SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 12b-25

Commission File Number: 000-52140

NOTIFICATION OF LATE FILING

| ¨Form 10-K |

¨ Form 20-F |

¨ Form 11-K |

ý Form 10-Q |

| ¨ Form 10-D |

¨ Form N-CEN |

¨ Form N-CSR |

|

For Period Ended: September 30, 2022

| ¨ Transition Report on Form 10-K |

¨ Transition Report on Form 11-K |

| ¨ Transition Report on Form 20-F |

¨ Transition Report on Form 10-Q |

For the Transition Period Ended: _______________________________________

Nothing in this form shall

be construed to imply that the Commission has verified any information contained herein.

If the notification relates

to a portion of the filing checked above, identify the item(s) to which the notification relates: _______________________________________

PART I

REGISTRANT INFORMATION

| Full name of registrant |

Imperalis Holding Corp. |

| Address of principal executive office |

1421 McCarthy Blvd. |

| City, state and zip code |

Milpitas, CA 95035 |

PART II

RULE 12b-25 (b) AND (c)

If the subject report could

not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25 (b), the following should

be completed. (Check box if appropriate.)

|

x |

(a) The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

(b) The

subject annual report, semi-annual report, transition report on Form10-K, Form 20-F, Form11-K, Form N-CEN or Form N-CSR, or portion thereof,

will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition

report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day

following the prescribed due date; and

(c) The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III

NARRATIVE

State below in reasonable

detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed

within the prescribed time period.

The

compilation, dissemination and review of the information required to be presented in the Form 10-Q for the fiscal quarter ended September

30, 2022 has imposed requirements that have rendered timely filing of the Form 10-Q impracticable without undue hardship and expense to

the registrant.

Part

IV

Other

Information

(1) Name and telephone number of person to contact in regard to this

notification

| David J. Katzoff |

(949) |

774-2570 |

| (Name) |

(Area Code) |

(Telephone Number) |

(2) Have all other periodic reports required under

Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12

months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

x Yes

¨ No

(3) Is it anticipated that any significant change

in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof?

x Yes

¨ No

If so: attach an explanation of the anticipated

change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be

made.

On September 6, 2022 (the “Closing Date”),

the registrant (“IMHC”) closed on a transaction (the “Acquisition”) whereby the BitNile Holdings, Inc. (“Parent”

or “BitNile”) (i) delivered to the registrant, all of the outstanding shares of common stock of TurnOnGreen Inc. (“TOGI”)

held by the Parent, and (ii) eliminated all of the intercompany accounts between the Parent and TOGI evidencing historical equity investments

made by the Parent to TOGI, in the approximate amount of $36 million, all in consideration for the issuance by the registrant to the Parent

of an aggregate of 25,000 newly designated shares of Series A Preferred Stock (the “Series A Preferred Stock”), with each

such share having a stated value of $1,000. The Series A Preferred Stock has an aggregate liquidation preference of $25 million, is convertible

into shares of IMHC’s common stock, par value $0.001 per share (the “Common Stock”) at the Parent’s option, is

redeemable by the Parent, and entitles the Parent to vote with the Common Stock on an as-converted basis. Immediately following the Acquisition,

the TOGI became a wholly-owned subsidiary of the registrant.

The Acquisition between IMHC and TOGI, which were

under common control of the Parent as of December 16, 2021, resulted in a change in reporting entity and required retrospective combination

of the entities for all periods presented other than the three and nine months ended September 30, 2021 statements of operations and the

2021 statement of changes in stockholders’ equity, as if the combination had been in effect since the inception of common control.

While the registrant is deemed to be the legal acquirer of TOGI, TOGI is considered the acquiror for accounting and financial reporting

purposes. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior

to IMHC and TOGI being under common control will be those of TOGI, and it’s subsidiaries, and will be recorded at the historical

cost basis of TOGI. The consolidated financial statements after completion of the Acquisition will include the assets and liabilities,

historical operations and operations of IMHC, TOGI and its subsidiaries.

TOGI’s historical financial information

for the three and nine months ended September 30, 2021 have been derived from TOGI’s consolidated financial statements and the related

notes. IMHC’s historical financial information for the three and nine months ended September 30, 2021 have been derived from IMHC’s

consolidated financial statements and the related notes, in IMHC’s Quarterly Report on Form 10-Q for the corresponding periods.

The registrant’s revenue decreased by $0.4

million to $3.9 million for the nine months ended September 30, 2022 compared to the nine months ended September 30, 2021. This was primarily

due to certain customers delaying or canceling projects previously awarded.

Operating expenses increased by approximately

$1.8 million for the nine months ended September 30, 2022 compared to the nine months ended September 30, 2021. The change was primarily

due to rent, marketing, licensing fees, payroll fees, and IMHC operating expenses being included in the 2022 results (as the entities

were not under the common control of the Parent during the 2021 period), increasing by $0.7 million, $0.3 million, $0.3 million, $0.3

million and $45,000, respectfully. These increases were driven by new sales office and facility rents, sponsoring efforts, product safety

certification fees related to electric vehicle chargers, payroll taxes and benefits related to new hires, and the business combination

completed in the third quarter of 2022, respectively.

During the nine month period ended September 30,

2022, IMHC was combined with certain entities under the common control of our Parent. As part of this change and during 2022 the newly

formed entity has started issuing Preferred dividends which has resulted in a decrease in the net loss available to common stockholders

of $0.1 million.

IMPERALIS HOLDING CORP.

(Name of Registrant as Specified in Charter)

Has caused this notification to be signed on its

behalf by the undersigned thereunto duly authorized.

| Dated: November 14, 2022 |

|

/s/ David J. Katzoff |

| |

|

By: David J. Katzoff |

| |

|

Title: Chief Financial Officer |

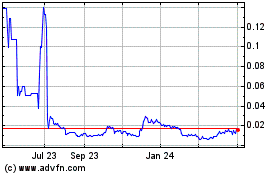

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

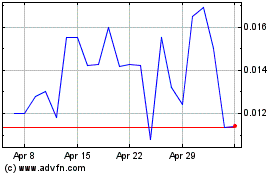

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024