authID Inc. (Nasdaq: AUID), a leading provider of secure identity

authentication solutions, today reported financial and operating

results for the third quarter and nine months ended September 30,

2022.

“I am pleased to report that the efforts of our team during the

third quarter led to the successful introduction of Human Factor

Authentication™ (HFA) and the launch of Verified 3.0, authID’s

transformative platform,” said Tom Thimot, CEO of authID.

“Potential partners and customers are finding Verified 3.0’s

pioneering human-centric authentication solution compelling, as it

addresses cyber risks that exploit human error, removes barriers to

workforce productivity, and achieves reduced friction for

consumers.

“authID has evolved significantly during the year. Today’s

Verified 3.0 platform responds to the alarming increase in

cybersecurity breaches that exploit compromised credentials and

legacy MFA. HFA identifies the human behind the device, and our own

FIDO2 certified, passwordless authentication technology delivers a

more secure, streamlined authentication solution for our customers.

Our strong sales pipeline gives us confidence that our highly

differentiated Human Factor Authentication addresses

mission-critical security issues.

“Macro-economic headwinds have lengthened sales cycles and

impacted our revenues. Looking ahead, with our technology and

competitive position strengthened, we believe the Company has

sufficient cash and credit facilities to support operations through

2023. During this time, we anticipate sales to ramp to support our

revised target of reaching positive cash flow in late 2024,”

concluded Thimot.

Financial Results for the Three Months

and Nine Months Ended September 30, 2022The following

highlights comprise results from continuing operations, and reflect

the Company’s previously announced plan to exit non-core businesses

in South Africa and Colombia. The Cards Plus business was sold on

August 29, 2022, and the exit from the non-core business in

Colombia is in process. These businesses are classified in authID’s

financial statements as discontinued operations and assets held for

sale.

- For both the

three and nine-month periods, Verified software license revenue

increased year over year. Total revenue for the three months ended

September 30, 2022 was $0.03 million comprising only Verified

software license revenue, compared with total revenue of $0.2

million for the same period in 2021, of which $0.01 million was

from licenses of Verified software. For the nine months ended

September 30, 2022, total revenue was $0.3 million, of which $0.1

million comprised Verified software license revenue. This compared

with total revenue for the nine months ended September 30, 2021 of

$0.5 million, of which $0.05 million was from Verified software

license sales.

- Net loss

for the three months ended September 30, 2022 was $6.3 million,

compared with $5.2 million a year ago. For the nine-month period in

2022, net loss totaled $18.2 million, of which non-cash charges

were $8.3 million. This compared with a net loss of $10.7 million,

of which $5.3 million were non-cash charges, for the comparable

period in 2021. Expenses for the nine months of 2022 rose from a

year ago as the company accelerated its investment in staff,

technology, and sales and marketing, starting in the second half of

2021.

- Net loss per

share for the three months ended September 30, 2022 was $0.25,

compared with $0.22 for the three months ended September 30, 2021.

For the nine months ended September 30, 2022, net loss per share

totaled $0.73, compared with a net loss of $0.50 per share for the

comparable period a year ago.

- Adjusted EBITDA

loss for the three months ended September 30, 2022 was $3.3

million, compared with $2.6 million for the three months ended

September 30, 2021. For the nine months ended September 30, 2022,

Adjusted EBITDA loss was $9.1 million, compared with $5.0 million,

for the comparable period a year ago.

Refer to Table 1 for reconciliation of net loss to Adjusted

EBITDA (a non-GAAP measure).

Highlights for the Third Quarter of 2022 and Subsequent

Weeks:

- In September, signed with financial compliance platform

Kompliant, as well as additional financial services customers

during the quarter

- In October, launched Verified 3.0, a next-generation platform

that delivers Human Factor Authentication™. Verified HFA closes

security gaps for enterprise workforce and consumer applications by

combining passwordless authentication with biometric certainty to

shut down access, privileges, and lateral movement for unauthorized

users and provide a streamlined path to zero trust architecture.

Verified 3.0’s best-of-breed FIDO2 passwordless authentication is

FIDO Alliance certified ensuring it is compliant and interoperable

with FIDO specifications and binds strong, “unphishable”,

passwordless authentication with biometric identity.

- With the launch of Verified 3.0 and enhanced support for

OpenIdConnect protocols, the Company is building a more robust

CloudConnect environment that offers its customers streamlined

access to the ecosystem of Identity Access Management (IAM),

Privileged Access Management (PAM), and Endpoint Detection and

Response (EDR) providers, including Okta, Auth0, BeyondTrust,

Senhasegura, and VMWare.

- In October, was awarded “Best Biometrics Use in Payments” by

Juniper Research whose Future Digital Awards recognize the most

impactful financial products and services driving innovation across

banking, retail, fintech, payments, and retail.

Today’s Conference Call and Webcast

The Company will host a webcast and conference call today at

5:30 p.m. EST to discuss the financial results and provide a

corporate update.

- To listen to the webcast and view the presentation, investors

can follow this link:

https://edge.media-server.com/mmc/p/6q7ucquo

- Those parties interested in asking questions during the live

call should also register here: Registration Link for

Teleconference Dial In. Participants can pre-register in advance of

the call and receive the dial in number and a PIN, which cannot be

shared with others.

- A replay of the event and a copy of the presentation will also

be available for 90 days via authID’s Investor Relations news and

events web page at:

https://investors.authid.ai/news-and-events/events-and-presentations

About authIDAt authID (Nasdaq: AUID), We Are

Digital Identity®. authID provides secure identity authentication

through Verified™, an easy-to-integrate Human Factor

Authentication™ (HFA) platform. Human Factor Authentication

combines strong FIDO2 passwordless device authentication with cloud

biometrics to authenticate the human behind the device. Powered by

sophisticated biometric and artificial intelligence technologies,

authID eliminates passwords to fortify enterprise security and

trust between organizations, employees, and customers. For more

information, go to www.authid.ai.

Forward-Looking StatementsInformation contained

in this announcement may include “forward-looking statements.” All

statements other than statements of historical facts included

herein, including, without limitation, those regarding the future

results of operations, cash flow, cash position and financial

position, business strategy, plans and objectives of management for

future operations of both authID Inc. and its business partners,

future service launches with customers, the outcome of pilots and

new initiatives and customer pipeline are forward-looking

statements. Such forward-looking statements are based on a number

of assumptions regarding authID’s present and future business

strategies, and the environment in which authID expects to operate

in the future, which assumptions may or may not be fulfilled in

practice. Implementation of some or all of the new services

referred to is subject to regulatory or other third-party

approvals. Actual results may vary materially from the results

anticipated by these forward-looking statements as a result of a

variety of risk factors, including the risk that implementation,

adoption and offering of the service by customers, consumers and

others may take longer than anticipated, or may not occur at all;

changes in laws, regulations and practices; changes in domestic and

international economic and political conditions, the as yet

uncertain impact of the war in Ukraine, the Covid-19 pandemic,

inflationary pressures, rising energy prices, increases in interest

rates, and others. See the Company’s Annual Report on Form 10-K for

the Fiscal Year ended December 31, 2021 filed

at www.sec.gov and other documents filed with the SEC for

other risk factors which investors should consider. These

forward-looking statements speak only as to the date of this

announcement and cannot be relied upon as a guide to future

performance. authID expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statements contained in this announcement to

reflect any changes in its expectations with regard thereto or any

change in events, conditions, or circumstances on which any

statement is based.

|

Investor Relations Contacts: |

|

|

| Grace DeFriesauthID SVP,

Marketing Communications & Investor

Relationsinvestor-relations@authID.ai |

|

Ina McGuinnessThe Bliss

Group805.427.1372 |

Non-GAAP Financial Information

The Company provides certain non-GAAP financial measures in this

statement. Management believes that Adjusted EBITDA, when viewed

with our results under GAAP and the accompanying reconciliations,

provides useful information about our period-over-period results.

Adjusted EBITDA is presented because management believes it

provides additional information with respect to the performance of

our fundamental business activities and is also frequently used by

securities analysts, investors and other interested parties in the

evaluation of comparable companies. We also rely on Adjusted EBITDA

as a primary measure to review and assess the operating performance

of our company and our management. These non-GAAP key business

indicators, which include Adjusted EBITDA, should not be considered

replacements for and should be read in conjunction with the GAAP

financial measures.

We define Adjusted EBITDA as GAAP net loss adjusted to exclude:

(1) interest expense, (2) interest income, (3) income tax expense,

(4) depreciation and amortization, (5) stock-based compensation

expense and (6) certain other items management believes affect the

comparability of operating results. Please see Table 1 below for a

reconciliation of Adjusted EBITDA – continuing operations to net

loss – continuing operations, the most directly comparable

financial measure calculated and presented in accordance with

GAAP.

Table 1

Reconciliation of Loss from continuing

operations to Adjusted EBITDA continuing operations

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Loss from continuing

operations |

|

$ |

(6,190,347 |

) |

|

$ |

(4,933,687 |

) |

|

$ |

(17,656,872 |

) |

|

$ |

(10,309,438 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Addback: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

437,301 |

|

|

|

29,577 |

|

|

|

931,205 |

|

|

|

580,928 |

|

| Other expense (income) |

|

|

42,148 |

|

|

|

(491,643 |

) |

|

|

38,908 |

|

|

|

(971,799 |

) |

| Severance cost |

|

|

- |

|

|

|

- |

|

|

|

150,000 |

|

|

|

- |

|

| Depreciation and

amortization |

|

|

213,049 |

|

|

|

288,731 |

|

|

|

673,882 |

|

|

|

868,166 |

|

| Taxes |

|

|

(7,052 |

) |

|

|

(2,393 |

) |

|

|

1,048 |

|

|

|

4,554 |

|

| Stock compensation |

|

|

2,227,764 |

|

|

|

2,533,943 |

|

|

|

6,726,871 |

|

|

|

4,795,069 |

|

| Adjusted EBITDA continuing

operations (Non-GAAP) |

|

$ |

(3,277,137 |

) |

|

$ |

(2,575,472 |

) |

|

$ |

(9,134,958 |

) |

|

$ |

(5,032,520 |

) |

The company defines Booked Annual Recurring Revenue or BARR, as

the amount of annual recurring revenue represented by either (a)

the minimum amounts payable under contracted orders for our

Verified products booked by customers with authID, or (b) the

estimated amounts of annual recurring revenue, we believe will be

earned under such contracted orders. The amount of BARR signed in

the third quarter of 2022 was $40,000, bringing the cumulative

amount of BARR as of September 30, 2022 to $201,000.

The company defines Annual Recurring Revenue or ARR, as the

amount of recurring revenue derived from sales of our Verified

products during the last month of the relevant period (in this case

September 2022) as determined in accordance with GAAP, multiplied

by 12. The amount of ARR as of September 30, 2022 is approximately

$132,000.

BARR may be distinguished from ARR, as BARR does not take into

account the time to implement any contract for Verified, nor for

any ramp in adoption, or seasonality of usage of the Verified

products. BARR and ARR have limitations as analytical tools, and

you should not consider them in isolation from, or as a substitute

for, analysis of our results as reported under GAAP. Some of these

limitations are:

- BARR & ARR

should not be considered as predictors of future revenues but only

as indicators of the direction in which revenues may be trending.

Actual revenue results in the future as determined in accordance

with GAAP may be significantly different to the amounts indicated

as BARR or ARR at any time.

- BARR and ARR are to

be considered “forward looking statements” and subject to the same

risks, as other such statements (see note on “Forward Looking

Statements” above).

- BARR & ARR only

include revenues from sale of our Verified products and not other

revenues.

- BARR & ARR do

not include amounts we consider as non-recurring revenues (for

example one-off implementation fees).

AUTHID INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

|

|

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Verified software license |

|

$ |

30,023 |

|

|

$ |

12,281 |

|

|

$ |

116,925 |

|

|

$ |

45,302 |

|

|

Legacy authentication services |

|

|

- |

|

|

|

157,068 |

|

|

|

144,559 |

|

|

|

418,878 |

|

|

Total revenues, net |

|

|

30,023 |

|

|

|

169,349 |

|

|

|

261,484 |

|

|

|

464,180 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

3,914,580 |

|

|

|

4,467,040 |

|

|

|

11,583,798 |

|

|

|

8,526,671 |

|

|

Research and development |

|

|

1,620,344 |

|

|

|

811,724 |

|

|

|

4,689,515 |

|

|

|

1,765,098 |

|

|

Depreciation and amortization |

|

|

213,049 |

|

|

|

288,731 |

|

|

|

673,882 |

|

|

|

868,166 |

|

|

Total operating expenses |

|

|

5,747,973 |

|

|

|

5,567,495 |

|

|

|

16,947,195 |

|

|

|

11,159,935 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

|

(5,717,950 |

) |

|

|

(5,398,146 |

) |

|

|

(16,685,711 |

) |

|

|

(10,695,755 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

(42,148 |

) |

|

|

491,643 |

|

|

|

(38,908 |

) |

|

|

971,799 |

|

|

Interest expense, net |

|

|

(437,301 |

) |

|

|

(29,577 |

) |

|

|

(931,205 |

) |

|

|

(580,928 |

) |

|

Other income (expense), net |

|

|

(479,449 |

) |

|

|

462,066 |

|

|

|

(970,113 |

) |

|

|

390,871 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations before income taxes |

|

|

(6,197,399 |

) |

|

|

(4,936,080 |

) |

|

|

(17,655,824 |

) |

|

|

(10,304,884 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (expense) benefit |

|

|

7,052 |

|

|

|

2,393 |

|

|

|

(1,048 |

) |

|

|

(4,554 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations |

|

|

(6,190,347 |

) |

|

|

(4,933,687 |

) |

|

|

(17,656,872 |

) |

|

|

(10,309,438 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain (Loss) from discontinued operations |

|

|

43,645 |

|

|

|

(265,218 |

) |

|

|

(363,385 |

) |

|

|

(437,076 |

) |

|

Loss from sale of a discontinued operation |

|

|

(188,247 |

) |

|

|

- |

|

|

|

(188,247 |

) |

|

|

- |

|

|

Total loss from discontinued operations |

|

|

(144,602 |

) |

|

|

(265,218 |

) |

|

|

(551,632 |

) |

|

|

(437,076 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(6,334,949 |

) |

|

$ |

(5,198,905 |

) |

|

$ |

(18,208,504 |

) |

|

$ |

(10,746,514 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss Per Share - Basic and

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(0.25 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.73 |

) |

|

$ |

(0.50 |

) |

|

Discontinued operations |

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Shares

Outstanding - Basic and Diluted |

|

|

24,821,962 |

|

|

|

22,088,865 |

|

|

|

24,353,206 |

|

|

|

20,703,970 |

|

AUTHID INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

Cash |

|

$ |

7,105,967 |

|

|

$ |

5,767,276 |

|

|

Accounts receivable, net |

|

|

36,080 |

|

|

|

26,846 |

|

|

Other current assets |

|

|

1,009,323 |

|

|

|

502,721 |

|

|

Current assets held for sale |

|

|

81,412 |

|

|

|

629,752 |

|

|

Total current assets |

|

|

8,232,782 |

|

|

|

6,926,595 |

|

|

|

|

|

|

|

|

|

|

|

|

Property and Equipment, net |

|

|

- |

|

|

|

25,399 |

|

|

Other Assets |

|

|

300,172 |

|

|

|

2,501 |

|

|

Intangible Assets, net |

|

|

1,744,143 |

|

|

|

2,379,451 |

|

|

Goodwill |

|

|

4,183,232 |

|

|

|

4,183,232 |

|

|

Non-current assets held for sale |

|

|

28,857 |

|

|

|

312,831 |

|

|

Total assets |

|

$ |

14,489,186 |

|

|

$ |

13,830,009 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

2,007,631 |

|

|

$ |

1,778,092 |

|

|

Convertible debt |

|

|

662,000 |

|

|

|

662,000 |

|

|

Deferred revenue |

|

|

96,933 |

|

|

|

199,007 |

|

|

Current liabilities held for sale |

|

|

100,368 |

|

|

|

295,332 |

|

|

Total current liabilities |

|

|

2,866,932 |

|

|

|

2,934,431 |

|

|

Non-current Liabilities: |

|

|

|

|

|

|

|

|

|

Convertible debt |

|

|

7,699,754 |

|

|

|

- |

|

|

Total liabilities |

|

|

10,566,686 |

|

|

|

2,934,431 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 250,000,000 and 1,000,000,000

shares authorized; 24,914,418 and 23,294,024 shares issued and

outstanding as of September 30, 2022 and December 31, 2021,

respectively |

|

|

2,490 |

|

|

|

2,329 |

|

|

Additional paid in capital |

|

|

137,889,398 |

|

|

|

126,581,702 |

|

|

Accumulated deficit |

|

|

(134,108,443 |

) |

|

|

(115,899,939 |

) |

|

Accumulated comprehensive income |

|

|

139,055 |

|

|

|

211,486 |

|

|

Total stockholders’ equity |

|

|

3,922,500 |

|

|

|

10,895,578 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

14,489,186 |

|

|

$ |

13,830,009 |

|

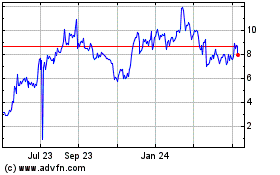

authID (NASDAQ:AUID)

Historical Stock Chart

From Mar 2024 to Apr 2024

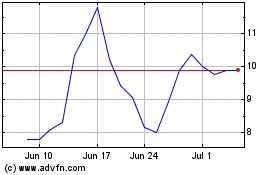

authID (NASDAQ:AUID)

Historical Stock Chart

From Apr 2023 to Apr 2024