Vislink (Nasdaq: VISL), a global technology leader in the capture,

delivery and management of high quality, live video and associated

data in the media & entertainment, law enforcement and defense

markets, announced its results for the quarter ended September 30,

2022. Company management will host a live video conference call to

discuss the third quarter 2022 results on Tuesday, Nov. 15, 2022,

at 10:00 a.m. Eastern (9:00 a.m. Central) which will be followed by

a Q&A session. The conference call will be accessible at the

following link:

https://marketscale.com/live/vislink-q3-2022-financial-results-video-conference-call/.

An archived replay will be made available after the call ends.

Financial Update

- Revenues for the

three months ended September 30, 2022 were $7.1 million, compared

to $11.2 million for the three months ended September 30,

2021.

-

Net loss attributable to common shareholders was $2.7 million, or

$(0.06) per share in the third quarter of 2022 compared to net

income of $676,000, or $(0.01) per share in the third quarter of

2021.

- EBITDA (earnings before interest,

taxes depreciation and amortization) for the three months ended

September 30, 2022 was negative $1.9 million compared to $1.04

million for the three months ended September 30, 2021.

- Ended the third

quarter of 2022 with $24 million in cash.

Note Related to Stock Dividend

Announcement

On November 9, 2022, Vislink announced the

declaration of a Series A Preferred Stock dividend for its common

stockholders. The dividend will be issued later this month, on or

about November 22, 2022, to holders of record as of November 21,

2022. That press release can be viewed at the following link:

https://www.vislink.com/2022/11/09/vislink-announces-distribution-of-series-a-preferred-stock-to-holders-of-its-common-stock/.

“Our financial results in the third quarter were

below our expectations, but we believe that we have laid the

groundwork for substantial future improvements,” said Carleton

Miller, CEO of Vislink. “Revenue in our live news, sports and

entertainment markets increased by 42% over the prior year, as the

products we have introduced for these sectors have been met with a

very positive response. Today’s audiences crave immediate and

immersive content, and broadcast organizations are seeking new ways

to tap into this demand. Our expanded portfolio of AI-automated

platforms, private 5G network solutions and live remote production

techniques answer this need. With products like the Cliq mobile

transmitter, Quantum receiver and 5G 4Live Event Product Solution,

we have the potential to revolutionize the way content is captured,

distributed, and monetized. We offer a way for these organizations

to realize new revenue streams, increased audience engagement and

higher returns on live event coverage than previously

possible.”

He continued, “Markets for our government

business are also showing strength and our quoting is robust. While

our revenue in this sector was down, and primarily caused by a

reduction in military orders related to Afghanistan, this was

mitigated in part by a rebound in first responder business. Our

comprehensive airborne video downlink solution (AVDS) remains the

leading option for law enforcement, public safety and first

responder organizations who require pristine video quality and

reliable transmissions to keep both the public and their personnel

safe. Meanwhile, our Aerolink product, the newest component of the

AVDS, has enabled additional capabilities requested by the public

safety community. For these reasons, we remain optimistic about

this part of our business delivering a positive impact on our

results.”

“On the operations side, we continue to focus on

driving our cost base lower through headcount and footprint

reduction, maximizing efficiencies throughout the organization and

streamlining our processes. We are confident that these internal

optimizations, combined with our suite of solutions that uniquely

address the challenges of the markets we operate in, will allow us

to realize positive business results in subsequent quarters.”

Non-GAAP Financial Measure:

EBITDA

To supplement our financial results presented in

accordance with Generally Accepted Accounting Principles (GAAP), we

are presenting EBITDA in this earning release and the related

earning conference call. EBITDA is a non-GAAP financial measure

that is not based on any standardized methodology prescribed by

GAAP and is not necessarily comparable to similarly titled measures

presented by other companies. We define EBITDA as our net income

(loss), excluding the impact of depreciation and amortization

expense and interest income (expense). We have presented EBITDA

because it is a key measure used by our management and board of

directors to understand and evaluate our operating performance, to

establish budgets and to develop operational goals for managing our

business. In particular, we believe that excluding the impact of

these expenses in calculating EBITDA can provide a useful measure

for period-to-period comparisons of our core operating

performance.

About Vislink Technologies,

Inc.

At Vislink, we’ve been bringing live video to

life for over 50 years. Our vision is to foster the connection of

people and communities to information that informs, protects, and

entertains them — by building rich experiences through the power of

live video. We’re powering the next generation of live event

production with cutting-edge solutions that include AI-automated

technologies, emerging bonded cellular and 5G systems, and

innovative remote production platforms. We are also a trusted

provider of secure, high-quality, real-time video communications

that deliver actionable intelligence to police, military and other

government entities. With a global client roster of tier-1

broadcasters, sports teams, and law enforcement organizations, we

are a dynamic company whose impressive history is only matched by

the exciting future ahead of it. Vislink common stock is listed on

the NASDAQ Stock Exchange under the ticker symbol

VISL. For more information, visit

www.vislink.com.

Note on Forward-looking Statements

Certain statements in this press release are

forward-looking statements that involve substantial risks and

uncertainties for purposes of the safe harbor provided by the

Private Securities Litigation Reform Act of 1995. This press

release contains forward-looking statements that involve

substantial risks and uncertainties for purposes of the safe harbor

provided by the Private Securities Litigation Reform Act of 1995.

Any statements, other than statements of historical fact included

in this press release, including those regarding the Company’s

strategy, the ability to meet the Nasdaq minimum bid price

requirement as a result of the proposed reverse split, future

operations, future financial position, future revenues including

from bookings activity, risks of supply chain constraints and

inflationary pressures, projected expenses, prospects, plans

including footprint and technology asset consolidations, objectives

of management, new capabilities, product and solutions launches

including AI-assisted and 5G streaming technologies, expected

contract values, projected pipeline sales opportunities,

acquisitions integration, and expected market opportunities across

the Company’s operating segments including the live event

production market, the effects of the COVID-19 pandemic, the

sufficiency of the Company’s capital resources to fund the

Company’s operations and any statements regarding future results

are forward-looking statements. Vislink may not actually achieve

the plans, carry out the intentions or meet the expectations or

projections disclosed in any forward-looking statements such as the

foregoing and you should not place undue reliance on such

forward-looking statements. Such statements are based on

management’s current expectations and involve risks and

uncertainties, including those discussed in Vislink’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2021, filed

with the SEC on March 31, 2022 and in subsequent filings with, or

submissions to, the SEC.

The statements made in this press release speak

only as of the date stated herein, and subsequent events and

developments may cause the Company’s expectations and beliefs to

change. While the Company may elect to update these forward-looking

statements publicly at some point in the future, the Company

specifically disclaims any obligation to do so, whether as a result

of new information, future events or otherwise, except as required

by law. These forward-looking statements should not be relied upon

as representing the Company’s views as of any date after the date

stated herein.

Contacts

Investor Relations:investors@vislink.com

Media Relations:Charlotte van

HertumCharlotte.vanhertum@vislink.com

VISLINK TECHNOLOGIES, INC. AND

SUBSIDIARIESUNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS ANDCOMPREHENSIVE

LOSS(IN THOUSANDS EXCEPT NET LOSS PER SHARE

DATA)

|

|

|

For the Three Months Ended |

|

|

For the Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue, net |

|

$ |

7,114 |

|

|

$ |

11,200 |

|

|

$ |

21,024 |

|

|

$ |

22,840 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue and operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of components and personnel |

|

|

3,616 |

|

|

|

4,224 |

|

|

|

10,225 |

|

|

|

9,994 |

|

|

Inventory valuation adjustments |

|

|

207 |

|

|

|

278 |

|

|

|

404 |

|

|

|

589 |

|

|

General and administrative expenses |

|

|

4,624 |

|

|

|

6,007 |

|

|

|

13,973 |

|

|

|

13,405 |

|

|

Research and development expenses |

|

|

885 |

|

|

|

841 |

|

|

|

3,154 |

|

|

|

2,161 |

|

|

Impairment of right-of-use assets |

|

|

88 |

|

|

|

— |

|

|

|

88 |

|

|

|

— |

|

|

Amortization and depreciation |

|

|

502 |

|

|

|

343 |

|

|

|

1,424 |

|

|

|

860 |

|

|

Total cost of revenue and operating expenses |

|

|

9,922 |

|

|

|

11,693 |

|

|

|

29,268 |

|

|

|

27,009 |

|

|

Loss from operations |

|

|

(2,808 |

) |

|

|

(493 |

) |

|

|

(8,244 |

) |

|

|

(4,169 |

) |

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in fair value of derivative liabilities |

|

|

— |

|

|

|

25 |

|

|

|

— |

|

|

|

8 |

|

|

Gain on settlement of debt |

|

|

17 |

|

|

|

1,168 |

|

|

|

26 |

|

|

|

1,362 |

|

|

Other income |

|

|

— |

|

|

|

1 |

|

|

|

32 |

|

|

|

3 |

|

|

Interest expense |

|

|

(3 |

) |

|

|

(25 |

) |

|

|

(8 |

) |

|

|

(29 |

) |

|

Total other income (expense) |

|

|

14 |

|

|

|

1,169 |

|

|

|

50 |

|

|

|

1,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income before income taxes |

|

|

(2,794 |

) |

|

|

676 |

|

|

|

(8,194 |

) |

|

|

(2,825 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax benefits |

|

|

54 |

|

|

|

— |

|

|

|

161 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(2,740 |

) |

|

$ |

676 |

|

|

$ |

(8,033 |

) |

|

$ |

(2,825 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.07 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

47,409 |

|

|

|

45,748 |

|

|

|

46,448 |

|

|

|

42,696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(2,740 |

) |

|

$ |

676 |

|

|

$ |

(8,033 |

) |

|

$ |

(2,825 |

) |

|

Unrealized gain (loss) on currency translation adjustment |

|

|

746 |

|

|

|

(394 |

) |

|

|

1,885 |

|

|

|

(408 |

) |

|

Comprehensive loss |

|

$ |

(1,994 |

) |

|

$ |

282 |

|

|

$ |

(6,148 |

) |

|

$ |

(3,233 |

) |

The accompanying notes are an integral part of

these condensed consolidated financial statements.

VISLINK TECHNOLOGIES, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(IN THOUSANDS EXCEPT SHARE AND PER SHARE

DATA)

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

24,476 |

|

|

$ |

36,231 |

|

|

Accounts receivable, net |

|

|

9,386 |

|

|

|

9,069 |

|

|

Inventories, net |

|

|

15,069 |

|

|

|

11,894 |

|

|

Prepaid expenses and other current assets |

|

|

1,577 |

|

|

|

2,470 |

|

|

Total current assets |

|

|

50,508 |

|

|

|

59,664 |

|

|

Right of use assets, operating leases |

|

|

1,124 |

|

|

|

1,362 |

|

|

Property and equipment, net |

|

|

1,361 |

|

|

|

1,173 |

|

|

Intangible assets, net |

|

|

4,648 |

|

|

|

5,921 |

|

|

Total assets |

|

$ |

57,641 |

|

|

$ |

68,120 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,979 |

|

|

$ |

3,075 |

|

|

Accrued expenses |

|

|

1,788 |

|

|

|

3,155 |

|

|

Notes payable |

|

|

251 |

|

|

|

99 |

|

|

Operating lease obligations, current |

|

|

451 |

|

|

|

560 |

|

|

Customer deposits and deferred revenue |

|

|

2,163 |

|

|

|

2,113 |

|

|

Total current liabilities |

|

|

7,632 |

|

|

|

9,002 |

|

|

Operating lease obligations, net of current portion |

|

|

1,152 |

|

|

|

1,507 |

|

|

Deferred tax liabilities |

|

|

818 |

|

|

|

978 |

|

|

Total liabilities |

|

|

9,602 |

|

|

|

11,487 |

|

|

Commitments and contingencies (See Note 10) |

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Preferred stock – $0.00001 par value per share: 10,000,000 shares

authorized on September 30, 2022, and December 31, 2021; -0- shares

issued and outstanding as of September 30, 2022, and December 31,

2021, respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, – $0.00001 par value per share, 100,000,000 shares

authorized, 47,419,317 and 45,825,089 shares issued and 47,416,658

and 45,822,430 outstanding at September 30, 2022, and December 31,

2021, respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

345,070 |

|

|

|

343,746 |

|

|

Accumulated other comprehensive income |

|

|

(2,182 |

) |

|

|

(297 |

) |

|

Treasury stock, at cost – 2,659 shares as of September 30, 2022,

and December 31, 2021, respectively |

|

|

(277 |

) |

|

|

(277 |

) |

|

Accumulated deficit |

|

|

(294,572 |

) |

|

|

(286,539 |

) |

|

Total stockholders’ equity |

|

|

48,039 |

|

|

|

56,633 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

57,641 |

|

|

$ |

68,120 |

|

The accompanying notes are an integral part of

these condensed consolidated financial statements.

Reconciliation of GAAP to Non-GAAP Results

VISLINK TECHNOLOGIES,

INC. RECONCILIATION OF GAAP to

NON-GAAP RESULTS QUARTER ENDING

SEPTEMBER 30, 2022(IN

THOUSANDS)

Reconciliation of net income to

EBITDA

|

Net loss |

|

$ |

(2,740 |

) |

|

Interest expense |

|

|

(3 |

) |

|

Amortization and depreciation |

|

|

502 |

|

|

Tax |

|

|

(54 |

) |

|

Impairment Charge |

|

|

(88 |

) |

|

Stock-based compensation |

|

|

(316 |

) |

|

EBITDA |

|

$ |

(2,289 |

) |

|

Impairment Charge |

|

|

(88 |

) |

|

Stock-based compensation |

|

|

(316 |

) |

|

EBITDA Non-GAAP Adjusted |

|

($ |

1,885 |

) |

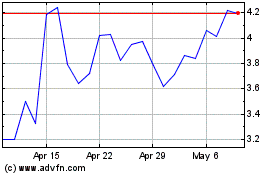

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Apr 2023 to Apr 2024