Additional Proxy Soliciting Materials (definitive) (defa14a)

November 10 2022 - 6:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. _)

| Filed by the Registrant ☒ |

Filed by a Party other than the

Registrant ☐ |

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

| NUZEE,

INC. |

| (Name

of Registrant as Specified In Its Charter) |

| |

| |

| Name

of Person(s) Filing Proxy Statement, if other than the Registrant |

| Payment of Filing Fee (Check the appropriate

box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SUPPLEMENT

TO PROXY STATEMENT

RELATING TO SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 9, 2022

This

proxy statement supplement should be read together with the definitive proxy statement (the “Proxy Statement”) of NuZee,

Inc., a Nevada corporation (the “Company”), filed with the Securities and Exchange Commission on November 3, 2022 in connection

with the Company’s special meeting of stockholders (the “Special Meeting”) to be held on December 9, 2022. All terms

used herein and not defined shall have the respective meanings set forth in the Proxy Statement.

The

purpose of this filing is to update the information contained in the Proxy Statement relating to the “broker non-vote” rules

and voting requirements regarding (a) Proposal One: Amendment to the Company’s Articles of Incorporation, and authorization of

the Company’s Board of Directors, to effect a reverse stock split of the Company’s issued and outstanding Common Stock, within

a range from 1-for-10 to 1-for-50, with the exact ratio of the reverse stock split to be determined by the Board (“Proposal One”);

and (b) Proposal Three: Approval of one or more adjournments of the Special Meeting to a later date or dates, if necessary or appropriate,

to solicit additional proxies if there are insufficient votes to approve any of the preceding proposals at the time of the Special Meeting,

or in the absence of a quorum (“Proposal Three”).

The Proxy Statement indicated that Proposal One and Proposal Three were

“non-routine” items and that, therefore, a broker does not have the discretion to vote uninstructed shares on Proposal One

and Proposal Three. The New York Stock Exchange has determined that Proposal One and Proposal Three are in fact “routine”

matters and therefore a broker who has not received instructions from its clients will have the discretion to vote its clients’

uninstructed shares on Proposal One and Proposal Three. Accordingly, the Company is hereby revising the information in the Proxy Statement

to state that Proposal One and Proposal Three are “routine” proposals for which a broker will be permitted to exercise its

discretion to vote uninstructed shares.

Except

as specifically supplemented by the information contained above, all information set forth in the Proxy Statement remains unchanged.

From and after the date of this Proxy Statement supplement, all references to the “Proxy Statement” are to the Proxy Statement

as supplemented hereby.

CHANGES

TO PROXY STATEMENT

The

following question and answer contained in the Proxy Statement is amended and restated in its entirety as follows:

What

are the effects of broker non-votes?

A

broker “non-vote” generally occurs when a broker or other nominee holding shares for a beneficial owner does not vote on

a proposal because the broker or other nominee has not received instructions as to such proposal from the beneficial owner and does not

have discretionary powers as to such proposal. These proposals are referred to as “non-routine” matters. If you are a beneficial

owner and do not provide your broker or other nominee with instructions on how to vote your street name shares, your broker or nominee

will not be permitted to vote them on “non-routine” matters (a broker non-vote).

The

Company believes that Proposal Two is a non-routine matter under applicable rules. Accordingly, we believe that, without your specific

voting instructions, your broker or nominee will not be permitted to vote your shares on Proposal Two, but will be permitted to

vote shares on Proposal One and Proposal Three. However, this remains subject to the final determination from the NYSE regarding which

of the proposals are “routine” or “non-routine.” If you hold your shares in street name, it is therefore particularly

important that you instruct your brokers on how you wish to vote your shares so that your vote can be counted. We encourage you to provide

instructions to your broker regarding the voting of your shares.

Shares

subject to a broker non-vote will have the effect of a vote against each of Proposals One and Two. Shares subject to a broker non-vote

will not be considered entitled to vote with respect to Proposal Three and will not affect its outcome.

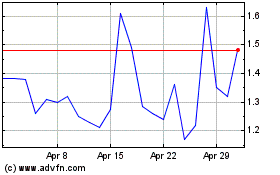

NuZee (NASDAQ:NUZE)

Historical Stock Chart

From Mar 2024 to Apr 2024

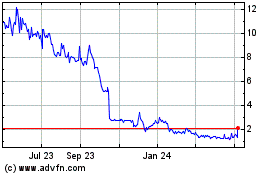

NuZee (NASDAQ:NUZE)

Historical Stock Chart

From Apr 2023 to Apr 2024