0000884650true00.001335611246000000029061883000029061883290610000000000000000000000000017014345687300000001500000000002190000.100.100.102650003344672255000000.060.060.011000000000009900003667000124305000.05193541443818.37566679580.080.130.040.080.070.07P2Y10M24DP2Y10M24DP2Y10M24D819205170819140000.0601672810000016000109300.2500008846502022-01-012022-06-300000884650imci:FinancingArrangementMember2022-02-032022-02-150000884650imci:FinancingArrangementMember2022-02-1500008846502022-01-3100008846502022-08-100000884650imci:AndrewHoyenMemberus-gaap:SubsequentEventMember2022-07-2900008846502022-08-012022-08-100000884650imci:SimpleIraPlanMember2020-12-310000884650imci:SimpleIraPlanMember2021-12-310000884650imci:FourZeroOneKPlanMembersrt:MaximumMember2021-01-012021-12-310000884650imci:FourZeroOneKPlanMember2021-01-012021-12-310000884650imci:SimpleIraPlanMembersrt:MaximumMember2021-01-012021-12-310000884650imci:SimpleIraPlanMember2021-01-012021-12-310000884650us-gaap:DomesticCountryMember2021-12-310000884650us-gaap:DomesticCountryMember2020-12-310000884650us-gaap:StateAndLocalJurisdictionMember2020-12-310000884650us-gaap:StateAndLocalJurisdictionMember2021-12-310000884650imci:JHDarbieCoIncMember2021-11-012021-11-030000884650imci:JHDarbieCoIncMember2021-11-0300008846502021-11-012021-11-0300008846502021-11-030000884650imci:MastHillFundLPMember2022-04-290000884650srt:MaximumMember2022-01-012022-06-300000884650srt:MinimumMember2022-01-012022-06-3000008846502019-05-012019-05-0700008846502021-04-012021-04-060000884650us-gaap:OptionMember2020-01-012020-12-3100008846502020-11-012020-11-1700008846502019-05-0700008846502020-08-2400008846502020-11-1700008846502020-08-012020-08-2400008846502019-01-012019-12-3100008846502021-04-1900008846502021-04-060000884650us-gaap:PerformanceSharesMember2021-12-3100008846502021-04-012021-04-190000884650srt:MaximumMember2020-01-012020-12-310000884650srt:MaximumMember2021-01-012021-12-310000884650srt:MinimumMember2020-01-012020-12-310000884650srt:MinimumMember2021-01-012021-12-310000884650imci:DonaldWReeveMember2022-09-010000884650imci:DonaldWReeveMember2022-01-012022-06-300000884650imci:TalosVictoryFundMember2022-04-012022-04-120000884650imci:MastHillFundLPMember2022-04-120000884650imci:MastHillFundLPMember2022-05-012022-05-270000884650imci:MastHillFundLPMember2022-04-012022-04-120000884650imci:TalosVictoryFundMember2022-04-120000884650imci:MastHillFundLPMember2022-06-300000884650imci:MastHillFundLPMember2022-05-270000884650imci:TwoThousandNinePlanMember2020-12-310000884650imci:TwoThousandFivePlanMember2020-12-310000884650imci:TwoThousandFivePlanMember2021-12-310000884650imci:TwoThousandNinePlanMember2021-12-310000884650imci:TwoThousandTwentyPlanMember2021-12-310000884650imci:TwoThousandNinteenPlanMember2021-12-310000884650imci:ConvertibletermnotepayablesecureddueJanuaryTwoThousandTwentyFourMember2019-05-022019-05-070000884650imci:ConvertiblenotepayabledueJuneMember2015-02-032015-02-120000884650imci:ConvertiblenotespayableSixMember2021-01-010000884650imci:TwoThousandTwoNotepayabledueJanuaryMember2020-01-012020-12-310000884650imci:NotepayableofuptodueAugustMember2021-01-012021-12-310000884650imci:NotepayableofuptodueAugustMember2020-01-012020-12-310000884650imci:NotepayableofuptodueAugustMember2019-01-012019-12-310000884650imci:NotepayableofuptodueAugustMember2021-12-310000884650imci:NotepayableofuptodueAugustMember2019-05-070000884650imci:ConvertibletermnotepayablesecureddueJanuaryMember2016-03-140000884650imci:ConvertiblenotespayabledueJanuaryMember2021-01-010000884650imci:ConvertiblenotespayabledueJanuaryMember2022-01-010000884650imci:ConvertiblenotespayabledueJanuaryMember2020-12-310000884650imci:NotepayablesecureddueJanuaryTwoThousandEighteenMember2018-01-310000884650imci:NotepayablesecureddueJanuaryTwoThousandEighteenMember2003-01-012003-12-310000884650imci:NotepayablesecureddueJanuaryTwoThousandEighteenMember2004-01-012004-12-310000884650imci:ConvertibletermnotepayablesecureddueJanuaryTwoThousandTwentyFourMember2021-12-310000884650imci:NotepayablelineofcreditSixunsecuredMember2015-02-120000884650imci:NotepayablelineofcreditunsecuredMember2015-02-120000884650imci:ConvertiblenotepayabledueJuneMember2015-02-120000884650imci:ConvertiblenotepayabledueJuneMember2021-12-310000884650imci:ConvertiblenotespayableSixMember2021-12-310000884650imci:ConvertiblenotespayabledueJanuaryMember2021-12-310000884650imci:ConvertibletermnotepayablesecureddueJanuaryMember2021-12-310000884650imci:NotepayablesecureddueJanuaryTwoThousandEighteenMember2021-12-310000884650imci:NotepayablelineofcreditSixunsecuredMember2017-09-210000884650imci:NotepayablelineofcreditunsecuredMember2017-07-180000884650imci:TwoThousandTwentynotepayableunsecureddueAugustMember2021-01-012021-12-310000884650imci:TwoThousandSixteenNotepayableunsecureddueDecemberTwentyOneMember2016-03-022016-03-140000884650imci:TermnotepayablePBGCsecuredMember2018-09-150000884650imci:TwoThousandTwoNotepayabledueJanuaryMember2020-12-310000884650imci:NotepayableofuptodueAugustMember2011-10-170000884650imci:TermnotepayablePBGCsecuredMember2021-12-310000884650imci:TermnotepayablePBGCsecuredMember2011-10-170000884650imci:TwoThousandSixteenNotepayableunsecureddueDecemberTwentyOneMember2020-12-310000884650imci:TwoThousandSixteenNotepayableunsecureddueDecemberTwentyOneMember2021-12-310000884650imci:TwoThousandSixteenNotepayableunsecureddueDecemberTwentyOneMember2016-03-140000884650imci:AnnualAmortizationMember2021-12-310000884650imci:AnnualPaymentsMember2021-12-310000884650imci:AccruedInterestDueMember2021-12-310000884650imci:AccruedInterestDueMember2020-12-310000884650imci:NotesPayableRelatedParty6Member2021-12-310000884650imci:NotesPayableRelatedParty6Member2020-12-310000884650imci:NotesPayableRelatedParty5Member2021-12-310000884650imci:NotesPayableRelatedParty5Member2020-12-310000884650imci:NotesPayableRelatedParty4Member2021-12-310000884650imci:NotesPayableRelatedParty4Member2020-12-310000884650imci:NotesPayableRelatedParty3Member2021-12-310000884650imci:NotesPayableRelatedParty3Member2020-12-310000884650imci:NotesPayableRelatedParty2Member2021-12-310000884650imci:NotesPayableRelatedParty2Member2020-12-310000884650imci:NotesPayableRelatedParty1Member2021-12-310000884650imci:NotesPayableRelatedParty1Member2020-12-310000884650imci:AccruedInterestMember2020-12-310000884650imci:AccruedInterestMember2021-12-310000884650imci:NotesPayableBanksAndOther7Member2021-12-310000884650imci:NotesPayableBanksAndOther7Member2020-12-310000884650imci:NotesPayableBanksAndOther6Member2021-12-310000884650imci:NotesPayableBanksAndOther6Member2020-12-310000884650imci:NotesPayableBanksAndOther5Member2021-12-310000884650imci:NotesPayableBanksAndOther5Member2020-12-310000884650imci:NotesPayableBanksAndOther4Member2021-12-310000884650imci:NotesPayableBanksAndOther4Member2020-12-310000884650imci:NotesPayableBanksAndOther3Member2021-12-310000884650imci:NotesPayableBanksAndOther3Member2020-12-310000884650imci:NotesPayableBanksAndOther2Member2021-12-310000884650imci:NotesPayableBanksAndOther2Member2020-12-310000884650imci:NotesPayableBanksAndOther1Member2021-12-310000884650imci:NotesPayableBanksAndOther1Member2020-12-310000884650imci:DemandNotesPayableToDirectorMember2021-12-310000884650imci:DemandNotePayableOfficerAndDirectorMember2020-12-310000884650imci:DemandNotesPayableToOfficerAndDirectorMember2020-12-310000884650imci:DemandNotePayableToEmployeeMember2020-12-310000884650imci:DemandNotePayableOfficerAndDirectorMember2021-12-310000884650imci:DemandNotesPayableToOfficerAndDirectorMember2021-12-310000884650imci:DemandNotePayableToEmployeeMember2021-12-310000884650imci:DemandNotesPayableToDirectorMember2020-12-310000884650us-gaap:PurchaseCommitmentMember2021-01-012021-06-300000884650us-gaap:PurchaseCommitmentMember2021-12-310000884650us-gaap:PurchaseCommitmentMember2021-01-012021-12-310000884650us-gaap:PurchaseCommitmentMember2022-01-012022-06-300000884650us-gaap:PurchaseCommitmentMember2021-06-300000884650us-gaap:PurchaseCommitmentMember2022-06-300000884650us-gaap:SoftwareDevelopmentMember2021-01-012021-12-310000884650us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-12-310000884650us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2021-01-012021-12-310000884650srt:MaximumMemberus-gaap:EquipmentMember2021-01-012021-12-310000884650srt:MinimumMemberus-gaap:EquipmentMember2021-01-012021-12-310000884650us-gaap:FurnitureAndFixturesMember2021-12-310000884650us-gaap:FurnitureAndFixturesMember2020-12-310000884650imci:PropertyPlantAndEquipmentsMember2021-12-310000884650imci:PropertyPlantAndEquipmentsMember2020-12-310000884650us-gaap:SoftwareDevelopmentMember2021-12-310000884650us-gaap:SoftwareDevelopmentMember2020-12-310000884650us-gaap:AccountsReceivableMemberimci:CustomerAMember2020-01-012020-12-310000884650us-gaap:AccountsReceivableMemberimci:CustomerAMember2021-01-012021-12-310000884650us-gaap:SalesRevenueNetMemberimci:CustomerAMember2020-01-012020-12-310000884650us-gaap:SalesRevenueNetMemberimci:CustomerAMember2021-01-012021-12-3100008846502022-01-012022-12-310000884650us-gaap:AccountsReceivableMemberimci:CustomerAMember2021-01-012021-06-300000884650us-gaap:AccountsReceivableMemberimci:CustomerAMember2022-01-012022-06-300000884650us-gaap:SalesRevenueNetMemberimci:CustomerAMember2021-01-012021-06-300000884650us-gaap:SalesRevenueNetMemberimci:CustomerAMember2021-04-012021-06-300000884650us-gaap:SalesRevenueNetMemberimci:CustomerAMember2022-04-012022-06-300000884650us-gaap:SalesRevenueNetMemberimci:CustomerAMember2022-01-012022-06-300000884650imci:CustomerOneMembersrt:MinimumMember2022-01-012022-06-300000884650imci:CustomerOneMembersrt:MaximumMember2022-01-012022-06-300000884650imci:CustomerOneMember2021-12-310000884650imci:OtherServicesMember2021-01-012021-12-310000884650imci:OtherServicesMember2020-01-012020-12-310000884650imci:CybersecurityProjectsAndSoftwareMember2021-01-012021-12-310000884650imci:CybersecurityProjectsAndSoftwareMember2020-01-012020-12-310000884650imci:ManagedSupportServicesMember2021-01-012021-12-310000884650imci:ManagedSupportServicesMember2020-01-012020-12-310000884650imci:OtherITConsultingServicesMember2022-04-012022-06-300000884650imci:CybersecurityProjectsAndSoftwareMember2022-04-012022-06-300000884650imci:ManagedSupportServicesMember2022-04-012022-06-300000884650imci:OtherITConsultingServicesMember2022-01-012022-06-300000884650imci:CybersecurityProjectsAndSoftwareMember2022-01-012022-06-300000884650imci:ManagedSupportServicesMember2022-01-012022-06-300000884650imci:OtherITConsultingServicesMember2021-01-012021-06-300000884650imci:CybersecurityProjectsAndSoftwareMember2021-01-012021-06-300000884650imci:ManagedSupportServicesMember2021-01-012021-06-300000884650imci:OtherITConsultingServicesMember2021-04-012021-06-300000884650imci:CybersecurityProjectsAndSoftwareMember2021-04-012021-06-300000884650imci:ManagedSupportServicesMember2021-04-012021-06-300000884650imci:ThreeRelatedPartiesMember2020-12-310000884650srt:BoardOfDirectorsChairmanMember2021-12-310000884650imci:RelatedPartyMember2021-12-310000884650imci:ThreeRelatedPartiesMember2020-01-012020-12-310000884650imci:LongTermDebtAgreementMember2021-12-310000884650imci:LongTermDebtAgreementMember2021-01-012021-12-310000884650srt:BoardOfDirectorsChairmanMember2021-01-012021-12-310000884650imci:RelatedPartyMember2021-01-012021-12-310000884650imci:TalosVictoryFundMember2022-01-012022-06-300000884650imci:MastHillFundLPMember2022-01-012022-06-300000884650imci:MastHillFundLPMember2022-01-012022-12-310000884650imci:MastHillFundLPMember2021-01-012021-12-310000884650imci:TwentyTwentyThreeAndTwentyTwentyFourMember2021-12-310000884650imci:RelatedPartyMember2020-12-310000884650us-gaap:RetainedEarningsMember2022-06-300000884650us-gaap:AdditionalPaidInCapitalMember2022-06-300000884650us-gaap:CommonStockMember2022-06-300000884650us-gaap:RetainedEarningsMember2022-04-012022-06-300000884650us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000884650us-gaap:CommonStockMember2022-04-012022-06-3000008846502022-03-310000884650us-gaap:RetainedEarningsMember2022-03-310000884650us-gaap:AdditionalPaidInCapitalMember2022-03-310000884650us-gaap:CommonStockMember2022-03-3100008846502022-01-012022-03-310000884650us-gaap:RetainedEarningsMember2022-01-012022-03-310000884650us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000884650us-gaap:CommonStockMember2022-01-012022-03-3100008846502021-06-300000884650us-gaap:RetainedEarningsMember2021-06-300000884650us-gaap:AdditionalPaidInCapitalMember2021-06-300000884650us-gaap:CommonStockMember2021-06-300000884650us-gaap:RetainedEarningsMember2021-04-012021-06-300000884650us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300000884650us-gaap:CommonStockMember2021-04-012021-06-300000884650us-gaap:RetainedEarningsMember2021-12-310000884650us-gaap:AdditionalPaidInCapitalMember2021-12-310000884650us-gaap:CommonStockMember2021-12-310000884650us-gaap:RetainedEarningsMember2021-01-012021-12-310000884650us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000884650us-gaap:CommonStockMember2021-01-012021-12-3100008846502021-03-310000884650us-gaap:RetainedEarningsMember2021-03-310000884650us-gaap:AdditionalPaidInCapitalMember2021-03-310000884650us-gaap:CommonStockMember2021-03-3100008846502021-01-012021-03-310000884650us-gaap:RetainedEarningsMember2021-01-012021-03-310000884650us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310000884650us-gaap:CommonStockMember2021-01-012021-03-310000884650us-gaap:RetainedEarningsMember2020-12-310000884650us-gaap:AdditionalPaidInCapitalMember2020-12-310000884650us-gaap:CommonStockMember2020-12-310000884650us-gaap:RetainedEarningsMember2020-01-012020-12-310000884650us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000884650us-gaap:CommonStockMember2020-01-012020-12-3100008846502019-12-310000884650us-gaap:RetainedEarningsMember2019-12-310000884650us-gaap:AdditionalPaidInCapitalMember2019-12-310000884650us-gaap:CommonStockMember2019-12-3100008846502020-01-012020-12-3100008846502021-01-012021-12-3100008846502021-01-012021-06-3000008846502021-04-012021-06-3000008846502022-04-012022-06-3000008846502020-12-3100008846502022-06-3000008846502021-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

As filed with the Securities and Exchange Commission on November 1, 2022

Registration No. 333-262167

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

(Pre-Effective Amendment No. 8)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INFINITE GROUP, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 7372 | | 52-1490422 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Infinite Group, Inc.

175 Sully’s Trail, Suite 202

Pittsford, New York 14534

(585) 385-0610

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James Villa

Chief Executive Officer

Infinite Group, Inc.

175 Sully’s Trail, Suite 202

Pittsford, New York 14534

(585) 385-0610

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Alexander R. McClean, Esq. C. Christopher Murillo, Esq. Harter Secrest & Emery LLP 1600 Bausch & Lomb Place Rochester, New York 14604 (585) 232-6500 | | Anthony W. Basch, Esq. J. Britton Williston, Esq. Kaufman & Canoles, P.C. 1021 East Cary Street, Suite 1400 Richmond, Virginia 23219 (804) 771-5700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

_______________________________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the Company is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED NOVEMBER 1, 2022 |

Up to 3,500,000 Common Units

Each Consisting of

One Share of Common Stock and

Three Redeemable Warrants Each to Purchase One Share of Common Stock

Up to 3,500,000 Pre-funded Units

Each Consisting of

One Pre-funded Warrant to Purchase One Share of Common Stock and

Three Redeemable Warrants Each to Purchase One Share of Common Stock

This prospectus relates to the firm commitment public offering of 3,500,000 units of Infinite Group, Inc. (“Infinite Group,” the “Company,” “we,” “our,” or “us”), a Delaware corporation, based on an assumed initial offering price of $4.38 per common unit. We are offering up to 3,500,000 of units consisting of either (i) one share of common stock and three redeemable warrants each to purchase one share of common stock (the “common units”); or (ii) one pre-funded warrant to purchase one share of common stock at an exercise price of $0.001 per share and three redeemable warrants each to purchase one share of common stock (the “pre-funded units” and together with the common units, the “units”). We anticipate that the initial public offering price will be $4.38. The offering price of units at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business, may be at a discount to the current market price of our shares of common stock.

The pre-funded units are being offered to purchasers in lieu of common units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. There can be no assurance that we will sell any of the pre-funded units being offered. The purchase price of each pre-funded unit is equal to the price per unit being sold to the public in this offering, minus $0.001. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. We are offering the pre-funded units at an assumed public offering price of $4.379 per pre-funded unit based on an assumed initial offering price of $4.38 per common unit.

The units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of our common stock or pre-funded warrants, as the case may be, and the redeemable warrants comprising our units can only be purchased together in this offering, but the securities included in the units are immediately separable and will be issued separately in this offering.

The redeemable warrants included within the units will be exercisable immediately, have an exercise price per share of common stock of $4.00, and will expire five years from the date of issuance or when redeemed.

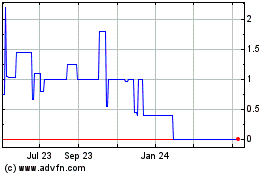

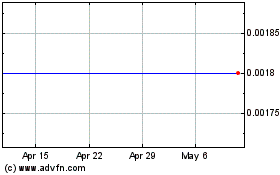

Our common stock is presently traded on the over-the-counter market and quoted on the OTCQB market under the symbol “IMCI.” We have applied to list our common stock and redeemable warrants on the Nasdaq Capital Market under the symbols “IMCI” and “IMCIW,” respectively. No assurance can be given that our application will be approved. On October 13, 2022, the last reported sale price of our common stock was approximately $5.4225 per share after giving effect to the 75-to-1 reverse stock split. If our application is not approved or we otherwise determine that we will not be able to secure the listing of our common stock on Nasdaq, we will not complete this offering. There is no established public trading market for the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the pre-funded warrants on any national securities exchange or other nationally recognized trading system.

The final offering price of the units will be determined between the underwriter and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business, and may be at a discount to the current market price. Therefore, the recent market price used throughout this prospectus may not be indicative of the actual public offering price for our units.

On December 15, 2021, our board of directors approved a reverse stock split of our outstanding shares of common stock by a ratio within the range of 3-to-1 and 75-to-1, to be effective at the ratio and date to be determined by our board of directors. Our stockholders approved the reverse stock split range at our annual meeting on January 26, 2022. On October 17, 2022 our board of directors approved a reverse stock split of our outstanding shares of common stock by a ratio of 75-to-1, which became effective October 19, 2022. Unless otherwise noted, the share and per share information in this prospectus reflects the effect of the reverse stock.

This prospectus contains or incorporates by reference summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or have been incorporated by reference as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the heading “Where You Can Find More Information.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Unit | | | Total | |

Public Offering Price | | $ | | | | $ | | |

Underwriting Discounts and Commissions (1) | | $ | | | | $ | | |

Proceeds to us before expenses (2) | | $ | | | | $ | | |

1. | We have also agreed to issue warrants to purchase shares of our common stock to the underwriter and to reimburse the underwriter for certain expenses. Does not include a non-accountable expense allowance equal to 1% of the public offering price. See “Underwriting” for additional information regarding total underwriter compensation. |

| |

2. | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) over-allotment option (if any) we have granted to the managing underwriter as described below and (ii) warrants being issued to the underwriter in this offering; or (iii) the redeemable warrants. |

We have granted the underwriters a 45-day option to purchase up to 525,000 additional shares of common stock and/or pre-funded warrants, representing 15% of the shares and pre-funded warrants sold in the offering and/or up to 1,575,000 additional redeemable warrants, representing 15% of the redeemable warrants sold in the offering, solely to cover over-allotments, if any. The purchase price to be paid per additional share of common stock will be equal to the public offering price of one common unit, less the purchase price for the redeemable warrants included within the common unit and the underwriting discount. The purchase price to be paid per pre-funded warrant will be equal to the public offering price of one pre-funded unit, less the purchase price for the one redeemable warrant included within the pre-funded unit and the underwriting discount. The purchase price to be paid per each additional redeemable warrant will be $0.01.

The underwriter expects to deliver the securities against payment to the investors in this offering on or about , 2022.

| Sole Book-Running Manager | |

| | |

| Aegis Capital Corporation | |

The date of this prospectus is , 2022.

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not authorized anyone to provide you with additional information or information different from the information contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are intended to qualify for the “safe harbor” created by those sections. The words “anticipate,” “believe,” “could,” “estimate,” “continue,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” “is likely”, “forecast”, “seek” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. All statements other than statements of historical facts contained in this prospectus, including among others, statements regarding this offering, our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements.

Our actual results and the timing of certain events may differ materially from those expressed or implied in such forward-looking statements due to a variety of factors and risks, including, but not limited to, those set forth under “Risk Factors,” those set forth from time to time in our other filings with the SEC, including risks related to the following:

| · | our ability to continue as a going concern and our history of losses; |

| · | our ability to obtain additional financing; |

| · | the ongoing coronavirus (“COVID-19”) pandemic; |

| · | our lack of significant revenues; |

| · | our ability to prosecute, maintain or enforce our intellectual property rights; |

| · | disputes or other developments relating to proprietary rights and claims of infringement; |

| · | the accuracy of our estimates regarding expenses, future revenues and capital requirements; |

| · | the implementation of our business model and strategic plans for our business and technology; |

| · | the successful development of our sales and marketing capabilities; |

| · | the potential markets for our products and our ability to serve those markets; |

| · | the rate and degree of market acceptance of our products and any future products; |

| · | our ability to retain key management personnel; |

| · | regulatory developments and our compliance with applicable laws; and |

| · | our liquidity. |

The forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events.

The forward-looking statements in this prospectus are made only as of the date hereof or as indicated and represent our views as of the date of this prospectus. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as the result of new information, future events or otherwise, except as required by law.

Notwithstanding the above, Section 27A of the Securities Act and Section 21E of the Exchange Act expressly state that the safe harbor for forward looking statements does not apply to companies that issue penny stocks. We believe we will not be considered an issuer of penny stock after this offering. However, if we are considered to be an issuer of penny stock, the safe harbor for forward looking statements under Section 27A of the Securities Act and Section 21E of the Exchange Act will not be available to us.

Industry and Market Data

This prospectus contains estimates made, and other statistical data published, by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are inherently subject to a high degree of uncertainty and actual events or circumstances may differ materially from events and circumstances reflected in this information. We caution you not to give undue weight to such projections, assumptions and estimates. While we believe that these publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified by any independent source.

PROSPECTUS SUMMARY This summary highlights certain information appearing elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information included elsewhere in this prospectus. Before you make an investment decision, you should read this entire prospectus carefully, including the risks of investing in our securities discussed under the section of this prospectus entitled “Risk Factors” and similar headings. You should also carefully read our financial statements, and the exhibits to the registration statement of which this prospectus is a part. Overview Headquartered in Pittsford, New York, Infinite Group is a developer of cybersecurity software and related cybersecurity consulting, advisory, and managed information security services. We principally sell our software and services through indirect channels such as Managed Service Providers (“MSPs”), Managed Security Services Providers (“MSSPs”), agents and distributors and government contractors, whom we refer to collectively as our channel partners. We also sell directly to end customers. We believe our ability to succeed depends on how successful we are in differentiating ourselves in the cybersecurity market at a time when competition and consolidation in these markets are on the rise. Our strategy to differentiate our cybersecurity software and services from our competitors is to combine customized software and professional services, and grow our business by designing, developing, and marketing cybersecurity software-as-a-service (“SaaS”) solutions that can be deployed in myriad environments. Software and services are initially developed in our wholly-owned subsidiary, IGI CyberLabs (“CyberLabs”), to fill technology gaps we identify, and then we bring these software and services to market through our existing channel partner and customer relationships. Our software and services are designed to simplify and manage the security needs of our customers and channel partners in a variety of environments. We focus on the small and medium-sized enterprises market. We support our channel partners by providing recurring-revenue business models for both services and through our cybersecurity SaaS solutions. Products may be sold as standalone solutions or integrated into existing environments to further automate the management of cybersecurity and related IT functions. As part of these software and service offerings we: |

| | |

| · | Internally developed and brought to market Nodeware®, a patented SaaS solution that automates network asset identification, and cybersecurity vulnerability management and monitoring. Nodeware simply and affordably enhances security by proactively identifying, monitoring, and addressing potential cybersecurity vulnerabilities on networks, which creates enhanced security to safeguard against hackers and ransomware. Nodeware provides an economical solution for small and medium-sized enterprises as compared to more costly solutions focused on enterprise-sized customers, and is designed to accommodate the varying network needs of our end customers’ organizations and networks. Nodeware’s flexibility allows it to span from a single network to several subnetworks, as well as accommodating larger, more complex organizations with more advanced network needs. Nodeware is sold as a SaaS solution and continuously releases enhancements, updates, and upgrades to stay current with security needs and changes in the market. Nodeware is also designed to be integrated into other technology platforms. We primarily sell Nodeware through our channel partners, with a small percentage being sold directly to end customers. We intend to continue to develop our intellectual property to serve as the core to our proprietary software and services. In addition to our proprietary software and services we also act as a master distributor for other cybersecurity software, principally Webroot, a cloud-based endpoint security platform solution, where we market to and provide support for over 225 small channel partners across North America. For the six months ended June 30, 2022, our software revenue was approximately $532,000, with approximately 29% of that being related to Nodeware. For the twelve months ended December 31, 2021, our software revenue was approximately $1,011,000, with approximately 17% of that being related to Nodeware; |

| · | Provide cybersecurity consulting and advisory services to channel partners and direct customers across different markets, including banking, manufacturing, supply chain, and technology. As part of our consulting and advisory services, we are contracted to support existing information technology and executive teams at both the customer and channel partner level, and provide security leadership and guidance. We validate overall corporate and infrastructure cybersecurity with the goal of maintaining and securing the integrity of confidential client information, preserving the continuity of services, and minimizing potential data damage from threats and incidents. For the six months ended June 30, 2022, our cybersecurity consulting services revenue, excluding software sales, was approximately $627,000. For the twelve months ended December 31, 2021, our cybersecurity consulting services revenue, excluding software sales, was approximately $1,769,000; and |

| · | Provide managed support services related to information security, principally as a subcontractor for Peraton, a large information technology provider and U.S. government contractor, by providing in-depth troubleshooting, backend analysis, and technical and security support, commonly referred to as Level 2 support, for mission critical technical infrastructure from the server level to the end user interface application in a critical government environment. For the six months ended June 30, 2022, our managed support services revenue was approximately $2,205,000. For the twelve months ended December 31, 2021, our managed support services revenue was approximately $4,325,000. |

| | |

Sales and Marketing Strategy During 2021, approximately 89% of our business comes from our channel sales and approximately 11% from direct sales to end customers. Managed support services accounts for approximately 60% of total sales, cybersecurity software and services accounts for approximate 38% of total sales and other consulting services accounts for approximately 2% of total sales. Virtually all managed information security support services revenue is derived from one customer, a major independent agency of the U.S. Government for which we manage one of the nation’s largest physical and virtual Microsoft Windows environments as a subcontractor through our channel partner, Peraton. We are working to expand our managed information security support services business with our channel partner Peraton, and to potentially grow the current federal enterprise customer and to expand to other Peraton customers. We sell our cybersecurity software and services, including Nodeware, through our channel partners, which include direct channel partners, Telarus, TD SYNNEX, and Staples, and through our direct cybersecurity services teams. Our cybersecurity services include Chief Information Security Team as a Service (CISOTaaS ™), PenLogic™ penetration testing services, security assessments, incident response and others, and are provided through our channel partners and direct to end customers as a cybersecurity solution to the technical services they provide. Our channel partners utilize our expertise in cybersecurity to bring additional services to their end customers that are beyond their normal scope of offerings, and building our network of channel partners allows us the ability to efficiently gain access to a greater number of customers. We continue to drive development of our cybersecurity business through channel and direct marketing, social media programs, and fostering our extensive cybersecurity industry relationships. We are not reliant on any one customer for our cybersecurity software and services sales given that we work with a number of channel partners and direct customers. In addition to our cybersecurity software and services, we provide from time to time other information technology consulting services to existing clients. Recent Developments During the six months ended June 30, 2022, we had sales of approximately $3,364,000 million, an operating loss of approximately $1,295,000 and a net loss of approximately $1,701,000. During the year ended December 31, 2021, we had sales of approximately $7.2 million, an operating loss of approximately $1.4 million and a net loss of approximately $1.6 million. These losses were due primarily to increased investment in sales and marketing for Nodeware and related services, together with increased costs associated with our preparations to list on Nasdaq and with assessing potential acquisition targets. As a result of growing demand and accelerated growth in the cybersecurity market, we continue to grow our team of cybersecurity sales and technical consultants internally and leverage contractors when needed to fill short term gaps. For the six months ended June 30, 2022, we added 3 new employees, primarily to the sales and marketing team. We added 12 new employees, primarily in the areas of sales, marketing, and technical consulting for cybersecurity services in 2021. We had full year sales of approximately $7.2 million in 2020 and $7.1 million in 2019, generating operating income of approximately $1,000 and $329,000 and net income of approximately $676,000 and $48,000, respectively. On August 8, 2022, the Company, as borrower, entered into a financing arrangement (the “Loan Agreement”) with Celtic Bank (the “Lender”), a Utah corporation. Pursuant to the Loan Agreement, the Lender agreed to lend the Company $139,400 with a one-time fixed loan fee of $11,152 for a total obligation of $150,552. Under the terms of the Loan Agreement, payments are due beginning August 15, 2022, and shall consist of 25% of the Company’s receivables processed through Stripe, Inc.’s payment processing platform and then due and owing to the Company or $16,728 over a sixty day period, whichever is higher. Subsequent payments shall also consist of 25% of the Company’s receivables processed through Stripe, Inc.’s payment processing platform and then due and owing to the Company or $16,728 over a sixty day period, whichever is higher, with the final payment due on February 6, 2024. The Loan is subject to customary events of default. On July 29, 2022, the Company and Andrew Hoyen (“Hoyen Lender”), a director and executive officer of the Company, entered into a note modification agreement (the “Hoyen Modification”) with respect to the Line of Credit Note and Agreement in the original principal sum of up to $100,000, dated July 18, 2017, issued by the Company to the Hoyen Lender (the “Hoyen Note”). The Hoyen Note and the Hoyen Modification was approved by the disinterested members of our Board of Directors. The Hoyen Modification extends the due date of the Hoyen Note to July 31, 2023, on which date the current outstanding principal balance of $90,000 and accrued and unpaid interest will be due. Pursuant to the Hoyen Modification, the Company agreed to repay to Lender $16,000 of the accrued interest on the Hoyen Note and off-set such repayment against the exercise on July 29, 2022 by Lender of certain options to acquire 5,333 shares of the Company’s common stock. The remaining accrued and unpaid interest on the Note was $10,930 as of July 29, 2022. Except as set forth in the Hoyen Modification, the terms of the Hoyen Note remain the same. On June 30, 2022, and September 6, 2022 the Company and Donald W. Reeve (“Reeve Lender”), a director of the company, entered into note modification agreements (each a “Reeve Modification” and collectively, the “Reeve Modifications”) with respect to the Promissory Note originally dated December 30, 2020 (“2020 Note”) and the Promissory Note originally dated May 25, 2021 (“2021 Note”). The 2020 Note, the 2021 Note and the Reeve Modifications were each approved by the disinterested members of our Board of Directors. The Reeve Modification of the 2020 Note extended the due date of the first balloon payment under the 2020 Note of $100,000 to January 1, 2023. The Reeve Modification of the 2021 Note extended the maturity date of the 2021 Note to January 1, 2023, on which date the principal balance of $100,000 and accrued interest of $9,616 will be due. Except as set forth above, the terms of the 2020 Note and the 2021 Note remain the same. In June 2021, we created IGI CyberLabs, LLC, a wholly owned subsidiary, to support our Nodeware solution and continued software development. CyberLabs’s overarching mission is to drive sales of our Nodeware Cloud security solution, which we believe will drive monthly and annualized recurring revenue. CyberLabs will also drive product and platform enhancements in Nodeware and new cloud and SaaS cybersecurity related products that will be brought to market through our growing channel partner relationships. On November 3, 2021, we entered into a financing arrangement (the “Bridge Loan”) with Mast Hill Fund, L.P. (“Mast Hill”), a Delaware limited partnership. In exchange for a promissory note, the Mast Hill agreed to lend the Company $448,000, which bears interest at a rate of eight percent (8%) per annum, less $44,800 original issue discount. Under the terms of the Loan, amortization payments are due beginning March 3, 2022, and each month thereafter with the final payment due on November 3, 2022. As additional consideration for the financing, the Company issued Mast Hill a 5-year warrant to purchase 18,667 shares of Company common stock at a fixed price of $12.00 per share, subject to price adjustments for certain actions, including dilutive issuances below the exercise price of such warrants. On February 15, 2022, we entered into a second financing arrangement (the “Second Bridge Loan”) with Mast Hill. In exchange for a promissory note, the Mast Hill agreed to lend the Company $370,000, which bears interest at a rate of eight percent (8%) per annum, less $37,000 original issue discount. As additional consideration for the financing, the Company issued Mast Hill a 5-year warrant to purchase 12,333 shares of Company common stock at a fixed price of $12.00 per share, subject to price adjustments for certain actions, including dilutive issuances below the exercise price of such warrants. On April 12, 2022, we entered into a third financing arrangement (the “Third Bridge Loan”) with Talos Victory Fund, LLC (“Talos” and together with Mast Hill, the “Lenders”) on substantially the same terms as our financing arrangements with Mast Hill. In exchange for a promissory note, the Talos agreed to lend the Company $296,000, which bears interest at a rate of eight percent (8%) per annum, less $29,600 original issue discount. As additional consideration for the financing, the Company issued Talos a 5-year warrant to purchase 9,867 shares of Company common stock at a fixed price of $12.00 per share, subject to price adjustments for certain actions, including dilutive issuances below the exercise price of such warrants. On May 31, 2022, we entered into a fourth financing arrangement (the “Fourth Bridge Loan” and together with the Bridge Loan, Second Bridge Loan, and Third Bridge Loans, the “Loans”) with Mast Hill. In exchange for a promissory note, the Mast Hill agreed to lend the Company $355,000, which bears interest at a rate of eight percent (8%) per annum, less $35,500 original issue discount. As additional consideration for the financing, the Company issued Mast Hill a 5-year warrant to purchase 11,833 shares of Company common stock at a fixed price of $12.00 per share, subject to price adjustments for certain actions, including dilutive issuances below the exercise price of such warrants. Under the terms of the Loans, amortization payments are due beginning four months from the issue date, and each month thereafter with the final payment due on the one year anniversary of the Loans. Additionally, in the event of a default under the Loans or if the Company elects to pre-pay the Loans, the Lenders have the right to convert any portion or all of the outstanding and unpaid principal and interest into fully paid and non-assessable shares of the Company’s common stock at a conversion price of $7.50 per share. On April 29, 2022, Mast Hill exercised the warrant issued to them on November 3, 2021 in full on a cashless basis and acquired 11,470 shares of Common Stock. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” for more information regarding the Loans. As of October 19, 2022, Mast Hill holds warrants to purchase 13,516 shares of Common Stock and Talos holds warrants to purchase 9,867 shares of Common Stock issued in connection with the Loans (collectively, the “Loan Warrants”). The anti-dilution provisions of the Loan Warrants take effect if the Company’s common stock (or common stock equivalents, such as warrants) is sold or issued at a price lower than the initially stated $12.00 exercise price of the Loan Warrants. Accordingly, at the current assumed unit offering price of $4.38 (with warrants with an exercise price of $4.00 per share of common stock), the exercise price of the Loan Warrants would be reduced to $4.00 per share at the option of the holders thereof. In addition, the conversion price of the Loans upon default or prepayment would be reduced from $7.50 to $4.00 per share. |

On December 15, 2021, our board of directors (the “Board”) approved a reverse stock split of our outstanding shares of common stock by a ratio within the range of 3-to-1 and 75-to-1 of our outstanding shares of common stock and recommended that the stockholders of the Company authorize the Board, in its discretion, for one year, to determine the final ratio, effective date, and date of filing of the certificate of amendment to our Certificate of Incorporation, as amended, in connection with the reverse stock split. On January 26, 2022, the company’s stockholders voted to authorize the reverse stock split. On October 17, 2022, the Board approved a reverse stock split of our outstanding shares of common stock by a ratio of 75-to-1, which became effective October 19, 2022. The reverse stock split did not impact the number of authorized shares of common stock which remains at 60,000,000 shares. Unless otherwise noted, the share and per share information in this prospectus reflects the effect of the reverse stock split. Business Strategy We have a threefold business strategy composed of: |

| | |

| · | providing differentiated cybersecurity software and services to small to mid-sized enterprises who lack the internal resources to focus on cybersecurity related matters by combining customized software and professional services; |

| · | designing, developing, and marketing cybersecurity SaaS solutions, including our Nodeware solution; and |

| · | identifying other cybersecurity companies to acquire as part of a roll-up strategy. |

| | |

We believe our ability to succeed depends on how successful we are in differentiating ourselves in the market at a time when competition and consolidation in these markets is on the rise. Our software and services are designed to simplify the security needs of our customers and channel partners, with a focus on the small to mid-sized enterprises, and we believe our ability to integrate our product and service offerings differentiates them from our competitors. In addition, we support our channel partners by providing recurring-revenue business models for both services and our cybersecurity SaaS solutions. Cybersecurity is a constantly evolving field, so we devote significant efforts in developing proprietary software and services to meet our customer and channel partners’ evolving needs. These efforts have resulted in the development of our patented and patent-pending Nodeware solution. We expect to continue to make significant investments in developing other intellectual property to serve as the core to other proprietary software and services. Historically, a significant portion of our revenues has been derived through our managed support services, however, we believe our cybersecurity SaaS solutions, including Nodeware, present an opportunity for significant growth. We believe that Nodeware’s ability to be deployed in an underserved market segment, across a wide variety of networks and the ability to integrate it into existing and new cybersecurity software and services, will allow us to significantly grow this segment of our business. Similarly, we believe Nodeware’s SaaS recurring revenue business model and its flexibility as a standalone or integrated solution makes it an attractive part of our channel partners’ portfolio of products. Accordingly, in 2021 we made significant investments in Nodeware sales and marketing to grow our team of cybersecurity sales and technical consultants. As a result, we believe we are seeing the pipeline growth expected from focused efforts, which we anticipate will convert to revenue growth in 2022 and beyond. We believe the market for cybersecurity services for small and medium-sized enterprises is fragmented and does not currently meet the needs of this customer base. The market is fragmented and is beginning to consolidate, which is why we are seeking to strategically acquire other cybersecurity technology and services companies. Intellectual Property We believe that our intellectual property is an asset that will contribute to the growth and profitability of our business. We rely on a combination of patented, patent-pending and confidentiality procedures, trademarks and contractual provisions to establish and protect our intellectual property rights in the United States and abroad. We intend to rely on both registration and common law protection for our trademarks. Our current patent and trademark portfolio consists of a patent for the Nodeware solution and process for scanning for vulnerabilities and a pending patent covering the methodologies associated with identifying and cataloging the assets on or across any physical or cloud network, together with a registered trademark for the “Nodeware” name and other trademarks and tradenames associated with our company and products. We intend to continue to work to enhance our intellectual property position on the Nodeware solution and in other appropriate cybersecurity technology we generate. |

Research and Development Our research and development efforts are focused on ensuring our software and services continually adapt to ever-evolving cybersecurity threats, developing new and improved functionality to meet our customers’ needs, and to enable robust and efficient integration with other industry solutions. Our research and development team is responsible for the design, development, testing and quality of our software, including Nodeware, and works to ensure that our software is available, reliable and stable. Costs incurred prior to reaching technological feasibility are expensed as incurred, subsequently they are capitalized until product launch. Listing on the Nasdaq Capital Market Our common stock is presently traded on the over-the-counter market and quoted on the OTCQB market under the symbol “IMCI.” We have applied to list our common stock and redeemable warrants on the Nasdaq Capital Market under the symbols “IMCI” and “IMCIW,” respectively. No assurance can be given that our application will be approved. On October 13, 2022, the last reported sale price of our common stock was approximately $5.4225 per share, after giving effect to the 75-to-1 reverse stock split. If our application is not approved or we otherwise determine that we will not be able to secure the listing of our common stock on Nasdaq, we will not complete this offering. There is no established public trading market for the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the pre-funded warrants on any national securities exchange or other nationally recognized trading system. |

Summary of Principal Risks An investment in shares of our units involves a high degree of risk. If any of the factors enumerated below or in the section entitled “Risk Factors” occurs, our business, financial condition, liquidity, results of operations and prospects could be materially and adversely affected. In that case, the market price of our securities could decline, and you may lose some or all of your investment. Some of the more significant risks relating to this offering and an investment in our units include: |

| | |

| · | our ability to continue as a going concern, which could cause our stockholders to lose some or all of their investment in us; |

| · | the ongoing COVID-19 pandemic and its impact on our business and our operations; |

| · | our history of fluctuating operating results; |

| · | our ability to raise additional capital in this offering or through additional offerings, which may not be available on favorable terms, if at all, and without which we may not be able to continue as a going concern; |

| · | our highly leveraged financial status and working capital deficit; |

| · | our accrued liability for a previously-offered retirement plan; |

| · | our past and possible future use of an accounts receivable credit facility; |

| · | our ability to successfully protect our intellectual property rights, and claims of infringement by others; |

| · | our ability to successfully commercialize our patented software; |

| · | the risk of losing a major customer that accounts for a large portion of our revenue; |

| · | our reliance on our channel partners to generate a substantial amount of our revenue; |

| · | our reliance on certain of our vendors to competently operate certain functions of our business; |

| · | our reliance on third-party vendors and third-party software; |

| · | the impact to our business if federal, state, or local governments decreased the amount of business they do with us or our prime contractors; |

| · | our ability to effectively compete in a highly competitive environment; |

| · | the ability of our software and services to gain market acceptance, obtain market share, and maintain market share; |

| · | the ability of our software and services to correctly detect and identify vulnerabilities; |

| · | the ability of our software and services to meet and comply with applicable regulations and industry standards; |

| · | the market for cloud solutions for information technology, security, and compliance may not evolve as we anticipate; |

| · | our compliance with software licenses; |

| · | our compliance with federal, state, and local tax regulations governing sales and use tax or other taxes; |

| · | our ability to effectively manage the size of our business; |

| · | our ability to effectively manage and integrate businesses or business assets we acquire; |

| · | our ability to manage growth effectively; |

| · | our ability to retain key management personnel; |

| · | the exposure of our directors or officers because of our lack of directors and officers liability insurance; |

| · | our ability to create value from our investments; |

| · | our ability to hire and retain qualified and experienced technical, sales, and marketing teams; |

| · | cybersecurity, privacy, and data handling threats and incidents; |

| · | the volatility of our stock price, even once listed on Nasdaq; |

| · | our expectation that we will not declare dividends to our stockholders for the foreseeable future; |

| · | the immediate and substantial dilution in net tangible book value; |

| · | the dilution of our shares as a result of the issuance of additional shares in connection with financing arrangements; |

| · | the impact of the 75-to-1 reverse stock split on the liquidity of our shares; |

| · | the decline in the price of our stock due to offers or sales of substantial number of our shares; |

| · | the limited trading volume and price fluctuations of our shares; |

| · | the broad discretion of our management over the proceeds from this offering; |

| · | the speculative nature of the redeemable warrants offered in this offering; |

| · | the lack of established trading market for the redeemable warrants offered in this offering; |

| · | the redeemable warrants offered in this offering will only confer the right to acquire our shares at a fixed price, until such time as the redeemable warrants are exercised or redeemed; |

| · | the redeemable warrants offered in this offering could discourage an acquisition of us by a third party; |

| · | our ability to meet and comply with Nasdaq’s initial listing requirements; |

| · | our ability to meet and comply with Nasdaq’s initial listing requirements; and |

| · | our ability to maintain an effective system of disclosure controls. |

| | |

Corporate Information We were incorporated under the laws of the state of Delaware on October 14, 1986. Our principal corporate headquarters are located at 175 Sully’s Trail, Suite 202, Pittsford, New York 14534 and our phone number is (585) 385-0610. Our website address is www.igicybersecurity.com. We have not incorporated by reference into this prospectus the information included on or linked from our website and you should not consider it to be part of this prospectus. |

THE OFFERING |

| | |

Issuer: | | Infinite Group, Inc. |

| | |

Units offered: | | We are offering up 3,500,000 units consisting of either (i) common units or (ii) pre-funded units. The units will be offered at an assumed public offering price of $4.38 per unit. |

| | |

Common units offered: | | Each common unit consists of one share of our common stock and three redeemable warrants each to purchase one share of our common stock. The common units will not be certificated or issued in stand-alone form. The shares of our common stock and the redeemable warrants comprising the common units are immediately separable upon issuance and will be issued separately in this Offering. |

| | |

Pre-funded units offered: | | We are also offering to those purchasers, if any, whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units in lieu of common units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. There can be no assurance that we will sell any of the pre-funded units being offered. Each pre-funded unit will consist of a pre-funded warrant and three redeemable warrants. The purchase price of each pre-funded unit is equal to the price per unit being sold to the public in this offering, minus $0.001. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. We are offering the pre-funded units at an assumed public offering price of $4.379 per pre-funded unit based on an assumed initial offering price of $4.38 per common unit. For each pre-funded unit we sell, the number of common units we are offering will be decreased on a one-for-one basis. Because we will issue three redeemable warrants as part of each common unit or pre-funded unit, the number of redeemable warrants sold in this offering will not change as a result of a change in the mix of the common units and pre-funded units sold. This prospectus also relates to the offering of the common shares issuable upon exercise of the pre-funded warrants. . |

| | |

Shares of common stock outstanding prior to the offering (1): | | 453,149 shares. |

| | |

Shares of common stock outstanding after the offering (1): | | 3,953,149 shares (assuming the exercise of any pre-funded warrants and none of the redeemable warrants issued in this offering are exercised). |

| | |

Over-allotment option: | | We have granted the underwriters a 45-day option to purchase up to 525,000 additional shares of common stock and/or pre-funded warrants, representing 15% of the shares and pre-funded warrants sold in the offering and/or up to 1,575,000 additional redeemable warrants, representing 15% of the redeemable warrants sold in the offering, solely to cover over-allotments, if any. The purchase price to be paid per additional share of common stock will be equal to the public offering price of one unit, less the purchase price for the redeemable warrants included within the unit and the underwriting discount. The purchase price to be paid per pre-funded warrant will be equal to the public offering price of one pre-funded unit, less the purchase price for the redeemable warrants included within the pre-funded unit and the underwriting discount. The purchase price to be paid per additional redeemable warrant will be $0.01. |

| | |

Use of proceeds: | | We estimate that the net proceeds to us from this offering will be approximately $13,549,600 after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We plan on using the proceeds from this offering for marketing and sales, development costs, repayment of debt and working capital, among other things. Our management will retain broad discretion over the allocation of the net proceeds from this offering. For a more complete description of our intended use of the net proceeds from this offering, see “Use of Proceeds.” |

| | |

Description of the redeemable warrants: | | The redeemable warrants included within the units will be exercisable immediately and have an exercise price per share of common stock of $4.00. Each redeemable warrant is exercisable for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock, and in the event that the Company’s common stock trades below the exercise price during the 90 day period following this offering, as described herein. A holder may not exercise any portion of a redeemable warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99% of the outstanding common stock after exercise, as such percentage ownership is determined in accordance with the terms of the warrants, except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. Each redeemable warrant will be exercisable immediately upon issuance and will expire on , 2027 (five years after the initial issuance date) or when redeemed. The terms of the redeemable warrants will be governed by a Warrant Agreement, dated as of the effective date of this offering, between us and Issuer Direct, as the warrant agent (the “Warrant Agent”). The exercise price and number of shares of common stock issuable upon exercise of the redeemable warrants may be adjusted in certain circumstances within two (2) years from issuance, including in the event of a stock dividend or recapitalization, reorganization, merger, or consolidation. The redeemable warrants will also be adjusted for issuances of common stock at prices below its exercise price under certain circumstances. However, in no event will the exercise price be adjusted to a price below $2.00 per share (equal to 50% of the initial exercise price of $4.00). Additionally, on the date that is 90 calendar days immediately following the initial issuance date of the redeemable warrants, the exercise price of the redeemable warrants will be reduced to the reset price, provided that such value is less than the exercise price in effect on that date. The reset price is equal to the greater of (a) 50% of the initial exercise price or (b) 100% of the lowest daily volume weighted average price per share of common stock occurring during the 90 calendar days following the issuance date of the redeemable warrants. The lowest reset price is $2.00 per share (equal to 50% of the initial exercise price of $4.00). |

| | |

| | This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the redeemable warrants. For more information regarding the redeemable warrants, you should carefully read the section titled “Description of the Securities-Redeemable Warrants” in this prospectus. |

| | |

Redemption of redeemable warrants: | | We may redeem the outstanding warrants at a price of $0.01 per warrant share upon certain conditions where the price of our common stock has equaled or exceeded $ per share (as adjusted for share splits, share dividends, recapitalizations and similar events) for a 30 consecutive trading day period. We must give notice of our intent for redemption at least 30 days prior to the date of redemption. Upon our notice to warrant holders of our intent to call the warrants for redemption, each holder will have 30 trading days during which it may exercise its warrant prior to the planned redemption date; if such holder does not exercise prior to the redemption date, the warrants held by such holder will be redeemed and the warrant holder will have no other rights other than the right to receive the nominal redemption price of $0.01 per warrant share upon surrender of the warrant. • in whole and not in part; • at a price of $0.001 per warrant; • upon a minimum of 30 days’ prior written notice of redemption, which we refer to as the 30-day redemption period; and • if, and only if, the last sale price of our common stock equals or exceeds $10.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for a 20-trading day. |

| | |

Description of pre-funded warrants: | | The terms of the pre-funded warrants are substantially similar to the redeemable warrants, except that the pre-funded warrants have an exercise price of $0.001, are not redeemable, and do not expire. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants. For more information regarding the pre-funded warrants, you should carefully read the section titled “Description of the Securities-Pre-funded Warrants” in this prospectus. |

Underwriter’s Warrants: | | The registration statement of which this prospectus is a part also registers for sale shares underlying warrants (the “Underwriter’s Warrants”) to purchase 140,000 shares of our common stock to Aegis Capital Corp. (the “underwriter”), as the sole underwriter, as a portion of the underwriting compensation payable to the underwriter in connection with this offering. The Underwriter’s Warrants will be exercisable beginning on a date which is six months from the commencement of sales under the registration statement of which this prospectus is a part at an exercise price of $5.48 (125% of the public offering price of the common units) and will expire five years from the date of such commencement of sales. Please see “Underwriting - Underwriter’s Warrants” for a description of these warrants. |

| | |

Trading symbol: | | Our common stock is presently traded on the over-the-counter market and quoted on the OTCQB market under the symbol “IMCI.” We have applied to list our common stock and redeemable warrants on the Nasdaq Capital Market under the symbols “IMCI” and “IMCIW,” respectively. No assurance can be given that our application will be approved. On October 13, 2022, the last reported sale price of our common stock was approximately $5.4225 per share, after giving effect to the 75-to-1 reverse stock split. If our application is not approved or we otherwise determine that we will not be able to secure the listing of our common stock on Nasdaq, we will not complete this offering. There is no established public trading market for the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the pre-funded warrants on any national securities exchange or other nationally recognized trading system. |

| | |

Reverse stock split: | | On December 15, 2021, our board of directors approved a reverse stock split of our outstanding shares of common stock by a ratio within the range of 3-to-1 and 75-to-1, to be effective at the ratio and date to be determined by our board of directors. Our stockholders approved the reverse stock split range at our annual meeting on January 26, 2022. On October 17, 2022 our board of directors approved a reverse stock split of our outstanding shares of common stock by a ratio of 75-to-1, which became effective October 19, 2022. Unless otherwise noted, the share and per share information in this prospectus reflects the effect of the reverse stock split. |

| | |

Lock-up Agreements: | | We and our directors, officers, and certain principal stockholders (holders of 10% or more of our outstanding shares) have agreed not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days after the date of this prospectus. See “Underwriting-Lock-Up Agreements.” |

| | |

Risk factors: | | Investing in our securities involves a high degree of risk and purchasers of our securities may lose their entire investment. See “Risk Factors” and the other information included and incorporated by reference into this prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our securities. |

(1) | Unless we indicate otherwise, the number of shares of our common stock outstanding is based on 453,149 shares of common stock outstanding on October 13, 2022, but does not include, as of that date: |

| | |

| · | 132,034 shares of our common stock issuable upon exercise of outstanding options at a weighted average exercise price of $6.07 per share; |

| · | 40,636 shares of our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $12.375 per share |

| · | 61,620 shares authorized for issuance pursuant to equity incentive plans; and |

| · | 139,397 shares of our common stock issuable upon conversion of convertible notes. |

| | |

Except as otherwise indicated, all information in this prospectus assumes: |

| | |

| · | no exercise of the outstanding options described above; |

| · | full exercise of any pre-funded warrants included in the pre-funded units; |

| · | no exercise of the redeemable warrants included in the units or the Underwriter’s Warrants; |

| · | no exercise of the underwriter’s over-allotment option; and |

| | |

Unless otherwise noted, the share and per share information in this prospectus reflects the effect of the reverse stock split of the outstanding common stock and treasury stock of the Company at a 75-to-1 ratio, which became effective October 19, 2022. |

RISK FACTORS

Any investment in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all information contained in this prospectus, before you decide whether to purchase our securities. If any of the following risks or uncertainties actually occurs, our business, financial condition, results of operations and prospects would likely suffer, possibly materially. In addition, the trading price of our common stock could decline due to any of these risks or uncertainties, and you may lose part or all of your investment.

Risks Related to our Business and Financial Condition

In the past, we have identified conditions and events that raise substantial doubt about our ability to continue as a going concern and it is possible that conditions and events in the future may negatively impact our ability to continue as a going concern.

As of June 30, 2022, we had a working capital deficit of approximately $4.4 million. We reported a net loss of approximately $1,701,000 for the six months ended June 30, 2022. We reported a stockholders’ deficiency of $5,387,542 as of June 30, 2022. We had net loss of approximately $569,000 for the six months ended June 30, 2021. At December 31, 2021, we had a stockholders’ deficiency of $4,097,889. These factors initially raise substantial doubt about our ability to continue as a going concern but this doubt has been alleviated.