REE Automotive Ltd. Updates That It Has Received Nasdaq Notification Regarding Minimum Bid Price Requirement

November 10 2022 - 5:00PM

REE Automotive Ltd. (NASDAQ: REE) (“REE” or the “Company”), an

automotive technology company and provider of electric vehicle

platforms, received a notification on November 7, 2022 from The

Nasdaq Stock Market (“Nasdaq”) notifying the Company that it no

longer satisfies Nasdaq Listing Rule 5450(a)(1) because for the

past 30 consecutive business days preceding the date of the

notification (“Notice”), the bid price per share of the Company’s

Class A Ordinary Shares, without par value (“Ordinary Shares”) had

closed below the $1.00 per share minimum bid price required for

continued listing on Nasdaq (the “Minimum Bid Price Requirement”).

The Notice has no immediate effect on the

listing of the Company’s Ordinary Shares, and the Company’s

Ordinary Shares continue to trade on Nasdaq under the symbol

“REE”.

Under Nasdaq Listing Rule 5810(c)(3)(A), if

during the 180 calendar day period following the date of the Notice

(the “Compliance Period”), the closing bid price of the Company’s

Ordinary Shares is at least $1.00 for a minimum of 10 consecutive

business days, the Company will regain compliance with the Minimum

Bid Price Requirement and its Ordinary Shares will continue to be

eligible for listing on Nasdaq absent noncompliance with any other

requirement for continued listing.

If the Company does not regain compliance with

the Minimum Bid Price Requirement by the end of the Compliance

Period, under Nasdaq Listing Rule 5810(c)(3)(A)(ii), the Company

may be eligible for an additional 180-day compliance period if it

applies to transfer the listing of its Ordinary Shares to the

Nasdaq Capital Market. To qualify, the Company would be

required to meet the continued listing requirement for the market

value of its publicly held Ordinary Shares and all other initial

listing standards for the Nasdaq Capital Market, with the exception

of the Minimum Bid Price Requirement, and provide written notice of

its intention to cure the minimum bid price deficiency during the

second compliance period.

If the Company does not regain compliance with

the Minimum Bid Price Requirement by the end of the Compliance

Period (or the Compliance Period as may be extended) the Company’s

Ordinary Shares will be subject to delisting.

The Company intends to monitor the closing bid

price of its Ordinary Shares and will consider its options in order

to regain compliance with the Minimum Bid Price Requirement.

About REE

REE Automotive (NASDAQ: REE) is an automotive

technology company that focuses on enabling companies to build any

size or shape of electric vehicle on their modular platforms. With

design freedom, vehicles Powered by REE are equipped with the

REEcorner, which packs critical vehicle components (steering,

braking, suspension, powertrain and control) into a single compact

module positioned between the chassis and the wheel, enabling REE

to build the industry’s flattest EV platforms with more room for

passengers, cargo and batteries. REE platforms are designed to be

autonomous capable, offer a low total cost of ownership, and reduce

the time to market for fleets looking to electrify. For more

information visit www.ree.auto.

Contacts

Investors

Kamal HamidVP Investor Relations | REE Automotive+1

303-670-7756investors@ree.auto

Dana RubensteinChief of

Staff1+972-54-671-2845investors@ree.auto

MediaJessica DingleyGlobal Communications

Director | REE Automotive+44 785-4545-705media@ree.auto

Caution About Forward Looking

Statements

This communication includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, may be forward-looking statements. Words such as

“may,” “will,” “should,” “likely,” “anticipates,” “expects,”

“intends,” “plan,” “projects,” “believes,” “views,” “estimates,”

“future,” “allow”, “aims,” “strives,” “endeavors” and similar

expressions are used to identify these forward-looking statements.

These forward-looking statements are based on REE’s expectations

and beliefs concerning future events and involve risks and

uncertainties that may cause actual results to differ materially

from current expectations. These factors are difficult to predict

accurately and may be beyond REE’s control. Forward-looking

statements in this communication or elsewhere speak only as of the

date made and REE undertakes no obligation to update its

forward-looking statements, whether as a result of new information,

future developments or otherwise, should circumstances change,

except as otherwise required by securities and other applicable

laws. In light of these risks and uncertainties, investors should

keep in mind that results, events or developments discussed in any

forward-looking statement made in this communication may not occur.

Uncertainties and risk factors that could affect REE’s future

performance and cause results to differ from the forward-looking

statements in this release include, but are not limited to: REE’s

ability to regain compliance with the Nasdaq Listing Rules, the

ability of the Company to transfer its listing to the Nasdaq

Capital Market, the satisfaction of certain conditions required by

Nasdaq, and other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in REE’s Annual Report on Form 20-F

filed with the U.S. Securities and Exchange Commission (the “SEC”)

on March 28, 2022 and in subsequent filings with the SEC. While the

list of factors discussed above and the list of factors presented

in the Annual Report on Form 20-F are considered representative, no

such list should be considered to be a complete statement of all

potential risks and uncertainties. Unlisted factors may present

significant additional obstacles to the realization of

forward-looking statements.

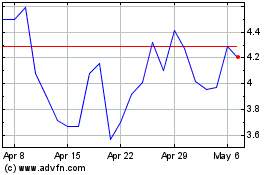

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Mar 2024 to Apr 2024

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Apr 2023 to Apr 2024