As

filed with the Securities and Exchange Commission on October 27, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

The

Glimpse Group, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

7371 |

|

81-2958271 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

15

West 38th St., 9th Fl,

New

York, NY 10018

(917)

292-2685

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive office)

Lyron

Bentovim

Chief

Executive Officer

15

West 38th St., 9th Fl,

New

York, NY 10018

(917)

292-2685

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Darrin M. Ocasio, Esq.

Jay

K. Yamamoto, Esq.

Sichenzia

Ross Ference LLP.

1185

Avenue of the Americas

New

York, NY 10036

(212)

930-9700

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does

it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED OCTOBER 27, 2022

$100,000,000

The

Glimpse Group, Inc.

Common

Stock

Preferred

Stock

Warrants

Rights

Units

We

may issue securities from time to time in one or more offerings, in amounts, at prices and on terms determined at the time of offering.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We

will provide the specific terms of these securities in supplements to this prospectus, which will also describe the specific manner in

which these securities will be offered and may also supplement, update or amend information contained in this prospectus. You should

read this prospectus and any applicable prospectus supplement before you invest. The aggregate offering price of the securities we sell

pursuant to this prospectus will not exceed $100,000,000.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “VRAR”. On October 26, 2022, the last reported

sale price of our common stock was $4.76.

We

are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain

reduced public company reporting requirements for future filings.

Investing

in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks

of investing in our securities in the section titled “Risk Factors” beginning on page 3 of this prospectus, an in any similar

section contained or incorporated by reference herein or in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2022

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”)

using the “shelf” registration process. Under this shelf registration process, we may from time to time sell any combination

of the securities described in this prospectus in one or more offerings for an aggregate offering price of up to $100,000,000.

This

prospectus provides you with a general description of the securities that may be offered. Each time that we offer and sell securities,

we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and

sold and the specific terms of that offering and, to the extent appropriate, any updates to the information about us contained in this

prospectus. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating

to these offerings. The prospectus supplement may also add, update or change information contained in this prospectus with respect to

that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you

should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable

prospectus supplement, together with the additional information described under the headings “Where You Can Find More Information”

and “Incorporation by Reference.”

We

have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus,

any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that

the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on

its respective cover or as otherwise specified therein and that any information incorporated by reference is accurate only as of the

date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

This

prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain or incorporate by reference,

market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information.

Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not

independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented

in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject

to change based on various factors, including those discussed under the heading “Risk Factors” contained or incorporated

by reference in this prospectus, the applicable prospectus supplement and any related free writing prospectus and under similar headings

in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on

this information.

As

used in this prospectus and unless otherwise indicated, the terms “we,” “us,” “our,” “Glimpse,”

or the “Company” refer to The Glimpse Group, Inc. and its wholly owned subsidiaries.

THE

COMPANY

Overview

We

are a Virtual (“VR”) and Augmented (“AR”) Reality platform company, comprised of a diversified group of wholly-owned

and operated VR and AR companies, providing enterprise-focused software, services and solutions. We believe that we offer significant

exposure to the rapidly growing and potentially transformative VR and AR markets, while mitigating downside risk via our diversified

model and ecosystem.

Our

platform of VR/AR subsidiary companies, collaborative environment and diversified business model aims to simplify the challenges faced

by companies in the emerging VR/AR industry, potentially improving each subsidiary company’s ability to succeed, while simultaneously

providing investors an opportunity to invest directly into the emerging VR/AR industry via a diversified infrastructure.

Leveraging

our platform, we strive to cultivate and manage the business operations of our VR/AR subsidiary companies, with the goal of allowing

each underlying company to better focus on mission-critical endeavors, collaborate with the other subsidiary companies, reduce time to

market, optimize costs, improve product quality and leverage joint go-to-market strategies. Subject to operational, market and financial

developments and conditions, we intend to carefully add to our current portfolio of subsidiary companies via a combination of organic

expansion and/or outside acquisition.

The

VR/AR industry is an early-stage technology industry with nascent markets. We believe that this industry has significant growth potential

across verticals, may be transformative and that our diversified platform and ecosystem create important competitive advantages. Our

subsidiary companies currently target a wide array of industry verticals, including but not limited to: Corporate Training, Education,

Healthcare, Branding/Marketing/Advertising, Retail, Financial Services, Food & Hospitality, Media & Entertainment, Architecture/Engineering/Construction

(“AEC”) and Social VR support groups and therapy. We do not currently target direct-to-consumer (“B2C’) VR/AR

software or services, only business-to-business (“B2B”) and business-to-business-to-consumer (“B2B2C”), and we

are hardware agnostic.

Our

Corporate Information

The

Glimpse Group, Inc. was incorporated on June 15, 2016, under the laws of the State of Nevada and is headquartered in New York, New York.

Our executive offices are located at 15 West 38th St, 9th Fl, New York, NY 10018, and our telephone number is 917-292-2685.

We maintain a corporate website at www.theglimpsegroup.com. The information on our website is not part of this prospectus. We have included

our website address as a factual reference and do not intend it to be active link to our website.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, or the Exchange Act. Forward-looking statements give current expectations or forecasts of future events or our

future financial or operating performance. We may, in some cases, use words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or the negative of those

terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements.

These

forward-looking statements reflect our management’s beliefs and views with respect to future events, are based on estimates and

assumptions as of the date of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that

could cause our actual results to differ materially from those in these forward-looking statements. We discuss many of these risks in

greater detail in this prospectus under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on September

28, 2022, as well as those described in the other documents we file with the SEC. Moreover, new risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments

or otherwise, except as may be required by applicable laws or regulations.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this

prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected

by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise indicated

in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus for general corporate

purposes, including working capital.

DESCRIPTION

OF COMMON STOCK

General

We

are authorized to issue 300,000,000 shares of common stock, $0.001 par value per share.

Holders

of the Company’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of

common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election

of directors can elect all of the directors to our board of directors. Holders of the Company’s common stock representing one-third

(33 1/3%) of the voting power of the Company’s common stock issued, outstanding and entitled to vote, represented in person or

by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority of the Company’s

outstanding shares is required to effectuate certain fundamental corporate changes such as a liquidation, merger or an amendment to the

Company’s articles of incorporation.

Subject

to the rights of preferred stockholders (if any), holders of the Company’s common stock are entitled to share in all dividends

that the Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or

winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities

and after providing for each class of stock, if any, having preference over the common stock. The Company’s common stock has no

pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to the Company’s common stock.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is ClearTrust, LLC.

Listing

Our

common stock is currently quoted on The Nasdaq Capital Market under the symbol “VRAR”.

DESCRIPTION

OF PREFERRED STOCK

We

are authorized to issue up to 20,000,000 shares of preferred stock, par value $0.001 per share, from time to time, in one or more series.

We do not have any outstanding shares of preferred stock.

Our

articles of incorporation authorizes our board of directors to issue preferred stock from time to time with such designations, preferences,

conversion or other rights, voting powers, restrictions, dividends or limitations as to dividends or other distributions, qualifications

or terms or conditions of redemption as shall be determined by the board of directors for each class or series of stock. Preferred stock

is available for possible future financings or acquisitions and for general corporate purposes without further authorization of stockholders

unless such authorization is required by applicable law, or any securities exchange or market on which our stock is then listed or admitted

to trading.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting

power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with

possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying, deferring or preventing

a change-in-control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering. Such

prospectus supplement will include:

| |

● |

the

title and stated or par value of the preferred stock; |

| |

|

|

| |

● |

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock; |

| |

|

|

| |

● |

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock; |

| |

|

|

| |

● |

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall accumulate; |

| |

|

|

| |

● |

the

provisions for a sinking fund, if any, for the preferred stock; |

| |

|

|

| |

● |

any

voting rights of the preferred stock; |

| |

|

|

| |

● |

the

provisions for redemption, if applicable, of the preferred stock; |

| |

|

|

| |

● |

any

listing of the preferred stock on any securities exchange; |

| |

|

|

| |

● |

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the conversion

price or the manner of calculating the conversion price and conversion period; |

| |

|

|

| |

● |

if

appropriate, a discussion of Federal income tax consequences applicable to the preferred stock; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in the preferred

stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory, at the option of the

holder or at our option, and may include provisions pursuant to which the number of shares of our common stock to be received by the

holders of preferred stock would be subject to adjustment.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with any preferred

stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will be issued under a

separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The warrant agent will act solely

as our agent in connection with the warrants of that series and will not assume any obligation or relationship of agency or trust for

or with any holders or beneficial owners of warrants. This summary of some provisions of the warrants is not complete. You should refer

to the warrant agreement, including the forms of warrant certificate representing the warrants, relating to the specific warrants being

offered for the complete terms of the warrant agreement and the warrants. The warrant agreement, together with the terms of the warrant

certificate and warrants, will be filed with the SEC in connection with the offering of the specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus

is being delivered:

| |

● |

the

title of the warrants; |

| |

|

|

| |

● |

the

aggregate number of the warrants; |

| |

|

|

| |

● |

the

price or prices at which the warrants will be issued; |

| |

|

|

| |

● |

the

designation, amount and terms of the offered securities purchasable upon exercise of the warrants; |

| |

|

|

| |

● |

if

applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants will be

separately transferable; |

| |

|

|

| |

● |

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise of

such warrants; |

| |

|

|

| |

● |

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of

the warrants; |

| |

|

|

| |

● |

the

price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants may

be purchased; |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants shall commence and the date on which the right shall expire; |

| |

|

|

| |

● |

the

minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

|

|

| |

● |

information

with respect to book-entry procedures, if any; |

| |

|

|

| |

● |

if

appropriate, a discussion of Federal income tax consequences; and |

| |

|

|

| |

● |

any

other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued in

registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent

or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased securities.

If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will be issued for the

remaining warrants.

Prior

to the exercise of any warrants to purchase preferred stock or common stock, holders of the warrants will not have any of the rights

of holders of the common stock or preferred stock purchasable upon exercise, including in the case of warrants for the purchase of common

stock or preferred stock, the right to vote or to receive any payments of dividends on the preferred stock or common stock purchasable

upon exercise.

DESCRIPTION

OF RIGHTS

The

following description, together with the additional information we include in any applicable prospectus supplement, summarizes the general

features of the rights that we may offer under this prospectus. We may issue rights to our stockholders to purchase shares of our common

stock and/or any of the other securities offered hereby. Each series of rights will be issued under a separate rights agreement to be

entered into between us and a bank or trust company, as rights agent. When we issue rights, we will provide the specific terms of the

rights and the applicable rights agreement in a prospectus supplement. Because the terms of any rights we offer under a prospectus supplement

may differ from the terms we describe below, you should rely solely on information in the applicable prospectus supplement if that summary

is different from the summary in this prospectus. We will incorporate by reference into the registration statement of which this prospectus

is a part, the form of rights agreement that describes the terms of the series of rights we are offering before the issuance of the related

series of rights. The applicable prospectus supplement relating to any rights will describe the terms of the offered rights, including,

where applicable, the following:

| |

● |

the

date for determining the persons entitled to participate in the rights distribution; |

| |

|

|

| |

● |

the

exercise price for the rights; |

| |

|

|

| |

● |

the

aggregate number or amount of underlying securities purchasable upon exercise of the rights; |

| |

|

|

| |

● |

the

number of rights issued to each stockholder and the number of rights outstanding, if any; |

| |

|

|

| |

● |

the

extent to which the rights are transferable; |

| |

|

|

| |

● |

the

date on which the right to exercise the rights will commence and the date on which the right will expire; |

| |

|

|

| |

● |

the

extent to which the rights include an over-subscription privilege with respect to unsubscribed securities; |

| |

|

|

| |

● |

anti-dilution

provisions of the rights, if any; and |

| |

|

|

| |

● |

any

other terms of the rights, including terms, procedures and limitations relating to the distribution, exchange and exercise of the

rights. |

Holders

may exercise rights as described in the applicable prospectus supplement. Upon receipt of payment and the rights certificate properly

completed and duly executed at the corporate trust office of the rights agent or any other office indicated in the prospectus supplement,

we will, as soon as practicable, forward the securities purchasable upon exercise of the rights. If less than all of the rights issued

in any rights offering are exercised, we may offer any unsubscribed securities directly to persons other than stockholders, to or through

agents, underwriters or dealers or through a combination of such methods, including pursuant to standby underwriting arrangements, as

described in the applicable prospectus supplement.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred stock,

warrants or rights or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

| |

● |

the

terms of the units and of any of the common stock, preferred stock, rights and warrants comprising the units, including whether and

under what circumstances the securities comprising the units may be traded separately; |

| |

● |

a

description of the terms of any unit agreement governing the units; and |

| |

|

|

| |

● |

a

description of the provisions for the payment, settlement, transfer or exchange of the units. |

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including

our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities may be distributed at a fixed

price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices,

or negotiated prices. The prospectus supplement will include the following information:

| |

● |

the

terms of the offering; |

| |

|

|

| |

● |

the

names of any underwriters or agents; |

| |

|

|

| |

● |

the

name or names of any managing underwriter or underwriters; |

| |

|

|

| |

● |

the

purchase price of the securities; |

| |

|

|

| |

● |

any

over-allotment options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

● |

the

net proceeds from the sale of the securities; |

| |

|

|

| |

● |

any

delayed delivery arrangements; |

| |

|

|

| |

● |

any

underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| |

|

|

| |

● |

any

initial public offering price; |

| |

|

|

| |

● |

any

discounts or concessions allowed or reallowed or paid to dealers; |

| |

|

|

| |

● |

any

commissions paid to agents; and |

| |

|

|

| |

● |

any

securities exchange or market on which the securities may be listed. |

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more

transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our

other securities (described in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters

may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly

by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters

to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered

securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts

or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may

then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement

will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities

may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or

sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement,

any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the

Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions

to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery

on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The

applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Continuous

Offering Program

Without

limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a broker-dealer,

under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales agent. If we enter

into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’ transactions on the

Nasdaq Capital Market or other market on which our shares may then trade at market prices, block transactions and such other transactions

as agreed upon by us and the broker-dealer. Under the terms of such a program, we also may sell shares of common stock to the broker-dealer,

as principal for its own account at a price agreed upon at the time of sale. If we sell shares of common stock to such broker-dealer

as principal, we will enter into a separate terms agreement with such broker-dealer, and we will describe this agreement in a separate

prospectus supplement or pricing supplement.

Market

Making, Stabilization and Other Transactions

Unless

the applicable prospectus supplement states otherwise, other than our common stock, all securities we offer under this prospectus will

be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in the over-the-counter

market. Any underwriters that we use in the sale of offered securities may make a market in such securities, but may discontinue such

market making at any time without notice. Therefore, we cannot assure you that the securities will have a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104

under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market for the

purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases of the securities

in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate

member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering

transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions.

The underwriters may, if they commence these transactions, discontinue them at any time.

General

Information

Agents,

underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities,

including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage

in transactions with or perform services for us, in the ordinary course of business.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP, New York,

New York.

EXPERTS

The

financial statements of The Glimpse Group, Inc. as of and for the years ended June 30, 2022 and 2021 appearing in The Glimpse Group,

Inc.’s Annual Report on Form 10-K for the year ended June 30, 2022, have been audited by Hoberman & Lesser CPA’s, LLP,

as set forth in its report thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated

herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. The SEC maintains an Internet site that contains

reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our SEC filings

are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby under

the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration statement,

including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement from the

SEC’s internet site.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means

that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered

to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information.

Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying

prospectus supplement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein,

modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus.

We

incorporate by reference the documents listed below and any future documents that we file with the SEC (excluding any portion of such

documents that are furnished and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date

of the initial filing of the registration statement of which this prospectus forms a part prior to the effectiveness of the registration

statement and (ii) after the date of this prospectus until the offering of the securities is terminated:

| |

● |

Our

Annual Report on Form 10-K for the year ended June 30, 2022 as filed with the SEC on September 28, 2022; |

| |

● |

Current

Reports on Form 8-K filed with the SEC on July 19, 2022, August 2, 2022 and as amended on October 11, 2022, and September 28, 2022;

and |

| |

● |

The

description of the Registrant’s common stock which is contained in a Registration Statement on Form 8-A filed on June 29, 2021

(File No. 001-40556) under the Exchange Act, including any amendment or report filed for the purpose of updating such description. |

$100,000,000

The

Glimpse Group, Inc.

Common

Stock

Preferred

Stock

Warrants

Rights

Units

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following table provides information regarding the various expenses (other than placement agent fees) payable by us in connection with

the issuance and distribution of the securities being registered hereby. All amounts shown are estimates except the SEC registration

fee.

| Expense | |

Amount

Paid or

to be Paid | |

| SEC registration fee | |

$ | 11,020 | |

| Legal fees and expenses | |

| (1) | |

| Accounting fees and expenses | |

| (1) | |

| Miscellaneous expenses | |

| (1) | |

| Total | |

$ | 11,020 | |

| (1) |

These

fees and expenses are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated

at this time. |

Item

15. Indemnification of Officers and Directors.

The

Registrant’s Articles of Incorporation provide that none of its directors or officers shall be personally liable to the Registrant

or its stockholders for monetary damages for any breach of fiduciary duty by such person as a director or officer, except that a director

or officer shall be liable, to the extent provided by applicable law, (1) for acts or omissions which involve intentional misconduct,

fraud, or a knowing violation of law, or (2) for the payment of dividends in violation of restrictions imposed by Section 78.300 of the

Nevada Revised Statutes (“NRS”). The effect of these provisions is to eliminate the rights of the Registrant’s stockholders,

either directly or through stockholders’ derivative suits brought on behalf of the Registrant, to recover monetary damages from

a director or officer for breach of the fiduciary duty of care as a director or officer except in those instances provided under the

NRS.

The

Registrant has adopted provisions in its bylaws that require it to indemnify its directors, officers, and certain other representatives

against expenses, liabilities, and other matters arising out of their conduct on the Registrant’s behalf, or otherwise referred

to in or covered by applicable provisions of the NRS, to the fullest extent permitted by the NRS.

Section

78.7502 of the NRS provides that a corporation may indemnify its directors and officers against expenses, including attorneys’

fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the director or officer in connection with

an action, suit or proceeding in which the director or officer has been made or is threatened to be made a party, if the director or

officer acted in good faith and in a manner which the director or officer reasonably believed to be in or not opposed to the best interests

of the corporation, and, with respect to any criminal proceeding, had no reason to believe the director’s or officer’s conduct

was unlawful. Any such indemnification may be made by the corporation only as ordered by a court, provided for in the articles of incorporation,

bylaws, or another agreement with the corporation, or as authorized in a specific case upon a determination made in accordance with the

NRS that such indemnification is proper in the circumstances.

Indemnification

may not be made under the NRS for any claim, issue, or matter as to which the director or officer has been adjudged by a court of competent

jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation,

unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines

that in view of all the circumstances of the case, that the director or officer is fairly and reasonably entitled to indemnity for such

expenses as the court deems proper. To the extent that a director or officer of a corporation has been successful on the merits or otherwise

in defense of any action, suit, or proceeding or in defense of any claim, issue, or matter therein, the director or officer must be indemnified

under the NRS by the corporation against expenses, including attorney’s fees, actually and reasonably incurred by the direct or

officer in connection with the defense.

Item

16. Exhibits.

*

To be filed, if applicable, by amendment or incorporated by reference pursuant to a Current Report on Form 8-K.

Item

17. Undertakings.

The

undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective

amendment thereof) which individually or in the aggregate, represent a fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective Registration Statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or

any material change to such information in the Registration Statement;

provided,

however, that paragraphs (1)(i), (1)(ii) and (1)(iii) of this section do not apply if the information required to be included in

a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required

by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of

the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering

described in prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement

to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date; and

(5)

The undersigned hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act of 1934 that is incorporated by reference in the Registration

Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(6)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of

the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses

incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of New York, State of New York, on the 27th day of October, 2022.

| THE

GLIMPSE GROUP, INC. |

|

| |

|

|

| By: |

/s/

Lyron Bentovim |

|

| |

Lyron

Bentovim |

|

| |

Chief

Executive Officer and Director (Principal Executive Officer) |

|

| |

|

|

| By: |

/s/

Maydan Rothblum |

|

| |

Maydan

Rothblum |

|

| |

Chief

Financial Officer (Principal Financial Officer) |

|

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Lyron Bentovim and Maydan Rothblum

and each of them, his or her true and lawful attorneys-in-fact and agents with full power of substitution, for him or her and in his

or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this

registration statement, and to sign any registration statement for the same offering covered by the registration statement that is to

be effective upon filing pursuant to Rule 462(b) promulgated under the Securities Act, and all post-effective amendments thereto, and

to file the same, with all exhibits thereto and all documents in connection therewith, with the Securities and Exchange Commission, granting

unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite

and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby

ratifying and confirming all that said attorneys-in-fact and agents or any of them, his, hers or their substitute or substitutes, may

lawfully do or cause to be done or by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the dates indicated.

| Date |

|

Name

and Title |

|

Signature |

| |

|

|

|

|

| October

27, 2022 |

|

Lyron

Bentovim |

|

/s/

Lyron Bentovim |

| |

|

President

Chief Executive Officer & Chairman |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Maydan

Rothblum |

|

/s/

Maydan Rothblum |

| |

|

Chief

Financial Officer, Chief Operating Officer, Secretary, Treasurer & Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Jeff

Meisner |

|

/s/

Jeff Meisner |

| |

|

Chief

Revenue Officer & Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

D.J.

Smith |

|

/s/

D.J. Smith |

| |

|

Chief

Creative Officer & Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Sharon

Rowlands |

|

/s/

Sharon Rowlands |

| |

|

Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Jeff

Enslin |

|

/s/

Jeff Enslin |

| |

|

Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Lemuel

Amen |

|

/s/

Lemuel Amen |

| |

|

Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Alexander

Ruckdaeschel |

|

/s/

Alexander Ruckdaeschel |

| |

|

Director |

|

|

| |

|

|

|

|

| October

27, 2022 |

|

Ian

Charles |

|

/s/

Ian Charles |

| |

|

Director |

|

|

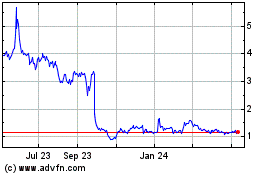

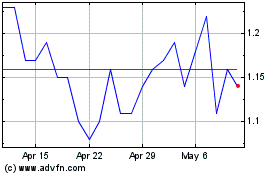

Glimpse (NASDAQ:VRAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Glimpse (NASDAQ:VRAR)

Historical Stock Chart

From Apr 2023 to Apr 2024