refuse to enter into such agreements with us, and we may not have adequate remedies for such breaches. Furthermore, these agreements may not provide meaningful protection for our trade secrets or other proprietary information and may not provide an adequate remedy in the event of unauthorized use or disclosure of confidential information or other breaches of the agreements. Despite our efforts to protect our trade secrets, we or others may unintentionally or willfully disclose our proprietary information to competitors.

If we fail to maintain trade secret protection, our competitive position may be adversely affected. Competitors may also independently discover our trade secrets. Enforcement of claims that a third party has illegally obtained and is using trade secrets is expensive, time consuming and uncertain. If our competitors independently develop equivalent knowledge, methods and know-how, we would not be able to assert our trade secrets against them and our business could be harmed.

We cannot ensure that patent rights relating to inventions described and claimed in our pending patent applications will issue, that patents based on our patent applications will not be challenged and rendered invalid and/or unenforceable, or that third parties will not find ways to circumvent our patent rights or claim co-ownership thereof.

We have patent applications pending with respect to the treatment of Alzheimer’s disease with Trappsol® Cyclo™. However, we cannot predict:

| |

●

|

if and when patents may issue based on our patent applications;

|

| |

|

|

| |

●

|

the scope of protection of any patent issuing based on our patent applications;

|

| |

|

|

| |

●

|

whether the claims of any patent issuing based on our patent applications will provide protection against competitors;

|

| |

|

|

| |

●

|

whether or not third parties will find ways to invalidate or circumvent our patent rights, or claim co-ownership rights in our patent rights, which may impact our ability to enforce our patent rights against third parties;

|

| |

|

|

| |

●

|

whether or not others will obtain patents claiming aspects similar to those covered by our patents and patent applications; or

|

| |

|

|

| |

●

|

whether we will need to initiate litigation or administrative proceedings to enforce and/or defend our patent rights which will be costly whether we win or lose.

|

We cannot be certain that the claims in our pending patent applications will be considered patentable by the U.S. Patent and Trademark Office or by patent offices in foreign countries. Even if the patents do issue based on our patent applications, third parties may challenge the validity, enforceability or scope thereof, which may result in such patents being narrowed, invalidated or held unenforceable. Furthermore, even if they are unchallenged, our patents may not adequately exclude third parties from practicing relevant technology or prevent others from designing around our claims. If the breadth or strength of our intellectual property position with respect to our product candidates is threatened, it could dissuade companies from collaborating with us and threaten our ability to commercialize our product candidates. It is possible that third parties with whom we have collaborated may contend that they co-own patent rights we have filed, which, if correct and in the absence of an agreement to the contrary, could prevent us from asserting the patent rights against our competitors. Furthermore, in the event of litigation or administrative proceedings, we cannot be certain that the claims in any of our issued patents will be considered valid by courts in the United States or foreign countries.

We are susceptible to intellectual property suits that could cause us to incur substantial costs or pay substantial damages or prohibit us from selling our product candidates.

There is a substantial amount of litigation over patent and other intellectual property rights in the biotechnology industry. Whether or not a product infringes a patent involves complex legal and factual considerations, the determination of which is often uncertain. Searches typically performed to identify potentially infringed patents of third parties are often not conclusive and, because patent applications can take many years to issue, there may be applications now pending, which may later result in issued patents which our current or future products may infringe or be alleged to infringe. In addition, our competitors or other parties may assert that our product candidates and the methods employed may be covered by patents held by them. If any of our products infringes a valid patent, we could be prevented from manufacturing or selling such product unless we are able to obtain a license or able to redesign the product in such a manner as to avoid infringement. A license may not always be available or may require us to pay substantial royalties. We also may not be successful in any attempt to redesign our product to avoid infringement, nor does a later redesign protect the Company from prior infringement. We are aware of third party U.S. patents and patent applications, which may be relevant to our lead product candidate Trappsol® Cyclo™ for treating Niemann-Pick Type C disease, and may be relevant to the use of Trappsol® Cyclo™ for treating Alzheimer’s disease. Although we believe that we would not infringe a valid claim of those patents or pending patent applications, if issued, the owner of the patent rights may disagree with our assessment and bring an infringement action against us. There is no assurance that a court would find in our favor on questions of infringement or validity. Infringement and other intellectual property claims, with or without merit, can be expensive and time-consuming to litigate and can divert our management’s attention from operating our business.

We may need to initiate lawsuits to protect or enforce our intellectual property rights, which could be expensive and, if we lose, could cause us to lose some of our intellectual property rights, which would harm our ability to compete in the market.

In order to protect or enforce our intellectual property rights, we may initiate patent, trademark and related litigation against third parties, such as infringement suits or requests for injunctive relief. Our ability to establish and maintain a competitive position may be achieved in part by prosecuting claims against others who we believe to be infringing its rights. Any lawsuits that we initiate could be expensive, take significant time and divert our management’s attention from other business concerns and the outcome of litigation to enforce our intellectual property rights in patents, trade secrets or trademarks is highly unpredictable. Litigation also puts our patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing, or adversely affect our ability to distribute any products that are subject to such litigation. In addition, we may provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, including attorney fees, if any, may not be commercially valuable.

Risks Related to Legal and Regulatory Compliance Matters

The pharmaceutical business is subject to increasing government regulation and reform, including with respect to price controls, reimbursement and access to drugs, which could adversely affect our future revenues and profitability.

To the extent our products are developed, commercialized, and successfully introduced to market, they may not be considered cost-effective, and third-party or government reimbursement might not be available or sufficient. Globally, governmental and other third-party payors are becoming increasingly aggressive in attempting to contain health care costs by strictly controlling, directly or indirectly, pricing and reimbursement and, in some cases, limiting or denying coverage altogether on the basis of a variety of justifications, and we expect pressures on pricing and reimbursement from both governments and private payors inside and outside the U.S. to continue.

If we obtain the required regulatory approval to sell our drug candidates, we will be subject to substantial pricing, reimbursement, and access pressures from state Medicaid programs, private insurance programs and pharmacy benefit managers, and the implementation of U.S. health care reform legislation that is increasing these pricing pressures. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act, instituted comprehensive health care reform, and includes provisions that, among other things, reduce and/or limit Medicare reimbursement, and impose new and/or increased taxes. The future of the Affordable Care Act and its constituent parts are uncertain at this time.

In almost all markets, pricing and choice of prescription pharmaceuticals are subject to governmental control. Therefore, the price of our products and their reimbursement in Europe and in other countries is and will be determined by national regulatory authorities. Reimbursement decisions from one or more of the European markets may impact reimbursement decisions in other European markets. A variety of factors are considered in making reimbursement decisions, including whether there is sufficient evidence to show that treatment with the product is more effective than current treatments, that the product represents good value for money for the health service it provides, and that treatment with the product works at least as well as currently available treatments.

The continuing efforts of government and insurance companies, health maintenance organizations, and other payors of health care costs to contain or reduce costs of health care may affect our future revenues and profitability or those of our potential customers, suppliers, and collaborative partners, as well as the availability of capital.

United States federal and state privacy laws, and equivalent laws of other nations, may increase our costs of operation and expose us to civil and criminal sanctions.

Regulation of data processing is evolving, as federal, state, and foreign governments continue to adopt new, or modify existing, laws and regulations addressing data privacy and security, and the collection, processing, storage, transfer, and use of data. These new or proposed laws and regulations are subject to differing interpretations and may be inconsistent among jurisdictions, and guidance on implementation and compliance practices are often updated or otherwise revised, which adds to the complexity of processing personal data. These and other requirements could require us or our collaborators to incur additional costs to achieve compliance, limit our competitiveness, necessitate the acceptance of more onerous obligations in our contracts, restrict our ability to use, store, transfer, and process data, impact our or our collaborators’ ability to process or use data in order to support the provision of our products, affect our or our collaborators’ ability to offer our products in certain locations, or cause regulators to reject, limit or disrupt our clinical trial activities.

We and our collaborators may be subject to federal, state and foreign data protection laws and regulations (i.e., laws and regulations that address privacy and data security). In the United States, numerous federal and state laws and regulations, including federal health information privacy laws, state personal information laws, state data breach notification laws, state health information privacy laws and federal and state consumer protection laws and regulations that govern the collection, use, disclosure and protection of health-related and other personal information could apply to our operations or the operations of our collaborators. In addition, we may obtain health information from third parties (including research institutions from which we obtain clinical trial data) that are subject to privacy and security requirements under the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH. Depending on the facts and circumstances, we could be subject to civil or criminal penalties if we knowingly use or disclose individually identifiable health information maintained by a HIPAA-covered entity in a manner that is not authorized or permitted by HIPAA.

Risks Related to Employee Matters

We are dependent on our executive officers, and we may not be able to pursue our current business strategy effectively if we lose them.

Our success to date has largely depended on the efforts and abilities of our executive officers, namely N. Scott Fine, our Chief Executive Officer, and Lise Kjems, MD, PhD, our Chief Medical Officer. Our ability to manage our operations and meet our business objectives could be adversely affected if, for any reason, such officers do not remain with us.

Our employees, clinical trial investigators, CROs, consultants, vendors and any potential commercial partners may engage in misconduct or other improper activities, including non-compliance with regulatory standards.

We are exposed to the risk of fraud or other misconduct by our employees, clinical trial investigators, CROs, consultants, vendors and any potential commercial partners. Misconduct by these parties could include intentional, reckless and/or negligent conduct or disclosure of unauthorized activities to us that violates: (i) U.S. laws and regulations or those of foreign jurisdictions, including those laws that require the reporting of true, complete and accurate information, (ii) manufacturing standards, (iii) federal and state health and data privacy, security, fraud and abuse, government price reporting, transparency reporting requirements, and other healthcare laws and regulations in the United States and abroad or (iv) laws that require the true, complete and accurate reporting of financial information or data. Such misconduct could also involve the improper use of information obtained in the course of clinical trials, which could result in regulatory sanctions and cause serious harm to our reputation. We have adopted a code of conduct applicable to all of our employees, as well as a disclosure program and other applicable policies and procedures, but it is not always possible to identify and deter employee misconduct, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting us from governmental investigations or other actions or lawsuits stemming from a failure to comply with these laws or regulations. If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business, including the imposition of significant civil, criminal and administrative penalties, damages, fines, disgorgement, individual imprisonment, exclusion from government funded healthcare programs, such as Medicare, Medicaid and other federal healthcare programs, contractual damages, reputational harm, diminished profits and future earnings, additional integrity reporting and oversight obligations, and the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business and our results of operations.

If we fail to comply with the U.S. federal Anti-Kickback Statute and similar state and foreign country laws, we could be subject to criminal and civil penalties and exclusion from federally funded healthcare programs including the Medicare and Medicaid programs and equivalent third country programs, which would have a material adverse effect on our business and results of operations.

A provision of the Social Security Act, commonly referred to as the federal Anti-Kickback Statute, prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration, directly or indirectly, in cash or in kind, to induce or reward the referring, ordering, leasing, purchasing or arranging for, or recommending the ordering, purchasing or leasing of, items or services payable, in whole or in part, by Medicare, Medicaid or any other federal healthcare program. The federal Anti-Kickback Statute is very broad in scope and many of its provisions have not been uniformly or definitively interpreted by existing case law or regulations. In addition, many states have adopted laws similar to the federal Anti-Kickback Statute that apply to activity in those states, and some of these laws are even broader than the federal Anti-Kickback Statute in that their prohibitions may apply to items or services reimbursed under Medicaid and other state programs or, in several states, apply regardless of the source of payment. Violations of the federal Anti-Kickback Statute may result in substantial criminal, civil or administrative penalties, damages, fines and exclusion from participation in federal healthcare programs.

While we believe our operations will be in compliance with the federal Anti-Kickback Statute and similar state laws, we cannot be certain that we will not be subject to investigations or litigation alleging violations of these laws, which could be time-consuming and costly to us and could divert management’s attention from operating our business, which in turn could have a material adverse effect on our business. In addition, if our arrangements were found to violate the federal Anti-Kickback Statute or similar state laws, the consequences of such violations would likely have a material adverse effect on our business, results of operations and financial condition.

Risks Related To Our Fine Chemical Business

A small number of our customers account for a substantial portion of our revenue and receivables, and the loss of any of these customers would materially decrease our revenues.

In 2021, four major customers accounted for 73% of total revenues. Accounts receivable balances for these major customers represented 94% of total accounts receivable at December 31, 2021. For the three months ended September 30, 2022, two customers accounted for 86% of total revenues, and for the nine months ended September 30, 2022, three major customers accounted for 67% of total revenues. We have a supply contract with only one of our major customers. The loss of one of these customers would materially decrease our revenues if we were unable to replace such customers.

We are dependent on certain third-party suppliers.

We purchase the Trappsol® cyclodextrin products we sell from third-party suppliers and depend on those suppliers for the cyclodextrins we use in our Aquaplex® products. We are also dependent on outside manufacturers that use lyophilization techniques for our Aquaplex® products. We purchase substantially all of our Trappsol® products from bulk manufacturers and distributors in the U.S., Japan, China, and Europe. Although products are available from multiple sources, an unexpected interruption of supply, or material increases in the price of products, for any reason, such as regulatory requirements, import restrictions, loss of certifications, power interruptions, fires, hurricanes, war or other events could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We may be negatively affected by currency exchange rate fluctuations.

Our earnings and cash flows are influenced by currency fluctuations due to the geographic diversity of our suppliers, which may have a significant impact on our financial results. As we buy inventory from foreign suppliers, the change in the value of the U.S. dollar in relation to the Euro, Yen and Yuan has an effect on our cost of inventory, and will continue to do so. We buy most of our products from outside the U.S. using U.S. dollars. Our main supplier of specialty cyclodextrins and complexes, Cyclodextrin Research & Development Laboratory, is located in Hungary and its prices are set in Euros. The cost of our bulk inventory often changes due to fluctuations in the U.S. dollar. These products currently represent a significant portion of our revenues. When we experience short-term increases in currency fluctuation or supplier price increases, we are often not able to raise our prices sufficiently to maintain our historical margins and therefore, our margins on these sales may decline. If the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions may adversely affect our results of operations and financial condition.

Risks Related To Our Common Stock and This Offering

Our management has broad discretion as to the use of the net proceeds from this offering.

We currently intend to use the net proceeds that we receive from this offering to (i) continue with our pivotal Phase III trial for the treatment of NPC with Trappsol® Cyclo™, (ii) fund further development of our preclinical programs towards IND filings and clinical trials for the treatment of Alzheimer’s disease with Trappsol® Cyclo™ and (iii) fund working capital and general corporate purposes using any remaining amounts. Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in “Use of Proceeds.” Accordingly, you will have to rely upon the judgment of our management with respect to the use of the proceeds. Our management may spend a portion or all of the net proceeds from this offering in ways that holders of our common stock may not desire or that may not yield a significant return or any return at all. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may also invest the net proceeds from this offering in a manner that does not produce income or that loses value.

There is no market for our common warrants or pre-funded warrants.

The public offering price for the securities will be determined by negotiations between us and the underwriter, and may not be indicative of prices that will prevail in the trading market. We do not intend to apply to list the common warrants or pre-funded warrants on The Nasdaq Capital Market or any nationally recognized trading system, and accordingly, there will be no trading market for such warrants. In the absence of an active public trading market:

| |

●

|

you may not be able to resell your securities at or above the public offering price;

|

| |

|

|

| |

●

|

the market price of our common stock may experience more price volatility; and

|

| |

|

|

| |

●

|

there may be less efficiency in carrying out your purchase and sale orders.

|

The ability to exercise our common warrants is contingent upon stockholder approval.