HeartCore Reports Third Quarter 2022 Financial Results

November 14 2022 - 8:30AM

HeartCore Enterprises, Inc. (“HeartCore” or “the

Company”), a leading software development company, today

reported financial results for the third quarter ended September

30, 2022.

Third Quarter 2022 and Recent Operational

Highlights

- Grew total number of global

enterprise customers to 889 as of September 30, 2022.

- HeartCore’s Content Management

System (“CMS”) led Japan in CMS market share for the seventh

straight year according to ITR Corporation, an independent IT

consulting and research firm.

- Signed fourth Go IPO consulting

service agreement within a six-month period by engaging Metros

Development.

- Entered into a licensing agreement

with Transcosmos Digital Technology Inc. to license its advanced

process mining tool, Apromore.

- Hosted HeartCoreDAY2022, a special

event focused on solutions that promote digital transformation

through two business lines within HeartCore’s CMS product offering,

which help businesses create, manage, and modify web content and

Digital Transformation.

- Executed a deal with GMO MAKESHOP

Co. Ltd., to offer its CMS and help augment GMO MAKESHOP’s digital

transformation efforts prior to the launch of its Cloud E-Commerce

Plan.

- Signed a definitive agreement to

acquire a 51% majority stake in privately held Sigmaways, Inc.

(“Sigmaways”), a software engineering service provider delivering

IT solutions.

Management Commentary“Even with a softer

financial quarter, we are very encouraged by the qualitative

progress that is being made across each front of our business, as

the advancements being made today are setting us up for success

going forward,” said CEO Sumitaka Yamamoto. “As the CMS leader in

Japan by market share, we are confident in our ability to further

augment our footprint into the U.S. by utilizing Sigmaways’

network, which we expect will add significant revenue in calendar

year 2023. By acquiring Sigmaways, we will be able to develop

software in-house at a lower cost instead of using outsourcing

partners. Furthermore, we plan to cross-sell and upsell HeartCore

solutions to our 800+ existing clients by utilizing Sigmaways'

development capabilities, whereas before we would rely on our

partners to do the development work for us. We have already hit the

ground running in jointly conducting business and look forward to

completing the acquisition and further enhancing growth

opportunities for both entities in 2023.”

“Furthermore, we remain extremely active on the Go IPO

consulting end, as we are offering a white glove service to each of

our four signed on clients and are continuing to receive

significant inbound interest from prospective companies. In

particular, with two of our Go IPO clients scheduled to go public

over the coming months, we are expected to receive warrants as part

of our contract, which would contribute significantly to our bottom

line. Looking ahead into calendar year 2023, our goal is to help 10

companies through the Go IPO process and assist each of them reach

the objective of becoming a publicly-traded entity.”

Third Quarter 2022 Financial ResultsRevenues

were $1.9 million compared to $3.5 million in the same period last

year. The decrease in revenues was due to a decrease in sales

of on-premise software, and primarily because of an accounting

based principle around an important customer that renewed its

software license in July 2021. The five-year term customer renewal

had its total contract recognized as revenue in the third quarter

of 2021. On Yen-based sales, revenues decreased by 24%

year-over-year.

Operating expenses increased to $2.3 million from $1.5 million

in the same period last year. The increase was due to an increase

in general and administrative expense. In particular, the increase

resulted from an increase of hiring for the Go IPO Consulting

Service and advertising.

Net loss attributable to HeartCore Enterprises, Inc. was $2.0

million, or $(0.11) per diluted share, compared to a net

income attributable to HeartCore Enterprises, Inc. of

approximately $186,000 or $0.01 per diluted share, in the same

period last year. The net loss was primarily due to an increase in

operating expenses and a decrease in revenues.

As of September 30, 2022, the Company had a cash and cash

equivalents of $7.8 million compared to $3.1 million as of December

31, 2021.

About HeartCore Enterprises, Inc.Headquartered

in Tokyo, Japan, HeartCore Enterprises is a leading software

development company offering Software as a Service (SaaS) solutions

to enterprise customers in Japan and worldwide. The Company also

provides data analytics services that allow enterprise businesses

to create tailored web experiences for their clients through

best-in-class design. HeartCore's customer experience management

platform (CXM Platform) includes marketing, sales, service and

content management systems, as well as other tools and

integrations, which enable companies to enhance the customer

experience and drive engagement. HeartCore also operates a digital

transformation business that provides customers with robotics

process automation, process mining and task mining to accelerate

the digital transformation of enterprises. Additional information

about the Company's products and services is available at

www.heartcore.co.jp and https://heartcore-enterprises.com/.

Forward-Looking StatementsAll statements other

than statements of historical facts included in this press release

are forward-looking statements. In some cases, forward-looking

statements can be identified by words such as “believe,” “intend,”

“expect,” “anticipate,” “plan,” “potential,” “continue” or similar

expressions. Such forward-looking statements include risks and

uncertainties, and there are important factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. These factors, risks and

uncertainties are discussed in HeartCore’s filings with the

Securities and Exchange Commission. Investors should not place any

undue reliance on forward-looking statements since they involve

known and unknown, uncertainties and other factors which are, in

some cases, beyond HeartCore’s control which could, and likely

will, materially affect actual results, levels of activity,

performance or achievements. Any forward-looking statement reflects

HeartCore’s current views with respect to future events and is

subject to these and other risks, uncertainties and assumptions

relating to operations, results of operations, growth strategy and

liquidity. HeartCore assumes no obligation to publicly update or

revise these forward-looking statements for any reason, or to

update the reasons actual results could differ materially from

those anticipated in these forward-looking statements, even if new

information becomes available in the future. The contents of any

website referenced in this press release are not incorporated by

reference herein.

HeartCore Investor Relations Contact:Gateway

Group, Inc.Matt Glover and John YiHTCR@gatewayir.com(949)

574-3860

HeartCore Enterprises,

Inc.Condensed Consolidated Statements of

Operations and Comprehensive Income (Loss)

| |

|

|

|

|

|

|

| |

|

|

For the three months ended September 30, |

| |

|

|

2022 |

|

|

2021 |

| |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Revenues |

|

$ |

1,872,476 |

|

|

$ |

3,470,510 |

|

| Cost of

revenues |

|

|

1,543,256 |

|

|

|

1,786,125 |

|

|

Gross profit |

|

|

329,220 |

|

|

|

1,684,385 |

|

| |

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

Selling expenses |

|

|

771,496 |

|

|

|

79,438 |

|

|

General and administrative expenses |

|

|

1,513,028 |

|

|

|

1,202,701 |

|

|

Research and development expenses |

|

|

58,275 |

|

|

|

189,686 |

|

|

Total operating expenses |

|

|

2,342,799 |

|

|

|

1,471,825 |

|

| |

|

|

|

|

|

|

|

Income (loss) from operations |

|

|

(2,013,579 |

) |

|

|

212,560 |

|

| |

|

|

|

|

|

|

|

Other income (expenses): |

|

|

|

|

|

|

|

Interest income |

|

|

21,707 |

|

|

|

1,598 |

|

|

Interest expense |

|

|

(10,500 |

) |

|

|

(6,695 |

) |

|

Other income |

|

|

15,195 |

|

|

|

1,341 |

|

|

Other expenses |

|

|

(2,826 |

) |

|

|

(3,933 |

) |

|

Total other income (expenses) |

|

|

23,576 |

|

|

|

(7,689 |

) |

| |

|

|

|

|

|

|

|

Income (loss) before income tax provision |

|

|

(1,990,003 |

) |

|

|

204,871 |

|

| |

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

(19,069 |

) |

|

|

13,522 |

|

| |

|

|

|

|

|

|

| Net

income (loss) |

|

|

(1,970,934 |

) |

|

|

191,349 |

|

| Less: net

income attributable to non-controlling interest |

|

|

- |

|

|

|

5,176 |

|

| Net

income (loss) attributable to HeartCore Enterprises,

Inc. |

|

$ |

(1,970,934 |

) |

|

$ |

186,173 |

|

| |

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

| Foreign

currency translation adjustment |

|

|

128,705 |

|

|

|

(15,309 |

) |

| |

|

|

|

|

|

|

|

Total comprehensive income (loss) |

|

|

(1,842,229 |

) |

|

|

176,040 |

|

| Less:

comprehensive income attributable to non-controlling interest |

|

|

- |

|

|

|

4,770 |

|

|

Comprehensive income (loss) attributable to HeartCore

Enterprises, Inc. |

|

$ |

(1,842,229 |

) |

|

$ |

171,270 |

|

| |

|

|

|

|

|

|

| Net

earnings (loss) per common share attributable to HeartCore

Enterprises, Inc. |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.11 |

) |

|

$ |

0.01 |

|

|

Diluted |

|

$ |

(0.11 |

) |

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

Basic |

|

|

17,835,027 |

|

|

|

15,242,454 |

|

|

Diluted |

|

|

17,835,027 |

|

|

|

15,515,943 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

HeartCore Enterprises,

Inc.Condensed Consolidated Balance

Sheets

|

|

|

|

|

|

|

|

|

|

|

|

September

30, |

|

|

December

31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

| |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

7,843,208 |

|

|

$ |

3,136,839 |

|

| Accounts

receivable, net |

|

|

621,345 |

|

|

|

960,964 |

|

| Prepaid

expenses |

|

|

618,955 |

|

|

|

444,405 |

|

| Due from

related party |

|

|

43,900 |

|

|

|

50,559 |

|

| Loan

receivable from employee |

|

|

- |

|

|

|

8,341 |

|

| Other

current assets |

|

|

143,999 |

|

|

|

15,654 |

|

|

Total current assets |

|

|

9,271,407 |

|

|

|

4,616,762 |

|

| |

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

| Property and

equipment, net |

|

|

199,329 |

|

|

|

261,414 |

|

| Operating

lease right-of-use assets |

|

|

2,458,485 |

|

|

|

3,319,749 |

|

| Deferred tax

assets |

|

|

242,358 |

|

|

|

297,990 |

|

| Security

deposits |

|

|

221,460 |

|

|

|

278,237 |

|

| Long-term

loan receivable from related party |

|

|

234,316 |

|

|

|

335,756 |

|

| Loan

receivable from employee, non-current |

|

|

- |

|

|

|

4,518 |

|

| Other

non-current assets |

|

|

2,188 |

|

|

|

8,737 |

|

|

Total non-current assets |

|

|

3,358,136 |

|

|

|

4,506,401 |

|

| |

|

|

|

|

|

|

|

Total assets |

|

$ |

12,629,543 |

|

|

$ |

9,123,163 |

|

| |

|

|

|

|

|

|

| LIABILITIES

AND SHAREHOLDERS' EQUITY (DEFICIT) |

| |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

445,752 |

|

|

$ |

646,425 |

|

| Accrued

payroll and other employee costs |

|

|

245,113 |

|

|

|

255,082 |

|

| Due to

related party |

|

|

3,622 |

|

|

|

1,110 |

|

| Current

portion of long-term debts |

|

|

622,937 |

|

|

|

849,995 |

|

| Insurance

premium financing |

|

|

89,652 |

|

|

|

- |

|

| Operating

lease liabilities, current |

|

|

264,387 |

|

|

|

332,277 |

|

| Finance

lease liabilities, current |

|

|

19,502 |

|

|

|

37,459 |

|

| Income tax

payables |

|

|

1,867 |

|

|

|

10,919 |

|

| Deferred

revenue |

|

|

1,386,559 |

|

|

|

1,690,917 |

|

| Mandatorily

redeemable financial interest |

|

|

- |

|

|

|

447,986 |

|

| Other

current liabilities |

|

|

42,475 |

|

|

|

281,673 |

|

|

Total current liabilities |

|

|

3,121,866 |

|

|

|

4,553,843 |

|

| |

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

| Long-term

debts |

|

|

1,133,945 |

|

|

|

1,871,580 |

|

| Operating

lease liabilities, non-current |

|

|

2,259,284 |

|

|

|

3,076,204 |

|

| Finance

lease liabilities, non-current |

|

|

3,573 |

|

|

|

23,861 |

|

| Other

non-current liabilities |

|

|

124,963 |

|

|

|

156,627 |

|

|

Total non-current liabilities |

|

|

3,521,765 |

|

|

|

5,128,272 |

|

| |

|

|

|

|

|

|

|

Total liabilities |

|

|

6,643,631 |

|

|

|

9,682,115 |

|

| |

|

|

|

|

|

|

|

Shareholders' equity (deficit): |

|

|

|

|

|

|

| Preferred

shares ($0.0001 par value, 20,000,000 shares authorized, no shares

issued and outstanding as of September 30, 2022 and December 31,

2021) |

|

|

- |

|

|

|

- |

|

| Common

shares ($0.0001 par value, 200,000,000 shares authorized;

18,999,276 and 15,819,943 shares issued; 17,649,886 and 15,546,454

shares outstanding as of September 30, 2022 and December 31, 2021,

respectively) |

|

|

1,899 |

|

|

|

1,554 |

|

| Additional

paid-in capital |

|

|

18,220,206 |

|

|

|

3,350,779 |

|

| Treasury

shares, at cost (1,349,390 and 0 shares as of September 30, 2022

and December 31, 2021, respectively) |

|

|

(3,500,000 |

) |

|

|

- |

|

| Accumulated

deficit |

|

|

(9,149,139 |

) |

|

|

(3,896,113 |

) |

| Accumulated

other comprehensive income (loss) |

|

|

412,946 |

|

|

|

(15,172 |

) |

|

Total shareholders' equity (deficit) |

|

|

5,985,912 |

|

|

|

(558,952 |

) |

|

Total liabilities and shareholders' equity

(deficit) |

|

$ |

12,629,543 |

|

|

$ |

9,123,163 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

HeartCore Enterprises,

Inc.Consolidated Statements of Cash

Flows

| |

|

|

|

|

|

|

|

| |

|

|

For the nine

months ended September 30, |

|

|

|

|

2022 |

|

|

|

2021 |

| |

|

|

(unaudited) |

|

|

|

(unaudited) |

| Cash

flows from operating activities: |

|

|

|

|

|

|

|

| Net income

(loss) |

|

$ |

(5,253,026 |

) |

|

|

$ |

414,826 |

|

|

Adjustments to reconcile net income (loss) to net

cash |

|

|

|

|

|

|

|

|

provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

Depreciation expenses |

|

|

64,398 |

|

|

|

|

80,297 |

|

|

Amortization of debt issuance costs |

|

|

3,051 |

|

|

|

|

4,358 |

|

|

Non-cash lease expense |

|

|

207,549 |

|

|

|

|

254,848 |

|

|

Deferred income taxes |

|

|

(5,843 |

) |

|

|

|

85,004 |

|

|

Share-based compensation |

|

|

1,225,477 |

|

|

|

|

- |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

168,021 |

|

|

|

|

(634,711 |

) |

|

Prepaid expenses |

|

|

(56,553 |

) |

|

|

|

(177,880 |

) |

|

Other assets |

|

|

(142,967 |

) |

|

|

|

34,568 |

|

|

Accounts payable and accrued expenses |

|

|

(96,238 |

) |

|

|

|

684,960 |

|

|

Accrued payroll and other employee costs |

|

|

59,059 |

|

|

|

|

63,126 |

|

|

Due to related party |

|

|

3,098 |

|

|

|

|

- |

|

|

Operating lease liabilities |

|

|

(213,691 |

) |

|

|

|

(265,984 |

) |

|

Finance lease liabilities |

|

|

(370 |

) |

|

|

|

(961 |

) |

|

Income tax payables |

|

|

(7,704 |

) |

|

|

|

2,092 |

|

|

Deferred revenue |

|

|

45,938 |

|

|

|

|

639,643 |

|

|

Other liabilities |

|

|

(206,569 |

) |

|

|

|

55,064 |

|

| Net

cash flows provided by (used in) operating activities |

|

|

(4,206,370 |

) |

|

|

|

1,239,250 |

|

| |

|

|

|

|

|

|

|

| Cash

flows from investing activities: |

|

|

|

|

|

|

|

| Purchases of

property and equipment |

|

|

(41,672 |

) |

|

|

|

(24,675 |

) |

| Advance and

loan provided to related parties |

|

|

- |

|

|

|

|

(126,390 |

) |

| Repayment of

loan provided to related party |

|

|

33,042 |

|

|

|

|

- |

|

| Net

cash flows used in investing activities |

|

|

(8,630 |

) |

|

|

|

(151,065 |

) |

| |

|

|

|

|

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

|

|

|

| Proceeds

from initial public offering, net of issuance cost |

|

|

13,602,554 |

|

|

|

|

- |

|

| Proceeds

from issuance of common shares prior to initial public

offering |

|

|

220,572 |

|

|

|

|

- |

|

| Repurchase

of common shares |

|

|

(3,500,000 |

) |

|

|

|

- |

|

| Payments for

finance leases |

|

|

(29,051 |

) |

|

|

|

(42,941 |

) |

| Proceeds

from long-term debt |

|

|

258,087 |

|

|

|

|

- |

|

| Repayment of

long-term debts |

|

|

(699,407 |

) |

|

|

|

(770,181 |

) |

| Repayment of

insurance premium financing |

|

|

(298,886 |

) |

|

|

|

- |

|

| Payments for

debt issuance costs |

|

|

(1,030 |

) |

|

|

|

(3,033 |

) |

| Payment for

mandatorily redeemable financial interest |

|

|

(430,489 |

) |

|

|

|

- |

|

| Net

cash flows provided by (used in) financing activities |

|

|

9,122,350 |

|

|

|

|

(816,155 |

) |

| |

|

|

|

|

|

|

|

| Effect of

exchange rate changes |

|

|

(200,981 |

) |

|

|

|

(239,423 |

) |

| |

|

|

|

|

|

|

|

| Net change

in cash and cash equivalents |

|

|

4,706,369 |

|

|

|

|

32,607 |

|

| |

|

|

|

|

|

|

|

| Cash and

cash equivalents - beginning of the period |

|

|

3,136,839 |

|

|

|

|

3,058,175 |

|

| |

|

|

|

|

|

|

|

| Cash

and cash equivalents - end of the period |

|

$ |

7,843,208 |

|

|

|

$ |

3,090,782 |

|

| |

|

|

|

|

|

|

|

|

Supplemental cash flow disclosure: |

|

|

|

|

|

|

|

| Interest

paid |

|

$ |

38,387 |

|

|

|

$ |

22,100 |

|

| Income taxes

paid |

|

$ |

3,013 |

|

|

|

$ |

9,738 |

|

| |

|

|

|

|

|

|

|

|

Non-cash investing and financing transactions |

|

|

|

|

|

|

|

|

Remeasurement of the lease liability and right-of-use asset due to

lease modification |

|

$ |

- |

|

|

|

$ |

225,983 |

|

| Payroll

withheld as repayment of loan receivable from employees |

|

$ |

12,034 |

|

|

|

$ |

9,399 |

|

| Expense paid

by related party on behalf of the Company |

|

$ |

- |

|

|

|

$ |

107,178 |

|

|

Reclassification of non-controlling interest to mandatorily

redeemable financial interest |

|

$ |

- |

|

|

|

$ |

447,986 |

|

| Liabilities

assumed in connection with purchase of property and equipment |

|

$ |

17,731 |

|

|

|

$ |

- |

|

| Share

repurchase liability settled by issuance of common shares |

|

$ |

16 |

|

|

|

$ |

- |

|

| Deferred

offering costs recognized against the proceeds from the

offering |

|

$ |

178,847 |

|

|

|

$ |

- |

|

| Insurance

premium financing |

|

$ |

388,538 |

|

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

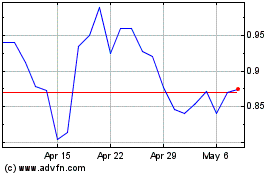

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Apr 2023 to Apr 2024