Alaunos Therapeutics, Inc. (“Alaunos” or the “Company”) (Nasdaq:

TCRT), a clinical-stage oncology-focused cell therapy company today

announced financial results for the third quarter ended September

30, 2022.

“Our team has worked diligently over the past

year to transform our promising technology and scientific

foundation into meaningful clinical progress. We were excited to

present early data from our TCR-T Library Phase 1/2 trial at CICON,

where we showed for the very first time, an objective clinical

response in a solid tumor using a non-viral TCR-T cell therapy.

These initial safety, persistence and efficacy data reinforce the

promise of our Sleeping Beauty TCR-T cell therapy to safely achieve

measurable regression in solid tumors, even at the lowest dose,”

commented Kevin S. Boyle, Sr., Chief Executive Officer of Alaunos.

“In tandem, we have successfully doubled our manufacturing

capacity. We look forward to dosing the next patient in our TCR-T

Library Phase 1/2 Trial as well as filing an IND amendment to

expand our TCR Library and enhance the speed and flexibility of our

manufacturing process using cryopreserved cell products in the

fourth quarter.”

Recent Developments and Upcoming

Milestones

Presented encouraging clinical data from

TCR-T Library Phase 1/2 Trial at CRI-ENCI-AACR Sixth International

Cancer Immunotherapy Conference (CICON): In September

2022, the Company presented early data from its TCR-T Library Phase

1/2 trial targeting KRAS, TP53, and EGFR mutations across six solid

tumor indications. The data represent the first report of a

successful TCR-T cell therapy using the non-viral Sleeping Beauty

system for solid tumors. The Company expects to dose the next

patient in the study in 4Q22.

Key highlights include:

- First patient dosed was diagnosed

with NSCLC and was treated at dose level 1 with TCR-T cells

targeting a KRAS G12D mutation. The patient achieved six-month

progression-free survival, with a best overall response of

objective, partial regression of greater than 50% of target lesions

at 12 weeks post-cell therapy.

- Second patient dosed was diagnosed

with colorectal cancer and was treated at dose level 2 with TCR-T

cells targeting a TP53 R175H mutation. This patient achieved a best

overall response of stable disease at six weeks with 12-week

progression-free survival.

- Persistence of TCR-T cells was

evident in both patients. Patient 1 had persistence at 24 weeks

with approximately 30% of all T-cells being TCR-T cells in the

blood. Patient 2 had persistence at 12 weeks with approximately 20%

of all T-cells being TCR-T cells in the blood.

- In both patients, the TCR-T cell

therapy was well-tolerated and presented a manageable safety

profile, with no dose limiting toxicities or immune effector

cell-associated neurotoxicity syndrome (ICANS) observed.

Additional information about the trial is

available at www.clinicaltrials.gov using the identifier:

NCT05194735.

Expanded manufacturing capacity to produce two products

simultaneously: The Company continues to execute on its

multi-pronged strategy to expand manufacturing capacity. As a

result of this initiative, the Company has doubled its existing

manufacturing capacity to produce two products simultaneously.

Expect to file IND amendment in 4Q22 to expand its TCR

Library and move from a fresh to cryopreserved manufacturing

process: Alaunos expects to file an IND amendment in the

fourth quarter, which will add two new TCRs to the Company’s TCR

Library targeting frequent mutations and HLAs. This should allow

the Company to increase the potential addressable market for its

T-cell therapies. In addition, the Company has successfully

completed process qualification runs using cryopreserved cell

products to manufacture TCR-T cells, which reduces manufacturing

process time from 30 days to 26 days, a 13% decrease. The IND

amendment will enable the Company to move to a cryopreserved

manufacturing process and add flexibility for patient scheduling

and treatment.

Presented data highlighting potential of

the Company’s hunTR™ platform to expand its TCR

Library at the Society for Immunotherapy of Cancer’s (SITC) 37th

Annual Meeting: In November 2022, the Company presented a

poster at the SITC annual meeting, highlighting its proprietary

hunTR™ (human neoantigen T-cell Receptor) platform. hunTR™ is a

high-throughput screening process that uses state-of-the-art

bioinformatics and next generation sequencing to interrogate and

deconvolute thousands of single T cells simultaneously. In the

study, Alaunos evaluated hundreds of thousands of

TCR+HLA+neoantigen permutations in nine patients across colorectal,

endometrial and breast cancers. All patients screened had at least

one detectable neoantigen-reactive TCR, including one shared KRAS

mutation. Further screening of additional patients only for KRAS

mutations resulted in discovery of KRAS-G12V reactive TCRs. The

Company plans to expand the application of hunTR to screen for

additional shared KRAS, TP53, and EGFR mutations in order to

rapidly advance new TCR library candidates from the lab through to

clinical translation.

Third Quarter Ended September 30, 2022

Financial Results

Collaboration Revenue:

Collaboration revenue was $2.9 million for the third quarter of

2022, compared to $0.4 million for the third quarter of 2021, an

increase of 631%. The increase was primarily due to the achievement

of sales-based milestones of darinaparsin in Japan, which was

largely offset by a one-time corresponding $2.5 million Research

& Development expense.

Research and Development

Expenses: Research and development expenses were $7.9

million for the third quarter of 2022, compared to $14.5 million

for the third quarter of 2021, a decrease of approximately 46%.

Research and Development expenses during the third quarter of 2022

included a one-time $2.5 million expense as a result of the

achievement of sales-based milestones of darinaparsin in Japan.

General and Administrative

Expenses: General and administrative expenses were $3.3

million for the third quarter of 2022, compared to $8.2 million for

the third quarter of 2021, a decrease of approximately 60%.

Net Loss: Net loss was $8.9

million, or $(0.04) per share, for the third quarter of 2022,

compared to a net loss of $22.7 million, or $(0.11) per share, for

the same period in 2021.

Cash and Cash Equivalents: As

of September 30, 2022, Alaunos had approximately $37.8 million in

cash and cash equivalents and restricted cash of $13.9 million.

Operating cash burn for the third quarter of 2022 was $6.1 million

compared to $9.6 million in the third quarter of 2021, a decrease

of $3.4 million or 36%.

Conference Call and Webcast

Alaunos will host a conference call and webcast

today, November 14, 2022, at 8:30am ET. Participants may access the

live webcast using the link here or by visiting the “Investors”

section of the Alaunos website at www.alaunos.com. To participate

via telephone, please register in advance at this link. Upon

registration, all telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number along with a unique passcode and

registrant ID that can be used to access the call. After the live

webcast, the event will be archived on the Company’s website for

approximately 30 days after the call.

About Alaunos

TherapeuticsAlaunos is a clinical-stage oncology-focused

cell therapy company, focused on developing T-cell receptor (TCR)

therapies based on its proprietary, non-viral Sleeping Beauty gene

transfer technology and its TCR library targeting shared

tumor-specific hotspot mutations in key oncogenic genes including

KRAS, TP53 and EGFR. The Company has a clinical and strategic

collaboration with the National Cancer Institute. For more

information, please visit www.alaunos.com.

Forward-Looking Statements

Disclaimer This press release contains forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995, as amended. Forward-looking statements are statements

that are not historical facts, and in some cases can be identified

by terms such as “may,” “will,” “could,” “expects,” “plans,”

“anticipates,” “believes” or other words or terms of similar

meaning. These statements include, but are not limited to,

statements regarding the Company's business and strategic plans,

the anticipated outcome of preclinical and clinical studies by the

Company or its third-party collaborators, the Company’s cash

runway, the Company’s manufacturing capabilities and the timing of

the Company's research and development programs, including the

expected timeline for enrolling and dosing patients and the timing

and forums for announcing data from the Company's clinical trials.

Although the management team of Alaunos believes that the

expectations reflected in such forward-looking statements are

reasonable, investors are cautioned that forward-looking

information and statements are subject to various risks and

uncertainties, many of which are difficult to predict and generally

beyond the control of Alaunos, that could cause actual results and

developments to differ materially from those expressed in, or

implied or projected by, the forward-looking information and

statements. These risks and uncertainties include, among other

things, changes in the Company’s operating plans that may impact

its cash expenditures; the uncertainties inherent in research and

development, future clinical data and analysis, including whether

any of Alaunos’ product candidates will advance further in the

preclinical research or clinical trial process, including receiving

clearance from the U.S. Food and Drug Administration or equivalent

foreign regulatory agencies to conduct clinical trials and whether

and when, if at all, they will receive final approval from the U.S.

Food and Drug Administration or equivalent foreign regulatory

agencies and for which indication; the strength and enforceability

of Alaunos’ intellectual property rights; and competition from

other pharmaceutical and biotechnology companies as well as risk

factors discussed or identified in the public filings with the

Securities and Exchange Commission made by Alaunos, including those

risks and uncertainties listed in the most recent periodic report

filed by Alaunos with the Securities and Exchange Commission.

Alaunos is providing this information as of the date of this press

release, and Alaunos does not undertake any obligation to update or

revise the information contained in this press release whether as a

result of new information, future events, or any other reason.

Investor Relations Contact:Alex

LoboStern Investor RelationsAlex.lobo@sternir.com

Alaunos Therapeutics,

Inc.Statement of Operations(In thousands except per share

data)

|

|

|

For the Three Months EndedSeptember 30(Unaudited) |

|

|

|

2022 |

|

|

2021 |

|

|

Collaboration revenue |

$ |

2,911 |

|

|

398 |

|

|

Operating expenses: |

|

|

|

|

|

Research and development |

$ |

7,893 |

|

$ |

14,521 |

|

|

General and administrative |

|

3,282 |

|

|

8,173 |

|

|

Total operating expenses |

|

11,175 |

|

|

22,694 |

|

|

Loss from operations |

|

(8,264 |

) |

|

(22,296 |

) |

|

Interest expense |

|

(841 |

) |

|

(444 |

) |

|

Other income, net |

|

254 |

|

|

7 |

|

|

|

|

|

|

|

|

Net loss |

|

(8,851 |

) |

|

(22,733 |

) |

|

Basic and diluted net loss per share |

$ |

(0.04 |

) |

$ |

(0.11 |

) |

|

Weighted average common shares outstanding, basic and diluted |

|

215,098,995 |

|

|

214,542,465 |

|

Alaunos Therapeutics,

Inc.Selected Balance Sheet Data(In thousands)

|

|

|

(unaudited) |

|

(audited) |

|

|

|

September 30, 2022 |

|

December 31, 2021 |

|

Cash and cash equivalents |

$ |

37,807 |

$ |

76,054 |

|

Restricted cash |

$ |

13,938 |

$ |

- |

|

Working capital, excluding restricted cash |

$ |

8,698 |

$ |

62,790 |

|

Total assets |

$ |

67,344 |

$ |

94,865 |

|

Total stockholders’ equity |

$ |

32,113 |

$ |

58,057 |

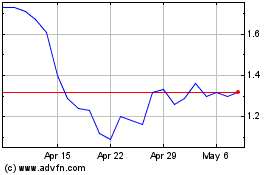

Alaunos Therapeutics (NASDAQ:TCRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alaunos Therapeutics (NASDAQ:TCRT)

Historical Stock Chart

From Apr 2023 to Apr 2024