LIZHI INC. (“LIZHI” or the “Company” or “We”) (NASDAQ: LIZI), an

audio-based social and entertainment platform, today announced its

unaudited financial results for the third quarter ended September

30, 2022.

Third Quarter 2022 Financial and

Operational Highlights

- Net revenues were

RMB565.2 million (US$79.5 million) in the third quarter of 2022,

representing a 12% increase from RMB504.8 million in the third

quarter of 2021.

- Average total mobile

MAUs1 in the third quarter of 2022 was

49.7 million, compared to 58.9 million in the third quarter of

2021, primarily due to reduced advertisement spending on users with

lower commercialization capability.

- Average total monthly

paying users2 in the third quarter of

2022 was 476.7 thousand, compared to 485.5 thousand in the third

quarter of 2021.

Mr. Jinnan (Marco) Lai, Founder and CEO of

LIZHI, commented, “We are pleased to announce a strong performance

for the third quarter, posting new record highs for both revenues

and net income, demonstrating our market competitiveness and

sustainability of our business model amidst the current macro

conditions. In the third quarter, we remained focused on advancing

our dual pillar approach of interactive entertainment plus

audio-based social networking business and diversifying the product

matrix through innovative product features. Internationally, we

continued to strengthen our globalization capabilities; and the

enhancement of our core technologies also empowered our global

business expansion. Next, we will continue solidifying our core

competencies, dedicated to creating greater value for our users and

shareholders.”

Ms. Chengfang Lu, Acting Chief Financial Officer

of LIZHI, said, “Our third quarter results are a testament to our

strategic execution ability, with quarterly revenues growing by 12%

year-over-year and 10% quarter-over-quarter to a new record high of

RMB565.2 million. As we unceasingly endeavor to optimize our

operational efficiency, we achieved a profit for the fourth

consecutive quarter on a GAAP basis in the third quarter of 2022,

with net income growing 5% sequentially to RMB19.8 million. Going

forward, we aim to continuously develop our product matrix,

strengthen core technological capabilities, and unleash our

commercialization potential to achieve sustainable growth over the

long term.”

Third Quarter 2022 Unaudited Financial

Results

Net revenues were RMB565.2

million (US$79.5 million) in the third quarter of 2022,

representing an increase of 12% from RMB504.8 million in the third

quarter of 2021, primarily due to the growth in average user

spending on our audio entertainment products. While certain regions

have started to ease the COVID-19 related restrictions, given the

uncertainties as to the development of the pandemic, it is

difficult to predict the extent to which it might impact the

Company’s operations beyond the third quarter of 2022. This will

depend on the COVID-19’s development in China and overseas, which

may be subject to changes and uncertainties.

Cost of revenues was RMB376.2

million (US$52.9 million) in the third quarter of 2022,

representing a 6% increase from RMB353.6 million in the third

quarter of 2021, mainly attributable to an increase in the revenue

sharing fees to our content creators as the Company’s revenues

grew, and partially offset by decreases in the salary and welfare

benefits expenses related to decreases in our operation’s headcount

and share-based compensation expenses.

Gross profit was RMB189.1

million (US$26.6 million) in the third quarter of 2022,

representing an increase of 25% from RMB151.3 million in the third

quarter of 2021.

Non-GAAP gross

profit3 was RMB190.8 million (US$26.8

million) in the third quarter of 2022, representing an increase of

24% from RMB154.5 million in the third quarter of 2021.

Gross margin in the third

quarter of 2022 was 33%, compared to 30% in the third quarter of

2021. Non-GAAP gross margin in the third quarter

of 2022 was 34%, compared to 31% in the third quarter of 2021.

Operating expenses were

RMB176.6 million (US$24.8 million) in the third quarter of 2022,

compared to RMB191.3 million in the third quarter of 2021.

Research and development expenses were RMB78.3

million (US$11.0 million) in the third quarter of 2022,

representing an increase of 7% from RMB73.4 million in the third

quarter of 2021. The increase was primarily due to the higher

salary and welfare benefits expenses and rental expenses.

Selling and marketing expenses were RMB71.2

million (US$10.0 million) in the third quarter of 2022, compared to

RMB88.2 million in the third quarter of 2021, primarily

attributable to the decrease in branding and marketing expenses,

partially offset by the increased salary and welfare benefits

expenses. The Company will evaluate and adjust its marketing

strategy and budget based on the Company's performance, operational

needs and market conditions.

General and administrative expenses were RMB27.1

million (US$3.8 million) in the third quarter of 2022, compared to

RMB29.7 million in the third quarter of 2021, mainly driven by a

decrease in share-based compensation expenses and other

miscellaneous expenses.

Operating income was RMB12.5

million (US$1.8 million) in the third quarter of 2022, compared to

an operating loss of RMB40.1 million in the third quarter of

2021.

Non-GAAP operating

income4 was RMB20.2 million (US$2.8

million) in the third quarter of 2022, compared to non-GAAP

operating loss of RMB30.1 million in the third quarter of 2021.

Net income was RMB19.8 million

(US$2.8 million) in the third quarter of 2022, compared to net loss

of RMB37.1 million in the third quarter of 2021.

Non-GAAP net income was RMB27.5

million (US$3.9 million) in the third quarter of 2022, compared to

non-GAAP net loss of RMB27.2 million in the third quarter of

2021.

Net income attributable to LIZHI

INC.’s ordinary shareholders was RMB19.8

million (US$2.8 million) in the third quarter of 2022, compared to

net loss attributable to LIZHI INC.’s ordinary shareholders of

RMB37.1 million in the third quarter of 2021.

Non-GAAP net income attributable to

LIZHI INC.’s ordinary

shareholders5 was RMB27.5 million (US$3.9

million) in the third quarter of 2022, compared to non-GAAP net

loss attributable to LIZHI INC.’s ordinary shareholders of RMB27.2

million in the third quarter of 2021.

Basic and diluted net income per

ADS6 were RMB0.38 (US$0.05) in the third

quarter of 2022, compared to basic and diluted net loss per ADS of

RMB0.73 in the third quarter of 2021.

Non-GAAP basic and diluted net income

per ADS7 were RMB0.53 (US$0.07) in the

third quarter of 2022, compared to non-GAAP basic and diluted net

loss of RMB0.54 per ADS in the third quarter of 2021.

Balance Sheets

As of September 30, 2022, the Company had cash

and cash equivalents, short-term investments and restricted cash of

RMB623.1 million (US$87.6 million).

Litigation Update

On October 1, 2022, the U.S. District Court for

the Eastern District of New York (the “Federal Court”) dismissed in

full a putative securities class action that had been filed against

the Company and denied the plaintiff’s request for leave to amend

the complaint. The Federal Court’s dismissal follows the March 2022

dismissal of a substantively similar putative class action filed in

the New York Supreme Court, New York County (the “State Court”).

Both lawsuits were filed in January 2021 on behalf of a putative

class of purchasers of the Company’s ADSs and alleged that LIZHI’s

registration statement on Form F-1 dated January 16, 2020 contained

material misstatements and/or omissions regarding the impact of

COVID-19 on the Company in violation of the U.S. Securities Act of

1933. Both the Federal Court and the State Court granted the

Company’s motions to dismiss all claims, concluding that LIZHI’s

registration statement was not misleading as a matter of law.

Conference Call

The Company’s management will host an earnings

conference call at 8:00 AM U.S. Eastern Time on November 16, 2022

(9:00 PM Beijing/Hong Kong Time on November 16, 2022).

For participants who wish to join the call,

please access the link provided below to complete the online

registration 20 minutes prior to the scheduled call start time.

Upon registration, participants will receive details for the

conference call, including dial-in numbers, a personal PIN and an

e-mail with detailed instructions to join the conference call.

|

Registration Link: |

https://register.vevent.com/register/BIdc851386d54e40d198eab6de87458639 |

Once complete the registration, please dial-in

10 minutes before the scheduled start time of the earnings call and

enter the personal PIN as instructed to connect to the call.

Additionally, a live webcast of the conference

call and a replay of the webcast will be available on the Company's

investor relations website at http://ir.lizhi.fm.

About LIZHI INC.

LIZHI INC. has created a comprehensive

audio-based social ecosystem with a global presence. The Company

aims to cater to users’ interests in audio entertainment and social

networking through its product portfolios. LIZHI INC. envisions an

audio ecosystem where everyone can be connected and interact

through voices. LIZHI INC. has been listed on Nasdaq since January

2020.

For more information, please visit:

http://ir.lizhi.fm.

Use of Non-GAAP Financial

Measures

The unaudited condensed consolidated financial

information is prepared in conformity with accounting principles

generally accepted in the United States of America (“U.S.

GAAP”).

LIZHI uses non-GAAP gross profit, non-GAAP gross

margin, non-GAAP operating loss/income, non-GAAP net loss/income,

non-GAAP net loss/income attributable to LIZHI INC.’s ordinary

shareholders and non-GAAP basic and diluted net loss/income per

ADS, which are non-GAAP financial measures. Non-GAAP gross profit

is gross profit excluding share-based compensation expenses.

Non-GAAP gross margin is non-GAAP gross profit as a percentage of

net revenues. Non-GAAP operating loss/income is operating

loss/income excluding share-based compensation expenses. Non-GAAP

net loss/income is net loss/income, excluding share-based

compensation expenses. Non-GAAP net loss/income attributable to

LIZHI INC.’s ordinary shareholders is net loss/income attributable

to LIZHI INC.’s ordinary shareholders, excluding share-based

compensation expenses. Non-GAAP basic and diluted net loss/income

per ADS is non-GAAP net loss/income attributable to LIZHI INC.’s

ordinary shareholders divided by the weighted average number of ADS

used in the calculation of basic and diluted net loss/income per

ADS. The Company believes that separate analysis and exclusion of

the non-cash impact of the above reconciling item adds clarity to

the constituent parts of its performance. The Company reviews these

non-GAAP financial measures together with GAAP financial measures

to obtain a better understanding of its operating performance. It

uses the non-GAAP financial measure for planning, forecasting and

measuring results against the forecast. The Company believes that

non-GAAP financial measure is useful supplemental information for

investors and analysts to assess its operating performance without

the non-cash effect of share-based compensation expenses.

However, the use of non-GAAP financial measures

has material limitations as an analytical tool. One of the

limitations of using non-GAAP financial measures is that they do

not include all items that impact the Company’s net income for the

period. In addition, because non-GAAP financial measures are not

measured in the same manner by all companies, they may not be

comparable to other similarly titled measures used by other

companies. In light of the foregoing limitations, you should not

consider non-GAAP financial measures in isolation from, superior

to, or as an alternative to the financial measure prepared in

accordance with U.S. GAAP.

The presentation of these non-GAAP financial

measures is not intended to be considered in isolation from, or as

a substitute for, the financial information prepared and presented

in accordance with U.S. GAAP. For more information on these

non-GAAP financial measures, please see the table captioned

“Unaudited Reconciliations of GAAP and Non-GAAP Results” near the

end of this release.

Exchange Rate Information

This announcement contains translations of

certain RMB amounts into U.S. dollars at a specified rate solely

for the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars and from U.S. dollars to RMB

are made at a rate of RMB7.1135 to US$1.00, the exchange rate on

September 30, 2022, set forth in the H.10 statistical release of

the Federal Reserve Board. The Company makes no representation that

the RMB or U.S. dollars amounts referred could be converted into

U.S. dollar or RMB, as the case may be, at any particular rate or

at all.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, and a number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to the

following: LIZHI’s goals and strategies; LIZHI’s future business

development, results of operations and financial condition; the

expected growth of the online audio market; the expectation

regarding the rate at which to gain active users, especially paying

users; LIZHI’s ability to monetize the user base; fluctuations in

general economic and business conditions in China and overseas

markets; the impact of the COVID-19 to LIZHI’s business operations

and the economy in China and elsewhere generally; any adverse

changes in laws, regulations, rules, policies or guidelines

applicable to LIZHI; and assumptions underlying or related to any

of the foregoing. In some cases, forward-looking statements can be

identified by words or phrases such as “may,” “will,” “expect,”

“anticipate,” “target,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other

similar expressions. Further information regarding these and other

risks, uncertainties or factors is included in the Company’s

filings with the Securities Exchange Commission. All information

provided in this press release is as of the date of this press

release, and the Company does not undertake any duty to update such

information, except as required under applicable law.

For investor and media inquiries, please

contact:

In China:

LIZHI INC.IR DepartmentTel: +86 (20) 3866-4265E-mail:

ir@lizhi.fm

The Piacente Group, Inc.Jenny CaiTel: +86 (10) 6508-0677E-mail:

Lizhi@tpg-ir.com

In the United States:

The Piacente Group, Inc. Brandi PiacenteTel:

+1-212-481-2050E-mail: Lizhi@tpg-ir.com

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS(All amounts in thousands, except for share, ADS,

per share data and per ADS data)

|

|

December31,2021 |

|

September30,2022 |

|

September30,2022 |

|

|

RMB |

|

RMB |

|

US$ |

| ASSETS |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

Cash and cash equivalents |

533,293 |

|

517,470 |

|

72,745 |

|

Short-term investments |

- |

|

100,136 |

|

14,077 |

|

Restricted cash |

4,155 |

|

5,538 |

|

779 |

|

Accounts receivable, net |

6,458 |

|

3,338 |

|

469 |

|

Prepayments and other current assets |

33,604 |

|

28,852 |

|

4,056 |

|

|

|

|

|

|

|

| Total current

assets |

577,510 |

|

655,334 |

|

92,126 |

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

Property, equipment and leasehold improvement, net |

33,391 |

|

30,039 |

|

4,223 |

|

Intangible assets, net |

2,245 |

|

1,349 |

|

190 |

|

Right-of-use assets, net |

28,941 |

|

26,652 |

|

3,747 |

|

Other non-current assets |

799 |

|

296 |

|

42 |

|

|

|

|

|

|

|

| Total non-current

assets |

65,376 |

|

58,336 |

|

8,202 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

642,886 |

|

713,670 |

|

100,328 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

Accounts payable |

80,793 |

|

51,388 |

|

7,224 |

|

Deferred revenue |

20,657 |

|

26,514 |

|

3,727 |

|

Salary and welfare payable |

123,075 |

|

133,472 |

|

18,763 |

|

Taxes payable |

5,564 |

|

5,792 |

|

814 |

|

Short-term loans |

68,999 |

|

42,000 |

|

5,904 |

|

Lease liabilities due within one year |

13,929 |

|

18,028 |

|

2,534 |

|

Accrued expenses and other current liabilities |

53,486 |

|

62,031 |

|

8,720 |

|

|

|

|

|

|

|

| Total current

liabilities |

366,503 |

|

339,225 |

|

47,686 |

|

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

Lease liabilities |

17,076 |

|

10,195 |

|

1,433 |

|

Other non-current liabilities |

4,452 |

|

4,261 |

|

599 |

|

|

|

|

|

|

|

| Total non-current

liabilities |

21,528 |

|

14,456 |

|

2,032 |

|

|

|

|

|

|

|

| TOTAL

LIABILITIES |

388,031 |

|

353,681 |

|

49,718 |

| |

|

|

|

|

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS (CONTINUED)(All amounts in thousands, except for

share, ADS, per share data and per ADS data)

|

|

|

December31,2021 |

|

|

September30,2022 |

|

|

September30,2022 |

|

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

| |

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

|

Class A Ordinary shares (US$0.0001 par value, 1,268,785,000 shares

authorized, 798,962,260 shares issued and 782,801,250 shares

outstanding as of December 31, 2021; 1,268,785,000 shares

authorized, 818,962,260 shares issued and 798,323,930 shares

outstanding as of September 30, 2022). |

|

530 |

|

|

543 |

|

|

76 |

|

| Class B Ordinary shares

(US$0.0001 par value, 231,215,000 shares authorized, issued and

outstanding as of December 31, 2021 and September 30, 2022,

respectively). |

|

168 |

|

|

168 |

|

|

24 |

|

| Treasury stock |

|

(11 |

) |

|

(14 |

) |

|

(2 |

) |

| Additional paid in

capital |

|

2,630,456 |

|

|

2,651,759 |

|

|

372,779 |

|

| Accumulated deficit |

|

(2,366,531 |

) |

|

(2,311,434 |

) |

|

(324,935 |

) |

| Accumulated other

comprehensive (loss)/income |

|

(9,757 |

) |

|

18,971 |

|

|

2,669 |

|

| TOTAL LIZHI Inc.’s

shareholders’ equity |

|

254,855 |

|

|

359,993 |

|

|

50,611 |

|

| |

|

|

|

|

|

|

| Non-controlling interests |

|

- |

|

|

(4 |

) |

|

(1 |

) |

| |

|

|

|

|

|

|

| TOTAL SHAREHOLDERS’

EQUITY |

|

254,855 |

|

|

359,989 |

|

|

50,610 |

|

| |

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

642,886 |

|

|

713,670 |

|

|

100,328 |

|

| |

|

|

|

|

|

|

|

|

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(All amounts in thousands, except

for share, ADS, per share data and per ADS data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September30,2021 |

|

|

June30,2022 |

|

|

September30,2022 |

|

|

September30,2022 |

|

|

September30,2021 |

|

|

September30,2022 |

|

|

September30,2022 |

|

| |

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audio entertainment revenues |

|

500,792 |

|

|

513,018 |

|

|

562,573 |

|

|

79,085 |

|

|

1,545,171 |

|

|

1,589,613 |

|

|

223,464 |

|

| Podcast, advertising and other

revenues |

|

4,052 |

|

|

2,676 |

|

|

2,655 |

|

|

373 |

|

|

14,011 |

|

|

8,022 |

|

|

1,128 |

|

| Total net

revenues |

|

504,844 |

|

|

515,694 |

|

|

565,228 |

|

|

79,458 |

|

|

1,559,182 |

|

|

1,597,635 |

|

|

224,592 |

|

| Cost of revenues

(1) |

|

(353,575 |

) |

|

(340,063 |

) |

|

(376,159 |

) |

|

(52,880 |

) |

|

(1,124,099 |

) |

|

(1,064,843 |

) |

|

(149,693 |

) |

| Gross

profit |

|

151,269 |

|

|

175,631 |

|

|

189,069 |

|

|

26,578 |

|

|

435,083 |

|

|

532,792 |

|

|

74,899 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling and marketing

expenses |

|

(88,230 |

) |

|

(60,756 |

) |

|

(71,167 |

) |

|

(10,004 |

) |

|

(315,345 |

) |

|

(191,932 |

) |

|

(26,981 |

) |

| General and administrative

expenses |

|

(29,736 |

) |

|

(30,550 |

) |

|

(27,093 |

) |

|

(3,809 |

) |

|

(72,425 |

) |

|

(80,021 |

) |

|

(11,249 |

) |

| Research and development

expenses |

|

(73,377 |

) |

|

(70,262 |

) |

|

(78,320 |

) |

|

(11,010 |

) |

|

(191,183 |

) |

|

(219,676 |

) |

|

(30,882 |

) |

| Total operating

expenses |

|

(191,343 |

) |

|

(161,568 |

) |

|

(176,580 |

) |

|

(24,823 |

) |

|

(578,953 |

) |

|

(491,629 |

) |

|

(69,112 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

(loss)/income |

|

(40,074 |

) |

|

14,063 |

|

|

12,489 |

|

|

1,755 |

|

|

(143,870 |

) |

|

41,163 |

|

|

5,787 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest (expenses)/income,

net |

|

(393 |

) |

|

480 |

|

|

1,321 |

|

|

186 |

|

|

(949 |

) |

|

1,746 |

|

|

245 |

|

| Foreign exchange losses |

|

(279 |

) |

|

(424 |

) |

|

(311 |

) |

|

(44 |

) |

|

(427 |

) |

|

(1,121 |

) |

|

(158 |

) |

| Investment income |

|

8 |

|

|

146 |

|

|

409 |

|

|

57 |

|

|

468 |

|

|

649 |

|

|

91 |

|

| Government grants |

|

4,084 |

|

|

4,169 |

|

|

4,178 |

|

|

587 |

|

|

9,664 |

|

|

10,973 |

|

|

1,543 |

|

| Others, net |

|

(446 |

) |

|

480 |

|

|

1,736 |

|

|

244 |

|

|

(1,051 |

) |

|

1,787 |

|

|

251 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss)/income before

income taxes |

|

(37,100 |

) |

|

18,914 |

|

|

19,822 |

|

|

2,785 |

|

|

(136,165 |

) |

|

55,197 |

|

|

7,759 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expenses |

|

- |

|

|

(61 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(104 |

) |

|

(15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

(loss)/income |

|

(37,100 |

) |

|

18,853 |

|

|

19,822 |

|

|

2,785 |

|

|

(136,165 |

) |

|

55,093 |

|

|

7,744 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (income)/loss attributable

to the non-controlling interests shareholders |

|

- |

|

|

(7 |

) |

|

1 |

|

|

- |

|

|

- |

|

|

4 |

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders |

|

(37,100 |

) |

|

18,846 |

|

|

19,823 |

|

|

2,785 |

|

|

(136,165 |

) |

|

55,097 |

|

|

7,745 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (CONTINUED)(All amounts in

thousands, except for share, ADS, per share data and per ADS

data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September30,2021 |

|

June30,2022 |

|

September30,2022 |

|

September30,2022 |

|

September30,2021 |

|

September30,2022 |

|

September30,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income |

|

(37,100 |

) |

|

18,853 |

|

|

19,822 |

|

2,785 |

|

(136,165 |

) |

|

55,093 |

|

7,744 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income/(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments |

|

1,184 |

|

|

15,344 |

|

|

14,602 |

|

2,053 |

|

(2,696 |

) |

|

28,728 |

|

4,039 |

| Total comprehensive

(loss)/income |

|

(35,916 |

) |

|

34,197 |

|

|

34,424 |

|

4,838 |

|

(138,861 |

) |

|

83,821 |

|

11,783 |

| Comprehensive (income)/loss

attributable to non‑controlling interests shareholders |

|

- |

|

|

(7 |

) |

|

1 |

|

- |

|

- |

|

|

4 |

|

1 |

| Comprehensive

(loss)/income attributable to LIZHI INC.’s ordinary

shareholders |

|

(35,916 |

) |

|

34,190 |

|

|

34,425 |

|

4,838 |

|

(138,861 |

) |

|

83,825 |

|

11,784 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

(0.04 |

) |

|

0.02 |

|

|

0.02 |

|

0.00 |

|

(0.14 |

) |

|

0.05 |

|

0.01 |

|

—Diluted |

|

(0.04 |

) |

|

0.02 |

|

|

0.02 |

|

0.00 |

|

(0.14 |

) |

|

0.05 |

|

0.01 |

| Weighted average

number of ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

1,014,757,633 |

|

|

1,031,036,519 |

|

|

1,040,595,117 |

|

1,040,595,117 |

|

981,348,659 |

|

|

1,031,562,237 |

|

1,031,562,237 |

|

—Diluted |

|

1,014,757,633 |

|

|

1,035,130,441 |

|

|

1,045,863,031 |

|

1,045,863,031 |

|

981,348,659 |

|

|

1,035,643,138 |

|

1,035,643,138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders per

ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

(0.73 |

) |

|

0.37 |

|

|

0.38 |

|

0.05 |

|

(2.78 |

) |

|

1.07 |

|

0.15 |

|

—Diluted |

|

(0.73 |

) |

|

0.36 |

|

|

0.38 |

|

0.05 |

|

(2.78 |

) |

|

1.06 |

|

0.15 |

| Weighted average

number of ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

50,737,882 |

|

|

51,551,826 |

|

|

52,029,756 |

|

52,029,756 |

|

49,067,433 |

|

|

51,578,112 |

|

51,578,112 |

|

—Diluted |

|

50,737,882 |

|

|

51,756,522 |

|

|

52,293,152 |

|

52,293,152 |

|

49,067,433 |

|

|

51,782,157 |

|

51,782,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (CONTINUED)(All amounts in

thousands, except for share, ADS, per share data and per ADS

data)

(1) Share-based compensation was

allocated in cost of revenues and operating expenses as

follows:

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September30,2021 |

|

June30,2022 |

|

September30,2022 |

|

September30,2022 |

|

September30,2021 |

|

September30,2022 |

|

September30,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

3,183 |

|

1,211 |

|

1,728 |

|

243 |

|

8,965 |

|

5,545 |

|

780 |

| Selling and marketing

expenses |

|

1,084 |

|

267 |

|

455 |

|

64 |

|

2,392 |

|

1,729 |

|

243 |

| General and administrative

expenses |

|

2,968 |

|

2,644 |

|

2,157 |

|

303 |

|

9,617 |

|

7,590 |

|

1,067 |

| Research and development

expenses |

|

2,708 |

|

2,993 |

|

3,359 |

|

472 |

|

7,050 |

|

8,713 |

|

1,225 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIZHI INC.

UNAUDITED RECONCILIATIONS OF GAAP AND

NON-GAAP RESULTS(All amounts in thousands, except for

share, ADS, per share data and per ADS data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September30,2021 |

|

June30,2022 |

|

September30,2022 |

|

September30,2022 |

|

September30,2021 |

|

September30,2022 |

|

September30,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

151,269 |

|

|

175,631 |

|

189,069 |

|

26,578 |

|

435,083 |

|

|

532,792 |

|

74,899 |

| Share-based compensation

expenses |

|

3,183 |

|

|

1,211 |

|

1,728 |

|

243 |

|

8,965 |

|

|

5,545 |

|

780 |

| Non-GAAP gross

profit |

|

154,452 |

|

|

176,842 |

|

190,797 |

|

26,821 |

|

444,048 |

|

|

538,337 |

|

75,679 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

(loss)/income |

|

(40,074 |

) |

|

14,063 |

|

12,489 |

|

1,755 |

|

(143,870 |

) |

|

41,163 |

|

5,787 |

| Share-based compensation

expenses |

|

9,943 |

|

|

7,115 |

|

7,699 |

|

1,082 |

|

28,024 |

|

|

23,577 |

|

3,315 |

| Non-GAAP operating

(loss)/income |

|

(30,131 |

) |

|

21,178 |

|

20,188 |

|

2,837 |

|

(115,846 |

) |

|

64,740 |

|

9,102 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

(loss)/income |

|

(37,100 |

) |

|

18,853 |

|

19,822 |

|

2,785 |

|

(136,165 |

) |

|

55,093 |

|

7,744 |

| Share-based compensation

expenses |

|

9,943 |

|

|

7,115 |

|

7,699 |

|

1,082 |

|

28,024 |

|

|

23,577 |

|

3,315 |

| Non-GAAP net

(loss)/income |

|

(27,157 |

) |

|

25,968 |

|

27,521 |

|

3,867 |

|

(108,141 |

) |

|

78,670 |

|

11,059 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders |

|

(37,100 |

) |

|

18,846 |

|

19,823 |

|

2,785 |

|

(136,165 |

) |

|

55,097 |

|

7,745 |

| Share-based compensation

expenses |

|

9,943 |

|

|

7,115 |

|

7,699 |

|

1,082 |

|

28,024 |

|

|

23,577 |

|

3,315 |

| Non-GAAP net

(loss)/income attributable to LIZHI INC.’s ordinary

shareholders |

|

(27,157 |

) |

|

25,961 |

|

27,522 |

|

3,867 |

|

(108,141 |

) |

|

78,674 |

|

11,060 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

(0.03 |

) |

|

0.03 |

|

0.03 |

|

0.00 |

|

(0.11 |

) |

|

0.08 |

|

0.01 |

| —Diluted |

|

(0.03 |

) |

|

0.03 |

|

0.03 |

|

0.00 |

|

(0.11 |

) |

|

0.08 |

|

0.01 |

| Weighted average

number of ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

1,014,757,633 |

|

|

1,031,036,519 |

|

1,040,595,117 |

|

1,040,595,117 |

|

981,348,659 |

|

|

1,031,562,237 |

|

1,031,562,237 |

|

—Diluted |

|

1,014,757,633 |

|

|

1,035,130,441 |

|

1,045,863,031 |

|

1,045,863,031 |

|

981,348,659 |

|

|

1,035,643,138 |

|

1,035,643,138 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders per

ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

(0.54 |

) |

|

0.50 |

|

0.53 |

|

0.07 |

|

(2.20 |

) |

|

1.53 |

|

0.21 |

| —Diluted |

|

(0.54 |

) |

|

0.50 |

|

0.53 |

|

0.07 |

|

(2.20 |

) |

|

1.52 |

|

0.21 |

| Weighted average

number of ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

50,737,882 |

|

|

51,551,826 |

|

52,029,756 |

|

52,029,756 |

|

49,067,433 |

|

|

51,578,112 |

|

51,578,112 |

| —Diluted |

|

50,737,882 |

|

|

51,756,522 |

|

52,293,152 |

|

52,293,152 |

|

49,067,433 |

|

|

51,782,157 |

|

51,782,157 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________

1 Refers to the average monthly number of active

users across our platforms and Apps in a given period, calculated

by dividing (i) the sum of mobile active users for each month of

such period, by (ii) the number of months in the same period.2

Refers to the average monthly number of paying users in a given

period, calculated by dividing (i) the total number of paying users

in each month of such period by (ii) the number of months in the

same period.3 Non-GAAP gross profit is a non-GAAP financial

measure, which is defined as gross profit excluding share-based

compensation expenses. This adjustment amounted to RMB1.7 million

(US$0.2 million) in the third quarter of 2022. Please refer to the

section below titled “Unaudited Reconciliations of GAAP and

Non-GAAP Results” for details.4 Non-GAAP operating income is a

non-GAAP financial measure, which is defined as operating income

excluding share-based compensation expenses. This adjustment

amounted to RMB7.7 million (US$1.1 million) in the third quarter of

2022. Please refer to the section below titled “Unaudited

Reconciliations of GAAP and Non-GAAP Results” for details.5

Non-GAAP net income attributable to LIZHI INC.’s ordinary

shareholders is a non-GAAP financial measure, which is defined as

net income attributable to LIZHI INC.’s ordinary shareholders

excluding share-based compensation expenses. These adjustments

amounted to RMB7.7 million (US$1.1 million) and RMB9.9 million in

the third quarter of 2022 and 2021, respectively. Please refer to

the section below titled “Unaudited Reconciliations of GAAP and

Non-GAAP Results” for details.6 ADS refers to American Depositary

Share. Each ADS represents twenty Class A ordinary shares of the

Company. Basic and diluted net income per ADS is net income

attributable to LIZHI INC.’s ordinary shareholders divided by

weighted average number of ADS.7 Non-GAAP basic and diluted net

income per ADS is a non-GAAP financial measure, which is defined as

non-GAAP net income attributable to LIZHI INC.’s ordinary

shareholders divided by weighted average number of ADS used in the

calculation of basic and diluted net income per ADS.

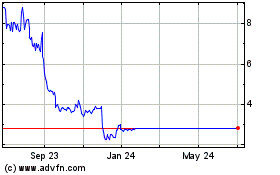

LIZHI (NASDAQ:LIZI)

Historical Stock Chart

From Mar 2024 to Apr 2024

LIZHI (NASDAQ:LIZI)

Historical Stock Chart

From Apr 2023 to Apr 2024